Market View Commentary 7-20-20

| Market Recap |

| WEEK OF JUL. 13 THROUGH JUL. 17, 2020 |

| The S&P 500 rose 1.25% last week as banks kicked off the Q2 earnings season with several reporting results above analyst expectations, and investors grew more hopeful for a coronavirus vaccine thanks to encouraging data from a vaccine candidate study.

Still, worries about a continued rise in COVID-19 cases kept the gains in check. The S&P 500 ended the week at 3,224.73, up from last week’s closing level of 3,185.04. This marks the index’s third consecutive weekly gain. The measure is now up 12% for the past three months but still down 0.19% for the year to date. The industrial sector had the largest percentage increase of the week, up 5.9%, followed by a 5.5% rise in materials and a 5.1% boost in health care. On the downside, technology led the decliners with a 1.2% drop, followed by a 0.5% slide in communication services. The activity comes as investors are weighing better-than-expected earnings results against signs the COVID-19 pandemic is far from over. As the number of coronavirus cases continues to rise, some US states are increasing restrictions by closing stores, bars, and restaurants in an effort to clamp down on the spread of the virus. Alongside industrials, shares of several airline operators climbed. While airlines have been warning of potential job cuts, investors are anticipating Congress may pass another aid package as aviation unions are calling for payroll aid to be extended by six months. United Airlines (UAL) shares jumped 3.8% this week. In materials, agriculture stocks rose amid bullish ratings and commentary from some analysts. Among them, shares of CF Industries (CF) climbed 8.0% as the fertilizer manufacturer received an investment-rating upgrade from Bank of America to buy from sell. The firm said it sees improving demand in India and Brazil. Shares of fellow fertilizer maker Mosaic (MOS) rose 9.0%. Also boosting the sector, Alcoa (AA) reported a narrower-than-expected Q2 adjusted net loss amid higher-than-expected revenue. Shares of Alcoa climbed more than 14.5% on the week. Meanwhile, the health care sector’s climb came as investors grew more optimistic about a COVID-19 vaccine. Shares of Moderna (MRNA) soared 51.5% as the company said interim results from an early-stage clinical study showed its vaccine candidate produced an immune response against the coronavirus that causes the respiratory disease. The financial sector also benefited from stronger-than-expected earnings reports this week, up 2.1%, as banks including Goldman Sachs (GS) and Morgan Stanley (MS) posted Q2 earnings above analysts’ expectations. Shares of Goldman Sachs climbed 2.9% on the week while Morgan Stanley shares rose 5.2%. The consumer discretionary sector, however, was weighed down by a 7.4% drop in Amazon.com (AMZN) shares while the technology sector was weighed down by decliners that included Microsoft (MSFT), down 5.1%, as investors braced for the companies’ upcoming earnings reports. Next week, investors also will get data on the housing market for June with existing home sales being released Wednesday and new home sales on Friday. July readings for manufacturing and services purchasing managers indexes are also due Friday. Provided by MT Newswires. |

My thoughts for this week?

- Stay at home stocks

- Earnings – are companies going to get a pass on earnings

MSFT – What will push them up?

- Office revenue

- Cloud computing/software

- Foreign market expansion

- How many employees working from home are going to be less efficient while being paid the same?

- Pretty much already at analyst expected price level

FB –

- Companies pulling ads from facebook/ boycott

- “Stay at home stock” positivity outweging boycott?

- More active users

- Work well as a company remotely

- Some bad headlines as companies pull ads. Will it be enough to hurt?

To me FB is better situated to continue to profit from the current stay at home environment.

Earnings soon:

AAPL 07/30 AMC

BA 07/29 BMO

BIDU 08/17 est

COST 09/24 AMC

DIS 08/04 AMC

F 07/30 AMC

FB 07/29 AMC

KEY 07/22 BMO

LLY 07/30 BMO

MU 09/24 AMC

TGT 08/19 BMO

UAA 07/28 BMO

V 07/28 AMC

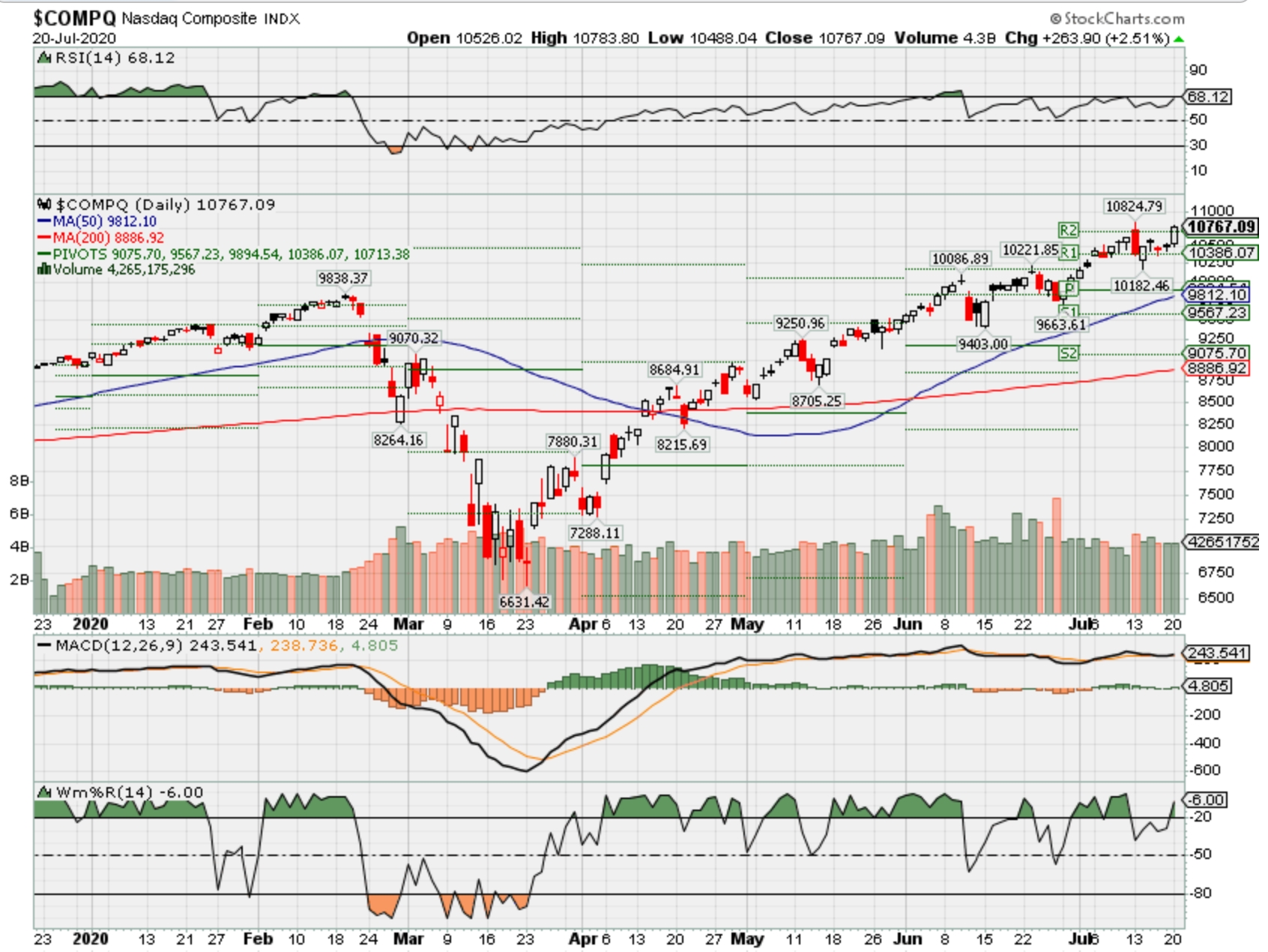

Where will our markets end this week?

DJIA – Bullish

Where Will the SPX end July 2020?

07-20-2020 +1.5%

07-13-2020 +1.0%

07-07-2020 +0.0%

06-29-2020 +0.0%

Earnings:

Mon: HAL, PHG, ZION

Tues: KO, LMT, PM, COF, ISRG, SNAP, TXN, UAL, AMTD

Wed: KEY, LAD, NDAQ, DFS, KMI, LVS, MSFT, TSLA, VMI, WHR

Thur: ALK, AAL, T, HSY, KMB, PHM, LUV, TWTR, UNP, ETFC, MAT, TMUS, FCX, AUY, INTC

Fri: AXP, HON, SLB, VZ

Econ Reports:

Mon:

Tues:

Wed: MBA, FHFA Housing Price Index, Existing Home Sales

Thur: Initial Claims, Continuing Claims, Leading Indicators

Fri: New Home Sales

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Preparing protection for earnings

Adjusting options after verified trends after earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Jamie Dimon’s warning for the U.S. economy — nobody knows what comes next

PUBLISHED SAT, JUL 18 20209:45 AM EDTUPDATED SAT, JUL 18 202012:42 PM EDT

KEY POINTS

- The range of outcomes for the economy in the second half is incredibly wide: JPMorgan Chase sees no fewer than five different paths it can take.

- The bank has gotten more pessimistic, seeing unemployment in its default “base” scenario hitting nearly 11% by the end of this year, 4.3% worse than when it made the same forecast in April.

- In a worst-case scenario where the virus surges further in the fall, forcing another round of widespread shutdowns, unemployment could peak at roughly 23%, the bank said.

- “The word unprecedented is rarely used properly,” Dimon said this week. “This time, it’s being used properly. It’s unprecedented what’s going on around the world, and obviously Covid itself is a main attribute.”

Attempting to forecast the path of the American economy right now is like peering into a dark well — nobody knows how deep the hole goes.

Even Jamie Dimon, CEO of JPMorgan Chase and veteran prognosticator of all things financial, is flummoxed. As head of the financial system’s bellwether, a bank with $3.2 trillion in assets that serves almost half of U.S. households and a wide swath of its businesses, Dimon has a unique vantage on the world’s largest economy.

“The word unprecedented is rarely used properly,” Dimon said this week after JPMorgan reported second-quarter earnings. “This time, it’s being used properly. It’s unprecedented what’s going on around the world, and obviously Covid itself is a main attribute.”

More than four months into the coronavirus pandemic, the financial damage wrought by the outbreak has yet to fully register. Take JPMorgan, for instance: The bank added $15.7 billion to reserves for expected loan losses in the first half of this year. But second-quarter loan charge-offs in its sprawling retail bank actually declined 3% to $1.28 billion, or roughly the same level seen before the virus.

That’s because the $2.2 trillion CARES Act injected billions of dollars into households and businesses, masking the impact of widespread closures. As key components of that law begin to phase out, the true pain may begin. As many as 25.6 million Americans will lose enhanced unemployment benefits by the end of July, and it’s unclear if Congress will extend the $600 per week in additional payments that has buoyed so many households.

“In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that’s true here,” Dimon said. “Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you’re just not going to see it right away because of all the stimulus.”

The bank has provided forbearance on 1.7 million accounts; so far, more than half of credit card and mortgage customers in the programs have made at least one monthly payment. But these vulnerable customers could stop paying altogether as their federal benefits lapse.

Coupled with the historic steps taken by the Federal Reserve to prop up financial markets, several banks actually had a banner quarter. JPMorgan earned the most revenue ever in the second quarter, $33.8 billion, largely driven by a boom in trading activity and a rush by corporations to tap debt and equity markets. It was the best quarter for Wall Street in a decade, allowing Goldman Sachs and Morgan Stanley to notch records as well.

But investors haven’t piled into bank stocks; shares of JPMorgan have barely budged since posting results. Fear of the future, of the long term impact of defaults and low interest rates, and of potential dividend cuts, is keeping them back.

Complicating matters is the surge in coronavirus cases in the U.S., which topped 70,000 new daily cases reported for the first time Friday as outbreaks worsened in the South and West. That has prompted states including California to reverse aspects of its economic reopening, and even cities that have managed to suppress the virus are taking precautions.

Banks have to provision for potential loan losses, but in the pandemic, they are flying blind. JPMorgan sees no fewer than five different paths the economy can take. The firm has gotten more pessimistic, seeing unemployment in its default “base” scenario hitting nearly 11% by the end of this year, 4.3% worse than when it made the same forecast in April.

In a worst-case scenario where the virus surges further in the fall, forcing another round of widespread shutdowns, unemployment could peak at roughly 23%, the bank said.

The range of outcomes for the country is incredibly wide, and that will directly impact households, businesses and ultimately, investors.

If the more benign base case happens, JPMorgan is largely done setting aside cash for defaults. In that event, it could begin to repurchase billions of dollars in its stock again, perhaps as early as the fourth quarter. But in the most dire scenarios, JPMorgan could be forced to cut its 90 cent quarterly dividend to preserve capital.

At this point, it’s not much more than a guess, Dimon says.

“If you look at the base case, an adverse case, an extremely adverse case, they’re all possible and we’re just guessing at the probabilities of those things; that’s all we’re doing,” he said. “You’re going to have a much murkier economic environment going forward than you had in May and June, and you have to be prepared for that.”

“We simply don’t know,” Dimon added, “and, by the way, we’re wasting time guessing.”

Top analysts are betting on stocks like Apple and Disney for long-term gains

PUBLISHED SUN, JUL 19 20209:26 AM EDTUPDATED SUN, JUL 19 20209:29 AM EDT

Harriet Lefton, TipRanks.com

KEY POINTS

- We used TipRanks analyst forecasting service to pinpoint Wall Street’s best-performing analysts.

- They include Apple, Akebia Therapeutics, UnitedHealth, Disney, ServiceNow and Zscaler.

- In this unprecedented time, it makes sense to follow the stock picks of analysts with a proven track record of success.

This earnings season, investors have to balance spiking coronavirus levels against encouraging vaccine progress as well as rising trade tensions with China.

In this unprecedented time, it makes sense to follow the stock picks of analysts with a proven track record of success.

We used TipRanks analyst forecasting service to pinpoint Wall Street’s best-performing analysts. These are the analysts with the highest success rate and average return measured on a one-year basis- and factoring in the number of ratings made by each analyst.

Here are the best-performing analysts’ six favorite stocks:

Apple

On July 16, five-star Canaccord Genuity analyst Michael Walkley reiterated his Apple buy rating, while significantly ramping up the price target from $310 to $444. Despite Apple rising 33% year-to-date, his new stock price forecast still indicates 14% upside from current levels.

Walkley cites the 5G upgrade cycle as a likely catalyst in 2021 as well as a continued business mix shift towards high-margin services as behind his increasingly bullish take on the stock.

Apple’s ecosystem approach, including an installed base of more than 1.5 billion devices, should continue to generate strong services revenue, says Walkley. He sees the higher-margin services revenue growth ultimately outpacing total company growth while delivering strong attach rates for multiple hardware purchases. That’s alongside a market share leading position in wearables with Watch and AirPods, and $83 billion in net cash to invest in long-term growth.

“Ahead of the Covid-19 shock to global economies, we were encouraged by the strong demand for the iPhone 11 lineup and believe Apple will maintain its market share leadership of premium-tier smartphones that should expand with its iPhone 12 lineup supporting 5G along with other strong features,” the analyst told investors.

One of TipRanks’ Top 100 analysts, Walkley scores a stellar 17.1% average return per recommendation.

Akebia Therapeutics

Shares in Akebia have almost doubled year-to-date, and with good reason, says HC Wainwright analyst Ed Arce. He reiterated a buy rating on the biopharma on July 15, citing a new study evaluating vadadustat for coronavirus-related acute respiratory distress syndrome.

The investigator-sponsored, placebo-controlled study is conducted under an investigational new drug application filed with the Food and Drug Administration for up to 300 adult patients with coronavirus related hypoxemia. Hypoxemia is a below-normal level of oxygen in the blood, that can signal breathing or circulation-related difficulties.

Arce believes Akebia’s lead product candidate vadadustat could be efficacious in preventing lung injury in patients who experience acute respiratory distress syndrome, and protecting other organs, according to a report on July 15. However, his valuation on the company is primarily based on vadadustat’s potential US approval for anemia due to chronic kidney disease.

This means that the upcoming top-line data readout in mid-2020 from the second Phase 3 pivotal program of vadadustat in non-dialysis-dependent kidney disease is the next major milestone for the stock, says the analyst. He calculates for an early 2022 launch for vadadustat with a $2.8 billion peak U.S. sales in 2030. He has a $17 stock price forecast, a 38% upside potential.

Arce is ranked 265 out of over 6,750 analysts, thanks to a 17.7% average return per rating.

UnitedHealth

Diversified healthcare giant UnitedHealth has just reported a large second-quarter earnings beat, while maintaining its conservative guidance. Oppenheimer’s Michael Wiederhorn reiterated his UnitedHealth buy rating with a $353 price target, up from $343 previously.

UnitedHealth produced strong second-quarter results as medical costs declined precipitously due to the pandemic, the analyst explained. For instance, UnitedHealth reported second-quarter adjusted earnings per share of $7.12, easily beating consensus of $5.28. Looking forward, UnitedHealth stuck with its fiscal-year 2020 adjusted earnings-per-share guidance of $16.25 to $16.55.

“Since management is factoring in elevated medical costs in its 2H:20 outlook and 2021 pricing, we believe there should be upside to numbers should costs remain depressed due to the environment,” Wiederhorn wrote on July 15. As a result, the analyst told investors “we would continue to be long-term buyers.”

In general, Wiederhorn believes UnitedHealth is well-positioned by virtue of its diversification, strong track record, elite management team, and exposure to certain higher growth businesses. Meanwhile the company’s Optum business is a nice complement to its core managed care operations and continues to account for a large share of earnings.

Ranked by TipRanks as one of the Top 100 analysts, Wiederhorn boasts a 70% success rate and 16.3% return on his recommendations.

Disney

Top Goldman Sachs analyst Brett Feldman has just initiated coverage on Disney, starting the House of Mouse off with a buy rating and $137 stock price forecast, a 13% upside potential. Disney is rapidly emerging as a global streaming leader, says Feldman, and ranks well ahead of peers on its direct-to-consumer video offering, Disney+.

According to the Goldman analyst, the market is undervaluing Disney’s direct-to-consumer segment by a more than 50%. He sees Disney+ reaching a “conservative” 150 million subscribers by 2025 out of a total market of 721 million, and achieving profitability by 2021, versus a consensus of 2023.

As Disney approaches Netflix-like scale, it will approach Netflix-like economics, says Feldman. He estimates that the market is now valuing Disney’s direct-to-consumer segment at a 50% to 60% discount to Neflix. “We believe such a material discount is unwarranted and expect this valuation gap to close as Disney+ ramps its customer base and achieves profitability,” the analyst argued.

Moreover, Feldman expects that Disney’s Parks and Studios segments will fully recover post-coronavirus, adding that synergies between these two segments are also underappreciated.

Feldman scores a 77% success rate and 17.1% average return on a one-year basis.

ServiceNow

Ahead of ServiceNow’s second-quarter earnings report, five-star RBC Capital analyst Alex Zukin singled out the company as a top stock to watch. He called the cloud company one of his “favorite names” and boosted his stock price forecast from $372 to $500 on July 14.

“Our discussions with partners lead us to believe the 2Q report will be strong as NOW potentially becomes both a near and longer-term Remote Work beneficiary” the analyst commented.

Specifically, Zukin is modeling for above-guidance second-quarter subscriber revenue of $999.7 million, or 28% year over year, but adds that the company could score a beat close to historical levels of 1.3%, implying $1.013 billion in revenue.

In particular, he sees the IT product portfolio driving demand improvement in the quarter, with businesses seeking to optimize remote working and ensure operational resiliency. Feedback was solidly more positive than last quarter, says Zukin, and partner tone was notably more confident.

“Our research suggests ServiceNow has leveraged its strong IT incumbency, flexible product portfolio, and best-in-class sales leadership to capitalize on shifting immediate customer priorities and level-up its position as a strategic vendor to its customers” the Top 20 analyst concluded.

Zscaler

“Cloud momentum building for the ZS Freight Train into 2021” cheered Wedbush analyst Daniel Ives on July 16. He reiterated his buy rating on the cloud-based cybersecurity stock while bumping up his price target to $150 from $100. The new price target suggests 25% further upside potential lies ahead.

Based on recent checks in the field for the July quarter, the analyst is confident that Zscaler’s deal flow is holding up extremely well in this coronavirus pandemic environment. The company’s DNA plays right into the Remote access/work from home cloud theme serving a major need given the lockdowns globally, says Ives.

“Across the board we are seeing an uptick in deal flow for ZS, as the company’s unique product suite in the sweets spot as more enterprises/governments shift workloads to the cloud” Ives told investors.

Plus larger deals are getting accelerated by C-level decision makers with enterprises needing stepped up cloud deployments as well as security architecture.

Overall, he believes ZS looks to be in the driver’s seat on the cloud cyber security shift over the next decade and the current global lockdown environment will only accelerate its ability to capture it. “In our opinion, ZS is the best pure play in the cloud security arena, which we believe is still in the very early innings of taking off” the five-star analyst summed up.

4 ways your tax return can help you save money in 2020

PUBLISHED SUN, JUL 19 20209:30 AM EDT

Darla Mercado, CFP®@DARLA_MERCADO

KEY POINTS

- With Tax Day out of the way, it’s time to review your 2019 return and spot opportunities for saving on taxes for the remainder of the year.

- Tips you can utilize include boosting your 401(k) contribution to lower your taxable income and reevaluating your withholding to make sure you’re paying just the right amount in taxes.

- The CARES Act also has 2020 tax planning implications. You have until Aug. 31 to roll back required minimum distributions into an IRA, which can cut your tax bill.

Resist the urge to shove your completed 2019 tax return into a drawer. It could help you save money next spring.

Taxpayers and tax professionals were focused on the sprint to July 15 – the new deadline for 2019 federal income tax returns and payments.

Indeed, the IRS received 147.1 million individual income tax returns as of July 10, the most recent data available. It issued more than 96 million tax refunds, delivering an average check of $2,762.

More from Personal Finance:

Small businesses rehire staff but cut pay and hours

Treasury canceling stimulus checks to dead recipients

Coronavirus unemployment claims are worst in history

Now that you know where you stand with Uncle Sam, it’s time to strategize for the remainder of 2020.

“You look at the returns and what things look like for clients,” said Albert Campo, CPA and managing partner of AJC Accounting Services in Manalapan, New Jersey. “Were they in a significant deficit position? This is why and this is what needs to change.”

Here are four steps you can take to improve your outcomes when you file next spring – and potentially keep a few more of your dollars in your pocket.

1. Review your withholding

A hefty check from Uncle Sam feels good, but the reality is that you’re only getting your own money back from the federal government.

Whether you get a huge bill or a generous refund from the IRS, it often comes down to how much income tax you are withholding from your paycheck during the year.

Withhold too much, and you wind up with an oversized refund from the government. The downside is that you’ll end up taking home less money.

Withhold too little, and you’ll keep more of your paycheck. However, you could end up on the hook for taxes.

Here’s another reason to revisit your withholding at work.

The Treasury Department and IRS have overhauled the way income taxes are pulled from your paycheck, bringing in new withholding tables and updating Form W-4, which employees use to tell their employer how much to withhold.

Talk to your tax professional to get a sense of how to best fill out your W-4. The IRS also has a withholding calculator which you can use – along with your tax return – to hash out how much you want to pay Uncle Sam during the year.

2. Boost your workplace savings

Score a win-win for your finances by increasing your contribution to your 401(k) retirement plan at work.

This year, you can stash up to $19,500 in your 401(k), plus $6,500 if you’re age 50 and over.

Not only are you shoring up your own retirement nest egg, you’re also cutting your tax bill. Money you save in this plan is excluded from your taxable income, which trims your tax load.

Of course, the more you contribute to these accounts, the less you’ll be taking home. Make sure you understand how raising these contributions would affect your cash flow.

3. Undo or skip your 2020 RMD

The CARES Act, which went into effect this spring, allowed savers to skip the 2020 required minimum distribution out of retirement accounts.

This is the annual withdrawal you must take from your individual retirement account and 401(k) plans after you turn 70½ — or, starting this year, 72.

If you already took the money, however, you have until Aug. 31 to put it back. This applies to account holders, as well as beneficiaries of inherited IRAs.

Considering RMDs are subject to taxes, waiving a distribution or putting the money back could whittle your tax bill for 2020.

“It’s an enormous tax strategy,” said Adam Markowitz, enrolled agent at Howard L. Markowitz PA CPA in Leesburg, Florida. “I have to reach out to about 100 to 125 taxpayers and explain to them that they can put the money back.”

4. Collecting unemployment? Keep your documents

As more people apply for unemployment benefits, taxpayers must keep in mind the tax ramifications at play.

Any unemployment income you receive must be included in your income for that year. You could have income taxes withheld from your unemployment check by filing Form W-4V.

The other option is to pay quarterly estimated taxes on your unemployment. But you have to be mindful of the deadlines or else face penalties.

Many people don’t realize that unemployment is taxable.

Neal Stern

July 15 was the deadline for first- and second-quarter payments. The next one is on Sept. 15, followed by Jan. 15.

The government reports your unemployment income on Form 1099-G, which you’ll need when you file taxes next year.

“Many people don’t realize that unemployment is taxable,” said Neal Stern, CPA and member of the American Institute of CPA’s national CPA financial literacy commission. “There’s a decent chance that it will catch up with you and you’ll be stuck with something you really don’t want.”

Despite a massive recession, JPMorgan Chase just posted record revenue — here’s how the bank did it

PUBLISHED TUE, JUL 14 202012:18 PM EDTUPDATED TUE, JUL 14 20202:33 PM EDT

KEY POINTS

- JPMorgan posted a record $33.8 billion in second-quarter revenue because of shrewd moves made under CEO Jamie Dimon to build up its investment bank in the years after the financial crisis.

- Surging volatility and unprecedented steps taken by the Federal Reserve to support credit markets have created the best environment for trading and advising on debt and equity issuance in years.

- JPMorgan’s corporate and investment bank posted a record $5.5 billion profit for the second quarter, which is more money than most entire banks typically generated before the coronavirus pandemic.

- The bank’s Wall Street division helped offset losses in two of JPMorgan’s four main businesses, its consumer and commercial bank, as the firm set aside $8.9 billion for expected loan defaults across its operations.

JPMorgan Chase managed to throw off the most quarterly revenue in its history at the same time that the U.S. economy is in the throes of a sharp recession.

The bank posted $33.8 billion in second-quarter revenue, helping it earn a better-than-expected $4.69 billion in profit for the period, because of shrewd moves made under CEO Jamie Dimon to build up its investment bank in the years after the financial crisis.

JPMorgan is known to most as one of the biggest U.S. retail banks, with a coast-to-coast network of branches that has fueled much of the lender’s dominance over the past decade. Thanks to the coronavirus pandemic, that division has left the company exposed to billions of dollars in potential loan defaults across credit card, mortgage and auto lines.

But JPMorgan also has the world’s biggest Wall Street bank by revenue, a business that is helping it capture opportunities created by the response to the pandemic. Surging volatility and unprecedented steps taken by the Federal Reserve to support credit markets have created the best environment for trading and advising on debt and equity issuance in years.

Now, Dimon’s moves to grab market share in trading and investment banking from weakened European rivals like Deutsche Bank are looking especially smart. JPMorgan’s corporate and investment bank posted a record $5.5 billion profit for the second quarter, which is more money than most entire banks typically generated before the coronavirus pandemic.

The Wall Street division helped offset losses in two of JPMorgan’s four main businesses, its consumer and commercial bank, as the firm set aside $8.9 billion for expected loan defaults across its operations.

JPMorgan traders exceeded expectations that were already heightened for the quarter after management said in late May that markets revenue was headed for a 50% increase. That figure jumped by 79% to a record $9.7 billion, driven especially by strong fixed income trading.

Bond traders posted revenue of $7.3 billion, a 120% increase from a year earlier, crushing the $5.84 billion estimate by almost $1.5 billion. Equities traders posted revenue of $2.4 billion, beating the $2.07 billion estimate.

Investment banking revenue climbed 91% to $3.4 billion on record advisory fees as big corporate clients tapped debt and equity markets at a furious pace to build cash positions amid the uncertainty of the pandemic.

“We’ve raised record amounts of capital for our clients, advised them on strategic opportunities and helped them navigate the markets, all while facing personal challenges caused by the pandemic,” Daniel Pinto, co-president of JPMorgan and head of the corporate and investment bank, said Tuesday in a staff memo. “It’s difficult to predict what the rest of 2020 will look like, but we do expect to return to more normal activity levels.”

Meanwhile, JPMorgan’s retail banking division posted a $176 million loss, compared with a $4.2 billion profit a year earlier, driven by the addition of reserves in credit cards and other products. It was a similar story at the firm’s commercial bank, which posted a $691 million loss, compared with a $1 billion profit a year earlier.

The firm’s asset management division was less impacted by the pandemic, posting an 8% profit decrease to $658 million as it built loan loss reserves.

As for the path forward, it’s not entirely clear, JPMorgan executives conceded Tuesday. Federal stimulus programs have supported individuals and small businesses in the second quarter, masking the true impact of the pandemic, Chief Financial Officer Jennifer Piepszak said Tuesday on a conference call.

If a relatively benign scenario emerges, JPMorgan will have too much capital saved and could resume stock buybacks as early as the fourth quarter, Dimon told analysts. If a more severe recession happens, caused by a second wave of infections in the fall, the bank could be forced to cut its dividend, he said.

“We’re really hitting the moment of truth in the months ahead,” Piepszak said.

Wells Fargo shares tumble 5% after posting $2.4 billion loss, dividend slashed to 10 cents

PUBLISHED TUE, JUL 14 20207:56 AM EDTUPDATED TUE, JUL 14 202012:33 PM EDT

KEY POINTS

- The bank had a net loss of $2.4 billion in the second quarter, or a loss of 66 cents a share, worse than the 20 cents a share loss expected by analysts surveyed by Refinitiv.

- Revenue of $17.8 billion was also weaker than analysts’ $18.4 billion estimate.

- The bank also announced a new quarterly dividend of 10 cents a share, a deeper-than-expected reduction in its payout that may indicate the bank’s pessimism about the coming year.

- Shares of the San Francisco-based bank fell.

Wells Fargo on Tuesday posted its first quarterly loss since the Great Recession as the bank set aside $8.4 billion in loan loss reserves tied to the coronavirus pandemic.

The bank had a net loss of $2.4 billion in the second quarter, or a loss of 66 cents a share, worse than the 20 cents a share loss expected by analysts surveyed by Refinitiv. Revenue of $17.8 billion was also weaker than analysts’ $18.4 billion estimate.

Shares of the bank fell 5% in New York trading after falling as much as 8% earlier.

“We are extremely disappointed in both our second quarter results and our intent to reduce our dividend,” CEO Charlie Scharf said in the release. “Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter, which drove the $8.4 billion addition to our credit loss reserve in the second quarter.”

The embattled banking giant was widely expected to post a loss as it had telegraphed its need to set aside billions of dollars for soured loans tied to the pandemic. The company is laboring under a dozen regulatory consent orders tied to its 2016 fake accounts scandal, including one from the Federal Reserve that caps its asset growth. These have made running the bank during the coronavirus crisis harder, and Scharf strongly hinted last month that he would have to cut expenses and jobs this year.

The bank’s bleak outlook for profits is one reason it was forced by regulators to cut its dividend from its previous level of 51 cents a share.

But on Tuesday the bank announced a new quarterly payout of 10 cents a share, a deeper-than-expected reduction to its dividend that may indicate the bank’s pessimism about the coming year. Wells Fargo was the only bank among the six biggest U.S. lenders to be forced to cut its dividend after the annual Federal Reserve stress test; all the others are maintaining their quarterly payouts.

The bank’s quarterly loss is a sharp reversal from the firm’s pre-coronavirus results: A year ago, the bank posted $6.2 billion in second quarter profit.

Wells Fargo is also struggling to adjust to a lower interest rate environment. The bank’s net interest margin, a key measure of a bank’s profitability, plunged by 33 basis points from the prior quarter to 2.25%, below the 2.33% estimate of analysts surveyed by FactSet.

The bank is also hamstrung by its structure: Unlike JPMorgan Chase or Citigroup, Wells Fargo lacks a sizable Wall Street trading division, and that business has been on fire this year amid surging volatility and unprecedented Fed support. Record trading results helped JPMorgan beat expectations for the quarter.

In part because of the Fed restriction, Wells Fargo has also pulled back from swaths of the mortgage and auto market, particularly in riskier products like jumbo home loans.

While bank stocks have rebounded from their March lows, they have underperformed the broader indexes, which have been buoyed by the roaring technology sector.

One factor keeping bank stocks down: Low interest rates have pressured net interest margin, a key measure of profitability in the banking sector. The industry’s loan books have also begun to shrink, driven in part by lower credit card usage and the fear of rising defaults

Correction: The initial headline misstated the amount of the bank’s dividend cut.

Biden’s Tax Plan Could Cut S&P 500 Earnings By 12%, Goldman Sachs Warns

Sarah HansenForbes Staff

If he’s elected in November, Democratic candidate Joe Biden’s tax policies could have a major negative impact on earnings for companies in the S&P 500, according to Goldman Sachs analysts.

The presumptive Democratic presidential nominee Joe Biden speaks at McGregor Industries on July 09, … [+]

KEY FACTS

Goldman’s researchers, led by David Kostin, expect Biden’s tax plan to reduce their S&P earnings estimates by 12%, from $170 per share to $150 per share.

That estimate is based on several likely Biden policies including raising the statutory federal tax rate on domestic income by 7%, doubling the tax rate on certain foreign income, imposing a minimum tax rate of 15%, and creating an additional payroll tax on high earners.

The researchers also expect Biden’s tax policy to create a drag on earnings that’s comparable to the boost companies saw after the 2017 Tax Cuts and Jobs Act (and the corporate tax benefits that came with it).

However, Goldman also notes that the massive fiscal stimulus proposals in Biden’s $700 billion economic rescue plan could help boost earnings and economic growth.

Goldman’s analysts say the chance of a Democratic sweep in the fall has increased “substantially” since February and now stands above 50%.

KEY BACKGROUND

Trump’s tax cuts—which Biden promised to roll back in 2019 by enacting $1 trillion in new corporate taxes—are widely considered to be a major factor driving the stock market’s explosive growth that has pushed the Dow Jones Industrial Average and the S&P 500 to record highs. The growth has even persisted despite the coronavirus pandemic: even after huge losses in March, the S&P had recovered all of its losses and turned positive for the year by the second week of June. Those tax cuts are part of the reason many investors and wealthy executives supported President Trump, even if they didn’t voice that support in public.

https://seekingalpha.com/article/4359246-bank-of-america-why-backing-up-truck-now-after-q2-earnings

Bank Of America: Why I’m Backing Up The Truck Now After Q2 Earnings

Jul. 19, 2020 2:09 PM ET

Summary

Last month I explained why I believe BAC is a great pick for patient dividend investors.

The second quarter earnings report proved that the dividend is safe and that BAC remains undervalued.

This rare opportunity to purchase BAC at a great price persists.

Written by Sam Kovacs

Bank of America (BAC) is undervalued, I’ve been adding more to my position in the stock for the past few months.

As far as my coverage of the stock goes on Seeking Alpha, we first talked about the value we saw in the stock when we introduced our “all weather dividend portfolio”. A couple weeks later I wrote an article detailing the reasons why I believed the stock was great value. I added more to my portfolio, and more to our model All Weather portfolio.

Source: mad-dividends.com

The stock market was staging a V shaped recovery, and I figured BAC would sail with the rest, as it was trending. That didn’t happen, with the stock losing much of its momentum in the following weeks.

BAC is still trading at 65% of its pre-Covid-19 prices. A couple days ago, BAC posted its second quarter earnings, in which it beat estimates on both revenues and earnings.

With uncertainty about the recessionary environment within which we currently are, some investors question the valuation of different securities. My favorite stocks in this current market are the high quality companies which haven’t shared in the V-shaped recovery.

Often, these stocks are companies which are not considered extremely sexy, not in hot markets. But hot & sexy are not traits which I search for in stocks (I’m not trying to date my stocks after all). I want stocks which have solid dividend policies, have an anchored position within their industry, are well managed, and trading at attractive valuations.

Bank of America ticks all of these boxes.

In this article I will review my initial thesis while tying in the news from the latest earnings call. If anything, this earnings call provides me with more certainty that BAC is a total bargain when offering a yield of 3%.

BAC generates plenty of earnings: the dividend is safe.

The initial thesis for purchasing Bank of America was that it was so well run, that even with massive provisions for credit losses cutting earnings in half, it would still generate enough earnings to pay its dividend twice.

This has proved to be the case once again in the second quarter. While the company’s earnings of $0.37 per share was half of last years $0.74 per share, this can be totally attributed to the massive provision for credit losses which the company booked. This provision amounts to about $0.46 per share.

The capital build for potential losses which the bank has built still keeps its dividend extremely secure. BAC pays $0.18 per quarter, which gives the bank a payout ratio of 50%.

For your dividend to require only 50% of your earnings in these dire times, you have to have a dividend policy which isn’t over constraining. This is definitely the case for BAC.

The Fed capped dividend payments for banks to no more than they paid in the second quarter and no more than their average earnings during the past 4 quarters. The news which was announced late June was expected to have little impact on BAC’s dividend. This turned out to be the case.

BAC’s dividend safety is not in question. The company had cut the dividend to a meek $0.01 per share after the past Great Recession.

Some investors might be worried that banks might share the fate they had in the past recession. Yet banks are entering this crisis in a much better shape than they were in 2008.

Like management said in the last earnings call:

“A key difference in our company now versus the last crisis is the unsecured card portfolio is basically half of what it was going into the Great Recession and with better asset quality.”

After the Great Recession, it took a while for BAC’s dividend to get going again. Since 2014, BAC started sharing an ever more significant portion of earnings with investors. For the last 4 years, the dividend increased generously every year.

Source: mad-dividends.com

The dividend was still very much in a “ramp up” phase, during which it is increased aggressively each year from a small base for a few years, while management gets comfortable and committed to the payout.

This meant that the dividend policy hadn’t yet matured to a large portion of earnings, which created a huge buffer for the company.

However, because of the Fed’s restrictions, there will be no dividend growth next quarter (even though BAC could have gotten away with an increase) which will bring the short lived streak of increases to an end.

No dividend growth? No problem!

So why am I, who am always talking about the importance of dividend growth, not phased by this?

Because as awful as the world has seemed in 2020, it is but a transient phase for our lives, and for banks. The strongest banks will come out with a bang, and be well positioned for the recovery.

The crisis will be behind us, and so will be the opportunity to buy BAC with a 3% yield.

Consider the past decade, before this year you virtually never had the opportunity to buy BAC at a 3% yield.

Source: mad-dividends.com

When I purchase a stock which yields 3%, I generally expect dividend growth to average around 7% and to oscillate between say 5% and 9%.

I believe that once BAC is in a position to resume its dividend growth, it will do it at a 10-15% CAGR for 4-5 years. This assumption is important to my case in purchasing BAC as a dividend investor. What I see, is that when we look to the next 5-7 years, the dividend will have grown at a CAGR of at least 7%, making it a good investment at current prices.

For instance, if we assume no dividend growth for the next 2 years, then 10% growth for 5 years straight (the lowest range of my estimates), then over 7 years, the CAGR will come out to about 7%.

I believe over the next 10 years BAC will average a 10% annual dividend growth rate.

Source: mad-dividends.com

Assuming a straight line 10% dividend growth and dividend reinvestment at a 3% yield provides a good picture of expected income growth over 10 years. A $10,000 investment would provide $1,000 in yearly income in a decade.

Obviously this model is very simplistic and doesn’t take into account the bumpiness, but I have found this sort of back of the napkin calculation to be of great use when investing. It is better to be approximately right than precisely wrong.

BAC is significantly undervalued

I also expect BAC to return to more traditional valuation multiples once the whole situation is behind us, which would unlock significant capital appreciation.

BAC is a high quality asset, yet is trading at basement multiples as the whole sector has been slammed.

Just look at the PE lines chart: BAC is trading at some of the lowest multiples of the past 10 years, way below its 25th percentile PE line.

Source: mad-dividends.com

BAC trades at similar multiples to the sector median, despite being a strong, well run, all weather, too big to fail, you pick the term, high quality bank.

This undervaluation provides an opportunity which might not last.

BAC’s dividend yield of 3.1% is in fact higher than the sector median of 2.9%.

The fact that BAC is trading as if it were a run of the mill bank spells OPPORTUNITY. While the first quarter earnings showed challenges, with management seeing the recessionary environment lasting longer than initially planned, BAC showed that it is extremely well positioned to weather the storm.

Conclusion.

BAC’s dividend is safe. The company is a highly well run stock. Once dividend growth returns, patience will pay off with superior dividend growth. The nonsensical valuation relative to the sector provides an opportunity for patient investors.

I will be adding more BAC to my portfolio, and to the All Weather dividend portfolio this month.

Liked this article? Then click on the orange “follow” button at the top of this page so that we can let you know the next time we publish dividend related articles here on Seeking Alpha.

HI Financial Services Mid-Week 06-24-2014