HI Market View Commentary 07-22-2019

What is your daily “grind”

I am usually up 5:45AM MST to check futures and news

An UP day in the market is a possible day off

A DOWN day and I am by the phone the whole day ie…I’m in an office

On either day I do my due diligence

I take my daughter at 6:40 AM to Gymnastics and I’m home at 7:20 Every morning

I listen to Sirius Radio and Fox news, CNBC, Bloomberg on our drive

5:45 – 6:40 I am showering and then read the news to see what’s moving our markets from the media stand point

IF I am placing a trade it is 8:30ish AM MST after the first hour when E-minis have cleared and out and we have a true market trend for the day

I am usually watching CNBC, the Fox news then Bloomberg after the post market close

At the close of the European market 9:30 and see if we have an influx of volume

10:30 – 11:30 MST the east coast goes to lunch

1pm watch the last hour and trade the last 30 minutes into the close

At the close I write my overall performance to see if I am ok in general with how HI did

The I go through each account to make sure they are in the acceptable range and if NOT fix the situation

Where will our markets end this week?

Higher

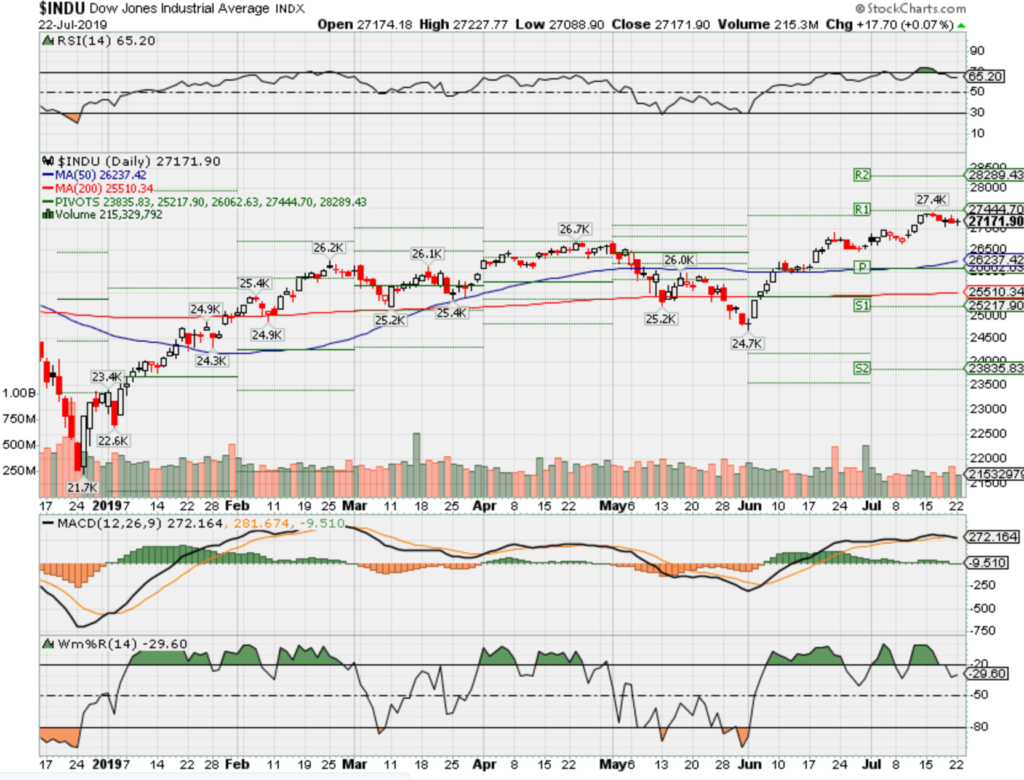

DJIA – Bullish Market

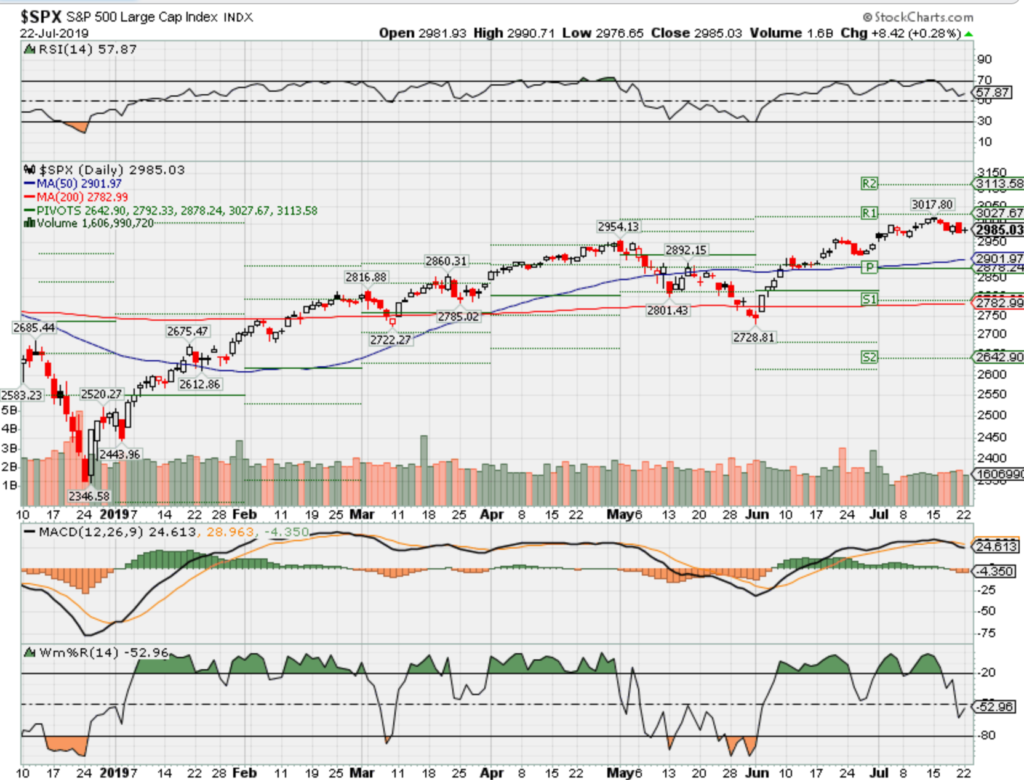

SPX – Bullish

COMP – Bullish

Where Will the SPX end July 2019?

07-22-2019 +3.5%

07-15-2019 +2.5%

07-08-2019 +2.5%

07-01-2019 +2.5%

Earnings:

Mon: HAL, WHR

Tues: HOG, HAS, KEY, JBLU, KMB, LMT, CMG, DFS, VMI, V,

Wed: T, UPS, VFC, LVS, TSLA, FCX, CAT, BA, F, FB

Thur: MMM, AAL, BMY, IP, TREE,RTN, VLO, WM, ALK, AMZN, GOOG, FSLR, INTC, TMUS, SBUX,

Fri: CL, MCD, PSX, TWTR

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, Existing Home Sales

Wed: MBA, New Home Sales

Thur: Initial, Continuing, Durable Goods, Durable Ex-trans

Fri: GDP, GDP Deflator

Int’l:

Mon –

Tues –

Wed –

Thursday – ECB Interest Rate Decision

Friday-

Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AAPL – 7/30 AMC Bull PUT currently on AAPL that I want take the short put off

AOBC – 8/29 est

BA – 7/24 BMO

BIDU – 7/30 est

CVS – 8/07 BMO

CVX – 8/02 BMO

DIS – 8/06 AMC

F – 7/24 BMO

FB – 7/24 AMC

FCX – 7/24 BMO

MRO – 8/07 AMC

MU – 9/19 est

MRVL 9/05 est

V – 7/23 AMC

ZION – 7/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Disney bought Marvel for $4 billion in 2009, a decade later it’s made more than $18 billion at the global box office

PUBLISHED SUN, JUL 21 2019 2:00 PM EDTUPDATED SUN, JUL 21 2019 2:33 PM EDT

KEY POINTS

- Disney has earned more than $18.2 billion at the global box office from Marvel movies since purchasing the company in 2009.

- The House of Mouse has produced and distributed 16 of the 23 Marvel Cinematic Universe films.

- On Saturday at Comic-Con in San Diego, Marvel unveiled the 10 films and TV projects will all be released in the next two years, some theatrically and the rest on Disney’s upcoming streaming service Disney+.

A decade ago, moviegoers were introduced to Tony Stark.

He was a fast-talking genius, playboy, billionaire, soon-to-be philanthropist played by the comeback kid himself Robert Downey Jr.

Marvel’s “Iron Man” arrived in theaters in 2008 just as rival DC’s gritty Dark Knight trilogy, directed by Christopher Nolan, was making its bow. It was a near polar opposite to the dark, gloomy story of billionaire Bruce Wayne, aka the masked vigilante Batman.

In its opening weekend, “Iron Man” snared nearly $100 million at the box office, before going on to garner just under $600 million worldwide. At the time, opening weekend ticket sales of “Iron Man” were just short of the first-weekend sales for “Spider-Man,” the 2002 blockbuster that held the record for the top non-sequel superhero movie opening.

A year later, Disney made its move. While Marvel had already contracted several films with Paramount and Universal as part of its Marvel Cinematic Universe, CEO Bob Iger closed on a deal to purchase the comic book company for around $4 billion.

“This is perfect from a strategic perspective,” Iger said at the time. “This treasure trove of over 5,000 characters offers Disney the ability to do what we do best.”

It seems he was right.

Since releasing its first Disney produced Marvel movie in 2012, the company has earned more than $18.2 billion at the global box office. And it’s already on its way to make billions more.

At San Diego Comic-Con on Saturday, Marvel announced its upcoming slate of films and TV shows that expand on the 23 movies already in the MCU.

Disney has produced 16 of those films. Paramount distributed “Iron Man,” “Captain America: The First Avenger,” “Thor” and “Iron Man 2″; and Universal distributed “The Incredible Hulk” as part of deals that predated Disney’s acquisition of Marvel.

More recently, Sony has produced two Spider-Man films — “Homecoming” and “Far From Home” — in partnership with Disney, allowing the character to appear in the MCU.

In total, all of the movies in the Marvel Cinematic Universe have made more than $22 billion at the global box office.

To be sure, these box office numbers do not include the cost of production or marketing costs. They also don’t count the billions in merchandising that Disney has made over the last decade.

Box office glory

When the trailer for “Avengers: Endgame” first came out, there was little doubt that it was going to be a big movie at the box office.

“Infinity War” had left the fate of most of the cast of superheroes uncertain. Theories about what happened to those that were dusted in the final moments of the film circulated on message boards, forums and social media. How was Marvel going to bring them back?

Certainly, the studio would have to. After all, Spider-Man had his own standalone feature coming out just a few months after “Endgame” was set to be released, and Marvel had green lit sequels for Black Panther and Doctor Strange, among others.

Early estimates had the film making just over $2 billion, a sizable feat for a superhero movie. But, could it take on the top box office spots? Perhaps not.

And then on opening weekend, “Endgame” did the impossible. It hauled in $357 million in the U.S. and $1.2 billion at the global box office — and people began to reassess what was possible.

Within 87 days in theaters, “Endgame” became the highest grossing film of all time. The film had earned $2.79 billion, topping “Avatar’s” record of $2.7897 billion.

What comes next

With “Spider-Man: Far From Home,” Phase 3 of the Marvel Cinematic Universe came to a close. On Saturday in Hall H at San Diego Comic-Con, Marvel’s president, Kevin Feige, unveiled Phase 4.

The 10 films and TV projects will all be released in the next two years, some theatrically and the rest on Disney’s upcoming streaming service Disney+.

Films include “Black Widow,” “Eternals,” “Shang-Chi and the Legend of the Ten Rings,” “Doctor Strange in the Multiverse of Madness” and “Thor: Love and Thunder.”

The Disney+ productions are “The Falcon and the Winter Soldier,” “WandaVision,” “Loki,” “Hawkeye,” and an animated series called “What If?.”

“We didn’t even mention that we’re making ‘Black Panther 2,‘” Feige said at the end of the panel. “We didn’t even talk about that ′Guardians of the Galaxy, Vol. 3’ is coming. We didn’t have time to talk about ‘Captain Marvel 2.’ ”

“I didn’t even have time to talk about the Fantastic Four,” he added, the crowd roaring with excitement. “And there’s no time left to talk about mutants and how mutants come into the MCU.”

Many of these teased films would not have been possible before Disney acquired a number of Fox properties earlier this year. Feige also revealed that a “Blade” movie would be going into production.

Trump’s choice: Yield to China or raise trade tariffs and pave the way for Fed’s easing

PUBLISHED SUN, JUL 21 2019 11:02 PM EDTUPDATED MON, JUL 22 2019 10:40 AM EDT

Dr. Michael Ivanovitch@MSIGLOBAL9

KEY POINTS

- There’s no way that China can give Washington the trade deal it wants. Tariffs are the only instrument left for addressing China’s systematic and excessive surpluses on its U.S. trades.

- Downward cyclical pressures caused by the trade rebalancing process should lead to the U.S. Federal Reserve’s easier credit conditions, paving the way for similar moves by China, the European Central Bank and the Bank of Japan.

- Such an increase in global liquidity would support economic activity, employment creation and asset prices.

Washington apparently went too far. Instead of seeking an immediate and rapid rebalancing of U.S.-China trade, the White House asked for legislative changes in China’s trade and economic systems under a permanent threat of sanctions.

And then it got worse. China seemed to have offered a bait, pretending that it might acquiesce into such unthinkable concessions, only to show its political establishment Washington’s true intentions.

What followed was a theatrical coda to a negotiating collapse. When word got back from China that Washington’s conditions were unacceptable, the White House cried foul, accusing Beijing and President Xi Jinping of reneging on a “done deal.” The Chinese simply retorted that they were in a negotiating process where nothing was agreed until everything was agreed.

Predictably, trade negotiations broke off.

China’s message is clear

While both sides agreed at the G-20 meeting to resume talks and hold off any new tariffs for the time being, Washington and the media still seem to have problems in decoding China’s conditions for trade negotiations.

Indeed, Beijing’s repeated statements that it wants to negotiate in an environment of respect, equality and due consideration of its national interests have been widely ignored as declaratory posturing.

But what do the Chinese mean?

Beijing is simply warning that it would not tolerate any foreign attempts to interfere in its:

- trade and economic regulations,

- national unity and territorial integrity — referring to Hong Kong, Taiwan and Tibet,

- maritime borders,

- religious issues that could destabilize China, and

- development of flagship industries.

If those conditions are met, China would be willing to talk — trade or anything else.

The White House received that message with comments that the Chinese were eager to do a trade deal, because their economy was in trouble with a growth rate of 6.2% in the second quarter of this year — 10 or 20 basis points below the markets’ wishful thinking.

Nobody seemed to notice that the Chinese were laughing all the way to the bank with $137.1 billion of surpluses on their U.S. trades in the first five months of this year, based on numbers from the U.S. Department of Commerce. Taken at an annual rate, that’s close to $400 billion of America’s wealth and technology transfers to China’s economy.

The question is: When will the White House understand that the trade deal it wants with China is a mirage?

Beijing is playing hardball because it knows that an election-bound President Donald Trump wants a trade deal to calm down Wall Street, boost asset prices and maintain growing economic output, demand and employment. The Chinese see no reason to oblige, unless that’s done on their terms. Both sides are miles apart from what the other wants.

US has the upper hand

What can Trump do? The answer is simple: With negotiations going nowhere, Trump should respond with a devastating one-two strategy, instead of sending that meekly defensive tweet last Friday that his people “had a very good talk” with their Chinese counterparts.

What’s that lethal one-two combination?

It’s an immediate tariff hike on all Chinese imports, and a signal to the Federal Reserve to cut interest rates in order to support domestic demand and America’s long-suffering import-competing industries.

Trump should ignore the free-traders’ howls for a number of reasons.

First, Beijing has a limited scope to retaliate. Taking, as an example, the bilateral trade in the first five months of this year, China could raise tariffs on $43 billion of its U.S. imports. That’s nothing compared to Trump’s knockdown punch to $180 billion worth of Chinese goods sold to American markets.

But that’s a huge disruption of supply chains? No, it isn’t. The Chinese will absorb most of the tariff hikes to maintain competitive pricing and defend their U.S. market shares. Chinese suppliers will not simply fold and vanish from markets where they invested for decades. If allowed — and that’s another policy lever for Trump — they would also rush to invest in U.S.-based production facilities.

And if the policy change on China trade is credible, U.S. industries would get a breather and an incentive to stand up and compete. A long shot perhaps, but that’s an outcome import tariffs are supposed to produce.

Second, such a trade blow would soften China on bilateral commerce and finance, and probably on a range of other issues as well. Trump’s quest for balanced trade would be taken seriously — and he may even get the Chinese to expedite mega deals with his financially exhausted Farm Belt supporters.

Third, to prevent market exaggerations of “trade war” chatter, the Fed would then have a good reason to come in with interest rate cuts — reminding China that Wall Street responds to the U.S. central bank and nobody else.

Fourth, the ensuing new wave of dollar liquidity would be another blow to China and the rest of the large trade surplus countries. They all know it’s too tough to compete with a cheap dollar.

And more would follow. China would respond with credit easing of its own. The European Central Bank would do the same thing to pacify German automobile and machine tool exporters, and the Japanese businesses may no longer consider that there was no need for the Bank of Japan’s new liquidity provisions.

That would mean that Trump did what the G-20 and G-7 failed to do to revive the world economy.

Trump, of course, would get no credit because mercantilists’ opprobrium remains his lot.

But he might not care because four more years at the White House could be his consolation prize. Many other people would not mind that either, if Trump got more jobs and incomes for the U.S. and the rest of the world.

Investment thoughts

There’s no way that China can give Trump the trade deal he wants. The stage, therefore, is set for escalating tariffs as the only instrument for addressing China’s systematic and excessive surpluses on its U.S. trades.

As a candidate for re-election, Trump cannot tolerate a continuation of decades-old massive transfers of America’s wealth and technology to China.

U.S. difficulties with China will send a message to the EU and Japan that their excessive trade surpluses with America must be cut — fast and radically.

The downward cyclical pressures caused by the trade rebalancing process in more than half of the world economy should lead to the Fed’s easier credit conditions, paving the way for similar moves by China, the European Central Bank and the Bank of Japan.

Such an increase in global liquidity would convey an unambiguous policy intent to support economic activity, employment creation and asset prices.

Commentary by Michael Ivanovitch, an independent analyst focusing on world economy, geopolitics and investment strategy. He served as a senior economist at the OECD in Paris, international economist at the Federal Reserve Bank of New York, and taught economics at Columbia Business School.

UPDATE 1-Box Office: ‘The Lion King’ Rules With $185 Million Debut

PUBLISHED SUN, JUL 21 2019 1:39 PM EDT

OS ANGELES, July 21, (Variety.com) – Simba and Mufasa reigned supreme this weekend as Disney’s “The Lion King” dominated box office charts. Director Jon Favreau’s remake of the animated classic collected a massive $185 million from 4,756 North American theaters during its first three days of release.

In yet another win for Disney, the movie landed the best domestic launch for a PG film and set a new record for the month of July. That figure represents the second-best domestic debut of the year behind Disney and Marvel’s “Avengers: Endgame” ($357 million). The Buena Vista company now holds five of the top six biggest movies of 2018 so far.

Overseas, “The Lion King” felt the love with $269 million for a global start of $433 million. The film launched in China last weekend and has since earned $98 million, boosting the worldwide haul to $531 million.

“We have a lot to celebrate,” Cathleen Taff, Disney’s president of global distribution, said on a Sunday morning call. ”‘The Lion King’ has such a resonance in pop culture that you see all different types of people coming out. People wanted to be part of this.”

The state-of-the-art technology used to bring the Pride Lands and its inhabitants to life drew a polarizing response from reviewers, but the newest version of Disney’s crown jewel proved to be critic-proof, and the prospect of hearing Donald Glover’s Simba and Beyonce’s Nala harmonize to Disney classics was irresistible. Moviegoers flocked en masse to see Simba’s grand return to the big screen, and to much enthusiasm. “The Lion King” holds an A CinemaScore.

Audiences also shelled out to see the hyper-realistic movie in the best quality possible. Imax theaters accounted for $25 million of tickets sold, while 36% of global ticket sales came from 3D screens.

“The Lion King” provided a much-needed jolt to the domestic box office. Heading into the weekend, box office receipts were pacing over 9% behind last year. Now, theatrical earnings are down just over 7%, according to Comscore.

“The Lion King” is already one of the most recognizable stories across the world, but the remake benefitted from an equally buzzy voice cast including Glover as Simba, Beyonce as Nala, Chiwetel Ejiofor as Scar, and Billy Eichner and Seth Rogen as Timon and Pumbaa. James Earl Jones reprised his role as Mufasa from the original movie. The updated version also includes a new song from Beyonce.

Disney has re-imagined five of its classics to mostly consistent success. Outside of “The Lion King,” 2017′s “Beauty and the Beast” had the strongest start with $174 million, followed by 2010′s “Alice in Wonderland” launched with $116 million. In 2016, Favreau’s “The Jungle Book” earned a strong $103 million in its inaugural weekend. In May, Guy Richie’s “Aladdin” debuted with $91.5 million and is approaching the $1 billion mark globally. However, Tim Burton’s “Dumbo” stumbled with $45 million earlier this year.

In a banner weekend for Disney, the studio is now home to the highest-grossing movie in history. “Avengers: Endgame” crossed $2.7892 billion at the global box office, officially dethroning the 10-year record of James Cameron’s “Avatar.”

Since other Hollywood studios refrained from releasing a movie against “The Lion King,” a number of holdovers filled out domestic box office charts. In a distant second place, Sony’s “Spider-Man: Far From Home” collected $21 million during its third weekend in theaters, lifting domestic ticket sales to $319 million. The web-slinging superhero adventure has generated $569 million at the international box office.

Disney and Pixar’s “Toy Story 4” landed in third with $14 million. In five weeks, the animated movie has generated $375 million in North America and $859 million globally, making it the seventh Pixar film to surpass the $800 million mark.

At No. 4, Paramount’s alligator thriller “Crawl” generated $6 million for a domestic tally of $23 million. Rounding out the top five is Universal’s musical rom-com “Yesterday,” which pocketed $5.1 million during its fourth weekend of release. The movie has grossed $57.5 million to date.

Among specialty releases, Sony Pictures Classics opened its documentary “David Crosby: Remember My Name” in four locations, where it earned $41,050.

Meanwhile, A24 expanded Lulu Wang’s “The Farewell” to 35 locations in its second weekend, generating a promising $1.17 million. The comedic drama starring Awkwafina debuts nationwide on Aug. 2.

In honor of the 50th anniversary of the moon landing, Neon’s documentary “Apollo 11” returned to theaters, making $75,000 from 107 venues. With $9 million in North America, it’s now the highest grossing non-fiction film of 2019. Neon owns the three biggest docs of the year so far with “Amazing Grace” ($4.5 million) and “The Biggest Little Farm” ($4 million).

“It’s remarkable to see ‘Apollo 11’ cross $9 million to become the highest grossing doc of 2019 and on the 50th anniversary of the moon landing,” Elissa Federoff, Neon’s head of theatrical distribution said in a statement. “A true testament to an extraordinary piece of cinema and one of the best reviewed films of the year.”

‘Avengers: Endgame’ is now the highest-grossing film of all time, dethroning ‘Avatar’

PUBLISHED SUN, JUL 21 2019 11:36 AM EDTUPDATED SUN, JUL 21 2019 12:18 PM EDT

KEY POINTS

- “Avengers: Endgame” is now the highest-grossing film of all time.

- On Sunday, Disney said the film had earned $2.79 billion at the global box office, topping “Avatar’s” record of $2.7897 billion.

- It should be noted that with the acquisition of Fox earlier this year, Disney now owns “Avatar” and its upcoming slate of four sequels.

“Avengers: Endgame” is now the highest-grossing film of all time.

On Sunday, Disney said the film had earned $2.79 billion at the global box office, topping “Avatar’s” record of $2.7897 billion.

“Endgame” has been in theaters for just 87 days. “Avatar,” for comparison, ran for 234 days during its first run, and was then rereleased in 2010.

“Endgame” had its own rerelease, of sorts, in June. Marvel Studios began showing a new theatrical release of the film with a special tribute to Stan Lee, a deleted scene from “Endgame” and a teaser for “Spider-Man: Far From Home” at the end of the credits.

The hope was to drive buzz and lure moviegoers back to theaters to see the film again. At the time, “Endgame” was still $40 million behind “Avatar” and there were questions about whether the film would be able to overtake the record before the end of the summer.

”‘Avatar’ was a tenacious king of the box office mountain warding off all challengers for about a decade and against seemingly insurmountable odds, ‘Endgame’ did whatever it took to take the crown,” Paul Dergarabedian, senior media analyst at Comscore said.

On Saturday, Kevin Feige, the head of Marvel Studios announced to a crowd of thousands in Hall H at San Diego Comic-Con that the film was within a few days of overtaking “Avatar.”

“A huge congratulations to the Marvel Studios and Walt Disney Studios teams, and thank you to the fans around the world who lifted ‘Avengers: Endgame’ to these historic heights,” Alan Horn, co-chairman and chief creative officer of The Walt Disney Studios, said in a statement Saturday.

“Of course, even with the passage of a decade, the impact of James Cameron’s ‘Avatar’ remains as powerful as ever, and the astonishing achievements of both of these films are ongoing proof of the power of movies to move people and bring them together in a shared experience,” he said. “The talented filmmakers behind these worlds have much more in store, and we look forward to the future of both the Marvel Cinematic Universe and Pandora.”

It should be noted that with the acquisition of Fox earlier this year, Disney now owns “Avatar” and its upcoming slate of four sequels.

https://seekingalpha.com/article/4276338-baidu

How And Why To Own Baidu

Jul. 22, 2019 3:33 AM ET

Summary

Baidu is undervalued based on the sum of its parts.

Baidu is more than just search and its stakes in Ctrip and iQIYI.

There are safer ways to own Baidu beyond owning shares outright.

Investors are afraid to own Chinese stocks right now, and down about 30% YTD, fewer Chinese stocks exemplify that fear more than Baidu (NASDAQ:BIDU). Baidu lost money last quarter for the first time in many years as a result of increased expenses. Trade negotiations between the US and China are creating uncertainty and central bankers are warning of a global economic slowdown. There’s a lot to fear when it comes to investing in Baidu, so is it time to be greedy?

Current Value

Let’s start by attempting to establish a fair value for Baidu by summing up its major components. Baidu’s main and most valuable business is search where it commands an impressive 15% of the global search market, second only to Google (NASDAQ:GOOG) (NASDAQ:GOOGL) with ~75% globally. In 2018, Google has operating cash flow of $50B with at least $40B coming from search. Baidu with roughly 1/5 the market share would come to $40/5 = $8B, with a 50% discount to be conservative, gets us to $4B. Attaching a 15x multiple would mean the fair value of Baidu’s search business is about $60B. There’s been talk that Baidu is losing share in the search market to competitors, but the stats make it clear that Baidu has maintained its dominance:

The stakes in Ctrip (NASDAQ:CTRP) and iQIYI (NASDAQ:IQ) are easy because they are publicly traded:

Ctrip – 19% * $20B = $3.8B

iQIYI – 58% * $14.25B = $8.2B

Its Apollo business is a little more difficult to value using US comparisons, but we do have some useful data points. Ford’s (NYSE:F) Argo AI is now worth $7B based on the recent investment by VW (OTCPK:VWAGY), and GM (NYSE:GM) Cruise is valued near $15B after SoftBank’s (OTCPK:SFTBY) investment. Analysts have speculated that Waymo could be worth $175B, but that’s speculation, so we’ll ignore that number entirely. Apollo is well established as the self-driving leader in China, so we ought to be able to conservatively assign it a value similar to a mid-tier US equivalent, i.e. Argo AI.

Beyond iQIYI and Ctrip, Baidu has other investments. In the last year alone it has put $440M into WM Motor, $310M into Xinchao Media, $600M into NetEase Cloud Music, plus Baidu Ventures has $500M in early stage tech/biotech investments. These other investments are worth roughly $3B using market prices.

Finally, current assets not already counted equal $23.5B – total liabilities of $19.5B = $4B. This number excludes goodwill and intangible assets to be conservative.

Growth Potential

Cloud Computing, a $14B industry in China in 2018 is a major growth source for Baidu. An IDC study found China IaaS grew by 88% and PaaS by 124% with the Baidu Cloud achieving more growth than any other service provider, bumping it up into the top five public cloud services in China. Compare that to a $300B cloud computing market worldwide and it becomes clear that China has a lot of room to grow. Microsoft’s (NASDAQ:MSFT) Azure exceeded a $20B ARR. I’ll use Microsoft because I didn’t think it was fair to use AWS, the market leader as a comparison point. Even so, assuming the Baidu Cloud can only achieve a quarter of Azure’s success and will trade at a conservative 2x P/S ratio gets us a value around $10B.

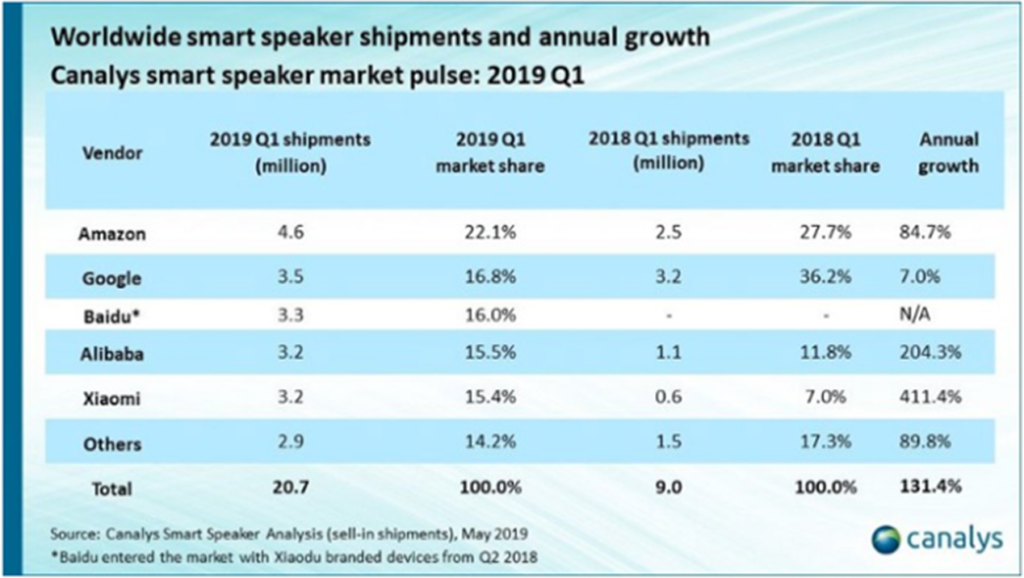

Baidu’s China leadership in smart speakers with DuerOS is perhaps one of its most undervalued growth drivers.

Global Smart Speaker Market Share

This expands Baidu’s market share in overall advertising beyond search into the product space. This makes Baidu enormously valuable to a company like JD.com (NASDAQ:JD), China’ largest retailer by revenue, in its fierce battle against Alibaba (NYSE:BABA). Given that the two have been partners in this space since 2017, expect that relationship to grow moving forward, especially with Baidu Maps and Apollo having applications in logistics and delivery. Baidu’s DuerOS is being installed in homes, hotels, communities, and cars, meaning Baidu will be advertising to, and gathering information on, consumers wherever they are.

Furthermore, because the Chinese smart speaker market is fairly mature, unlike cloud, it’s likely that the current leaders will be the leaders going forward. Valuing this business is difficult with competitors playing the long game, selling hardware with low margins in exchange for advertising, licensing, and information gathering dominance later. We do know that some of the largest companies in the world, Amazon (NASDAQ:AMZN), Google, Apple (NASDAQ:AAPL), Alibaba, and others are aggressively pursuing this market, meaning they think it will be meaningful to their bottom line. Operating cash flow for Alibaba in FY19 came in at $22.5B, and we can make a conservative assumption that they wouldn’t be chasing this market for anything less than 10% of that, ~$2B. Attaching a 15x multiple would value the smart speaker market around $30B.

Putting the Value Together

| Search | $60B |

| iQIYI | $8.2B |

| Ctrip | $3.8B |

| Apollo | $7B |

| Other Investments | $3B |

| Other Assets | $4B |

| Cloud | $10B |

| Smart Speakers / DuerOS | $30B |

| Total | $126B |

How To Own Baidu

Assuming you agree that Baidu is undervalued, let’s look at using long-dated options to limit our risk while maintaining a healthy upside. We’ll consider a call spread with strikes above the current price for those looking to maximize upside as well as a protective collar for the risk-averse. The tables below use options expiring Jan 2021, with Baidu currently trading at $112/share.

Call Spread

The goal in buying the lower strike call is to spend as little as possible while keeping your break-even price low, which typically means buying a call with a strike price between the stock’s current value and 10% above that price. The $120 strike fits those conditions at the current stock price. The upper strike call is a balance between maximizing upside and minimizing overall position cost, which means choosing a strike that’s achievable by the expiration date. If $126B is fair value, let’s take half of that, $63B, equating to $180/share at the expiration in Jan 2021. The risk-reward for this hypothetical position as of this writing on 7/18/19 with Baidu trading at $112/share for one contract:

| Call Spread Cost (Max Loss) | $1,300 |

| Max Gain | $4,700 |

| Break-even | $133/share |

| Max Gain % | 360% |

| Annualized Max Gain % | 240% |

Protective Collar

The risk to the call spread is that Baidu needs to increase 19% by 2021 to simply break-even. A protective collar sacrifices upside for downside protection and avoids leverage. It requires the owner to buy 100 shares then buy a put and sell a call for equal amounts. As a hypothetical example, consider buying the $80 put and selling the $170 call for a net cost of zero.

| Total Collar Cost | $11,200 |

| Max Gain | $5,800 |

| Max Loss | $3,200 |

| Break-even | $112/share |

| Max Gain % | 52% |

| Annualized Max Gain % | 34% |

For those considering owning shares outright, a protective collar allows for a respectable ROI while providing protection in the case of a black swan event.

Conclusion

At Baidu’s current stock price, it’s an extremely compelling value and growth investment. Its mature businesses fund its growth opportunities without having to take on debt. Despite the upside, owning a piece of the business comes with risks. Fortunately, those risks can be appropriately mitigated through the use of options. With earnings coming up, I would caution against going all in, regardless of the strategy you choose. Undervalued stocks can always get cheaper, and it’s important to have some dry powder should that opportunity present itself.

Disclosure: I am/we are long BIDU, JD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

HI Financial Services Mid-Week 06-24-2014