HI Market View Commentary 09-06-2022

Historically what happens the first trading day of a new month? New money comes in

What happens the last trading day of the end of a month?= It goes down. WHY? Rebalancing happens usually the last few trading days of the month

So what happened today? Range was +0.50% and down -0.55% Finishing at -0.41

Better than expected ISM Services Index 56.9 vs ext 55.2

GDP here in the US looks to be 2.6% for the quarter

New money was coming in today to keep us from falling down another 1%

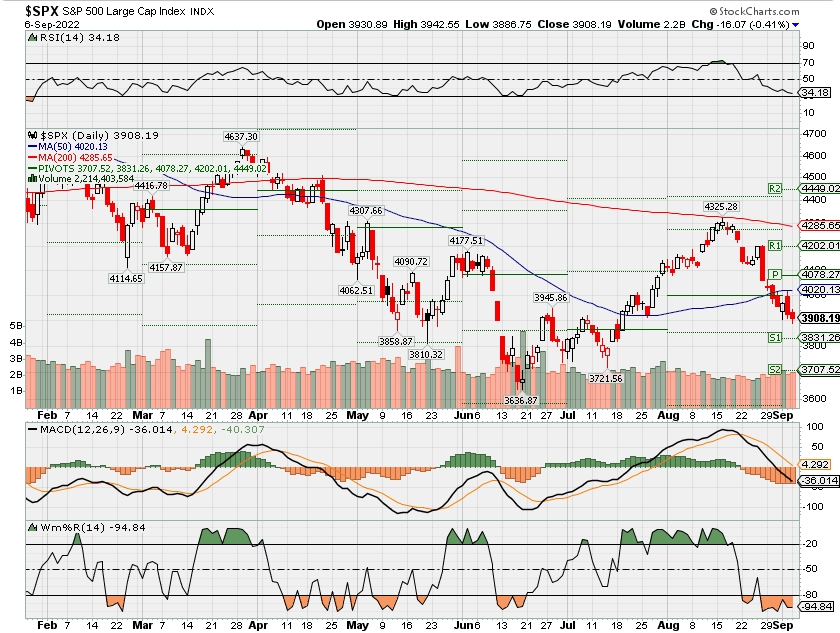

Our markets are approaching the over sold area EXPECTING little bounce then lower

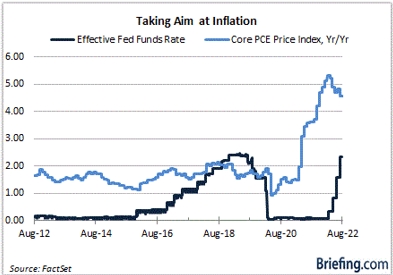

Trigger = Fed Sept 27 -28 rate hike meeting = 0.75 rate hike =means once again the fed overshot the market

Why did they over shoot the mark = Because it is supply and demand driven not inflation driven

SO IF You truly don’t understand what is going on what do you do? Protect, research the heck out of what you don’t understand and you get a game plan ready.

We don’t know if we are in a hard or soft landing yet?

IF you don’t know what’s going on and you can’t calculate a bottom or reasoning for a fall you shouldn’t be in the market. You don’t have to be right but you do have to be able to explain what you are doing and why

Earnings dates:

COST 9/22 AMC – ????

MU 9/28 – NO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 26-Aug-22 14:53 ET | Archive

Powell and the Fed mean business in restoring price stability

We liked the speech Fed Chair Powell delivered at the Jackson Hole Economic Symposium. It was, in his own words, “shorter,” “narrower,” and “more direct” than prior speeches given there. That did not make it any less impactful, however.

If anything, the brevity of his remarks, versus the gravity of the topic, suggested he and the Fed are now properly focused on the primary task at hand: bringing inflation back down to the Federal Open Market Committee’s 2 percent goal.

That task, though, will have adverse consequences.

Pedal to the Metal

A major point of relief with the speech is that it is over. Talking heads must be walking around with a collective case of laryngitis, having talked ad nauseum leading up to the speech about what the Fed Chair might, or might not, say.

The takeaway is that he did not say anything truly surprising based on a battery of commentary heard from other Fed officials preceding his speech. What was surprising was the terse nature of his remarks.

From our vantage point, it sounded more credible this time that the Fed knows its job and that, even though it contributed to history repeating itself with inflation running amok, it is not going to let history repeat itself by cutting rates in a willy-nilly fashion because it happens to see a comforting inflation number here and there.

The Fed Chair spent a good portion of his brief speech talking about the experiences of the past, particularly the “high and volatile inflation of the 1970s and 1980s,” and how the policy approaches then have helped inform the Committee’s thinking on its policy approach today.

That is, it aims to avoid the misguided policy decisions that necessitated a lengthy period of very restrictive monetary policy under Paul Volcker to reduce inflation and to rein in inflation expectations.

This was not a speech that implied the Fed is going to be quick to take its policy foot off the gas pedal. The Fed knows it needs to keep driving beyond the neutral rate (longer run estimate of 2.5%) to a restrictive destination that is yet to be determined.

It is thought by some at the Fed that 3.75-4.00% could be the stopping point, but what the Fed Chair conceded in his Jackson Hole speech is that the Fed will keep driving until it is confident the job is done.

He also provided a reality check that there will not be a quick pivot to a rate-cut cycle, saying “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

Showing Respect

The initial reaction in the capital markets to Mr. Powell’s speech had a respectable level of appropriateness to it that was lacking when he spoke following the July 26-27 FOMC meeting. Stock prices trended lower, the dollar increased, and the 2-yr note yield fell in price, pushing its yield higher.

The respective moves connoted a sense of respect for the Fed Chair’s message, which contained an acknowledgment that the effort to bring down inflation “will also bring some pain to households and businesses.”

The debate topic for talking heads now is just how much pain there will be. That debate will revolve around expectations for a soft landing or a hard landing.

In either case, there is going to be a step down in economic activity because the stated aim of the Fed’s monetary policy is to produce a moderation in demand so that it better aligns with supply. That will inevitably lead to job losses that will help tame wage-based inflation pressures.

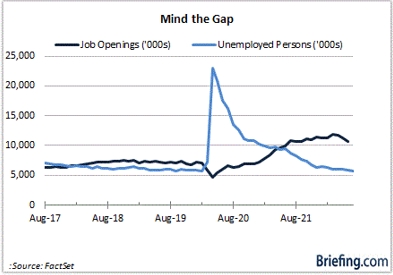

Those pressures have not been tamed yet, and with an unemployment rate of 3.5% and roughly 1.9 job openings for every unemployed worker, Fed officials have an unenviable, but necessary, task on their plate.

This becomes a reality check for the stock market, too, because weakening demand will translate into weakening economic activity, which should then manifest itself in weakening earnings growth.

Accordingly, multiple expansion will be, and should be, harder to come by as interest rates rise and earnings growth slows or possibly contracts.

What It All Means

It can take a while sometimes to get a point across. The stock market hasn’t necessarily been convinced that the Fed is going to be the policy disciplinarian it says it aims to be.

Fed Chair Powell, however, delivered a speech at Jackson Hole that put the market on notice that it means business in restoring price stability. We should all appreciate that.

At the same time, though, investors need to appreciate that there will be some earnings pain in that pursuit that translates into a more challenging stock market environment.

We might have seen peak inflation, but what Fed Chair Powell implied in his speech is that we are not at peak hawkishness. Moreover, when we get there, the Fed is not going to be quick to climb down until it knows the inflation ground below is stable again — and that is still a long climb given where things stand now.

—Patrick J. O’Hare, Briefing.com

(Editor’s note: the next installment of The Big Picture will be published the week of September 5)

| https://go.ycharts.com/weekly-pulse WEEK OF AUG. 29 THROUGH SEP. 2, 2022 Happy Labor Day from YCharts! |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –technically bearish

COMP – Bearish

Where Will the SPX end September 2022?

09-06-2022 -2.0%

08-29-2022 -2.0%

Earnings:

Mon:

Tues:

Wed: GME,

Thur: DOCU,

Fri: KR,

Econ Reports:

Mon:

Tues: ISM Non-Manufacturing

Wed: MBA, Trade Balance

Thur: Initial Claims, Continuing Claims, Consumer Credit

Fri: Wholesale Inventory

How am I looking to trade?

Currently protection on most core holdings and letting some stocks run

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

‘Why shouldn’t it be as bad as the 1970s?’: Historian Niall Ferguson has a warning for investors

PUBLISHED FRI, SEP 2 202212:15 PM EDT

Karen Gilchrist@_KARENGILCHRIST

KEY POINTS

- Top historian Niall Ferguson warned Friday that the world is sleepwalking into an era of political and economic upheaval akin to the 1970s — only worse.

- Speaking to CNBC at the Ambrosetti Forum in Italy, Ferguson said that the catalyst required to spark a repeat of the 70s — namely inflation and international conflict — had already occurred.

- “The ingredients of the 1970s are already in place,” Ferguson, Milbank Family Senior Fellow at the Hoover Institution, Stanford University, told CNBC’s Steve Sedgwick.

Top historian Niall Ferguson warned Friday that the world is sleepwalking into an era of political and economic upheaval akin to the 1970s — only worse.

Speaking to CNBC at the Ambrosetti Forum in Italy, Ferguson said the catalyst events had already occurred to spark a repeat of the 70s, a period characterized by financial shocks, political clashes and civil unrest. Yet this time, the severity of those shocks was likely to be greater and more sustained.

“The ingredients of the 1970s are already in place,” Ferguson, Milbank Family Senior Fellow at the Hoover Institution, Stanford University, told CNBC’s Steve Sedgwick.

“The monetary and fiscal policy mistakes of last year, which set this inflation off, are very alike to the 60s,” he said, likening recent price hikes to the 1970′s doggedly high inflation.

“And, as in 1973, you get a war,” he continued, referring to the 1973 Arab-Israeli War — also known as the Yom Kippur War — between Israel and a coalition of Arab states led by Egypt and Syria.

As with Russia’s current war in Ukraine, the 1973 Arab-Israeli War led to international involvement from then-superpowers the Soviet Union and the U.S., sparking a wider energy crisis. Only that time, the conflict lasted just 20 days. Russia’s unprovoked invasion of Ukraine has now entered into its sixth month, suggesting that any repercussions for energy markets could be far worse.

“This war is lasting much longer than the 1973 war, so the energy shock it is causing is actually going to be more sustained,” said Ferguson.

2020s worse than the 1970s

Politicians and central bankers have been vying to mitigate the worst effects of the fallout, by raising interest rates to combat inflation and reducing reliance on Russian energy imports.

But Ferguson, who has authored 16 books, including his most recent “Doom: The Politics of Catastrophe,” said there was no evidence to suggest that current crises could be avoided.

“Why shouldn’t it be as bad as the 1970s?” he said. “I’m going to go out on a limb: Let’s consider the possibility that the 2020s could actually be worse than the 1970s.”

Among the reasons for that, he said, were currently lower productivity growth, higher debt levels and less favorable demographics now versus 50 years ago.

“At least in the 1970s you had detente between superpowers. I don’t see much detente between Washington and Beijing right now. In fact, I see the opposite,” he said, referring to recent clashes over Taiwan.

The fallacy of global crises

Humans like to believe that global shocks happen with some degree of order or predictability. But that, Ferguson said, is a fallacy.

In fact, rather than being evenly spread throughout history, like a bell curve, disasters tend to happen non-linearly and all at once, he said.

“The distributions in history really aren’t normal, particularly when it comes to things like wars and financial crises or, for that matter, pandemics,” said Ferguson.

“You start with a plague — or something we don’t see very often, a really large global pandemic — which kills millions of people and disrupts the economy in all kinds of ways. Then you hit it with a big monetary and fiscal policy shock. And then you add the geopolitical shock.”

That miscalculation leads humans to be overly optimistic and, ultimately, unprepared to handle major crises, he said.

“In their heads, the world is kind of a bunch of averages, and there aren’t likely to be really bad outcomes. This leads people … to be somewhat overoptimistic,” he said.

As an example, Ferguson said he surveyed attendees at Ambrosetti — a forum in Italy attended by political leaders and the business elite — and found low single-digit percentages expect to see a decline in investment in Italy over the coming months.

“This is a country that’s heading towards a recession,” he said.

Don’t expect the S&P 500 to make much progress with rates this high

PUBLISHED TUE, SEP 6 20221:10 PM EDTUPDATED 2 HOURS AGO

Michael Santoli@MICHAELSANTOLI

This is the daily notebook of Mike Santoli, CNBC’s senior markets commentator, with ideas about trends, stocks and market statistics.

- An oversold U.S. market is trying to come to grips with three days of challenging but not wholly surprising macro headlines, leaving the indexes whippy around the 3,900 level of the S&P 500.

- European energy scarcity/runaway power costs are mostly manifest in depleted global-growth expectations and an unrelenting (so far) surge in the dollar. But oil/gas prices are sort of selling the news and the macro message does little to undermine the idea of relative U.S. economic resilience set by Friday’s jobs numbers and today’s ISM services gauge.

- The key short-term task for the tape is to respond to some significant oversold conditions (very low percentage of stocks above a 10-day average, etc.) after three straight down weeks and a 1.5% afternoon drop on Friday. The S&P 500 has spent very little time under 3,900 (or over 4,200) the past four months, with the dive toward 3,600 representing peak stagflation panic and the ramp to 4,300 into mid-August animated by a powerful oversold rally and some “Federal Reserve pivot” expectations taking hold.

FactSet

- The “don’t overthink it” take on the market remains a cautious one: Stocks are in a well-defined downtrend. They failed exactly at the declining 200-day average. The Fed is tightening into a slowdown (or worse) and might go until something ruptures. The European Central Bank is hiking into a recession. September is historically ungenerous. Further, if you think Fed balance sheet reduction is a real-world threat (vs. my take that it’s largely irrelevant), it accelerates this month.

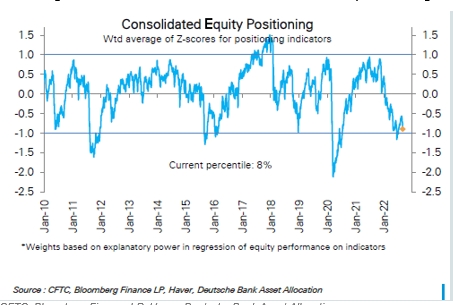

- Against this, we have a market that already — at the lows — has undergone the typical damage of a nonrecessionary or mild-recession bear market. Valuations have returned toward roughly neutral levels. Only housing is unequivocally in contraction mode. We saw some pretty encouraging/reliable breadth/momentum signals fire off the June lows and sentiment/positioning remain quite pessimistic/defensive.

CFTC, Bloomberg Finance LP, Haver, Deutsche Bank Asset Allocation

- Treasury yields are still rising and restraining equity risk sentiment: The 2-year note is back up to 3.5% and the 10-year near 3.34%. Stocks haven’t been able to make much progress in years with a 3%+ 10-year: It rose back above there in mid-August as S&P rolled over. Not an ironclad relationship, but with fragile growth and a strident-sounding Fed this will restrain valuations all else equal.

- The consumer price index release next week will come when the Fed is in a speaker blackout period, so the market will have to sort out whether it tilts the September hike toward 50 or 75 basis points (or other). I still think either of those moves — along with a sense that it’s the last large hike and maybe a pause is in sight — should be fairly unthreatening to stocks.

- The steadfast bears such as Mike Wilson of Morgan Stanley are vociferous in calling for earnings forecasts to drop hard in coming months, ushering in another flush lower for stocks. It’s hard to prove it won’t happen, though decent top-line trends and the ballast of steadier-earning megacaps make it less likely index profits collapse without much notice. It is true, though, that valuations are merely neutral (15x forward excluding the five largest S&P 500 index weights) and that’s only if profit forecasts hold up.

- Those calling for a break of the June lows are clustering around 3,300-3,500 (prepandemic highs) as a target. The Sept. 2, 2020, preelection peak of 3,580 is also interesting if we again begin to approach the June lows (which isn’t a forgone conclusion). It’s worth keeping in mind that even bad bear markets have tended not to spend all that much time at the ultimate lows — one of the things that makes tactically positioning for a “final flush” difficult.

- Market breadth today is soft but not dramatically weak. Credit markets are holding up pretty well. VIX up small, in the 26s, uneasy but not a rush for protection. Lots of single-stock put buying last week based on aggregate volumes, so this is another “oversold” indicator that suggests it’s a pretty hedged-up market prone to quick bounces.

New Electric Mustang Only Lasted 6 Months Without Dangerous Complications – Ford Announces Major EV Recall

By Jack Davis September 1, 2022 at 3:43pm

Ford’s electric version of its legendary Mustang muscle car has been hit with a recall.

Ford is recalling 1,175 of its 2022 Mustang Mach-E electric vehicles due to concerns that the right-rear axle half shafts may have a manufacturing defect, according to Ford Authority.

The defect means that the part could break.

The website YourMechanic noted the danger of a broken axle.

“When your axle fails, it’s possible that you’ll lose control of the car, possibly causing an accident,” the site advised.

“If you suspect that your axles are about to break, time is of the essence. Once broken completely, your car won’t move, and if they break while you’re driving, it could cause a serious accident.”

As part of the recall, dealers will inspect the Mach-E and replace right-rear half shafts as necessary.

There have been no reports from owners of problems with the vehicle, Ford Authority reported.

The recall covers Mach-E models produced between July 18 and July 29 at the Cuautitlan assembly plant in Mexico.

The base price of a Mustang Mach-E when the 2022 model was unveiled was $43,995, Car and Driver reported last year. The first deliveries of the 2022 Mach-E were in February.

The Mach-E has been hit with recalls before, according to cars.com.

In June, Ford recalled some 2021-2022 vehicles because the high-voltage battery main contactors may overheat.

In May, a recall was issued for the all-wheel drive version of the car. The Mach-E’s powertrain control module safety software was found unable to detect some software errors that could have led to unintended acceleration or deceleration.

A 2021 recall was issued because the car’s windshields could detach. Another 2021 recall was issued because the front subframe bolts may not have been tightened properly during assembly.

Among the recalls issued for electric vehicles was a recent one for Toyota’s bZ4X electric SUV.

In June, Toyota warned owners not to drive the car for fear the wheels could fall off. Toyota said at the time the cause was a mystery, but it would look into the glitch.

The company has not yet found the problem and last month offered to buy back the SUV from any owner who wants to be rid of a vehicle that cannot be driven.

11 of Warren Buffett’s funniest and most frugal quirks

Published Tue, May 9 201711:57 AM EDTUpdated Tue, May 9 201711:57 AM EDT

Kathleen Elkins@KATHLEEN_ELKuffett’s most eccentric traits

Billionaire investor Warren Buffett, 86, is quite the character.

In the 2017 Berkshire Hathaway annual meeting, he and longtime business partner Charlie Munger, 93, entertained a crowd of 40,000 with hours of wit and wisdom, including Buffett’s opener: “That’s Charlie. I’m Warren. You can tell us apart because he can hear and I can see.”

Besides being funny, the second-richest man in the world is also frugal. Here are 11 of our favorite Warren Buffett quirks.

He never spends more than $3.17 on breakfast

On his five-minute drive to the office, which he’s been doing for the past 54 years, Buffett stops by McDonald’s.

Depending on how prosperous he’s feeling, he orders one of three items: two sausage patties for $2.61, a sausage, egg and cheese for $2.95 or a bacon, egg and cheese for $3.17.

On mornings when McDonald’s isn’t an option, such as when he’s visiting his good friend Bill Gates, he prefers Oreos for breakfastps his breakfast under $3.17

He drinks at least five Cokes a day

“I’m one quarter Coca-Cola,” Buffett tells Fortune. “If I eat 2700 calories a day, a quarter of that is Coca-Cola. I drink at least five 12-ounce servings.”

His explanation for his sugar-centric diet: “I checked the actuarial tables, and the lowest death rate is among six-year-olds. So I decided to eat like a six-year-old. It’s the safest course I can take.”

He lives in the same home he bought in 1958

It’s a five-bedroom in central Omaha that he bought for $31,500, or about $260,000 in today’s dollars.

If you want to be Buffett’s neighbor, the house across the street will cost you about $2.15 million.

He has “instructive art” hanging on his office walls

Buffett has copies of old New York Times front pages depicting economic crises, like the Panic of 1907 and the Great Depression.

“I wanted to put on the walls days of extreme panic in Wall Street just as a reminder that anything can happen in this world,” he says in HBO’s documentary, “Becoming Warren Buffett.” “It’s instructive art, you can call it.”cret to investing lays in the game of baseball

He’s been based in the same office building for more than 50 years

“It’s a different sort of place,” Buffett says of the small Berkshire Hathaway headquarters in Omaha where he’s been investing for more than 50 years.

As HBO’s documentary reveals, he likes continuity. He says, “We have 25 people in the office and if you go back, it’s the exact same 25. The exact same ones. We don’t have any committees at Berkshire. We don’t have a public relations department. We don’t have investor relations. We don’t have a general counsel. We just don’t go for anything that people do just as a matter of form.”

He doesn’t keep a computer on his desk

His work area also lacks a phone. In fact, Buffett has somehow managed to send only one email his entire life. That was to Jeff Raikes of Microsoft.

He reads about six hours a day

“I read and think,” Buffett tells Time. “So I do more reading and thinking, and make less impulse decisions than most people in business. I do it because I like this kind of life.”

When he’s not reading or thinking, he’s playing bridge

He spends about 12 hours a week playing bridge, often with Gates.

He once had a vanity license plate that read “THRIFTY”

It was on the back of his Lincoln Town Car.

Despite his billions, he’s a careful investor

The Oracle of Omaha has two rules of investing, he says in “Becoming Warren Buffett”: “Rule number one: Never lose money. Rule number two: Never forget rule number one.”

And he still uses coupons

The self-made billionaire still values a good deal. Buffett once bought Gates, the richest man in the world, lunch at McDonald’s with coupons.

Goldman’s Hatzius sees ‘encouraging signs’ that the economy could still achieve a soft landing

PUBLISHED TUE, SEP 6 202212:35 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

The Federal Reserve’s goal of achieving a “soft landing” for the U.S. economy amid soaring inflation and slowing growth remains a difficult but achievable task, according to Goldman Sachs’ top economist.

All the central bank needs to see is an economy growing below its potential for an extended period of time with a closer gap between labor supply and demand and a sizeable inflation decline.

If all that sounds difficult, it’s because it is.

Jan Hatzius, Goldman’s chief economist, acknowledged that “the path is narrow,” though he said several factors point to it being doable.

“While much can still go wrong and our probability that a (mild) recession will start in the next year remains about one in three, we see some encouraging signs that the economy is moving toward all three of these goals,” Hatzius said Monday in a client note.

His comments come with the U.S. dealing with a slowing economy that showed negative GDP growth in the first two quarters, compounded by inflation running near its highest levels in more than 40 years. Fed officials are raising interest rates to tame inflation but hope that the policy tightening won’t be so severe that it sends the economy into a deep recession.

Hatzius sees a number of factors working in the Fed’s favor.

Among them: A slow rebound in real income, a tightening of labor market conditions that will ease the upward pressure on wages and signs that the worst of the inflation hit is over. Those features in turn could allow the Fed to be less aggressive in its rate increases and give the economy some room to breathe even amid tighter fiscal and monetary policy.

“The recent news on inflation has been particularly encouraging,” Hatzius wrote. “Sharply lower commodity prices, a stronger dollar and large improvements in supply-chain disruptions all suggest that goods price inflation will continue to abate.”

Fed officials have said repeatedly they think they can control inflation without tanking the economy.

They have never defined, however, what a “soft landing” could look like. Chairman Jerome Powell has made the term even more nebulous by adding “softish” to his universe of potential outcomes, and warned earlier this summer that conditions are in flux.

“So anyone who is really sure that it’s impossible or really sure that it will happen is probably underestimating the level of uncertainty,” Powell said July 27 at his news conference following the last Federal Open Market Committee meeting. “And so I would certainly say it’s an uncertain, uncertain thing. Nonetheless, it’s our goal to achieve it, and we’ll keep trying to do that.”

However, Powell also warned recently that there will be “some pain” involved on the way to a soft landing.

The economy looks to be on course to avoid a third consecutive quarter of negative GDP growth. According to the Atlanta Fed’s GDPNow rolling gauge of economic data, the third quarter is on track to grow 2.6%.

Indicators of consumer spending have looked strong lately, and nonfarm payrolls rose 315,000 in August, the lowest monthly gain since April 2021 but still indicative of solid hiring growth. At the same time, the unemployment rate ticked higher to 3.7%, but for a reason the Fed likes to see, namely an increase in the labor force size that, if sustained, could compress that supply-demand imbalance that is driving wages higher.

However, the employment picture remains mixed, with openings outnumbering available workers by nearly 2 to 1 in July. Job openings are up 4.2% from a year ago, though Hatzius noted they have declined on net over the past three months.

At the same time, housing is mired in a deep slump amid rising mortgage rates that have led to the sharpest decline ever in affordability.

So while Hatzius said the U.S. is likely to avoid a serious recession, he said growth will remain subdued.

“All told, we remain comfortable with our forecast that U.S. growth will remain well below trend over the next year,” he said.

These are Wall Street’s favorite defensive stocks amid September’s reputation for market losses

The U.S. stock market has dropped for three straight weeks, with even a solid jobs report on Friday failing to stop an afternoon slide ahead of a holiday weekend, and now Wall Street is hitting it weakest seasonal period.

The summer rally is quickly slipping away, as investors struggle to find a reason for the market to turn back around.

“What I think we’ve seen in the past couple of weeks, and really got turbocharged with Powell’s speech at Jackson Hole last week, was the fact that the market was probably getting a bit overly optimistic or getting some wishful thinking about the potential for a dovish pivot from the Fed,” said Jacob Jolly, senior investment strategist at BNY Mellon Investment Management. “And I think that that idea has been pretty cleanly wiped out of the market at this point.”

And the market’s August decline has now bled into September, which has been the worst month for stocks since 1950, according to the Stock Trader’s Almanac, despite some recent strong years. In fact, the average September has seen stocks fall by 0.5% since 1950.

The downward trend and historical context will lead some investors to hunt for defensive stocks until the coast is clear. CNBC Pro screened for stocks in the utility, health care and consumer non-cyclicals sectors with high approval ratings from Wall Street, upside of at least 10% to their average price target and dividend yields above 2%.

DEFENSIVE STOCKS WITH BACKING FROM WALL STREET

| TICKER | COMPANY | % BUY RATING | TARGET PRICE % UPSIDE | DIV YIELD | YTD % PERFORMANCE |

| AES | AES Corp. | 76.9 | 10.6 | 2.4 | 6.4 |

| ETR | Entergy | 70.0 | 10.0 | 3.5 | 3.9 |

| ABBV | AbbVie | 54.2 | 14.6 | 4.0 | 2.3 |

| PEG | Public Service Enterprise Group | 59.1 | 13.9 | 3.2 | -2.8 |

| CVS | CVS Health | 60.0 | 19.5 | 2.2 | -3.1 |

| MDLZ | Mondelez International | 73.9 | 17.1 | 2.3 | -6.5 |

| TGT | Target | 54.8 | 16.7 | 2.3 | -28.8 |

Source: FactSet

Utility stocks are well represented on the list, with AES Corp. leading the group with a buy rating from nearly 77% of analysts, according to FactSet. The stock has also risen about 6% this year.

Because of their regulated status, utilities tend to have relatively consistent profits in good times and bad, which can make them more attractive during economic downturns.

Utility stocks do not typically present big upside in market rebounds, but Public Service Enterprise Group is trading about 14% below its average price target. The stock also has a dividend yield above 3.2%.

Outside of utilities, pharmaceutical stock AbbVie has also squeaked out a small gain year to date and pays a 4% dividend. The stock was named one of JPMorgan’s top ideas for September, specifically for investors looking at a value strategy.

Snack food company Mondelez International is the second most-liked stock on the list, with buy ratings from more than 70% of analysts. The Oreo cookie maker is coming off a strong revenue beat in the second quarter, when it also lifted its dividend.

“This quarter is another in a long line of stronger than expected performances for Mondelez speaking to the strength of its business fundamentals and the strong growth profile of its categories,” Stifel analyst Christopher Growe, who has a buy rating on the stock, wrote in a note to clients in late July. “The company is managing the inflationary environment well — pricing was up 8% and volume actually grew, up 5%, and well ahead of our estimate,” Growe added.

One stock on the list that has not been defensive so far this year is Target. The retailer has struggled to manage its inventories as consumer spending has shifted toward services and away from goods.

However, after two rough quarters, Target’s earnings per share may soon rebound, according to Citi analyst Paul Lejuez.

“While TGT’s 1H22 EPS declined by 65%, management is guiding to an 11% decrease in 2H EPS. And within that 2H guide, they assume a 3Q EPS decline of 30%+ while 4Q is expected to be up close to 10%,” Lejuez, who has a neutral rating on the stock, wrote in a note to clients on Aug. 23.

Other analysts are more bullish on Target than Lejeuz is, with about 55% of them having buy ratings on the stock. Target is trading more than 16% below analysts’ average price target.

— CNBC’s Michael Bloom contributed to this report.

We’re in a ‘housing recession,’ experts say. Here’s what that means for homeowners, sellers and buyers

KEY POINTS

- Sales of existing homes were down last month by 20.2% to 4.8 million properties from 6 million a year earlier.

- However, the median price last month was $403,800, up 10.8% from July 2021, and homes are still selling quickly.

- There are implications for buyers and sellers, who may already be seeing shifts in their local market.

Just months ago, the housing market remained in overdrive: surging home prices, historically low interest rates and unrelenting demand. However, data now suggests to some experts that the market is in a “housing recession.”

For example, sales of existing homes in July fell by 5.9% from June, marking the sixth straight month of a decline — and a drop of more than 20% from a year earlier. What’s more, there have been layoffs and slower job growth in the industry, homebuilder sentiment has turned negative and buyers are canceling contracts in the face of interest rates that have jumped to 5.72% from below 3.3% heading into 2022.

“We’re witnessing a housing recession in terms of declining home sales and home building,” Lawrence Yun, chief economist for the National Association of Realtors, said in a recent report.

At this point, however, it’s a different story for homeowners, buyers and sellers.

“It’s not a recession in home prices,” Yun added. “Inventory remains tight and prices continue to rise nationally with nearly 40% of homes still commanding the full list price.”

But there are signs the market is starting to shift in buyers’ favor.

‘Homeowners are in a very comfortable position’

“Prices are still rising in nearly all markets across the country … and inventory is improving slightly, but not greatly so,” Yun told CNBC.

“Homeowners are in a very comfortable position financially, in terms of their housing wealth,” Yun said. He also recently said homeowners are “absolutely not” in a recession.

Sales of existing homes were down in July by 20.2% to 4.8 million properties from 6 million a year earlier, according to NAR. However, the median price last month was $403,800, up 10.8% from July 2021.

With interest rates roughly double where they were six months ago, buyers have had more trouble qualifying for loans or affording higher rates.

“I am seeing homebuyers cancel a contract if their payment is just a little bit higher than what they expected — I’m talking about $100,” said Al Bingham, a mortgage loan officer at Momentum Loans in Sandy, Utah. “Homebuyers are very cautious right now.”

Buyers may encounter ‘a more balanced market’

For buyers, the slowdown in demand is generally good news, experts say.

“Buyers should expect a little better price negotiation possibility,” Yun said. “Last year, they were at the mercy of whatever sellers were asking … and there were multiple offers. Buyers may not face that now.”

While it depends on the specific market, there’s more of a chance that buyers will see more normal buying experiences. In some places, the slowdown means less competition and more likelihood that sellers will accept offers that come with contingencies — such as the buyer must sell their own home first.

“We’re seeing contingencies be accepted and that wasn’t happening,” said Stephen Rinaldi, president and founder of Rinaldi Group, a mortgage broker based near Philadelphia. “We’ll probably see a more balanced market.”

Sellers ‘need to be realistic’

Sellers, meanwhile, may want to temper their expectations.

“Sellers need to be realistic about the changing market,” Yun said. “They cannot expect to simply list their home at a high price and easily find a buyer.

“Too many buyers chasing after too few properties — those days are over,” he said.

At the same time, homes are still selling quickly. In July, properties typically remained on the market for 14 days, down from 17 days a a year earlier, according to the Realtors association.

HI Financial Services Mid-Week 06-24-2014