HI Market View Commentary 11-15-2021

Let’s talk about “pulling the trigger” AKA placing or closing out a trade

What have you always been taught by education ? 20% return, Just hit singles, book a profit and get back in

They want you to learn a repeatable process even though some methods will contradict each other

When you make your decision can you stand by it whether it was right or wrong

Statically a stock can lose or gain in a 4-6 week period 10%+ during the two weeks before earning and the four weeks after

It never hurts to take a profit

What will happen to our Christmas Rally – Better than last year because people want to spend money

https://www.briefing.com/the-big-picture

Last Updated: 12-Nov-21 14:13 ET

An absurd monetary policy position is a risk we should all see coming

Consumer price inflation hit a 30-year high of 6.2% in October. Producer price inflation increased 8.6% year-over-year in October. That is the highest year-over-year increase in a series that only goes back to November 2010, but, regardless, it is extremely high.

You want to know something? The Federal Reserve didn’t even have a discussion at the latest FOMC meeting about whether it has met the test for a rate hike. It only dared itself to reduce the pace of its super-sized asset purchases by $15 billion per month.

Now, instead of buying at least $80 billion of Treasury securities per month and at least $40 billion of agency mortgage-backed securities per month, it will buy at least $70 billion of Treasury securities per month and at least $35 billion of agency mortgage-backed securities per month.

The Fed aims to reduce the pace of net asset purchases by $15 billion per month, such that its asset purchase program will end in June 2022. Between now and then, however, another $500 billion will have been added to the Fed’s balance sheet.

This policy approach is absurd for the world we live in, which is nowhere near the world of hurt we were in when it was introduced.

Multiple Concerns

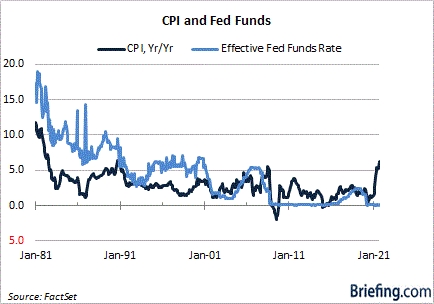

It makes zero sense that the target range for the fed funds rate would be at the zero bound now when the inflation rate sits at 6.2%, the unemployment rate rests at 4.6%, and real GDP growth has averaged 5.0% this year.

We made a similar argument in July when CPI was up “only” 5.4% year-over-year, the unemployment rate stood at 5.9%, and nominal GDP was nearly 5% higher than it was in the fourth quarter of 2019 (i.e., pre-pandemic).

The S&P 500, meanwhile, was up 102% from its March 2020 low at the time of our July post. At its high on November 5, it was up 115%.

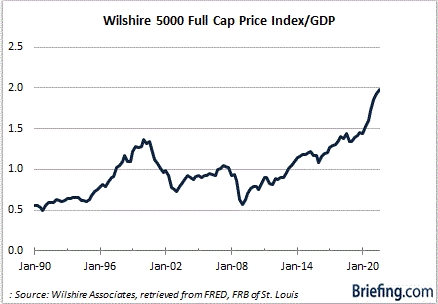

The Wilshire 5000 Full Cap Price Index is nearly twice the size of nominal GDP now. At the peak of the dotcom bubble in 2000, it was 137% greater than nominal GDP.

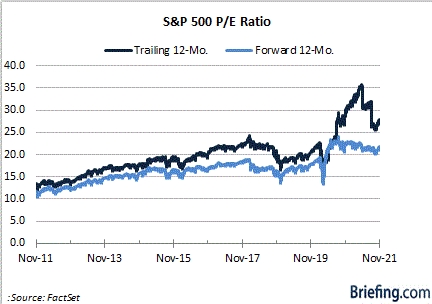

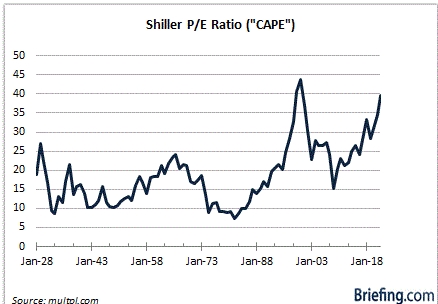

The trailing twelve-month P/E multiple for the S&P 500 is 27.5. That’s a 38% premium to its 10-year average. The forward 12-month P/E multiple for the S&P 500 is 21.4. That is a 28% premium to its 10-year average. The Shiller PE Ratio, or CAPE ratio, which is based on average inflation-adjusted earnings from the previous 10 years, is 39.6. That is a 44% premium to the 10-year average and the highest ratio since January 1, 2000, when it stood at 43.8.

Shock Value

The Fed’s latest Financial Stability Report observed that “Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall.”

What was missing in that report was the Fed acknowledging the role its monetary policy has played in driving up asset prices and leaving them increasingly vulnerable to a significant decline should investor risk sentiment deteriorate. After all, when the policy rate is held at the effective lower bound and trillions of dollars of excess liquidity are available, it only makes sense that valuations would be high relative to historical norms. Investors take on more risk under those parameters, easily extrapolate best-case scenarios well into the future, and misallocate capital in pursuit of excess returns.

And, boy, is it fun and rewarding while it’s happening without incident. It’s even better when there are secular growth stories dominating the narrative, like the rise of the internet did in the late 1990s, and how the rise of EVs, clean energy, the metaverse, cryptocurrencies, and space travel are now.

When interest rates are zero and capital is easily available, every secular growth story sounds like a home run. The secular theme itself might be a home run, but as we learned in the dotcom bust, not every company/stock associated with that secular theme will be a home run. Many will turn out to be a foul ball “should investor risk sentiment deteriorate” and the abundant liquidity stops flowing in a “climate change.”

An exogenous shock could trigger a climate change for risk assets. Such shocks are unpredictable, yet they need to be respected nonetheless in a market trading well above historical norms. Sometimes, though, the greatest risk can be the one you see coming. In the case of the stock market, that risk is a spike in interest rates.

Blinded by the Light

So much of the bull market narrative has been predicated on the persistence of low interest rates and a Fed that doesn’t seem to be in any hurry to raise its policy rate.

Fed Chair Powell has said the Fed won’t hesitate to use its tools to preserve price stability “If we were to see signs that the path of inflation or longer-term inflation expectations was moving materially and persistently beyond levels consistent with our goal.”

Sidebar: consumer price inflation has been running above 5% for five straight months, the five-year breakeven inflation rate is at an all-time high of 3.08%, the 10-yr breakeven inflation rate is at an all-time high of 2.70%, and consumer sentiment, as measured by the University of Michigan, fell to its lowest level in November since November 2012 “due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation.”

The Fed Chair also said the Fed is going to let the data lead it to where it needs to go. Really? Seems to us as if the Fed has been blinded by the light of inflation; moreover, it fails to see that its policy acts with a lag. That is the Treasury market’s concern. The Fed will wait too long and end up taking more aggressive policy actions to rein in inflation.

One more thing hard to believe is that the implication in the Fed’s resistance to raising rates now is that it thinks a move in the target range from 0.00-0.25% to 0.25-0.50% will squash the recovery in the labor market.

The Fed is sitting on its hands with consumer inflation at a 30-year high. San Francisco Fed President Mary Daly (a 2021 FOMC voter) told Bloomberg TV after the October CPI report that “Right now it would be premature to start changing our calculations about raising rates,” and that the Fed has to “wait and watch with vigilance.” It’s an astounding position considering the fed funds rate was at 7.75% the last time the consumer inflation rate was at 6.2%. Heck, before the pandemic hit, the fed funds rate was at 1.75% while CPI was up just 2.5%.

Somehow, though, a 6.2% inflation rate doesn’t compute right now in the Fed’s mind as something that should be tamed with an interest rate increase off the zero bound.

What It All Means

Who knows? Maybe the Fed will be right, and inflation will ease back to more palatable levels as supply chain issues get rectified, labor shortages ease, and transportation bottlenecks improve. It’s a huge, open-ended question.

Still, the overarching point is that the fed funds rate doesn’t belong at the zero bound. Not anymore.

At this juncture, it poses more risk than support. It is penalizing savers who don’t own stocks or a house. It is stoking inflation and inflation expectations. It is hurting individuals living on a fixed income. It is resurrecting animal spirits in the stock market. It is encouraging moral hazard.

The Fed is playing with fire still sitting on the zero bound with the inflation rate at 6.2%, an economy averaging 5.0% real GDP growth, and the unemployment rate at 4.6%. It’s an absurd policy position, because it’s the same position the Fed had when the inflation rate stood at 0.2%, real GDP was negative 31.2%, and the unemployment rate was close to 13.0%.

It won’t surprise us in the least if the stock market keeps running, but, honestly, would it surprise anyone if there is a nasty correction or — egad — a bear market because of an interest rate shock or an exogenous shock?

The stock market sports a valuation well above historical norms; there is a ton of new supply hitting the market; there is an infatuation with can’t miss secular investment themes; and every pullback is seen as a buying (and winning) opportunity. Any of that sound familiar? It does if you experienced the dotcom days.

So, ask yourself this: Would you prefer the pilot puts the wheels down before landing or when the plane reaches the tarmac? If the stoplight is red, should you start breaking a comfortable distance before the intersection or when you get to the intersection? If you are skydiving, would you want to deploy your parachute in the sky or when you hit the ground?

The answers should be obvious. The right answers lead to smoother, and safer, experiences. The wrong answers lead to trouble that could be fatal.

The Fed at this juncture should not be waiting on more data to move off the zero bound or to moderate the pace of its asset purchases. The data have arrived, and they make it abundantly clear that it’s an absurd policy position to be sitting at the zero bound and still be purchasing Treasury and agency mortgage-backed securities, let alone $500 billion more between now and June 2022.

The stock market is taking advantage of this absurd policy stance, but understandably so. The higher it climbs, though, the harder it will fall when an exogenous shock hits or that policy support gets pulled abruptly.

Investors are in a good spot still to capitalize on the easy monetary policy, but just be sure to use prudent risk management strategies on the way up because the Fed’s absurd policy position is a risk we should all see coming.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

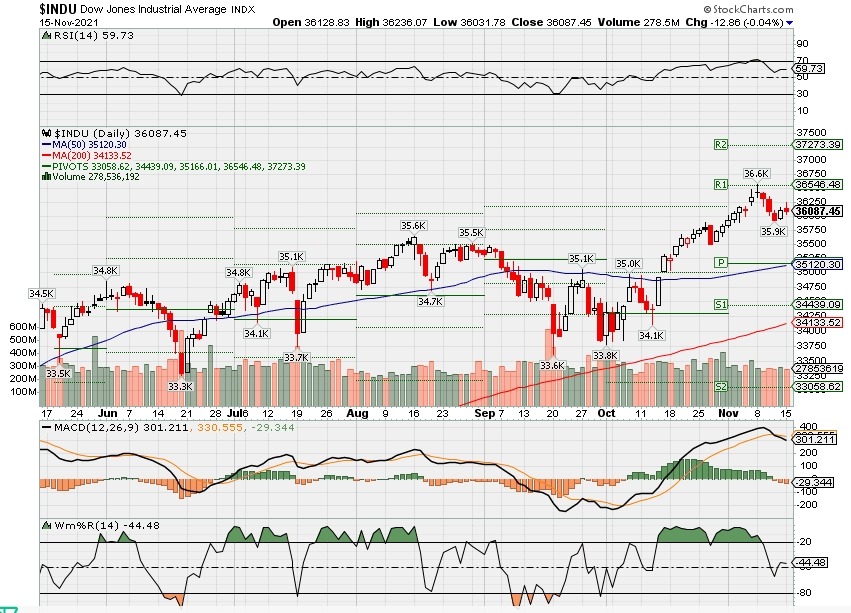

DJIA – Bullish

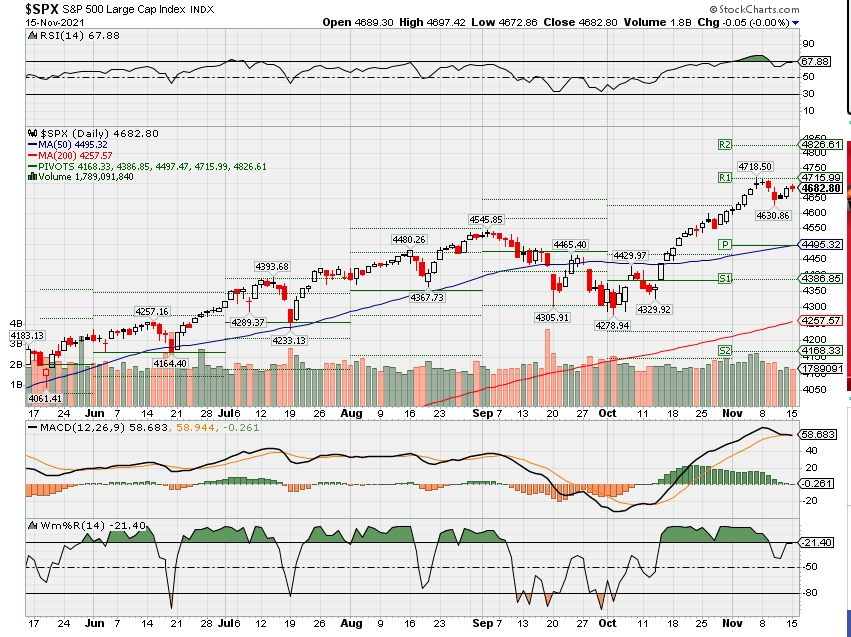

SPX – Bullish

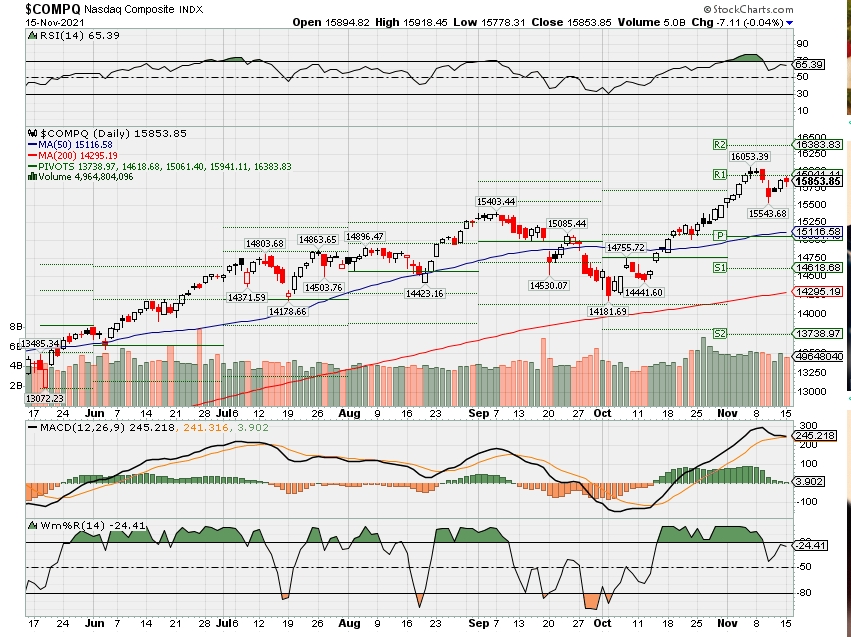

COMP – Bullish

Where Will the SPX end November 2021?

11-15-2021 +2.5%

11-08-2021 +2.5%

11-01-2021 +2.5%

Earnings:

Mon: TSN, COOK,

Tues: HD, NTES, WMT, RMAX,

Wed: IQ, LOW, TJX, CSCO, NVDA, TGT, BIDU

Thur: BABA, BJ, JD, M, AMAT, ROST, WDAY,

Fri: FL

Econ Reports:

Mon: Empire Manufacturing

Tues: Retail Sales, Retail Sales ex-auto, NAHB Housing Price Index, Industrial Production, Capacity Utilization, Business Inventories, Import, Export, Net Long term TIC Flows,

Wed: MBA, Housing Starts, Building Permits

Thur: Initial Claims, Continuing Claims, Phil Fed, Leading Indicators

Fri: Monthly Options Expire

How am I looking to trade?

Long put protection has been added and getting ready for earnings

BIDU – 11/16

COST – 12/09

TGT – 11/17 BMO

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Morgan Stanley Says Duo “Betrayed” Former Partner in Move to J.P. Morgan

by Miriam Rozen

A New York state judge has ordered two brokers who joined J.P. Morgan Advisors last month to justify why the court shouldn’t grant their ex-employer Morgan Stanley’s request for a temporary restraining order to bar them from soliciting former clients.

Morgan Stanley filed a petition seeking the TRO in mid-October, a week after New York-and-Miami brokers Joseph Donnelly and Sean Donnelly moved to J.P. Morgan. The wirehouse alleged the two brokers had been encouraging customers to move their business to their new firm in violation of their one-year non-solicitation agreements and teaming agreements.

Morgan Stanley also alleged the duo betrayed their former partner Jonathan Rynsky, a 16-year industry veteran, by doctoring client statements in the months leading up to their move to remove his name in “a transparent effort to have clients view them as the lead advisors entrusted with their assets who they should follow to J.P. Morgan,” and by disparaging him as “unethical” to former customers before and after their departure.

“This case, however, is not a typical situation where a departing financial advisor

simply asks clients to follow them to their new employer,” Morgan Stanley’s lawyers wrote. “Instead, before departing Morgan Stanley, Respondents carefully plotted their unlawful solicitation of clients and betrayal of their partner, Mr. Rynsky.”

Within a week of their move, the Donnellys, who are not related, had persuaded 25 clients with more than $48 million in assets to transfer to J.P. Morgan, according to the filing. They had managed $250 million in assets at the time of their move, a J.P. Morgan spokeswoman had said previously.

Neither of the Donnellys responded to a request for comment and no attorney has been listed as representing them on the court’s docket. A spokeswoman for J.P. Morgan, which was not named as a party in the case, also declined to comment.

The hearing on the order to show cause is scheduled for November 23.

“Morgan Stanley will take appropriate action to ensure that departing employees comply with their legal obligations,” a firm spokesperson said in response to request for comment for this story.

Rynsky, who has worked from Morgan Stanley’s One Penn Plaza branch in New York since 2013, according to BrokerCheck, referred all questions to the Morgan Stanley spokesperson.

Morgan Stanley said that starting in April, the Donnellys had removed Rynsky’s name from account statements and other correspondence with clients and replaced him with Sean’s name despite the fact that Sean was the “most junior financial advisor” and had a “negligible role” in the partnership.

The wirehouse said the duo was incentivized to take the risk of soliciting their client book because J.P. Morgan offered them a recruiting deal that included “several million dollars” upfront and another “several million dollars” if they succeed in bringing a “certain amount of business.”

“[I]n Respondents’ calculation, the potential for upfront bonuses in the millions of dollars outweighed the risk of liability from breaching their nonsolicitation agreements with Morgan Stanley,” the wirehouse wrote.

Joseph, who works from Miami and started as a Morgan Stanley broker in 2010, was ranked on Forbes’ top next-gen broker list in 2021 and #118 on the best-in-state list in 2019. He was also a Pacesetter Club Financial Advisor, a recognition award given to him as a fast-growing novice in 2013, according to his former website.

Sean began his career at Morgan Stanley in 2017, according to BrokerCheck.

The case reflects Morgan Stanley’s continued willingness to ask courts to enforce non-solicitation agreements since it withdrew in 2017 from the Protocol for Broker Recruiting–the industry’s hiring truce that allows brokers to contact their former customers.

Morgan Stanley last month reached an agreement with another broker, Robert Sevcik in Medford, Oregon, on a stipulated preliminary injunction order in a case it filed seeking to restrain him, according to court filings. As in the New York state court case, Morgan Stanley had alleged Sevcik violated agreements he had made with another advisor.

The stipulated injunction bars Sevcik and his new firm, regional brokerage D.A. Davidson, from contacting Morgan Stanley clients who are the subject of either the Financial Advisor Program and Joint Production Agreements that he had previously signed.

But the injunction also explicitly allows Sevcik to process account transfer requests received from FAP and JPA clients, if the clients initiate the moves. Also, the injunction calls for Morgan Stanley to provide contact information for Sevcik if FAP or JPA clients seek it.

Morgan Stanley had fired Sevcik prior to his move to D.A. Davidson as part of its review of alleged abuses in its inherited account program.

Initially, Sevcik had prevailed in a hotly contested legal battle over a temporary restraining order blocking him from contacting his former customers at his new firm.

But then on October 6, the U.S. District Judge Ann Aiken in Oregon issued an order, denying Sevcik’s motion to compel Morgan Stanley to arbitrate and concluding that the wirehouse “is entitled to a preliminary injunction hearing.”

Sevcik and Morgan Stanley on Oct. 14 filed a joint motion for the stipulated preliminary injunction, which the judge granted the next day.

Sevcik’s lawyer declined to comment on the litigation. A Morgan Stanley spokesperson did not provide a comment about the Sevcik litigation.

Fed is losing credibility over its inflation narrative, Mohamed El-Erian says

KEY POINTS

- “I’ve argued that it is really important to reestablish a credible voice on inflation and this has massive institutional, political and social implications,” El-Erian said Monday.

- He was speaking to CNBC’s Dan Murphy at the ADIPEC energy industry forum in Abu Dhabi, the United Arab Emirates.

- Fed Chair Jerome Powell has previously said he expects inflation conditions to persist “well into next year” and conceded it is “frustrating” that supply chain issues are showing no sign of improvement.

The Federal Reserve is losing credibility over its long-standing view that inflation is transitory, according to Mohamed El-Erian, chief economic advisor at Allianz.

“I think the Fed is losing credibility,” El-Erian said Monday. “I’ve argued that it is really important to reestablish a credible voice on inflation and this has massive institutional, political and social implications.”

He was speaking to CNBC’s Dan Murphy at the ADIPEC energy industry forum in Abu Dhabi, the United Arab Emirates.

El-Erian contended that the Fed’s inflation stance weakened the central bank’s forward guidance and undermined President Joe Biden’s economic agenda. He said that people shouldn’t forget that those on low incomes are hardest hit by rising consumer prices.

“So, it is a big issue and I hope that the Fed will catch up with developments on the ground,” he added.

A spokesperson for the Federal Reserve was not immediately available to comment when contacted by CNBC.

Fed Chair Jerome Powell has previously said he expects inflation conditions to persist “well into next year” and conceded it is “frustrating” that supply chain issues are showing no signs of improvement. The Fed has largely stuck to its messaging, however, that rising inflation is largely tied to the coronavirus pandemic and these supply chain problems will pass.

The consumer price index, which covers products ranging from gasoline and health care to groceries and rents, rose 0.9% on a monthly basis in October, the Labor Department reported on Nov. 10, significantly higher than expectations. The reading climbed to 6.2% year over year, hitting its highest point since December 1990.

‘It is not transitory’

“We are in this transition of central banks mischaracterizing inflation. The repeated narrative: ‘It is transitory, it is transitory, it is transitory.’ It is not transitory,” El-Erian said, warning the Fed risked making a major policy mistake.

“We have ample evidence that there are behavioral changes going on,” El-Erian said. “Companies are charging higher prices [and] there’s more to come. Supply disruptions are lasting for a lot longer than anybody anticipated. Consumers are advancing purchases in order to avoid problems down the road — that of course puts pressure on inflation. And then wage behaviors are changing.”

“So, if you look at the underlying behavioral element that leads to inflation, you come up with the conclusion that this will last for a while. And that’s even before you talk about the renewed Covid disruptions,” he added.

https://buy.tinypass.com/checkout/offer/show?displayMode=inline&containerSelector=.nonpremium-pro-video&templateId=OT22LE29SGTR&offerId=OFM2EQ9FEKFR&formNameByTermId=%7B%7D&showCloseButton=false&experienceId=EXMVVFAI6X8Y&widget=offer&iframeId=offer-0-Sl8q6&url=https%3A%2F%2Fwww.cnbc.com%2F2021%2F11%2F15%2Fmohamed-el-erian-says-fed-is-losing-credibility-over-its-inflation-narrative.html%3F__source%3Diosappshare%257Ccom.apple.UIKit.activity.Mail&parentDualScreenLeft=38&parentDualScreenTop=11&parentWidth=961&parentHeight=687&parentOuterHeight=807&aid=o19WonOrHQ&userProvider=publisher_user_ref&userToken=&customCookies=%7B%7D&hasLoginRequiredCallback=true&initMode=context&width=854&_qh=2b6f958164 El-Erian cited the reintroduction of public health restrictions and the closure of ports in big manufacturing nations, such as China and Vietnam, as examples of renewed supply chain disruptions.

When asked what the most appropriate response from the Fed would be, El-Erian said, “To accelerate, in December, the pace of tapering.”

The Fed said on Nov. 3 that it would start tapering the pace of its monthly bond purchases “later this month.” The process will see reductions of $15 billion each month — $10 billion in Treasurys and $5 billion in mortgage-backed securities — from the current $120 billion a month that the Fed is buying.

“And secondly, start doing what the Bank of England is doing … which is start preparing people for higher interest rates,” El-Erian said, citing similar steps taken by central banks from Australia, New Zealand and Norway, among many others.

— CNBC’s Jeff Cox contributed to this report.

Correction: Mohamed El-Erian spoke Monday. An earlier version misstated the day.

Sales of pregnancy tests are on the rise. That’s good news for retailers like Walmart and Target, Bank of America says

KEY POINTS

- A “millennial baby boom” could start this year and boost food and baby merchandise sales, according to a note by Bank of America.

- Retail analyst Robby Ohmes said that trend could benefit grocers like Kroger, big-box players like Walmart and Target, and membership clubs like Costco.

- One of the leading indicators is elevated sales of pregnancy tests, which have jumped significantly since June 2020, according to data from Nielsen.

A millennial-fueled baby boom appears on its way and could lift sales for retailers, including Target, Walmart and Costco, according to a note published Tuesday by Bank of America.

Birth rates are up, more pregnancy tests are being sold, and more couples say they are trying to have a baby, the company’s research shows.

That could spell good news for grocers, big-box stores and warehouse clubs that sell diapers, strollers and other baby merchandise — or are simply located closer to suburban homes where new parents may settle, according to Robby Ohmes, a equity research analyst. He predicted the baby boom could start this year. Among the beneficiaries, he called out Albertsons, Kroger, Dollar General and BJ’s Wholesale Club.

Millennials have surpassed baby boomers to become the largest generation in the country, according to the U.S. Census Bureau. The group — made up of roughly 72.1 million people — ranges in age from 25 to 40, according to the Pew Research Center.

One of the leading indicators of the potential “millennial baby boom” is elevated sales of pregnancy tests. Sales of pregnancy tests have grown by an average of 13% year over year since June 2020, according to data from Nielsen and research by Bank of America. This compares with an average of up 2% year over year from 2016 to 2019.

If this plays out, it would reverse a decline in births during the pandemic. Live births increased 3.3% in June 2021, the highest level of growth seen since 2013, according to Bank of America research.

In a monthly survey by the company, 11.3% of respondents said they or their partner are expecting or trying to have a baby over the next 12 month period. That survey was conducted in October with approximately 1,000 people. It marked an all-time high since Bank of America launched the survey in December 2020.

Some retailers have already credited millennials — and their upswing in marriages, babies and home purchases — for driving more sales. Best Buy said the generation has become its biggest cohort of customers. Home improvement retailers Home Depot and Lowe’s have said that generational trends — not just pandemic-induced nesting — are powering the companies’ strong sales.

Barclays downgrades Disney, says streaming subscriber growth is slowing

The New York Stock Exchange welcomes The Walt Disney Company (NYSE: DIS), on Tuesday, May 4, 2021, in honor of Star Wars Day.

Source: NYSE

The growth story for Disney’s streaming business appears to be running out of steam, according to Barclays.

Analyst Kannan Venkateshwar downgraded Disney to equal weight from overweight, saying Monday in a note to clients that the company’s long-term subscriber goals seemed optimistic.

“The roll out of Disney+ has been the most successful streaming launch ever, which is remarkable given that the company achieved this with very little new content,” the note said. “This year however, Disney+ growth has slowed significantly, despite launching new franchise titles, day and date movie releases and Star+. Part of this slowdown could be a function of growth pull forward into 2020 and promo roll offs, but we believe it could be due to structural factors capping growth.”

Disney reported in August it had 116 million subscribers for Disney+ and Hotstar, its international arm, as of July 3, up more than 100% year over year. The company also had more than 57 million combined subscribers for Hulu and ESPN+.

However, Disney+ is producing significantly less new content than Netflix, and the Hotstar service in India also faces a big risk from expiring sports rights to cricket, Barclays said.

“In order to get to its long term streaming sub guide, DIS needs to more than double its current pace of growth to at least the same level as Netflix. We believe this may be tough to do. … Consequently, we take estimates for Disney+Hotstar subs to ~200mm subs in 2024 vs the 250mm guidance midpoint,” the note said.

Barclays cut its price target on Disney to $175 per share from $210 per share. The stock closed at $176.46 per share on Friday. The firm also cut its fourth quarter and 2022 earnings estimates for Disney.

Shares of Disney have gained nearly 40% over the past 12 months but have pulled back and traded sideways since peaking in mid-March.

—CNBC’s Michael Bloom contributed to this report.

Yieldstreet launches fund for smaller investors to bet on art

KEY POINTS

- Yieldstreet is launching a fund to allow retail investors to buy into a portfolio of artworks, aiming to capitalize on the soaring prices and demand for fine art.

- The fund is the latest in a series of start-ups and new businesses that allow consumers to invest in art and collectibles by buying small ownership stakes.

- The Art Equity Platform is a collection of funds that will each hold a portfolio of works by major post-war and contemporary artists.

Yieldstreet is launching a fund to allow retail investors to buy into a portfolio of artworks, aiming to capitalize on the soaring prices and demand for fine art.

The fund is the latest in a series of start-ups and new businesses that allow consumers to invest in art and collectibles by buying small ownership stakes. While art investment funds have been around for decades, the new generation of funds use advanced databases, digital platforms and artificial intelligence to better buy and sell works that will gain value. Masterworks, which securitizes individual paintings and allows investors to buy shares for $20, recently announced a funding round at a valuation of $1 billion.

Yieldstreet announced Friday the launch of The Art Equity Platform, a series of funds that will each hold a portfolio of works by major postwar and contemporary artists. The first fund, which will likely be under $10 million, will include works by George Condo, Keith Haring and Kenny Scharf. Future funds will partner with art experts to offer a range of periods and genres, the company said.

Yieldstreet, which offers retail investors the chance to invest in a range of assets usually reserved for the wealthy, owns Athena Art Finance, which makes art loans and advises Yieldstreet on its art investment funds. Yieldstreet said it will use its years of proprietary data and research from Athena to identify the best works by the top artists likely to see higher prices.

The funds will aim for returns of between 15% and 17%, net of fees, according to Rebecca Fine, managing director and head of art finance at Yieldstreet and Athena Art Finance. The minimum investment in the fund will be $10,000. The holding period will be for five years, with two one-year extensions.

“We have developed so much conviction and confidence in our lending model, that this is the organic next step in the segment,” Fine said.

The challenge for art funds will be whether they can reliably earn profits in a market that’s notoriously illiquid, opaque and cyclical. Over the past decade, many indexes that measure art prices have beaten the S&P 500. Yet while low interest rates, massive wealth creation during the pandemic and the rise of young collectors have fueled a recent art boom, it’s unclear how long it will last.

Most collectors also prefer to buy art to put it on their walls rather than simply buying for profits. Fine said that while the details are still in development, the company is planning events where investors can view the artworks and learn more about collecting from art experts and artists.

“The experiential aspect will be a big part of the platform,” Fine said. “Ideally we’re hoping to inspire them to not just invest, but buy physical art and build more of their own collection.”

Elon Musk taunts Tesla rival Rivian after its blockbuster market debut

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- “There have been hundreds of automotive startups, both electric and combustion, but Tesla is [the] only American carmaker to reach high volume production & positive cash flow in past 100 years,” Musk said in a tweet Thursday.

- Rivian has never recorded revenue and it expects less than $1 million in sales for the third quarter.

- It says it has 55,400 preorders for its R1S SUV and R1T pickup truck and a contract to build 100,000 electric vans with Amazon by 2030.

Tesla CEO Elon Musk said high production and break-even cash flow will be the true test for rival carmaker Rivian, which had a blockbuster IPO this week and now has a market value of more than $100 billion.

“There have been hundreds of automotive startups, both electric and combustion, but Tesla is [the] only American carmaker to reach high volume production & positive cash flow in past 100 years,” Musk said in a tweet Thursday.

He added, “I hope they’re [Rivian] able to achieve high production and breakeven cash flow. That is the true test.”

Rivian, which did not immediately respond to a CNBC request for comment on Musk’s tweets, has never recorded revenue and it expects less than $1 million in sales for the third quarter.

It says it has 55,400 preorders for its R1S SUV and R1T pickup truck and a contract to build 100,000 electric vans with Amazon by 2030.

But trusting Rivian to assemble the vehicles and deliver them profitably represents a massive gamble for investors who are already valuing the company higher than traditional auto giants Ford and General Motors.

Despite the lack of revenue, Rivian raised around $12 billion in its market debut Wednesday, making the initial public offering the largest in the world this year. The IPO also made Rivian the second most valuable car manufacturer in the U.S. behind Tesla.

After its first two days of trading in 2010, Tesla had a market cap of just more than $2 billion. Meanwhile, R.J. Scaringe, CEO of Rivian, was worth that much on his own after his company’s second day on the public market.

Rivian shares popped 57% in their first two days on the Nasdaq. Scaringe, who founded Rivian in 2009, owns 17.6 million shares, valued at $2.2 billion, based on Thursday’s closing stock price of $122.99. The shares were up more than 3% in premarket trading Friday.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/061eb7cf-1f94-418d-9173-fb6d46212128/embed “We began thinking about the truck, SUV, and crossover segments as they presented a massive opportunity for us to demonstrate how a clean sheet, technology-focused vehicle could eliminate long accepted compromises,” Scaringe wrote in the company’s IPO prospectus.

“We wanted to establish our brand by delivering a combination of efficiency, on-road performance, off-road capability, functional utility, and product refinement that simply didn’t exist in the market.”

Rivian has poached numerous former Tesla employees, including key engineers who helped to build the Tesla Model 3.

It’s not the first time Musk has thrown shade at Rivian. Last month he tweeted “prototypes are trivial compared to scaling production and supply chain.”

— Additional reporting by CNBC’s Ari Levy.