HI Market View Commentary 11-10-2025

Why did we sell out of MU ? $253.30

We are taking a huge profit, We are using a stock replacement strategy to still be in stock 220/300 Bull Call, We used a short call with 9.30 credit like we got out at a net $219.30 only missing $0.70 with our stock replacement strategy, IT IS WAY Stretched via valuations

I am NOT PERFECT !!!

Yes I want to pay as little in taxes as we possibly can!!! Long term capital gains

YES the long puts are a short term capital gain that I turn into more shares

YES I was within $0.05 of the EPS and within 10 million dollars of the revenue for META AND the damn still went down

YES, I Always use level 1 = Fundamental, Technical, Sentimental Analysis before I place any trade

You entered 630/700 Dec 26 META bull call. WHY?

Do you protect verticals = NO it already has the protection in the short call side

Should you have taken the gains on META for the Dec25/Jan26 verticals = YES, before the earnings NO, and maybe I might have made a mistake in taking the verticals off because it might be back to trading at $750 by the end of the year

WE make the best, educated, though out, researched decision at the time = we still might be wrong

You said you were going to get out of BAC and you haven’t done it yet when you said you probably would by the beginning of last week?

The market is a living, breathing, ever changing, frustrating, loving beast AND what I say one day can change the next minute, the next hour, then nest day, the next week, the next month, the next year.

I would invest in BIDU over BABA = Because it owns 30% of BABA

Could BIDU be my flier next year, yes maybe

Earnings

BIDU 11/18 BMO

DIS 11/13 BMO

MU 12/15 est

NVDA 11/29 AMC

TGT 11/19 BMO

WMT 11/20 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 31-Oct-25 15:34 ET | Archive

Another rate cut in December would be absurd

Briefing.com Summary:

*A December rate cut isn’t a foregone conclusion, but the market still expects one.

*By one measure, financial conditions are as easy today as they were in 1998 and 2020.

*The Fed should not be cutting rates again at its December meeting.

In the Market View we published September 25, we shared our house view that two rate cuts before year-end is at least one too many. Well, the Fed cut rates at its October meeting, so that leaves just the December FOMC meeting before year-end, which means our house view now is that one more rate cut before year-end is one too many.

It sounds like the Fed may be having second thoughts about cutting rates again in December, too. Fed Chair Powell said it is not a foregone conclusion, “far from it,” as there were strongly differing views at the October meeting about how to proceed in December.

The fed funds futures market looks less conflicted. Notwithstanding the acknowledgement by Fed Chair Powell, the CME FedWatch Tool shows a 65.0% probability of a 25-basis-point cut in the target range for the fed funds rate to 3.50% to 3.75%. That is down from just over 90% a week ago, but it is far from a white-flag raising after the Fed Chair’s remark.

The market, from our vantage point, looks self-serving.

A Step Back in Time

Why would the Fed cut rates? Before we answer that, we are going to take you back to The Big Picture column we published in November 2021: An absurd monetary policy position is a risk we should all see coming.

The gist of that column is that it made no sense for the Fed to be at the zero bound and still embracing quantitative easing with the inflation rate at 6.2%, an economy averaging 5.0% real GDP growth, and the unemployment rate at 4.6%. It was the same policy position the Fed embraced in the throes of the Covid pandemic when the inflation rate stood at 0.2%, real GDP was negative 31.2%, and the unemployment rate was close to 13.0%.

In other words, we were imploring the Fed to raise rates and end quantitative easing. We called its ultra-accommodative position an absurd policy position and said it was a risk we should all see coming. Well, CPI inflation eventually peaked at 9.0% in June 2022, and the Fed raced to catch up with a series of rate hikes over the course of 2022, upending stocks and bonds in the process.

Nearly one-third of S&P 500 components saw a decline of at least 25% that year, as the S&P 500 in aggregate declined 19.4%. As an aside, Warren Buffett’s Berkshire Hathaway (BRK.B), the same one currently sitting on over $340 billion in cash and cash equivalents, increased 3.3% in 2022.

We digress. But now we are back. The situation today is different but risks being the same.

Briefing.com Analyst Insight

CPI inflation is 3.0% year-over-year. Real GDP growth was 3.8% in the second quarter and is projected to be 3.9% for the third quarter, per the Atlanta Fed GDPNow model. The unemployment rate, at the last check before the government shutdown, was 4.3%.

For added measure, the AI investment cycle is booming, the stock market has raced to record highs, led by the mega-cap stocks but energized by the meme stocks, and junk bond spreads are about as tight as they have been in the last 30 years. Simply put, financial conditions are easy.

The Chicago Fed’s National Financial Conditions Index (NFCI), which provides a weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems, supports the latter claim.

Positive values have been historically associated with tighter-than-average financial conditions, while negative values have been historically associated with looser-than-average financial conditions. The NFCI sits at -0.55 as of the week ending October 24, the same as it did in the week ending June 26, 1998, and the week ending November 20, 2020.

Fed Chair Powell also said at his press conference that he believes monetary policy is “modestly restrictive,” shortly before adding that he doesn’t see anything in the available data today that indicates the economy is seeing a significant deterioration. In his view, we are seeing a gradual cooling in the labor market and not much more than that.

The Fed, however, cut rates in September and again in October this year, citing its concerns about downside risks to the labor market. Some Fed officials are sounding a bit more circumspect about cutting rates again in December, but not all of them are.

We know which side the stock market is on, which presumably leaves us offside with our view that the Fed should not cut rates again in December. Financial conditions are easy, and the Fed would be making them more so with another rate cut at this juncture.

That would be absurd. Not as absurd as sticking at the zero bound and continuing with QE in November 2021, but in the zone of foolhardy with inflation well above target, animal spirits stirring in the stock market, quantitative tightening ending, stimulative tax policies in force, and GDP growth still above potential.

That sounds like a backdrop better suited for a rate hike than a rate cut. We know a rate hike isn’t going to happen, but neither should a rate cut.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of November 10.)

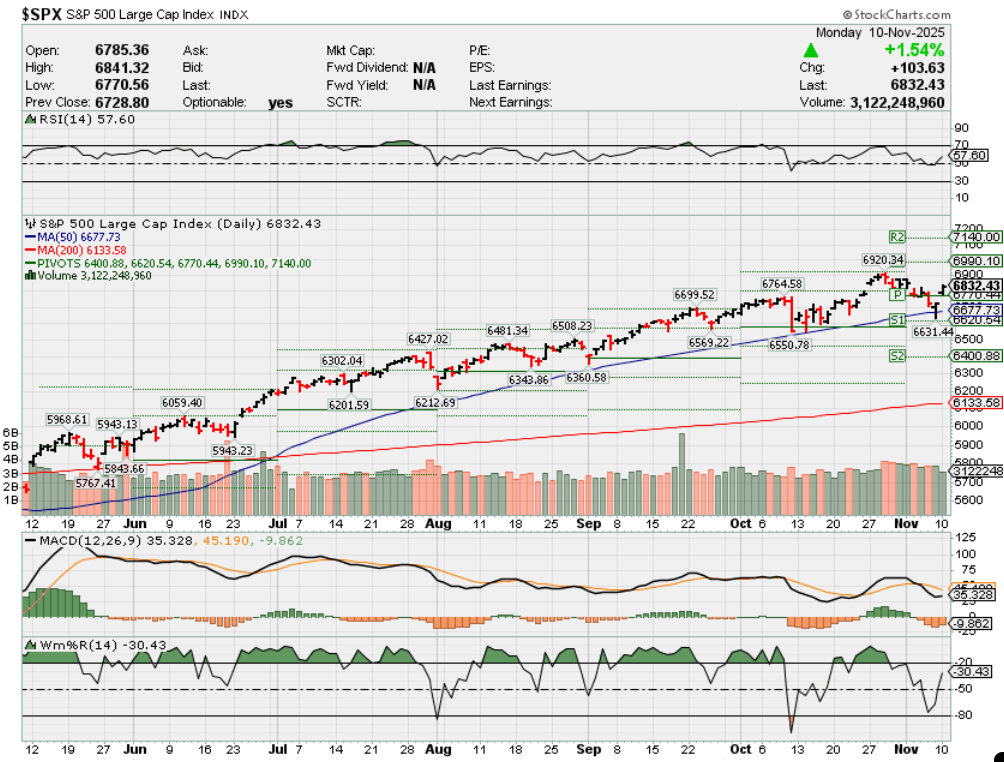

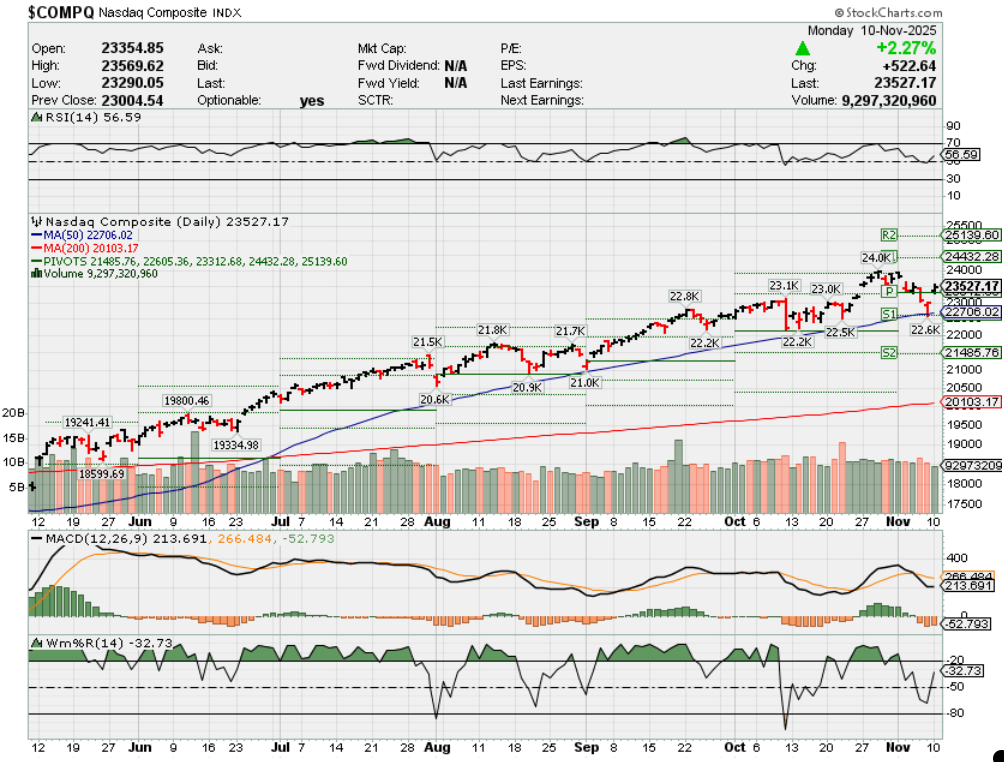

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end November 2025?

11-10-2025 +2.0%

11-03-2025 +2.0%

10-27-2025 +2.0%

Earnings:

Mon: CRWY, OXY

Tues: STUB

Wed: TME, CSCO

Thur: JD, BZH, DIS

Fri:

Econ Reports:

Mon:

Tue

Wed: MBA,

Thur: Initial Claims, Continuing Claims, CPI. Core CPI, Treasury Budget,

Fri: Retail Sales, Retail ex-auto, PPI, Core PPI, Business Inventories,

How am I looking to trade?

Time to let things continue to run

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2025/11/04/karp-big-short-burry-palantir-nvidia.html

Alex Karp blasts ‘Big Short’ investor Michael Burry as ‘bats— crazy’ for bets against Palantir, Nvidia

Published Tue, Nov 4 20259:20 AM EST

Alex Karp on ‘Big Short’ investor Michael Burry: ‘Bats— crazy’ for bets against Palantir, Nvidia

Palantir CEO Alex Karp ranted against short-sellers, calling out specifically Michael Burry after a filing revealed the investor of “The Big Short” fame had bets against the AI software company, as well as Nvidia, at the end of the last quarter.

“The two companies he’s shorting are the ones making all the money, which is super weird,” Karp told CNBC’s “Squawk Box.” “The idea that chips and ontology is what you want to short is bats— crazy.”

“He’s actually putting a short on AI… It was us and Nvidia,” Karp added.

Palantir shares slid roughly 9% Tuesday even after the software company beat Wall Street estimates for the third quarter and offered upbeat guidance. Investors have grown increasingly wary of lofty valuations in AI-linked names. Palantir shares, which were up 173% for the year heading into Tuesday’s trading, have a forward price-earnings ratio of 228. Nvidia fell more than 2% after gaining more than 50% this year.

“I do think this behavior is egregious and I’m going to be dancing around when it’s proven wrong,” said Karp of short-sellers.

Burry’s hedge fund Scion Asset Management disclosed put options with a notional value of about $187 million against Nvidia and $912 million against Palantir as of Sept. 30. in a filing. The filing didn’t specify the strike prices or expiration dates of the contracts.

It’s unclear whether Burry is profiting from Tuesday’s declines. The filing reflects his positions at the end of September, and he may have since adjusted his portfolio by now. Burry declined to comment.

“It’s not even clear he’s shorting us. It’s probably just, ‘How do I get my position out and not look like a fool?’” Karp said.

The disclosure comes after Burry hinted at renewed caution in markets in a cryptic post on X last week.

“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play,” he wrote to his 1.3 million followers on the platform.

Burry gained fame for his prescient bet against mortgage-backed securities before the 2008 financial crisis, a trade chronicled in Michael Lewis’ The Big Short and the Oscar-winning film of the same name.

“With the shorts it’s very complex…honestly I think what’s going on here is market manipulation,” Karp said. “We delivered the best results anyone’s ever seen. It’s not even clear he’s not doing this to get out of his position. I mean these people, they claim to be ethical, but they are actually shorting one of the great businesses of the world.”

Here are the most expensive stocks in the S&P 500 alongside Palantir

Published Tue, Nov 4 20259:22 AM ESTUpdated 37 Min Ago

There’s one thing Palantir’s post-earnings reaction shows: Valuations still matter on Wall Street.

The data analytics company that boasts big government contracts reported third-quarter earnings and revenue that beat analyst expectations. Revenue from its U.S. government business soared by 52% from the same period a year ago.

But shares fell more than 8%, as investors worried about the company’s lofty valuation. The stock trades at a forward price-to-earnings multiple of 228. In contrast, the S&P 500 sports a forward ratio of around 23. Palantir had jumped 20% in the past month going into the report, and nearly 30% in the past three months.

“Despite our admiration for the company, valuation is still very difficult to wrap our heads around,” Deutsche Bank analyst Brad Zelnick wrote.

But Palantir isn’t the only expensive stock investors have driven higher.

CNBC Pro looked at the three most common metrics used by investors to measure valuation: forward price-to-earnings ratio, forward price-to-free cash flow and forward price-to-sales. We then screened to find the companies which rank in the top 10th percentile in each of these three metrics among S&P 500 companies.

One could argue we are even being generous using the forward figures, because they are relying on Wall Street estimates for the next 12 months, which could prove too optimistic. Even using those estimates, the following companies are expensive on every measure.

Most expensive stocks in the S&P 500

| Symbol | Name | P/E NTM | P/FCF NTM | P/S NTM | YTD % chg |

| PLTR | Palantir Technologies | 228.1 | 207.6 | 85.9 | 173.9 |

| APP | AppLovin Corp. | 47.4 | 44.8 | 29.3 | 95.2 |

| CRWD | CrowdStrike Holdings | 122.6 | 79.9 | 24.8 | 61.3 |

| TPL | Texas Pacific Land | 38.3 | 34.5 | 24.6 | -16.4 |

| AVGO | Broadcom | 38.8 | 36.2 | 19.7 | 56.4 |

| ANET | Arista Networks | 48.8 | 47.1 | 19.0 | 42.6 |

| ISRG | Intuitive Surgical | 57.2 | 49.6 | 17.3 | 4.3 |

| AXON | Axon Enterprise | 93.7 | 82.7 | 17.3 | 21.8 |

| FICO | Fair Isaac | 41.2 | 43.3 | 16.3 | -17.1 |

| CDNS | Cadence Design Systems | 42.4 | 46.2 | 15.7 | 11.6 |

| MPWR | Monolithic Power Systems | 49.5 | 46.4 | 15.1 | 69.7 |

| DDOG | Datadog | 77.2 | 56.0 | 14.6 | 13.4 |

| TSLA | Tesla | 220.3 | 114.2 | 14.5 | 16.0 |

| PANW | Palo Alto Networks | 55.6 | 39.0 | 13.6 | 20.5 |

| IDXX | IDEXX Laboratories | 51.2 | 45.0 | 12.6 | 74.9 |

| NOW | ServiceNow | 45.9 | 32.4 | 12.4 | -13.8 |

| WELL | Welltower | 75.5 | 32.2 | 10.8 | 44.7 |

| AMD | Advanced Micro Devices | 44.0 | 60.4 | 10.3 | 115.0 |

| HWM | Howmet Aerospace | 48.3 | 43.7 | 9.3 | 89.0 |

Source: FactSet

While Palantir is head-and-shoulders above the other stocks on the list, AppLovin and CrowdStrike also trade at lofty levels by each of these yardsticks.

AppLovin has a PE multiple of 47.4 and a price-to-free cash flow ratio of 44.8. In terms of price to sales, it trades at 29.3 times. CrowdStrike’s earnings and free cash flow ratios are even higher, at 122.6 and 79.9, respectively. On a price-to-sales basis, it trades at 24.8.

The valuations haven’t stopped the stocks yet. AppLovin is ahead 95% and CrowdStrike by 61% in 2025. Palantir has soared 174% year to date.

In fact, 12 of the 19 stocks on the list are outperforming the S&P 500 this year, so investors are willing to pay up for these premium valuations for now.

But, such multiples do leave the stocks vulnerable if the broader market comes under pressure.

—CNBC’s John Melloy contributed reporting.

https://www.cnbc.com/2025/11/04/goldman-sachs-morgan-stanley-warn-of-a-market-correction.html

Goldman Sachs, Morgan Stanley warn of a market correction: ‘Things run and then they pull back’

Published Tue, Nov 4 20251:52 AM ESTUpdated Tue, Nov 4 20252:19 AM EST

Lee Ying Shan@in/ying-shan-lee@LeeYingshan

Key Points

- Goldman Sachs and Morgan Stanley expect 10% to 20% correction in equity markets over the next 1-2 years.

- IMF, Fed Chair Powell and Bank of England Governor Bailey have warned of overvalued equities.

Global markets may be due for a reality check after this year’s relentless rally, as Goldman Sachs and Morgan Stanley on Tuesday cautioned investors to brace for a drawdown over the next two years.

Equities worldwide have been soaring, hitting record highs this year, driven by AI-linked gains and expectations of rate cuts. Over the past month, key U.S. indexes have scaled new peaks, Japan’s Nikkei 225 and South Korea’s Kospi have hit fresh highs, while China’s Shanghai Composite has notched its strongest level in a decade on easing U.S-China tensions and a softer dollar.

“It’s likely there’ll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months,” said Goldman Sachs CEO David Solomon at the Global Financial Leaders’ Investment Summit in Hong Kong. “Things run, and then they pull back so people can reassess.”

However, Solomon noted that such reversals were a normal feature of long-term bull markets, noting that the investment bank’s standing advice to clients remains to stay invested and review portfolio allocation, not attempt to time markets.

“A 10 to 15% drawdown happens often, even through positive market cycles,” he said. “It’s not something that changes your fundamental, your structural belief as to how you want to allocate capital.”

Morgan Stanley CEO Ted Pick, speaking at the same panel, said investors should welcome periodic pullbacks, calling them healthy developments rather than signs of crisis.

“We should also welcome the possibility that there would be drawdowns, 10 to 15% drawdowns that are not driven by some sort of macro cliff effect,” he said.

Solomon and Pick’s views come on the back of recent warnings by the IMF of a possible sharp correction, while Federal Reserve Chair Jerome Powell and Bank of England Governor Andrew Bailey have also cautioned about inflated stock valuations.

Bright spots in Asia

Goldman Sachs and Morgan Stanley pointed to Asia as a bright spot in the next few years on the back of recent developments including the trade pact between the U.S. and China. Goldman expects global capital allocators to continue to be interested in China, adding that it remains one of the “largest and most important economies” in the world.

Morgan Stanley remains bullish on Hong Kong, China, Japan and India due to their unique growth stories. Japan’s corporate-governance reforms and India’s infrastructure build-out were singled out as multi-year investment themes.

“It’s hard not to be excited about Hong Kong, China, Japan and India — three vastly different narratives, but all part of a global Asia story,” Ted said. He highlighted the AI, EV and biotech sectors in China particularly.

Wall Street is too fixated on the high valuations of tech and speculative stocks, Cramer says

Published Tue, Nov 4 20257:12 PM EST

Key Points

- CNBC’s Jim Cramer examined Tuesday’s market action, reviewing Wall Street’s reaction to Palantir’s big decline.

- He suggested some investors are too focused on the large valuations of certain artificial intelligence-related stocks and speculative names.

Some stocks deserve a higher premium, says Jim Cramer

CNBC’s Jim Cramer suggested Wall Street is too fixated the on large valuations of certain tech and speculative stocks, chalking up Tuesday’s market-wide decline in part to Palantir’s nearly 8% loss despite strong earnings results.

“The larger issue is that we’re at the moment where money managers, when asked if the market’s too expensive, immediately think of the high-flying speculative stocks or those in the high-growth artificial intelligence column, and so they warn you away from the entire asset class,” he said. “These guys don’t think of the other 334 stocks in the S&P 500 that sell for less than 23 times earnings — those aren’t outrageous.”

Declines in Palantir and other artificial intelligence companies helped bring stocks down on Tuesday, with the S&P 500 losing 1.17%, the Dow Jones Industrial Average shedding 0.53% and the tech-heavy Nasdaq Composite sinking 2.04%. Palantir managed to beat the estimates and offer solid guidance, citing growth in the artificial intelligence business. But investors worried broadly about the huge valuations of tech giants that have been leading the market to new heights.

Investors who saw Palantir as their “north star” were alarmed by its big pullback after a great quarter, according to Cramer. The fears triggered “a raft of selling” as these investors questioned the market as a whole, he continued.

Palantir can be a tough stock to classify, Cramer suggested, saying it straddles two different market segments — one centered around tech and artificial intelligence, and another focused on speculative stocks. He noted that the data-driven software company is very lucrative and fast growing, and it “defies easy description.” He listed off a number of its business arms — including its work as a defense contractor and as a consultant for companies looking to modernize and improve profitability.

To Cramer, it’s reasonable to consider that there’s nothing wrong with Palantir, and it just needs “to cool off in order to grow into its market capitalization.”

“Sure, there are indeed some stocks that are visibly overvalued, and when you pull them apart, many of these valuations can be justified, some can’t,” he said. “I think the Magnificent Seven can be justified on the pace of the growth that’s ahead of them. Same, ultimately, with Palantir.”

Amazon upheaval: With morale shaken, Jassy looks for next big play after mass layoffs

Published Wed, Nov 5 20257:30 AM ESTUpdated Wed, Nov 5 202510:26 AM EST

Annie Palmer@in/annierpalmer/@annierpalmer

Key Points

- Amazon CEO Andy Jassy’s overhaul of the company’s corporate culture deepened last week with the announcement of 14,000 layoffs.

- The next big wave of job cuts is expected to start in January, after the holiday rush and Amazon’s annual re:Invent cloud conference, CNBC has learned.

- Before the company’s earnings beat last week, Amazon’s stock had badly underperformed its tech peers this year.

Amazon CEO Andy Jassy sat on a stage in a Seattle conference center in September, looking out at an audience of thousands of sellers who’d traveled from around the world to the company’s hometown.

He used the moment to lay out a vision for how he wants Amazon to operate like the “world’s largest startup,” getting rid of bureaucracy in order to move faster and stay competitive.

“We’re working hard to try to flatten our organization and have fewer layers because in the very earliest days of Amazon, it’s been true for many years, we had very high ownership at every level of the organization, including on the frontline,” Jassy said at the event.

Jassy, who took the helm from founder Jeff Bezos in 2021, has embarked on a major overhaul of Amazon’s corporate culture in recent years, including a hard pivot back to in-office work, with Covid largely in the rearview mirror, and a push for employees to do more with less.

The starkest example came last week, when Amazon announced it would lay off about 14,000 corporate employees and said more cuts are expected soon.

During Amazon’s earnings call on Thursday, Jassy used a familiar line when asked about the reductions.

“As a leadership team, we are committed to operating like the world’s largest startup,” Jassy said. “And that means removing layers.”

The next big wave of cuts is expected to start in January, CNBC has learned, after the holiday rush and Amazon’s annual re:Invent cloud conference, which is held in early December.

Amazon’s stores and human resources division, known as people experience and technology, are among the units that will be impacted, according to two people familiar with the matter who asked not to be named because the details are confidential.

In total, it’s expected to add up to the largest round of corporate layoffs in Amazon’s 31-year history, CNBC previously reported. Amazon has been trimming head count across the company since late 2022, resulting in more than 27,000 job cuts. Reductions have continued of late, though at a smaller scale.

Layoffs have been announced at companies across the tech, retail, auto and shipping industries in recent months, with executives citing myriad reasons, from artificial intelligence and tariffs to shifting business priorities and broader cost-cutting efforts. Meta, Google, Intel and others have also sought to reduce management layers or organizational bloat in hopes of boosting efficiency.

Before Amazon’s better-than-expected third-quarter earnings report late last week, Wall Street was taking a skeptical eye toward the company. The stock was very narrowly up for the year, badly trailing the broader market and Amazon’s megacap peers. However, a 14% jump over two trading days put the stock solidly in the green and lifted it to a record close Monday.

But as Jassy tries to reshape the company, plenty of hurdles remain, including rising costs, heightened cloud competition, delays at Alexa and what some employees describe as flagging morale.

While Amazon’s core e-commerce unit remains healthy, Amazon and other retailers have been navigating the uncertainty of President Donald Trump’s shifting tariff policies, which threaten to increase costs and dampen consumer demand.

Amazon Web Services, the dominant cloud infrastructure provider, has come under pressure from rivals Microsoft and Google, which are growing faster. AWS is also battling a perception that it’s a laggard in signing key artificial intelligence infrastructure deals. Amazon’s $38 billion cloud agreement with OpenAI, announced Monday, could help ease some of those concerns.

OpenAI strikes 7-year deal with Amazon to scale ChatGPT

Meanwhile, Amazon’s 11-year-old Alexa service, an early leader in the voice assistant market, was slow to bring to market an enhanced version, with competition building from generative AI companies, namely OpenAI.

Amazon released Alexa+ in February. But it’s unclear how well the upgraded Alexa, as well as companion devices that debuted in September, will fare against rivals and whether consumers will rush to buy them over the holidays.

Jassy has been searching for Amazon’s next opportunity, or “pillar,” for growth after e-commerce, cloud and its Prime membership program. The company has made big bets on satellite internet, health care, grocery, entertainment and self-driving vehicles, but with varying degrees of success.

Widespread cuts

The layoffs hit nearly all of Amazon’s business units, from logistics, AWS, retail and grocery stores to Prime Video, advertising and gaming, according to people familiar with the matter and employee posts on LinkedIn.

Jassy told investors last week that the cuts weren’t triggered by financial strain or AI replacing workers. He said he’s responding to a “culture” issue inside the company, spurred in part by a multiyear hiring spree that left it with “a lot more layers” and slower decision-making.

Current and former staffers, most of whom asked not to be named in order to speak candidly on the subject, told CNBC that several years of persistent cost cutting and layoffs have damaged morale, while pressure has simultaneously been building to innovate faster, especially around AI.

Amazon declined to comment.

Jassy outlined his plan to flatten Amazon’s structure in September 2024, at the same time that he instructed staffers to return to five days a week in the office. He set a goal for each major organization inside Amazon to increase the ratio of individual contributors to managers by at least 15% by the end of the first quarter of 2025.

He also established a “no bureaucracy email alias” for employees to flag unnecessary processes or rules. In September of this year, Jassy said that led to about 455 changes inside the company.

Jassy’s cost cuts haven’t just been around layoffs. He’s shuttered several of Amazon’s physical store chains and axed some of its more unprofitable or unproven bets, including a roving sidewalk robot, telehealth service, health and fitness wearable, and a virtual tours initiative.

An employee in Amazon’s cloud unit said in an interview that efforts to slash management layers and reduce costs have made staffers feel like they’re under an “incredible amount of pressure” and “burdened with more work” than before. The potential for more layoffs next year has created further anxiety, the person added.

Is AI behind recent job cuts? Here’s what to know

A staffer in Amazon’s customer support division who was laid off last week after 15 years at the company described how the push to flatten organizations meant “they remove people but not the work.” The person said senior leadership appears “extremely disconnected from the workers.”

In the memo announcing the latest layoffs, human resources chief Beth Galetti used the phrase “staying nimble” in the headline.

It quickly became a meme on internal Slack channels and in Reddit threads. One image posted on Slack shows Keanu Reeves in “The Matrix,” labeled with the word “employees,” attempting to dodge a bullet labeled “Staying nimble, getting stronger, reducing layers, shifting resources.”

Another meme shows a cat with the animatronic bear from “Five Nights at Freddy’s,” a popular horror video game, lurking behind it and labeled with the title of the memo, “Staying nimble and continuing to strengthen our organizations.”

That’s not to say the changes are universally opposed. An AWS employee told CNBC that some organizations became too bloated and that fewer layers would help speed up decision-making. A former manager in Amazon’s retail business said the company overhired in recent years, creating too many layers of management.

AI doubts

Then there’s the impact of AI.

In June, Jassy said efficiency gains from using AI internally would shrink Amazon’s corporate staff in the coming years. The company is already reining in the growth of its white-collar workforce.

At the same time, Amazon is racing to keep up with the other hyperscalers by aggressively investing in AI infrastructure. In its earnings report last week, the company said it plans to boost capital expenditures this year to $125 billion, up from an earlier estimate of $118 billion. CFO Brian Olsavsky said that number will likely increase in 2026.

Amazon has also pushed corporate employees to use AI in their work and regularly experiment with internal tools. The company monitors AI adoption by employees, and some staffers were counseled to use the services more to speed up their work, or were informed that their usage could be factored into performance evaluations, according to three people familiar with the matter.

Workers are asking for clarity.

Amazon Employees for Climate Justice, an internal advocacy group, published an open letter on its website last week calling on Amazon executives to establish a “more responsible rollout of AI” and urging staffers to co-sign it.

“We’re the workers who develop, train and use AI, so we have a responsibility to intervene,” AECJ wrote.

While Jassy is making the case that AI agents will transform work for the better and make jobs “even more exciting and fun” than they currently are, AECJ members suggest they may be planting the seeds of their own demise.

“Amazon is forcing us to use AI while investing in a future where it’s easier to discard us,” they wrote.

Preston Arquette, who was laid off from Amazon’s e-commerce platform team last week, said he’s not “anti-AI” but he questioned whether the technology has led to tangible results inside the company.

“In my role, I didn’t see the kind of efficiencies or improvements that would make you think all these layoffs are necessary,” Arquette said in a text message.

Medicaid Eligibility Income Chart by State (Updated Nov. 2025)

Last updated: November 04, 2025

The table below shows Medicaid’s monthly income limits by state for seniors. Income is not the only eligibility factor for Medicaid long-term care; there is also an asset limit and level of care requirement. Additionally, there are state-specific details. Click on the state name to see that state’s complete Medicaid eligibility criteria.

A free, non-binding Medicaid Eligibility Test is available here. This test takes approximately 3 minutes to complete.

The maximum income limits vary dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid, and the type of Medicaid for which they are applying. Nursing Home Medicaid may have a different income limit than Medicaid Home and Community Based Services, and both of those may differ from the Aged, Blind and Disabled Medicaid income limits.

Exceeding the income limit does not mean an individual cannot qualify for Medicaid. Most states have multiple pathways to Medicaid eligibility, such as a Medically Needy Pathway. Furthermore, many states allow the use of Miller Trusts or Qualified Income Trusts to help persons who cannot afford their care costs to become income-eligible. There are also Medicaid Planning Professionals that employ other complicated techniques to help persons become eligible.

What Happens to One’s Income When They Enter a Nursing Home

While persons residing in Medicaid-funded nursing homes are generally permitted to have monthly income as high as $2,982 in 2026, they are not permitted to keep all of it. Instead, nearly all of their income except for a Personal Needs Allowance (which ranges for $30 – $200 / month), must go towards paying for their care costs. Often, the nursing home coordinates directly with Social Security so the income a resident would have otherwise received goes straight to the nursing home.

What Happens to One’s Income When They Qualify for a Medicaid HCBS Waiver

When persons receive Medicaid long-term care at home or “in the community” (outside of a nursing home) through a Medicaid Waiver, they still have expenses that must be paid. Rent, food, and utilities, as an example, are expenses that end when one enters a nursing home, but continue when one receives Medicaid at home. Therefore, Medicaid beneficiaries that receive assistance through a Medicaid HCBS Waiver are permitted to keep their monthly income (up to a certain amount) to pay those expenses.

Should one’s income exceed the limits in the table below, it may still be possible to qualify for Medicaid through working with a Certified Medicaid Planner. Find a Medicaid Planner that provides services in your area.

| 2026 Medicaid Eligibility Income Chart – Updated Nov. 2025 | ||||

| State | Type of Medicaid | Single | Married (both spouses applying) | Married (one spouse applying) |

| Alabama | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alabama | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alabama | Regular Medicaid / Medicaid for Elderly and Disabled | $1,014 / month | $1,511 / month | $1,511 / month |

| Alaska | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alaska | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alaska | Regular Medicaid / Aged Blind and Disabled | $1,795 / month (eff. 1/25 – 12/25) | $2,658 / month (eff. 1/25 – 12/25) | $2,658 / month (eff. 1/25 – 12/25) |

| Arizona | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arizona | Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arizona | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 2/25 – 1/26) | $1,763 / month (eff. 2/25 – 1/26) | $1,763 / month (eff. 2/25 – 1/26) |

| Arkansas | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arkansas | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arkansas | Regular Medicaid / Aged Blind and Disabled | $1,043.33 / month (eff. 4/25 – 3/26) | $1,410 / month (eff. 4/25 – 3/26) | $1,410 / month (eff. 4/25 – 3/26) |

| California | Institutional / Nursing Home Medicaid | No income limit, but resident is only permitted to keep $35 / month. | No income limit, but resident is only permitted to keep $35 / month. | No income limit, but resident is only permitted to keep $35 / month. |

| California | Medicaid Waivers / Home and Community Based Services | $1,801 / month (eff. 4/25 – 3/26) | $2,433 / month (eff. 4/25 – 3/26) | $2,433 / month for applicant (eff. 4/25 – 3/26) |

| California | Regular Medicaid / Aged Blind and Disabled | $1,801 / month (eff. 4/25 – 3/26) | $2,433 / month (eff. 4/25 – 3/26) | $2,401 / month (eff. 4/25 – 3/26) |

| Colorado | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Colorado | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Colorado | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Connecticut | Institutional / Nursing Home Medicaid | Income must be less than the cost of nursing home | Income must be less than the cost of nursing home | Income must be less than the cost of nursing home |

| Connecticut | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Connecticut | Regular Medicaid / Aged Blind and Disabled | $1,370 / month (eff. 3/25 – 4/26) | $2,198 / month (eff. 3/25 – 4/26) | $1,663 / month (eff. 3/25 – 4/26) |

| Delaware | Institutional / Nursing Home Medicaid | $2,485 / month | $4,970 / month ($2,485 / month per spouse) | $2,485 / month for the applicant |

| Delaware | Home and Community Based Services / Long Term Care Community Services | $2,485 / month | $4,970 / month ($2,485 / month per spouse) | $2,485 / month for the applicant |

| Delaware | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Florida | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Florida | Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Florida | Regular Medicaid / Medicaid for Aged and Disabled | $1,149 / month (eff. 4/25 – 3/26) | $1,522 / month (eff. 4/25 – 3/26) | $1,522 / month (eff. 4/25 – 3/26) |

| Georgia | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Georgia | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Georgia | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Hawaii | Institutional / Nursing Home Medicaid | No hard income limit. One’s entire income except for $50 / month must go towards cost of care. | No hard income limit. Each spouse’s entire income except for $50 / month must go towards cost of care. | No hard income limit. Applicant’s entire income except for $50 / month must go towards cost of care. |

| Hawaii | Home and Community Based Services | If one lives at home $1,500 / month (eff. 2/25 – 1/26) | Each spouse is considered separately. If they are living at home, each spouse can have up to $1,500 / month. (eff. 2/25 – 1/26) | If one lives at home, applicant income limit of $1,500 / month (eff. 2/25 – 1/26) |

| Hawaii | Regular Medicaid / Aged Blind and Disabled | $1,500/ month (eff. 2/25 – 1/26) | $2,027 / month (eff. 2/25 – 1/26) | $2,027/ month (eff. 2/25 – 1/26) |

| Idaho | Institutional / Nursing Home Medicaid | $3,002 / month | $5,984 / month | $3,002 / month for applicant |

| Idaho | Medicaid Waivers / Home and Community Based Services | $3,002 / month | $5,984 / month | $3,002 / month for applicant |

| Idaho | Regular Medicaid / Aged Blind and Disabled | $1,047 / month | $1,511 / month | $1,511 / month |

| Illinois | Institutional / Nursing Home Medicaid | $1,304 / month (eff. 4/25 – 3/26) | $1,762 / month (eff. 4/25 – 3/26) | $1,304 / month for applicant (eff. 4/25 – 3/26) |

| Illinois | Medicaid Waivers / Home and Community Based Services | $1,304 / month (eff. 4/25 – 3/26) | $1,762 / month (eff. 4/25 – 3/26) | $1,304 / month for applicant (eff. 4/25 – 3/26) |

| Illinois | Regular Medicaid / Aid to Aged Blind and Disabled | $1,304 / month (eff. 4/25 – 3/26) | $1,762/ month (eff. 4/25 – 3/26) | $1,762 / month (eff. 4/25 – 3/26) |

| Indiana | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Indiana | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Indiana | Traditional Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) |

| Iowa | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Iowa | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Iowa | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Kansas | Institutional / Nursing Home Medicaid | No set income limit. Income over $62 / month must go towards one’s cost of care. | No set income limit. Income over $62 / month (per spouse) must go towards one’s cost of care. | No set income limit. Applicant’s income over $62 / month must go towards one’s cost of care. |

| Kansas | Medicaid Waivers / Home and Community Based Services | No set income limit. Income over $2,982 / month must be paid towards one’s cost of care. | No set income limit. Income over $2,982 / month (per spouse) must be paid towards one’s cost of care. | No set income limit. Applicant’s income over $2,982 / month must be paid towards one’s cost of care. |

| Kansas | Regular Medicaid / Aged Blind and Disabled | $967 / month (eff. 7/1/25) | $1,450 / month (eff. 7/1/25) | $1,450 / month (eff. 7/1/25) |

| Kentucky | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Kentucky | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Kentucky | Regular Medicaid / Aged Blind and Disabled | $235 / month | $291 / month | $291 / month |

| Louisiana | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Louisiana | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Louisiana | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Maine | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Maine | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Maine | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| Maryland | Institutional / Nursing Home Medicaid | Cannot exceed the cost of nursing home care | Cannot exceed the cost of nursing home care | Applicant’s income cannot exceed the cost of nursing home care |

| Maryland | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Maryland | Regular Medicaid / Aged Blind and Disabled | $350 / month | $392 / month | $392 / month |

| Massachusetts | Institutional / Nursing Home Medicaid | No hard limit. Income over $72.80 / month must go towards care costs. | No hard limit. Income over $72.80 / month (per spouse) must go towards care costs. | No hard limit. Income over $72.80 / month must go towards care costs. |

| Massachusetts | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Massachusetts | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) |

| Michigan | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Michigan | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Michigan | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) |

| Minnesota | Institutional / Nursing Home Medicaid | $1,305 / month (eff. 7/25 – 6/26) | $1,764 / month (eff. 7/25 – 6/26) | $1,305 / month for applicant (eff. 7/25 – 6/26) |

| Minnesota | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Minnesota | Regular Medicaid / Elderly Blind and Disabled | $1,305 / month (eff. 7/25 –6/26) | $1,764 / month (eff. 7/25 –6/26) | $1,764 / month (eff. 7/25 –6/26) |

| Mississippi | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Mississippi | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Mississippi | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Missouri | Institutional / Nursing Home Medicaid | All available income except for $50 / month must be paid towards care | All available income except for $50 / month (per spouse) must be paid towards care | All applicant’s available income except for $50 / month must be paid towards care |

| Missouri | Medicaid Waivers / Home and Community Based Services | Structured Family Caregiving Waiver ($1,109 / month – eff. 4/25 – 3/26) Aged & Disabled Waiver ($1,690 / month – eff. 1/25 – 12/25) | Structured Family Caregiving Waiver ($1,109 / month per spouse – eff. 4/25 – 3/26) Aged & Disabled Waiver ($1,690 / month per spouse – eff. 1/25 – 12/25) | Structured Family Caregiving Waiver ($1,109 / month for applicant – eff. 4/25 – 3/26) Aged & Disabled Waiver ($1,690 / month for applicant – eff. 1/25 – 12/25) |

| Missouri | Regular Medicaid / Aged Blind and Disabled | $1,109 / month for Aged & Disabled (eff 4/25 – 3/26). $1,305 / month for Blind (eff 4/25 – 3/26). | $1,499 / month for Aged & Disabled (eff 4/25 – 3/26). $1,763 / month for Blind (eff 4/25 – 3/26). | $1,499 / month for Aged & Disabled (eff 4/25 – 3/26). $1,763 / month for Blind (eff 4/25 – 3/26). |

| Montana | Institutional / Nursing Home Medicaid | Income must be equal or less than the cost of nursing home care | Income must be equal or less than the cost of nursing home care | Applicant’s income must be equal or less than the cost of nursing home care |

| Montana | Medicaid Waivers / Home and Community Based Services | $994 / month | $1,988 / month ($994 / month per spouse) | $994 / month for applicant |

| Montana | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Nebraska | Institutional / Nursing Home Medicaid | $1,305 / month (eff. 1/25 – 12/25) | $1,305 / month per spouse (eff. 1/25 – 12/25) | $1,305 / month for applicant (eff. 1/25 – 12/25) |

| Nebraska | Medicaid Waivers / Home and Community Based Services | $1,305 / month (eff. 1/25 – 12/25) | $1,305 / month per spouse (eff. 1/25 – 12/25) | $1,305 / month for applicant (eff. 1/25 – 12/25) |

| Nebraska | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| Nevada | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Nevada | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Nevada | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| New Hampshire | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Hampshire | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Hampshire | Regular Medicaid / Old Age Assistance | $981 / month (eff. 1/25 – 12/25) | $1,451 / month (eff. 1/25 – 12/25) | $1,451 / month (eff. 1/25 – 12/25) |

| New Jersey | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Jersey | Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Jersey | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| New Mexico | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Mexico | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Mexico | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| New York | Institutional / Nursing Home Medicaid | $1,800 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) | $1,800 / month for applicant (eff. 1/25 – 12/25) |

| New York | Medicaid Waivers / Home and Community Based Services | $1,800 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) | $1,800 / month for applicant (eff. 1/25 – 12/25) |

| New York | Regular Medicaid / Aged Blind and Disabled | $1,800 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) |

| North Carolina | Institutional / Nursing Home Medicaid | Must be less than the amount Medicaid pays for nursing home care (est. $7,898.40 – $11,217.90 / mo.) | Must be less than the amount Medicaid pays for nursing home care (est. $7,898.40 – $11,217.90 / mo.) | Applicant’s income must be less than the amount Medicaid pays for nursing home care (est. $7,898.40 – $11,217.90 / mo.) |

| North Carolina | Medicaid Waivers / Home and Community Based Services | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,305 / month for applicant (eff. 4/25 – 3/26) |

| North Carolina | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) |

| North Dakota | Institutional / Nursing Home Medicaid | No set limit. Applicant is allowed $100 for personal needs and the remaining income goes towards the cost of care. | No set limit. Couple is allowed $200 for personal needs. The remaining income goes towards the cost of care. | No set limit. Applicant is allowed $100 for personal needs and the remaining income goes towards the cost of care |

| North Dakota | Medicaid Waivers / Home and Community Based Services | $1,174 / month (eff. 4/25 – 3/26) | $1,587 / month (eff. 4/25 – 3/26) | $1,174 / month for applicant (eff. 4/25 – 3/26) |

| North Dakota | Regular Medicaid / Aged Blind and Disabled | $1,174 / month (eff. 4/25 – 3/26) | $1,587 / month (eff. 4/25 – 3/26) | $1,587 / month (eff. 4/25 – 3/26) |

| Ohio | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Ohio | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Ohio | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Oklahoma | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oklahoma | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oklahoma | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) |

| Oregon | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oregon | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oregon | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Pennsylvania | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Pennsylvania | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Pennsylvania | Regular Medicaid / Aged Blind and Disabled | $989.10 / month (eff. 1/25 – 12/25) | $1,483.30 / month (eff. 1/25 – 12/25) | $1,483.30 / month (eff. 1/25 – 12/25) |

| Rhode Island | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Rhode Island | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Rhode Island | Regular Medicaid / Elders and Adults with Disabilities (EAD) | $1,304 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| South Carolina | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Carolina | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Carolina | Regular Medicaid / Aged Blind or Disabled | $1,305 / month (eff 3/25 – 2/26) | $1,763 / month (eff 3/25 – 2/26) | $1,763 / month (eff 3/25 – 2/26) |

| South Dakota | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Dakota | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Dakota | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Tennessee | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Tennessee | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Tennessee | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Texas | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Texas | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Texas | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Utah | Institutional / Nursing Home Medicaid | No income limit. One’s monthly income determines how much one must pay towards the cost of care. | No income limit. Each spouse’s monthly income determines how much each spouse must pay towards the cost of care. | No income limit. Applicant’s monthly income determines how much one must pay towards the cost of care. |

| Utah | Medicaid Waivers / Home and Community Based Services | Aging Waiver ($1,305 / month – eff. 3/25 – 2/26) New Choices Waiver ($2,982 / month – eff. 1/26 – 12/26) | Aging Waiver (Each spouse is allowed up to $1,305 / month – eff. 3/25 – 2/26) New Choices Waiver (Each spouse is allowed up to $2,982 / month – eff. 1/26 – 12/26) | Aging Waiver ($1,305 / month for applicant – eff. 3/25 – 2/26) New Choices Waiver ($2,982 / month for applicant month – eff. 1/26 – 12/26) |

| Utah | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) |

| Vermont | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Vermont | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Vermont | Regular Medicaid / Aged Blind and Disabled (outside Chittenden County) | $1,333 / month (eff. 1/25 – 12/25) | $1,333 / month (eff. 1/25 – 12/25) | $1,333 / month (eff. 1/25 – 12/25) |

| Vermont | Regular Medicaid / Aged Blind and Disabled (inside Chittenden County) | $1,441 / month (eff. 1/25 – 12/25) | $1,441 / month (eff. 1/25 – 12/25) | $1,441 / month (eff. 1/25 – 12/25) |

| Virginia | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Virginia | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Virginia | Regular Medicaid / Aged Blind and Disabled | $1,044 / month (eff. 1/25 – 12/25) | $1,410 / month (eff. 1/25 – 12/25) | $1,410 / month (eff. 1/25 – 12/25) |

| Washington | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Washington, DC | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington, DC | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington, DC | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| West Virginia | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| West Virginia | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| West Virginia | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Wisconsin | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wisconsin | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wisconsin | Regular Medicaid / Elderly Blind and Disabled (EBD) | $1,050.78 / month (eff. 1/25 – 12/25) | $1,582.05 / month (eff. 1/25 – 12/25) | $1,582.05 / month (eff. 1/25 – 12/25) |

| Wyoming | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wyoming | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wyoming | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

2 comments

Simply wish to say your article is as amazing The clearness in your post is just nice and i could assume youre an expert on this subject Well with your permission let me to grab your feed to keep updated with forthcoming post Thanks a million and please carry on the gratifying work

Excellent breakdown, I like it, nice article. I completely agree with the challenges you described. For our projects we started using Listandsell.us and experts for our service, Americas top classified growing site, well can i ask zou a question regarding zour article?