HI Market View Commentary 08-19-2019

OK let’s talk about Valuation, Drawdowns and China

Valuation is determining how cheap or expensive a stock price is

How can you buy low and sell high – I look like Buffett at the “cheapness” of the stock price

Just to remind you there is a significant difference between taking a loss and having a drawdown in your portfolio

Once again we are in a first time ever “Presidential Tweet driven, headline risk market”

I feel like the media is also fake news and full of crap most of the time

Kevin why do you invest in BIDU?

International portfolio exposure, most profitable stock I’ve ever invested in

Where will our markets end this week?

Higher

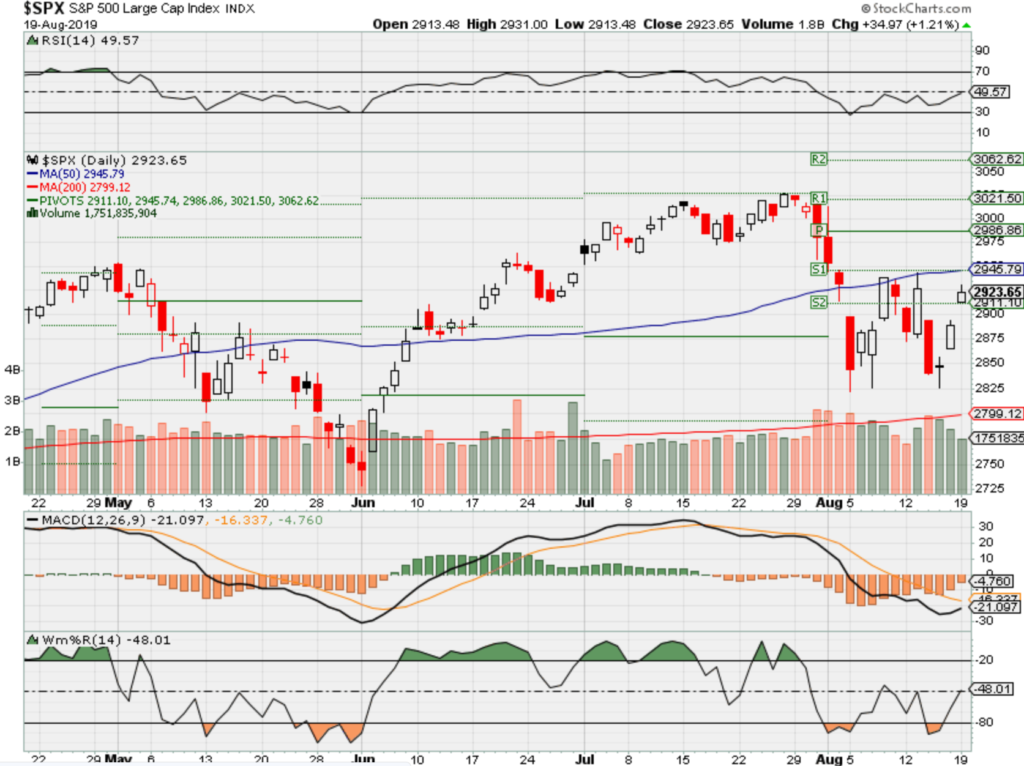

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end Aug 2019?

08-10-2019 -1.0%

08-12-2019 -1.0%

08-05-2019 0.0%

07-29-2019 +0.5%

Earnings:

Mon: BIDU, EL

Tues: HD, KSS, MDT, SDRL, CREE, TOL, URBN

Wed: LOW, TGT, LB, JWN

Thur: BJ, DKS, HPQ, ROST, CRM, VMW

Fri: BKE, FL, RRGB

Econ Reports:

Mon:

Tues:

Wed: MBA, Existing Home Sales,

Thur: Initial, Continuing, Leading Indicators,

Fri: New Home Sales

Int’l:

Mon –

Tues –

Wed –

Thursday – ECB Monetary Policy Meeting Accounts

Friday-

Saturday/Sunday – G7 Meeting

How am I looking to trade?

I’m preparing for earnings = Adding long puts

BIDU – 8/19 est

MU – 9/19 est

MRVL 9/05 est

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Disney’s bundle of Disney+, ESPN+ and ad-supported Hulu will cost $12.99 per month

PUBLISHED TUE, AUG 6 2019 4:57 PM EDTUPDATED THU, AUG 8 2019 3:59 PM EDT

KEY POINTS

- U.S. customers would be able to get Disney+, ESPN+ and ad-supported Hulu for $12.99 a month.

- The bundle will be available when Disney+ launches on Nov. 12.

Disney is finally bundling its three streaming services and it’s going to cost you $12.99 a month.

On an earnings call Tuesday, CEO Bob Iger said that U.S. customers would be able to get Disney+, ESPN+ and ad-supported Hulu for under $15 a month.

Iger said the bundle will be available when Disney+ launches on Nov. 12.

“Our play… is to have general entertainment, we’ll call it Hulu, more family-like entertainment which is Disney+ and sports.,” Iger said on the call. “And that bundle that we’re creating, that $12.99 bundle where you can buy all three, offers consumers tremendous volume, tremendous quality and tremendous variety — for a good price.”

The Disney+ video streaming service will draw on Disney’s deep catalog of content and offer up new shows featuring favorite characters from “Toy Story” and “Monsters Inc.” to Marvel and “Star Wars.”

Also, with the Fox acquisition now closed, Disney will put all episodes of “The Simpsons” on the service on day one as well as “The Sound of Music,” “The Princess Bride” and “Malcolm in the Middle.”

“We’re also focused on leveraging Fox’s vast library of great titles to further enrich the content mix on our DTC platforms. For example, reimagining ‘Home Alone,” “Night at the Museum,” “Cheaper by the Dozen” and “Diary of a Wimpy Kid,’” Iger said on the call.

All Disney films released in 2019 will also be available on Disney+ as soon as their theatrical and home entertainment windows have closed. “Frozen II” will also be available exclusively on the platform by the summer of 2020.

Disney+ on its own will cost users $6.99 a month, or $69.99 for a full year.

ESPN+ is part of Disney’s plan to revitalize the sports network. Viewership has been on the decline, relationships between cable operators and networks are tense, and the situation remains unstable as more people ditch cable for streaming services.

It has seen fast growth in the ESPN+ service since launching last year, adding more than 2 million subscribers.

Also, having a sports streaming service separates Disney from competitors like Netflix and Amazon Prime Video, which have limited live sports programming. Prime does stream Thursday Night Football games in the U.S. and Premier League games in the U.K.

10 money rules that helped me become a millionaire at 28

Published Wed, Jun 5 2019 11:54 AM EDTUpdated Thu, Jun 6 2019 1:15 PM EDT

Sam Dogen, Contributor@FINANCIALSAMURA

There are roughly 11.8 million Americans with a net worth of at least $1 million, making up 3% of the U.S. population, according to Spectrem Group’s 2019 Market Insights report. Although being a millionaire today isn’t what it used to be, reaching that milestone is still a significant achievement.

Before I became a millionaire at 28, I told myself I was either going to make it or be an absolute failure by the time I turned 30. The fear of having no job, no savings, no investments and no option to retire early kept me motivated.

There’s no “secret formula” to amassing wealth. But I can tell you that road to becoming a millionaire is much easier when you’re in your 20s: You have more energy, less dependents and little to lose.

Here are the 10 money rules that helped me reach a $1 million net worth at 28:

1. Stay focused in school

Slacking in school won’t get you anywhere. Your binge-watching habits will only hurt your GPA. There are tons of people who graduate in the top 1% of their class every year. Be one of them. You’re paying thousands of dollars for your education, so why not take advantage of it?

You can keep insisting that grades don’t matter, but it won’t change the job market competition. While some prestigious companies will tell you that “GPA isn’t the whole story,” it doesn’t mean they won’t ask for your transcript — because believe me, they will.

Graduating with a 3.78 GPA helped me land a job at Goldman Sachs. But it still wasn’t easy. I spent six months aggressively applying for jobs and went through 55 interviews before getting an offer.

2. Save until it hurts

I was once a poor college student, so just landing a job with any consistent salary made me feel rich. But I continued living like a student for years even after my first full-time job. It took a lot of willpower and discipline to save as much as I did.

I didn’t make excuses as to why I needed nice clothes or a new car. I shared a tiny studio with a friend for two years to keep my living costs low. That allowed me to max out my 401(k) on a modest salary and also save another 20% of my 401(k) cash flow.

Try to save at least 20% of your after tax income every year, no matter what. Remember, if you’re not in pain from the amount of money you’re saving each month, you’re not saving enough.

3. Work hard and know your place

Working hard takes absolutely no skill. I promise that if you’re the first person in the office and the last to leave, you’ll get ahead. Pay your dues early and you can relax when you’re older. Will your social life suffer? A little bit, yes. But you’re young, remember? Your energy is limitless!

Early in my career, I got to work at 5:30 a.m. and left after 7:30 p.m. I learned a lot, got more done and gained the respect of my peers. And because my boss recognized my hard work ethics, I was able to save my job during the 2000 dot-com bubble burst.

4. Consider both aggressive and conservative strategies

Investing in an S&P 500 index fund is fine, but if you want to get rich fast, I recommend making more high-risk bets. You can land bigger wins for a small portion of your portfolio.

Don’t go crazy and blow all your money away, but be willing to experiment with aggressive investment strategies. Like I said, when you’re young, you have very little to lose.

When I was 22, I only had about $4,000 to my name. Regardless, I invested 80% of my money in one stock and got a 5,000% return. Part of it was luck. But I did my research, took a big risk and it paid off.

5. Make property your best friend

Inflation is a beast. Make it a goal to own a primary residence as soon as you know where you want to live for the next five to 10 years. If you put a 20% down payment on a home and it goes 3% up per year, that’s a 15% return on your cash.

At 26, I used the lucky win I made from one stock investment and bought a two-bedroom, two-bathroom condo in San Francisco for $580,500. The mortgage has since been paid off and the property now generates a steady stream of income.

6. Live like you’re poorer than you actually are

The richer you become, the more frugal and low-key you should be. Too many young people waste money on things they don’t need — simply to show off to their friends or on social media.

There’s no shame in being young and poor. Drive a cheap car. Live in a modest home. Don’t eat out every day. Don’t buy clothes you don’t need (thanks to Mark Zuckerberg and Steve Jobs, wearing the same thing every day is cool). And then be the unassuming millionaire next door.

Once I became a millionaire, I purchased a six-year-old car and drove it for the next 10 years. After that, I leased a Honda Fit and drove it for three years. I still wear the same casual athletic clothes I wore in my 20s.

7. Start a side hustle

You can make money by working a full-time job or by starting a business. Better yet, you can do both. Over time, your side hustle might turn into a big business that will generate even more income than your full-time job.

In 2009, I launched Financial Samurai as a way to make sense of all the financial chaos. Little did I know that the site would grow so big and so fast. It gave me the confidence to negotiate a severance in 2012 and leave my full-time job for good.

8. Build a strong support network

To get ahead, you’ve got to build as many allies as possible. Being a hard worker isn’t enough. You have to talk to people, show an interest in them and get them to like you.

Once you have someone with significant power on your side, your entire career will advance much faster. I always made it a point to take a colleague out for coffee at least once a week. Building deep relationships helped me get promoted to vice president at 27.

9. Invest in your education

Your brain is your greatest asset. A strong education is the most valuable thing you have, so keep expanding your knowledge — even after college. Thanks to the Internet, you can now learn almost anything for free.

After completing my part-time MBA program, I continued taking courses to stay up to date with everything finance-related. That also fueled me to keep writing on Financial Samurai — and the more I did, the more money I made.

10. Keep track of your progress

The amount of money you save is more important than the amount you earn. I know tons of people who made millions and then ended up broke a few years later because they had no idea where their money went.

Take advantage of free financial tools online. Track your cash flow, analyze your investment portfolio, calculate your financial needs in retirement — just stay on top of your finances.

I’ve been using a free online wealth management tool since 2012. By diligently tracking my net worth, I’ve been able to optimize my wealth to the fullest.

A $1 trillion US budget deficit is one big reason the Fed may have to cut rates

PUBLISHED TUE, AUG 13 2019 1:40 PM EDTUPDATED TUE, AUG 13 2019 2:20 PM EDT

KEY POINTS

- The recent debt deal between the White House and Congress virtually guarantees trillion-dollar deficits well into the future.

- A Credit Suisse analyst says that if the Fed doesn’t cut interest rates, markets could be disrupted by the big influx of debt.

- Taxpayers have shelled out nearly half a trillion dollars already this year for debt servicing costs.

If low inflation, a wobbly economy and tariff jitters weren’t enough to push the Federal Reserve to lower interest rates, there’s also the simple reason of the swelling national debt.

The recent debt deal struck between the White House and Congress virtually guarantees trillion-dollar deficits well into the future as well as continued acceleration of the government’s collective IOU, which is now at $22.3 trillion.

Trying to finance all that red ink is going to be tricky. Investors will need to be willing to sop up all that paper and may want a little extra yield for doing so.

With all that in mind, the Fed could have no choice but to lower rates, unless it wants to go back to buying Treasurys itself.

The supply of debt coming to market will lead to “acute funding stresses,” Credit Suisse managing director Zoltan Pozsar said in a note. He called the situation a ”‘fiscal dominance’ of money markets” and warned of the consequences of an inverted yield curve, where the fed funds rate sits well above the benchmark 10-year Treasury note yield.

“Absent a technical bazooka, stresses will leave one option left: more rate cuts,” he said. Reductions in the benchmark overnight funds rate will need to be “aggressive enough to re-steepen the Treasury curve such that dealer inventories can clear and inventories don’t drive funding market stresses.”

“The curve remains deeply inverted relative to actual funding costs that matter; dealer inventories are at a record; and banks that fund dealer inventories are at their intraday liquidity limits,” he added. “Supply won’t be well received given the inversion.”

Markets already expect the Fed to cut rates after July’s 25 basis point reduction, the first time that had been done in nearly 11 years. Popular reasons for the cut are concerns that the global economic slowdown will infect the U.S., the persistently low inflation that policymakers fear has held back living standards, and the ongoing tariff war with China.

What seldom gets mentioned is just how much pressure the government debt situation exerts, particularly with the Fed deciding to exit the bond market.

The taxpayers’ tab

Credit Suisse estimates that the Treasury Department will issue $800 billion in new debt before the end of the year and increase its cash balance by $200 billion, compared with the current $167 billion.

Over at the Fed, the central bank just ended a program in which it was reducing the bonds it was holding on its balance sheet by allowing some proceeds to roll off each month. Pozsar called the end of this so-called quantitative tightening “a nice gesture, but not a solution.”

The most feasible solution to alleviate market pressures, he said, is a rate cut.

“We recognize that the Fed doesn’t bend to the circumstances of dealers and carry traders, but we’d also note that we never had this much Treasury supply during a curve inversion on top of record inventories with leverage constraints!” Pozsar wrote.

Taxpayers, of course, are on the hook to those buying the government’s debt.

Servicing costs for the dent in the current fiscal year are just shy of half a trillion dollars — $497.2 billion through July — and certain to pass 2018′s record $523 billion. Over the past decade’s debt explosion, taxpayers have shelled out $4.4 trillion in financing costs.

President Donald Trump has repeatedly pressed the Fed for more rate cuts and an end to quantitative tightening, citing the competitive disadvantage the U.S. has with other global economies where central banks have loosened.

Should the Fed not deliver, Pozsar said, there would be troublesome market results. He said the funds rate could end up printing outside the 2% to 2.25% range where the Fed targets the benchmark, and there likely would be stresses in the international overnight markets that could be tantamount to another hike.

Strategist: Yield curves predict ‘absolutely nothing,’ and central banks ‘never run out of bullets’

PUBLISHED THU, AUG 15 2019 12:50 AM EDTUPDATED THU, AUG 15 2019 7:14 AM EDT

KEY POINTS

- “My view has always been that yield curve predicts absolutely nothing,” says Viktor Shvets, head of Asian strategy at Macquarie Commodities and Global Markets.

- “It has to be made clear: Central banks never run out of bullets, ever,” he says.

- While fiscal responsibility and structural reforms are good ideas in theory, they almost never work in practice, the strategist adds.

Fears are rising that a recession looms after a closely watched market metric flashed a warning signal, but one strategist told CNBC the supposed indicator “predicts absolutely nothing.”

The yield on the 10-year U.S. Treasury briefly broke below the 2-year rate on Wednesday stateside. That so-called inverted yield curve has historically been regarded as a precursor to an economic recession. U.S. markets fell following the inversion, with the Dow Jones Industrial Average losing around 800 points. The rates inverted again in the morning of Asian trading hours on Thursday.

Nevertheless, Viktor Shvets, head of Asian strategy for Macquarie Commodities and Global Markets, brushed off those concerns.

“My view has always been that yield curve predicts absolutely nothing,” he told CNBC’s “Squawk Box” on Thursday.

“What it does tell you (is) that you will have a recession if you don’t do something about it,” Shvets added.

The yield curve inversion, he said, may demonstrate that the global economy is slowing down. That’s because of a lack of liquidity, absence of reflationary momentum and a de-globalization of trade and capital flows, according to Shvets.

“If you reverse those elements, then the yield curve will respond very quickly,” the strategist said, adding that, to him, “recession equals policy errors.”

Central banks ‘never run out of bullets’

Weighing in on concerns that central banks may not have enough fuel in their tanks to make their policy count, Shvets said that notion was “nonsense.”

“It has to be made clear: Central banks never run out of bullets, ever,” he said. “There are so many tools that central banks can bring to bear, (other than) just looking at interest rates. ”

Asked if he is worried that the markets and economy would become numb and weaken the impact of central bank action, Shvets had questions of his own.

“Would you rather have a deep recession? Would you rather have closures of factories? Would you rather have banks going down and people losing their deposits?” he asked. “If the answer you give me is ‘no,’ then there is no choice but to take various forms of drugs.”

Taking the analogy further, he said: “One of the things we’ve been suggesting is that there are drugs that have lower side effects than monetary policy. And I think we need to brace those other drugs, not because they are fixing the problem, but because they are extending our life.”

While fiscal responsibility and structural reforms are good ideas in theory, they almost never work in practice because “people are reluctant to embrace” them, Shvets added.

“What people would like to see is a perpetual growth machine. That’s what we got used to, for the last 30, 40 years,” he said. “To break away from that is almost impossible without really gut-wrenching adjustment.”

Given the choice between resetting the system and finding new ways to extend growth, he said most would choose the less painful option.

“It just can’t go on forever,” he said. “But we can extend it for another decade or longer.”

— CNBC’s Thomas Franck and Eustance Huang contributed to this report.

Greenspan says ‘there is no barrier’ to negative yields in the US

PUBLISHED TUE, AUG 13 2019 2:17 PM EDTUPDATED TUE, AUG 13 2019 2:33 PM EDT

Maggie Fitzgerald@MKMFITZGERALD

KEY POINTS

- Former Federal Reserve Chairman Alan Greenspan said nothing is stopping the U.S. from getting sucked into the global trend of negative yielding debt, Bloomberg reported Tuesday.

- “There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, beside being a certain level,” Greenspan told Bloomberg on the phone.

Former Federal Reserve Chairman Alan Greenspan said nothing is stopping the U.S. from getting sucked into the global trend of negative yielding debt, Bloomberg reported Tuesday.

“There is international arbitrage going on in the bond market that is helping drive long-term Treasury yields lower,” Greenspan said in a phone interview. “There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, beside being a certain level.”

With global central banks engaging in unprecedented monetary easing, a record $15 trillion of government bonds worldwide now trade at negative yields. As uncertainty reigns, investors are looking for a safe haven for their money, even if it means getting back less than they gave.

“Why people continue to buy long-term Treasurys at such low yields may be also due to forces having altered people’s time preferences,” Greenspan said. “But there is hundreds of years of history showing the long-term stability in time preference, so these changes won’t be forever.”

Greenspan, who chaired the central bank from 1987 to 2006, said nothing is standing in the way of the U.S. breaching the zero level.

The U.S.-China trade war is putting pressure on the 10-year Treasury note, which nearly inverted with 2-year Treasury note, a historic recession indicator. Weaker economic data domestically and abroad also pressured the Federal Reserve in July to cut interest rates for the first time since the financial crisis.

Greenspan is not alone in his hypothesis.

Pimco, one of largest fixed income mangers in the world, said last week that “U.S. Treasuries – which many investors view as the ultimate ‘safe haven’ apart from gold – may be no exception to the negative yield phenomenon. And if trade tensions keep escalating, bond markets may move in that direction faster than many investors think.”

JP Morgan, in a 2016 analysis, said the Fed might one day be pushed to negative yields.

“If recession risks were realized, the need for substantial additional policy support would likely push the Fed towards NIRP,” the bank wrote.

Growth forecasts are rising and economy looks nowhere near as bad as bond market predicts

PUBLISHED THU, AUG 15 2019 12:57 PM EDTUPDATED THU, AUG 15 2019 3:32 PM EDT

KEY POINTS

- Economists ratcheted up their GDP forecasts for the third quarter to a median 2.1% after a batch of better-than-expected data, according to to the CNBC/Moody’s Analytics Rapid Update.

- The data paints a picture of an economy that looks nowhere near as bad as recent action in the bond market would suggest, and economists say it’s the strength of the U.S. consumer driving the economy

- The manufacturing sector does show signs of strain, but the consumer is two-thirds of the economy and it is pulling its weight.

By many measures, the economy is outshining the depressed picture the bond market has been painting of growth, and a big reason is the resilient American consumer.

The latest batch of U.S. economic data, released Thursday, shows a strong consumer and a mixed picture for manufacturing, but still better than expected. Based on the data, economists surveyed in the CNBC/Moody’s Analytics Rapid Update raised their forecasts for third quarter GDP by 0.2 to a median 2.1% pace of growth.

July’s retail sales, which take the pulse of consumer spending, jumped a much stronger-than-expected 0.7%, and two key business indexes for the New York and Philadelphia area showed continued expansion in August. Productivity in the second quarter grew at a better-than-expected pace of 2.3%, but industrial production was weaker, declining 0.2% in July after gaining a revised 0.2% in June.

“The U.S. is pretty strong actually. The markets are trading more off the headline risk, particularly around tariffs, than the actual fundamentals, at least from the U.S. data,” said Tony Bedikian, head of global markets at Citizens Bank. “The jury is still out whether the market is going to be correct here, and whether we are going to see a slowdown. We’re not seeing that in the data. Broadly, we’ve seen some slower growth, but it’s still growth. It’s waning a bit but it’s still kind of a Goldilocks scenario.”

Bedikian said the Fed is still expected to cut interest rates, which should help the markets and economy, even though the data shows a fairly solid economy.

Another piece of data released Thursday was homebuilders confidence, which rose as mortgage rates fell sharply this month. Builder confidence for single-family homes hit 66 in August, 1 point higher than in July, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index. Anything above 50 is considered positive.

Yield curve inversion

Markets have been spooked by the steep decline in bond yields since the Federal Reserve’s rate cut July 31, and most recently by the inversion of the 2-year and 10-year Treasury yields.Inversion means the yield on a shorter duration security, in this case the 2-year Treasury note, moved higher than the longer duration note, or the 10-year Treasury. While the spread is no longer inverted, it still could easily move that way again. An inverted curve has been a very reliable signal of a recession.

In fairness, U.S. yields have also been moving lower as investors seek better yielding sovereign debt in the Treasury market. Yields move opposite price, and the yields on some sovereign bonds in Japan and Europe are negative. Bond yields have also been moving lower as global data from China and elsewhere has looked weak, and strategists say the bond market is reflecting both a flight to safety and fear the U.S. will fall into the weakening trends in Asia and Europe.

Chris Rupkey, MUFG’s chief financial economist, said the bond market is not reflecting reality but fear brought on by the U.S.-China trade wars.

“It’s certainly overstated. If you look at retail sales, one of the signs of a recession is three consecutive monthly declines in retail sales, and we’re seeing just the opposite,” said Rupkey. He noted that retail sales reports were weak at the end of last year and beginning of this year before recovering.

Michelle Meyer, head of U.S. economics at Bank of America Merrill Lynch, had expected the consumer to look strong in July, and her forecast for 0.6% gain was nearly double the sales increase expected in the consensus forecast. One of the big drivers of the gain was Amazon’s Prime Day, which triggered lots of promotional activity at other retailers.

“The promotion season was so big, and it was retailers outside of Amazon trying to compete,” said Meyer. She said a weak consumer would not have been lured by promotions. “It shows the consumer was able to spend.”

Economists say the consumer has been supported by a solid labor market, which is showing some signs of slowing but still adding jobs at a solid pace. Weekly jobless claims is a closely watched indicator because it is the freshest signal on employment, and one of the first pieces of data to show weakness when the employment picture changes.

The weekly jobless report on Thursday showed claims rose by 9,000 to 220,000 last week, but one economist noted the number of new claims being filed has been locked in a narrow range between 207,000 to 222,000 in 13 of the last 14 weeks. “Firms are struggling so much with a scarcity of qualified workers that it is hard to imagine layoffs rising much any time soon unless the economy falls off a cliff,” said Stephen Stanley, chief U.S. economist at Pierpont Amherst.

The monthly employment report two weeks ago showed the economy added 164,000 nonfarm payrolls in July, nearly as expected and about the average monthly gain for the year. That pace is down from 2018′s strong average monthly job growth of 223,000 payrolls, but economists see the level as still solid, with an unemployment rate at 3.7%.

“Factory output is not out of the woods yet in this latest soft patch caused by trade war uncertainty and slowing exports growth,” Rupkey said. “Production is down but not out as the trend is largely sideways since the low for the year was made back in April.”

‘Consumer is two-thirds of the economy’

But Rupkey adds that the output from manufacturing is mostly exported so with volumes lower as a result of the trade war, manufacturing is soft.

“The biggest surprise is consumer spending continues at such a rapid rate. There’s still a question mark over the trade war and what that’s doing to manufacturing production in this country,” said Rupkey. “I think the more powerful data is really the consumer. The consumer is two-thirds of the economy. Manufacturing is only 10% of private jobs.”

He noted that manufacturing has fallen more than 1.5% this year, marking the second time in a decade that it has declined outside of a recession. But Rupkey does not believe it will have negative implications for the broader economy. “The health of factories is still an important driver of growth and the soft patch for production remains a factor that is keeping economic growth in the slow lane,” he said.

The worry, however, is the weakness in manufacturing and investment spending will spill over to the consumer economy if companies become more negative in their outlook and hold back on hiring or paying wage increases.

But economists said they were encouraged Thursday by better-than-expected business surveys.

“I was pleasantly surprised by the Empire Manufacturing and Philadelphia Fed. Both came in above expectations and these are August surveys,” said Meyer, adding respondents would have known about the latest escalation in the trade wars and tariffs. “Their sentiment actually improved in the month.”

The Empire State Manufacturing Survey had been expected to show a reading of 0.5 while the Philadelphia Fed Business Outlook Survey was projected at 8, according to economists surveyed by Dow Jones. Both readings were well above those expectations, with the New York gauge posting a 4.8 reading and Philadelphia 16.8.

Trump called the CEOs of the biggest US banks on Wednesday as the stock market plunged

PUBLISHED FRI, AUG 16 2019 12:13 PM EDTUPDATED SAT, AUG 17 2019 9:11 AM EDT

KEY POINTS

- Trump held the call with J.P. Morgan Chase CEO Jamie Dimon, Bank of America’s Brian Moynihan and Citigroup’s Michael Corbat, according to people with knowledge of the situation.

- The president asked the three men to give him a read on the health of the U.S. consumer, according to one of the people.

- The executives responded that the consumer is doing well, but that they could be doing even better if issues including the China-U.S. trade war were resolved, this person said.

President Donald Trump held a conference call with the CEOs of the three biggest U.S. banks as the stock market tanked Wednesday.

Trump held the call with J.P. Morgan Chase CEO Jamie Dimon, Bank of America’s Brian Moynihan and Citigroup’s Michael Corbat, according to people with knowledge of the situation. The Dow plunged 800 points, or 3%, in its worst day of the year on Wednesday amid a recession warning from the bond market.

The president asked the three men to give him a read on the health of the U.S. consumer, according to one of the people. The executives responded that the consumer is doing well, but that they could be doing even better if issues including the China-U.S. trade war were resolved, this person said.

The CEOs also told Trump that the trade dispute is damaging the outlook for capital spending by corporations, according to another person with knowledge of the discussions. The president was receptive to the notion that uncertainty over trade is hurting corporate confidence, this person said.

They also talked about the Federal Reserve and the global economic slowdown that has central banks around the world moving to ease monetary conditions, this person said. One opinion batted around during the call: A 25 basis point cut by the Fed won’t likely change capital flows in the markets.

The call, which lasted about 20 minutes, happened after the CEOs concluded a previously scheduled meeting with Treasury Secretary Steven Mnuchin in Washington. Trump wanted to speak to the three executives, the men were informed, and he called in from his property in New Jersey. Bloomberg first reported on the conference call.

Trump has been reaching out to corporate leaders this week amid his concerns that a slowing U.S. economy could impact his reelection chances, according to a Thursday piece from The Washington Post.

The discussion was reminiscent of one held in December by Mnuchin during an earlier stock market rout with the heads of the six biggest U.S. lenders.

Bank stocks are among the most hammered recently after the yield curve inverted Wednesday, an unusual event where yields on longer-term bonds fall below that of short-term ones. That’s because falling rates pressure the industry’s profit margins, and also the signal typically means that a recession is coming, which would lead to increased loan defaults.