HI Market View Commentary 08-08-2022

Kevin,

You are receiving this email because I NEED YOUR HELP. What a rough year and I’m giving up. I just can’t do it and my account is down big!!!!! This is bullstuff and I would like to ask for your honest assessment for what I am doing wrong. If it is possible, without naming names, would you review my portfolio and teach me what I should be doing. I would like to see an overview of investing the Hurley Investments way. I will be attending next Monday and I am heartbroken for the accident your family has gone through with your son. God bless you and your son. Best wishes and blessing on your son and family,

Well here we go, DOWN Big 63% on a six figure portfolio

First is that we are measured against the S&P 500. Why?

Because it is a tangible reference point, it’s something that represents the stock market as a whole

It’s a measuring stick

Past History…..I’ve traded everything: Penny Stocks, Day Traded, Stock picked, Option traded, Futures, Forex, Commodities, futures for commodities, spread traded, diversification, long/short, equity swaps, newsletter, adjusting trades, bonds, bond funds, reits, treasuries, I’ve dumped 5K in 50 different coins, NFT, garbage, Artificial intelligence, Algorithms, Technical analysis red/green arrows

I can tell you 50K can go to 255K and back down to 50K, 20K can go to 85K and back down to 15K but I took about 5 K out

I don’t spread trade much at all because……

Lost and done, 15% max should be a portfolio in stock replacement strategies, 20% spread trades

It’s speculative, BECAUSE NOT ALL ADJUSTMENTS WORK

It pisses me off

There is no other form of trading with a competitive advantage for the investor EXCEPT collar trading or protective put

There is also no average rate of return to count on even though we have been doubling portfolios every 4.5 to 5.5 years

SO HI Collar trades with these assumptions

Averages are not your friends

Anything made up on the way down is profit on the way back up

Taking a profit even when you could have made more is not a bad thing

Dollar cost averaging without having to invest more money

Nobody truly knows where the market goes in the short term – 1 year, 3 years, 5 years, 10 years

Weekly we touch base with clientele to let them know what we are doing

Our markets are acting ridiculously resilient

This is a longer cycle than our 2020 stealth 20% drop Google/YouTube Hurley Investments results 2020

Earnings dates:

BIDU 8/30 BMO – Pricing power

COST 9/22 AMC – ????

DG 8/25 AMC – NO

DIS 8/10 AMC – Pricing power

MU 9/28 – NO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 05-Aug-22 15:22 ET | Archive

The labor market’s glass is full and half empty

Remember February 2020? Those were the good old days (so to speak). COVID was out there, but it wasn’t anything close to what it would eventually become as an economic disruptor.

There might have been a chill in the air in February 2020 (it was winter after all), but in the labor market things were nice and warm for the most part, and downright hot in some respects.

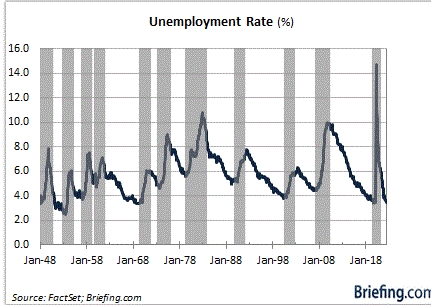

Nonfarm employment was 152,504,000 and the unemployment rate of 3.5% was close to a 50-year low in February 2020.

What we know following the release of the July 2022 Employment Situation Report is that the labor market is full again. Nonfarm employment stands at 152,536,000 and the unemployment rate sits at 3.5%.

Even so, it’s hard to shake the idea that the labor market’s glass is starting to feel half empty.

A Head Scratcher

The recovery in nonfarm payrolls has been astounding. According to the Bureau of Labor Statistics, nonfarm payroll employment has increased by 22 million since reaching a low in April 2020.

Many reports suggest nonfarm payroll employment has more room to grow, too. To that end, there were 5.67 million people officially counted as being unemployed in July, yet the most recent JOLTS Job Openings and Labor Turnover Survey showed there were 10.698 million job openings is June. That is nearly 1.9 job openings for every unemployed worker.

It remained a bit of a head scratcher then that the labor force participation rate dipped to 62.1% in July from 62.2% in June. There are lots of available jobs out there, but plenty of people are choosing not to seek them.

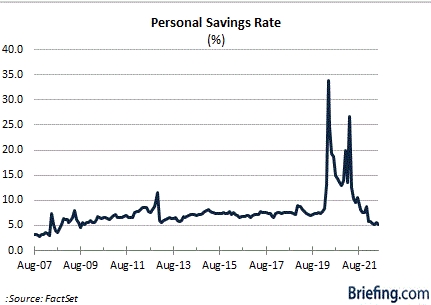

The reasons why are debatable, but worries about COVID exposure in the workplace, an inability to find affordable childcare, early retirements, and a cushion of excess savings from stimulus payments have often been cited as causal factors.

If more people returned to the labor force, then the unemployment rate would presumably move higher. That isn’t happening — not yet anyway. Instead, we are back to an unemployment rate that is close to the lowest in 50 years.

That is something that can, and should be, celebrated. The party-pooper observation, however, is that the unemployment rate is typically quite low in front of a recession or extended period of economic weakness.

That’s because hiring activity picks up in stronger periods of growth, but those stronger periods can also stoke inflation and tighter monetary policy designed to keep the economy from overheating.

Lo and behold, we have inflation running at a 9.1% annual rate and a Federal Reserve that is busily raising the target range for the fed funds rate to get inflation under control.

The confounding factor, considering what we just wrote, is that the U.S. economy recently recorded its second straight quarter of contraction. Real GDP decreased at annual rate of 0.9% in the second quarter after decreasing at an annual rate of 1.6% in the first quarter.

There are better forecasts for the third quarter. The Atlanta Fed’s GDPNow model estimate for real GDP growth in the third quarter is 1.4%. That is better than negative growth, but still below potential.

If They So Choose

Policy rates work with a lag effect. The Fed only started raising the target range for the fed funds rate off the zero bound in March, so arguably that move is only now just starting to be felt in the broader economy — which is saying something because the Fed raised rates again in May, June, and July, and is destined to raise rates in September and likely in November and December as well.

The strong July employment report has solidified those expectations.

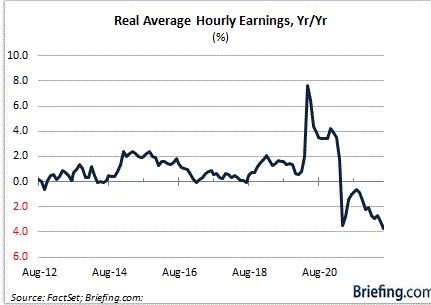

Stronger-than-expected average hourly earnings growth whipped up inflation concerns again, not only from a headline perspective but from the inexplicit takeaway that the dip in the labor force participation rate could keep wage rates elevated as employers try to fill available openings if they so choose.

That is the question, however. Will they choose to do so?

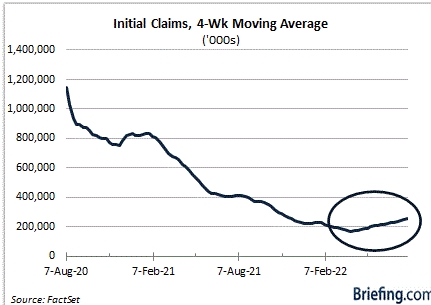

The trend in initial jobless claims — a leading indicator — has started to turn higher.

The anecdotal evidence is starting to build, too, that companies are re-thinking their hiring plans due to signs of a slowdown in demand and/or concerns that demand will slow due to rising interest rates here and elsewhere, as well as the inflation pressures consumers are feeling.

Recall that Walmart said it is seeing its customers spend less on general merchandise categories because they are being adversely impacted by food and fuel inflation. We also know from the June Personal Income and Spending Report that real disposable personal income was down 3.2% year-over-year.

Clearly, the housing sector is weakening, as is homebuilder sentiment, amid rising mortgage rates. One is hard pressed to think that a homebuilder or mortgage broker is going to ramp up hiring activity in this environment.

Alas, it might be seen as good news that average hourly earnings in July were up 5.2% year-over-year until one recognizes that they were negative on an inflation-adjusted basis. That is a real discretionary spending pressure for consumers, lest they turn to increased use of credit cards or personal savings to maintain a higher discretionary standard of living — or simply to meet their basic needs.

We saw in the same personal income and spending report that the personal savings rate, as a percentage of disposable personal income, dropped to 5.1% from 5.5% in May. That is the lowest personal savings rate since 2009.

What It All Means

The July employment report was a good piece of economic news. It stood out in a world where “better than feared” qualifies as great news. No dispensations were needed with the employment report, however. It was strong.

Unfortunately, it can’t shake the label of being a lagging indicator, particularly in the face of coincident and leading indicators that are portending a more challenging economic road ahead:

- The Treasury yield curve is inverted.

- Federal Reserve officials are talking up the need to move above a neutral fed funds rate to weaken demand.

- Initial jobless claims have inflected and are starting to trend higher.

- The Bank of England is forecasting a recession in the UK starting in the fourth quarter and lasting for five quarters.

- The geopolitical tension between the U.S. and China is as thick as ever.

- Purchasing power has weakened with the high inflation rate.

- The eurozone faces an ongoing energy crisis as Russia’s war on Ukraine rages on.

- Leading companies are announcing plans to freeze or slow the pace of their hiring activity.

- The housing market is rolling over with rising mortgage rates and high home prices creating stiff affordability pressures for homebuyers.

- Consumer and business confidence is at, or near, record lows.

- While a plus for inflation trends, commodity prices are slumping on weaker demand.

The catch-all factor is that global growth is slowing as inflation pressures hit home in all corners of the globe and as many central banks work feverishly to get inflation under control. Their actions are just now starting to be felt, but in the case of the European Central Bank, it is only just getting started.

The U.S. labor market’s glass looks full based on the July employment report — and it is for a lagging indicator. It’s the view ahead, based on many coincident and leading indicators, that creates a half empty feeling when thinking about the labor market.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF AUG. 1 THROUGH AUG. 5, 2022 The S&P 500 index started August with a 0.4% weekly increase as more Q2 earnings reports as well as July US jobs growth surpassed estimates but added to concerns over the pace of future interest rate increases. The market benchmark ended Friday’s session at 4,145.19, up from last Friday’s closing level of 4,130.29. However, the S&P 500 remains solidly in the red for 2022 with a year-to-date decline of 13%. The week’s slight gain comes after better-than-expected quarterly earnings fueled a relief rally in July, giving the S&P 500 its strongest month of gains since November 2020. Still, as worries persisted over rate increases, inflation and shrinking gross domestic product, all eyes were on Friday’s payroll report. The July jobs data showed US nonfarm payrolls rose by 528,000 last month, more than double the 250,000 increase that was expected in a survey compiled by Bloomberg, while June payrolls had an upward revision to a 398,000 increase. The report also said the US unemployment rate fell to 3.5% in July from 3.6% in June, surpassing expectations for the rate to stay at 3.6%. This marks the first time the unemployment rate has been that low since February 2020, the last month before COVID-19 was declared a pandemic. However, stocks fell slightly on the data, with the S&P 500 slipping 0.2% in Friday’s session, as investors saw the larger-than-expected payroll gains as increasing the chances for the Federal Reserve’s policy-setting committee to raise interest rates at a faster pace to tame inflation. The technology sector had the largest percentage gain last week, up 1.9%, followed by advances of 1.2% each in the consumer discretionary and communication services sectors. Other sectors in the black included industrials, utilities and consumer staples. On the downside, meanwhile, the energy sector weighed with a 6.8% tumble, followed by declines of 1.3% each in real estate and materials. Health care and financials were also in the red. In the technology sector, shares of EPAM Systems (EPAM) soared 22% as the digital transformation services and product engineering company reported Q2 adjusted EPS and revenue above year-earlier results and analysts’ expectations. The company also forecast Q3 results above analysts’ mean estimates at the time. The consumer discretionary sector’s gainers included MGM Resorts International (MGM), whose shares rose 6% on the week. The casino operator reported Q2 adjusted earnings before interest, taxes, depreciation and amortization above analysts’ mean estimate while revenue also topped the Street view. In communication services, shares of Dish Network (DISH) jumped 11%. The satellite television company reported Q2 earnings per share above analysts’ expectations despite a revenue miss. Investors were also pleased to hear the company’s management discuss potential plans to raise capital on Dish’s earnings call. The energy sector’s slide came as crude oil futures fell. Among the hardest-hit energy stocks, shares of APA Corp. (APA) fell 15% on the week despite the oil and gas company’s report of better-than-expected Q2 adjusted EPS and revenue that also topped year-earlier results. Marathon Oil (MRO) was also among the decliners, down 12%, despite its report of Q2 adjusted EPS and revenue above year-earlier results and analysts’ mean estimates. Next week’s earnings calendar features companies such as Dominion Energy (D), American International Group (AIG), Tyson Foods (TSN), Roblox (RBLX) and Walt Disney (DIS). Economic reports in focus will include the July consumer price index to be released Wednesday, followed by the July producer price index on Thursday and the University of Michigan’s preliminary reading of August consumer sentiment on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2022?

08-08-2022 +2.0%

08-01-2022 +2.0%

Earnings:

Mon: GOLD, GRPN, D

Tues: H, RL, SAVE, AKAM, WYNN

Wed: JACK, WEN, DIS

Thur: CAH, DDS, SIX

Fri:

Econ Reports:

Mon:

Tues: Productivity, Unit Labor Costs

Wed: MBA, CPI, Core CPI, Treasury Budget, Wholesale Inventories

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Import, Export, Michigan Sentiment

How am I looking to trade?

Currently protection on some core holding and making decisions on earnings, after earning sI am letting some stocks run

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

So if we start to head sideways I will add the short call at higher strike prices to create a short term revenue stream

Danger ahead: The U.S. economy has yet to face its biggest recession challenge

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- There is no historical precedent to indicate that an economy in recession can produce 528,000 jobs in a month, as the U.S. did during July.

- But that doesn’t mean there isn’t a recession ahead, and, ironically enough, it is the labor market’s phenomenal resiliency that could pose the biggest danger.

- The Federal Reserve’s rate tightening to address inflation poses a recession threat into 2023.

You’d be hard-pressed now to find a recession in the rearview mirror. What’s down the road, though, is another story.

There is no historical precedent to indicate that an economy in recession can produce 528,000 jobs in a month, as the U.S. did during July. A 3.5% unemployment rate, tied for the lowest since 1969, is not consistent with contraction.

But that doesn’t mean there isn’t a recession ahead, and, ironically enough, it is the labor market’s phenomenal resiliency that could pose the broader economy’s biggest long-run danger. The Federal Reserve is trying to ease pressures on a historically tight jobs situation and its rapid wage gains in an effort to control inflation running at its highest level in more than 40 years.

“The fact of the matter is this gives the Fed additional room to continue to tighten, even if it raises the probability of pushing the economy into recession,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “It’s not going to be an easy task to continue to tighten without negative repercussions for the consumer and the economy.”

Indeed, following the robust job numbers, which included a 5.2% 12-month gain for average hourly earnings, traders accelerated their bets on a more aggressive Fed. As of Friday afternoon, markets were assigning about a 69% chance of the central bank enacting its third straight 0.75 percentage point interest rate hike when it meets again in September, according to CME Group data.

So while President Joe Biden celebrated the big jobs number on Friday, a much more unpleasant data point could be on the way next week. The consumer price index, the most widely followed inflation measure, comes out Wednesday, and it’s expected to show continued upward pressure even with a sharp drop in gasoline prices in July.

That will complicate the central bank’s balancing act of using rate increases to temper inflation without tipping the economy into recession. As Rick Rieder, chief investment officer of global fixed income at asset management giant BlackRock, said, the challenge is “how to execute a ‘soft landing’ when the economy is coming in hot, and is landing on a runway it has never used before.”

“Today’s print, coming in much stronger than anticipated, complicates the job of a Federal Reserve that seeks to engineer a more temperate employment environment, in keeping with its attempts to moderate current levels of inflation,” Rieder said in a client note. “The question though now is how much longer (and higher) will rates have to go before inflation can be brought under control?”

More recession signs

Financial markets were betting against the Fed in other ways.

The 2-year Treasury note yield exceeded that of the 10-year note by the highest margin in about 22 years Friday afternoon. That phenomenon, known as an inverted yield curve, has been a telltale recession sign particularly when it goes on for an extended period of time. In the present case, the inversion has been in place since early July.

But that doesn’t mean a recession is imminent, only that one is likely over the next year or two. While that means the central bank has some time on its side, it also could mean it won’t have the luxury of slow hikes but rather will have to continue to move quickly — a situation that policymakers had hoped to avoid.

“This is certainly not my base case, but I think that we may start to hear some chatter of an inter-meeting hike, but only if the next batch of inflation reports is hot,” said Liz Ann Sonders, chief investment strategist at Charles Schwab.

Sonders called the current situation “a unique cycle” in which demand is shifting back to services from goods and posing multiple challenges to the economy, making the debate over whether the U.S. is in a recession less important than what is ahead.

That’s a widely shared view from economists, who fear the toughest part of the journey is still to come.

“While economic output contracted for two consecutive quarters in the first half of 2022, a strong labor market means that currently we are likely not in recession,” said Frank Steemers, senior economist at The Conference Board. “However, economic activity is expected to further cool towards the end of the year and it is increasingly likely that the U.S. economy will fall into recession before year end or in early 2023.”

Bank of England launches biggest interest rate hike in 27 years, predicts lengthy recession

KEY POINTS

- The sixth consecutive increase takes borrowing costs to 1.75% and marks the first half-point hike since the bank was made independent from the British government in 1997.

- The bank now expects headline inflation to peak at 13.3% in October and to remain at elevated levels throughout much of 2023, before falling to its 2% target in 2025.

- The MPC now projects that the U.K. will enter recession from the fourth quarter of 2022, and that the recession will last five quarters.

LONDON — The Bank of England on Thursday hiked interest rates by 50 basis points, its largest single increase since 1995, and projected the U.K.’s longest recession since the global financial crisis.

The sixth consecutive increase takes borrowing costs to 1.75% and marks the first half-point hike since the bank was made independent from the British government in 1997.

The Monetary Policy Committee voted by a majority of 8-1 in favor of the historic half-point rise, and cited climbing inflationary pressures in the U.K. and the rest of Europe since its previous meeting in May.

“That largely reflects a near doubling in wholesale gas prices since May, owing to Russia’s restriction of gas supplies to Europe and the risk of further curbs,” the MPC said in its accompanying statement.

“As this feeds through to retail energy prices, it will exacerbate the fall in real incomes for UK households and further increase UK CPI inflation in the near term.”

Britain’s energy regulator, Ofgem, increased the energy price cap by 54% from April to accommodate soaring global costs, but is expected to rise by a greater degree in October, with annual household energy bills predicted to surpass £3,600 ($4,396).

The bank now expects headline inflation to peak at 13.3% in October and to remain at elevated levels throughout much of 2023, before falling to its 2% target in 2025.

The MPC noted that the labor market remains tight, with domestic cost and price pressures elevated, adding that there is a risk that a “longer period of externally generated price inflation will lead to more enduring domestic price and wage pressures.”

“The labour market has remained tight, with the unemployment rate at 3.8% in the three months to May and vacancies at historically high levels,” the MPC said. “As a result, and consistent with the latest Agents’ survey, underlying nominal wage growth is expected to be higher than in the May Report over the first half of the forecast period.”

Sterling was down over 0.5% against the dollar following the bank’s announcement, trading at around $1.209, while the FTSE 100 index climbed 0.5%.

Cost-of-living crisis

In a news conference following the announcement, Bank of England Governor Andrew Bailey said the shock of Russia’s war in Ukraine is now the largest contributor to U.K. inflation “by some way.”

“There is an economic cost to the war, but I have to be clear, it will not deflect us from setting monetary policy to bring inflation back to the 2% target,” he added.

Markets had broadly priced in the more aggressive approach at the August meeting, after U.K. inflation hit a new 40-year high of 9.4% in June as food and energy prices continued to surge, deepening the country’s historic cost-of-living crisis.

Bailey vowed last month that there would be “no ifs or buts” in the central bank’s commitment to returning inflation toward its 2% target.

The Bank is simultaneously forecasting a long recession starting later this year and an even higher peak in inflation. This is a toxic economic combination, which would be difficult for the central bank to navigate at the best of times, let alone when it is increasingly being dragged into the political spotlight.

Luke Bartholomew

SENIOR ECONOMIST, ABRDN

Analysts had been keen to assess the bank’s language, particularly its previous commitment to act “forcefully” on inflation, and the MPC retained that language in Thursday’s report.

“I recognize the significant impact this will have, and how difficult the cost-of-living challenge will continue to be for many people in the United Kingdom,” Bailey said.

“Inflation hits the least well-off hardest, but if we don’t act to prevent inflation becoming persistent, the consequences later will be worse, and that will require larger increases in interest rates.”

The bank said that it intends to start active government bond sales worth approximately £10 billion ($12.1 billion) per quarter from September, subject to a final green light from policymakers.

Recession incoming

The bank issued a dire outlook for economic growth, suggesting that the latest gas price rise has led to another “significant deterioration” in the outlook for activity in the U.K. and the rest of Europe.

The MPC now projects that the U.K. will enter recession from the fourth quarter of 2022, and that the recession will last five quarters as real household post-tax income falls sharply in 2022 and 2023 and consumption begins to contract.

“Growth thereafter is very weak by historic standards. The contraction in output and weak growth outlook beyond that predominantly reflect the significant adverse impact of the sharp rises in global energy and tradable goods prices on U.K. household real incomes,” the MPC said in its monetary policy report.

The forecast warns of a peak-to-trough fall in output of 2.1%, with the economy beginning to shrink in the fourth quarter of 2022 and contracting throughout 2023.

Luke Bartholomew, senior economist at Abrdn, said the bank’s forecasts make clear just how difficult the U.K.’s economic picture is compared with other major countries.

“The Bank is simultaneously forecasting a long recession starting later this year and an even higher peak in inflation. This is a toxic economic combination, which would be difficult for the central bank to navigate at the best of times, let alone when it is increasingly being dragged into the political spotlight,” he said.

Liz Truss, the favorite to win the Conservative Party leadership contest and succeed Boris Johnson as prime minister, is reportedly considering a review of the Bank of England’s inflation mandate and the extent of its independence from the central government.

“With inflation now expected to stick around for longer, it is hard to see how the Bank can pivot towards supporting the economy any time sooner. As such, investors should expect further interest rate increases from here even as markets and the economy struggle,” Bartholomew added.

HI Financial Services Mid-Week 06-24-2014