HI Market View Commentary 08-23-2021

Crypto Is ‘95% Fraud, Hype, Noise, and Confusion,’ Fed President Kashkari Says

Neel Kashkari, the president of the Minneapolis Federal Reserve, was pressed on his stance on digital assets at a regional economic summit in Montana Tuesday. He claimed that the crypto space bankrolls illegal activities and is full of scams.

- “I was more optimistic about crypto and Bitcoin five or six years ago,” said the central banker. “So far what I’ve seen is …95% fraud, hype, noise, and confusion.”

- Kashkari argued that the dollar remains strong because of restrictions on its creation and use—no one can mint their own U.S. currency, for good reason. “There are thousands of these garbage coins that have been created—some of them are complete fraud Ponzi schemes,” the Fed president said.

- The central banker also said he has struggled to find people who can articulate how Bitcoin is meant to solve meaningful problems better than existing currencies. “I’ve not seen any use case—other than funding illicit activities like drugs and prostitution—that is legitimate so far that Bitcoin solves,” he said.

What’s Next: Kashkari is the latest voice to criticize crypto. The head of the European Central Bank called for the global regulation of Bitcoin earlier this year, saying that multilateral action was needed to stop “funny business” and money laundering. The price of Bitcoin was down more than 2% to around $45,300 Wednesday.

—Jack Denton

How many times have we placed a warning at buying crypto currency here at HI ?!?!?!!! BE CAREFUL

Another gamble with some semi not so solid data is Autonomous and electric cars

Kevin you charge them at night with the low cost wattage

Dominion Energy now has a tier system for usage over each tier significantly makes the energy more expensive

The Fed Has a Minor Problem—It Has No Idea Where Economy’s Headed

Any decision must and will be “data driven,” central bankers keep repeating as the moment comes when they will start unwinding the trillion-dollar (or pound, or euro) asset-buying programs they have unleashed on the world economy in the last two years.

The Federal Reserve’s minutes of its July meeting, published today, will give an idea of the state of the debate among U.S. central bankers, and maybe—hope springs eternal—give markets a clearer indication of when a decision on the long-awaited “tapering” will come.

But if any decision must be driven by data, then data should speak clearly. To say the least, this isn’t quite the case for now.

Fed Chair Jerome Powell seemed to acknowledge as much when he said Tuesday that “it is not yet clear whether the Delta variant will have important effects on the economy.” Numbers on growth, inflation, and unemployment both in the U.S. and Europe, are for now too uncertain to provide a firm guidance for the world’s major central banks.

This is a dilemma for all western central bankers. Inflation is back, but this may be temporary—or not. Growth is accelerating, but supply-chain bottlenecks and the Delta variant of coronavirus could stifle the recovery. Employment is up, but hundreds of businesses could go under once public support wanes.

So Powell may well have given the most honest summary of central bankers’ guidance to markets Tuesday, when asked about the economy: “We’ll have to see about that,” he said.

—Pierre Briançon

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF AUG. 16 THROUGH AUG. 20, 2021 The S&P 500 index fell 0.6% last week, snapping a two-week winning streak, amid concerns about the economic recovery and when the Federal Open Market Committee will begin slowing down its bond-buying program. The market benchmark ended Friday’s session at 4,441.67, down from last Friday’s closing price of 4,468.00, which was a record closing high at the time. The index closed higher yet on Monday, setting another record close at 4,472.94, before falling Tuesday and Wednesday. It edged up on Thursday and Friday but still ended Friday’s session in the red versus last week. However, the S&P 500 is still in positive territory for the month, up 1.1% for August so far, and up 18% for the year to date. Last week’s decline, which marked the S&P 500’s first weekly drop this month, came as investors grew more concerned about rising COVID-19 cases just as the Federal Reserve appears to be preparing for a slowdown of its bond-buying program. Minutes released Wednesday from the late-July meeting of the US central bank’s policy-setting committee indicated its members are looking to possibly begin to slow down purchases of mortgage-backed securities this year. The commodities-focused sectors were hit the hardest last week as futures of some raw materials including crude oil and copper fell amid strengthening in the US dollar. A stronger dollar typically pressures US-denominated commodities as it makes them more expensive for holders of other currencies. The energy sector had the largest percentage drop of the week, down 7.3%, followed by a 3.1% slide in materials. Other significant decliners included industrials and financials, down 2.3% each, and consumer discretionary, down 2.2%. Communication services edged down 0.4%. Still, five sectors managed to buck the declines, led by gains of 1.8% each in health care and utilities. The other sectors in the black for the week included real estate, up 0.5%, as well as consumer staples and technology, up 0.4% each. Among the energy sector’s decliners, shares of APA (APA) fell 10% last week, Occidental Petroleum (OXY) shed 15% and Hess (HES) lost 8%. All three stocks received reductions in their price targets from Goldman Sachs earlier last week. In materials, the week’s decliners included Freeport-McMoRan (FCX), down 14%. In consumer discretionary, shares of Norwegian Cruise Line Holdings (NCLH) fell 5.6%. Wedbush cut its price target on the cruise operator’s stock to $30 per share from $35, citing a “longer route to full travel recovery.” On the upside, the health care sector’s gainers included shares of Pfizer (PFE) as the US government recommended booster shots for Americans who received the company’s COVID-19 vaccine. The booster shots are recommended eight months after each individual’s second vaccine dose and are expected to begin Sept. 20. Shares of Pfizer edged up 0.5% on the week. Next week’s slate of economic data will feature revised Q2 gross domestic product, due Thursday, and the core personal consumption expenditures price index for July, due Friday. Among the reports expected earlier in the week, Markit will release its August readings on the manufacturing and services sectors on Monday. Monday will also feature July existing home sales, followed by the Tuesday release of July new home sales. July durable goods orders are due Wednesday. |

Earnings Dates

COST – 09/23 AMC

Where will our markets end this week?

Higher

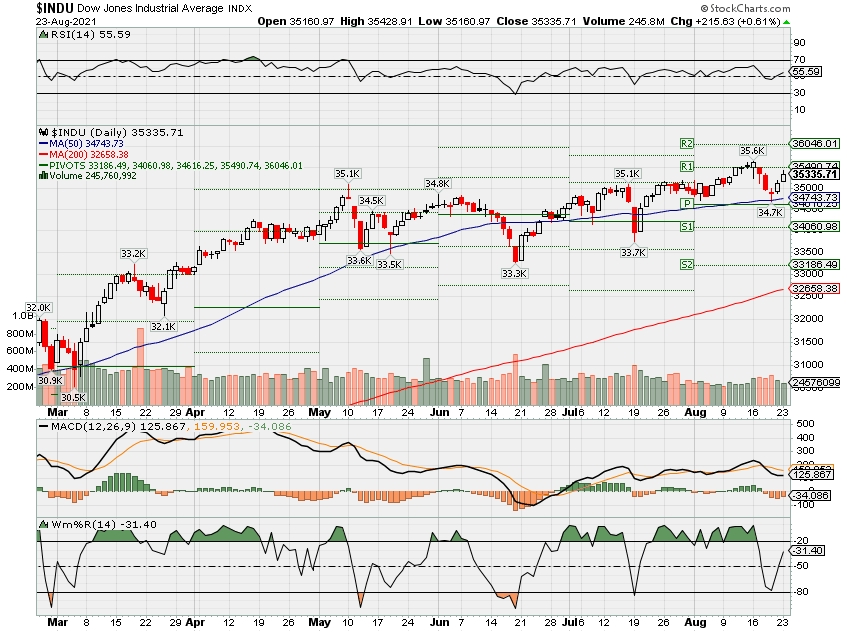

DJIA – Bearish

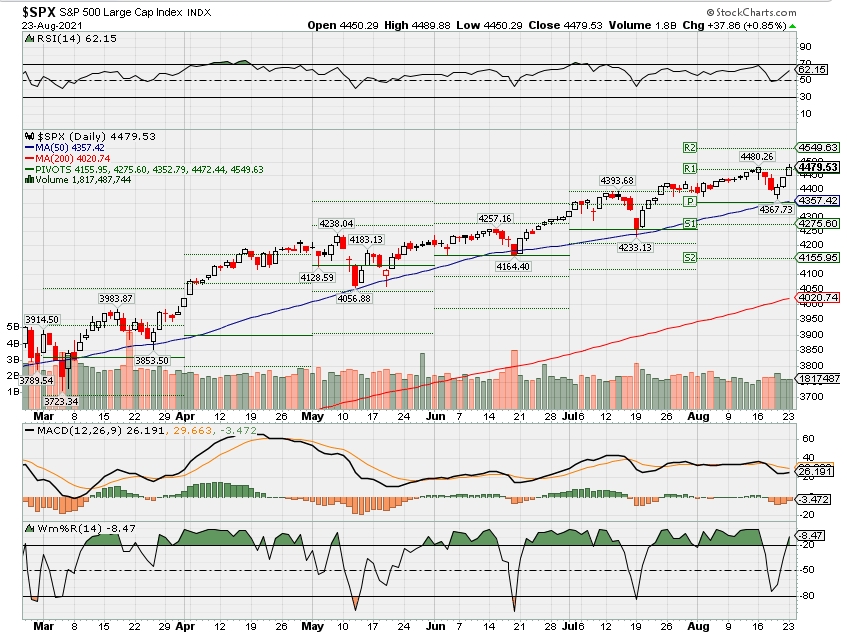

SPX – Bearish

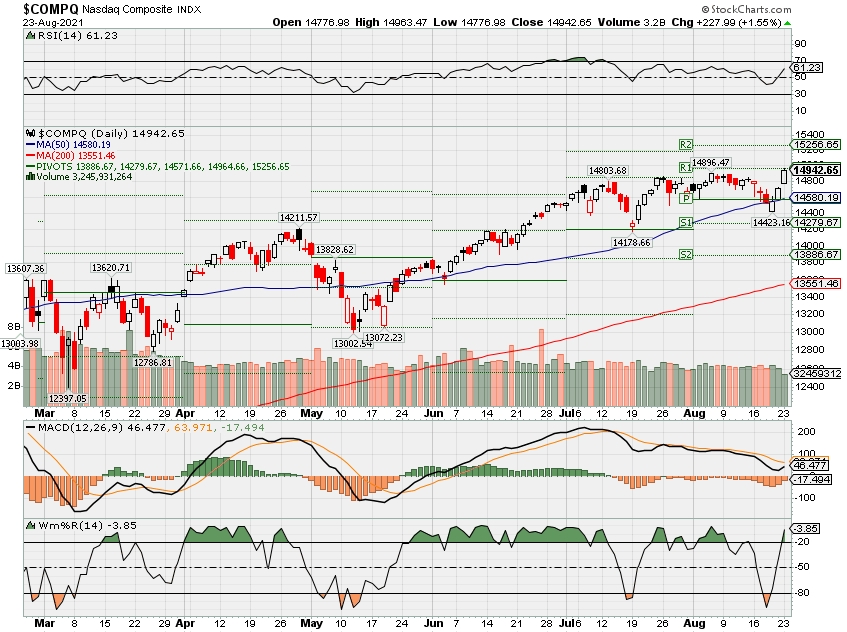

COMP – Bearish

Where Will the SPX end September 2021?

08-23-2021 -1.0%

Earnings:

Mon: JD, PANW

Tues: AAP, BBY, MDT, INTU, JWN, TOL, URBN

Wed: DKS, NTAP, CRM, ULTA

Thur: ANF, BURL, DELL, HPQ, GPS, MAVL, VMW, PTON, DG, DLTR

Fri: BIG

Econ Reports:

Mon: Existing Home Sales,

Tues: New Home Sales,

Wed: MBA, Durable Goods, Durable ex-trans

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator

Fri: PCE Prices, PCE Core, Michigan Sentiment , Personal Income, Personal Spending

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Running stock higher until the seasonal pull back AND taking long put protection off some stocks that seem to be at a bottom

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.ksl.com/article/50221664/600m-gone-the-biggest-crypto-theft-in-history

NEWS / FEATURES / SCIENCE & TECH

$600M gone: The biggest crypto theft in history

By Brian Fung, CNN Business | Posted – Aug. 11, 2021 at 8:27 a.m.

ATLANTA — Hackers have stolen some $600 million in cryptocurrency from the decentralized finance platform Poly Network, in what it says is the largest theft in the industry’s history.

A vulnerability in Poly Network allowed the thief to make off with the funds, the platform said Tuesday, begging the attacker to return the money.

“The amount of money you hacked is the biggest one in the defi history,” Poly Network wrote in a letter to the attacker it posted to Twitter. “The money you stole are from tens of thousands of crypto community members … you should talk to us to work out a solution.”

Poly Network urged other members of the cryptocurrency ecosystem to “blacklist” the assets coming from addresses used by the attacker to siphon away the funds — which included a mix of various coins including $33 million of Tether, according to Tether’s CTO. The cryptocurrency exchange Binance said it was “coordinating with all our security partners to actively help.” Poly Network links together the blockchains of multiple virtual currencies to create interoperability among them.

Following the hack, Poly Network established several addresses to which it said the attacker could return the money. And it appears the hacker is cooperating: As of 7:47 a.m. ET Wednesday, Poly Network said, it had received about $4.7 million back. It was not immediately clear who was behind the hack or why the money is being returned.

Regulators have increased their scrutiny of crypto platforms as investors pour billions of dollars into digital currencies. Senator Elizabeth Warren recently asked SEC Chair Gary Gensler to investigate the SEC’s ability to oversee trading on crypto platforms.

In response, last week, Gensler said: “Right now, I believe investors using these platforms are not adequately protected.”

Strong Demand for Gas Vehicles Drives Detroit Production Plans, Clouds Biden’s 2030 Goal for EVs

BY TOM OZIMEK

August 16, 2021 Updated: August 16, 2021

Automakers in North America plan to build more pickup trucks and sport utility vehicles than electric vehicles well into the late 2020s, with strong consumer demand for gasoline-powered vehicles charting sales trends that run counter to the Biden administration’s goal of boosting electric vehicles (EVs) to half the market by 2030, according to internal production forecasts reported on by Reuters.

President Joe Biden signed an executive order earlier in August establishing the goal of making half of all new vehicles sold in the United States either hybrid or fully electric by 2030. Biden’s order also set a new schedule for the development of new long-term fuel efficiency and emissions standards to tackle pollution and other objectives.

https://subs.youmaker.com/template/show?tid=b5aee884-f497-4168-bedc-defd2012f158&sid=www.theepochtimes.com&v=1&ck=JTdCJTIyZXBvY2hfdXNlcl9pZCUyMiUzQSUyMiUyMiUyQyUyMmVwb2NoX3Nlc3Npb25pZCUyMiUzQSUyMiUyMiUyQyUyMmVwb2NoX3Rva2VuJTIyJTNBJTIyJTIyJTJDJTIyZXBvY2hfc3Vic2NyaWJlZCUyMiUzQSUyMiUyMiU3RA==&pl=https%3A%2F%2Fwww.theepochtimes.com%2Fmkt_breakingnews%2Fstrong-demand-for-gas-vehicles-drives-detroit-production-plans-clouds-bidens-2030-goal-for-evs_3950581.html%3Futm_source%3Dnewsnoe%26utm_medium%3Demail%26utm_campaign%3Dbreaking-2021-08-16-1%26mktids%3D8cdb991559fb6fd60a6810ecfb7453fb%26est%3DT0kTdjwJJTP9Zgo8uKaejNTPl9CjORtS1TQrw8LH2kiMZKBnhE14HNcN3lJqnw%253D%253D&tn=middle-article-widget&dna=%7B%22u_s%22%3A%22newsnoe%22%2C%22u_c%22%3A%22breaking-2021-08-16-1%22%2C%22r%22%3A%22%22%2C%22pid%22%3A%22anon2518-57ad-48f2-a93d-40eeaecb5b6a%22%2C%22x%22%3A%22215-235-429%22%2C%22vt%22%3A0%2C%22g1%22%3A%22us%22%2C%22g2%22%3A%22ut%22%7D General Motors, Ford, and Chrysler-parent Stellantis have endorsed Biden’s zero-emissions sales target, saying in a joint statement on Aug. 5 that they aspired “to achieve sales of 40-50 percent of annual U.S. volumes of electric vehicles … by 2030,” adding that the goal can only be met with more government investment in charging stations and other infrastructure. Biden’s 50 percent goal and the automakers’ 40 to 50 percent aspiration includes battery electric, fuel cell, and plug-in hybrid vehicles that also have gasoline engines.

That objective would mean boosting annual North American output of electric and plug-in hybrid electric vehicles to 7 million vehicles or more. But the entire industry is currently planning to build just 2.6 million battery electric vehicles and another 585,000 plug-in hybrid electric vehicles (PHEV) in 2028, according to AutoForecast Solutions (AFS), which compiles industry production estimates.

Sam Fiorani, head of AFS global vehicle forecasting, told Reuters that weak consumer demand is a stumbling block on the road to the Biden administration’s electric vehicle production objectives.

“Far more demand for electric vehicles will be needed in order to hit the 2030 goal of 40-50%,” Fiorani told the outlet, adding that he expects many buyers will be reluctant to make the switch to electric.

About four in 10 Americans (39 percent) told Pew Research pollsters in June that the next time they buy a vehicle, they are at least somewhat likely to seriously consider going electric, while 46 percent said they aren’t too likely—or at all likely—to do so. At the same time, 51 percent said they oppose proposals to phase out production of gasoline-powered vehicles, while 47 percent expressed support.

According to Pew, just 7 percent of U.S. adults said they currently have an electric or hybrid vehicle, with 28 percent of them telling pollsters that they are unlikely to consider an electric car or truck next time around.Automakers sticking to the production plans outlined by AutoForecast would mean EVs would account for just 15 percent of total North American production in 2028, with plug-in hybrids representing another 3.4 percent. For automakers to meet Biden’s goal under such circumstances, they would have to more than double EV and PHEV production within two years between 2028 and 2030.

Still, Ford told Reuters that it expects battery-electric vehicles to account for at least 40 percent of global volume by 2030, GM told the outlet it hopes to achieve the 40 to 50 percent target, and Stellantis said it doesn’t comment on speculation regarding future products.

Meanwhile, a national security expert told The Epoch Times that the success of Biden’s electric vehicle production goals would mean greater dependence on China.

“Unless the United States and its allies control more of the battery supply chain, the Biden administration’s ability to move towards its EV goals—and, for that matter, U.S. automakers’ ability to reach their EV goals, which are all pretty ambitious—will mean more dependence on China,” former White House deputy national security adviser for strategy Nadia Schadlow told The Epoch Times on Aug. 10.

“Encouraging EV adoption while we still rely on China for batteries risks granting Beijing a lot of leverage,” she said.

Mark Tapscott and Reuters contributed to this report.

Tom Ozimek

REPORTER

Tom Ozimek has a broad background in journalism, deposit insurance, marketing and communications, and adult education. The best writing advice he’s ever heard is from Roy Peter Clark: ‘Hit your target’ and ‘leave the best for last.’

Short seller Chanos on AMC: There’s no way it can be profitable

CNBC’s “Squawk Box” team discusses markets, meme stocks like AMC and more with short seller Jim Chanos, president of Kynikos Associates, the private investment management company he founded.

Under Armour Posts Huge FCF Gains in Q2, Implying Near-40% Upside

Mark R. Hake

August 6, 2021·

Under Armour (NYSE:UA, NYSE:UAA), the U.S.-based sports clothing and footwear retailer, posted truly amazing results for its second quarter, ending June 30. This implies that UAA stock could easily rise 86.6% to $46.30 over the next year and a half, assuming its free cash flow (FCF) margins hold up on 2022 sales forecasts.Source: Sorbis / Shutterstock.com

Keep in mind that UAA stock closed Thursday at $24.81, up 31% from July 19 when it bottomed out at a close of $18.90. So my price target of $46.30 is really more than a double (+145%) from its recent trough.

Even with a slightly more conservative assumption, my minimum target is $34.24, or 38% over Thursday’s close. This article will explain how I came up with this estimate for Under Armour stock.

Excellent Earnings and FCF Margins

On Aug. 2, Under Armour reported that revenue was up 91% year over year (YOY) to $1.351 billion for Q2. Moreover, its gross margin was 49.5% and adjusted net income was $110 million, representing 8.1% of sales.

But even more importantly, its Q2 FCF exploded to $233.1 million. That can be seen on the Seeking Alpha page which shows its quarterly cash flow from operations of $252.8 million, less $19.7 million in capex spending. More importantly, this $252.8 million in FCF represented 17.25% of its $1.351 billion in Q2 revenue.

Therefore, if we assume that by 2022 the company can continue to make 17.3% FCF margins, we can expect a very high FCF number. For example, Yahoo! Finance, which uses Refinitiv data for analyst estimates, has an average forecast of $5.65 billion for 2022. This is even lower than the Seeking Alpha forecast of $2.75 billion for 2022. If we apply a 17.25% margin against the $5.65 billion estimate for 2022 sales, FCF will hit $975 million in 2022. That is almost $1 billion in FCF by next year.

What Under Armour Stock Is Worth

We can use this to estimate the value of Under Armour stock by the end of 2022. For example, if we use a 5% FCF yield metric, UAA can be seen as having a potential value of $19.492 billion. We derive this by dividing $974.6 million by 5%.

That results in a market cap target of $19.492 billion. This is 86.6% over Thursday evening’s market capitalization of $10.442, according to Yahoo! Finance, which I find is the most accurate site for market caps. In other words, UAA stock is worth 86.6% more than that $24.81, making its price target is $46.30 per share.

The bottom line here is that people are back to shopping now and have come out of their lockdown holes. If lockdowns start to come back, this could hurt spending somewhat. But I still think the consumer is back. They are no longer scared like last year.

Using Lower FCF Margin To Value UAA Stock

Analysts on Wall Street are not as sanguine about UAA stock as I am. For example, TipRanks.com reports that 14 sell-side analysts who’ve written on the stock in the past three months have an average target of $29.23. That represents a potential upside of 16% over today’s price. That is much lower than my target.

Keep in mind that there are a good number of risks with my target price. For example, if we assume that the FCF is 15% lower on average by 2022 at a level of 15% of sales instead of 17.25%, the total FCF forecast will be $848 million, instead of $975 million. Using a 5% FCF yield metric that implies a target value of $16.95 billion, or just 62.2% over today’s price. That lowers the price target to $40.24.

What to Do With UAA Stock

Moreover, to be even more conservative, let’s assume that it takes 1.5 years for that price to occur (i.e., by the end of 2022). This lowers the annual compound return to 38% annually. The math on that is a little complicated but here is the formula:( (1.622 ^(1/1.5))-1 = 0.38.

Therefore, the target price in one year is $34.24 (i.e., 1.38 x $24.81). That is fairly close to the $29.23 TipRanks price target.

So, by being conservative, using a 15% FCF margin estimate and a 5% FCF yield metric, our best guess is that UAA stock will rise at least 38% by next year. That is a very good prospective ROI for most investors.

On the date of publication, Mark R. Hake did not hold a position in any security mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Mark Hake writes about personal finance on mrhake.medium.com and runs the Total Yield Value Guide which you can review here.

When Will Disney, Ford, and AMC Pay Dividends Again?

A lot of companies suspended their payouts in 2020. Some of them aren’t coming back anytime soon.

Aug 21, 2021 at 8:05AM

Key Points

- Disney has returned to profitability sooner than expected, but long-term losses at Disney+ and the need to invest in content may keep its payout in check.

- Ford has been profitable in four of the past five quarters, and only the need to ramp up investing in electric vehicles could keep a dividend away.

- The number of AMC shares have increased fivefold over the past year, and that’s not even the biggest reason its distributions aren’t returning anytime soon.

Income investors saw some of their dividend streams shrivel up last year. A lot of companies suspended their payouts in early 2020, bracing for the impact of the COVID-19 crisis. The pandemic isn’t fading in the rearview mirror the way it was two months ago, but it’s fair to start wondering when some of the more prolific companies that nixed their distributions will return to cutting shareholder checks.

Disney (NYSE:DIS), Ford (NYSE:F), and AMC Entertainment Holdings (NYSE:AMC) are three widely followed stocks currently yielding 0%. Will that change? More importantly, does that have to change? All three stocks are trading sharply higher now than they were when they paused their payouts. Let’s see how soon the dividends can return — and how likely that is to happen in 2022.

Disney

The House of Mouse was shelling out $0.88 a share twice a year until the pandemic hit. It wasn’t a surprise. Its theme parks and cruise ships as well as the multiplexes it relied on for theatrical distribution of its popular films all closed down in mid-March of last year.

Disney braced for the worst, and reality proved to be substantially kinder. After a pair of quarterly losses during the early stretch of the crisis Disney has come through with three consecutive quarterly profits. Even its theme parks segment returned to profitability in its latest report.

The dividend has a good chance of returning at some point in the next year, but Disney is probably in no rush to make it happen. Disney+ is expected to continue to lose money until 2024, and it needs content to keep growing. Some analysts have argued that a better use of the $3.2 billion it returned to investors in 2019 would be better served on new video content. It’s fair, but it would still be a surprise if the distributions don’t come back in Disney’s fiscal 2022 if the economy holds up with its end of the bargain.

Ford

The other name on this list that could beat Disney to the payout restarting lines is Ford. The automaker pioneer was a bigger draw to income investors than Disney given its much larger pre-pandemic yield. Ford has also been profitable in four of the past five quarters, one more period in the black than Mickey Mouse.

If Ford doesn’t return to its quarterly distributions soon it won’t be because it lacks confidence in its near-term outlook. Ford is just investing in its reinvention. It has made a well-received push into electric vehicles, and it’s a market darling again. The stock is trouncing the market in 2021 with a 42% year-to-date gain. If Ford thinks it will need to preserve more of its capital to ramp up its presence in electric vehicles it may not return to its chunky suspended dividend that would translate to a yield of nearly 5% at the current price. However, it would be surprising if it doesn’t come back with at least a smaller token quarterly disbursement in the coming months.

AMC Entertainment

It’s not going to happen. A lot has happened at AMC since it last cut a dividend check. It’s still losing money, and even if it wasn’t, its share count has exploded nearly fivefold over the past year. In other words, it would cost AMC five times as much to pay its former per-share dividend.

There are clearly better uses for its money. It can buy back stock. It can update its theaters. It can make more investments in home streaming to make sure it’s not left out of the migration away from the neighborhood multiplex. It can even invest in exclusive content.

None of these options may seem feasible in the near term, with analysts expecting the red ink to continue until 2024. However, AMC has armed itself with a record $2 billion in liquidity. It does have options to improve its turnaround chances, but you can be sure that it won’t involve sending some of that cash to its shareholders in the form of dividend checks. Let them eat complimentary popcorn.

Disney and Ford should return to being dividend stocks in the next year. Payout out regular distributions just isn’t part of the movie trailer at AMC.

6 Dow Jones Stocks To Buy And Watch In August 2021: Apple Rallies

- SCOTT LEHTONEN

- 09:32 AM ET 08/20/2021

The Dow Jones Industrial Average remains at record highs in the second week of August, as the current stock market rally continues. The best Dow Jones stocks to buy and watch in August 2021 are Apple (AAPL), Boeing (BA), Goldman Sachs (GS), Microsoft (MSFT) and Nike (NKE).

There are clear winners — and losers — in the eight month of 2021. The top three performing Dow Jones stocks through Aug. 6 were Goldman Sachs, American Express (AXP) and Microsoft with advances of 50.9%, 41.7% and 30.1%, respectively.

The three biggest Dow Jones losers through Aug. 6 were Verizon Communications (VZ), Merck (MRK) and Disney (DIS) with declines of 6%, 3.3% and 2.2%, respectively.

Amid the current stock market rally, the tech-heavy Nasdaq ended July up 13.9%. The S&P 500 was up 17%, while the DJIA was up 14.1% through July 30.

What Is The Dow Jones Industrial Average?

Founded in 1896 with 12 stocks, the Dow Jones Industrial Average is one of the oldest stock market indexes. There are 30 Dow Jones stocks designed to serve as a bellwether for the general U.S. stock market. Other major stock indexes include the technology-heavy Nasdaq composite and the S&P 500 index — an index of the 500 largest companies in the United States.

Best Dow Jones Stocks To Buy And Watch

| Company Name | Symbol | Closing Price | 2021 YTD Performance |

| Apple | (AAPL) | 145.86 | +9.9% |

| Boeing | (BA) | 226.48 | +5.8% |

| Disney | (DIS) | 176.02 | -2.85% |

| Goldman Sachs | (GS) | 374.88 | +42.2% |

| Microsoft | (MSFT) | 284.91 | +28.1% |

| Nike | (NKE) | 167.51 | +18.4% |

Source: IBD Data As Of July 30, 2021

Amid the current stock market rally — according to the IBD Big Picture — investors should focus on buying top stocks breaking out past correct buy points.

Focus on stocks that show strong relative strength during the recent stock market strength. They could be some of market’s leaders if the Dow Jones Industrial Average is able to hit more record highs.

Potential Dow Jones stocks to buy and watch in August 2021 that are in or near buy zones include Apple, Boeing, Goldman Sachs, Microsoft and Nike.

Apple Stock

Among the top Dow Jones stocks, Apple rallied 0.3% Friday. Apple stock is below a 148 trend-line buy point. The stock hit an all-time high on Aug. 17 15 at 151.68.

According to the IBD Stock Checkup, Apple stock shows a 95 out of a best-possible 99 IBD Composite Rating. The Composite Rating — an easy way to identify top growth stocks — is a blend of key fundamental and technical metrics to help investors gauge a stock’s strengths.

Boeing Stock

Airplane maker Boeing is back below its 50-day line, according to IBD MarketSmith chart analysis. Shares are about 15% off their 52-week high.

Boeing stock moved down 0.7% Friday. The company reported its first quarterly profit since 2019 on July 28, earning 40 cents per share on revenue of $17 billion.

Disney Stock

Disney stock rose 0.1% Friday, as it continues to hold above its 50-day moving average. Shares are trying to break out above an early entry at 186.39.

Last week, Disney beat Q3 estimates. The company earned 80 cents per share on revenue of $17.02 billion. Disney+ subscriptions of 116 million beat FactSet views for 115.2 million. ESPN+ had 14.9 million, and Hulu had 42.8 million.

Goldman Sachs Stock

Goldman Sachs stock is trying to break out past a 393.36 buy point in a flat base and is in buy range, according to IBD MarketSmith chart analysis. The 5% buy zone goes up to 413.03.

Shares lost 0.4% Friday.

https://research.investors.com/ibdchartswp.aspx?cht=pvc&type=daily&symbol=MSFT Microsoft Stock

Software giant Microsoft moved up 1% Friday. Shares of the Dow Jones leader are out of buy range above a new cup base’s 263.29 buy point.

Microsoft is an IBD Leaderboard stock. Per Leaderboard commentary, “Microsoft has passed its buy point from a new cup, and is now mildly above the buy zone. The relative strength line is ascending again, hitting new highs and backing the stock’s advance.”

Nike Stock

Nike blew away fiscal fourth-quarter earnings estimates on June 24. The company reported EPS of 93 cents on revenue of $12.3 billion, much higher than analyst estimates.

The stock moved up 0.2% Friday, and remains extended past a consolidation’s 148.05 buy point, according to IBD MarketSmith chart analysis.

Tip: Before making any investment decisions, be sure to check current market conditions, and use IBD Stock Checkup to see if your stock gets passing ratings for the most important fundamental and technical criteria. To get ongoing chart analysis, and alerts to buy and sell signals, check out the unique features, stock lists and chart annotations at MarketSmith, Leaderboard and SwingTrader.

HI Financial Services Mid-Week 06-24-2014