HI Market View Commentary 04-13-2020

| Market Recap |

| WEEK OF APR. 6 THROUGH APR. 10, 2020 |

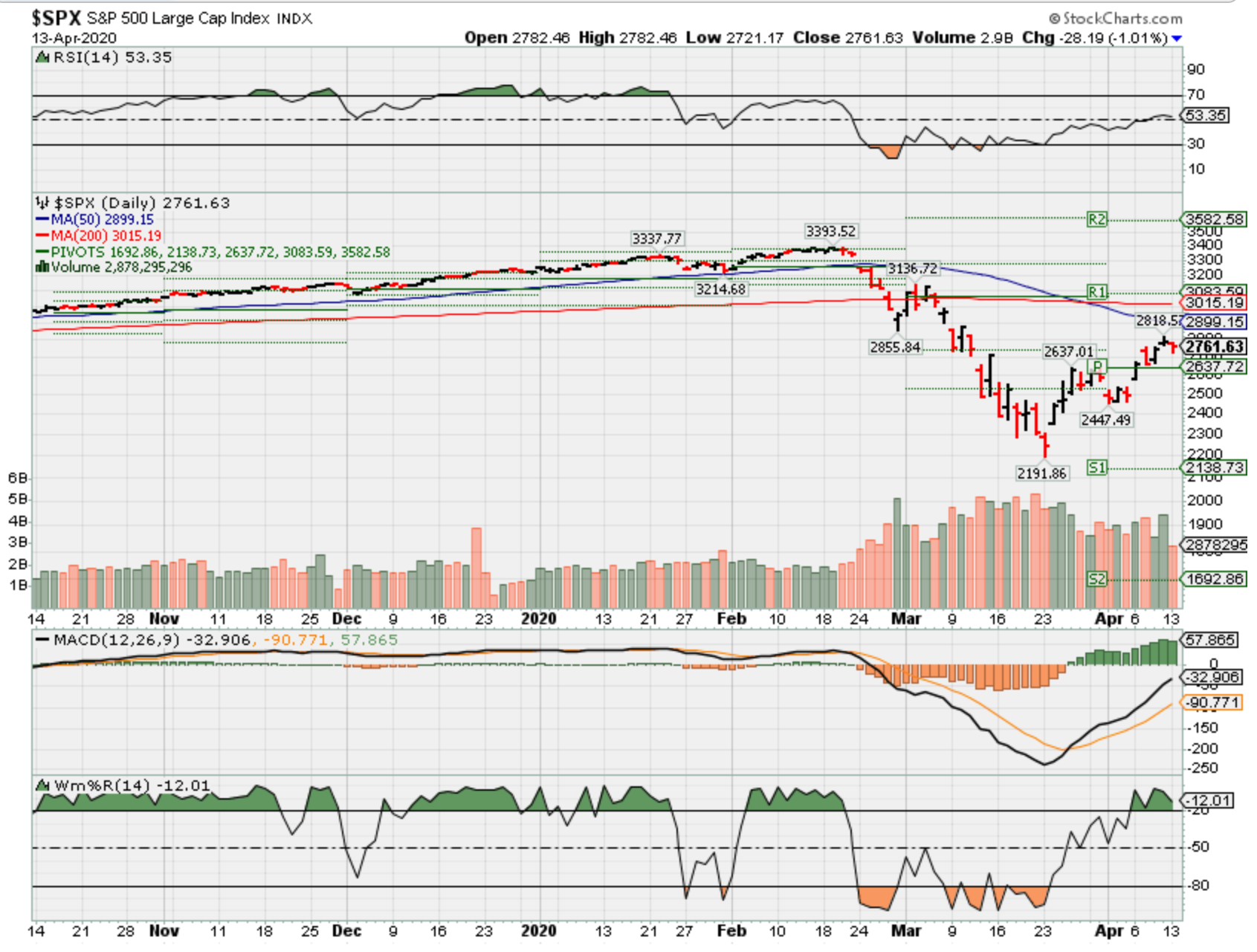

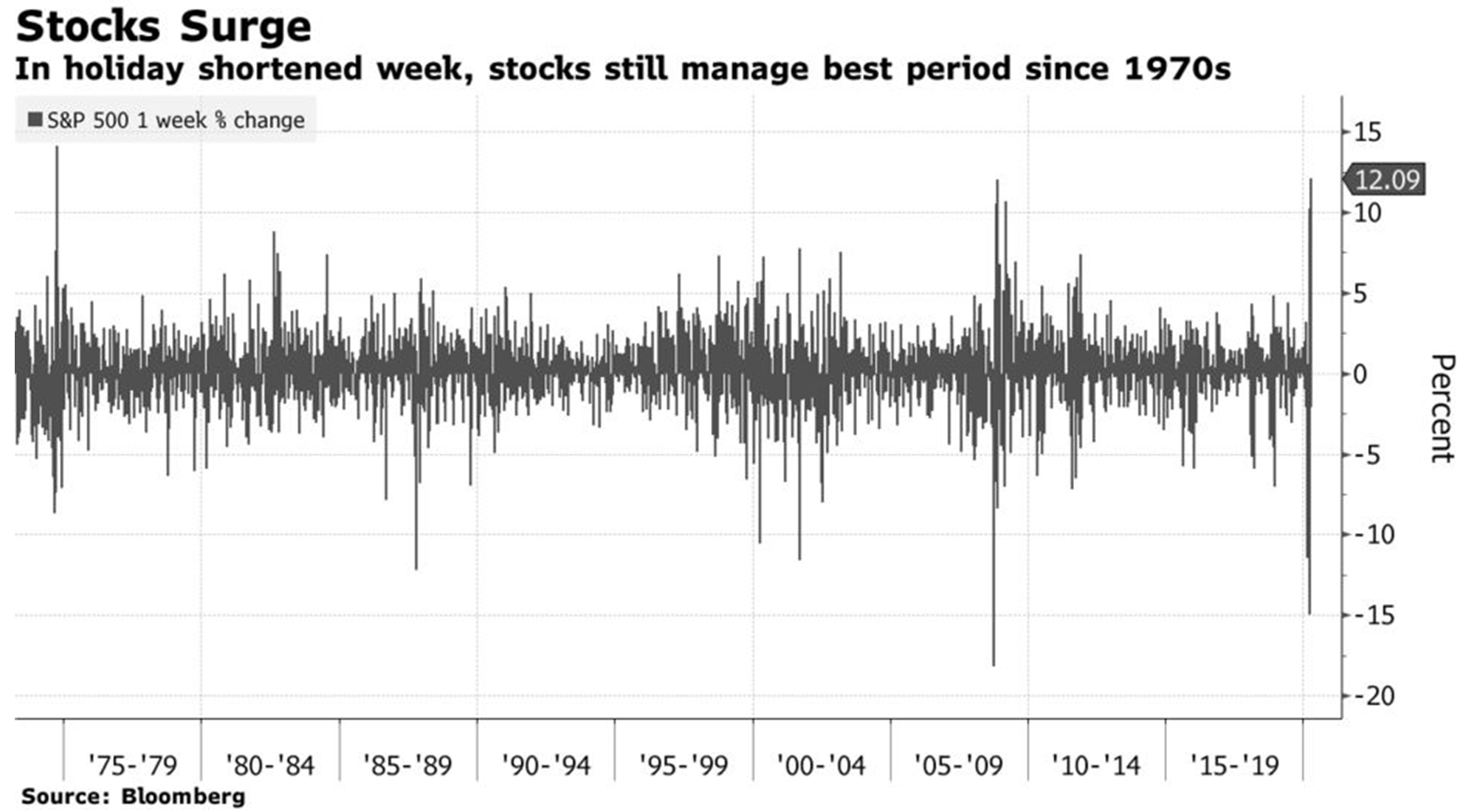

| The Standard & Poor’s 500 had its best week since 1974 as signs of a plateau in new COVID-19 cases restore investor confidence and bumped the index by 12%.

The benchmark average closed the week at 2,789.82, up from last week’s close of 2,488.65, making this only the second time in eight weeks that the S&P has closed higher. Italy — regarded as ground-zero for the coronavirus in Europe — recorded a promising deceleration in new COVID-19 cases. All eleven sectors of the S&P ended the week with substantial gains as government officials tentatively proposed new timelines to re-open the economy. Investors poured into the materials and real-estate sectors, resulting in gains of more than 20% for both. In the real estate sector, mall operator Simon Property Group (SPG), which lost more than two-thirds of its stock value in just the last seven weeks, was this sector’s top-performing stock with a gain of 46% from last Friday’s close. In the materials sector, shares of Dow (DOW) and Freeport-McMoRan (FCX) rallied by almost 30%. Credit Suisse raised their rating on Freeport this week to neutral from underperform and viewed the stock’s current value as the “best buying opportunity in the sector in the past 20 years.” With interest rates bottoming and the Fed loosening its strict lending restrictions on banks, the financial sector advanced by 19% from last week. Shares of Wells Fargo (WFC) gained 27% for the week and topped equally substantial gains of 24%, 26% and 22% for Bank of America (BAC), Citigroup (C) and JP Morgan (JPM), respectively. An 11% gain in the technology sector was fueled by the credit services industry as virus-mitigation efforts encourage the use of credit and debit cards over cash, putting Alliance Data Systems (ADS) at the top of the leaderboard. The stock rallied by 46% this week. Though oil struggled late in the week on the disappointing outcome to the pivotal OPEC-Plus meeting, high-fliers in the exploration and production industry including Apache (APA), Diamondback Energy (FANG) and Occidental (OXY) fueled a 13% gain in the energy sector. |

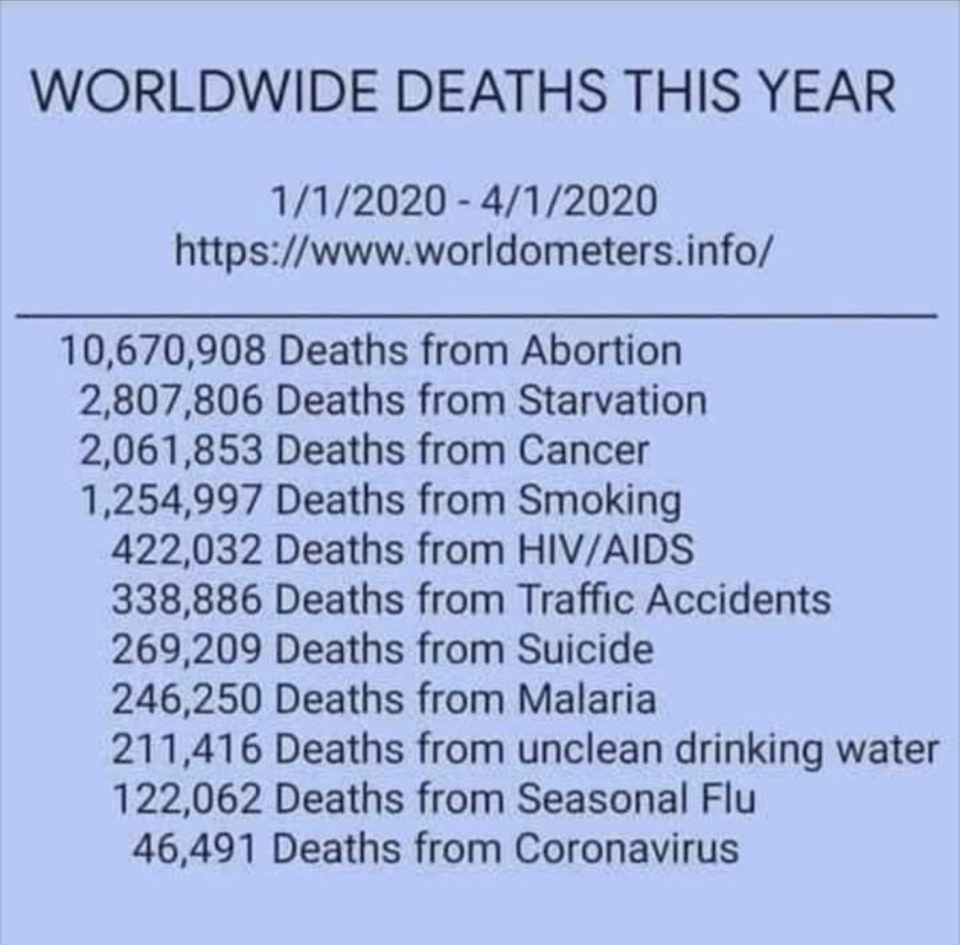

Does it really warrant shutting down the world economy ? NO

But, we will probably have round 2 in the fall and two years from now we will probably have another twice as deadly virus that will pass through the world yet again

Opinions don’t matter but reactions to the markets do

Where will our markets end this week?

???? This is the test week to see how the markets will accept failed earnings, no guidance, no future expectations

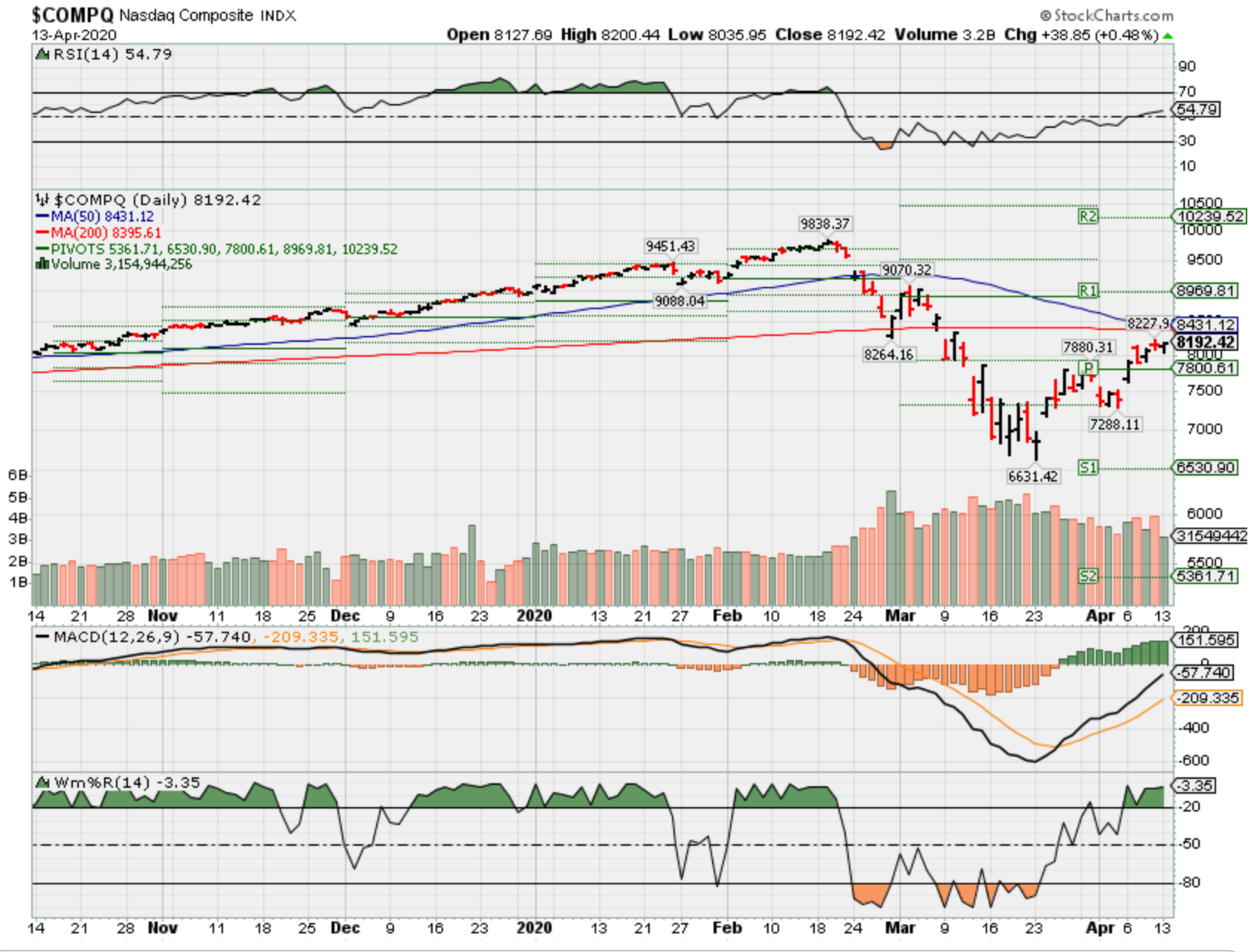

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end April 2020?

04-13-2020 +5.0%

04-06-2020 +2.0%

03-30-2020 0.0%

Earnings:

Mon: CCL,

Tues: FAST, FHN, JNJ, WFC, UAL, JPM

Wed: SCHW, C, GS, MS, USB, UNH, BBBY, LVS, BAC, KEY

Thur: ABT, BLK, HON, ISRG, SKX,

Fri: SLB

Econ Reports:

Mon:

Tues: Import, Export,

Wed: MBA, Empire Manufacturing, Retail Sales, Retail ex-auto, Capacity Utilization, Industrial Production, Business Inventory, Fed Beige Book

Thur: Initial, Continuing, Housing Starts, Building Permits, Phil Fed

Fri: MONTHLY OPTIONS EXPIRATION

Int’l:

Mon –

Tues – CN: Import, Exports, Trade Balance

Wed –

Thursday –

Friday- CN: GDP

Sunday –

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

The Stock Market Has Had a Heck of a Bounce. Why It’s Time for Another Drop.

Updated April 8, 2020 4:19 pm ET / Original April 8, 2020 1:04 pm ET

The stock market finally made a higher high —and for some that means the worst is behind us . I don’t think so.

Ever since the market bottomed and started moving higher, I’ve been working under the assumption that there will be a retest of the lows . That’s largely because that’s how the market works: It sells off when a problem is first identified, rallies as the situation gets stabilized, and then falls again as the economic damage becomes clear. That was what happened in 2008: The market tumbled after Lehman went bust, rallied when TARP and other acronyms helped stabilize the financial system, and then fell again as the economic—and earnings damage becomes clear. I expect the market to follow that playbook again.

Still, the market’s rally raises doubts. I expected a bounce, but not one like this. The scenario that frightens me the most from a markets perspective—only because it would make me look stupid—is that we get a repeat of 1998, when the market tumbled on emerging-market debt concerns, the Fed stepped in , and the crisis passed, and it was off to the races until the tech bubble really popped in March 2000. If that actually happens, it would be glorious.

More likely though, the market’s bounce has been a supersize reaction of a supersize loss, both of which happened at nearly unprecedented rates. And at some point, the upside momentum will give way as reality sets in. “There is a genuine shift from crisis to recovery (e.g. NY may have plateaued),” writes Nordea strategist Sebastien Galey. “[We] are still very much in troubled waters waiting for the second wave of the crisis to sink in (household behaviors, defaults…).”

And that economic reality probably will be tougher than the market expects. Right now, investors appear to be operating under the assumption that as long as the health situation improves enough for the economy to start up again, then it will quickly return to its normal self. Bank of America strategist Carol Zhang isn’t so sure. “In a few weeks’ time, the world will still need to wrestle with disruptions in everyday activities, supply-chain hiccups and social unrest around the world, all hurting the labor market, consumer confidence and investor risk appetite,” she writes. “Pricing in such a reality means the ‘lower for longer’ theme has just become ‘lower for a lot longer.’ And US yields could see a new low as a result of another risk-off move.”

And that assumes that spread of coronavirus can be controlled. To see the numbers improve in New York, where I live, is heartening, and has certainly heartened the stock market, as has the possibility that economies could spring back to life in Europe and Asia. But it may still be too early to know if social distancing can end by May, and if it does, whether the disease will return in the fall and force economies to shut down again, writes Bernstein strategist Inigo Fraser Jenkins. “Despite the understandable excitement at seeing an initial relaxation of the lockdown, this is not fully accounting for the fact that lockdowns will likely need to be re-imposed at a future date in response to increases in infection rates,” he explains. Needless to say, that would not be an ideal outcome for the stock market.

As I said, I hope I’m wrong. It would mean that the disease has faded away, that people have stopped getting sick, and that life has started to return to normal. But I’m afraid I’m not.

Be safe.

Write to Ben Levisohn at Ben.Levisohn@barrons.com

‘The mutual fund industry is in trouble,’ investor warns as hidden-asset ETFs hit the scene

PUBLISHED SAT, APR 11 20209:16 AM EDT

There could be trouble ahead for mutual funds.

With American Century launching Wall Street’s first two actively managed, nontransparent exchange-traded funds, some investors are wondering what the implications could be for competing actively managed mutual funds.

The funds, launched in late March, began trading last week under American Century Focused Dynamic Growth ETF (FDG) and American Century Focused Large Cap Value ETF (FLV).

Unlike traditional ETFs, which are required to disclose their holdings daily, nontransparent ETFs will take a page from the mutual fund’s book. Once approved, they are allowed to disclose their holds on a monthly or quarterly basis.

ETFs are also largely cheaper to own than mutual funds and more liquid, meaning they can be bought and sold on the open market. Generally, mutual funds can only be bought or sold after the market has closed.

All this makes the ETF structure an attractive one for ailing active managers, who for years have struggled to find alpha under the more costly and rigid mutual fund umbrella.

“From our perspective, we want to offer the investors choice,” Ed Rosenberg, head of ETFs and senior vice president at American Century, told CNBC’s “ETF Edge” on Monday. “There are clients who are going to prefer mutual funds. It’s just their normal habit, whether it’s been dollar-cost averaging or 401(k)s or 529s. There are other investors who want more control, and those are the investors that we’re going to be targeting.”

As more and more fund issuers and platforms waive trader commissions, cut fees and allow for fractional share trading to try and make their mutual fund offerings more attractive, that should benefit ETFs as well, Rosenberg said.

“There’s going to be a point where they become a level playing field, and ETFs, with their benefits, could outweigh those of mutual funds in the long term,” Rosenberg said.

John Davi, founder and chief investment officer of Astoria Portfolio Advisors, said in the same interview that the ETF market’s impressive resilience in recent weeks could also pose a risk to the fate of mutual funds.

With ETFs establishing themselves as reliable vehicles for price discovery, “I think the mutual fund industry is in trouble, obviously,” Davi said.

“For my money, we prefer a little bit more transparency than less in general, but I’m always amazed about the ETF product” Davi said. “I’ve been working in the ETF ecosystem for 20 years. I remember when iShares first launched 25 ETFs in one day. People were like, ‘Why do you need a single country? Why do you need a subsector ETF?’ And sure enough, we have an entire industry now. So, there’s always a market.”

With mutual fund companies’ price-to-earnings ratios already on the decline, nontransparent ETFs could find success sooner than many think — depending on a few key factors, Davi said.

“I think the market is telling the mutual fund industry, ‘Hey, you need to get on the ball here and get involved in the ETF ecosystem in one shape or form,’ and ANTs is one way to do it,” he said. “You’ll kind of know what type of firm you have if you are able to successfully raise assets, because I don’t think anyone’s going to buy it unless you either have strong distribution or really good performance.”

For Rosenberg and his firm’s newly launched ETFs, that success will largely predicate on client preferences, he said.

FDG and FLV both hit new highs in Thursday’s trading session.

The content of this website is published in the United States of America and persons who access it agree to do so in accordance with applicable U.S. law.

All opinions expressed by the analysts quoted here are solely their opinions and do not reflect the opinions of CNBC, NBC UNIVERSAL, their parent company or affiliates, and may have been previously disseminated by them on television, radio, Internet or another medium.

You should not treat any opinion expressed on this website as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of an opinion. Such opinions are based upon information the analysts consider reliable, but neither CNBC nor its affiliates and/or subsidiaries warrant its completeness or accuracy, and it should not be relied upon as such.

The analysts, CNBC, its affiliates and/or subsidiaries are not under any obligation to update or correct any information available on this website. The “Fast Money” participants are professional traders who may be actively involved in securities discussed herein, on behalf of themselves, their companies and their clients.

Also, the opinions expressed by the analysts may be short term in nature and are subject to change without notice.

The analysts and CNBC do not guarantee any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment discussed on this website. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested. Investments or strategies mentioned on this website may not be suitable for you. This material does not take into account your particular investment objectives, financial situation or needs and is not intended as recommendations appropriate for you.

You must make an independent decision regarding investments or strategies mentioned on this website. Before acting on information on this website, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

Bill Gates: This is how long it may take before Americans ‘can be completely safe’ from COVID-19

Published Wed, Apr 8 20201:23 PM EDT

Catherine Clifford@CATCLIFFORD

It might not be until fall 2021 that Americans “can be completely safe” from COVID-19, Bill Gates said in a Tuesday interview with Judy Woodruff on PBS Newshour.

That’s because it will take more than a year before a vaccine can be developed and deployed, according to researchers working to develop a treatment for COVID-19.

“The vaccine is critical, because, until you have that, things aren’t really going to be normal,” the billionaire philanthropist told Woodruff. “They can open up to some degree, but the risk of a rebound will be there until we have very broad vaccination.”

Social distancing is helping to lower the number of COVID-19 cases. The goal, Gates explained, is to get that number down to a point where “contact tracing” (a process in which those within close contact with an infected person are closely monitored) can be done, in order to maintain necessary quarantines.

To understand what life in the U.S. will look like six to 12 months from now, Gates suggested China as a good model. “They are sending people back to work, but they’re wearing masks. They’re checking temperatures. They’re not doing large sporting events. And so they have been able to avoid a large rebound,” he said.

One possibility is that gatherings will be permitted, depending on the ages of the people involved.

“So having a classroom with 30 young people in it may be just fine, because their role in transmitting the disease, we will understand in the next month or so. It may be so limited that you’re far more liberal with young people getting together than you would be with a general-age audience,” Gates said.

Still, he stressed that larger public gatherings “may not resume until broad vaccination has taken place.”

Beyond that, “returning to some semblance of normal,” as Woodruff put it, can be predicted by watching the behaviors of other countries. Sweden, for example, isn’t “locking down quite as much,” so their experience will be informative, Gates explained.

Gates has been partnering with The Institute for Health Metrics and Evaluation, a global health research center at the University of Washington, to further understand “which policies in which countries seem to be working.”

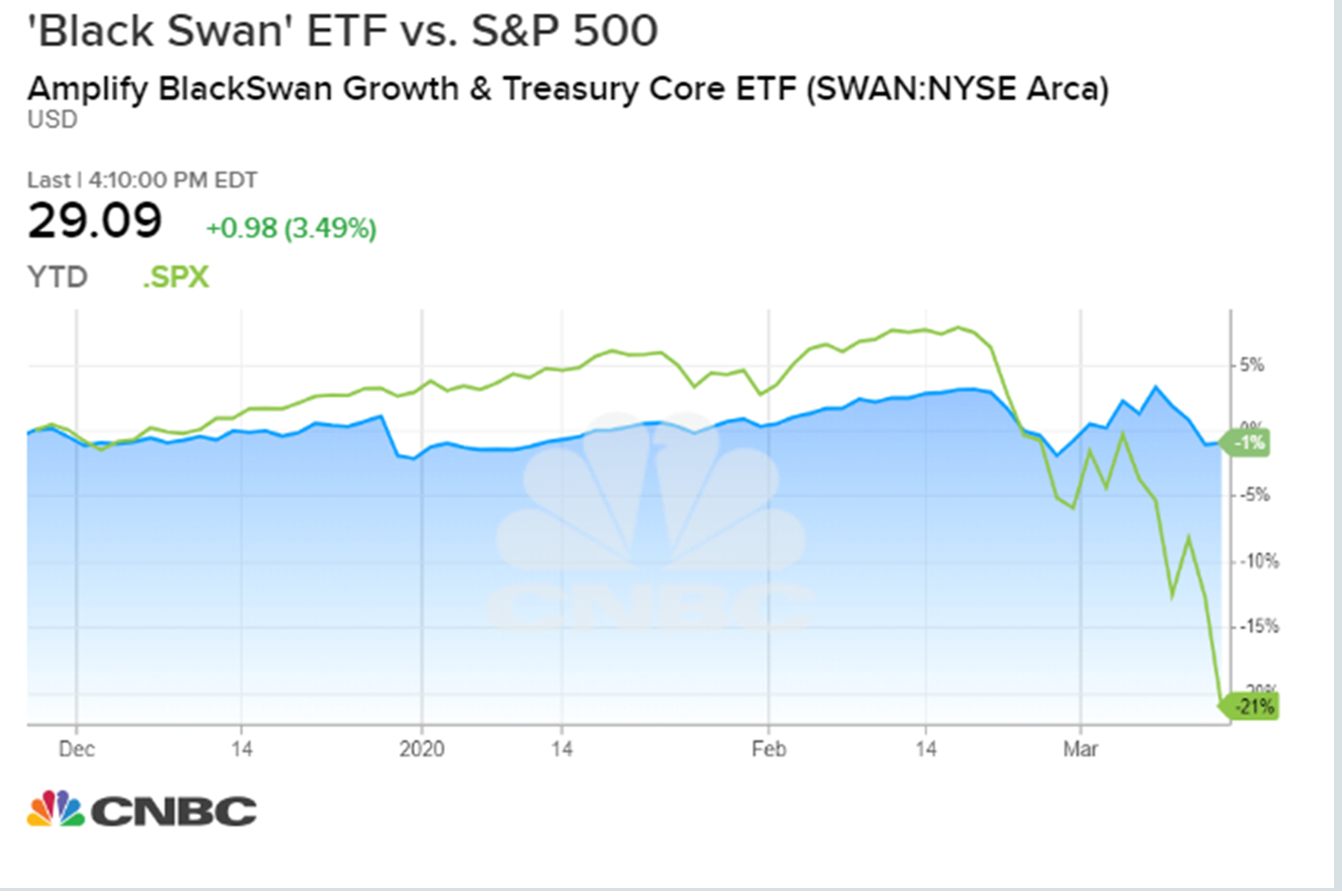

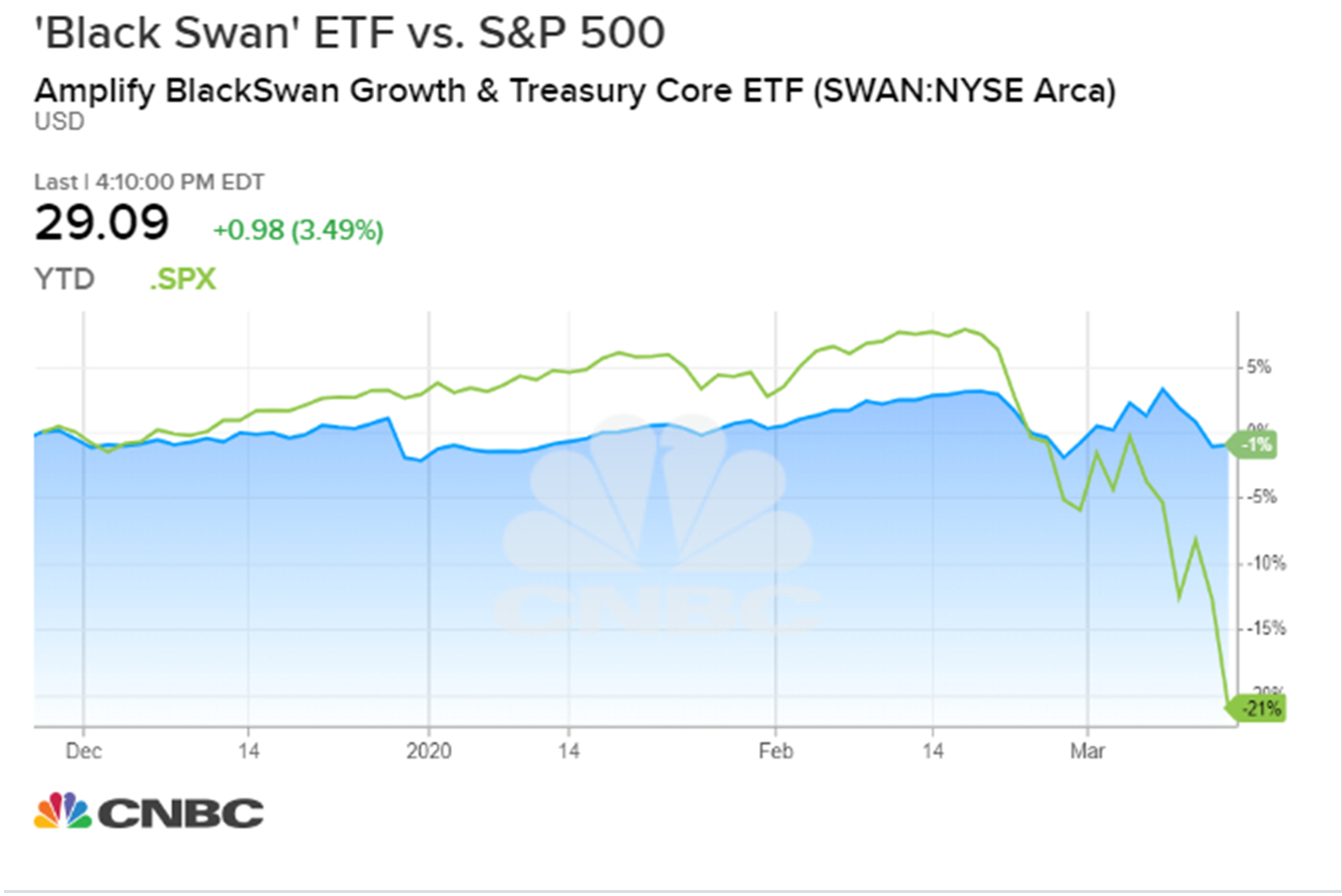

This ETF hedges against ‘black swan’ market events — here’s how it’s holding up this year

PUBLISHED SAT, MAR 14 20209:01 AM EDT

When it comes to black-swan events, a global pandemic certainly makes the cut.

With the spread of the coronavirus sending U.S. markets into a tailspin in recent weeks — occasionally punctuated by big upswings as stocks tried to recover from the steep declines — investors are likely seeking some stability.

Some have been flocking to exchange-traded funds that invest in stocks with lower volatility profiles such as the iShares Edge MSCI Min Vol USA ETF (USMV) or the Invesco S&P 500 Low Volatility ETF (SPLV).

But with those two funds still down sharply for the year — USMV has fallen 16% to a new 52-week low as of Friday, while SPLV has shed about 17% — CNBC’s “ETF Edge” looked into another option that’s been holding up much better.

Amplify’s Black Swan Growth and Treasury Core ETF (SWAN) is only down about 1% year to date versus the S&P 500′s 21% decline, which can be attributed in part to the fund’s makeup, Amplify founder and CEO Christian Magoon told “ETF Edge” this week.

“The theory behind Black Swan is to own S&P exposure, but to also own U.S. Treasurys. During times of market crisis, Treasurys are bought up like crazy and they act as a great negative-correlated asset to equity exposure,” Magoon said Monday.

The fund is roughly 65% Treasurys and 35% S&P exposure via LEAP options, or option contracts that expire in at least one year (LEAP stands for long-term equity anticipation), Magoon said, adding that it rebalances twice a year, but keeps its exposure “fairly constant.”

“This works a lot like a traditional, balanced portfolio, but really shines during times of market crisis,” he said. “This is a fund that does work [to] hedge against black-swan risks, but [is] also something you can hold in an upward-moving market. So, it’s really a core holding.”

Others, including Dave Nadig, chief investment officer and director of research at ETF Trends, said investors would be wise to do their research before buying into funds like these.

“The important thing is you really have to understand the mechanics of how these things are going to work,” he said in the same “ETF Edge” interview. “You’ve really got to be careful.”

That means understanding things like tail-risk funds, which leverage put options to hedge against higher market volatility and can have varying degrees of performance, Nadig said. As of Monday, he saw “a 30% dispersion” between the best- and worst-performing tail-risk ETFs so far in 2020.

SWAN gained nearly 3.5% in Friday’s trading session.

To Understand the Wild U.S. Stock Rally, Just Forget About 2020

April 10, 2020, 5:00 AM MDT

Firms facing short-term profit pressure have rebounded fast

Investors expect a short recession, but that’s in question

The stats border on the ridiculous. On the eve of an earnings season nobody has a clue about, the S&P 500 notches its best week in 46 years. About $4 trillion has been added to share prices, a few weeks after $10 trillion was sheared off.

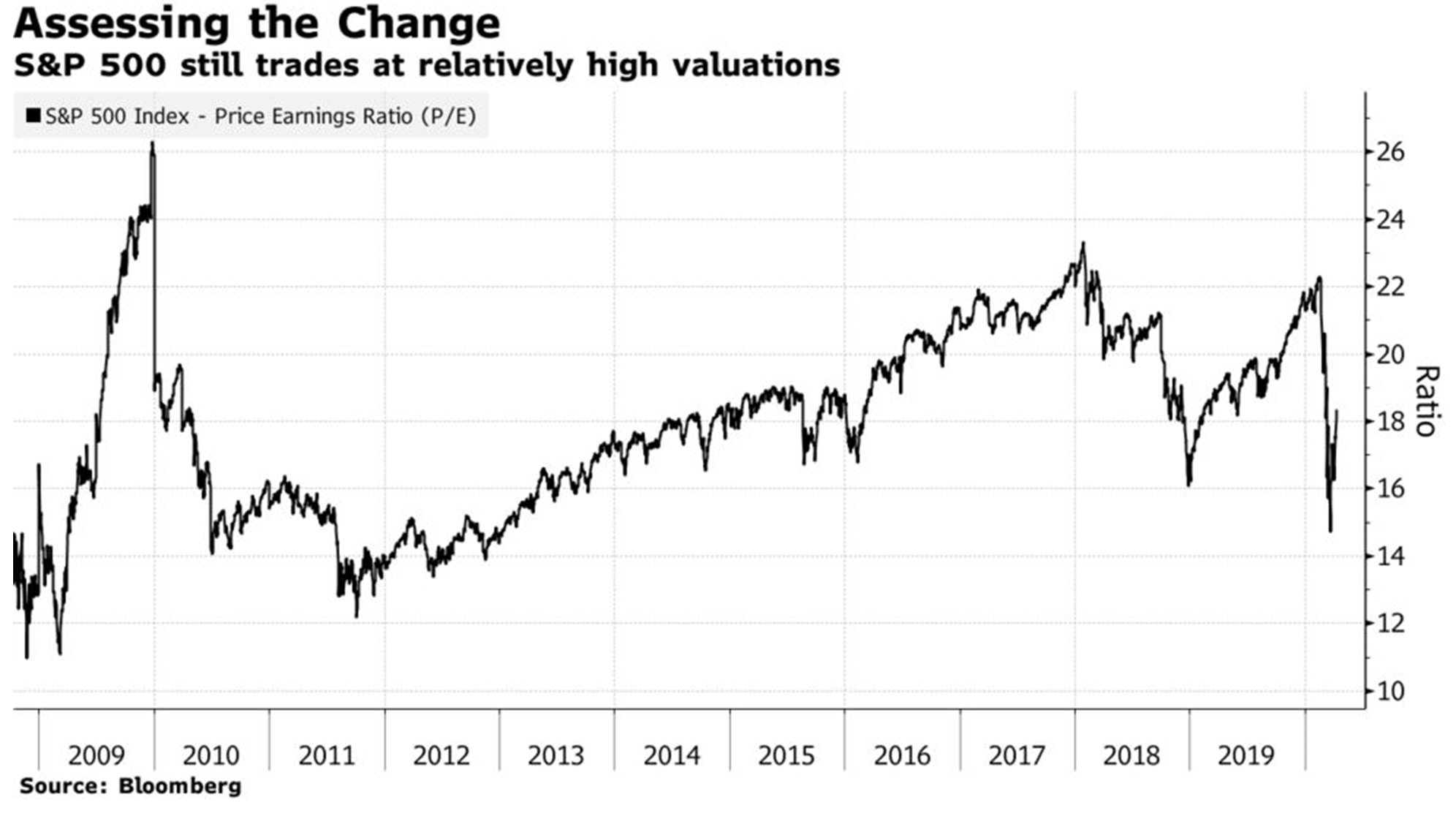

Does it make any sense? To skeptical Wall Street veterans, the answer is obvious: no. While stimulus is flowing and the curve may be flattening, investors are bidding up stocks at a time unemployment may already be 15%, with economists forecasting one of the biggest contractions ever. Only a fool buys equities trading at 40 times the worst estimates for this year’s profits.

To all that, a single rebuttal exists. That in the absence of clarity, investors have no choice but to write this year off entirely. No matter how bad the recession gets, markets look forward — relentlessly. Whatever horrors the world is yet to endure investors will focus on the recovery.

“It’s almost as if nobody is even going to worry about 2020,” said Chris Gaffney, president of world markets at TIAA. “If the earnings are so bad that it looks like the company won’t be able to survive, that matters. But for most companies, investors have to look past 2020 because nobody knows what’s going to happen.”

To be sure, it takes a radical bull case to ignore everything going on now. Companies may be suffering lasting structural damage to their earnings power. Surely equities are worth less in a recession, objectors say, and who knows how long it will take to rebuild the economy? That’s why Wall Street has been heaping mud on the S&P 500’s 25% jump since March 23, saying it’s a bear-market bounce. But it’s the only viable way to explain a week in which the Nasdaq 100 ended just a couple big days away from erasing its 2020 decline.

While there’s no historical parallel for what’s going on today, the experience of individual companies that survived sudden blows to their profits may be relevant. It’s a deeply inexact model, prone to survivorship bias, since when faced with existential threats, many companies don’t make it. But a few examples, particularly of industrial megacaps who had profits for entire years gutted by giant fines, may hold clues for the S&P 500 should the recession prove brief.

Consider BP PLC. After the oil explorer and producer coughed up a record $20.8 billion in 2015 to pay for damages caused by an oil spill, earnings per share dropped roughly 50% for two years straight before tripling in 2017. Its stock price came back even faster. After falling 14% in 2015, shares soared 44% in 2016 for the best year since 1993.

Similarly, when Volkswagen AG was forced to set aside tens of billions of dollars for lawsuits and damages after an emissions scandal dubbed “Dieselgate,” it didn’t take long for a rebound to materialize. Shares plunged 18% in 2018, then surged 25% in 2019.

A more sobering model — though possibly a more pertinent one — is financial institutions in the 2008 crisis. While the collapse of Lehman Brothers Holdings Inc. is the highest profile, more than 400 banks failed by 2011, according to the Federal Deposit Insurance Corporation. But massive bail-outs helped others survive. After plummeting 50% in 2008 and seeing a fifth of its members removed, the KBW Bank Index fell less than 4% in 2009 before jumping 22% in 2010. By the end of that year, the gauge was up 180% from its lows.

“It’s a small fraction of companies that are going to go bankrupt, and the surviving companies will end up with a better competitive position,” said Chris Brightman, the chief investment officer of Newport Beach, California,-based Research Affiliates. “We saw that very clearly in the global financial crisis. Did a few banks go bankrupt? Yes. Was the entire banking system going to go bankrupt? Of course not. Did that set the remaining banks up for a fabulous run during the recovery? It absolutely did.”

Of course, the surviving companies in question above were otherwise healthy before whatever crisis struck. Solvency concerns do run high in the current environment, as no one truly knows how long global economies will remain shut due to the coronavirus, but odds are most survive, and activity will return in time. According to Bloomberg Intelligence, any 2020 economic downturn may be sharp, but short, and duration matters more than the depth for stocks.

Still, the time frame is “entirely dependent on the length of the shutdown,” wrote strategists including Gina Martin Adams.

Investors expecting to look past a quick recession may have longer to wait than they realize. Restrictions forced on the economy by virus-related measures will prolong its slump “through 2020 and much of 2021,” wrote Narayana Kocherlakota in a column for Bloomberg Opinion published Thursday. The former president of the Fed Bank of Minneapolis says the likely length of the downturn means governmental stimulus efforts need to be much more ambitious.

If history serves as a guide, a deep, yet brief recession would be rare. The average recession since World War II has lasted 11 months, according to LPL Financial, and the shortest ever was six months. The probability of a U.S. recession in the next 12 months jumped to 100% in March, a Bloomberg Economics model shows. If one began last month, then an average recession would would put the economy on track to climb out in February of 2021.

The market has a strong track record figuring out when a recession may end. Stocks bottomed an average of five months before downturns ended in 10 of the last 11 recessions, according to Luke Tilley, chief economist at Wilmington Trust Corp. and a former adviser with the Federal Reserve Bank of Philadelphia. He currently sees the U.S. economy starting to recover in the third or fourth quarter, meaning “stocks could start to price in that recovery and begin a sustainable rally relatively soon — assuming the market has not yet bottomed,” he said.

An escape of a re-test of the stock market’s lows would be unparalleled, though, in Bank of America’s view, considering bear markets that coincide with economic downturns are strongly tied to their depth and length. The firm’s economists expect one of the deepest recessions on record, and equity strategists including Savita Subramanian see S&P 500 profits plummeting 29% this year to $115 a share.

Based on BofA’s models, it may take a few years for earnings to return to peak levels, but the snapback should be faster than usual considering quick and aggressive policy measures and a higher quality makeup of the S&P 500 as industries like software have grown more important and energy less so. During the financial crisis it took 17 quarters to recoup all lost earnings, and eight years after the Great Depression. The firm sees profits rising as much as 35% in 2021 to $155 a share.

“Markets will look through and forecast what they think are permanent impairment to earnings as opposed to short term, a couple of quarters of severe pressure on earnings,” said Matt Forrester, chief investment officer at BNY Mellon’s Lockwood Advisors. “How much damage is very up in the air, that’s why markets have had so much volatility. We’ll begin to get some assessment of that.”

— With assistance by Vildana Hajric, and Claire Ballentine

Ford shares fall after automaker warns of first-quarter losses and a nearly 16% dive in revenue

PUBLISHED MON, APR 13 20209:44 AM EDTUPDATED 12 MIN AGO

KEY POINTS

- Ford expects a pretax loss of about $600 million, excluding $300 million in special items.

- Total revenue for the first quarter is expected to be about $34 billion, down 15.7% from a year ago.

Ford Motor expects to report an adjusted pretax loss of about $600 million for the first quarter as the coronavirus depresses sales and production.

The automaker said Monday that it couldn’t yet provide an accurate estimate of its total earnings, but told investors the pretax estimate excludes $300 million in special items. In the first quarter of 2019, Ford posted first-quarter net income of $1.15 billion, and earned $2.4 billion after adjustments.

Ford said total revenue for the first quarter is expected to be about $34 billion, down 15.7% from $40.3 billion a year ago.

Ford’s stock was down more than 5% during Monday morning trading at around $5.05. Shares of the automaker, which last month had its credit rating cut to junk status by rating agency S&P Global, are down more than 40% this year.

The company believes it has enough cash to get it through “at least the end of the third quarter with no incremental vehicle production and wholesales or financing actions,” said Ford CFO Tim Stone in a release.

As of Thursday, Ford sad it had about $30 billion in cash on its balance sheet, including $15.4 billion of proceeds from borrowings last month against two existing credit lines.

Ford, like many automakers, has been forced to conduct rolling plant shutdowns across the globe due to Covid-19. What started as a problem in China to begin the year, quickly grew to a supply base issue and then a global pandemic that shut down U.S. facilities, which remain shuttered.

Urged by the United Auto Workers union, Ford, Fiat Chrysler and General Motors announced plans to temporarily close their plants due to the coronavirus on March 18. Fiat Chrysler last week announced plans to restart production on May 4, while GM and Ford have not yet disclosed new dates to reopen their facilities.

Shares of GM were down about 5% Monday morning, while Fiat Chrysler shares decreased by around 3%.

Currently, Ford said only its operations in China, where coronavirus risks developed earlier and are now moderating, are producing and wholesaling vehicles.

Ford’s first-quarter vehicle wholesales were down 21% compared with a year ago, “largely as a result of lower production and demand related to the coronavirus,” according to the company.

“We continue to opportunistically assess all funding options to further strengthen our balance sheet and increase liquidity to optimize our financial flexibility,” Stone said. “We also are identifying additional operating actions to enhance our cash position.”

Stone said the company is taking other steps to preserve cash, including by lowering operating costs, reducing capital expenditures and deferring portions of executive salaries. The company last month also suspended its $600 million regular quarterly dividend and its share repurchase program.

Ford is scheduled to report first-quarter results on April 28.

HI Financial Services Mid-Week 06-24-2014