HI Market View Commentary 03-28-2022

OK three things today:

Biden’s Budget and what it means = Billionaire tax rate of 20%, Increase in Defensive spending, 21% to 28% corporate tax rate increase

Who get hit with the increase to 28% corporate tax rate?= Corporations, Customers, Shareholders, US

US = Any LLC, Sub S corporation, C-corporation and possibly any profitable trusts

Billionaires tax increase to 20% of “unrealized gains”

No tax increase for anyone making less than 400K

10 million to 1 million dollar capital gains tax would fall under this “umbrella”

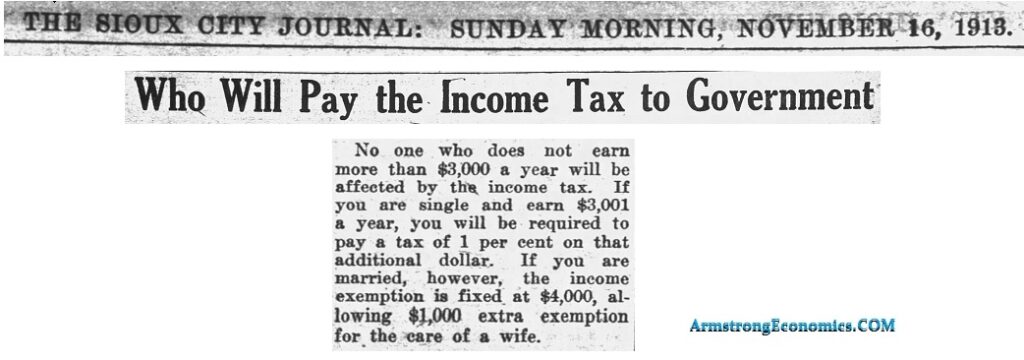

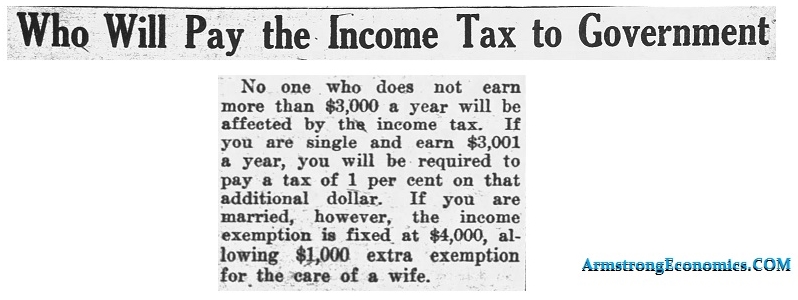

History lesson – Income tax was supposed to be for millionaires only

Biden ran on no tax increase for the middle class and no extra pork for areas like defensive spending

Will it pass? Probably in the house with some revisions and probably NOT in the senate

Russia more likely to settle dispute and what it means for our portfolios

I found interesting that it brought our market back today – Unverified and no plan of action

IF we get a Russia/Ukraine settlement then our market pops roughly 5-7%

WE need to put the long put insurance profits back into shares

Disconnect between the GDP, Supply and demand with the supply shortage, and inflation

What about Oil and looking at new oil company investments

What do you think of FANG vs CVX

Fundamentals CheckList

Check off 10 to 11 out of the 14

☺ Institutional Ownership 91.60%

☺ Average Daily Volume 2.93M

☺ Dividend 1.42% or $2

☺ High/Low – Extended Quote Info 146.40 High 65.60 to the low side

☺ Debt to Equity 0.55/ long term 0.55

☺ Overall Debt 0.55

☺ Revenue Growth Rate

☺ Earnings Surprises

☺ Profit Margin

☺ P/E Ratio

☺ PEG Ratio

☺ Sector Growth

☺ Rank in Industry

☺ Beta

I wouldn’t be investing in energy at this time !!!!!

Any flour or grain manufacturer will receive higher prices going into next year due the conflict

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 25-Mar-22 14:02 ET

Let the front-loading begin

On March 16 the Federal Open Market Committee (FOMC) raised the target range for the fed funds rate for the first time since December 2018. It was a tidy 25 basis points, which took the target range from 0.00-0.25% to 0.25-0.50%.

There wasn’t unanimous consent for that decision. St. Louis Fed President Bullard wanted the FOMC to raise rates by 50 basis points.

Mr. Bullard didn’t get his wish in March, but it’s sounding increasingly as if he will in May and perhaps even at some additional meetings after that.

Still Chasing the Rabbit

The Summary of Economic Projections conveyed an otherwise hawkish bent. The median estimate for the fed funds rate in 2022 increased to 1.9% from 0.9% in December. Furthermore, the median estimate for the fed funds rate in 2023 jumped to 2.8% from 1.6%, leaving it above the longer-run rate of 2.4%.

The projection for 2022 implied an expectation for seven rate hikes in 2022, including the one that was announced in March. The projection for 2023, meanwhile, suggested the Fed expects to be operating with a restrictive stance in 2023 since the median estimate is above the longer-run rate. Of course, the restrictive rate is only as good as the forecast for inflation and the longer-run rate.

The Fed’s inflation estimates since the pandemic began have been woefully conservative, although the most recent estimate has sprinkled a little more reality into the situation.

Still, with the PCE inflation rate at 6.1% in January and the Core PCE inflation Rate at 5.2% (before the Russia-Ukraine situation worsened the inflation picture), the latest estimate still looks more like a case of the dog chasing the rabbit.

| Fed Economic Projections (median estimate for 2022) | ||

| PCE Inflation | Core PCE Inflation | |

| June 2020 | 1.7% | 1.7% |

| September 2020 | 1.8% | 1.8% |

| December 2020 | 1.9% | 1.9% |

| March 2021 | 2.0% | 2.0% |

| June 2021 | 2.1% | 2.1% |

| September 2021 | 2.2% | 2.3% |

| December 2021 | 2.6% | 2.7% |

| March 2022 | 4.3% | 4.1% |

Source: Federal Reserve Summary of Economic Projections

Remarkably, the stock market rallied in the wake of the FOMC announcement with Fed Chair Powell winning plaudits for his presentation style during the press conference. He indicated at the press conference that the Fed would use its tools to ensure that higher inflation does not become entrenched.

Stock investors reportedly liked the implication that the Fed is going to get tough and get inflation in check, seemingly forgetting that the process for doing that will entail a series of rate hikes and reducing the size of the Fed’s balance sheet — actions that should slow economic and earnings growth, if not drive them into a contraction.

Treasuries, however, quickly woke up to the reality that policy rates are headed higher. The 2-yr note yield, which settled at 1.85% the day before the FOMC announcement, now sits at 2.31%.

Getting Personal

Strikingly, several Fed officials issued some personal opinions in the days following the FOMC meeting about how they think the Fed might have to think about removing policy accommodation.

- Mr. Bullard (arguably the biggest hawk at the Fed) said he thinks the fed funds rate should be above 3.0% this year.

- Fed Governor Waller said he favors the Fed front-loading its rate hikes, which could entail raising rates by 50 basis points at one or more meetings in the near future.

- Minneapolis Fed President Kashkari (arguably the biggest dove at the Fed) acknowledged that he moved his SEP submission for the fed funds rate for year-end 2022 from 0.50-0.75% in December to 1.75-2.00% in the most recent SEP and said the Fed may need to get modestly above neutral while inflation dynamics unwind or even move to a contractionary stance if the economy persists in a high-pressure, high-inflation equilibrium.

- Fed Chair Powell, in a speech for the NABE Conference, reiterated that the Fed will be more aggressive if necessary to ensure a return to price stability, including raising the fed funds rate by more than 25 basis points at a meeting or meetings and tightening beyond common measures of neutral and into a more restrictive stance if needed.

- Cleveland Fed President Mester thinks a fed funds rate of 2.5% by year end looks appropriate.

- Chicago Fed President Evans expects the federal funds rate at 2.75-3.00% by the end of 2023 and 2024.

What was peculiar about all these remarks is that they were made despite an awareness that peace talks between Russia and Ukraine are getting bogged down. Recall that the Fed took a more conservative step with the first rate hike, predominately because of the uncertainty surrounding the Russia-Ukraine situation which is still highly uncertain.

Only days after doing so, “front-loading” has become the new buzzword when it comes to discussing future policy moves.

What It All Means

Fed officials are talking tough about needing to rein in inflation. That’s good to hear because inflation is out of hand and it promises to get worse still before getting better. Then again, Fed officials know they have to talk tough given that there hasn’t been any noticeable downshift in inflation expectations following the first rate hike and their median estimate that another six rate hikes are likely to follow this year.

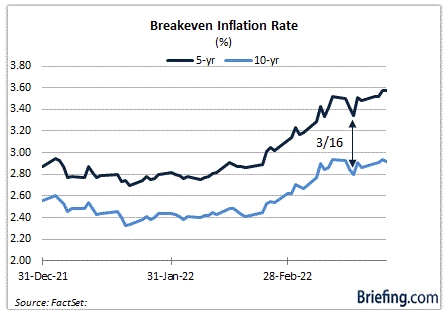

The 5-year breakeven inflation rate stood at 3.42% on March 15. Today it sits at 3.57%. The 10-yr breakeven inflation rate stood at 2.84% on March 15. Today it sits at 2.92%.

Inflation expectations are inflated, sitting at 20-year highs. The bump in inflation expectations after the first rate hike is not what the Fed wants to see. Not surprisingly, then, the jawboning about front-loading rate hikes has gone up an octave or two.

By the same token, the fed funds futures market looks to be taking the more vocal Fed officials at their word. According to the CME’s FedWatch Tool, the December fed funds futures show an 86.6% probability of the fed funds rate being at 2.25-2.50% and a 51.5% probability that it will be at 2.50-2.75%.

That jibes with Ms. Mester’s view, but it’s still short of Mr. Bullard’s thinking.

In any case, it points to an awareness that the Fed has a lot of catching up to do if it wants not only to tame inflation but also inflation expectations.

Let the front-loading begin.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of April 4)

Where will our markets end this week?

Lower

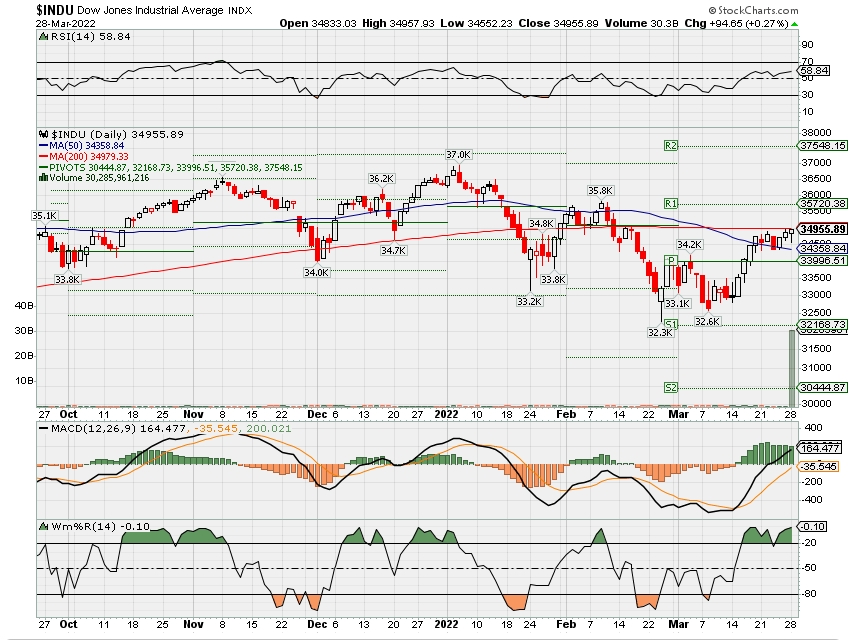

DJIA – Bullish 5,20 day

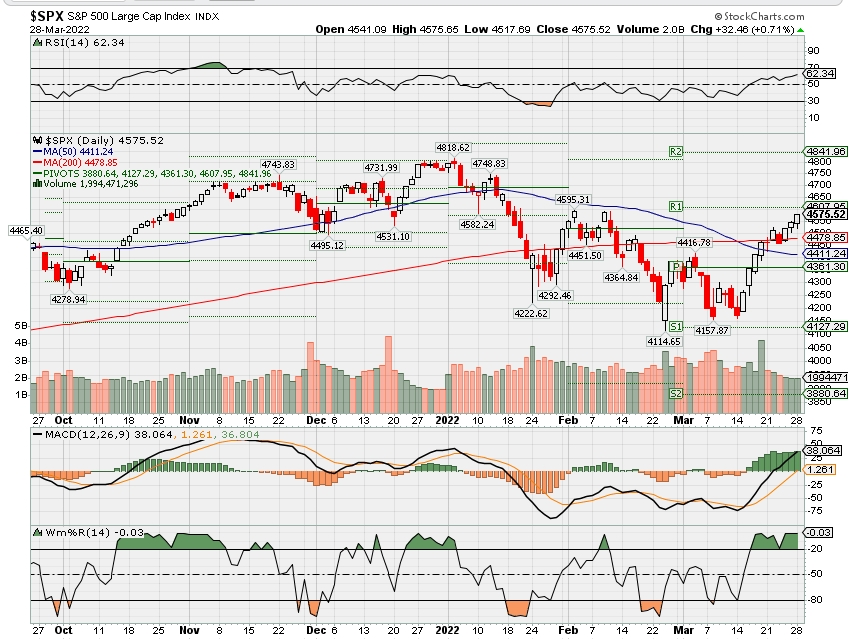

SPX – Bullish

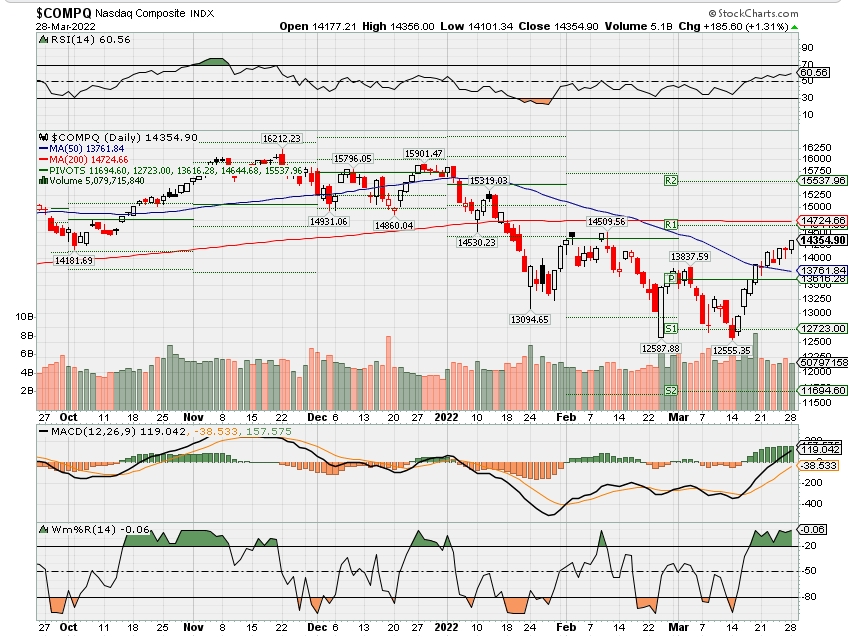

COMP – Bullish

Where Will the SPX end April 2022?

03-28-2022 +2.0%

Earnings:

Mon:

Tues: CALM, PVH, SPWH, MU

Wed: FIVE, PAYX

Thur: BB

Fri:

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, S&P Case Shiller, Consumer Confidence

Wed: MBA, ADP Employment, GDP, GDP Deflator

Thur: Initial Claims, Continuing Claims, Chicago PMI, Personal Income, Personal Spending, PCE Prices

Fri: Average Work Week, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, ISM Manufacturing, Construction Spending

How am I looking to trade?

Currently letting a lot of things just run without protection

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Why Bill Gates warns against investing in Bitcoin: ‘If you have less money than Elon, watch out’

Bill Gates delivers a speech at the fundraising day at the Sixth World Fund Conference in Lyon, France, on October 10, 2019.

Plenty of celebrity and tech icons have hopped on the Bitcoin train. Don’t count Bill Gates among them.

In a resurfaced interview from February 2021, the billionaire Microsoft co-founder told Bloomberg Technology that he was wary of the frenzy over Bitcoin, particularly because the value of the cryptocurrency could be swayed by something as simple as a tweet from Tesla CEO Elon Musk.

“Elon has tons of money, and he’s very sophisticated, so I don’t worry that his Bitcoin will randomly go up or down,” Gates said. “I do think people get brought into these manias who may not have as much money to spare, so I’m not bullish on Bitcoin.”

He added, “If you have less money than Elon, you should probably watch out.”

Musk — the world’s richest person, with a net worth of $233 billion, according to Forbes — is notably a Bitcoin fan, tweeting about it as recently as Wednesday morning. But Gates said his fellow tech billionaire was merely an example of why he’s turned off by everyday Bitcoin use.

Specifically, Gates said, he’s primarily concerned about the lack of regulation around the cryptocurrency. He highlighted two of the main risks associated with Bitcoin and other forms of cryptocurrency: They’re decentralized, and they can be highly volatile.

″[Bitcoin] happens to promote anonymous transactions,” Gates said. “They’re not reversible transactions.”

Gates said that the Bill and Melinda Gates Foundation actually “does a lot in terms of digital currency,” but only when “you can see who is making the transaction.” He said “digital money is a good thing,” especially when it comes to funding poorer countries and getting “money out to their citizens very, very efficiently.”

The good news for Gates is that regulation may be coming. On Wednesday, President Joe Biden signed an executive order encouraging federal agencies like the U.S. Treasury to develop new crypto-related policy recommendations — with an eye on addressing consumer protection, financial stability, illicit activity, U.S. competitiveness, financial inclusion and responsible innovation.

Those are important areas: Crypto experts often warn that altcoins, in their current state, are at a high risk for fraud — and that they can gain and lose value very quickly, making them deeply unreliable as investments.

“Be very careful about how much you allocate and understanding what you an tolerate,” Douglas Boneparth, a certified financial planner and president of Bone Fide Wealth, told CNBC Make It last year. “Because if 80% of your net worth is tied to bitcoin, and it goes down 30%, that’s rough.”

President Joe Biden to propose new 20% minimum billionaire tax

KEY POINTS

- The “Billionaire Minimum Income Tax” would assess a 20% minimum tax rate on U.S. households worth more than $100 million.

- Over half the revenue could come from those worth more than $1 billion.

President Joe Biden is expected to propose a new minimum tax that would largely target billionaires when he unveils his 2023 budget, according to a document obtained by CNBC.

Called the “Billionaire Minimum Income Tax,” it would assess a 20% minimum tax rate on U.S. households worth more than $100 million. Over half the revenue could come from those worth more than $1 billion.

“This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters,” the document said.

The proposed levy is expected to reduce the deficit by about $360 billion in the next decade, according to the document.

If a wealthy household is already paying 20% on their full income, they won’t pay an additional tax under the proposal. If they pay less than 20%, they’ll owe a “top-up payment” to meet the new minimum.

“As a result, this new minimum tax will eliminate the ability for the unrealized income of ultra-high-net-worth households to go untaxed for decades or generations,” the document stated.

The new tax proposal is part of Biden’s 2023 budget expected to be released on Monday. His new spending plan would trim $1.3 trillion from the deficit over the next decade, according to a fact sheet released from the White House on Saturday.

What remains to be seen is whether Congress will move forward on Biden’s proposal. Last year, Senate Democrats unveiled a billionaires’ tax, which would have levied the unrealized capital gains of the wealthiest Americans. The measure ultimately did not proceed.

In fiscal year 2021, the federal deficit totaled nearly $2.8 trillion — about $360 billion less than in 2020, according to the Congressional Budget Office.

The swift economic recovery after pandemic lows is also a factor in lowering the deficit. The White House credited the American Rescue Plan, crafted to support relief to struggling Americans during the Covid crisis, for helping the economy grow 5.7% in 2021.

Not only will less economic and pandemic support be needed for people and businesses, but a stronger economy means higher incomes for households and businesses. Because of this, the government is projected to collect more than $300 billion in additional revenues compared to last year, the fact sheet stated.

Biden’s 2023 budget would hike taxes on the ultra-rich and corporations, boost defense and police spending

Christina Wilkie@CHRISTINAWILKIE

WASHINGTON — President Joe Biden’s 2023 federal budget, released Monday, proposes tax hikes on the ultra-wealthy and corporations while providing billions of dollars in new spending at the Defense Department and the Justice Department.

The proposal sent to Congress touts a reduction in the federal budget deficit of more than $1 trillion over the next 10 years. This is paid for, in part, by raising the corporate tax rate from 21% up to 28%, a rate favored by progressive Democrats but opposed by key moderates. Biden also proposes a new 20% minimum tax on the top 0.01% earners and households worth more than $100 million.

This year over year deficit reduction is also achieved in large part by the phasing out of the Covid-19 pandemic’s most generous federal safety net programs.

Overall, the budget shifts focus away from the pandemic, which has subsided after the massive Omicron wave late last year. Notably, there are no emergency pandemic or supplemental funds being requested.

In place of Covid, the budget focuses on the need to tackle crime and public safety, and the global peril created by Russia’s invasion of Ukraine.

Here are some key items:

- Approximately $31 billion in new defense spending, which will bring the total national defense spending up to $813 billion.

- As part of that defense spending, $6.9 billion is directed to NATO, European defense, Ukraine and countering Russian aggression, according to the White House.

- More than $32 billion in spending to fight crime at home, including more than $20.6 billion at the Justice Department and another $3.2 billion for state and local law enforcement grants and for hiring police officers.

- Roughly $10.6 billion for global health security, which includes Covid as well as future pandemics.

The president’s budget request to Congress also serves as a platform for their party to run on.

Biden Out to Destroy the US Financial Markets – Tomorrow

Blog/The Hunt for Taxes

Posted Mar 27, 2022 by Martin Armstrong

Spread the love

The REASON Biden needs war is very simple. The world monetary system is collapsing. The negative interest rates in Europe since 2014 have wiped out all the pension funds that needed 8% to break even. This is what is being the Guaranteed Basic Income because the politicians have destroyed the future of pensions. Even in the USA, 100% of social security is invested in US government bonds that pay well below 8% and this has undermined the fund going forward. Biden is following the FDR playbook and since COVID failed to produce the Great Depression they were counting on, they are shifting to PHASE 2 which is war.

With World War III, they will call upon patriotism to get through not just their BUILD BACK BETTER agenda but to install a full-blown Marxist agenda. They need WWIII to justify significant tax changes that will be introduced tomorrow.

Tomorrow will be D-DAY in the Financial Markets. Not only will they introduce ECASH which will create the digital currency NOT issued by the Federal Reserves, but by the Treasury. Now there have been the haters of the Federal Reserve because they do not understand the entire purpose of Elastic Money and that the Fed has been independent of the White House. For the Treasury to issue the digital dollar means that the power to create money will shift from the Federal Reset to the White House. On top of that, they want to restrict the amount of digital cash you will be allowed to have to $2,000. The object will be to force everyone onto the grid to be fully taxed. Then they will push to eliminate the paper money.

That is just one assault on the financial system. The next is the Minimum Billionaire’s Tax to be set to 20%. Most people will cheer on taxing the Billionaires. But what is also in this proposal is Elizabeth Warren’s dream of Marxism come true. The “definition” of income will include UNREALIZED gains. That means that people who started major companies like Tesla, Google, Amazon, Apple, Microsoft, and so on, will be forced to sell their stock to just raise money to pay 20% of that UNREALIZED gain. They are cheering that they expect to raise $360 billion from this alone and have no idea that such a proposal can crash the stock market and undermine everyone’s pensions because of their hatred of the rich.

The UNREALIZED tax will eventually be expanded down to everyone. The Income-tax began the same way – it would only apply to millionaires back then. The UNREALIZED taxation will work similar to gambling where you pay tax on your gains, but no credit for losses. So if you buy a stock, it triples and you make $1 million, you will have to pay $200,000 to the Feds so you will be forced to sell at least some stock and as the price declines, so be it. You are taxed on where it was at the end of that period – no credit for the decline. Then next year, you will pay 20% again on what is left until the entire gain is paid in taxes and you will be left with NOTHING.

They always target the rich to justify the tax and then extend it down to everyone. Janet Yellen tried to bullshit everyone lowering reporting every transaction down to $600 claiming they were after billionaires. They always count on people just being stupid.

The ONLY way to avoid this disaster of a 20% wealth tax, which would apply even to your home, is you can no longer invest. But it also means you should NOT take your company public or expand it for you will be punished for doing so.

Everyone will have to become a trader. So to avoid paying endless taxes on the value of your home thanks to inflation is to sell it and rent from Larry Fink at Blackrock, who is on the board of guess who – Kaus Schwab’s World Economic Forum. So in the end, Biden is ushering taxes to force you into YOU WILL OWN NOTHING AND BE HAPPY. Fink will be exempt for it is owned by a fund.

Yes, a number of people have asked in Fink is a subscriber to our model after he came out and said globalization is dead, I have no idea but I would NOT advise Fink anymore than I would Advise Schwab. The only question I would ask is why the hell are you trying to destroy the world economy? Investing in Blackrock emerging markets you better get out before it’s too late. These people have destroyed the world economy in just 8.6 weeks come the week of April 18th.

So while Biden calls for a regime change in Russia where he said: “For God’s sake, this man cannot remain in power,” I think he was looking at himself in the mirror. Putin is not a threat to the future of my family – Biden and his Marxists are. We need a regime change not in Russia – but right here in what used to be America.

The Founding Fathers KNEW the danger that an income tax would do for it renders all citizens nothing but economic slaves to the state and they must know everything we do at all times. Thus, in Article I the Founding Fathers PROHIBITED any form of a Direct Tax. We are now witnessing the destruction of the United States because of political corruption.

HI Financial Services Mid-Week 06-24-2014