HI Market View Commentary 03-14-2022

I am excited for the first time in almost two years about the market opportunities !!!

How much have stocks fallen that we are currently in ?

BIDU – 75%

F – 45%

UAA – 50%+

AAPL – 18%

BA – 50% +

FB – 50% +

DIS – 35%

SO for collar trading what does this mean?

We are sitting on a lot of cash and we are ready to add shares shortly !!!!

BIDU we have money to add 40% more shares of stock

F we have money to buy 100% more shares of stock

UAA we can buy 40% more shares of stock

BA we can buy 40% more shares of stock

FB we already bought 66% more shares of stock

DIS we can add 30% more shares of stock

BTO a share of stock for $100

For 100 shares we have a purchase price totaling 10K

RISK in the trade is?= $100

Added Long puts @ $100 and it cost $5%

New cost basis = 100 + 5 = 105

New risk in the trade?105 – 100 = $5 of 5% of total invested capital

SO when the stock loses 40% we can add 40% more shares of stock? NO IT NOT

100 share * $100 = 10,000 / 60 = 166shares

We have 140 with a cost basis of (per share) = Total value =

SO if the stock gets back to $65 per share = 166 * $65 = $10,790

SO if the stock gets back to $75 per share = 166 * $75 = $12,450

SO if the stock gets back to $90 per share = 166 * $65 = $14,940

I’m EXCITED because our markets have moved and we have a cash horde to buy more shars

2.5 million cash and the selling of puts = 1.65 million or 25% of portfolio are cash

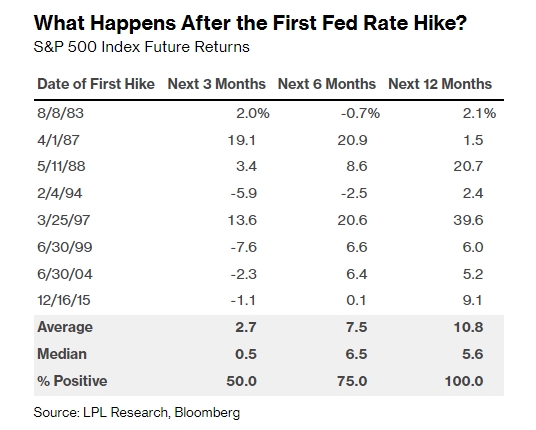

The trigger to buy low and sell high = A bottoming of the bearish trend, after Wed FOMC rate hike meeting and probably a week after that meeting for tax selling = NEXT Wednesday thru Friday

We have been suffering downward movement and the cycle to go higher will net us plenty of new shares to also go higher

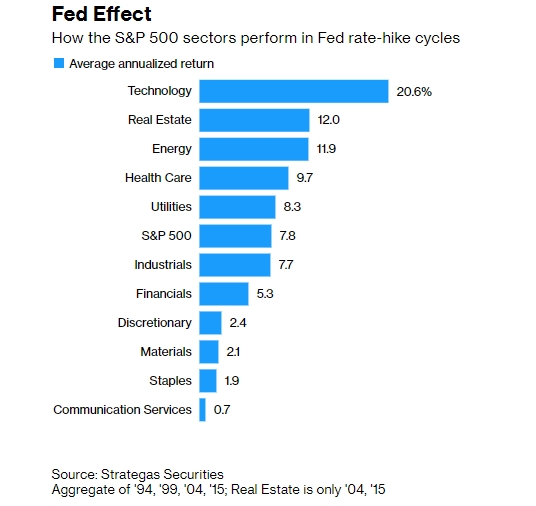

What sectors are “normally” better in an Interest rate hike environment ?

When will the Russia/ Ukraine war stop be shoved underneath the carpet ?

When supply lines come back on to 90% we will see supply far exceed demand?

Auto, Health Care, Consumer Staples

I’m really excited because earnings were too high yet

DOWNLOAD THE Handout !!!

What moving our market higher?= Capital Flows into the US markets, Personal Income rising

Right now everyone has RUN out of the store when the whole market went on sale !!!

Just a relief rally makes us very profitable for the year

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 11-Mar-22 15:20 ET

Russia, gas prices, the Fed, and earnings estimates leave a lot to be irked about

We are writing from an objectively irked disposition this week because there are a lot of things that are irksome.

We wish it wasn’t so, but when you combine a delusional dictator with naive central bankers and stubbornly optimistic analysts, it is just that.

Gas Pains

Russian President Putin is everyone’s worst enemy right now — well, almost everyone. China hasn’t had the backbone or moral character to penalize Russia for invading Ukraine. Instead, the wannabe world power hides behind a self-serving foreign policy that won’t stretch beyond its own interests.

That is irksome and it should irritate anyone who isn’t part of Putin’s inner circle or misguided ilk. But here we are. Russia has invaded Ukraine and China can’t even bring itself to call it an invasion.

Commodity prices have risen sharply in the aftermath of the invasion, particularly energy, agricultural, and metals futures, all of which will translate into higher costs for producers that, in turn, will translate into higher costs for consumers.

That point is hitting home already for anyone driving a car or buying food, which covers just about everyone.

Your author, who resides in a suburb of Chicago, needed 20.5 gallons of gas yesterday to fill a nearly empty tank. That cost $92.00. A month ago, a similar fill up cost $75.00, and a year ago, it cost $61.00, according to AAA.

That was irksome.

Same Old, Same Old

In the coming week, we will get a new policy directive and updated economic projections from the Federal Reserve. You know, the same Federal Reserve led by a chairperson who kept convincing his colleagues that the Fed’s consensus view should be that inflation pressures are going to be temporary.

The same Federal Reserve that didn’t think roughly $9 trillion of fiscal and monetary stimulus — or close to 40% of GDP — would create anything other than transitory inflation pressure even though it saw demand come roaring back from the pandemic low (because of the stimulus) at a time when supply chains were broken.

The same Federal Reserve that saw the consumer inflation rate hit a near 40-year high of 7.5% in January and then said it would continue to buy Treasury and mortgage-backed securities into March.

The same Federal Reserve that is now trying to convince everyone not to worry, that it has a line now on how to get inflation under control, and that — this might be the most irksome point of all — it isn’t behind the curve in fighting inflation.

Well, that curve got longer in February, as everyone saw in the Consumer Price Index. The 7.5% inflation rate in January — surprise! — elevated to 7.9% in February. But wait, there’s more.

With the commodity inflation seen this month, not to mention rising rent costs and further price increases for just about everything else, it’s a safe bet that March CPI will have at least an 8-handle on it.

And you want to know something? The policy rate has yet to be raised. That will change in the coming week with a whopping 25-basis points increase to a target range of 0.25-0.50%.

If inflation were a person, it would be taunting the Fed something awful right now. “Oooooh, 25 basis points, I’ll behave now… I promise.”

It’s irksome knowing the Fed hasn’t done anything yet, which makes it irksome to see the inflation rate where it’s at, and just as irksome to know that the Fed should have gotten off the zero bound some time ago so that it would have some rate-cutting flexibility in the event there is a material shock to the economy.

An Earnings Shock

If you ask us, there has been a shock to the earnings outlook since the year began. Let’s review:

- Russia invaded Ukraine. We don’t recall that risk factor cited in any of the year-ahead preview notes. It wasn’t in our preview.

- There has been an energy-price shock that is hitting hard in Europe and is starting to hit home around the globe. WTI crude prices are up 45% in 2022 and natural gas prices are up 34%.

- Wage pressure have increased, but discretionary spending potential has been pinched by the decline in inflation-adjusted wages.

- Consumer confidence levels have sunk as inflation expectations have risen.

- The dollar has strengthened, which will weigh on earnings prospects for multinational companies.

- Prices for raw materials have risen appreciably (good for energy and materials companies, but not so good for others).

- Global equity markets have suffered steep losses, eroding investor confidence and diminishing the wealth effect.

- Supply chain uncertainty has been exacerbated with export controls by Russia and against Russia.

- Interest rates have gone up (and should keep going up considering the Fed hasn’t even raised rates once yet).

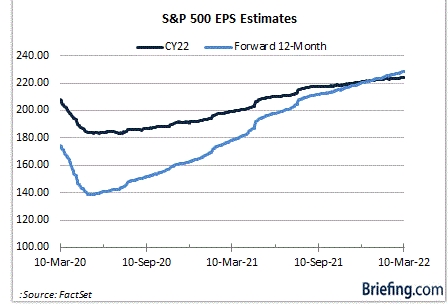

These factors notwithstanding, earnings estimates have been increasing. According to FactSet, the forward 12-month EPS estimate has increased from $221.92 on December 31, 2021, to $228.28 today, and the calendar year 2022 EPS estimate has increased from $221.92 on December 31, 2021, to $224.00 today.

Maybe it’s just us, but we’re inclined to think the estimate trend is divorced from reality. It’s irksome to us anyway that analysts’ aggregate earnings estimate has moved higher as the fundamental backdrop has worsened.

To be succinct, interest rates are higher, inflation is higher, real wages are negative, consumer confidence is weak, oil and gas prices have surged along with food costs, and, lest we forget, there is a war on the European continent that has been started by a delusional leader with nuclear weapons at his disposal.

Earnings estimates are too high.

What It All Means

It’s not a familiar position to be irked by so much, but it was an impossible feeling to avert this week.

It is the culmination of geopolitical uncertainty, monetary policy angst, and what strike us as glaringly unrealistic earnings expectations. In other words, there were continued reminders that volatility in the stock market should remain high and that return expectations this year should get dialed down.

Granted there could be a significant rally if the Russia-Ukraine situation gets defused and Russian troops turn tail and go back to Moscow. Even so, the road ahead for the stock market this year won’t be easy even if the Russia-Ukraine situation is no longer a situation. That’s because the Fed needs to be more aggressive to get on top of the inflation situation.

To do so will require tighter monetary policy, which has proven through history to be an irksome undertaking for the stock market.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bearish

Rolling 12 month gains – +0.51%

SPX – Bearish

Rolling 12 months gains 5.83% or down 21% from the highs

COMP – Bearish

Rolling twelve month average -5.55 or down just over 30% from the highs

Where Will the SPX end March 2022?

03-14-2022 -4.0%

03-07-2022 -2.0%

02-28-2022 -2.0%

Earnings:

Mon: MTN

Tues: DOLE

Wed: JBL, GES

Thur: FDX, GME, DG

Fri:

Econ Reports:

Mon:

Tues: PPI, Core PPI, Empire

Wed: MBA, Retail Sales, Retail ex-auto, Business Inventories, NAHB Housing, Import, Export, FOMC

Thur: Initial Claims, Continuing Claims, Phil Fed, Housing Starts, Building Permits, Industrial Production, Capacity Utilization,

Fri: Existing Home Sales

How am I looking to trade?

What about BIDU as it scares me and the humanity issues over in China?

#1 to my knowledge we’ve never D-listed a stock over humanity atrocities in another country

#2 they were not one of the 5 companies listed in the SEC report – BABA, Yum China

#3 IF BABA, BIDU, JD, NETEASE, they D-List they our shares will relist on the HONG KONG and there is billions of Asian money waiting to invest into their own regional shares

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

In a bull market for defense stocks, Boeing’s commercial business is at risk.

What happened

In contrast to yesterday, when defense stocks of all stripes moved in only one direction — up — Russia’s continuing attack on Ukraine had divergent effects on defense stocks today. By the time the closing bell rang, shares of defense hardware giant Lockheed Martin ( LMT 5.26% ) had gained 5.3% and Palantir Technologies ( PLTR 2.79% ) — a powerhouse of the defense IT industry — was up 3%.

In contrast, Boeing ( BA -5.08% ), maker of F-15 Strike Eagles fighter jets for the Air Force and F-18 Super Hornets for the Navy, saw its stock plunge 5.1%. Why is that?

In a bull market for defense stocks, Boeing’s commercial business is at risk.

What happened

In contrast to yesterday, when defense stocks of all stripes moved in only one direction — up — Russia’s continuing attack on Ukraine had divergent effects on defense stocks today. By the time the closing bell rang, shares of defense hardware giant Lockheed Martin ( LMT 5.26% ) had gained 5.3% and Palantir Technologies ( PLTR 2.79% ) — a powerhouse of the defense IT industry — was up 3%.

In contrast, Boeing ( BA -5.08% ), maker of F-15 Strike Eagles fighter jets for the Air Force and F-18 Super Hornets for the Navy, saw its stock plunge 5.1%. Why is that?

Image source: Getty Images.

So what

At last report, more than one dozen NATO member states had announced plans to send military aid to Ukraine. The total amount of military equipment being sent — both lethal and non-lethal — now stretches into the billions of dollars, versus less than just $1 billion that had been promised prior to Russia’s Feb. 24 invasion.

But even those billions in military equipment being shipped to Ukraine pale in significance to the tens of billions of dollars that now stand to be poured into the enlarged defense budgets of NATO members back home. Just this past weekend, Germany announced plans to triple its defense spending in 2022, by adding $112 billion in supplemental spending. Furthermore, Germany committed to raising its ongoing defense spending to in excess of 2% of GDP — which on a $3.8 trillion economy implies that Germany will grow defense spending to $76 billion annually going forward — about a 50% permanent increase.

Now what

As more and more NATO countries follow in Germany’s footsteps, I suspect we will see a tidal wave of new investment in defense all across Europe — tens of billions of extra defense dollars spent every year going forward. It makes sense, therefore, that investors would be betting today that Lockheed, Palantir, and Boeing would benefit from all that spending.

(Indeed, when this morning equity research firm Wolfe Research upgraded Lockheed Martin stock to outperform, it also took the opportunity to upgrade the entire defense sector to overweight, as TheFly.com reports.)

The more interesting question today is why Boeing is not benefiting from this positive sentiment?

Granted, Boeing’s not a pure-play defense business like Lockheed is. But at $26.5 billion in annual revenue, Boeing’s defense, space, and security business is certainly big enough — even if Lockheed’s defense business is two times bigger.

Granted, too, Boeing announced last night that it has had to close its offices in Kyiv and “pause” Boeing airplane training at its Moscow campus in reaction to, respectively, attacks on Kyiv and sanctions against Russia. Such moves reinforce the notion that Boeing’s commercial airplanes business will take a hit from this conflict that the more defense-oriented Lockheed will not suffer.

But even so, I suspect that the rearmament of Europe is a big enough trend that it should be giving Boeing stock a lift as well as Lockheed Martin. Were it not for the fact that Boeing stock already looked overpriced relative to Lockheed Martin going into this conflict, I might even be tempted to call today’s sell-off a buying opportunity for Boeing stock.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis – even one of our own – helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

Rich Smith has no position in any of the stocks mentioned. The Motley Fool owns and recommends Palantir Technologies Inc. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

The housing market frenzy will pass. Just not this spring

BY

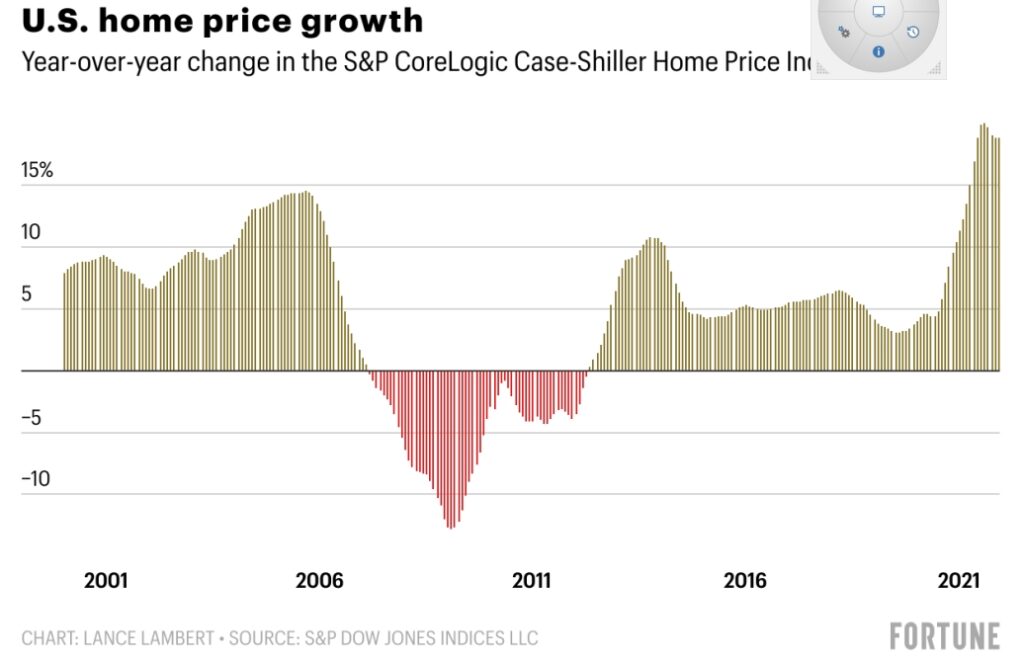

U.S. home prices are up 18.8% over the past 12 months. That’s well above the highest year-over-year rate (14%) notched leading up to the bursting housing bubble in 2008.

But housing economists are clear: This frenzy will eventually end. Simple economics dictates that home price growth can’t outpace income growth forever. At its latest reading, home prices were growing six times faster than wages.

The housing market will eventually cool. That’s the good news. The bad news? All signs point to the housing boom continuing through at least the spring housing market we’ve just entered.

https://e644b84f025c6bbd3239c194ba24d37d.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html “We are right in the heart of spring homebuying season, and it’s wild and it’s crazy out there. It is causing some frustration at this point in the real estate market,” Devyn Bachman, vice president of research at John Burns Real Estate Consulting, told Fortune. “It’s going to be tough [for buyers] through at least the spring.”

What’s going on? Heading into 2022, it was widely believed in the real estate industry that housing inventory, which had plummeted amid the housing boom, would finally begin to normalize. The thinking was that the end of COVID-19 mortgage forbearance protections would see more homes hit the market, while at the same time buyers would start to push back at sky-high prices. It didn’t happen. Instead, housing inventory fell even further. At this point last year, housing inventory on Zillow.com was 26% below pre-pandemic levels. Now it’s 42% below that level.

The lack of inventory isn’t isolated to a few hot markets. It’s a nationwide problem.

Coming out of the Great Recession, homebuilders, who were in financial distress, played it conservative. We went from 25 million homes built in 2005 to just 9.4 million in 2012. While it did begin to rebound in the last decade, it still wasn’t enough to match the wave of millennials who are ready to buy their first home. That’s causing inventory to dry up everywhere from California to West Virginia.

But the inventory problem—and the red-hot housing market—could begin to ease as we head into 2023. At least that’s what real estate forecasts show. While Fannie Mae forecasts home prices will still shoot up 11.2% in 2022, it predicts just a 4.2% bounce in 2023. The reason? Industry insiders hope that the combination of sky-high home prices and rising mortgage rates will help to rein in the market.

https://e644b84f025c6bbd3239c194ba24d37d.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html When asked what the housing market will look like next year, Bachman responded with a question of her own.

“How high do [home] prices get, and how high do [mortgage] rates get through this year?” she asked.

The higher rates and prices go in 2022, she says, the more buyer pushback we should see next year.

Manchin comes out against Biden Fed nominee Raskin, throwing her confirmation into doubt

KEY POINTS

- Sen. Joe Manchin, the most conservative Democrat in the Senate, said Monday that he opposes Sarah Bloom Raskin’s nomination to the Federal Reserve.

- “Her previous public statements have failed to satisfactorily address my concerns about the critical importance of financing an all-of-the-above energy policy,” Manchin said.

- The White House fired back by saying that many of the most intense attacks Raskin has faced have come from those with close ties to the energy industry.

- The Biden administration and Banking Committee Chair Sen. Sherrod Brown, D-Ohio, say they are seeking bipartisan support for Raskin’s nomination.

Sen. Joe Manchin, the most conservative Democrat in the Senate, said Monday that he opposes one of President Joe Biden’s nominees to the Federal Reserve, leaving her candidacy to join the central bank with the slimmest of hopes.

“I have carefully reviewed Sarah Bloom Raskin’s qualifications and previous public statements. Her previous public statements have failed to satisfactorily address my concerns about the critical importance of financing an all-of-the-above energy policy to meet our nation’s critical energy needs,” Manchin said in a statement.

“I have come to the conclusion that I am unable to support her nomination to serve as a member of the Federal Reserve Board,” he added.

Manchin’s formal opposition throws serious doubt on Raskin’s bid to be the Fed’s next vice chair for supervision, one of the most powerful banking regulators in the world. Raskin is a former Fed governor and served as the deputy Treasury secretary in the Obama administration.

While it’s possible she could garner support from a moderate Republican, a Senate split 50-50 means a single Democratic defection can imperil presidential nominations.

The White House said Monday that many of the most intense attacks against its candidate have come from those with close ties to the energy industry.

“Sarah Bloom Raskin is one of the most qualified people to have ever been nominated for the Federal Reserve Board of Governors,” a White House spokesperson told CNBC. “She has earned widespread support in the face of an unprecedented, baseless campaign led by oil and gas companies that sought to tarnish her distinguished career. We are working to line up the bipartisan support that she deserves, so that she can be confirmed by the Senate for this important position.”

A spokesperson for Sen. Sherrod Brown, the Ohio Democrat who serves as chair of the Senate Banking Committee, offered a similar outlook.

“Senator Brown is working to move forward Ms. Bloom Raskin’s nomination with bipartisan support, as Ms. Bloom Raskin has earned twice before,” Brown’s office told CNBC in an email.

Manchin, who last week said that his own party should advance Biden’s four other Fed nominees without Raskin, has for weeks worked to support the U.S. energy industry as oil and gas prices climb after Russia’s invasion of Ukraine.

Biden has also nominated Jerome Powell to a second term as Fed chair, chosen Lael Brainard as vice chair, and picked Lisa Cook and Philip Jefferson as Fed governors. A spokesperson for Senate Majority Leader Chuck Schumer, D-N.Y., did not immediately respond to CNBC’s request for comment.

Manchin’s statement Monday suggested that he doesn’t believe Raskin, who has previously called for stronger climate policies and critiqued the energy sector, could serve on the Fed without politicizing her decisions.

“The Federal Reserve Board is not an institution that should politicize its critical decisions,” Manchin said. “The time has come for the Federal Reserve Board to return to its defining principles and dual mandate of controlling inflation by ensuring stable prices and maximum employment. I will not support any future nominee that does not respect these critical priorities.”

Many of Manchin’s top donors include executives in the coal, oil and gas industries. Within the past year, Manchin has received donations from Ryan Lance, CEO of ConocoPhillips, Vicki Hollub, CEO of Occidental Petroleum, and R. Lane Riggs, the president of Valero Energy.

His remarks cap a weekslong standoff between Democrats and Republicans on the Senate Banking Committee, where the GOP has boycotted a vote on the president’s candidates out of opposition to Raskin.

Republicans, led by Banking Committee ranking member Sen. Pat Toomey of Pennsylvania, have said they are open to holding a vote on Powell, Brainard, Cook and Jefferson. But Democrats, led by the White House and Brown, have said they will hold a vote only if all of the nominees are included.

The two sides have fought since early February over Raskin’s fate.

Republicans began their attacks on Raskin during her confirmation hearing on Feb. 3. Several GOP senators criticized her views on climate policy and what many in the energy sector fear could be the Fed’s eventual move to discourage banks from lending to fossil fuel companies.

At that hearing, Sen. Cynthia Lummis, R-Wyo., also brought up Raskin’s prior work for fintech company Reserve Trust. The fintech business — like many others — was in 2017 trying to acquire a so-called master account at the Fed, which would grant it unprecedented access to the central bank’s payments system.

After Raskin’s personal intervention later that year, just months after she left her job as deputy Treasury secretary, the Kansas City Fed approved the company’s second request for an account in 2018.

Democrats have fired back at every turn and argue that the GOP’s revolving door concerns are a facade for the true reason they oppose Raskin: her prior research into how financial institutions could favor lending away from debt-laden fossil fuel producers.

The White House argues that there a few people more qualified to serve as the Fed’s top banks regulator given Raskin’s long history in government and prior work at the Treasury Department and the central bank. Many Obama-era administration officials, including former Treasury Secretary Jack Lew, have supported her nomination.

He and other economists note that the partisan dispute comes at a precarious time for the Fed, which is expected to raise interest rates later this week. With inflation running at a 7.9% annualized rate, economists say the central bank needs to crack down on rising prices without throwing the economy into a recession.

“As our nation continues its economic recovery from the pandemic, deals with rising inflation, and faces an end to decades of peace and security in Europe with Russia’s unjust invasion of Ukraine, we need the Federal Reserve to be at full force,” Lew wrote earlier in March.

Kim Kardashian’s advice to women in business is getting some major backlash

Kim Kardashian is on the receiving end of some heavy criticism this week after dishing out some eye-popping advice to women, with one career coach telling CNBC her comments potentially send a “dangerous” message to younger followers.

Kardashian had this guidance for women in business in an interview with Variety released on Wednesday: “Get your f—ing ass up and work. It seems like nobody wants to work these days.”

Unsurprisingly, it sparked a storm on social media, with Twitter users criticizing Kardashian for her “tone deaf” comments.

Actress Jameela Jamil weighed in on the comments, tweeting: “I think if you grew up in Beverly Hills with super successful parents in what was simply a smaller mansion … nobody needs to hear your thoughts on success/work ethic.”

Jamil added: “This same 24 hours in the day sh-t is a nightmare. 99.9% of the world grew up with a VERY different 24 hours.”

And Twitter users were quick to draw comparisons between Kardashian’s advice and comments made by Britain’s “Love Island” star Molly-Mae Hague in a podcast interview.

A clip of Hague’s interview on The Diary of a CEO podcast in December resurfaced a month later and quickly went viral. In the clip, the Brit doubled down on the argument that “Beyonce has the same 24 hours in a day that we do.”

Hague said: “When I’ve spoken about that before in the past I have been slammed a little bit with people saying ‘it’s easy for you to say that … you’ve not grown up in poverty, you’ve not grown up with major money struggles so for you to sit there and say that we have the same 24 hours in a day it’s not correct.’ But technically what I’m saying is correct, we do.”

Hague, who was a runner-up on the popular reality TV show “Love Island,” was named creative director of clothing brand Pretty Little Thing in August and reportedly earns six-figures (in British pounds) a month in her role.

Meanwhile, Kardashian is said to have a net worth of $1.8 billion, according to Forbes. On the back of the success of the reality TV show “Keeping Up With the Kardashians,” Kim and her family, have amassed their fortunes by creating an empire of retail brands.

Indeed, the very name of the show is a twist on that classic American dream message of “keeping up with the Joneses.”

And so it’s understandable that people look to emulate that success. However, one career coach suggests that both Kardashian and Hague’s comments could add to harmful social media messages on work ethic.

‘Toxic positivity’

Emma Harrison, a freelance careers coach, told CNBC that both Hague and Kardashian have “demonstrated ignorance of lived experience of the 99% and their messages pose real danger to their followers, especially those who are younger and more easily influenced.”

Harrison, a senior lecturer in careers, guidance and counselling at Canterbury Christ Church University in the U.K., noted that there had been a rise in influencers giving advice over social media, which was closely linked to messages of “toxic positivity” already present on these platforms.

“This idea that a person’s mindset can change everything or is the only thing holding them back is toxic and unhelpful in the same way that Kim Kardashian, Molly-Mae [Hague] and countless other influencer messages are,” she said.

CNBC contacted Kim Kardashian’s publicist Tracy Romulus, as well as Molly-Mae Hague’s manager Francesca Britton, and is yet to response a response.

‘Relevant and actionable’ advice

Kat Hutchings, a leadership and career coach who runs her own firm, told CNBC that “looking to people at the pinnacle of their career/success or have [Instagram] fame or celebrity status can create a feeling that we’ll never get there.”

In addition, she said it could also make people feel as if “we need to be someone other than ourselves in order to achieve” success.

Hutchings recommended seeking out role models who are two to five years ahead in their career and who remember what it was like to be in your shoes: “Their advice is helpful, relevant and actionable.”

She added that the people we admire in our career should also remind us that “having a vision and aspiration is important, but what’s more important is taking small steps every day towards what we want.”

Hutchings added that people should be able to be “less distracted by the glamour of someone operating in a wholly different context to us and [be] able to filter for the expertise and advice that helps us move forward.”

https://seekingalpha.com/article/4494034-meta-platforms-a-compelling-story

Meta Platforms: Its Metrics Still Tell A Compelling Story

Mar. 09, 2022 9:55 AM ETMeta Platforms, Inc. (FB)AAPL, GOOG11 Comments11 Likes

Summary

- Meta Platforms stock trades at historically low valuation multiples, down almost 42% since September 2021.

- Indeed, Apples’ policy changes will cost FB around $10 billion, but the encouraging analytics of the in-app shopping features may push Meta to pursue massive in-housing endeavors.

- The competition, especially TikTok, is on the rise, but with well over half of the global internet-using population on Meta’s platforms, its market share isn’t that easy to beat.

- With over two-fifths of the company’s market cap wiped off, the stock offers a great long-term value play.

Article Thesis

Meta Platforms, Inc. (FB) has lost about 42% of its share value since September 2021 as misfortunes hit the company one after another. The share decent is attributable to its whistleblowing scandal, weak 2022 guidance, intense competition that led to unimpressive monthly active users (MAU) YoY growth, and a first-time-ever quarterly MAU decline.

This article stipulates that Meta is well-positioned to subside these risks and will resume its upward trajectory to becoming a trillion-dollar company in the foreseeable future. Accordingly, the current dip offers an excellent chance for investors to rake up this long-term value opportunity. Accordingly, as a Meta platforms apps user, business customer, and shareholder, I rate the stock with a strong buy rating with at least two to three years of the investment horizon.

Apple’s Policy Changes – Let’s dig into the numbers

Facebook forecasted an estimated $10 billion loss of revenue during 2022 because of Apple Inc. (AAPL) App Tracking Transparency (ATT) feature in its earnings call. Apple introduced the ATT feature in 2021 in iOS 14.5 as part of its “The Identifier for Advertisers” (IDFA) policy, meaning to prevent app-makers from tracking user activity without consent. Facebook delivers results to advertisers by attributing consumer purchases to specific ads or campaigns by tracking user activity. This helps the advertisers interpret the efficiency of their advertisement budgets and allocate resources accordingly. However, with Apple’s new policy in place, Facebook’s ‘purchase attribution’ capability will be deeply compromised, affecting its ability to connect specific purchases to ads, thereby limiting the reliability of Facebook ad campaigns’ results.

According to Statista, about 98.5% of Facebook’s MAUs log in to the platform via mobile phone, out of which 14.3% are iPhone users. So, approximately 410 million (2912*98.5%*14.3%) of Facebook’s MAU log in to Facebook via an iPhone. However, according to CNBC, 62% of iPhone owners opt-out of being tracked. That means a loss of tracking from about 254 million MAUs, which is a little over 8.7% of Facebook’s total MAUs. Multiplying Facebook’s average revenue per user (ARPU) of $40.96 for 2021 with 8.73% of its total MAU (254.2 million) gives us the approximate loss of $10 billion revenue forecasted by Meta.

Facebook CEO Mark Zuckerberg quoted:

As Apple changes make e-commerce and customer acquisition less effective on the web, solutions that allow big businesses to set up shop right inside our apps will become increasingly attractive and important to them.

Accordingly, the company is exploring different measures to subside the issue of maximizing its user ID tracking capabilities and ad revenue potential, especially leveraging its in-app Shopping features, which have already amassed well over 1 billion MAUs. One million users regularly buy from Facebook Shops every month, with brands seeing significant results, including 66% higher order values from Shops than their websites.

This tussle with Apple may push Facebook to pursue massive in-housing endeavors, which, considering Facebook’s sheer reach (I’ll shed light on this in the next section), will not only cover the loss of revenue currently caused by Apple but demolish third-party tracking in the long run, liberating the company from relying on Apple, etc.

MAU Size and Growth

Meta Platforms has an MAU of over 2.9 billion and Daily Active Users (DAU) of 1.9 billion, meaning 66% of Facebook’s MAU log into the platform daily, making Facebook the most used online social network worldwide. This means that almost 37% of the world population uses Facebook monthly, and a quarter of the world population uses it daily. Facebook is banned in China, which means that excluding it, almost 45% of the world’s population already uses Facebook.

Around 4.95 billion or 62.5% of people worldwide use the internet, which means that Facebook has penetrated almost 60% of all the internet users out there. A 0.1% annual YoY MAU growth means that the company added 115 million users to its Facebook platform. With such a massive user base, it is unrealistic to expect its historical growth figures to continue indefinitely.

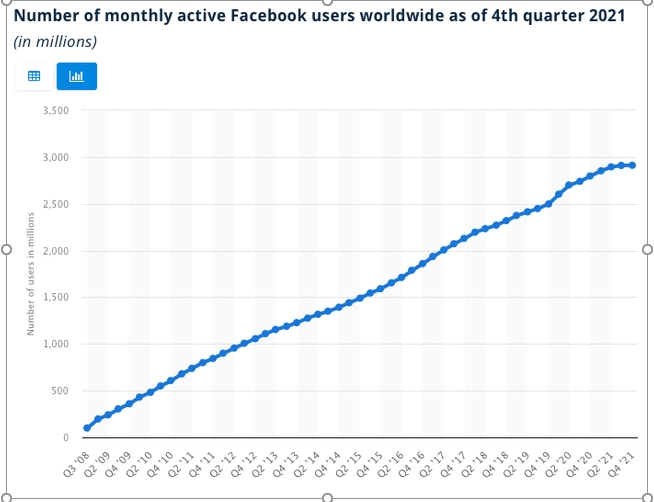

MAU Q4-2021 (Statista)

Mark’s Capital Allocation decisions have produced excess returns over the last decade. Moreover, considering the massive cash reserves of $48 billion and minimal debt, the company is well-positioned to pursue additional acquisitions in the future. Historically, the company has adopted and successfully implemented an acquisition growth strategy, and the latest acquisitions of Kustomer and Giphy are expected to improve WhatsApp’s and Instagram’s monetization meaningfully.

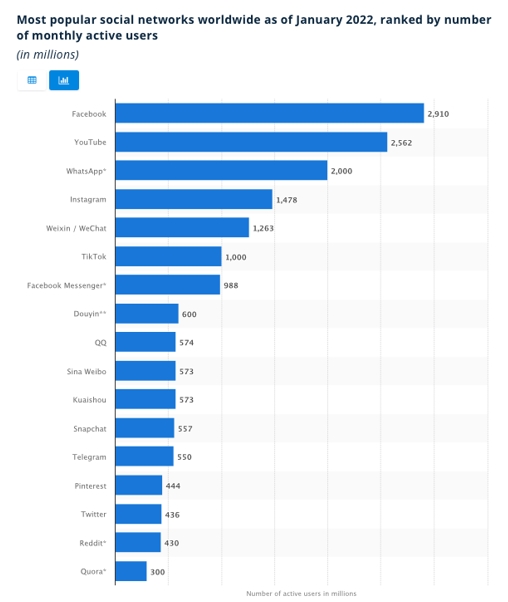

The company claims that its total advertising audience is 2.11 billion people, or 72.5% of the MAU, meaning that any serious advertiser can’t afford to skip Meta Platforms’ Ads. As you already know, Meta is more than just Facebook and owns four out of the ten most used online social platforms, i.e., Facebook, Messenger, Instagram, and WhatsApp. The largest global social network effect and the company’s access to a vast amount of user data have already created substantial barriers to entry for new competitors and make it hard for current users to abandon their digital friends and memories developed for years.

Most Popular Social Networks (Statista)EMarketer estimates that despite the negative press and privacy challenges, Facebook’s US Ad revenues will not decline in 2022, reaching a height of over $58 billion. This estimate bodes well with investors who are worried about the previously mentioned QoQ MAU decline since the 15.5% YoY growth is still a strong suit for the coming year, despite the expected headwinds.

US Facebook Net Ad Revenue (eMarketer)

Competition: TikTok Vs. Facebook Reels

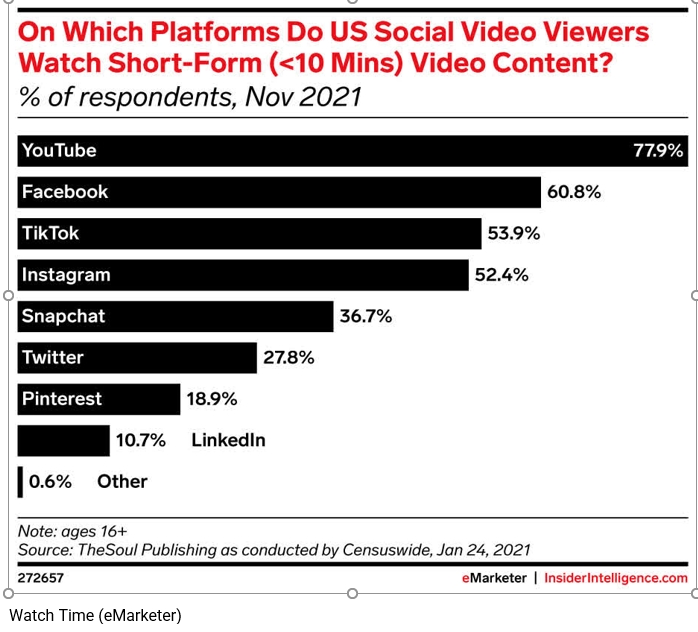

With TikTok’s growing popularity these days, one would assume that the platform leads short videos’ viewership, but it trails behind YouTube and Facebook, with 53.9% of Americans over 16 years of age using the platform. Not surprisingly, the frontrunners claim 77.9% of and 60.8% of the user share.

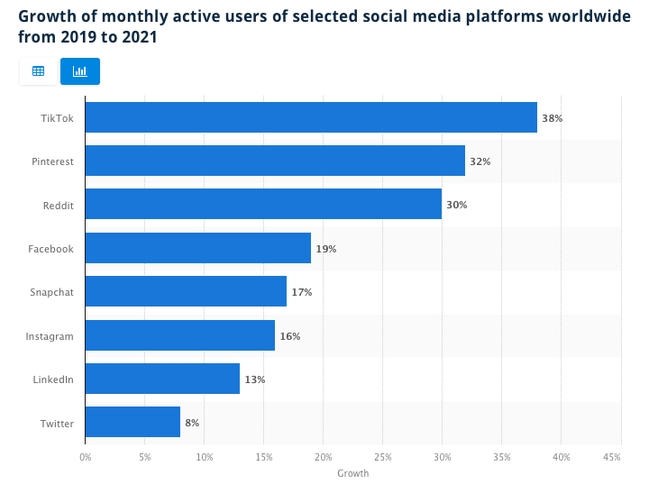

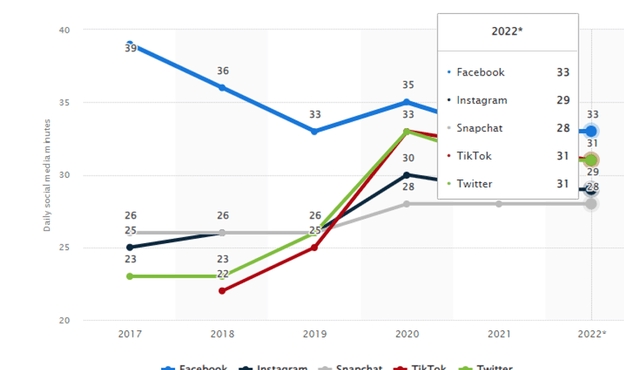

Watch Time (eMarketer)Most social media users do not use any singular platform in isolation but simultaneously use multiple platforms. For instance, 47.8% of Facebook users use TikTok, 48.8% use Twitter, and 36.1% use Pinterest. The company’s CEO singled out TikTok during the conference call as a fast-growing company which is apparent from the following graph chart. According to Statista, TikTok was the fastest MAU growing company from 2019 to 2021 with 38% YoY growth, double of Facebook at 19%.

Undoubtedly, this poses a serious threat to Facebook’s long-term prosperity unless the company preemptively invests in capturing the demographic where TikTok is leaping ahead, particularly young adults. Thus, Facebook has successfully jumped on the short films’ Facebook Reels’ initiative to counter TikTok.

The significant MAU and company size difference is advantageous to Facebook to pour resources and develop Reels as a viable alternative to retain its market share. Currently, Facebook leads TikTok in both MAU and usage. Still, the company needs to be proactive in developing a firm strategy to avoid being overtaken by TikTok in the long term due to the visible difference in their growth rates.

The sheer size of the user base in Facebook’s Family of Apps is a deep moat that gives the company an invaluable edge over the competition. Meta Platforms’ combined user base is a force to be reckoned with. For perspective, even if Facebook Reels doesn’t do anything that TikTok can’t, it gives 3 billion Facebook MAUs a major incentive to not switch to a different platform to use the same feature.

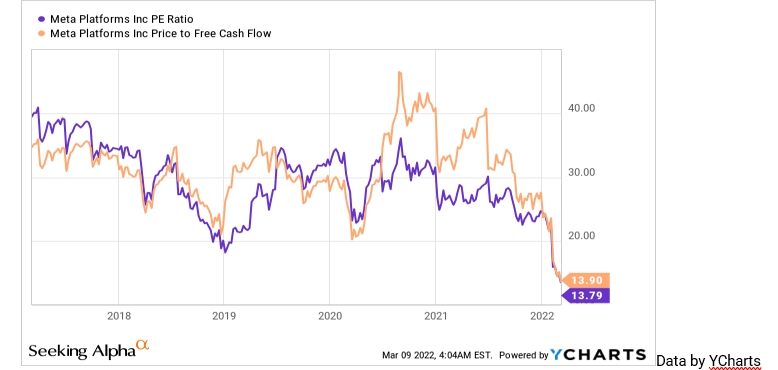

FB is trading at Historically Low Levels

The company was trading at a P/E multiple of around 25 in 2021 and is now being traded at a multiple of under 14. In contrast, Alphabet Inc. (GOOG) and AAPL are traded at over 24 and 26, respectively. Similarly, the company’s Price to Free Cash Flow is also crippled at 13.90. All these price multiples are at their lowest in over a decade. Further, with a cash balance of almost $48 billion, nearly 9% of the company’s market cap is entirely liquid. At these valuations, the stock is highly desirable.

Data by YCharts

Concluding Thoughts

Meta Platforms has changed its foremost priority from Facebook to Metaverse, which will be the significant benefactor of the company in the long run as it ups its spending from over $10 billion per annum over the coming years. I haven’t discussed Metaverse in this article to emphasize a horizon of less than a decade, whereas, in the company’s view, a fully mechanized Metaverse is about 10 to 15 years away.

Historically, Facebook came under fire in 2018 for the Cambridge Analytica scandal, resulting in a nearly 20% stock dip. However, the stock fully recovered when the company posted strong financial results mere two months later. That is a very strong precedent for the whistleblowing scandal, which initiated the current downtrend.

Similarly, the risks that have shot the company into a downward spiral during 2022 appear to be short-lived and temporary. The company’s deep moats and strong fundamentals are likely to strongly reflect the share price when it rebounds with its earnings in the coming year. With a 7% expected YoY revenue growth at the midpoint in Q1-2022, the stock may still be susceptible to volatility, but the long-term perspective on the company remains heavily positive. At historically lowest valuations, FB stock has become a true value stock I own in the current bear market and the way forward.

Ford and PG&E partner on electric F-150 powering homes, grid

KEY POINTS

- Ford will collaborate with Pacific Gas and Electric Co. in California to evaluate the capabilities of the electric F-150 Lightning to power homes and return energy to the power grid.

- Ford CEO Jim Farley and PG&E Corp. CEO Patti Poppe announced the plans Thursday night at the CERAWeek energy conference in Texas.

- The F-150 Lightning — due out this spring — already has the capability to power a home in the event of a power outage, according to the company. Ford calls it “Intelligent Backup Power.”

Ford Motor will collaborate with Pacific Gas and Electric Co. in California to evaluate the bidirectional charging capabilities of the electric F-150 Lightning to power homes and return energy to the power grid.

Ford CEO Jim Farley and PG&E CEO Patti Poppe announced the plans Thursday night at the CERAWeek energy conference in Texas.

Bidirectional charging involves an EV’s ability to return energy to a home or the power grid, a reverse of the home and grid charging the vehicle. The EVs can charge at night when rates are low and potentially provide energy back to the grid during peak hours. That would allow customers to save money on their electricity bill and create less strain on the grid.

The announcement comes two days after Poppe announced a pilot program with General Motors to make its electric vehicles capable of powering a home in the event of a power outage or grid failure.

Ford’s announcement differs from GM’s because it is “the first-to-market enablement of a Ford F-150 Lightning EV and bidirectional charging system,” a company spokeswoman said.

The F-150 Lightning — due out this spring — already has the capability to power a home in the event of a power outage, according to the company. Ford calls it “Intelligent Backup Power.”

Through the early adopter program, PG&E will explore how Ford’s technology interconnects with the electric grid and customer’s homes, the company said.

The first use of F-150 Lightning’s backup power is expected to begin in spring, supported by Sunrun Inc. as the automaker’s preferred installation partner.

Treasury Secretary Janet Yellen says Americans will likely see another year of ‘very uncomfortably high’ inflation

KEY POINTS

- Treasury Secretary Janet Yellen said Thursday that Americans will likely see another year of “very uncomfortably high” inflation.

- “We have seen a very meaningful increase in gas prices, and my guess is that next month we’ll see further evidence of an impact on U.S. inflation of Putin’s war on Ukraine,” Yellen said.

- The Treasury secretary’s comments came just hours after the Labor Department said consumer prices rose 7.9% in February, the fastest pace since 1982.

Treasury Secretary Janet Yellen said Thursday that Americans will likely see another year of “very uncomfortably high” inflation as Russia’s invasion of Ukraine muddles her prior forecast that price acceleration would moderate in the months ahead.

“I think there’s a lot of uncertainty that is related to what’s going on with Russia in Ukraine,” Yellen told CNBC’s “Closing Bell.”

“And I do think that it’s exacerbating inflation. I don’t want to make a prediction exactly as to what’s going to happen in the second half of the year,” she continued. “We’re likely to see another year in which 12-month inflation numbers remain very uncomfortably high.”

The Treasury secretary’s comments came just hours after the Labor Department published its latest gauge on how fast prices are climbing for American consumers. The report showed that consumer prices rose 7.9% in the 12 months ending in February, the hottest pace of inflation since 1982.

Those remarks also come just months after Yellen told CNBC that she expected inflation to moderate toward the end of 2022 as supply-chain hiccups resolved and met fiery consumer demand for goods.

She was reluctant to make a similar forecast on Thursday. Yellen said that Russia’s attack on Ukraine has introduced more uncertainty and driven up the price of several commodities including crude oil and wheat.

Crude oil futures leaped to multiyear highs earlier this week as the Kremlin intensified its assault on Kyiv, sending the price of West Texas oil for April delivery to nearly $130 a barrel on Tuesday. It has retreated somewhat since then and was last trading around $105 a barrel on Thursday.

But the price is still up about $30 a barrel from three months ago.

“We have seen a very meaningful increase in gas prices, and my guess is that next month we’ll see further evidence of an impact on U.S. inflation of Putin’s war on Ukraine,” Yellen said.

“Russia, in addition to exporting oil … Ukraine and Russia are major producers of wheat,” she added. “We’re seeing impacts on food prices, and I think that can have a very severe effect on some very vulnerable emerging market countries.”

The Treasury Department has led the Biden administration’s economic sanctions against Moscow, depriving the country of its access to U.S. dollars and blocking access to a significant portion of the global banking system.

Yellen said the litany of penalties against Russia have been overwhelming and that she continues to consult with her counterparts around the world on how to intensify sanctions if warranted.

“I think the sanctions have been devastating in their economic impact,” Yellen said. “We have all but cut Russia off from the international financial system.”

“The export controls that we have put in place will have a devastating longer, medium-run effect in depriving Russia of the technology that they need to run a modern economy and advance in defense and other areas,” she said. “Russia is experiencing very severe economic consequences. I expect there to be a severe downturn in the Russian economy.”

I think you might find this interesting.

Electric vehicles don’t add up

Jay Lehr is no lightweight, with respect to his views on this.

Click on Part 1 after reading this, and you will see the Electric Vehicle Scam

Dr. Jay Lehr and Tom Harris | Jan 15, 2022 |

Climate Change, Feature 1, Lifestyle, Politics

The utility companies have thus far had little to say about the alarming cost projections to operate electric vehicles (EVs) or the increased rates that they will be required to charge their customers. It is not just the total amount of electricity required, but the transmission lines and fast charging capacity that must be built at existing filling stations. Neither wind nor solar can support any of it. Electric vehicles will never become the mainstream of transportation!

In part 1 of our exposé on the problems with electric vehicles (EVs), we showed that they were too expensive, too unreliable, rely on materials mined in China and other unfriendly countries, and require more electricity than the nation can afford. In this second part, we address other factors that will make any sensible reader avoid EVs like the plague.

EV Charging Insanity

In order to match the 2,000 cars that a typical filling station can service in a busy 12 hours, an EV charging station would require 600, 50-watt chargers at an estimated cost of $24 million and a supply of 30 megawatts of power from the grid. That is enough to power 20,000 homes. No one likely thinks about the fact that it can take 30 minutes to 8 hours to recharge a vehicle between empty or just topping off. What are the drivers doing during that time?

ICSC-Canada board member New Zealand-based consulting engineer Bryan Leyland describes why installing electric car charging stations in a city is impractical:

“If you’ve got cars coming into a petrol station, they would stay for an average of five minutes. If you’ve got cars coming into an electric charging station, they would be at least 30 minutes, possibly an hour, but let’s say its 30 minutes. So that’s six times the surface area to park the cars while they’re being charged. So, multiply every petrol station in a city by six. Where are you going to find the place to put them?”

The government of the United Kingdom is already starting to plan for power shortages caused by the charging of thousands of EVs. Starting in June 2022, the government will restrict the time of day you can charge your EV battery. To do this, they will employ smart meters that are programmed to automatically switch off EV charging in peak times to avoid potential blackouts.

In particular, the latest UK chargers will be pre-set to not function during 9-hours of peak loads, from 8 am to 11 am (3-hours), and 4 pm to 10 pm (6-hours). Unbelievably, the UK technology decides when and if an EV can be charged, and even allows EV batteries to be drained into the UK grid if required. Imagine charging your car all night only to discover in the morning that your battery is flat since the state took the power back. Better keep your gas-powered car as a reliable and immediately available backup! While EV charging will be an attractive source of revenue generation for the government, American citizens will be up in arms.

Used Car Market

The average used EV will need a new battery before an owner can sell it, pricing them well above used internal combustion cars. The average age of an American car on the road is 12 years. A 12-year-old EV will be on its third battery. A Tesla battery typically costs $10,000 so there will not be many 12-year-old EVs on the road. Good luck trying to sell your used green fairy tale electric car!

Tuomas Katainen, an enterprising Finish Tesla owner, had an imaginative solution to the battery replacement problem—he blew up his car! New York City-based Insider magazine reported (December 27, 2021):

“The shop told him the faulty battery needed to be replaced, at a cost of about $22,000. In addition to the hefty fee, the work would need to be authorized by Tesla…Rather than shell out half the cost of a new Tesla to fix an old one, Katainen decided to do something different… The demolition experts from the YouTube channel Pommijätkät (Bomb Dudes) strapped 66 pounds of high explosives to the car and surrounded the area with slow-motion cameras…the 14 hotdog-shaped charges erupt into a blinding ball of fire, sending a massive shockwave rippling out from the car…The videos of the explosion have a combined 5 million views.”

We understand that the standard Tesla warranty does not cover “damage resulting from intentional actions,” like blowing the car up for a YouTube video.

EVs Per Block In Your Neighborhood

A home charging system for a Tesla requires a 75-amp service. The average house is equipped with 100-amp service. On most suburban streets the electrical infrastructure would be unable to carry more than three houses with a single Tesla. For half the homes on your block to have electric vehicles, the system would be wildly overloaded.

Batteries

Although the modern lithium-ion battery is four times better than the old lead-acid battery, gasoline holds 80 times the energy density. The great lithium battery in your cell phone weighs less than an ounce while the Tesla battery weighs 1,000 pounds. And what do we get for this huge cost and weight? We get a car that is far less convenient and less useful than cars powered by internal combustion engines. Bryan Leyland explained why:

“When the Model T came out, it was a dramatic improvement on the horse and cart. The electric car is a step backward into the equivalence of an ordinary car with a tiny petrol tank that takes half an hour to fill. It offers nothing in the way of convenience or extra facilities.”

Our Conclusion

The electric automobile will always be around in a niche market likely never exceeding 10% of the cars on the road. All automobile manufacturers are investing in their output and all will be disappointed in their sales. Perhaps they know this and will manufacture just what they know they can sell. This is certainly not what President Biden or California Governor Newsom are planning for. However, for as long as the present government is in power, they will be pushing the electric car as another means to run our lives.

HI Financial Services Mid-Week 06-24-2014