HI Market View Commentary 10-03-2022

So we didn’t get a recording last Thursday and a half dozen of you asked more questions after Thursday’s morning Trade Finding and Adjustments. Let me try to review some of the points we went over last Thursday.

There are times when you just don’t trade. Why? Too volatile or markets are unstable

There isn’t a clear direction or trend

Markets are flat is a tradable or money making opportunity in flat markets BUT it usually takes 3-4 weeks to identify

Did you do the work to identify your best choice or decision at that time AND how far out in time are you looking

Right now we know the trend is bearish = panic because everyone has been through a 2008

BUT this year is probably going to be worse? Why does it not feel worse this time around ?= Orderly and not so surprising,

Last time we had numerous first time events that we didn’t have historical reference points for

OK Let’s review the last 3 days in the market and what’s been done

Did we make a mistake in closing off and rolling protection out on Tuesday?

Allen says yes!!! Maybe not depending on your perception

TIMING is a fools game

Triggers for protection = Bearish or technical crossovers, earnings = 4-6 week period where stocks lose 15% or more

So explain to me how it was a mistake to book over $ 1.1million in long put profits and repositioned farther out in time new protection?

The difference between retail and professional trading is the time horizon = Years vs hours (retail)

It’s easier because most money managers don’t have money in the market = other peoples’ money principle

Make your best educated guess/decision and then find reasons to NOT stay with it

If you don’t know what to do, do NOTHING

Following a newsletter or trading service is not doing the work!!!

What are causes to our recession = Inflation, Fed higher interest rates=higher prices=stronger dollar= less overseas sales=higher input costs, Government, Ukraine/Russia War

Product shortages = Fuel, Energy, Chips, Fertilizer =Potash

Glut of inventory = Waffers, Materials, Steel,

Smart money isn’t so smart

Apple shares dip on rare Bank of America downgrade

PUBLISHED THU, SEP 29 202210:36 AM EDT

KEY POINTS

- Shares of Apple were down on Thursday after Bank of America analysts delivered the stock a rare downgrade.

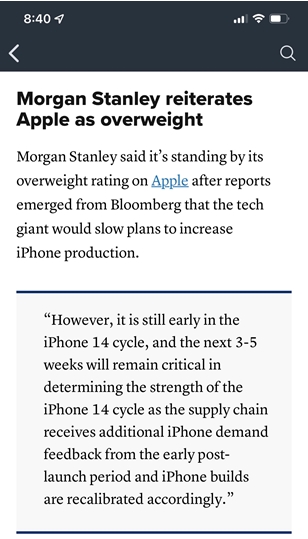

- Rosenblatt Securities disagreed with the BofA rating on Thursday, however, upgrading its rating on Apple from neutral to buy.

- The downgrade came on the heels of a Bloomberg report Wednesday that said Apple had told some suppliers to abandon plans to ramp up production for its new iPhone 14 after failing to see as high demand as anticipated.

Shares of Apple were down 4.5% on Thursday after Bank of America analysts delivered the stock a rare downgrade.

The analysts lowered their rating from buy to neutral, also cutting its price target from $185 to $160 per share. They said they anticipated “weaker consumer demand” over the next year and pointed to macroeconomic challenges.

17 HOURS AGO

The broader market was also negative on Thursday, but Apple’s fall was still greater than major indices like the S&P 500, which was down 2.5% Thursday morning.

The downgrade came on the heels of a Bloomberg report Wednesday that said Apple had told some suppliers to abandon plans to ramp up production for its new iPhone 14 after failing to see as high demand as anticipated. That also put pressure on Apple’s stock.

Another firm disagreed with the BofA rating on Thursday, however. Rosenblatt Securities upgraded its rating on Apple from neutral to buy and raised its price target from $189 to $160, implying a 25% rally from current levels. It made the call after its survey of over 1,000 U.S. adults showed strong demand for even the pricier new Apple products.

Rosenblatt cast doubt on the production report, writing that there’s “a recent history of comparable reports proving to be misleading when actuals come out.”

CNBC’s Michael bloom contributed to this report.

Small research firm disagrees with Bank of America call, upgrades Apple and predicts 25% rally

PUBLISHED THU, SEP 29 20227:34 AM EDT

Rosenblatt Securities on Thursday upgraded shares of Apple to buy from neutral, directly disagreeing with a rare downgrade from Bank of America.

The small firm boosted its rating on the technology heavyweight and raised its price target to $189 from $160, implying that shares could spike more than 25% from current levels. Bank of America, in its downgrade, said it doesn’t see Apple’s stock continuing to outperform.

This year, Apple has slipped about 15% but has outperformed the S&P 500′s roughly 22% slump. In addition, Apple shares have jumped in the third quarter, rallying more than 9%.

Rosenblatt’s bullish call comes after a survey of more than 1,000 U.S. adults from the firm showed strong demand for Apple products, including the new iPhone 14 Pro Max and Ultra Watch.

“Some 29% of respondents to our census representative survey of U.S. adults (which has a margin of error of 3% and was conducted Sept. 20 online via SurveyMonkey) said they already had or expect over the next 12 months to buy iPhone 14 — including 33% of current iPhone owners and 18% of Android owners,” analyst Barton Crockett wrote in a Thursday note. “This implies a 75 million base of people in Apple’s home country who want this device.”

The survey results also showed that consumers want the pricier, new Apple models. Some 40% of respondents said that the iPhone 14 Pro Max was their top choice to buy, while the less-costly iPhone 14 Pro came in second, with 26% picking the phone as their top choice. There were similar results showing that demand is strong for Apple’s new Ultra Watch, which has a base price of $799, according to the note.

In addition, Apple’s new features such as a capability to use satellites for emergency calls are resonating with consumers and show a considerable lead over competitors.

“Consumers want it — 42% in our survey said this feature was ‘Very Appealing’, 40% said ‘Somewhat Appealing,’” wrote Crockett, adding that 38% said the feature made them more interested in buying iPhone 14.

Production woes

Crockett also noted a recent Bloomberg News report that said Apple was bailing on plans to boost new iPhone production. However, he said he’s not worried.

“Bloomberg’s report yesterday that Apple was walking back previous guidance to suppliers for a modest bump to 2H22 production back to an original target of flat should be read in the context of consumers’ clear preference for the pricier models with higher ASPs,” he wrote. “There is also a recent history of comparable reports proving to be misleading when actuals come out.”

— CNBC’s Michael Bloom contributed to this report.

Earnings dates:

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 30-Sep-22 14:52 ET | Archive

First, the pain, then the gain

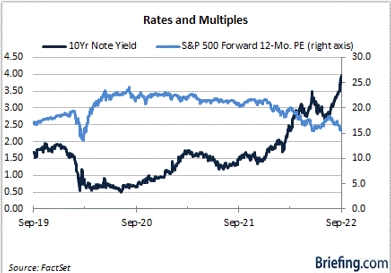

Market rates have moved up appreciably this year. The 2-yr note yield, which started the year at 0.73%, is at 4.17%. The 10-yr note yield, which started the year at 1.51%, is at 3.75%.

Normally, the 10-yr would be yielding more than the 2-yr, but we are not in a normal time. Things have gotten abnormal, because, ironically, high inflation has necessitated a normalization of monetary policy.

The worry for the market is that the Fed’s rush to normalization will go too far and invite a material economic slowdown, if not an actual recession. Hence, the 2-yr note and the 10-yr note are inverted with the former yielding more than the latter.

Things have gotten abnormal, because, as we stated last week, the Fed kept rates close to the zero bound for the better part of the last 14 years. Investors got used to this, so much so that a new generation of investors considered it a “normal” interest rate situation.

It was not. The pace at which policy rates and market rates have risen, however, has been abnormal. Be that as it may, it has also been a game changer.

A Changing Landscape

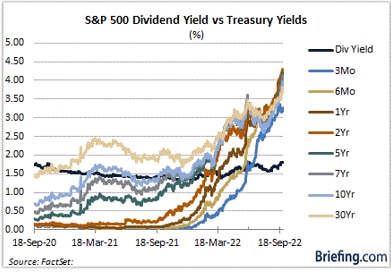

Treasuries have yield again. That is good news for fixed-income investors. It is also good news for investors looking for more balance in their investment portfolios.

It is bad news for prospective home buyers, as mortgage rates generally move in tandem with the 10-yr note yield.

It has not been good either for the stock market for a couple of reasons:

- A higher risk-free rate lowers the present value of future cash flows, making stocks worth less, which in turn drives multiple compression.

- Higher Treasury yields attract more investment capital, which in turn creates money flow competition for stocks.

We can see the changing landscape in the charts below.

When the year began, the forward 12-month P/E multiple for the S&P 500 stood at 21.2. It now stands at 15.4, or a 10% discount to the 10-year average (17.1), according to FactSet. There has been multiple compression with the move in the 10-yr note yield from 1.51% to 3.75% (and 4.00% earlier this week).

Notwithstanding the sharp drop in stock prices, the dividend yield for the S&P 500 is a paltry 1.81%. That is little return for a higher risk investment, especially knowing stock prices could fall further and that companies could decide to cut their dividends to preserve cash in a tougher economic environment.

Risk-free Treasuries (assuming the position is held to maturity) offer yields that exceed the S&P 500 dividend yield by close to 200 basis points in most cases.

What It All Means

The environment for stocks and the economy has gotten more challenging with the Fed’s rate hikes and suggestion that there are more rate hikes to come. The environment for stocks has also gotten more competitive because the yield that had been missing in the Treasury market during an abnormal period of rock-bottom interest rates has been found again.

That discovery process has not been without its pain. What fixed-income investors are gaining these days in yield has led to a painful transition for stocks.

Earnings multiples have compressed sharply as market rates have risen. That is a normal trade-off, but it sometimes happens in a more painful way when the pace of change is quick like it has been this year.

Bonds have certainly had their fair share of pain this year, too. The trade-off for the more attractive yields available today is lower bond prices. In other words, no pain, no gain.

That is also true for stocks. It has been a painful adjustment, but lower valuations create better long-term return opportunities. There is static on that line, though, because earnings estimates are still too high. According to FactSet, analysts’ consensus earnings growth projection for calendar 2023 is 8%.

That number is destined to come down in our estimation, meaning the lower market multiple today is not the true value it appears to be.

Better bargain-hunting opportunities will avail themselves when earnings estimates come down further to reflect the tougher economic environment that lies ahead. That will be true, because interest rates will eventually come down when that tougher climate avails itself more fully in the economic data.

Bear markets are painful no matter the catalyst. Rising interest rates are the source of pain for this bear market. They are making bonds more competitive for stocks, and they are compressing market valuations. It hurts now, but eventually there will be some healthy gains from that pain, which is normal coming out of a bear market.

—Patrick J. O’Hare, Briefing.com

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF SEP. 26 THROUGH SEP. 30, 2022 |

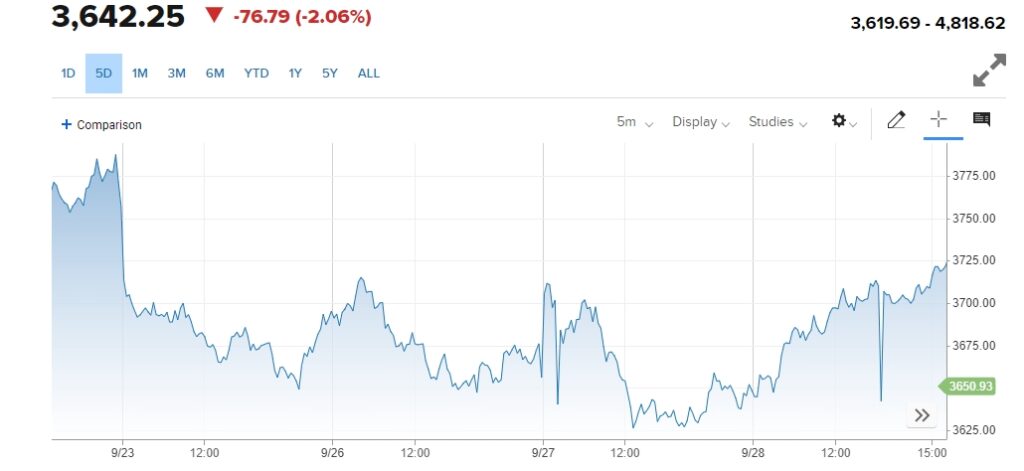

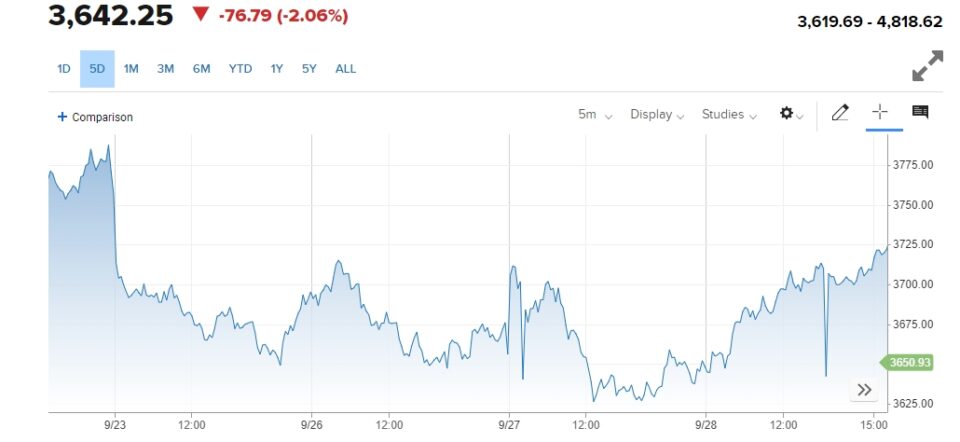

| The S&P 500 index fell 2.9% last week, its third consecutive week in the red, as investors concluded Q3 full of worries about the global economy. The S&P 500 ended Friday’s session at 3,585.62, down from last week’s closing level of 3,693.23. This brought the index to a 5.3% drop for Q3, including a 9.3% loss for the month of September and marking its third consecutive quarter in the red. With just one quarter remaining in 2022, the S&P 500 is now down 25% for the year to date. The S&P 500 has shed 12% in the past three weeks amid concerns about inflation, monetary tightening, and the effects on global economic growth. The slide comes as global central banks have been raising lending rates in an attempt to combat inflation, yet prices have remained elevated. With the Q3 earnings reporting season just weeks away, companies have been warning investors about the negative impacts of higher costs on their profitability. In the latest week, bond market turmoil became another cause for concern and helped send the S&P 500 to lows not seen since November 2020. Also adding to worries, data showed the average 30-year mortgage rate is now at its highest level since 2007 and confirmed a prior estimate that the US economy contracted by 0.6% in Q2 following a 1.6% contraction in Q1. Friday, fresh data showed while US consumer spending topped expectations for August, the Federal Reserve’s preferred inflation measure also rose by more than expected despite Fed efforts to tame it. The inflation measure, the core personal consumption expenditure price index, advanced to a 4.9% annual rate in August from 4.7% in July, surpassing the Street’s consensus view for a 4.8% reading. All but one of the S&P 500’s sectors participated in the weekly drop. Utilities had the biggest percentage decline, falling 8.8%, followed by a 4.2% drop in technology, a 4% slip in consumer staples, and a 3.9% decrease in real estate. Energy was the lone sector in positive territory for the week with a 1.8% increase. The decliners in the utilities sector included Duke Energy (DUK), whose shares slid 10% as the electric and natural gas company said Hurricane Ian cut power to many of its Florida customers. While the company said more than 650,000 customers have had power restored thus far, it also noted about 430,000 customers were still without power as of midday Friday, with outages spread throughout its territory. The technology sector was weighed down by shares of Apple (AAPL), which declined 8.1% on the week as BofA Securities Thursday downgraded its investment rating on the consumer technology company’s stock to neutral from buy amid expectations for consumer spending to slow. In consumer staples, shares of Walgreens Boots Alliance (WBA) shed 4.4% as fellow pharmacy retailer Rite Aid (RAD) reported a wider-than-expected fiscal Q2 loss and said it expects consumer spending and supply chain challenges to persist through the second half of the year. On the upside, the energy sector’s climb came despite weekly declines in crude oil and natural gas futures. The sector’s gainers included shares of Occidental Petroleum (OXY), which rose 4.6% as Berkshire Hathaway (BRK.A, BRK.B) said it added about six million of the company’s shares. Next week, October will kick off with data on September manufacturing and services as well as August construction spending and factory orders in the first few days of the week, but September jobs data due Friday will receive the most attention. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –technically bearish

COMP – Bearish

Where Will the SPX end October 2022?

10-02-2022 -2.0%

09-26-2022 -2.0% or 10%

Earnings:

Mon:

Tues:

Wed:

Thur: CAG, MKE, LEVI

Fri:

Econ Reports:

Mon: Construction Spending, ISM Manufacturing Index

Tues: Factory orders

Wed: MBA, ADP Employment, Trade Balance, ISM Services Index

Thur: Initial Claims, Continuing Claims,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Wholesale Inventories, Consumer Credit

How am I looking to trade?

Currently starting to take put protection off and will nibble on adding some more shares extra 10-50% more pus for shares, we also have SPY long puts and put spreads in play

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Fed’s preferred gauge shows inflation accelerated even more than expected in August

PUBLISHED FRI, SEP 30 20228:46 AM EDTUPDATED FRI, SEP 30 20229:22 AM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Core inflation rose 4.9% from a year ago in August and 0.6% on a monthly basis, according to a measure the Federal Reserve watches closely.

- Personal income rose 0.3%, the same as July and in line with the estimate. Spending rose 0.4% after declining 0.2% the month before.

- Headline inflation, including food and energy, also accelerated, despite a sharp drop in gasoline prices.

Inflation in August was stronger than expected despite the Federal Reserve’s efforts to bring down prices, according to data Friday that the central bank follows closely.

The personal consumption expenditures price index excluding food and energy rose 0.6% for the month after being flat in July. That was faster than the 0.5% Dow Jones estimate and another indication that inflation is broadening.

On a year-over-year basis, core PCE increased 4.9%, more than the 4.7% estimate and up from 4.7% the previous month.

Including gas and energy, headline PCE increased 0.3% in August, compared with a decline of 0.1% in July. It rose even with a sharp decline in gas prices that took the cost at the pump well below the nominal record above $5 a gallon earlier in the summer.

The Fed generally favors core PCE as the broadest indicator of where prices are heading as it adjusts for consumer behavior. In the case of either core or headline, the data Friday from the Commerce Department shows inflation running well above the central bank’s 2% long-run target.

Outside the inflation data, the numbers showed that income and spending continues to grow.

Personal income rose 0.3% in August, the same as July and in line with the estimate. Spending rose 0.4% after declining 0.2% the month before, beating the 0.3% expectation. After-tax income increased just 0.1% after rising 0.5% the previous month, while inflation adjusted spending rose 0.1%.

The inflation data reflected the shift in spending from goods back to services, which saw respective gains of 0.3% and 0.6% on the month. Food prices rose 0.8% while energy prices slid 5.5%. Housing and utilities prices were up 1% while health care rose 0.6%.

Markets showed little reaction to the news, with stock futures pointing to a slightly higher open on Wall Street.

The market, however, has been highly volatile as investors deal with the highest inflation since the early 1980s. To combat inflation, the Federal Reserve has enacted a series of interest rate increases this year totaling 3 percentage points, taking rates to their highest levels since early 2008.

However, with data showing that the rate hikes have yet to work their way through to bringing down prices, Fed officials have remained vigilant about the need to keep tightening policy.

Fed Chair Lael Brainard in a speech Friday morning cautioned against pulling back “prematurely,” saying rates will remain higher “for some time” until inflation is brought under control.

https://seekingalpha.com/article/4544228-apple-understanding-the-bofa-downgrade

Apple: Understanding The BofA Downgrade

Oct. 02, 2022 4:45 AM ETApple Inc. (AAPL)25 Comments12 Likes

Summary

- BofA recently downgraded Apple from Buy to Neutral with a revised price target of $160 from $185.

- As much as Apple is understood as the new gold in the volatile market, fundamentals are not immune to economic cycles.

- Lead times for iPhone 14 are shorter than previous models, while Services revenue may moderate as global app market sees a near-term slowdown.

- As wonderful of a business as Apple is, the stock is not always a no-brainer.

What happened?

BofA has recently downgraded Apple (NASDAQ:AAPL) from Buy to Neutral and cut its price target from $185 to $160. The firm previously had a 2023 revenue estimate of $406.5B (+4% YoY) and EPS of $6.24 (+3.5%) and has now reduced these figures to $379B and $5.87, which are lower than the current consensus of $412B and $6.46. Let’s go through the thinking behind the downgrade and discuss where things may go from here.

| BofA Estimates | Previous | Current | Diff. |

| 2022E Revenue (mm) | 391,166 | 390,695 | -0.1% |

| 2023E Revenue (mm) | 406,469 | 379,399 | -6.7% |

| 2024E Revenue (mm) | 421,283 | 405,886 | -3.7% |

| 2022E EPS | $6.03 | $6.02 | -0.2% |

| 2023E EPS | $6.24 | $5.87 | -5.9% |

| 2024E EPS | $6.73 | $6.48 | -3.7% |

Understanding the downgrade

Shares of Apple have outperformed not just most large cap peers but also the broader market. Like many major tech names, Apple is dealing with a slowing demand environment in 2022, yet the stock has received a very different treatment as companies of similar caliber like Alphabet (GOOG) have seen their shares drop more than 30% YTD.

Data by YCharts

In the last 3-6 months, Apple’s earnings estimates have experienced very little revisions with the consensus being that EPS will grow at ~5.9% in the next 2 fiscal years ending September. Given the current macro backdrop, these projections will likely be put under the microscope.

Seeking Alpha

According to data from Sensor Tower, global app store revenue experienced a decline in July and August, and fell by 5% in September (through 9/27). While this may not be representative of a long-term trend, the near-term slowdown indicates that Apple’s Services business may be moderating. Services accounts for almost 1/5 of Apple’s revenue. App Store and Licensing (eg. payments from Google to have Google Search as the default search engine) make up more than 60% of Services revenue.

BofA

Another major concern is weaker iPhone 14 sales. It’s been widely reported that Apple just canceled its plan to increase its iPhone 14 production and would stick to the original forecast of 90 million units (same as 2021). While this is still a respectable feat considering the smartphone market is expected to decline by 6.5% to 1.27 billion units in 2022 (IDC), it’s difficult to see iPhone 14 sales outperform expectations by a wide margin.

BofA

The above table compares the average lead times of the iPhone 14 family to previous models. The key takeaway here is that on average, it doesn’t take as long for consumers to acquire a new iPhone this year. For example, we can see that the average lead times for the iPhone 14 Pro have been trending down from 30 days (on day 14 since launch) to 25 days vs. 31 days of iPhone 13 Pro at the same time last year. Understandably, 2022 iPhone demand is not as strong as 2021 and 2020. For other devices like iPads and Macs, demand is even more likely to experience a reversion to pre-Covid levels.

Although Apple has been monetizing its iOS installed base extremely well by growing its high-margin Services revenue by 16% in FY20 and 27% in FY21, any revenue upside from here will still depend heavily on hardware sales as iPhone/iPad/Mac accounts for 53%/7%/9% of total revenue.

BofA estimates, company data

Per BofA estimates, Apple’s total revenue will see a 3% YoY decline in FY23 where Services will be the only segment to deliver growth. This seems conservative considering the Street is currently projecting a total revenue growth of 4.9% in FY23. Net-net, I think BofA has well-grounded reasons to believe Street estimates are still too optimistic. Consequently, don’t be surprised to see more analyst jumping on the downgrading bandwagon in the next few weeks or months.

Final thoughts

Apple is not immune to macroeconomic pressures as demand for consumer electronics soared during the pandemic and will likely take the backseat now that everything from rent to food is significantly more expensive. With the stock down 22% YTD vs. ~25% of the S&P 500 (SPY), it’s clear that markets have been treating Apple like a safe haven as no fund managers are likely to be fired for making it the largest position in their portfolios.

In my view, this type of groupthink is just as dangerous as the Nifty Fifty back in the 1970’s when investors believed religiously in the so-called “one decision” stocks like IBM and Polaroid, which led a disastrous outcome in the bear market that followed. As wonderful of a business as Apple is, the stock is not always a no-brainer, and investors should think carefully about piling into the name just because everything else is falling.

This article was written by

Follow

Individual investor, ex-HF analyst and ex-entrepreneur. Long/short. I’ve been gloriously right and hopelessly wrong. Focus mainly on technology and consumer. My humble opinions only. Not investment advice.

Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The fourth quarter starts now, and it’s not looking good for the economy

PUBLISHED SUN, OCT 2 20228:00 AM EDTUPDATED SUN, OCT 2 20228:55 AM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

If the outlook for fourth-quarter economic growth isn’t quite like staring into the abyss, it’s at least starting to get pretty dark and pretty deep.

With a recession seeming to be only a matter of when not if, economists are taking a dim view of what’s ahead, even if the last three months could still show some mildly positive growth.

Persistent inflation, pressure on corporate earnings and a major slide in the housing market are three big factors pressuring growth and raising fears that the year’s end may only be a precursor of the truly scary stuff on the horizon.

In fact, Credit Suisse recently titled a note, “The Worst Is Yet to Come.” The firm sees the efforts from central banks like the U.S. Federal Reserve to control inflation slowing the global economy to a virtual standstill before trend growth can resume. The U.S., the firm said, will close out 2022 with “close to zero” growth and then just 0.8% gains in GDP for 2022.

Other big forecasters also are not optimistic about the growth prospects.

Bracing for the fourth quarter

Bank of America said it expects the fourth quarter to post GDP growth of just 0.5%, though that is actually an upward revision from the previous estimate for a decline of 2%. BofA says a recession is coming, though it now expects the downturn to hit in 2023 rather than the previous prediction of late 2022.

Goldman Sachs also expects the economy to muddle through the next three months, but on Friday cut its 2023 outlook and is now seeing growth of just 0.9%.

Not much to like

Asked if he saw anything to be optimistic about on the horizon, economist Joseph LaVorgna said “not really.”

Like most of his peers, LaVorgna said he expects the Fed’s aggressive inflation campaign — five interest rate hikes over a six-month period totaling 3 full percentage points, and almost certainly more on the way — as squelching any reason to believe that the U.S. will avoid a recession, if not by year-end then early in 2023.

“We’re going to get a hard landing,” said LaVorgna, chief economist at SMBC Nikko Securities America and a former senior economist in the Trump administration. “My best guess is it will be a recession and it will not be mild, because you’ve got significant wealth destruction and you have a Fed that is committed to raising rates more.”

The economy is coming off a 1.6% GDP decline in the first quarter and a 0.6% drop in the second. That meets the criteria of two consecutive quarters of negative growth that is generally recognized as a recession. The Atlanta Fed’s GDP tracker is putting third-quarter growth at 2.4%. The estimate was revised up sharply following personal spending and income data on Friday.

Markets are split between whether the Fed will enact a fourth straight 0.75 percentage point rate hike at its November meeting, with another half- or quarter-point increase expected in December. That would elevate rates to their highest levels since late 2007, a time when the central bank was cutting as the worst of the financial crisis had not hit yet.

This time around, the Fed is deliberately trying to slow the economy — and specifically a hot labor market that shows no signs of letting up. A historically tight labor market that has two open jobs for every available worker is not only putting a floor under growth but also providing a headache for the inflation-minded central bank.

Nonfarm payrolls have risen by 3.5 million through the first eight months of the year and average hourly earnings are up 5.2% on a 12-month basis — a blistering pace by historical standards but still not enough to keep up with an 8.3% inflation rate.

Conventional wisdom is that Fed policy operates on a lag that can be anywhere from six months to a year or longer. Given that, the chances of the labor market being able to survive a pace of rate hikes not seen in decades is unlikely.

“Q3 is going to be negative [for GDP], Q4 will be more negative,” LaVorgna said. “So we will have on paper a recession for 2022, but it won’t feel like one until early next year when the labor market softens quite dramatically. It’s at that point where I could see a Fed pivot.”

Just a matter of ‘when’

Such a “pivot” could mean a number of things, and investors will be watching not only Fed policy actions but also verbal cues for a signal for when policymakers think they’ve done enough. Chair Jerome Powell’s news conferences will be of specific interest during this time.

For now, investors are growing increasingly nervous over what the policy moves could portend. Multiple market experts who spoke at CNBC’s “Delivering Alpha” conference last week expressed trepidation.

“I will be stunned if we don’t have a recession in ’23,” said Stanley Druckenmiller, chair of Duquesne Family Office. “Don’t know the timing, but certainly by the end of ’23. I will not be surprised if it’s not larger than the so-called average garden variety, and I don’t rule out — not my forecast — but I don’t rule out something really bad.”

Ken Griffin, who runs the Citadel hedge fund, said of a recession, “there will be one, it’s just a question of when and, frankly, how hard.” The ramifications will be serious, he said.

“We’re going to have had millions of Americans unemployed back to back twice in a three-and-change year period,” he said. “And from the perspective of our nation, the loss of human capital that that implies is devastating.”

For investors, Griffin advised making sure they can withstand the fallout from an economic downturn.

“You don’t want to own so many equities that when the inevitable recession happens, you’re forced to sell at the bottom,” he said. “That’s a much more important concept for investors to understand and to focus on than trying to prognosticate as to when the next recession is going to happen.”

Tim Cook says there are 4 traits he looks for in Apple employees: ‘It’s been a very good formula for us’

Published Sun, Oct 2 202210:00 AM EDT

Tim Cook doesn’t spend his days reviewing resumes — but in his 11-year stint as Apple’s CEO, he’s determined what it takes to thrive at the company.

At University of Naples Federico II’s commencement ceremony this week, Cook told graduates from the Naples, Italy, university that he noticed Apple’s success depends on its culture and who it hires. For instance, the company typically seeks out employees with four shared skills: the ability to collaborate, creativity, curiosity and expertise.

“It’s been a very good formula for us,” he said, noting those traits also contribute to an ambitious, yet supportive workplace culture. “It’s not like somebody goes in a corner or closet and figures out [how to build technology] by themselves.”

As he spoke, he appeared to rank the skill sets in that order. He said the reason collaboration is so important is because it combines all three of the other skills.

“We look for… the fundamental feeling that if I share my idea with you, that that idea will grow and get bigger and get better,” Cook said. “And that [collaborative] process is how Apple creates products.”

That sense of teamwork lends itself to creativity and curiosity, as all three are needed to launch new or improve old ideas, he said.

“We look for people that think different — that can look at a problem and not be caught up in the dogma of how that problem has always been [solved],” he said. “It’s a cliché, but there are no dumb questions. It’s amazing when somebody starts to ask questions as a kid would do.”

But whether Apple’s hiring tactics consistently ensure a positive working environment is up for debate. This year, the company dropped off Comparably’s annual list of global companies with the best workplace culture. It also received a “C” rating for office culture, despite ranking at No. 14 last year.

It also dropped more than 20 spots on Glassdoor’s yearly ranking of best places to work in the U.S., plummeting from No. 31 to No. 56. Employee reviews on both sites cited poor work-life balance, erratic schedules and high stress from a competitive working environment.

“We are and have always been deeply committed to creating and maintaining a positive and inclusive workplace,” Apple said in a statement to the New York Times, responding to employee complaints about a “toxic” culture that surfaced in September. “We take all concerns seriously and we thoroughly investigate whenever a concern is raised and, out of respect for the privacy of any individuals involved we do not discuss specific employee matters.”

Apple’s hiring tactic has been in place for at least six years, according to Cook. At the Utah Tech Tour in October 2016, Cook said Apple looked for brilliance, determination, obsessive curiosity, team focus and agitated idealism in its employees.

“We look for wicked smart people … [but] there are a lot of wicked smart people,” he said at the conference. “We look for people that are very collaborative because nobody — even somebody who has … a cape on their back — can do everything alone.”

https://www.cnbc.com/2022/09/29/stock-futures-are-flat-following-thursdays-broad-sell-off.html

Dow tumbles 500 points on Friday to end September down nearly 9%

Stocks fell in choppy trading Friday as Wall Street closed out a terrible week, month and quarter that brought the S&P 500 to a new 2022 low.

The Dow Jones Industrial Average closed below 29,000 for the first time since November 2020. The index fell 500.10 points, or 1.71%, to 28,725.51. The Nasdaq Composite was 1.51% lower, ending the day at 10,575.62.

Meanwhile, the S&P 500 was down 1.51% on Friday, falling to 3,585.62. The index closed out its worst month since March 2020.

Friday marked the last day of the month and the third quarter. For September, the Dow tumbled 8.8%, while the S&P 500 fell 9.3%. The Nasdaq lost 10.5%.

CNBC

“It’s been a tough, tough environment for equities and fixed income both, something that we had expected given our views around the Fed keeping interest rates higher for longer and markets are starting to come around to that view,” said Zachary Hill, head of portfolio management at Horizon Investments.

“In the near term, we are likely to have continued market volatility with a downward bias as we head into earnings season,” Hill said.

An inflation report closely watched by the Federal Reserve released Friday showed that prices continued to increase at a rapid pace.

Fed Vice Chair Lael Brainard on Friday underscored the need to bring down inflation, saying the central bank is “committed to avoiding pulling back prematurely” on restrictive monetary policy.

Nike fell sharply after reporting that sales increased, but supply chain and inventory issues hampered the bottom line in its fiscal first quarter. The stock closed down 12.8%.

Quarter to date, the S&P 500 and Nasdaq wrapped up their first three-quarter losing streak since 2009, losing 5.3% and 4.1%, respectively. The Dow dropped 6.7% in the third quarter and saw a third-straight losing quarter for the first time since 2015.

For the week, the major averages posted sharp losses. The S&P 500 slid 2.9% for the week. The Dow tumbled 2.9%, and the Nasdaq fell 2.7%.

Lea la cobertura del mercado de hoy en español aquí.

FRI, SEP 30 20224:56 PM EDT

Stocks wrap up ugly week, month and quarter with sharp losses

The three major indexes ended Friday with ugly losses on the week, month and quarter.

The S&P 500 ended Friday down 1.51%, closing at 3,585.62. The Nasdaq Composite closed 1.51% lower to end at 10,575.62. The Dow Jones Industrial Average shed 500.10 points to land at 28,725.51. Friday also marked the 30-stock Dow’s first close below 29,000 since November 2020.

All three major averages slid sharply for the week, with the S&P 500 and the Dow losing 2.9%. The Nasdaq dropped nearly 2.7%.

September was particularly tumultuous for the indexes, with the S&P 500 falling 9.3% and notching its worst monthly decline since March 2020. The Nasdaq dropped 10.5%, with tech stocks suffering as bond yields raced higher in the month. The Dow tumbled 8.8%.

Finally, on a quarterly basis, the S&P 500 fell 5.3%. The Nasdaq dropped 4.1%, and the Dow lost 6.7%. It was the first time the S&P 500 and the Nasdaq experienced three consecutive quarterly losses since 2009. Meanwhile, this was the first time the Dow faced three straight quarterly losses since 2015.

–Darla Mercado, Chris Hayes

FRI, SEP 30 20223:34 PM EDT

Third quarter earnings are now on pace to grow at the slowest rate in two years

Wall Street earnings analysts lowered their third quarter earnings estimates more than normal in the past three months, according to FactSet senior earnings analyst John Butters.

The estimated earnings growth rate for all the companies in the S&P 500 index now stands at 2.9% and, if that turns out to be the actual number for the quarter, it will prove the slowest rate of expansion since the third quarter of 2020, when earnings fell 5.7%.

How bad has the adjustment on the Street been? Butters says that when the second quarter ended on June 30, third quarter earnings were forecast to expand by 9.8%.

Because the denominator on the market has contracted, the forward 12-month price-to-earnings multiple on the S&P 500 is now 15.4, Butters says, against a 5-year average of 18.6 and a 10-year average of 17.1.

— Scott Schnipper

FRI, SEP 30 20223:22 PM EDT

The market is ‘the transmission mechanism’ of the Fed, financial adviser says

Some market observers say they see the Federal Reserve using the markets as a vehicle for curbing inflation by way of rate hikes.

“The market stinks,” said Jamie Cox, managing partner of Harris Financial Group. “But that’s basically what the Fed wants: tighten financial conditions, and they believe that that will help bring down inflation to the levels that they find acceptable. And they’re using the transmission mechanism of the market to make that happen.”

He said there are “large amounts of net worth being erased” as the rate hikes come. But Cox said the downturn could provide opportunity for savvy investors, specifically pointing fixed income as an area worth watching as the Fed’s war against inflation continues to play out.

— Alex Harring

FRI, SEP 30 20223:10 PM EDT

53 S&P 500 stocks fall to fresh lows

At least 53 stocks in the S&P 500 hit new 52-week lows during Friday afternoon trading.

Here are some of the names:

- Comcast (CMCSA) trading at lows not seen since May, 2016

- AT&T (T) trading at lows not seen since Apr, 2003

- Verizon (VZ) trading at lows not seen since Aug, 2015

- Advance Auto Parts (AAP) trading at lows not seen since Feb, 2021

- Best Buy (BBY) trading at lows not seen since Apr, 2020

- Carnival (CCL) trading at lows not seen since Oct, 1992

- Caesars Entertainment (CZR) trading at lows not seen since Aug, 2020

- eBay (EBAY) trading at lows not seen since Apr, 2020

- Garmin (GRMN) trading at lows not seen since May, 2020

- CarMax (KMX) trading at lows not seen since Apr, 2020

- Nike (NKE) trading at lows not seen since Apr, 2020

- PVH Corp. (PVH) trading at lows not seen since July, 2020

- Ralph Lauren (RL) trading at lows not seen since Nov, 2020

- VF Corp. (VFC) trading at lows not seen since Oct, 2011

- Whirlpool (WHR) trading at lows not seen since July, 2020

- Church & Dwight (CHD) trading at lows not seen since June, 2020

- Colgate-Palmolive (CL) trading at lows not seen since June, 2020

- Estee Lauder (EL) trading at lows not seen since Oct, 2020

- Kimberly-Clark (KMB) trading at lows not seen since Mar, 2020

— Chris Hayes, Sarah Min

FRI, SEP 30 20223:06 PM EDT

Twitter shares rise

Shares of Twitter rose about 3% following a Bloomberg Law report, citing people familiar with the matter, saying Hollywood super agent Ari Emanuel has attempted to seek a settlement between billionaire Elon Musk and Twitter.

Emanuel reportedly reached out to Twitter board member Egon Durban and suggested the two parties resolve their differences ahead of court proceedings.

Meanwhile, Musk was denied access to more documents from Twitter on its internal metrics for robot and spam accounts, according to a Bloomberg report. A judge on Friday ruled that the social media company had “done enough” to disclose accounts.

Tesla did not immediately respond to a request for comment. Neither did Endeavor, where Emanuel is CEO.

Twitter shares rise

— Sarah Min

FRI, SEP 30 20222:27 PM EDT

Celebrity-owned fitness chain leaps 40% on acquisition offer

Shares of F45 Training Holdings shot up more than 40% Friday after Kennedy Lewis Management made an offer to acquire the Mark Wahlberg-owned fitness company.

Funds affiliated with Kennedy Lewis owned approximately 14.6% of shares at the time the offer was filed, according to a letter to the F45 Board of Directors dated Friday. Kennedy Lewis offered $4 per share, an 82.6% increase from the stock’s value of $2.19 at Thursday close.

“Given the measures that the company has already taken together with the brand and operating repositioning that is needed, we believe that as a private company F45 would be in a stronger position to maximize its resources and realize strategic value that enhances its operations and supports its stakeholders,” the letter reads.

F45 shares surge on acquisition offer

The company is known for its namesake F45, a circuit and high intensity interval training workout. F45 has more than 600 studios across the U.S., according to its website.

— Alex Harring

FRI, SEP 30 20221:35 PM EDT

Some stocks jump this week despite broader market slides

Despite the major averages sliding this week, some stocks have gained more than 30%.

Pharmaceutical company Biogen is the best performer this week, jumping 32.4% after announcing what analysts call “best-case scenario” results from the third phase of its Alzheimer’s drug trial. But its upside is lower than other top performers at 1.4%.

Other stocks ranging from health care to tech posted gains breaking 20% so far this week. CNBC Pro subscribers can read more about how these stocks performed and where analysts see them headed here.

— Alex Harring

FRI, SEP 30 20221:09 PM EDT

S&P 500 heading for grim quarterly milestone

As it stands right now, the S&P 500 is on track for a troubling milestone.

According to Bespoke Investment Group, this could mark the first time in about 80 years that the S&P 500 posts a quarterly loss after being up more than 10% at one point during that three-month period.

The benchmark index was up as much as 14.3% at one point during the quarter. But through Friday afternoon, the S&P 500 was down 3.9%.

Huge quarterly reversal for S&P 500

— Fred Imbert

FRI, SEP 30 20221:00 PM EDT

Netflix is on pace for its best quarter since 2018

Netflix is headed for its best quarter since 2018.

Shares of Netflix are up 37.4% in the quarter ending Sept. 30, on pace to snap a three-quarter losing streak for the streaming company. It’s the best three-month period for Netflix since the first quarter in 2018 when it was up 53.86%.

The streaming giant is among the leading outperformers in the S&P 500 in what has been an ugly month for stocks. The broader market index is off 3.8% this quarter, and down 7.9% this month.

— Chris Hayes, Sarah Min

FRI, SEP 30 202212:59 PM EDT

Nike, Cruise lines are biggest losers

Shares of Nike slipped nearly 12% Friday after the company reported earnings weighed down by overstocked inventory that means aggressive discounting in the coming months.

In addition, shares of Carnival fell about 20% after the company reported disappointing third quarter earnings and a weak fourth quarter outlook, citing higher fuel costs and inflation. Shares of competing cruise lines Royal Caribbean and Norwegian also fell 11% and 15%, respectively.

—Carmen Reinicke

FRI, SEP 30 202212:58 PM EDT

JPMorgan’s Kolanovic admits 2022 price targets ‘at risk’

JPMorgan’s Marko Kolanovic optimism on the market is waning.

“The most recent increase of geopolitical and monetary policy risks puts our 2022 price targets at risk. While we remain above-consensus positive, these targets may not be realized until 2023 or when the above risks ease,” he wrote in a note Friday.

The firm’s positive outlook, and S&P 500 target of 4,800, was based on several factors that now seem to be in jeopardy, like the central banks not making a grave policy error and the war in Europe de-escalating.

“Given the recent escalation in hawkish rhetoric, the likelihood of central banks committing a policy mistake with negative global consequences has increased,” said Marko Kolanovic, the firm’s global markets strategist and co-head of global research.

He is also concerned about geopolitical tail risks following the destruction of underground Russian gas pipelines.

— Michelle Fox

FRI, SEP 30 202210:58 AM EDT

This month is worse than September 2008 for the Dow

The Dow Jones Industrial Average is headed for its worst September since 2002. In other words, this September is more awful for the index than the same month during the financial crisis in 2008. The Dow is also seeing its worst month since March 2020.

Meanwhile, the S&P 500 and Nasdaq Composite are having their worst September since 2008.

— Robert Hum, Sarah Min

FRI, SEP 30 202210:25 AM EDT

UMich consumer survey comes in lower than expected

Overall consumer sentiment in September came in lower than expected, according to a widely followed survey released Friday.

The University of Michigan’s Surveys of Consumers hit 58.6, higher than the prior month’s reading of 58.2 in August. It came in below the Dow Jones estimate of 59.5.

— Sarah Min

FRI, SEP 30 202210:21 AM EDT

Retail ETF slumps to a new low going back to 2020

The SPDR S&P Retail ETF (XRT) tumbled more than 2% around 10 a.m. ET. The fund was down more than 3% earlier in the session, hitting a fresh low dating back to November 2020.

Rent-a-Center shares led the losses in the ETF, sliding about 16%. The furniture rent-to-own company recently slashed guidance for third quarter per-share earnings to a range of 85 to 95 cents, versus prior guidance of $1.05 to $1.25.

Dick’s Sporting Goods and Qurate Retail were also among the notable decliners in the ETF, falling more than 6% and 3%, respectively.

–Darla Mercado, Gina Francolla

FRI, SEP 30 20229:44 AM EDT

Stocks open lower

Stocks opened lower Friday as traders looked to close out a terrible week that brought the S&P 500 to a new 2022 low.

The S&P 500 was down 0.69%. The Dow Jones Industrial Average lost 217 points, or 0.74%, while the Nasdaq Composite was 0.59% lower.

— Sarah Min

FRI, SEP 30 20229:13 AM EDT

Fed Vice Chair Brainard says the Fed shouldn’t pull away from inflation fight ‘prematurely’

Federal Reserve Vice Chair Lael Brainard said it’s imperative that the central bank not shrink from fighting inflation until the job is done.

“Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target,” she said Friday in remarks prepared for a speech in New York. “For these reasons, we are committed to avoiding pulling back prematurely.”

Inflation continues to push higher, according to the latest personal consumption expenditures price index data, the Fed’s preferred measure of inflation. Core PCE came in hotter than expected on Friday.

— Tanaya Macheel, Jeff Cox

FRI, SEP 30 20228:45 AM EDT

Core PCE comes in hotter than expected for August

August inflation data disappointed to the upside on Friday with a hotter-than-expected personal consumption expenditures reading, signaling that the Federal Reserve still has work to do to cool prices.

The PCE price index rose 0.3% month over month, and 0.6% when excluding food and energy. Economists surveyed by Dow Jones expected a 0.5% monthly increase for core PCE.

On a year over year basis, PCE rose 6.4%, and core PCE increased 5.0%.

Meanwhile, personal income rose 0.3% in August, matching expectations, and consumer spending rose 0.4%. Personal spending rose 0.1% when controlled for inflation.

— Jesse Pound

FRI, SEP 30 20228:44 AM EDT

Credit Suisse says this under-the-radar electric vehicle charging company can more than double its stock

Credit Suisse says this electric vehicle infrastructure provider known as Allego can see its shares rally more than 120% as consumers rapidly adopt the technology.

“Allego benefits from rapidly growing EV adoption, supportive policies, and incentives,” wrote analyst Maheep Mandloi said in a note to clients Friday. “The stock has been under pressure due to capital needs, but we are positive on Allego owing to its market leadership, strong backlog, and expanded debt facilities that help meet its near-term cash needs.”

CNBC Pro subscribers can check out the full story here.

— Samantha Subin

FRI, SEP 30 20228:07 AM EDT

Stocks making the biggest moves premarket

These companies are making headlines before the bell:

- Nike – Nike slumped 10% in the premarket after it reported a 44% increase in inventories for its latest quarter, and said it would offer more discounts heading into the holiday season. The athletic footwear and apparel maker reported better-than-expected profit and revenue for its latest quarter.

- Amylyx Pharmaceuticals – Amylyx surged 9.3% in the premarket after the FDA approved its new ALS drug. The treatment slows the progression of the disease, extends survival, and is the first ALS drug to gain FDA approval in five years.

- Rent-A-Center – Rent-A-Center tumbled 18.1% in the premarket after the rent-to-own company cut its current-quarter earnings guidance. The company said current economic conditions have impacted retail traffic and customer payment patterns.

Check out more premarket movers here.

— Peter Schacknow

FRI, SEP 30 20228:00 AM EDT

Investors should still bet on stocks despite recent selling, Jeremy Siegel says

Wharton professor Jeremy Siegel said investors investing for the long haul should stay in stocks despite the recent selling pressures.

“Despite all the ups and downs and crises, and bear markets that we’ve had over the last 30 years, the real return on stocks has been absolutely the same, which is really quite remarkable,” Siegel told CNBC’s Bob Pisani. “They have trouble when the Fed is tightening. We see that now. But once that tightening is done, once normalization comes back, they make up the lost ground and they get back to that long-term trend.”

CNBC Pro subscribers can read the full story here.

— Fred Imbert

FRI, SEP 30 20226:27 AM EDT

Raymond James says Microsoft can beat out competitors in recession

Raymond James analysts advised clients buy Microsoft shares, as the tech giant is well-positioned headed into a potential recession.

“Microsoft’s long track record and breadth of product offering (often including discounts for multi-product commitments) make them a competitor for a broader range of enterprise software RFPs than any competitor,” wrote analyst Andrew Marok in a note to clients Thursday.

CNBC Pro subscribers can read the full story here.

— Fred Imbert

THU, SEP 29 202210:24 PM EDT

China reports better-than-expected factory activity for September

China’s official manufacturing Purchasing Managers’ Index surprisingly grew in September to 50.1, much higher than the 49.6 predicted by analysts in a Reuters poll.

The 50-point mark separates growth from contraction. PMI prints compare activity from month to month.

Meanwhile, the Caixin/S&P Global manufacturing Purchasing Managers’ Index, a private survey of factory activity — reported a contraction with a reading of 48.1.

“Subdued demand conditions and lower production requirements led firms to cut back on their purchasing activity in September, with the rate of decline the quickest in four months,” the Caixin press release said.

The official non-manufacturing PMI came in at 50.6 in September, down from 52.6 in August.

— Abigail Ng

THU, SEP 29 20228:39 PM EDT

CNBC Pro: Is the Fed on the right track? Wall Street veteran Ed Yardeni says this is what it should do next

The U.S Federal Reserve announced yet another 75 basis point hike earlier this month, sending the federal funds rate up to a range of 3% to 3.25%. The central bank also signaled it may raise interest rates up to as high as 4.6% in 2023 to control inflation.

Ed Yardeni, the economist who coined the term “bond vigilantes,” gives his take as the Fed’s response to inflation comes under intense scrutiny.

Pro subscribers can read more here.

— Zavier Ong

THU, SEP 29 20226:52 PM EDT

Nike, Amylyx move in post-market trading

Nike and Amylyx Pharmaceuticals are moving after hours.

The sportswear giant Nike was down about 9.2% in after-hour trading Thursday after reporting first-quarter earnings after the bell. Despite beating revenue expectations, the company said supply chain and inventory issues hurt the bottom line.

On the other hand, Amylyx saw shares up nearly 10% in extended trading. The pharmaceutical company received approval from the Food and Drug Administration late in the afternoon for its controversial new drug expected to slow the progress of Lou Gehrig’s disease.

THU, SEP 29 20226:38 PM EDT

Indices slide week to date, month to date

The three major indices are all on pace to slide this week.

The Dow is down about 1.23% week to date, putting it on track for its sixth negative week out of the last second. It dropped 7.25% so far this month, which places it on pace for its worst month since March 2020 – when the pandemic began.

The S&P 500 was also on track for its sixth negative week out of the last seven, notching down 1.43% so far this week. It has fallen 7.95% month to date, which would be its worst month since June if it remains at that level.

Also heading toward its sixth negative week out of the last seven, the Nasdaq slid 1.2% so far this week. It is down 9.13% month to date, meaning it is on track for its worst monthly performance since April.

The three major indices slide in September

Futures tick up slightly in first hour

Futures ticked up slightly after open Thursday evening following a day of sell-offs as nervous investors continue wondering how the Federal Reserve’s fight against inflation will impact markets.

Futures for the S&P 500 were up 0.33%. The Dow Jones Industrial Average futures were up slightly less at 0.23%. Nasdaq 100 futures followed closely, up 0.21%.

— Alex Harring

HI Financial Services Mid-Week 06-24-2014