Trade Findings and Adjustments 03-17-2022

TODAY = Simple suggestions in profiting using options around collar or protective put strategies

When you are trading real money it is foolish to force trades daily, weekly, monthly or even quarterly

Please tell me what you are doing in regards to trading?!?!!!

Panicking and watching my portfolio lose money – NEITHER are appropriate in regards to managing, investing or trading

#1 You have to make an “educated” decision and be able to justify and stick with it over the short term

#2 You have to do the work: verifying all the level 1 information = Fundamentals, Technical, Sentiment analysis, COMMON SENSE

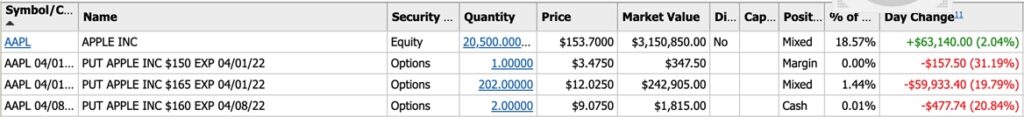

Trades:

Wide wing spreads on SPX?= Why would you try to bracket today’s market movement with a wings spreads? Are they far out in time to allow some growth, sell off 10% in either direction? IS this trade following the correct trend?

Selling credit spreads?= Are they following the trend? Do you understand risk/reward?

#3 Can I enough credit = Half the spread to make the risk reward worth it to me?

IF I can’t get half the credit of the difference between the spread or two strikes price IT IS ALWAYS better to do a debit trade

Losing $$ on Bull call spreads? IS the trend your friend? Are they out long term? Leap bull calls

Value Investing?= Have you done your fundamental research looking for higher prices later in time?

Please tell me what you are doing?!?!!!

We treated the FOMC Rate decision like an earnings event =

For example a long put used for stock ownership protection is placed?= ATM because you DON’T know which may the equity is going to move

REMEMEBR the market changes on a dime and we also must be nimble

FOMC rate decision was yesterday

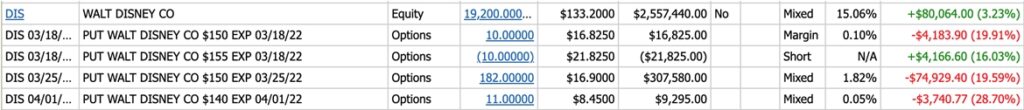

SO we Have BA, DIS, F, FB, SQ, UAA, V

Which Ones can move back to the all-time highs?

Let’s list what those highs are:

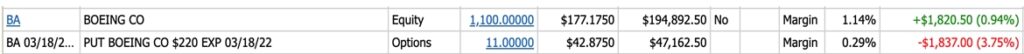

BA $380

DIS $208

F $25.87

FB $340

SQ $300

UAA $28

V $240

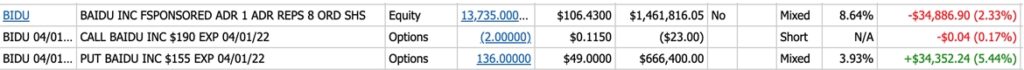

BIDU $350