Trade Findings and Adjustments 02-03-22

Keve Bybee – keve@hurleyinvestments.com

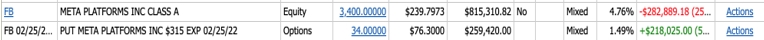

The Put Option

- The right to SELL stock at a certain price

- Increases in value when? When the stock price goes down

- Decreases in value when? Loses value when stock prices go up

- What price can you sell it at? Sell at the strike price

- Premium is what you pay for the option contract

What happened!?!?!?!?

- EPS was supposed to be $3.84 and came in at $3.67

- Revenue beat. $33.67b vs $33.4b

- Slowing revenue growth? Next quarter forecast is $27b and analysts wanted $30.15b

- Advertising challenges from Apple’s new iPhone policy. $10b revenue hit this year.

- “Reels” have become more popular but not as much ad revenue from them.

- Dividing out sections on earnings showing apps, medical, metaverse numbers to give investors a better idea what is happening on specific sections of the company.

- Spent 10b on metaverse. This is an investment into the future. Not “losing money” like it’s not successful.

- Market doesn’t seem to see that FB is investing as a huge plus right now

- Does all this justify losing 24% of their value? I don’t think so.

- Metaverse investments is more transitory and will drive future growth higher.

Why isn’t it making up EVERY DOLLAR on the way down?!

- Insurance: you pay a premium but you DON’T get it back when you get in a car wreck.

- Delta – How much the option price will change per dollar that the stock changes.

So do we sell FB?

- We can but we can also sell our put option and buy more shares at much lower prices.

- When? We have to wait and see where the stock goes.

- Do we some dip buying tomorrow?

- Do we see it fall below the $240 support level?

- Breaks support? Buy more puts!

BURN BABY BURN!!!!