HI Market View Commentary 09-20-2021

What is going on in today’s stock market:

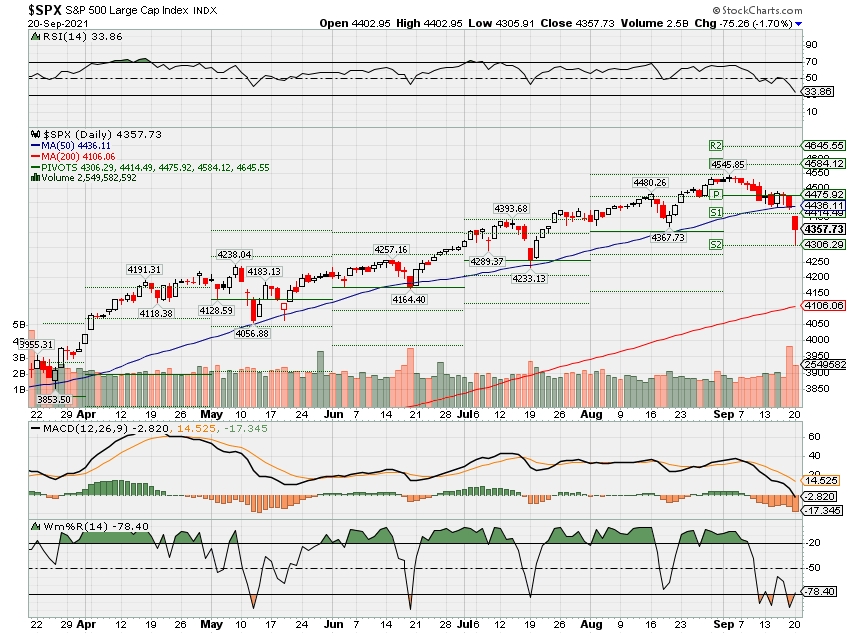

Seasonal bearish months, China worry with Evergrande borrowed 300 billion for real estate, inflation concerns, Covid at the highest levels ever in the US

The good news is we started protecting when at HI = Two weeks ago

This is exactly how we beat the market

What we are running into this year has been mostly stagnant stocks which does not work well with providing protection in a buy the dip market mentality

IF the market will continue to fall into a pullback or correction we are perfectly aligned to make up 80% or more of the downward movement = convert to shares and hopefully have a Christmas Rally

Kevin what are the Dogs = Dogs of the Dow which means we have stocks that one year don’t move and then the next are big movers

Am I ready to make a change ? HECK NO

DO we nee dot be worried about China? Right China has no intention of bailing out Evergrande which could lead to a Lehman Like drop in China real estate and financial markets = Blackrock and Hopefully Cathie Wood

Core Holding = AAPL, BIDU, DIS, F, FB, V, UAA, BAC,

So airlines had an announcement that globally more airline were expecting more passengers due to the increase of the Covid vaccine numbers = this has been announced for the last year and the numbers were coming back but now they are back down like they were at covid worst numbers. 55% of the capacity we had 2018

Conclusion a 10% correction from here give us 10-20% more shares of stock for a Christmas rally into the end of the year

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 17-Sep-21 14:58 ET

It’s quitting time

People quit their jobs every day. There are myriad reasons why yet underlying all those reasons typically is a single reason: they see a better opportunity elsewhere.

That better opportunity doesn’t always mean another job in the labor force. It could be the opportunity of going back to school. It could be the opportunity to stay at home and raise one’s children. It could be the opportunity to start their own business. To be fair, it doesn’t always mean finding a better-paying job either. It could be driven simply by a desire to find better working conditions.

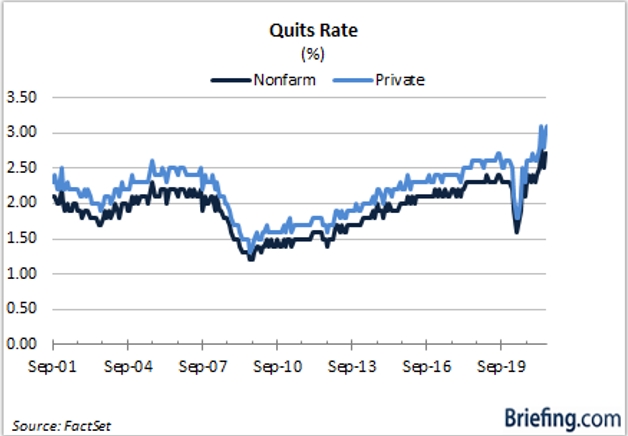

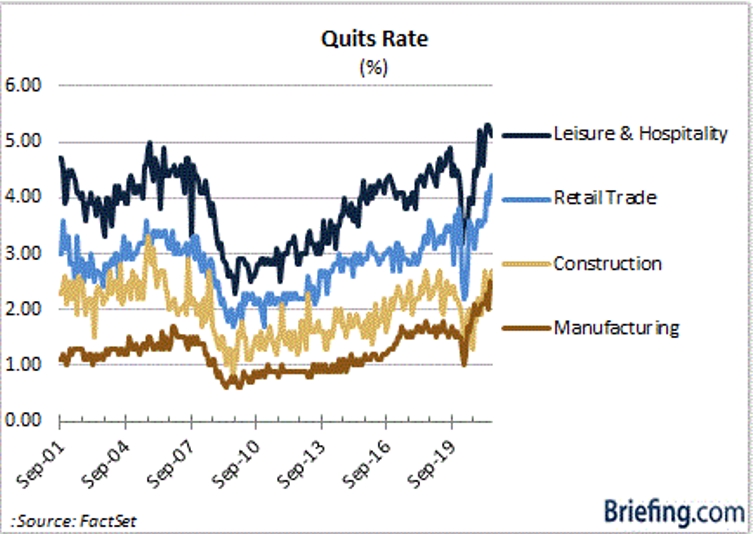

There’s just no telling, but what’s telling about the Job Openings and Labor Turnover (JOLTS) data is that both the nonfarm and private quits rate — the number of quits during the entire month as a percent of total employment — hit a record high in July.

A Pressing Situation

It should come as no surprise to hear that employees quit their jobs more readily when economic conditions are good. Alas, the quits rate dropped sharply at the start of the pandemic, which wasn’t exactly a good time to be quitting one’s job.

In the ensuing months, the economy would rebound sharply with the help of unprecedented monetary and fiscal stimulus. Coincidentally, the quits rate also rebounded sharply in those ensuing months.

That rebound, however, wasn’t entirely a vote of confidence in the recovery. It was also a reflection of the ongoing effects of the pandemic, which required added childcare coverage as schools went fully remote or to some form of a hybrid model.

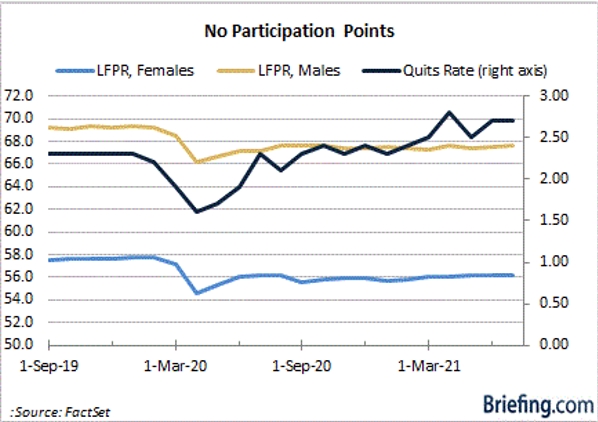

We can see that pressing situation in the chart below, which shows the nonfarm quits rate rising at the same time the labor force participation rate (“LFPR”) among females and males has been stagnating. In fact, the female labor force participation rate is the same today (56.2%) as it was in July 2020. For males, it is the same (67.7%) as it was in August 2020.

Presumably, participation rates for females and males should be rising in coming months now that schools are back to an in-person learning environment. Some would also argue that they should be rising now that the enhanced unemployment benefits have expired and given that there is empirical, as well as anecdotal, evidence that employers are paying more.

The Carrot of Higher Wages

There are plenty of jobs waiting. The July JOLTS report showed a record 10,934,000 job openings versus the current unemployed count of 8,834,000. The only two industries where there are fewer job openings today than a year ago are government, and transportation, warehousing, and utilities.

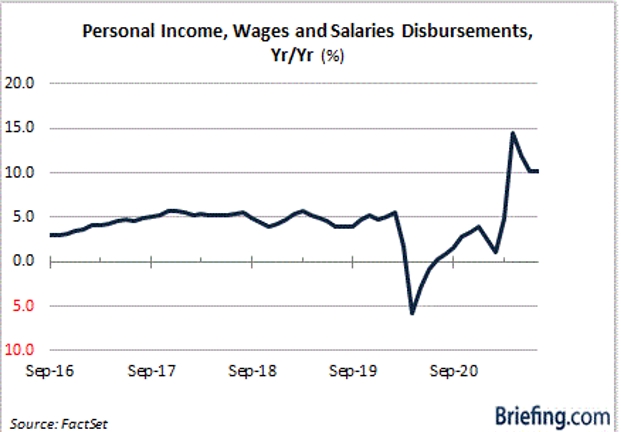

Many jobs may be left waiting if employers don’t use higher wages as the carrot to attract new talent and/or retain existing staff. It is evident in the JOLTS report where the wage pressures are likely building.

That would be in the leisure and hospitality industry, which has the highest quits rate (5.1%) among all industries. That isn’t so unusual given that it is an industry known for high turnover. The unusual element is that the quits rate for the leisure and hospitality industry is at an all-time high when job openings have more than doubled from a year ago.

The quits rate for the retail trade industry (4.4%) is also at an all-time high with job openings up 41% from a year ago.

To fill those jobs, businesses are likely going to need to pay more, particularly smaller businesses that are competing against larger organizations, like Amazon.com, Target, and Walmart, that are offering benefits, sign-on bonuses, and even free college tuition.

Strikingly, quits rates have been rising in the construction and manufacturing industries — two areas where industry conditions are robust and where it has been difficult to attract and retain skilled talent. The thing is the employees of those industries know it and can leverage their skills to command higher wages.

That may be just what they’re doing knowing executives in each of those industries have bemoaned the difficulties in attracting and retaining skilled labor.

What It All Means

The supply of labor to fill job openings should be ample, but it isn’t right now, and the reasons why are debatable.

Some say it is demographics (Baby Boomers aging out of the workforce or retiring early thanks to the wealth effect of rising home and stock values); some say it is a function of the opioid crisis; some say it is a fear of COVID; some say it is a willingness to make do with a single-income household; and some say it is because the stimulus help has acted as a disincentive to work.

We don’t the answer, but we know that prices go up when demand is high for something in short supply. Wage pressures are clear in certain pockets of the economy, but from Fed Chair Powell’s vantage point, the wage pressures aren’t spiraling into broad-based inflation pressures.

There is a belief, too, that coming months should see an easing of some of the labor supply pressures as COVID fears lessen with effective vaccines, the pursuit of employment picks up with enhanced unemployment benefits having expired, schools continue to run normally, and global economies continue to rebound.

It stands to reason, though, that if wage pressures persist and grow more pronounced, then inflation pressures are apt to remain stickier than the Fed thinks.

That’s not what the Fed is anticipating, but if the Fed is wrong, investors may start quitting the stock and bond markets at a higher rate, jolted by the specter of rising interest rates.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF SEP. 13 THROUGH SEP. 17, 2021 The S&P 500 index shed 0.6% last week amid disappointing readings on US employment and consumer sentiment as well as concerns about China’s economy. The market benchmark ended the week at 4,432.99, down from last Friday’s closing level of 4,459.44 and marking the index’s second consecutive weekly loss. With about two weeks remaining in the month, the S&P 500 is now down 2% for September to date. However, it is up 18% for the year to date. The week’s narrow loss comes as the end of Q3 is nearing and investors are looking for signs of what the quarter’s economic data and corporate results may show when quarterly reports start emerging in the weeks ahead. Among last week’s economic data, US retail and food service sales unexpectedly rose in August but weekly jobless claims for last week were higher than expected while the University of Michigan’s preliminary consumer sentiment index for September came in below expectations. Investors are also concerned about China’s economy. Chinese stocks tumbled on a round of disappointing economic data, with China’s retail sales for August significantly missing expectations while multiple indicators of the real estate market showed signs of a slowdown. The pullback in China comes amid the spread of the COVID-19 delta variant, which has been persistent in the US as well. The materials sector had the largest percentage drop of the week, down 3.2%, followed by the 3.1% slide in utilities and a 1.6% decline in industrials. Just two sectors managed to rise last week. Energy climbed 3.3% while consumer discretionary edged up 0.6%. In materials, shares of Eastman Chemical (EMN) slipped 5.8%. Tudor Pickering trimmed its price target on the stock to $113 from $117 while lowering its estimate for the company’s Q3 earnings, citing “recent management commentary that indicates the quarter is facing some unexpected pressures.” The utilities sector’s decliners included Evergy (EVRG), downgrades to neutral from buy by BofA Securities. Shares of the renewable energy company fell 3.7%. The energy sector’s climb coincided with a rise in crude oil futures. The sector’s gainers included EOG Resources (EOG), which received an upgrade to buy from hold earlier last week from Tudor Pickering. Shares of EOG jumped 11% on the week. Among consumer discretionary stocks, shares of Ford Motor (F) gained 6.9% as the auto maker said it will invest an additional $250 million and add 450 jobs to raise its annual production capacity to 80,000 all-electric trucks amid higher-than-expected demand for its F-150 Lightning. Next week’s economic reports will be heavy on housing data, with the National Association of Home Builders Index for September due Monday, followed by August building permits and housing starts on Tuesday, existing home sales Wednesday, and new homes sales Friday. Investors will also be focused next week on the two-day Federal Open Market Committee meeting that will conclude Wednesday with a statement from Fed Chair Jerome Powell. Provided by MT Newswires |

Earnings Dates

COST – 09/23 AMC

Where will our markets end this week?

Lower

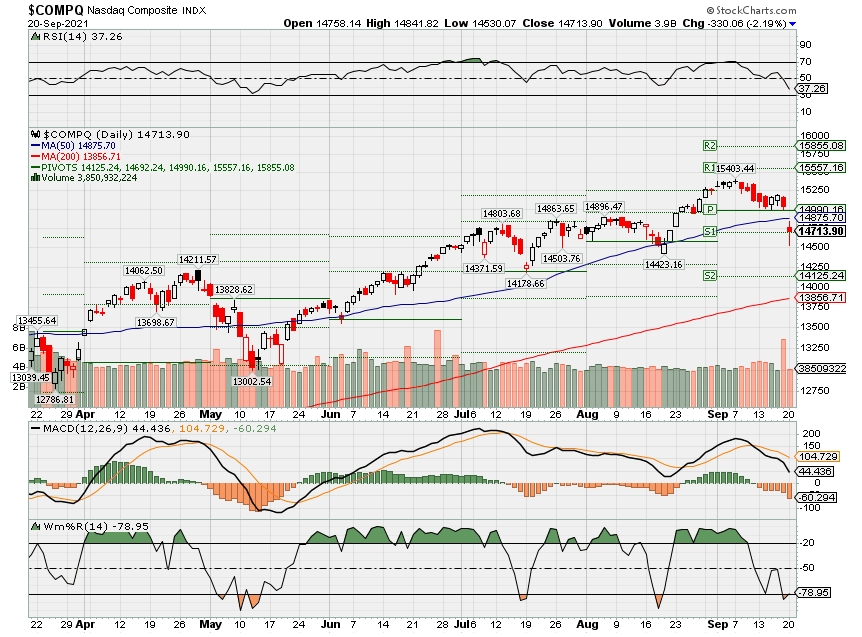

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end September 2021?

09-20-2021 -2.0%

09-13-2021 -1.0%

09-07-2021 -1.0%

08-30-2021 -1.0%

Earnings:

Mon: LEN

Tues: AZO, ADBE, FDX

Wed: GIS, FUL, KBH

Thur: CCL, DRI, RAD, MTN, COST

Fri:

Econ Reports:

Mon: NAHB Housing Market Index

Tues: Building Permits, Housing Starts

Wed: MBA, Existing Home Sales, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, Leading Indicators

Fri: New Home Sales

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Long put protection has been added

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

The generational theory espoused by Tom Lee and Cathie Wood that could drive the bull market PUBLISHED SAT, SEP 18 20219:10 AM EDT Maggie Fitzgerald @MKMFITZGERALD

Closely-followed investors Tom Lee and Cathie Wood both see one thing driving the bull market for over a decade: millennials.

“I do believe that both crypto and the equity markets are going to be powered by millennials,” Cathie Wood, founder and CEO of Ark Invest, said at the SALT conference on Monday.

Wood referenced research from Lee’s Fundstrat that suggests the bull market in stocks may extend to 2026 or even 2038 as millennials build out their investing portfolios. Millennials — which are individuals born between roughly 1981 and 1996 — are the largest single generation ever, even larger than Boomers, said Fundstrat. Plus, the group’s average age is 26.5, as they enter their prime income years.

Lee — known for his prescient call about the market bottom during the Covid recession — said long-term bull markets last between 20 and 42 years and peak returns accelerate to cumulative gain of 500%.

The current bull market has risen for 10 years and if the history plays out, the S&P 500 could reach 19,000 by the end of 2029, a Fundstrat report said. (It closed at 4,432.99 on Friday.)

The basis for the long-term forecast surrounds strong expected demand in the housing and auto markets driven by millennials. Fundstrat expects housing starts could reach more than 2.5 million per year over the next decade.

While Lee is betting that millennials will adopt the traditions of middle-aged Americans, like buying cars and home, Wood places large emphasis that millennials will disrupt the world order.

Wood garnered a large fan club after her flagship fund, Ark Innovation, returned nearly 150% last year. The hot-handed investor gets much of her attention from a younger demographic that she said appreciates the place innovation has in the world today.

Her fund is down about 5% this year amid a stark rotation from growth into value names; however, the portfolio manager told clients on Tuesday that this shift is coming back around imminently.

“We think we’re moving into the other side of the cycle,” Wood said during an Ark Invest webinar on Tuesday. “We don’t think we’re looking at a recession yet but we do believe the market will start rotating back toward growth and innovation.”

The rise of meme stocks

Millennials have already demonstrated the influence they can have on the market this year.

Speculative activity exploded this year with the rise of retail trading. Day traders in online chatrooms managed to create massive short squeezes in names like GameStop and AMC Entertainment, which inflicted huge pain for short sellers and jolted volatility in the overall market.

Many legislators and big investors have dismissed the amateur traders as reckless speculators who are not doing deep research. Wood said not to discount the sophistication and vision these smaller investors have.

“Don’t underestimate this group of people, they are actually more progressive than I think institutional investors are,” Wood said earlier this year.

“The millennials and the Gen Z’s…they love learning,” Wood added. “They’re really excited about the new technologies that are evolving today, they’re really at the leading edge of them and understand them and are comfortable with them and I have been very gratified at the kind of response we’ve gotten to our research and the engagement.”

Millennials love growth and crypto

While Fundstrat’s bold call is for the broader market, the firm notes that the type of stocks millennials prefer is important to this ongoing bull market.

Millennials tend to prefer growth stocks and digital based companies, Fundstrat told clients.

Many of these younger individuals are responsible for the $85 billion in assets under management for Wood’s Ark Invest. Wood invests in high-growth, innovative companies that she expects will disrupt the world order. Ark Invest owns large stakes in companies like Tesla, Teladoc Health, Zoom Video and Square.

Wood has been a longtime Tesla bull and her conviction on the electric car market hasn’t dented even after the stock’s massive rally in 2020. She said her base case for the stock is $3,000 in five years with the best case set around $4,000.

Tesla is the biggest holding of Ark’s flagship fund Innovation ARKK, accounting for more than 10.7% of the ETF.

Plus, millennials also love bitcoin and blockchain, noted Fundstrat.

Wood said the price of bitcoin could surge tenfold in the next five years to $500,000 if companies continue to diversify their cash and institutional investors continue to allocate 5% of their portfolio to the space.

The investor has grown increasingly bullish on ether, saying her portfolio now consists of 60% bitcoin and 40% ether.

“Ether is seeing an explosion in developer activity thanks to NFTs and De-Fi,” Wood said. “Our confidence in ether has gone up dramatically.”

The delta variant is causing many Americans to lose income. Here’s what to do if you’re one of them

KEY POINTS

- The effects of the delta variant are not yet fully evident in some government economic indicators, like jobs or unemployment reports.

- But one weekly measurement from Morning Consult finds that Americans are already feeling an income pinch as businesses react to the new highly contagious form of the virus.

- If your income has dried up or is unstable, there are things you can do to find resources. The key is to not be afraid to ask for help, one expert says.

As the delta variant has wound its way through the U.S., signs show it is also hitting the wallets of some Americans.

A new report from Morning Consult finds that the delta variant is spurring pay or income losses that have not yet shown up in the weekly unemployment insurance claims data.

That is according to its weekly Lost Pay/Income Tracker, which measures the share of U.S. adults who are currently experiencing income and pay losses.

The tracker was established in April 2020, and asks an average of 20,000 adults each week whether they are experiencing lost pay or income.

The latest results are pointing to increased financial strain among workers. For the week ending Sept. 11, the share reporting lost pay or income has risen to 13%. That’s up from a pandemic low of 11.4% for the week ending Aug. 14.

Those who are most likely to be taking a financial hit right now are people employed in service industries. Food and beverage workers are most likely to have seen losses in pay or income at 25.7%, up from 19.1% in the past four weeks. Leisure and hospitality workers are also likely to have seen significant drops in income, with 19.5%, according to the latest data.

Those sectors tend to have more hourly jobs that can change quickly due to the pandemic, said Jesse Wheeler, economic analyst at Morning Consult. Due to the face-to-face nature of many of those businesses, they are particularly susceptible to government-issued mandates and other restrictions.

“They’re more vulnerable, and we’ve seen their vulnerability increase in the last couple of weeks,” Wheeler said.

The unemployment numbers released on Thursday showed weekly jobless claims increased to 332,000, up 20,000 from the prior week. Meanwhile, the August jobs report released earlier this month showed just 235,000 positions were added, compared to expectations of 720,000.

This latest income drop comes as enhanced federal unemployment insurance benefits ended earlier this month. While weekly checks are now reduced, some people who were previously eligible, such as gig workers, can no longer file claims.

If the current trends in the Lost Pay/Income Tracker hold, that could lead to a disappointing September jobs report, Wheeler said.

If signs of a slowdown in the labor market persist, that could affect Federal Reserve policy, particularly with the timing of its plans to taper asset purchases, Wheeler said.

Admittedly, that will not help people who are suffering a loss of income now.

But there are steps that someone who is currently unemployed or facing reduced work can take to shore up their finances, according to Winnie Sun, managing director of Sun Group Wealth Partners.

The big thing that Sun said she tells anyone to do is Google “Covid financial assistance” with your location turned on. That way, you can search for federal, state and local programs that may be able to help you that were not even on your radar, she said.

While many people tend to reduce their budgets starting with smaller expenses like Netflix subscriptions, the key is to actually begin with the biggest costs, Sun said.

Take a look at your living costs and assess whether you can save money by moving in with a loved one, family member or friend. Alternatively, you may be able to have a roommate move in to help reduce your overhead.

If you live in a two-car household, consider whether you might be able to sell a car or rent it out.

If you know you will need health insurance, explore what is available to you beyond just COBRA.

(The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to continue group health benefits under certain circumstances.)

One way to discover new ways of obtaining coverage is to ask your primary care providers, Sun suggested.

“Oftentimes, they will know other low cost options that you haven’t even thought about,” Sun said.

While some adjustments may be unwelcome, it is important to remember they are temporary until things get back to normal, she said.

One key thing that should be a last resort is withdrawing money from your retirement accounts. “I wouldn’t touch that if you could,” Sun said.

Instead, focus on adding income where you can and reducing your recurring bills.

Also, do not be afraid to consult a professional, like an accountant or a financial advisor.

“So often people think that you should only be talking to us when you have a lot of income and you’re able to invest, and that’s actually not true,” Sun said.

Seeking the help of a professional you trust may help to identify government programs for which you may qualify or resources you had not even thought of using during this time.

Ray Dalio says if bitcoin is really successful, regulators will ‘kill it’

KEY POINTS

- Ray Dalio said regulators would ultimately take control of bitcoin if the cryptocurrency gains mainstream success.

- “I think at the end of the day if it’s really successful, they will kill it and they will try to kill it. And I think they will kill it because they have ways of killing it,” he said.

- The founder of the world’s largest hedge fund, Bridgewater Associates, still believes bitcoin makes a good alternative to cash.

Ray Dalio, founder of the world’s largest hedge fund, Bridgewater Associates, believes regulators would ultimately take control of bitcoin if the cryptocurrency gains mainstream success.

“I think at the end of the day if it’s really successful, they will kill it and they will try to kill it. And I think they will kill it because they have ways of killing it,” Dalio told Andrew Ross Sorkin Wednesday on CNBC’s “Squawk Box” at the SALT conference in New York.

U.S. regulators have stepped up their oversight of the volatile cryptocurrency space as the wild rides in the speculative markets continued to grab attention. Securities and Exchange Commission Chairman Gary Gensler said Tuesday that Wall Street’s top regulator is working overtime to create a set of rules to protect investors through better regulation of the thousands of new digital assets and coins.

Despite some heavy bouts of volatility, bitcoin has been quite successful as of late. The crypto has more than quadrupled the last 12 months and was around $47,500 on Wednesday. It hit a high above $60,000 earlier this year.

“You have El Salvador taking it on and you have India and China getting rid of it. And you have the United States talking about how to regulate it and it could still be controlled,” Dalio said.

In June, El Salvador has become the first country to adopt bitcoin as legal tender. Meanwhile, India is expected to propose a law banning cryptocurrencies and penalize miners and traders. China has started cracking down on the crypto markets, ordering miners to shut their operations.

Dalio said bitcoin doesn’t have intrinsic value, meaning the asset lacks fundamental and objective worth.

“There are so many things in a historical perspective that didn’t have intrinsic value and had perceived value. And then it went hot and it became cold. It could be either way. You just have to know what it is. It could be tulips in Holland,” Dalio said.

Still, the billionaire investor said bitcoin makes a good alternative to cash, and he owns a smaller percentage of the digital token compared with his gold exposure in the portfolio.

“I think it’s worth considering all the alternatives to cash and all the alternatives to the other financial assets. Bitcoin is a possibility. I have a certain amount of money in bitcoin,” Dalio said. “It’s an amazing accomplishment to have brought it from where that programming occurred to where it is through the test of time.”

Apple announces new products — Experts discuss what it means for the stock

Apple unveiled the latest smartphone model, the iPhone 13, as well as a new watch and iPad on Tuesday.

Here are five experts on what the new product releases could mean for Apple stock.

Delano Saporu, founder of New Street Advisors, said he is adding to his position in the name.

“It’s more just adding on any near-term weakness … We had the Epic ruling [last] week and we saw a little bit of a drawback in the share price, and I think investors that are kind of long-term bullish on a company like Apple should be adding on any near-term weakness … The stock has been rather sleepy for the better part of a year and now investors are starting to bid up. I think one of the reasons why, if you look at it on a trailing 12-month basis, price to earnings are about 29 times, which is lower than most of the FAANG names. I think there’s room for multiple expansion.”

Quint Tatro, president of Joule Financial, takes a contrarian view on the stock.

“It’s had that characteristic of late. When the market is weak, I think people flock to Apple. It’s got a consistent cash flow, it’s a steady name, but I have to take the other side of the trade here. I know it’s not a popular view, but I’m not a fan of Apple at these levels … Forward multiple of 35 is tough to justify when if they hit their numbers those numbers are growing at 10%. Meanwhile, the company has levered up its balance sheet. Now it’s a proxy for the market — 6.2% of the overall S&P. So if people are continuing to be bullish on the market and add passive index funds, it will continue to participate, but I just think there’s too many other opportunities out there that are of value.”

Stephanie Link, chief investment strategist at Hightower, sees the stock as a stable performer.

“I have a market weight. It’s 6% of my portfolio. So I don’t want to go over my skis given the concerns that I have, and, oh by the way, 76% of the sellside likes this thing. Everybody owns this. I don’t know what the incremental buyer is … I just don’t think you’re going to see a rush to see buying in the name. Now, if it were to pull back substantially, I definitely would take a look again. I’ve been overweight the name, but right now I think it’s prudent to be market weight.”

Tom Forte, senior research analyst at D.A. Davidson, said the new iPhone’s secret weapon is that it’s 5G-enabled.

“I think the good news for Apple for this year is similar to last year. The real star of the show is the 5G network. So I don’t think they need to have anything spectacular in the iPhone 13. It’s getting consumers a 5G device as they slowly but surely build out the 5G network. I think it will be very strong sales for iPhone for that reason, which is good news for Apple and its stock.”

Krish Sankar, senior research analyst at Cowen, said Apple should be able to weather materials shortages and supply chain squeezes.

“Apple probably has a better position than most other device makers to weather the [supply chain] storm, so largely I think at this point it’s probably going to be inline pricing similar to last year’s iPhone.”

These undervalued, ‘inflation-proof’ assets could outperform in the fourth quarter

Investors may be on the lookout for inflation hedges after better-than-expected consumer price data failed to keep the broader market afloat on Tuesday.

The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all closed lower on Tuesday despite the Labor Department’s Consumer Price Index showing a lower-than-expected increase in August.

The financials sector could offer some protection against a modest rise in inflation given its largely fixed operational costs, New Street Advisors Group CEO and founder Delano Saporu told CNBC’s “Trading Nation” on Tuesday.

His top pick in the space was JPMorgan for its “great loan book,” investment banking prowess and lower-than-usual valuation as of the last several months.

“This is one that’s a leader in global investment banking fees with 9% of the wallet share,” he said. “If you look at what they’ve traded at in the last three months as yields have lowered, this may be an opportunity for investors that have liked this stock to come back in at a more favorable price point.”

If inflation substantially rises, Saporu recommended turning to cryptocurrencies as stores of value.

“Cryptocurrency for people is a great hedge,” he said. “This is something that I’ve been adding … to my portfolio for myself and clients. You’re seeing the price floor come in. We’re seeing a little bit of a rise since about July [and] some better news flow.”

Joule Financial’s Quint Tatro backed a more traditional store of value: gold.

“You would think that gold, which is traditionally a hedge against inflation, would have been rising during these abnormally high CPI prints, and that has not been the case,” the firm’s chief investment officer said in the same interview.

But while some price increases — for automobiles and transportation, for instance — are likely transitory, rising costs for everyday goods and services may have more longevity, Tatro said.

“We don’t see that going away,” he said. “People are going to say, ‘Hey, this is not transitory. This is here to stay,’ and gold will finally play catch-up.”

His top stock recommendation was Newmont Mining, the world’s largest gold miner.

“Newmont has an incredible balance sheet. It is truly a proxy for gold. It should move in lockstep with gold if we’re right, and we get paid almost 4% to wait,” Tatro said, adding that his firm bought shares of the company in response to Tuesday’s CPI print.

“I think it will do very well,” he said. “You’re getting it at a discount, and I believe that it will continue to rise with gold if we continue to see core inflation move up as well.”

Disclosure: Delano Saporu is long bitcoin and ethereum. Joule Financial owns shares of Newmont Mining.

https://www.thestreet.com/markets/china-faces-lehman-moment-in-evergrande-bust-what-are-the-risks

China Faces ‘Lehman Moment’ With Evergrande Collapse, So What Are The Risks?

‘Lehman moment’ or managed failure? Either result has global markets rattled by the impending default of property developer China Evergrande.

MARTIN BACCARDAXChina Evergrande Group (EGRNF) shares slumped to a fresh 11-year low in Hong Kong trading Monday as the indebted property developer scrambles to find cash ahead of around $150 million in bond coupon payments due later this week.

Monday’s 10% slump extends the stock’s six-month decline to around 85% as investors dumped shares of the once-powerful developer — which boasted a market cap of more than $50 billion at its 2017 peak — amid a liquidity crisis that could threaten the nations multi-trillion property market.

Beyond the value of its plunging stock, however, lies a series of potential contagion risks that have investors in everything from European banks to U.S. steel companies closely tracking developments in Beijing and beyond this week as two key bond payments on September 23 look set to define the fate of one of China’s most influential companies.

“Yields on Chinese dollar-denominated junk bonds are trading at levels not seen since March 2020 in the midst of the initial global COVID crash in stocks and credit,” said Louis Navellier of Navellier & Associates. “That suggests that there is quite a bit of tension under the surface when it comes to the situation in China, which is a very different picture, not reflected in developed market stocks and bond market indexes.””No doubt the Chinese tech crackdown is happening at a precarious moment for companies like Evergrande, which could tip the situation into crisis territory,” he added. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2hvcml6b25fdHdlZXRfZW1iZWRfOTU1NSI6eyJidWNrZXQiOiJodGUiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NwYWNlX2NhcmQiOnsiYnVja2V0Ijoib2ZmIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1439816076846673922&lang=en&origin=https%3A%2F%2Fwww.thestreet.com%2Fmarkets%2Fchina-faces-lehman-moment-in-evergrande-bust-what-are-the-risks&sessionId=20e8e9fdc32eea92357b55247d6ee32a99d2c12e&siteScreenName=thestreet&theme=light&widgetsVersion=1890d59c%3A1627936082797&width=550px The first major risk is, of course, a straight-forward slide into default by China Evergrande if its misses either of the two separate payments due Thursday. Such a move would trigger a technical default amongst its myriad creditors — estimated at around 130 different financial institutions — and wholesale writedowns of its estimated $305 billion in outstanding debts.

Up next, however, is the spillover impact into local government financing, which relies on the sale of land to property developers such as Evergrande to raise cash to meet day-to-day operational needs.

Further down the line, banks with direct exposure to Evergrande, via the parent company, the property services group or its new energy business, are vulnerable to significant writedowns that could clip lending growth into the broader economy just as data begins to suggest a notable second-half slowdown in the world’s biggest economy. On top of that, the largest test China may face in an Evergrande collapse is the mettle of President Xi Jinping’s ‘common prosperity’ ambitions and his ongoing effort to reign in corporate profiteering across some of the country’s biggest business sectors, including property, which he has famously said must be for “living, not speculating”.

Last week, the state-backed Global Times newspaper said Evergrande shouldn’t consider itself “too big to fail”, suggesting Beijing may be willing to allow it to fall into administration instead of stumping up billions in financial support.

That might be a bet Xi is willing to make now, given the unpopularity of development companies in an economy where ordinary citizens are sitting on billions in mortgage debt amid a decades-long surge in property prices.

However, as the failure of Bear Stearns and Lehman Brothers demonstrated just over a decade ago, the resultant collapse in house prices that followed left home-owning Americans burdened with negative equity that strangled growth the consumer economy for years.

Should Xi blink and offer to prop up Evergrande as it negotiates with its creditors later this week, he’ll still need to consider the cost of financial support for a group that owes at least $850 million in bond payments between now and the end of the year. He’ll also need to calculate the impact of a fire sale of commercial and residential properties at a time when hundreds of thousands of new developments remain unfinished, owing to a backlog of payments to workers and contractors.

That has implications for steelmakers like Cleveland Cliffs (CLF) – Get Cleveland-Cliffs Inc Report, which was marked 7.3% lower in pre-market trading Monday at $20.25 per share, as well as investment groups such as BlackRock (BLK) – Get BlackRock, Inc. Report, which fell 3.5% to $845.96 each.

Others, however, are confident China can firewall the impending failure of its biggest property developer.

“On its own, a managed default or even messy collapse of Evergrande would have little global impact beyond some market turbulence,” said Simon MacAdam of London based Capital Economics. “Even if it were the first of many property developers to go bust in China, we suspect it would take a policy misstep for this to cause a sharp slowdown in its economy.”

“In a hard-landing scenario, several emerging markets are vulnerable,” he added. “But in general, the global impact of swings in Chinese demand is often overstated.”https://seekingalpha.com/article/4455556-these-banks-hedge-and-earn-10-percent

These Banks Hedge And Earn >10%

Sep. 16, 2021 10:17 AM ETBank of America Corporation (BAC), WFC48 Comments11 Likes

Summary

- We will likely see rising interest rates over the coming years.

- We could be in a rising interest rate environment supported by strong growth.

- Banks do very well in this macro backdrop.

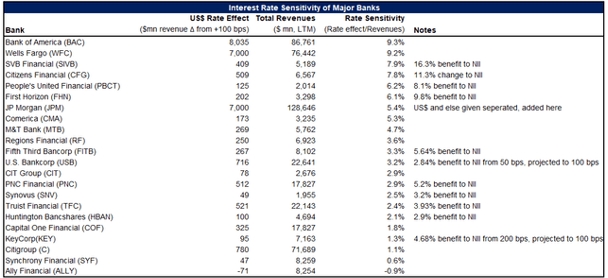

- Bank of America and Wells Fargo will benefit the most from rising rates and offer great yield.

Investment Thesis

We will likely see rising interest rates over the coming years. Deglobalization, fiscal stimulus, and labor effects of the pandemic could create demand-pull inflation. Investors need to prepare for this outcome.

We could be in a rising interest rate environment supported by strong growth. Banks do very well in this macro backdrop. Bank of America (BAC) and Wells Fargo (WFC) will benefit the most from rising rates.

These banks offer excellent yield and will award shareholders while defending their portfolios.

It’s a Good Time to Prepare for Rising Interest Rates

Most people wouldn’t guess that one of the strongest bull markets of the past 30 years has been bonds. The backbone of ever decreasing rates has been globalization putting a cap on inflation (especially wage inflation) along with immense monetary stimulus enacted to fight off the effects of the Global Financial Crisis. Bonds have been rising and rates have been falling ever since the inflationary days of Paul Volcker.

Now though, things could change. Globalization is working in the opposite direction with the world becoming more and more multipolar. The effects will likely alter supply chains and increase cost bases for companies and result in higher consumer prices.

Monetary stimulus is handing over the baton to fiscal measures. As the saying goes, everyone’s a Keynesian in a foxhole, and this is exactly what is happening. In a foxhole we are. From ECB President Christine Lagarde saying “Fiscal authorities have to continue to deploy fiscal tools…”, to Treasury Secretary Janet Yellen declaring “big package of stimulus is necessary to help the economy…” and Fed Chair Jerome Powell cheerleading for fiscal stimulus major monetarists and bankers are recommending the use of fiscal tools.

Fiscal stimulus is more inflationary than monetary. GFC was at its core a monetary crisis and was met with monetary measures. Monetary measures increase the money supply and raise asset prices. Assets are largely owned by wealthier individuals who tend to spend little of their wealth. This combined with globalization was the main reason we’ve been in a disinflationary spiral. Fiscal stimulus, however, increases economic activity directly. The spend is better targeted. More of the spending reaches lower income groups of the population who tend to spend more of it. Fiscal stimulus creates demand-pull inflation.

The pandemic will have inflationary after-shocks. Companies had to downsize dramatically. Many people started spending the daytime with their loved ones being able to do things they wanted to do. Health and wellbeing became top of mind, replacing work and careers. Now, with pent-up demand releasing, companies need to grow their workforce and can’t find employees. Many companies are struggling to find workers and have to increase wages, some are even offering sign-on bonuses. Mismatch in the labor market will likely cause wage inflation.

Wage inflation is the stickiest and healthiest kind of inflation. Higher wages lead to higher incomes and higher incomes lead to higher discretionary spending. This excess demand by consumers is met with higher demand by suppliers who now have more revenues and then can spend on higher wages; the positive feedback loop is great for the economy.

I’m betting that the Fed won’t interfere with this spiral, at least initially. The US has been facing stagnant wage inflation since the year 2000 and most of the gains went to higher earners. The labor share of income fell and fell. It is very unlikely that Fed will want to step in the way of a potential unwind of this trend especially in a world where Fed policy has led to wealth inequality. Many factors heating the economy and the Fed not touching the brake pedal means that investors must at the very least entertain the idea of inflation.

Many Wall Street gurus have a similar macro view for the future. Jamie Dimon, the legendary CEO of JPMorgan (JPM) is hoarding cash on its balance sheet expecting higher-yielding investment opportunities soon. A direct quote from the most recent earnings call by Mr. Dimon: “…is that inflation goes up, the 10-year bond goes up, the growth is still quite strong. You may have growth in the second half this year as stronger than it’s ever been in the United States of America, okay? And Europe is probably six months behind America. And so, growth can go into next year, and the 10-year bond goes to 3%…”. Morgan Stanley’s Mike Wilson who’s gotten the post-pandemic moves spot on so far is warning against higher interest rates. UBS is bearish on bonds expecting interest rates to at least top March highs. Merrill is citing rising interest costs. Market-leading banks are highlighting higher rates.

I am not writing this article to convey to readers that rates will rise. I think that it is likely that they will and above is my thesis. This article aims to provide a way to play the potential rising rates theme with positive carry. Higher rates are at the very least possible and it could be disruptive for the market. There is a way investors can hedge their portfolios while earning yield.

Big Banks Tend to Outperform in a High Growth and Rising Rate Environment

Higher rates have different effects on different parts of the market. Long-duration assets like long-dated bonds and growth stocks tend to struggle while value tends to do well. Cyclical assets prosper if higher rates are accompanied by a strong economy. One can assume that this is the case given the rapid post-pandemic demand surge, high expectations of fiscal stimulus, and Jamie Dimon’s comments of all time strong economy. What does best in an environment of high rates and a strong economy is banks.

Higher rates increase bank profits. Banks are highly tied to interest rates. They take deposits and lend out at a higher rate. As interest rates rise, so do bank earnings.

Banks are highly tied to the economy. Defaults represent significant costs for banks; loans that are not paid back. In a strong economy, banks incur fewer defaults and can lend to riskier parts of the market earning even higher rates at similar risk. Banks thrive in a strong economic environment.

Not All Banks Benefit the Same

Not all banks are created equal when it comes to interest rate sensitivity. Banks with a higher concentration of interest-free deposits like checking accounts benefit more from higher rates than banks with interest-bearing savings accounts since they don’t have to pay more when rates rise.

Banks that have a higher concentration of floating-rate loans benefit more from higher rates. As rates rise, floating rate loans’ interest payments rise. The value of fixed-rate loans stays the same. Investors need to prefer banks with a higher percentage of non-interest-bearing deposits and a higher percentage of floating rate loans in the macro-environment presented above.

I’ve gone through the balance sheets of all major banks to find out which ones are the most interest-rate sensitive. A few notes on my analysis:

- All numbers are from 10-Q filings as of June 30th, 2021.

- In certain cases, I had to make assumptions to bring numbers to par (when the only sensitivity given was to 50 bps or 200 bps moves in rates I had to alter to 100 bps move proportionally). My notes are in my work.

- I tried to include most large banks with deposit/lending operations. I did not include primarily investment banks (like Goldman Sachs (GS), Morgan Stanley (MS)) to not crowd the analysis.

- There are a lot of assumptions that go into the sensitivity analyses that banks conduct and due to difference in calculation numbers may vary from bank to bank (modeling differences in instantaneous vs. gradual change in rates, in actions taken by the bank, what is excluded from the model like MSRs, etc.) and the analysis should be taken with a grain of salt.

Below is my work:

Bank of America and Wells Fargo stand ahead of the pack in terms of interest rate sensitivity.

Buy Bank of America and Wells Fargo to Protect from Rising Rates and Earn Carry

Not only will these investments protect from a rising rate environment but also offer a great yield. Bank of America offers a 2.1% dividend yield for its investors. In addition, it announced a stock buyback program worth $25 bn which is more than 7% of today’s market cap. This is for a company trading with a ~7.5% earnings yield.

Wells Fargo is also very high-yielding everything taken into account. It has a 1.7% dividend yield and a buyback program worth $19 bn. This is even larger than that of Bank of America, worth ~9.4% of today’s market cap. Wells Fargo’s buyback program will be administered over the coming year as opposed to Bank of America’s which will be administered “overtime”. Wells Fargo offers a 7.4% earnings yield.

Investors are getting a total shareholder return of 4-7% with Bank of America in addition to 7.5% earnings on their money giving a >12% total yield. Wells Fargo offers 11% shareholder returns and >18% total yield. These numbers are extremely advantageous for investors as they will be compounded by beneficial revenue effects with rising rates.

I think investors will be handsomely rewarded in tomorrow’s macro-environment by buying Bank of America and Wells Fargo.

This article was written by

Rogue TraderFollow

131 Followers

Ex HF portfolio manager, Ex management consultant. Now I manage my own money and focus on anything that can… more

Long/Short Equity, Special Situations, Portfolio Strategy, Hedge Fund Analyst

Contributor Since 2021

Ex HF portfolio manager, Ex management consultant. Now I manage my own money and focus on anything that can create alpha. I will write on any idea I have and lay out my thesis and analysis openly to get feedback from and discuss with the SA community.

Disclosure: I/we have a beneficial long position in the shares of BAC, WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If the 2014 Fed taper is any guide, it’s time for investors to get defensive

As the Federal Reserve gears up to begin winding down its Covid-era easy monetary policy over the next few months, history shows defensive stocks could be taper winners.

Investors will be closely watching the Fed’s September meeting next week for clues about when the central bank will begin withdrawing its asset purchases, which have increased money supply and stimulated the economy during the pandemic.

Fed Chair Jerome Powell previously indicated that the central bank will likely begin tapering before the end of 2020.

There’s little precedent to show how the stock market would react to the Fed’s tapering. The Fed first used quantitative easing after the Great Recession, so the only other taper in U.S. history occurred Jan. 2 to Oct. 31 in 2014.

A look back at the 2014 taper period provides some clues about which types of stock could be safe bets for investors this time around.

Leading up to the taper, cyclical growth and cyclical value sectors both outperformed the market and defensive stocks, according to a Ned Davis Research analysis of S&P 500 sector performance from May 22, 2013, to Jan. 2, 2014.

However, “leadership quickly turned defensive once the taper got underway,” Ned Davis Research’s Rob Anderson and Thanh Nguyen said in the report.

https://datawrapper.dwcdn.net/cUxrg/1/ Cyclical growth stocks are those belonging to the consumer discretionary, information technology and communication services sectors, as defined by Ned Davis Research. Cyclical value stocks are energy, materials, industrials and financials names. Defensive stocks are shares that tend to be stable regardless of how the overall market performs: consumer staples, health care, utilities and real estate names.

Real estate, health care and utilities sectors saw the highest returns during the taper period, all gaining more than 20% compared with the S&P 500′s 10.2% gain, according to the firm’s analysis. Meanwhile, consumer discretionary and energy were the worst performing sectors during the 2014 taper, each seeing a 0.3% decline.

Exchange-traded funds tracking defensive sectors could be a way for investors to play the forthcoming taper, such as the Real Estate Select Sector SPDR Fund, Health Care Select Sector SPDR Fund and Utilities Select Sector SPDR Fund.

DEFENSIVE SECTOR ETFS

| ETF | TICKER | YTD RETURN (%) |

| REAL ESTATE SELECT SECTOR SPDR FUND | XLRE | 28.15% |

| HEALTH CARE SELECT SECTOR SPDR FUND | XLV | 17.24% |

| UTILITIES SELECT SECTOR SPDR FUND | XLU | 5.90% |

(Source: FactSet. As of Sept. 17, 2021)

The Real Estate Select SPDR Fund is outperforming the market this year with a 28% rally compared with S&P 500′s 18% run. The Health Care Select Sector SPDR Fund and Utilities Select Sector SPDR Fund are lagging in 2021, up about 17% and 6%, respectively.

While history suggests leadership could turn defensive when the Fed starts to taper asset purchases, Ned Davis Research emphasized that “COVID still remains the biggest driver of leadership trends.”

—CNBC’s Nate Rattner contributed to this report.

Op-ed: Social Security trust fund will die in 2033. You need to take action now

Ric Edelman, founder of independent RIA Edelman Financial Engines

Tens of millions of Americans lost their jobs due to Covid-19. Their loss of income caused problems for themselves and their families – and for the Social Security system.

The problem is that the Social Security system is paying out more money to retirees than it collects from workers. You see, the money coming out of your paycheck does not fund your future retirement. Instead, your money is given to current retirees; the next generation to pay for your benefits, and the generation after that will pay for theirs.

This is how the Social System has always worked. It’s performed just fine, thank you, for decades — because we always had lots more workers than retirees. Indeed, when the program started in 1935, there were 150 workers for every retiree. They provided more money than was needed to pay benefits, so the excess was placed into a trust fund. Today, it holds about $3 trillion.

But the worker/retiree ratio has shifted radically over the decades and Covid-19 made it worse by throwing tens of millions out of work. The result: there are now only three workers for every retiree.

The result is that the system is paying out more in benefits each year than it collects in payroll taxes. To cover the shortfall, SSA has been dipping into the trust fund. By 2033, SSA’s trustees now say, the trust fund will be depleted. When that happens, the only money SSA will be able to distribute to retirees is the money it collects from workers. That’s enough to cover only 76% of retiree benefits.

In other words, all retirees will suffer a Social Security benefit cut of 24%, starting in 2033. This would be a huge financial crisis for our nation. The average monthly check is about $1,400. For most retirees, it’s the majority of their income. If this situation isn’t averted, millions of retirees will lose their homes, be unable to pay for medicine and health care and suffer other financial challenges.

Solving the problem means cutting benefits and/or raising taxes, a problem for members of Congress seeking re-election. This is why Congress has largely ignored the issue, even though they all know this crisis is coming. To get Congress to act, I created the Funding Our Future Coalition in 2018, now the largest organization of its kind, with more than 50 academic institutions, non-profit groups, think tanks and corporate partners working together to get Congress to fix this problem.

If Congress acts now, cuts/increases will be merely annoying. If it waits, the changes will be financially devastating to tens of millions of families, threatening our entire economy.

What should you do about this? Some wonder if they should start to collect their Social Security benefits now, before the cut occurs. If you’re in your 20s to early 50s, it’s moot, because you can’t start to receive benefits until age 62. But if you or your parents are in your late 50s to early 60s, you already can (or soon will be able to) start receiving your monthly benefits. So, pay attention.

Financial advisors like me usually tell our clients to delay starting Social Security benefits until age 70, because the older you are when you start, the more you’ll receive each month. But if the benefits are being reduced 24% in 2033, should you start now, so you can enjoy the larger amounts in the meantime?

Good thinking, but no. Say you’re 62 and you start now, receiving about $17,000 per year, which is the average annual payout according to SSA. If you wait until age 70, you’ll receive more than $30,000 per year. Assuming you live into your 80s or beyond, you’re much better off by delaying benefits.

You’re also better off even if Congress does allow benefits to be cut. The difference is smaller, but you still end up with more money by waiting. And show of hands: do you really think Congress is going to let tens of millions of retirees suffer a 24% cut in benefits? That’s politically unlikely. More likely: Congress will offset at least some of the reduction by increasing taxes. And the less of a cut, the better off you are by waiting.

But perhaps your financial plan has called for you to start receiving benefits prior to age 70. If so, simply stick with your plan. The cut in benefits will be what it will be, and no change in your financial planning is required.

What is required is you and me – all of us – getting Congress to act, now. The sooner it acts, the smaller the benefit cuts or tax increases need to be. If Congress acts now, cuts/increases will be merely annoying. If it waits, the changes will be financially devastating to tens of millions of families, threatening our entire economy.

Contact your elected representatives in Congress and President Biden. Demand action now.

—By Ric Edelman, founder of independent RIA Edelman Financial Engines. Edelman has been ranked three times as the #1 Independent Financial Advisor in the nation by Barron’s.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: 5 great side hustles for people in their 50s: Some could pay thousands of dollars per month via Grow with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

HI Financial Services Mid-Week 06-24-2014