HI Market View Commentary 09-21-2020

| Market Recap |

| WEEK OF SEP. 14 THROUGH SEP. 18, 2020 |

| The S&P 500 index edged down 0.6% last week as gains in the energy, industrials, materials and health care sectors were outweighed by declines led by communication services, consumer discretionary and consumer staples. The S&P 500 ended Friday’s session at 3,319.47, down from last week’s closing level of 3,340.97. This marks the index’s third consecutive week in the red; it is now down 7.5% from the intraday record high recorded Sept. 2. However, the index is still in positive territory for 2020 with a year-to-date gain of 2.75%. Leading the week’s drop, the consumer staples and consumer discretionary sectors fell 1.5% each, followed by a 1.7% slip in communication services. Still, four sectors rose from last Friday’s closing levels, led by the energy sector, which climbed 3% in a partial recovery from the 6.4% drop the sector recorded last week. Industrials advanced 1.5%, materials added 1% and health care edged up 0.9%. The week’s mixed activity came as Federal Reserve Chair Jerome Powell signaled expectations the central bank’s policy-setting committee would keep rates low for the next three years, but the plans for continued low rates come amid expectations of longer spells of joblessness and economic weakness than the market had anticipated. Powell described the economic outlook as “highly uncertain.” Among the decliners in communication services, Facebook (FB) shares fell 5.3% amid a Wall Street Journal report stating the social network operator could face a potential antitrust lawsuit from the Federal Trade Commission over concerns it has been using its market position to stifle competition. The report, citing people familiar with the matter, said the FTC has investigated such concerns for more than a year and could file suit against the social media giant by year-end. In the consumer discretionary sector, shares of cruise operator Carnival (CCL) fell 13% as the company reported it swung to a fiscal Q3 adjusted net loss from an adjusted profit in the prior-year period. Carnival also warned it expects an adjusted net loss for the quarter ending Nov. 30. On the upside, the energy sector’s climb came amid a jump in crude-oil futures as weekly US crude inventories fell for the seventh time in eight weeks and reached a five-month low. Among the gainers, Occidental Petroleum (OXY) shares rose 14% this week while Diamondback Energy (FANG) also climbed 14%. In the industrial sector, General Electric (GE) shares jumped 16% as Chief Executive Larry Culp told investors he expects the company’s free cash flow to turn positive in the second half of the year. This comes after GE reported a negative cash flow of $2.1 billion in Q2 due to the COVID-19 pandemic. Next week, the market will get August housing data, with existing home sales due Tuesday and new home sales due Thursday. Markit’s September purchasing managers indexes for both manufacturing and services are expected Wednesday, while investors will get August durable goods orders and capital goods orders Friday. Provided by MT Newswires. |

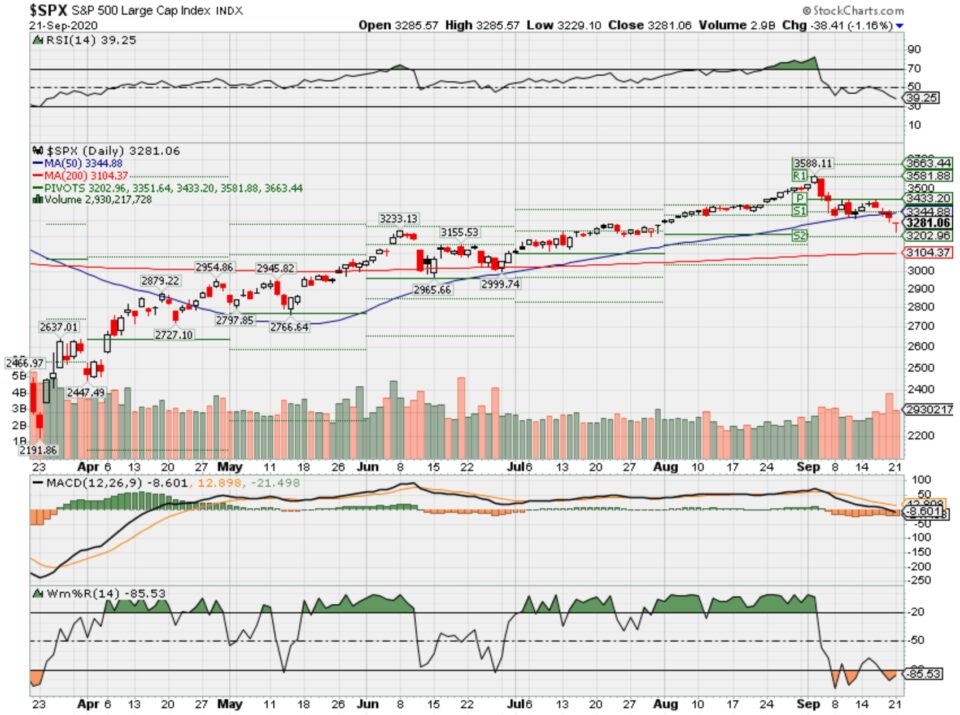

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end September 2020?

09-21-2020 -8.0%

09-14-2020 -5.0%

09-08-2020 -5.0%

08-31-2020 -5.0%

Earnings:

Mon:

Tues: AZO, SINA, WB, HTZ, KBH, NKE

Wed: GIS, FUL

Thur: BB, DRI, JBL, TCOM, MTN, COST

Fri: CCL

Econ Reports:

Mon: US fed Chair Powell’s Speech

Tues: Existing Home Sales

Wed: MBA, FHFA Housing Price Index

Thur: Initial Claims, Continuing Claims, New Home Sales

Fri: Durable Goods, Durable ex-trans

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

All positions are mostly protected and now looking for OTM covered calls to add for full collar positions

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Amazon Spent Years Learning What It Takes to Do Great Work. These 4 Steps Contributed Most to Its Success

“Skill is overrated,” says Jeff Bezos. These four things are not.

BY JUSTIN BARISO, AUTHOR, EQ APPLIED@JUSTINJBARISO

Yesterday, Amazon founder Jeff Bezos published his annual letter to shareholders, and it’s got some great advice for anyone who is striving to do great work.

After commending Amazon employees for their commitment to excellence, and Amazon customers for pushing Bezos and his team to continue raising the bar, Bezos delivered a lesson in how to stay ahead of customer expectations.

It all comes down to maintaining high standards, he writes.

And how do you do that?

Bezos continues:

“The four elements of high standards as we see it: they are teachable, they are domain specific, you must recognize them, and you must explicitly coach realistic scope.”

It took Amazon many successes–and billions of dollars of failures–to learn that lesson, says Bezos. “With those experiences as backdrop, I’d like to share with you the essentials of what we’ve learned (so far) about high standards inside an organization.”

So, here they are: the four elements of high standards, according to Jeff Bezos:

1. High standards are teachable.

“People are pretty good at learning high standards simply through exposure,” writes Bezos. “High standards are contagious. Bring a new person onto a high standards team, and they’ll quickly adapt. The opposite is also true. If low standards prevail, those too will quickly spread.”

The takeaway: It may be challenging to establish high standards in the beginning. It starts with hiring people who are open to learning and constructive criticism, and requires complete buy-in. But once those employees are used to working at a high level, it becomes self-sustaining.

2. High standards are domain specific.

“If you have high standards in one area, do you automatically have high standards elsewhere?” Bezos asks. “I believe high standards are domain specific, and that you have to learn high standards separately in every arena of interest.”

Bezos says when he founded Amazon, he had high standards for inventing, customer care, and hiring. But he didn’t have high standards on operational process: the actions needed to “keep fixed problems fixed” and “to eliminate defects at the root,” among other things.

“Understanding this point is important because it keeps you humble,” writes Bezos. “You can consider yourself a person of high standards in general and still have debilitating blind spots.”

The takeaway: Learn to recognize your strengths and weaknesses, as well as the strengths and weaknesses of others. Then, be humble and willing to learn from those who excel where you don’t.

3. High standards must be recognized.

How do you achieve high standards in a specific domain?

“First, you have to be able to recognize what good looks like in that domain,” answers Bezos.

Bezos goes on to speak about Amazon’s practice of starting meetings with silent reading of “narratively structured six-page memos,” which he describes as a kind of “study hall.” But not all of these memos are created equal.

“It would be extremely hard to write down the detailed requirements that make up a great memo,” states Bezos. “Nevertheless, I find that much of the time, readers react to great memos very similarly. They know it when they see it. The standard is there, and it is real, even if it’s not easily describable.”

The takeaway: You won’t always be able to quantify excellence, or even describe it in explicit terms. But if you identify and praise it when you see it, others will begin to recognize it, too.

And that motivates everyone to try harder.

4. High standards require realistic expectations.

Bezos says you must also have realistic expectations for the scope of a task or project: how much effort it takes to achieve a great result.

To illustrate, Bezos tells the story of a friend who recently decided to learn how to do a proper handstand. After her initial efforts left her frustrated, she decided to hire a coach to help her learn. The coach told her that most people think they can master a handstand in about two weeks of daily practice, but in reality, it takes about six months.

“Unrealistic beliefs on scope–often hidden and undiscussed–kill high standards,” concludes Bezos. “To achieve high standards yourself or as part of a team, you need to form and proactively communicate realistic beliefs about how hard something is going to be.”

Bezos then returns to the memo example.

“Often, when a memo isn’t great, it’s not the writer’s inability to recognize the high standard,” he says, “but instead a wrong expectation on scope: they mistakenly believe a high-standards, six-page memo can be written in one or two days or even a few hours, when really it might take a week or more! They’re trying to perfect a handstand in just two weeks, and we’re not coaching them right. The great memos are written and re-written, shared with colleagues who are asked to improve the work, set aside for a couple of days, and then edited again with a fresh mind. They simply can’t be done in a day or two.”

The takeaway: You can improve results simply by teaching scope. Make it clear exactly how much time and effort are needed to achieve a great result.

Why skill is overrated

It’s what Bezos says last that I found most interesting.

“How about skill?” he asks. “Surely to write a world class memo, you have to be an extremely skilled writer?… In my view, not so much, at least not for the individual in the context of teams. The football coach doesn’t need to be able to throw, and a film director doesn’t need to be able to act. But they both do need to recognize high standards for those things and teach realistic expectations on scope.”

In other words, Bezos says, someone on the team needs to have the necessary skill to perform a task (like writing a great memo), but it doesn’t have to be you. And this takes us back to point two: By learning to identify what individuals on your team do well, you can better delegate–giving you time to focus on your own strengths.

The result? A whole that is far greater than the sum of its parts.

The benefits of high standards

Bezos credits Amazon’s high standards with its ability to build better products and services for customers, as well as to recruit and retain the best (since high performers are drawn to high standards).

But there’s another, more subtle (and intrinsic) benefit.

“A culture of high standards is protective of all the ‘invisible’ but crucial work that goes on in every company,” writes Bezos. “I’m talking about the work that no one sees. The work that gets done when no one is watching. In a high standards culture, doing that work well is its own reward–it’s part of what it means to be a professional. And finally, high standards are fun!”

So, remember: High standards:

- Are teachable

- Are domain-specific

- Must be recognized

- Must be clearly communicated (especially regarding scope)

Achieving this is well worth the effort. Because as Bezos concludes:

“Once you’ve tasted high standards, there’s no going back.”

United CEO says travel demand unlikely to recover until vaccine is widely distributed

PUBLISHED SUN, SEP 13 202012:42 PM EDT

Tucker Higgins@IN/TUCKER-HIGGINS-5B162295/@TUCKERHIGGINS

KEY POINTS

- The CEO of United Airlines said on Sunday that a recovery for the aviation industry will have to wait until a Covid-19 vaccine is approved and widely available, a milestone he said the company projects the country will reach toward the end of 2021.

- “I hope that happens sooner, but our guess is that’s the end of next year,” Scott Kirby said during an interview on CBS’s “Face the Nation.”

- The coronavirus pandemic has ravaged the airline industry, bringing business travel to a standstill, preventing U.S. residents from traveling internationally, and curbing leisure trips.

The CEO of United Airlines said on Sunday that a recovery for the aviation industry will have to wait until a Covid-19 vaccine is approved and widely available, a milestone he said the company projects the country will reach toward the end of 2021.

“I hope that happens sooner, but our guess is that’s the end of next year,” Scott Kirby said during an interview on CBS’s “Face the Nation.”

Kirby’s comments are in line with predictions made by Dr. Anthony Fauci, one of the country’s leading experts on infectious diseases. But they contrast to recent statements made by President Donald Trump, who has suggested that the U.S. will soon return to normal as he makes his case for a second term ahead of the November contest against Democrat Joe Biden.

The coronavirus pandemic has ravaged the airline industry, bringing business travel to a virtual standstill, preventing U.S. residents from traveling internationally, and curbing leisure trips.

Kirby said that barring new federal legislation, United will be forced to lay off 16,000 workers as soon as next month, after the existing funds that were allocated in March dry up. He said that the company continues to burn through $25 million per day amid a decline in revenue of 85%.

“In a business like ours, demand is not going to come back until people feel safe being around other people, and that’s going to take a vaccine,” Kirby said. “And that’s just the reality. Some businesses can recover earlier, but in aviation and all the industries that we support, it is going to take longer.”

A new Covid-19 rescue bill is unlikely to emerge before October, with Republicans and Democrats deadlocked over how much to boost state assistance for the unemployed and funding for municipalities. Last week, an effort by the GOP to pass a so-called “skinny” relief bill failed in the Senate, where the party holds a majority.

“The reality is, without more government support for the whole economy, there are going to be more layoffs to come,” Kirby said.

The timing of Covid-19 vaccine approval and distribution remains uncertain, dependent on the results of clinical trials. U.S. regulators have yet to approve any vaccine as safe and effective, though there are a number of candidates at late stages in the process.

Trump has suggested that a vaccine could be approved ahead of Election Day, which is Nov. 3, leading to charges from Democrats that he is politicizing the scientific process. Trump said on Thursday that the U.S. was “rounding the corner” on the pandemic.

Experts, including Fauci, have said it would be possible for a vaccine to be approved by the end of the year, and possibly even November, but have cautioned that it will take longer for the country to return to normal.

In an interview on MSNBC on Friday, Fauci said that returning to normal could take “well into 2021, maybe even towards the end of 2021.”

Pelosi blasts GOP ‘skinny’ deals, doubles down on call for large coronavirus stimulus package

PUBLISHED TUE, SEP 15 202011:00 AM EDTUPDATED TUE, SEP 15 20201:38 PM EDT

KEY POINTS

- House Speaker Nancy Pelosi said Tuesday morning that she remains opposed to Republican efforts to pass a smaller version of her party’s coronavirus stimulus plan.

- Asked if she’d be willing to pass a “skinny” deal now and reconvene with Republicans on outstanding issues later, Pelosi fired back that “there is no later with this administration.”

- Pelosi’s insistence on a larger deal may put fellow Democrats in a tough position, with many members of her caucus in difficult reelection battles.

House Speaker Nancy Pelosi said Tuesday morning that she remains opposed to Republican efforts to pass a smaller version of her party’s coronavirus stimulus plan despite the looming 2020 election and economic fallout from the pandemic.

Asked by CNBC’s Jim Cramer if she’d be willing to pass a “skinny” deal now and reconvene with Republicans on outstanding issues later, Pelosi fired back that “there is no later with this administration.”

“This is the opportunity. And the skinny deal is a Republican bill: That’s not a deal at all,” Pelosi said on “Squawk on the Street.” “They’re making a skinny — in fact, Chuck Schumer and I call it an emaciated — proposal for a massive problem.”

“We can fiscally spend the appropriate amount of money to meet the needs of the American people,” she added. “And by the way: It’s stimulus. We are a consumer economy and the more we have, whether it’s food stamps or unemployment insurance … that is stimulus to the economy.”

The White House didn’t immediately respond to a request for comment.

The speaker touted the $3 trillion bill the House passed in May known as the Heroes Act. That legislation would allot nearly $1 trillion in relief for state and local governments, a second round of direct payments of $1,200 per person and an extension of the $600 per week federal unemployment insurance benefit that expired at the end of July.

Republicans looking for a compromise, such as Treasury Secretary Steven Mnuchin, have said they want to keep the price tag of the developing bill around $1 trillion thanks to better economic data and out of budgetary concerns.

The cumulative federal budget deficit for the first 11 months of fiscal 2020 was $3 trillion, according to the nonpartisan Congressional Budget Office, a result of intensified government spending to support the economy through the Covid-19 shutdown.

But Pelosi’s insistence on a larger deal may put fellow Democrats in a tough position, with many members of the House who won seats from Republicans in 2018 in tough reelection battles. Those representatives may find their races even more difficult if they return home to voters without any additional pandemic assistance enacted into law.

For their part, Republicans failed to advanced their own “skinny” bill last week in the Senate after all Democrats present voted against a procedural measure. That bill, though far smaller than the Heroes Act, would have reimposed enhanced federal unemployment insurance at a rate of $300 per week, half of the $600 weekly payment that expired at the end of July. Democrats said it didn’t go far enough.

Hoping to restart the stalled negotiations and underscoring the need to return to voters with a material boost to Covid relief, the House Problem Solvers Caucus on Tuesday released a coronavirus relief plan produced with input from both parties.

“Having seen no progress on a new COVID-19 relief package in four months, and in recognition of Americans’ increasing suffering, the Problem Solvers Caucus (PSC) has developed a comprehensive, bipartisan framework to meet the nation’s needs for the next 6-12 months, that can pass both chambers of Congress and be signed into law by the President,” the caucus said in a release.

The caucus’s proposal includes $450 per week in federal unemployment benefits for eight weeks, $500 billion in state and local relief, direct payments to American workers and additional Paycheck Protection Program funds. As the proposal includes provisions both major parties have opposed, it is unclear whether it can gain traction with congressional leaders.

Congressional report faults Boeing, FAA for 737 Max failures, just as regulators close in on recertification

PUBLISHED WED, SEP 16 20205:00 AM EDTUPDATED WED, SEP 16 202011:12 AM EDT

KEY POINTS

- The House committee’s report detailed multiple missteps by Boeing and the FAA in the development and approval of the 737 Max.

- The 238-page report outlined design flaws and immense pressure on employees amid competition from rival Airbus.

- The lawmakers found the FAA failed to protect the traveling public, in part because of “excessive” delegation of certification work to Boeing.

- The results of the investigation were released as regulators are getting closer to recertifying the planes.

Numerous design, management and regulatory failures during the development of the 737 Max preceded the “preventable death” of 346 people in two crashes of the popular Boeing jetliner, according to a damning congressional report released Wednesday.

The House Committee on Transportation and Infrastructure’s 238-page report, put together by its Democratic leaders and their staff, painted a Boeing that prioritized profits over safety and detailed “disturbing cultural issues” relating to employee surveys showing some experienced “undue pressure” as the manufacturer raced to finish the plane to compete with rival Airbus. The report said concerns about the aircraft weren’t sufficiently addressed to spur design changes.

Some bipartisan lawmakers this year introduced legislation that aims to increase the Federal Aviation Administration’s oversight of the industry. The lawmakers found the FAA failed to protect the traveling public, in part because of “excessive” delegation of certification work to Boeing.

Responding to the report, the agency said: “The FAA is committed to continually advancing aviation safety and looks forward to working with the Committee to implement improvements identified in its report.” It said it has implemented several initiatives “focused on advancing overall aviation safety by improving our organization, processes, and culture.”

High-ranking Republicans on the House committee — Reps. Sam Graves of Missouri and Garret Graves of Louisiana — said in a statement that nonpartisan recommendations “not a partisan investigative report — should serve as the basis for Congressional action.” Garret Graves is the ranking Republican on the aviation subcommittee. Sam Graves’ home state counts Boeing as a major employer.

“The Majority staff’s investigation began by concluding that our system was broken and worked backwards from there,” the congressmen said.

“As we have said from the beginning, if aviation and safety experts determine that areas in the FAA’s processes for certifying aircraft and equipment can be improved, then Congress will act,” they added. “That’s how we can address these two tragic accidents and make our safe system even safer.”

The report, in the works for about 18 months, comes as regulators are in the final stretch of work to recertify the planes. The 737 Max has been grounded worldwide since March 2019, following the second of the planes’ two fatal crashes.

“They were the horrific culmination of a series of faulty technical assumptions by Boeing’s engineers, a lack of transparency on the part of Boeing’s management, and grossly insufficient oversight by the FAA — the pernicious result of regulatory capture on the part of the FAA with respect to its responsibilities to perform robust oversight of Boeing and to ensure the safety of the flying public,” the report said. The lawmakers and staff said they received 600,000 pages of records from Boeing, the FAA, airlines and others, for its investigation, conducted interviews with two dozen employees and regulators, and considered comments from whistleblowers who reached out to the committee.

On Oct. 29, 2018, Lion Air Flight 610 from Jakarta, Indonesia, and on March 10, 2019, Ethiopian Airlines Flight 302 from Addis Ababa, Ethiopia, crashed shortly after takeoff, killing everyone on board. At the center of the crashes was an automated system known as MCAS, against which pilots for both flights battled to override. It was activated after receiving inaccurate sensor data.

Pilots were not informed of MCAS until after the first crash and mentions of it were removed from their manuals. Last year, the National Transportation Safety Board found Boeing overestimated pilots’ ability to handle a flurry of alerts during malfunctions.

Boeing has made changes to the MCAS system that render it less powerful, give pilots greater control and provide it with more data before it is activated. That is among other changes regulators have reviewed as part of the process in recertifying the planes as safe for the traveling public.

“We have learned many hard lessons as a company from the accidents of Lion Air Flight 610 and Ethiopian Flight 302, and from the mistakes we have made,” Boeing said in a statement. “As this report recognizes, we have made fundamental changes to our company as a result, and continue to look for ways to improve. Change is always hard and requires daily commitment, but we as a company are dedicated to doing the work.”

The House report, led by Rep. Peter DeFazio, D-Ore., the committee chair, and Rep. Rick Larsen, D-Wash., head of the aviation subcommittee, whose Seattle-area district includes Boeing’s Everett plant, said its investigation “leaves open the question of Boeing’s willingness to admit to and learn from the company’s mistakes.”

Some of crash victims’ family members say Boeing has not done enough.

“I think the project as a whole should be scrapped,” said Yalena Lopez-Lewis, whose husband, Antoine, was killed on the Ethiopian Airlines flight. “I think this was a rushed project and … now they’re rushing to recertify. You can’t place a dollar value on the lives of any passenger.”

Michael Stumo, whose daughter Samya Stumo also was killed in the Ethiopian crash, said Boeing and regulators didn’t do enough after the first crash five months earlier.

“Before Lion Air, it was a mistake. After Lion Air it was unforgivable,” he said.

The crashes pushed Boeing into its biggest-ever crisis, as its bestselling aircraft couldn’t be delivered to customers and costs mounted. The missteps cost Dennis Muilenburg his job as Boeing CEO and prompted the company to undergo an internal restructuring to improve its approach to safety. Now, the coronavirus pandemic that has roiled air travel demand worldwide coupled with the extensive grounding presents Boeing with a new problem: cancellations of the planes are piling up.

The manufacturer’s problems don’t end with the 737 Max. It recently discovered flaws on some 787 Dreamliners, prompting inspections that have slowed deliveries of the wide-body aircraft.

Blackstone warns of a ‘lost decade’ where stock market returns are ‘anemic’

PUBLISHED WED, SEP 16 202012:09 AM EDTUPDATED WED, SEP 16 202012:31 AM EDT

KEY POINTS

- Blackstone’s Executive Vice Chairman Tony James said there could be a “lost decade” for equity returns as stock investments turn “anemic.”

- He said interest rates will normalize and companies will face “plenty of headwinds” that put pressure on earnings in the coming years.

- Near zero interest rates are the main driver of the recent climb in stock markets, he added.

SINGAPORE — The coming years could be a “lost decade” for equity returns as companies struggle to grow their earnings, Blackstone’s Executive Vice Chairman, Tony James, told CNBC on Wednesday.

James, who’s attending the virtual Singapore Summit, told CNBC’s “Squawk Box Asia” that stock prices may not rise further after becoming fully valued over a “five- to 10-year horizon.”

“I think this could be a lost decade in terms of equity appreciation,” he said, referring to a term commonly used to describe a period in the 1990s when Japan experienced economic stagnation.

He explained that current low interest rates may not dip further and may instead rise to more normal levels in the coming years.

Higher interest rates, in many instances, tend to negatively affect corporate earnings and stock prices. High borrowing costs will eat into company profits and hurt share prices.

There’s a hunger for yield so investors are coming off the sidelines … and looking for investments that they can get some kind of returns.

Tony James

EXECUTIVE VICE CHAIRMAN, BLACKSTONE

In addition, companies will face “plenty of headwinds” that put pressure on earnings, he said. That include higher taxes, increase in operating costs, less efficient supply chains and “deglobalization” that will hurt productivity, explained James.

“All of that will be economic headwinds for companies. So I think you can have disappointing long term earnings growth with multiples coming in a little bit, and I can see anemic equity returns over the next five to 10 years,” he added.

Near zero interest rates drive markets up

Despite the severe economic hit from the coronavirus pandemic, U.S. stock markets have climbed higher after plunging in March.

James attributed such momentum to the Federal Reserve bringing interest rates down to near zero, which left investors hunting for yield with few options to park their money. That’s why investors are piling into riskier bonds and stocks, he explained.

“Zero interest rates is the driving force here, near zero interest rates,” he said.

“There’s a hunger for yield so investors are coming off the sidelines — there’s still a lot of money on the sidelines, actually — and looking for investments that they can get some kind of returns,” he added.

While that resulted in stock markets that are “fully valued” and “a little ahead of itself,” the U.S. central bank deserves credit for preventing what could have been a “major meltdown,” said James.

“The Fed move was unprecedented size and speed … without that, there was serious risk of spiraling down to a kind of depression and when you start having that credit problems, it will ripple through markets very quickly.”

Stock futures are flat as Wall Street tries to recover from 3-week losing streak

PUBLISHED SUN, SEP 20 20206:00 PM EDTUPDATED AN HOUR AGO

U.S. stock futures were little changed on Sunday night as the market tried to bounce back from its longest weekly losing streak in about a year.

Dow Jones Industrial Average futures traded 17 points lower, or 0.1%. S&P 500 futures hovered below the flatline and Nasdaq 100 futures climbed 0.2%.

The S&P 500, Dow Jones Industrial Average and Nasdaq Composite all fell for a third straight week. That marks the market’s longest weekly slide since 2019.

Those declines came as tech shares — which led the broader market off its coronavirus lows and into record territory — struggled. Facebook, Amazon, Apple, Netflix, Google-parent Alphabet and Microsoft all posted steep weekly losses. The S&P 500 tech sector pulled back by 1%.

Tech was under pressure last week in part because of valuation concerns within the space as well as options of individual stocks, ETFs and indexes expired.

“For the market to hold these levels buyers have to come into the technology sector over the next week to 10 days,” said Marc Chaikin, CEO of Chaikin Analytics, in a post. “Without the impetus of the call option buyers who helped propel the large cap tech stocks to extreme valuations, it is unlikely that the subsequent rally can exceed the September peak.”

Traders kept an eye on Washington heading into the new week as lawmakers struggle to make progress on a new coronavirus stimulus package. Republicans and Democrats have been in a stalemate since July after provisions from the previous stimulus bill expired.

President Donald Trump hinted last week he would back a bigger relief package. White House chief of staff Mark Meadows also said he was “probably more optimistic about the potential for a deal.”

However, stimulus negotiations could become more complicated after the passing of Supreme Court Justice Ruth Bader Ginsburg, which could lead to a bitter nomination process ahead of the election. Trump said he would nominate someone this week to take Ginsburg seat, drawing criticism from key Democrats and some GOP senators.

Chris Krueger, Washington strategist at Cowen, said in a note that a new coronavirus stimulus bill is now “unlikely until post Nov 3 as the fight over Justice Ginsburg’s empty seat will consume DC.”

There are “dueling prisms in which we view the unfortunate passing of Justice Ginsburg and filling her seat on the Supreme Court: political & procedural,” said Krueger. “In a zero-sum, crass political world the immediate read-through is that anything that turns 2020 away from a Trump referendum is a positive for Trump.”

“The other narrative is that this avails Democrats to run the successful 2018 playbook again: GOP trying to take away healthcare,” he said.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Trump to pick nominee to fill Ginsburg Supreme Court seat this week and the candidate will be a woman

PUBLISHED SAT, SEP 19 20201:32 PM EDTUPDATED SUN, SEP 20 20209:03 AM EDT

KEY POINTS

- Trump would like to see a vote before the November presidential election, though not firm decision has been made yet.

- Judge Amy Coney Barrett of the 7th Circuit Court of Appeals has emerged as a front-runner to fill the seat, according to NBC News.

- Critics of Barrett have zeroed in on her prolific academic writings, in which she raised questions about the importance of respecting precedent and referred to “unborn victims” of abortion.

President Donald Trump on Saturday said he would pick his nominee in the coming week to fill the late Justice Ruth Bader Ginsburg’s Supreme Court seat and the candidate would probably be a woman, making good on his promise to move “without delay” to appoint a conservative to the nation’s highest court.

Trump, speaking to reporters on the White House South Lawn, said he would like to see a vote before the November presidential election, though no firm decision has been made yet on the timing.

“I think the process could go very, very fast,” Trump said before departing for a rally in North Carolina. “I’ll be making my choice soon and when my choice is made I’ll be sending it over to Mitch in the Senate and they will do what they have to do. I think we’ll have a very popular choice whoever it may be but we’ll be sending over to the Senate.”

“If someone were to ask me now, I would say that a woman would be in first place, yes,” Trump said. “The choice of a woman I would say would certainly be appropriate.”

There are several leading contenders on Trump’s short list, all of whom are young and would likely have a decades-long career on the Supreme Court, potentially tipping the balance of power on the judicial body decisively in a conservative direction for a generation.

Judge Amy Coney Barrett, 48, of the 7th Circuit Court of Appeals in Chicago has emerged as a front-runner to fill the seat left vacant by the death of Ginsburg, three sources told NBC News on Saturday.

Allison Rushing, 38, of the 4th Circuit Court of Appeals based in Virginia is also being considered for the nomination, NBC News reported. Two other judges are under serious consideration as well, according to NBC News, including Barbara Lagoa, 52, of the 11th Circuit Court of Appeals in Georgia, and Amul Thapar, 51, of the Sixth Circuit Court of Appeals in Cincinnati.

Barrett who was appointed by Trump and has served on the federal appeals court in Chicago since 2017, was on a list of potential nominees Trump updated earlier this month. She was also among those considered to replace Justice Anthony Kennedy when he retired in 2018.

To fill Kennedy’s spot, Trump ultimately picked Brett Kavanaugh instead, an establishment Republican figure who angered some on the religious right for not being conservative enough even as he set off storms of panic on the left. Axios’ Jonathan Swan reported in 2019 that Trump said he was “saving [Barrett] for Ginsburg.”

Though any confirmation fight in the midst of a presidential election will be hard fought, the battle is expected to be amplified if Barrett is picked because of her track record. In particular, critics of Barrett have zeroed in on her prolific academic writings, in which she raised questions about the importance of respecting precedent and referred to “unborn victims” of abortion.

In a 2013 article in Notre Dame’s quarterly alumni magazine, Barrett is paraphrased as saying the landmark abortion ruling Roe v. Wade, the decision which legalized abortion nationwide, created “through judicial fiat a framework of abortion on demand.”

Barrett said in a 2013 speech at Notre Dame, however, that it is “very unlikely at this point that the court is going to overturn Roe [v. Wade].”

“The controversy right now is about funding,” she said, according to Notre Dame’s student newspaper. “It’s a question of whether abortions will be publicly or privately funded.”

During the 2016 hearings for her nomination to the 7th Circuit Court of Appeals, Democrats, including Sen. Dianne Feinstein of California, pressed Barrett on whether her Catholic faith would cloud her legal judgment. Feinstein’s line of questioning raised controversy about whether she was implying that Barrett was too religious for the bench.

“The dogma lives loudly within you, and that’s a concern,” Feinstein said during the hearing.

Barrett responded: “It’s never appropriate for a judge to impose that judge’s personal convictions, whether they arise from faith or anywhere else, on the law.”

Barrett was ultimately confirmed in a 55-43 vote by the Senate in 2017. The fact that she was already vetted and previously confirmed by the Senate could help her case in the Republicans’ effort to quickly confirm a nominee.

At the time of her 2017 confirmation, three Democratic senators supported her nomination: Joe Donnelly, who was voted out in 2018, Tim Kaine, D-Va., and Joe Manchin, D-W.Va.

Every Republican in the Senate at the time voted to confirm Barrett in 2017.

Barrett’s views on abortion, in particular, stand in stark contrast to the late Ginsburg, who died on Friday surrounded by her family at her home in Washington, D.C., due to complications of metastatic pancreatic cancer, the court said.

The vacancy allows Trump to nominate his third justice to the court, allowing him to swing the bench further to the right. He previously nominated Justices Neil Gorsuch and Kavanaugh.

Only an hour after the Supreme Court announced Ginsburg’s death, Senate Majority Leader Mitch McConnell on Friday pledged he will hold a vote on Trump’s eventual nominee to fill the vacancy. McConnell said last year he would seek to confirm a Trump nominee if a vacancy opened, despite vowing during President Barack Obama’s presidency to refuse any appointments during an election year.

The Supreme Court had a 5-4 majority of Republican appointed justices, and a 6-3 GOP majority could transform the shape of the law and maintain a conservative majority for years.

Ginsburg, a feminist icon who championed women’s rights, was appointed to the Supreme Court in 1993 and vowed to remain as long as her health allowed. Ginsburg told her granddaughter before she died that her “most fervent wish is that I will not be replaced until a new president is installed.”

Democratic presidential nominee Joe Biden, who has served as chairman of the Senate Judiciary Committee, said on Friday night that the vacancy should not be filled until after the November election and noted that Senate Republicans didn’t consider the nomination of Judge Merrick Garland during the Obama presidency.

“There is no doubt — let me be clear — that the voters should pick the president and the president should pick the justice for the Senate to consider,” Biden told reporters in Wilmington, Delaware. “This was the position the Republican Senate took in 2016 when there were almost 10 months to go before the election. That’s the position the United States Senate must take today.”

—CNBC’s Brian Schwartz, Tucker Higgins and Emma Newburger contributed to this report.

Here’s what a Biden presidential win may mean for your Social Security benefits

PUBLISHED SUN, SEP 20 202010:19 AM EDTUPDATED SUN, SEP 20 20203:56 PM EDT

KEY POINTS

- Democratic presidential nominee Joe Biden’s plan for Social Security includes increased benefits for low earners and more taxes for high-income individuals.

- The plan could have lasting implications for how much people at both sides of the income spectrum can spend over their lives, according to estimates from one economist.

- Here’s how much someone’s living standard could change, based on their income, if the plan is adopted.

The 2020 presidential election could be a make it or break it moment for Social Security.

The reason: Social Security’s funding, already on the verge of running out, could reach that threshold sooner, thanks to the economic damage brought on by Covid-19.

While some benefits will still be payable when that happens, talks on Capitol Hill have increasingly turned to how to restore the program’s solvency.

That means the next president could have the opportunity to help shape the program’s future in the next four years.

Democratic presidential nominee Joe Biden has emerged with a plan of his own. Broadly, it would boost benefits for low-income households while raising taxes on high earners.

How Biden wants to change Social Security

Biden would increase the special minimum benefit, which was created to provide low-earners with adequate benefits. Biden calls for setting that figure at 125% of the federal poverty line. That would bring it to $1,301 from $886 a month as of 2019, according to an analysis by the Penn Wharton Budget Model at the University of Pennsylvania.

Biden’s plan also calls for making survivor benefits more generous by increasing them about 20% more per month. Today, surviving spouses can see up to a 50% cut to their monthly checks when their partner passes away.

We definitely need to have higher taxes. It seems fair to ask the rich to pay more, but it is a good size hit

Larry Kotlikoff

FOUNDER, ECONOMIC SECURITY PLANNING

It also includes more generous checks for beneficiaries who live a long time. Increases totaling 5% of an individual’s primary insurance amount, or the benefit they receive at full retirement age, would be phased in at 1% per year from years 16 to 20 of claiming.

To pay for it, Biden’s plan also calls for applying payroll taxes on wages of $400,000 and above. Currently, workers and employers each pay 6.2% toward Social Security, but that is capped at wages of $137,700 as of 2020. (Employers and employees also each pay 1.45% toward Medicare.)

How the changes could affect lifetime spending

The benefit increases and higher taxes will have consequences when it comes to how much people are able to spend in their lifetimes, according to Larry Kotlikoff, a professor of economics at Boston University and founder of Economic Security Planning, a provider of financial planning tools.

Benefit increases for those who live long lives would benefit low income earners the most, based on scenarios run on his company’s MaxiFi Planner tool, which calculates how much more one can “spend” based on a variety of inputs such as retirement date, earnings history and more.

The reason for that is the 5% benefit increase is based on the average wage, and those at the bottom earned less than that rate.

HOW LIFETIME DISCRETIONARY INCOME COULD CHANGE UNDER BIDEN’S SOCIAL SECURITY PLAN

| INCOME | CURRENT DISCRETIONARY SPENDING | NEW DISCRETIONARY SPENDING – TAXED | INCREASE ($) | INCREASE (%) | NEW DISCRETIONARY SPENDING � UNTAXED | INCREASE ($) | INCREASE (%) |

| 50% AVERAGE WAGE INDEX* ($26,073) | $521,727 | $549,570 | $27,843 | 5.34% | $549,570 | $27,843 | 5.34% |

| 100% AWI ($52,146) | $951,964 | $979,828 | $27,864 | 2.93% | $979,828 | $27,864 | 2.93% |

| 200% AWI ($104,292) | $1,365,497 | $1,388,609 | $23,112 | 1.69% | 1,394,079 | $28,582 | 2.09% |

| 300% AWI ($156,438) | $1,517,388 | $1,540,235 | $22,847 | 1.51% | $1,546,208 | $28,820 | 1.90% |

“For somebody who is a low earner, like earning half the average, it’s like a 10% benefit increase,” Kotlikoff said.

Someone earning half of a benchmark known as the Average Wage Index would get the biggest boost in their ability to spend, according to Kotlikoff’s calculations. Those people would be earning about $26,073 per year, based on the latest numbers from the Social Security Administration. With the benefit increase, their ability to spend would go up by 5.34%.

“Their living standard gets to go up every year by 5.34%. They could spend 5.34% more every year,” Kotlikoff said. “Economics doesn’t say wait until you’re 78 to start spending the money … You can spend more now.”

Those who earn exactly the full average wage in the index, or $52,146 per year, would get a 2.93% increase in their ability to spend. That would be further reduced for those with incomes above that level, who unlike lower earners, would have their Social Security benefits taxed.

HOW PAYROLL TAXES ON WAGES OVER $400,000 COULD IMPACT LIFETIME DISCRETIONARY SPENDING

| INCOME (PER YEAR) | CURRENT DISCRETIONARY SPENDING (LIFETIME) | NEW DISCRETIONARY SPENDING (LIFETIME) | DECREASE (LIFETIME) |

| $500,000.00 | $7,400,192.00 | $7,181,199.00 | $218,993.00 |

| $1,000,000.00 | $12,463,677.00 | $11,150,404.00 | $1,313,273.00 |

| $2,000,000.00 | $22,676,433.00 | $19,161,805.00 | $3,514,628.00 |

| $5,000,000.00 | $53,285,816.00 | $43,211,152.00 | $10,074,664.00 |

Due to the payroll tax increases for those earning $400,000 and above, the highest earners would see a larger loss of spending power.

In another example based on the MaxiFi Planner’s calculations, someone who earns $5 million per year could see a loss of about $10.1 million in their spending from ages 45 to 65.

That’s based on the full 12.4% payroll tax. While 6.2% of that would come directly from workers’ paychecks, employees would also bear the cost of the levies paid by the employer through reduced pay.

“We definitely need to have higher taxes. It seems fair to ask the rich to pay more, but it is a good size hit,” Kotlikoff said. “It’s going to cut the super high earner’s spending by about 20%. It’s a bigger deal than people might think.”

Biden versus Trump on reform

In contrast to Biden’s proposal, President Donald Trump has implemented a temporary payroll tax deferral, which will allow employers and employees to delay paying Social Security payroll taxes through the end of the year.

They will, however, have to make up for those lost payments under the current terms of the executive order signed by the president. Trump has said that he plans to forgive those catch-up tax payments from the deferral period if he is re-elected.

The country is already facing a $53 trillion gap in Social Security, according to the latest trustees’ report released earlier this year. That estimate does not measure the effects of the Covid-19 pandemic.

“Cutting taxes when you’re so broke doesn’t make sense,” Kotlikoff said.

When it comes to whether Biden or Trump have the better approach to fix Social Security, Kotlikoff, who previously ran for president, said he prefers neither candidate.

Because both candidates are focusing on the 75-year fiscal gap, they are not addressing the full problem, he said.

“Given the way we do our accounting, it will look like we’re not at a crunch time until we are some years down the road,” Kotlikoff said. “We are actually in a crunch time today.”

HI Financial Services Mid-Week 06-24-2014