HI Market View Commentary 09-16-2019

SO what’s happing today in our market?

Saudi Arabia had a drone attack that basically cut world oil supply by 5.0% or 5.7 million barrels as day short fall for the near term

The US basically told the world via tweet and press release “We are locked and loaded” our belief it was IRAN – Saudi Arabia has not specifically said who was at fault. Supposedly Yemen’s Houthi rebels claimed responsibility

Futures last night around 3 am my time had come down to -133 Dow and -13.75 S&P from highs earlier at almost -200 down and -25.75 S&P

So as I looked at futures this morning I wasn’t so worried also Europe and Asia didn’t take a huge hit.

CHINA – Lower than expected Retail sales, Industrial Production

China’s LI came out and said it would be very hard to maintain the 6% GDP Growth in a world slowing economic cycle

Long put protection for stock ownership – Long Put = The right to sell your stock at a certain price for a certain period of time ie… Stock Insurance = Pay a premium for protection for a certain period of time

WHY – To make up some of the downward movement on stock

WHEN – Prior to earnings the reason why is because the probabilities of stock ownership heading bearish are highest during this time period. Stock technical bearish crossovers and index technical bearish crossovers

HOW – ATM At the money is the best bang for the buck. Reason why = it protects the current price of the stock. IF I was cheap and went to OTM then I have more real $ at risk when I lose on the stock and the long put premium I paid for protection. IF I go way ITM then I am over paying for the protection and lose the profits from a stock heading higher.

COST = Stock Ownership or current price $136.57

BTO 136 Long put for $1.90

New cost basis = 136.57 + 1.90 long put = $138.47

Risk in position= 138.47 – 136 right to sell = $2.47 or 1.78% of total invested position

Stock Ownership or current price $136.57

BTO 137 Long put for $2.35

New cost basis = 136.57 + 2.35 long put = $138.92

Risk in position= 138.47 – 137 right to sell = $1.92 or 1.38% of total invested position

Because if there is a war on Iran all world markets are going to fall

ADJUSTING – Take off long puts for a profit at $139

Add short puts when the stock price goes down to $135 add them at the $125 level

Add short puts if the stock goes sideways at $130

I’m adjusting to make up some of the cost in long puts but not trying to make up every penny

ANYTHING I make up on the way down is a profit when stock prices come back up. I know it levels out the volatility and portfolio swings because there is some kind of protection in play. ALSO, leap long calls is a form of protection by only investing 10-15% of the stock price for a two year period of time

Where will our markets end this week?

SIDEWAYS

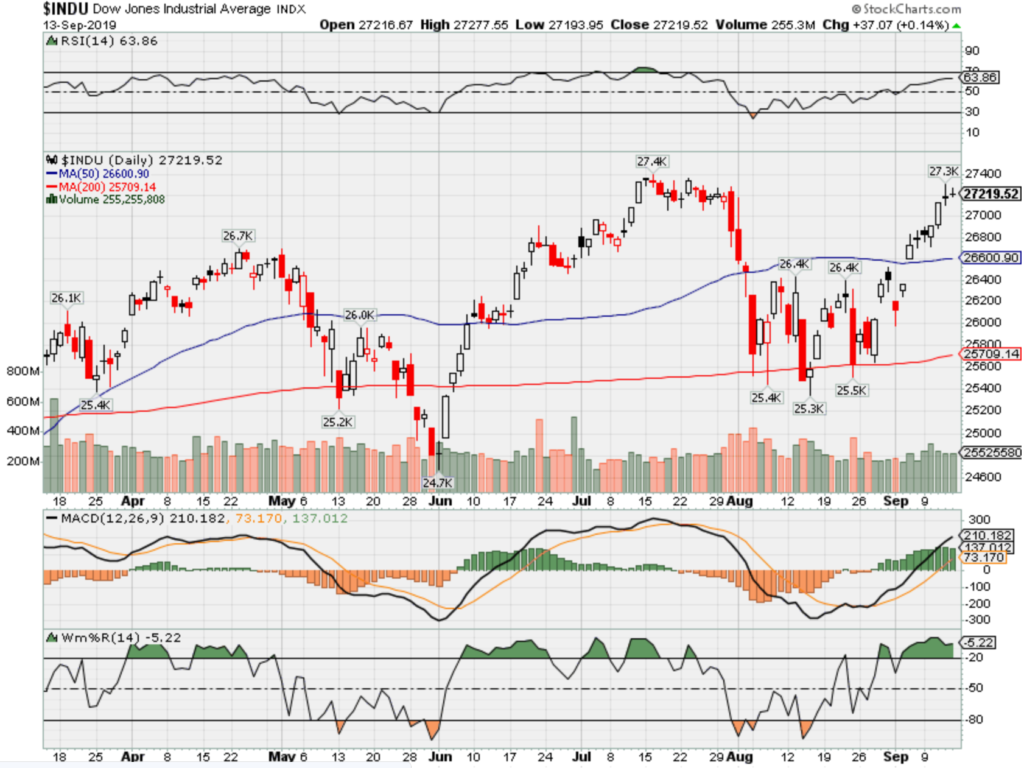

DJIA – Bullish

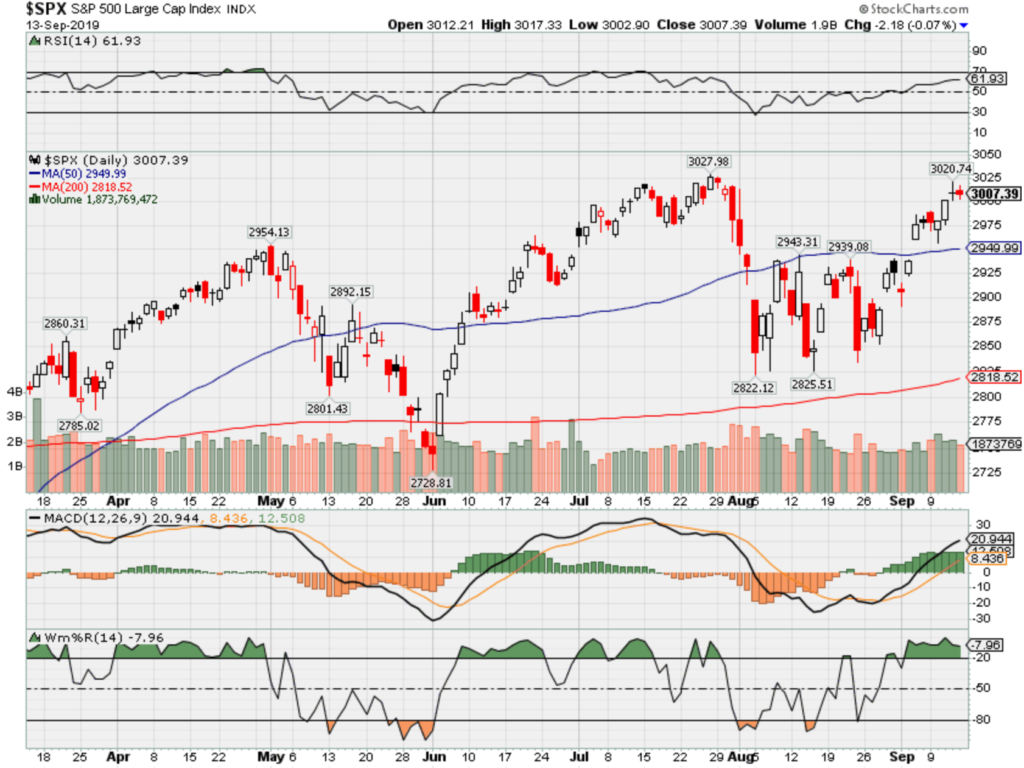

SPX – Bullish

COMP – Bullish

Where Will the SPX end Sept 2019?

09-16-2019 -1.0%

09-09-2019 -1.0%

09-02-2019 -1.0%

08-26-2019 -1.0%

Earnings:

Mon:

Tues: ADBE, FDX

Wed: GIS

Thur: DRI

Fri:

Econ Reports:

Mon: Empire

Tues: Industrial Production, Capacity Utilization, Net Long Term TIC Flows, NAHB Housing Market Index

Wed: MBA, Housing Starts, Building Permits, FOMC Rate Decision

Thur: Initial, Continuing, CPI, Current Account Balance, Phil Fed, Existing Home Sales, Leading Indicators

Fri: Monthly Option Expiration

Int’l:

Mon – CN: Retail Sales, Industrial Production

Tues – CN: Home Price Index

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

Long term and start to protect early for earnings in October

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Stocks are expected to break out to new highs, barring any errant presidential trade tweets

PUBLISHED MON, SEP 9 2019 2:49 PM EDTUPDATED MON, SEP 9 2019 4:19 PM EDT

KEY POINTS

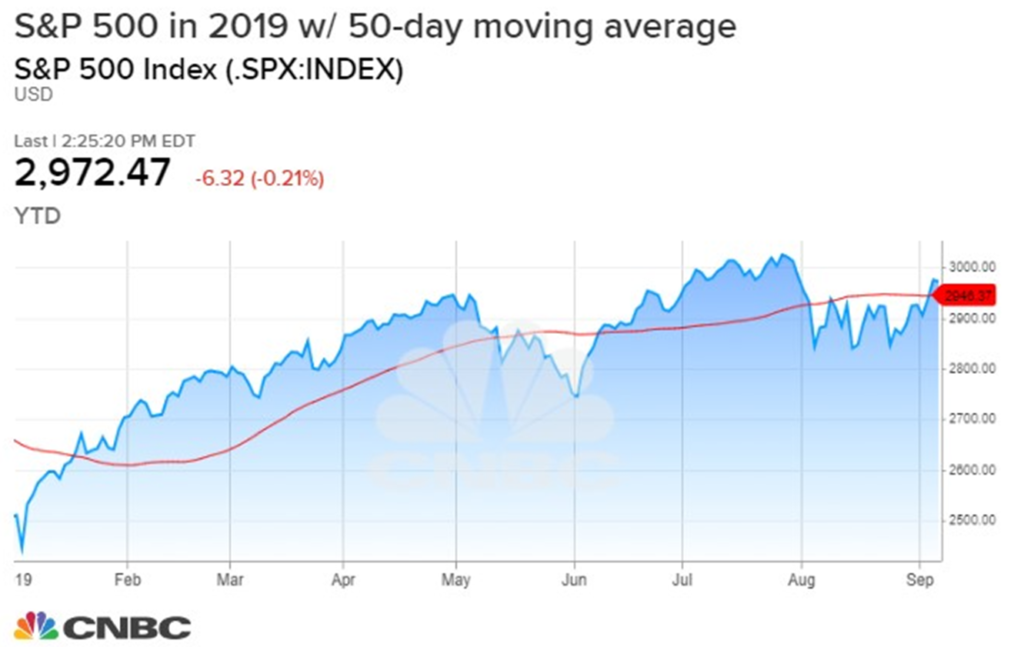

- The S&P 500 is within striking distance of a new high, which analysts expect to see unless there is a new bout of negative trade-related headlines or tweets.

- The market has made some positive technical moves in recent sessions and is holding above its August highs, a positive side.

- Analysts expect technology stocks to lead the market higher.

The stock market is itching to make new highs, and it may soon, as long as progress continues to appear to be made on the trade war front.

Technical market analysts, who watch stock charts, see an opportunity for stocks to break above previous highs, after the S&P 500 rose above its 50-day moving average last week and crossed above August highs, two signals of positive momentum.

For fundamental analysts, there are other positives in place for stocks, including a possible bottom in interest rates, central bank easing and a pick up in some economic data.

But the one wild card is the trade war, which appears to be making progress with talks planned for October between U.S. and Chinese officials.

The S&P 500 is about 1.7% away from its late July high of 3,027.98, and stocks have recently been driven higher by strength in technology and consumer discretionary stocks. Both sectors are within 2% of all-time highs.

“Technically, it set itself up, and now it has to keep itself there,” said Scott Redler, partner with T3Live.com. “For the camp that wants to see new all-time highs, they would like to see the S&P 500 to hold 2,940 to 2,955. The longer it holds that, the more likely it will be make 3028, the all-time high.”

September has started off on positive footing after August’s decline. Usually a weak month, the S&P 500 was up 1.7% so far for September, as of Monday. On Monday, the S&P closed at 2,978, down 0.2%.

Stocks started Monday higher, but were mixed to flattish in afternoon trading, as technology stocks gave up some gains. Small caps, however, were outperforming, with the Russell 2000 up 1.2% in afternoon trading. Small caps are a sector that has been lagging and was expected to rise as the market returned to its highs.

Bond yields, which have moved to worrisome low levels in August, have been higher in September. The 10-year Treasury was yielding 1.63% Monday afternoon.

‘Shakeout summer’

“Last week’s action was meaningful from a trading basis, in that we broke above the August range, the upper end of the range being 2,940,” on the S&P 500, said Ari Wald, technical analyst at Oppenheimer. “I think the underappreciated point for us is the market is coming off cyclically oversold levels.” in the past 52 weeks, the S&P has moved higher by just 2.75%, he added.

“After such little market progress, we’re starting to see signs conditions are getting better and global equities are beginning to base in a move higher,” said Wald.

He said the market is still reacting to last year’s sell-off, and is now in a position for a move higher. “When it’s done raining, it’s still wet outside, and that’s what we had in 2019. The storm was in 2018 when we had the big downturn in December,” Wald said. “2019 has been base building… It was our case there would be a shakeout summer.”

Wald said there is also a negative attitude on the part of investors, which could act as a contrarian positive. “The way things are shaping, I think we could experience a nice run up in the equity market in the next 12 months. Clients, and investors, are just coming up with every reason possible not to buy stocks. it’s very telling, on a contrarian basis,” he said.

Trump tweets

James Paulsen, chief investment strategist at Leuhtold Group, said there are fundamental factors at work, that are also helping stocks and could push them to highs.

“It’s near an all-time high but a mid-morning tweet could put it back,” said Paulsen, adding that the trade headlines have created turbulence for stocks. Strategists say tweets from President Donald Trump could move the market in either direction, and recently his trade tweets have been more negative than positive.

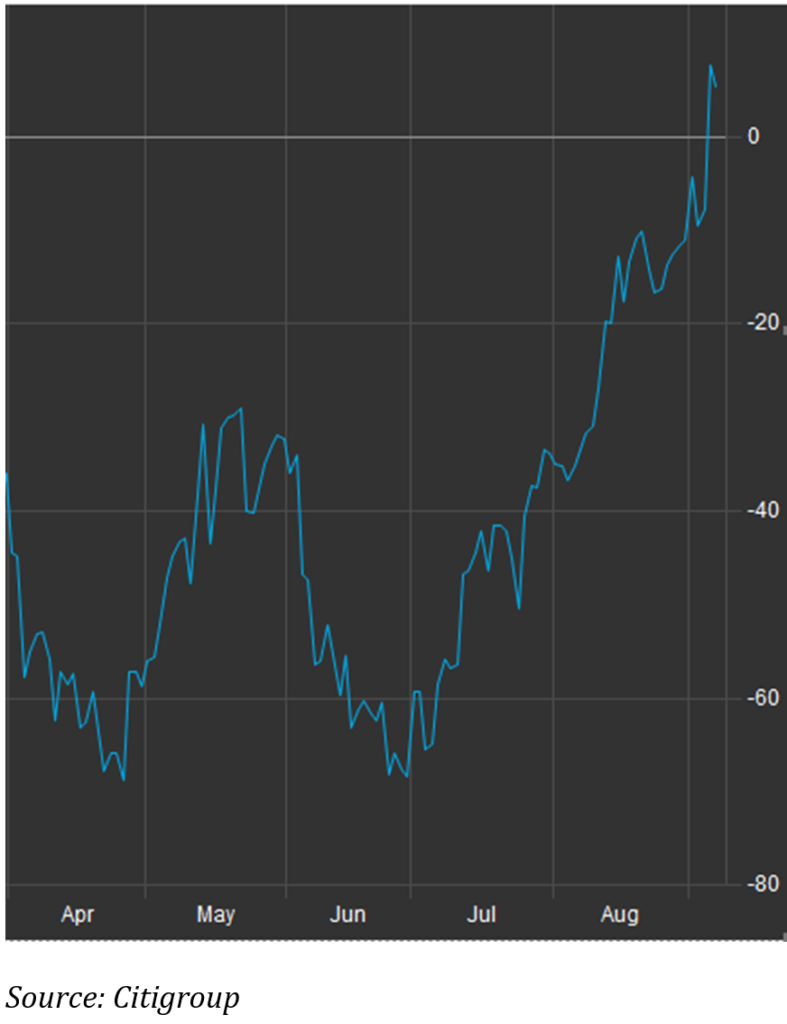

“It does seem, since the Trump tweet [on trade] in early August…the biggest thing that’s changed since then is the global economic reports have gotten better on average,” said Pauslen. Paulsen said he has been watching economic surprise indexes, and they are rising globally. The indexes measure beats against misses on economic data, and when they are positive it is perceived as good news for the stock market.

“Momentum might be improving. Along with that is recession fears are receding. Rates are going back up,” said Paulsen. When rates hit very low levels in August, the move reflected fears of a recession and stocks were also shaky.

Paulson said the improvement in the economic data is coming as some prior central bank easing is having an impact. “We’re focused on the Fed and the ECB, but there’s been easing for nine months, and that’s starting to come home to roost.”

But he cautions that if the yield curve does not steepen and is inverted that could undermine investor confidence, since it is a recession warning. The yield curve is inverted when short term intrest rates are higher than long duration rates. He said the Fed should cut rates by 50 basis points to help the process.

The European Central Bank meets this week and it is expected to take some action to possibly cut its already negative yields and boost its asset purchase program. The Fed meets next week, and it is expected to cut interest rates at least by a quarter point.

JP Morgan equity strategists expect the stock market to rise into year end, and they see a list of reasons to be positive about. “Better technicals, light positioning, more favourable seasonals, signs of a trough inactivity momentum, potential de-escalation in trade uncertainty, 2nd Fed cut— which might move ahead of market expectations this time, and finally the up coming restart of ECB’s QE are likely to be the positive catalysts for this up move, in our view,” the strategists wrote in a note.

U.S. economic surprise index

Source: Citigroup

With the change in tone for stocks, analysts say it’s time to shift holdings.

“Cyclicals/Defensives flows, price relatives and Value/Growth valuations all look stretched, with Banks in particular trading significantly below what peripheral spreads would imply,” noted the J.P. Morgan strategists in a note. “We have argued last week that a turn in sector leadership is upon us, especially if bond yields inflect higher, where Cyclicals and Banks should be favoured into the year-end.”

Paulsen said he sees opportunity in smaller tech names, versus the FANG stocks—Facebook, Twitter, Amazon and Alphabet, Google parent. To varying degrees, the FANG stocks have been subject to government scrutiny for possible new regulations or even taxes on the group.

“It’s still not easy out there. The rotation could be vicious at time, whereas in the last two weeks you just saw the cloud computing and software names lose momentum and get hit. You also saw the hot IPO sector lose momentum and get hit. You need to be in the right place at the right time,” said Redler. “Shorts aren’t doing so well. You really had to be a surgeon to pick the best spots and keep moving fast to stay with the sectors that are in vogue.”

Wald said one sector that is showing strength is semiconductors, despite the ups and downs of trade headlines. He said the Philadelphia Semiconductor Index SOX, which has reclaimed highs, is showing signs of a bigger breakout. Wald said he expects tech to continue leading the bull market higher.

All the new products Apple just announced

PUBLISHED TUE, SEP 10 2019 12:45 PM EDTUPDATED TUE, SEP 10 2019 10:25 PM EDT

KEY POINTS

- Apple unveiled new iPhones, Apple Watches and an iPad at its annual September product launch on Tuesday.

- The company also revealed launch timing and pricing details for its new subscription services, Apple TV+ and Apple Arcade.

- The new iPhone 11 and iPhone 11 Pro start shipping September 20.

Apple kicked off its annual fall product launch on Tuesday where it unveiled new iPhones, Apple Watches and an iPad, as well as new details about Apple TV+ and Apple Arcade.

The company debuted a trio of new smartphones, including the $699 iPhone 11, the $999 iPhone 11 Pro and the $1,099 iPhone 11 Pro Max. All three devices appear similar to their predecessors, but Apple has upgraded their respective camera systems to allow for wide-angle photos, while making improvements under the hood that result in a longer battery life and faster performance than before.

Apple also rolled out the Watch Series 5, which starts at $399 and features a new always-on display. Even so, the device is able to maintain 18-hour battery life, which is possible due to an OLED display technology that was specially created by Apple. Prior to that, the company unexpectedly announced a new seventh-generation iPad, which is priced at $329 and includes a 10.2-inch display.

In addition to new hardware, Apple also revealed launch dates and pricing for its much-anticipated Apple TV+ and Apple Arcade subscription services. Both services cost $4.99 per month, which undercuts competitors like Disney’s streaming platform, Disney+, and Google’s cloud gaming service, Stadia.

Here’s everything Apple has announced on Tuesday:

iPhone

The company unveiled its latest flagship smartphones, the iPhone 11 Pro, iPhone 11 Pro Max and iPhone 11. All the devices are available for pre-order starting on Friday at 5 a.m. Pacific Time and will start shipping Sept. 20. Apple’s latest software update, iOS 13, launches on Sept. 16 for the iPhone 6S and all newer models.

The iPhone 11 Pro and iPhone 11 Pro Max feature 5.8-inch and 6.5-inch OLED displays, respectively. Both devices come in green, space gray, silver and gold with a new matte finish to the back panel.

The devices have the same form factor as their predecessors, the iPhone XS and the iPhone XS Max, but feature an all new triple-lens camera on the back. The triple-lens camera system includes a telephoto camera, wide angle camera that lets in 40% more light, as well as an ultra wide camera with a 120-degree field of view. The cameras are also capable of shooting 4K resolution video at 30 frames per second.

Both the iPhone 11 Pro and iPhone 11 Pro Max have gotten major spec upgrades, making them faster, while using less power. The iPhone 11 Pro gets four more hours of battery life compared to the iPhone XS and the iPhone 11 Pro Max has five hours more battery life.

At $699, the iPhone 11 is $50 cheaper than its predecessor, the iPhone XR. The device features a 6.1-inch display, an hour longer battery life compared to the iPhone XR, faster Face ID and an A13 Bionic chip, making it the “fastest CPU and GPU ever in a smartphone,” the company said. The iPhone 11 comes in six new colors, including purple, green, yellow, white, red and black.

It features a dual-camera system on the rear panel, including an all-new wide-angle lens with 2x optical zoom out. The cameras are packed with upgraded sensors, allowing for features like multiscale tone mapping for improved highlights, as well as night mode, which helps brighten photos in dark environments. Additionally, the iPhone 11 features a 12-megapixel TrueDepth camera on the front, which lets users film slow motion videos, along with wide angle selfies.

As part of the iPhone launch, Apple also rolled out a new trade-in program for several countries. The new iPhones start at $399, $599 and $699 with trade ins, or at lower prices on a monthly basis.

Apple TV+ and Apple Arcade

Apple’s streaming video subscription service will roll out on Nov. 1 and starts at $4.99 per month for a family account. It’ll be available in 100 countries at launch, with new shows being added each month. The company said users can get a one year subscription for free with a purchase of a new iPhone, iPad, Mac or Apple TV.

Apple debuted a trailer for “See,” its new sci-fi drama starring Jason Momoa, that’s set to launch on Apple TV+ along with other original titles. Other original series that are expected to launch on the service include “The Morning Show,” which stars Jennifer Aniston, Reese Witherspoon and Steve Carell, in addition to “Dickinson,” a drama series about Emily Dickenson that stars Hailee Steinfeld.

Apple Arcade, its gaming subscription service, will launch on Sept. 19 in 150 countries around the world, with 100 new games, starting at $4.99 for families. As part of the launch, the company is rolling out a new Arcade tab in the App Store to house games for the subscription gaming service. New titles will be added every month, along with personalized recommendations, game trailers and game guides. Users can also sign up for a one-month free trial at launch.

Apple Watch

The Apple Watch Series 5 starts at $399 for a GPS version, then bumps up to $499 with 4G network connectivity. It’s available for order today and lands in stores on Sept. 20. Apple is still selling the older Series 3 watch, plus cutting the price to $199.

The new device includes a new always-on display, which allows users to be able to see the time and notifications when they haven’t raised their wrist. Even with the always on display, Apple says the new Watch still has 18-hours worth of battery life, thanks to a new low-temperature polysilicone and oxide display, as well as a low-power display driver.

Apple is launching the new Watch models with three different casing materials, including aluminum, ceramic and stainless steel, as well as titanium, which is a first for the company. It also includes new features like a compass and international emergency calling.

The company has continued its focus on health and fitness in the latest Apple Watch. The device now has menstrual cycle tracking, as part of the watchOS 6 software, as well as a new research app, which is set to launch in the US later this year. Users can enroll in three studies to start, such as hearing, women’s health and heart and movement.

iPad

The company took the wraps off of a new 10.2-inch iPad, replacing the 9.7-inch model. The seventh-generation device features a Retina display, an 8-megapixel camera and it has Apple’s A10 Fusion chip built in, which the company said is 2x faster than the top-selling PC. The device is compatible with Apple’s smart keyboard, as well as the first-generation Apple Pencil.

The new iPad is available for order today and will start shipping on Sept. 30. The device starts at $329 and education customers can buy the new iPad for $299.

Apple Store

Apple is reopening its flagship Fifth Avenue store in New York on Sept. 20, the same date that its new iPhones will launch.

Earlier this month, the company teased the store’s reopening by unveiling a new colorful glass coating. The entrance to the store was closed as of January 2017, while the store was moved to a temporary location. The rainbow colors are temporary and the cube will eventually return to its original clear design.

Buy the stocks of high-quality companies in the market that investors are dumping, Cramer says

PUBLISHED TUE, SEP 10 2019 7:35 PM EDT UPDATED WED, SEP 11 2019 10:02 AM EDT

KEY POINTS

- CNBC’s Jim Cramer suggests looking at the stock market rotation as an “opportunity to get in, not get out.”

- “If a high-quality stock is down enough, like Merck was this morning, then that’s your chance to pounce,” the “Mad Money” host says.

- “If this market wants to toss out high-quality merchandise, let their trash be your treasure,” he says.

Consistently growing stocks are out and cyclical stocks are officially back in as big fund investors rotate holdings based on their emotion, CNBC’s Jim Cramer said Tuesday.

Wall Street saw a mixed day of trading with the Dow Jones Industrial Average adding 73.92 points and the S&P 500 inching up 0.03%. The Nasdaq Composite went 0.04% the other way.

The market is a reflection of how institutional investors see the future. Cramer recommended that individual investors not try to game the rotation.

“I think you need to view it as an opportunity to get in, not get out,” the “Mad Money” host said. “If a high-quality stock is down enough, like Merck was this morning, then that’s your chance to pounce.”

Shares of Merck, one of the leading pharmaceutical companies in the world, have been on an uptrend since 2018, thanks to the introduction of its Keytruda cancer treatment for lung cancer. The stock gained nearly 20% between April and the end of August as the company explores expanding its use for other tumors, Cramer noted.

Yet, the stock has dropped below $82 from a high of $87.35 in late August on little news, the host said. It doesn’t help that Merck won’t benefit from a potential interest rate cut that investors are anticipating from the Federal Reserve, which appears more likely in the wake of Friday’s weaker-than-expected jobs report.

“I think it’s the rotation out of stocks that thrive in a slowing economy and into stocks that thrive in an accelerating economy,” Cramer said. “In other words, Merck’s gone out of style on that Wall Street fashion show … Merck’s not going to benefit from the expected rate cut, so the stock has lost its appeal, for now.”

Visa and MasterCard also took a hit during the session, falling almost 3% and 4%, respectively. Their stocks were benefiting from the secular growth in financial technology technology, along with giving investors exposure to the financial sector without owning bank stocks, Cramer said.

Citigroup, the cheaper of the bank stocks, instead has steadily climbed nearly 12% since late August. Cramer contended the stock would be falling if it weren’t for the rotation in the market.

“If this market wants to toss out high-quality merchandise, let their trash be your treasure,” the host said.

Disclosure: Cramer’s charitable trust owns shares of Citigroup and MasterCard.

https://seekingalpha.com/article/4290752-rising-yields-helping-bank-america

Rising Yields Are Helping Bank Of America

Sep. 10, 2019 12:19 PM ET

Summary

Rising yields are helping the bank’s stock.

The valuations are compelling.

The stock is seeing bullish momentum.

Looking for more stock ideas like this one? Get them exclusively at Reading The Markets. Get started today »

Rising yields and improving spreads may help to lift Bank of America’s (BAC) stock. Yields around the world have been on the rebound since reaching in some case record low levels in August on fear of a global growth slowdown. Now, with yields bouncing, spreads should continue to widen and act as a favorable tailwind for the banks and Bank of America.

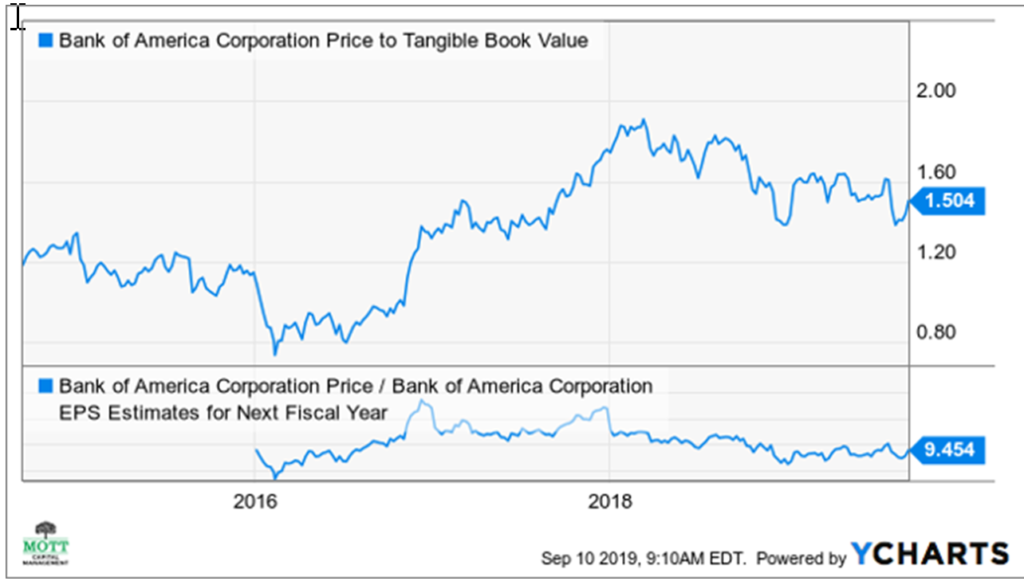

Another positive sign is that the price to tangible book value has fallen to its lowest level since December 2016. That low valuation could help to boost the stock over the near term as well, as some investors look for value plays. There is also a sign that momentum may be entering with some recent bullish options bets.

The last time I wrote on Bank of America was on August 9. At the time, I had noted that falling yields and spreads were likely to send the stock lower.

Improving yields

10-year yields have been on the rise in recent weeks from a low of about 1.45% to around 1.66% as of September 10. With the yield on the 10-year rising at a faster pace than the 2-year yield, it has resulted in the steepness of the yield curve to widen. Since August 27, the spread between the 10-year and the 2-year has expanded from a negative 0.06% to a positive 0.05%. Since that time, Bank of America’s stock has risen by almost 10% to $28.75 from around $26.20 as of September 9.

Valuation is Low

The stock is also at nearly its lowest valuation in the past three years, trading at a price to tangible book value of 1.50. Meanwhile, in one year, the forward PE ratio has fallen to its lowest valuation since late 2018. The low valuations are likely to act as a floor for the stock.

Bullish Options Betting

The options are suggesting the stock may rise as well over the near term. Recently, the January 17, 2020 calls saw their open interest rise by about 17,000 contracts to a total of 33,068. It appears the options were traded on the ASK, and that would suggest the calls were bought, and a bet that the stock would rise. The options trade for about $0.80 per contract, and that gives the open interest a total dollar value of approximately $2.6 million. It is a reasonably large bet given that the stock would need to rise to around $31.80 to break even if the options are held until the expiration date. That is about 10.6% higher than the stock prices of approximately $28.75 as of September 9.

Technical Strength

The technical chart shows that the stock is approaching a level of technical resistance at $29.50, and should the stock rise above that level, it could rise to around $31, a gain of about 8%.

The relative strength index is also trending higher, despite the stock trading sideways since the middle of January, a bullish divergence. It is a sign that the stock is likely to rise over the longer term.

As of now, as long as yields can continue to rise and spreads can widen, Bank of America’s stock may continue to rise. It would seem that based on the bullish option betting and technical chart, the bullish momentum is likely to continue to build, and shares should continue to rise.

We use fundamental, technical, and options market analysis to identify individual stock ideas and market trends. Also through unique video and audio content, we help you see how this works and learn from it. As a member of this service, you’ll get daily news and additional posts that will give you control, so you’re not just reacting to the news, you’re acting on and staying ahead of it.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

https://www.zerohedge.com/markets/epic-industry-shift-passive-funds-are-now-bigger-active

In “Epic” Industry Shift, Passive Funds Are Now Bigger Than Active

by Tyler Durden

Wed, 09/11/2019 – 18:45

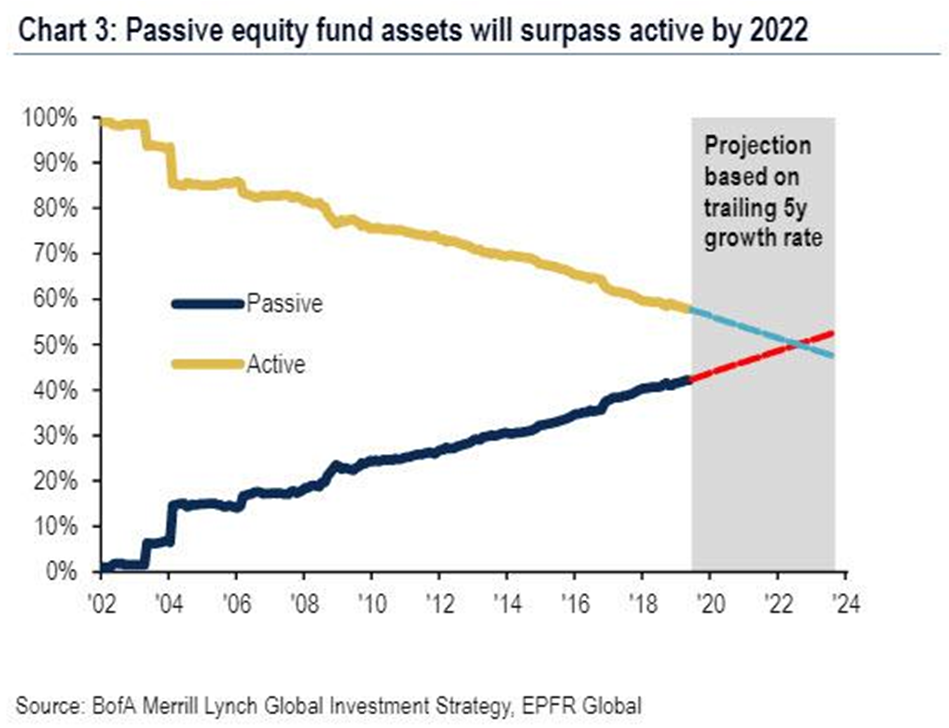

Several weeks ago, Bank of America predicted that if one extrapolates the existing trends in growing passive funds and shrinking active funds, the D-day when robots and ETFs overtake humans in asset allocation will take place some time in 2022.

In retrospect, Bank of America was wrong, because as Bloomberg just reported, this much anticipated “epic industry shift” in the $8 trillion stock-fund industry has just taken place, with the balance of power officially shifting away from humans.

Citing preliminary estimates released from Morningstar, Bloomberg reports that assets in “passive” mutual funds and exchange-traded funds tracking U.S. equity indexes surpassed those run by “active” stock-pickers for the first time last month.

10

Following the August flurry of fund outflows from active and inflows into passive funds, assets in equity index-tracking U.S. funds rose to $4.271 trillion, for the first time ever surpassing the $4.246 trillion run by stock-pickers. Specifically, investors added $88.9 billion to passive U.S. stock funds while pulling $124.1 billion from active managers this year through August, the Chicago-based firm estimated.

The inflection point, decades in the making, underscores changes upending a business built on the idea of pros getting paid to outsmart the masses.

And now that D-day for investors has come, the scramble by passive funds to attract even more investors (the only way this business makes sense at far lower margins is with volume and market share) will mean even lower asset management prices, and an even faster rotation out of active, as the market rapidly approaches the singularity that Michael Burry is now obsessed by: a world in which the passive investing bubble finally bursts, but not before markets become woefully inefficient and disconnected from fundamentals – as a reminder, index buying does not discriminate on a fundamental basis and does not reflect all new information available about the company, but merely rewards asset simply due to their presence in one index or another. Thus, in a feedback loop, the more popular and powerful passive investing becomes, the less relevant it will makes active investing, which will lead to even greater outflows from active and into passive.

The culprit behind all of this? Why the Fed of course, which over the past decade has become an activist central bank which has made any material market corrections impossible, thereby robbing – literally – active investors of their bread and butter: reward for getting the downside right, in addition to getting the upside.

The 5G Device Every American Must Have This Year

Jeff Brown, a former Silicon Valley CEO, holds live event at Yale University for select group of tech scholars to reveal new “5G Device” for first time.

Sponsored By Bonner & Partners

There is some hope for humans yet: in international stock funds, active funds still surpass passive, but the gap is narrowing.

Actually, scratch that – none other than America’s most important banker, Jamie Dimon, speaking at an industry conference yesterday, made it clear what the future is for financial professionals: “The battle is more in the tech world at this point than in having brilliant traders.”

That’s all one needs to know.

European Central Bank cuts its deposit rate, launches new bond-buying program

PUBLISHED THU, SEP 12 2019 7:46 AM EDTUPDATED THU, SEP 12 2019 12:58 PM EDT

KEY POINTS

- The central bank’s quantitative easing program will entail 20 billion euros per month of asset purchases for as long as it deems necessary.

- The ECB also cut its main deposit rate by 10 basis points to -0.5%, a record low but in line with market expectations.

- Markets had widely expected some form of stimulus package, though hawks within the European Central Bank (ECB) Governing Council had moved in recent weeks to downplay the scale of the impending measures.

- “In view of the weakening economic outlook and the continued prominence of downside risk, governments with fiscal space should act in an effective and timely manner,” ECB President Mario Draghi said.

The European Central Bank (ECB) announced a massive new bond-buying program Thursday in a bid to stimulate the ailing euro zone economy.

The central bank’s quantitative easing (QE) program will entail 20 billion euros ($21.9 billion) per month of net asset purchases for as long as it deems necessary.

The ECB also cut its main deposit rate by 10 basis points to -0.5%, a record low but in line with market expectations.

It now expects interest rates to remain at their present or lower levels until it has seen its inflation outlook “robustly converge to a level sufficiently close to but below 2% within its projection horizon, and such convergence has been persistent.”

In a press conference following the decision, ECB President Mario Draghi urged governments to take fiscal measures to supplement the central bank’s monetary stimulus and reinvigorate the euro zone economy.

“In view of the weakening economic outlook and the continued prominence of downside risk, governments with fiscal space should act in an effective and timely manner,” Draghi said.

“In countries where public debt is high, governments need to pursue prudent policies that will create the conditions for automatic stabilizers to operate freely. All countries should reinforce their efforts to achieve a more growth-friendly composition of public finances,” he added.

Additionally, the ECB changed its TLTRO (targeted long-term refinancing operations) rate to provide more favorable bank lending conditions and match that of its refinancing rate, erasing a previous 10 basis point spread.

A new system will see borrowers receive preferential rates if their eligible net lending exceeds a benchmark, providing an incentive for banks to use that money.

In line with market expectations, the ECB also introduced a two-tier rate system, a measure encouraged by the heads of various major European banks during the latest earnings season. The move is intended to alleviate some of the pressure of negative interest rates on the balance sheets of European banks, which have seen profits squeezed by the persistent low rate environment.

Draghi added in his press conference: “In order to support the bank-based transmission of monetary policy, the Governing Council decided to introduce a two-tier system for reserve remuneration, in which part of banks’ holdings of excess liquidity will be exempt from the negative deposit facility rate.”

‘Draghi’s final stunt’

Markets had widely expected some form of stimulus package, though hawks within the European Central Bank (ECB) Governing Council had moved in recent weeks to downplay the scale of the impending measures.

A slowing euro zone economy, persistent low inflation and the U.S.-China trade war had all pointed toward the central bank being forced to inject stimulus.

Recent economic data has not been promising, though the latest Purchasing Managers’ Indexes (PMIs) had indicated some stability despite enduring industrial weakness.

This will be the second round of QE from the ECB, the first coming four years ago in response to the chaotic fallout of the euro zone sovereign debt crisis.

Outgoing President Mario Draghi will be hoping his final policy decision at the helm will help the bloc avoid a recession and get growth and inflation back on track.

Incoming replacement Christine Lagarde has already called for more fiscal stimulus to complement the ECB’s policy.

ING Chief Economist Carsten Brzeski said in a note Thursday that “despite all market excitement now, the question remains whether this will be enough to get growth and inflation back on track as the real elephant in the room is fiscal policy.”

“It is clear that without fiscal stimulus, Draghi’s final stunt will not necessarily lead to a happy end,” Brzeski added.

Market reaction

The pan-European Stoxx 600 index jumped 0.6% immediately after the first announcement, as markets reacted positively to ECB President Mario Draghi delivering on expectations of a “bazooka” stimulus package.

Euro zone bond yields tumbled and the euro weakened as a result of the new measures. Germany’s benchmark 10-year bond yield tumbled 8 basis points to -0.64% while the euro slid back below $1.10.

European banking stocks plunged, however, giving back early gains to slip 0.9% below the flatline.

Artur Baluszynski, head of research at Henderson Rowe, said the ECB pushing rates further into negative territory is “essentially a tax on euro zone banks, and for the already weakened bank-financed economy like the euro zone, this move could spell more trouble.”

“Also, with the Fed still being the tightest of the G-7 central banks, the eurodollar liquidity could come under pressure adding further stress to the increasingly challenged European banking system,” he added.

HI Financial Services Mid-Week 06-24-2014