HI Market View Commentary 07-13-2020

| Market Recap |

| WEEK OF JUL. 6 THROUGH JUL. 10, 2020 |

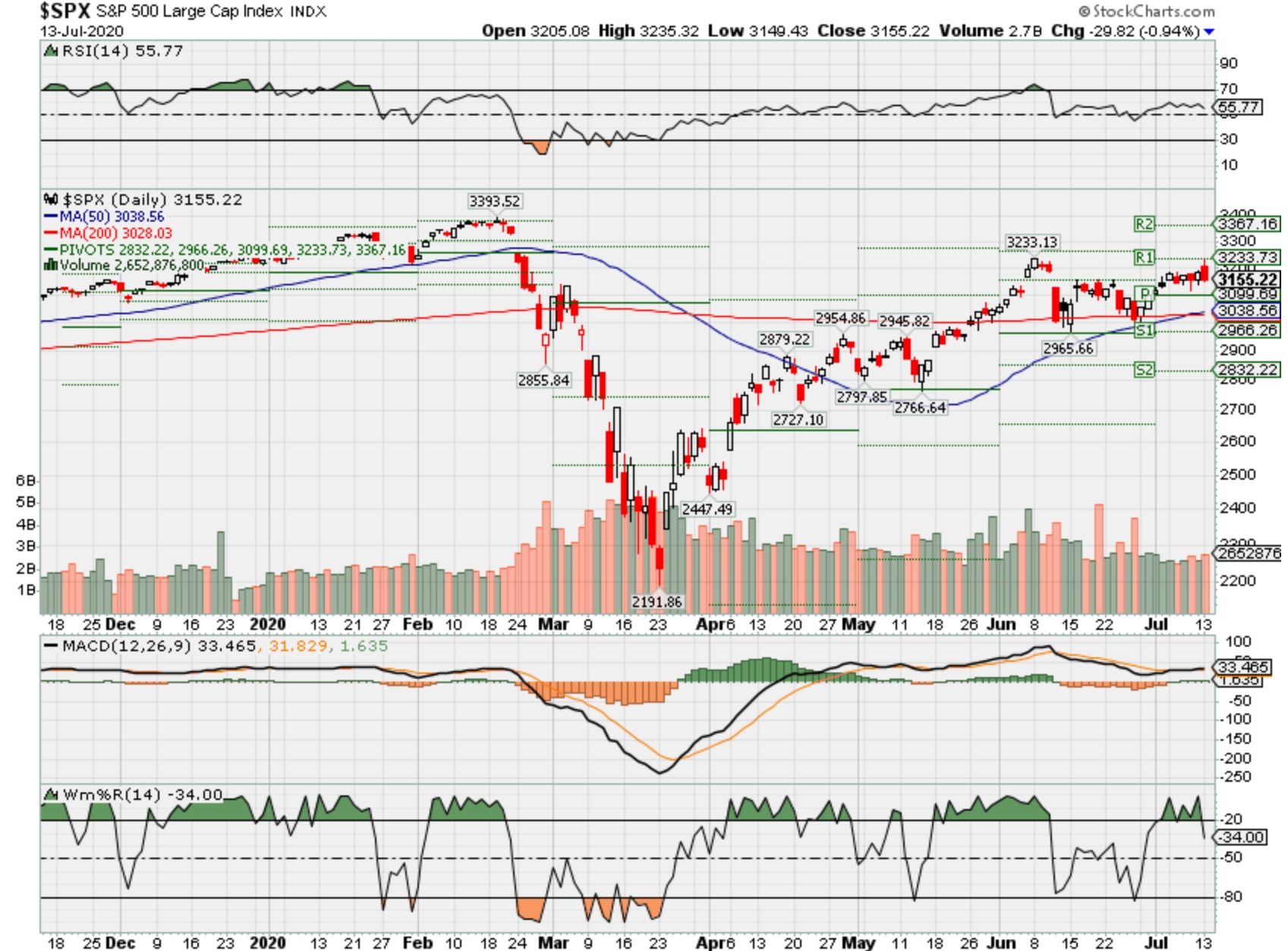

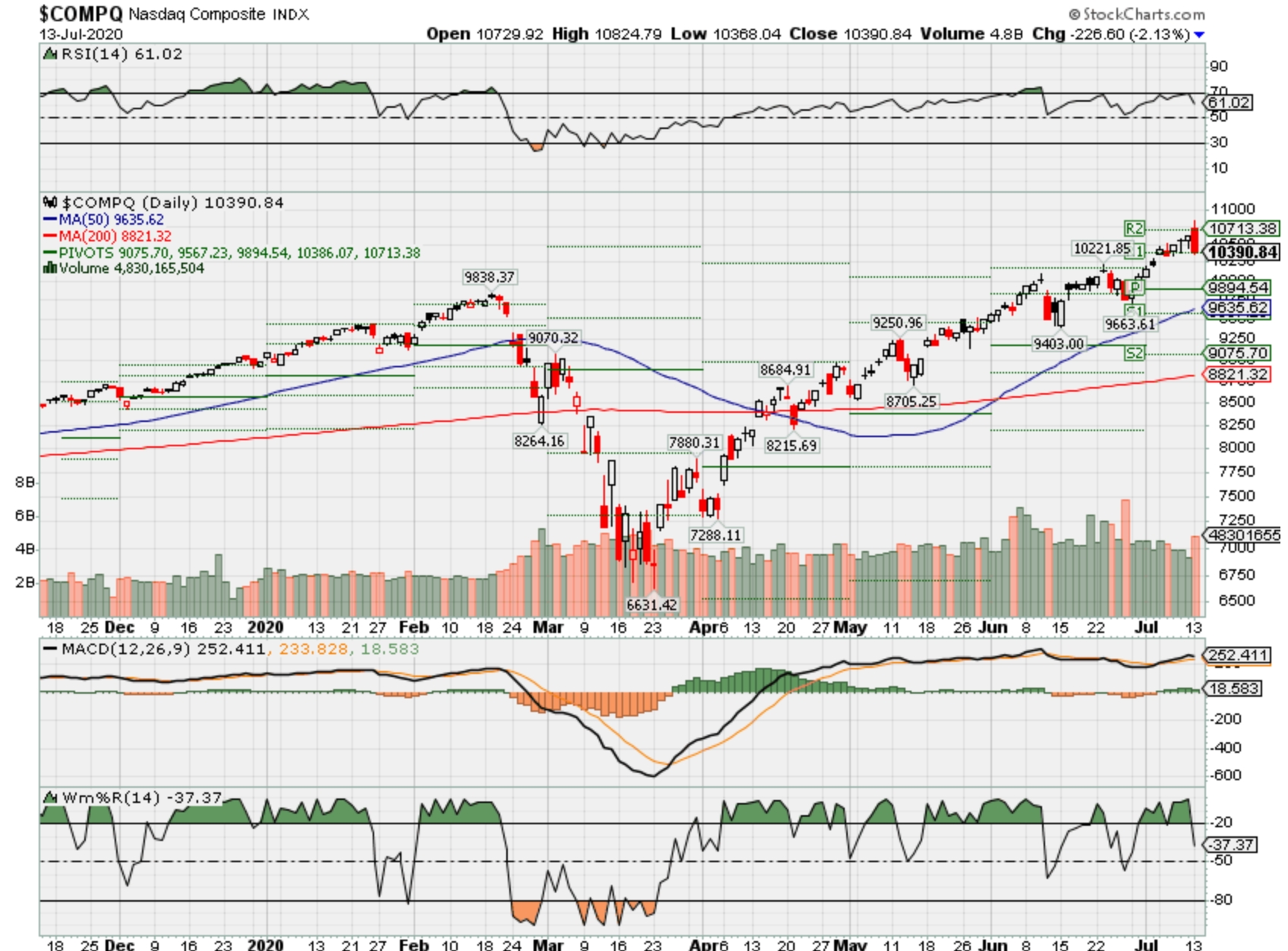

| Last week the S&P 500 index closed higher for a second straight week, led by gains in consumer discretionary stocks, even as investors continued to digest a worrisome resurgence in COVID-19 cases and the deteriorating relationship between the US and China.

The benchmark index closed at 3,185.04 on Friday, up 1.76% from last Thursday’s close of 3,130.01. Markets were closed Friday, July 3 in observance of the Independence Day holiday. Online retailer Amazon’s (AMZN) meteoric rise resulted in another record high this week, forcing analysts to scramble to hike their price targets fast enough to keep up with its gravity-defying run. The stock brushed off Walmart’s (WMT) plan to launch a comparable subscription service, and risks to its generous tax structure from presumptive Democratic presidential candidate Joe Biden, to easily eclipse $3,000 and gain 10.7% for the week. Communication stocks were up 4.5% this week. Twitter (TWTR) was the best performing stock within this sector with a 14.7% weekly gain fueled by a potential subscription service, and a possible US government ban on its competitor Tik Tok. Netflix (NFLX) shares were also instrumental in the bullish performance in the communications sector with this week’s 15% gain largely attributed to a price target hike by Goldman Sachs (street high of $670) and rising subscriptions as COVID cases spike. Wall Street’s insatiable appetite for tech stocks, specifically semiconductors, translated into a 2.7% gain for the technology sector with Advanced Micro Devices (AMD) and Nvidia (NVDA) in the lead. With COVID cases on the rise and businesses likely to extend their stay-at-home orders, remote-work stocks enjoyed a solid tailwind. Though this week’s economic data said otherwise, the risk to the economy as states reconsider reopening restaurants, gyms, and even schools weighed on the energy sector, leaving shares in that sector down by a collective 4.8%, making it the worst-performing sector in the S&P 500. The industrial sector also gave up ground as airline stocks were battered by the risk of travel restrictions and atrophied profits. The sector was down 1.4% from last week with United Airlines (UAL) and American Airlines (AAL) both down more than 4% for the week. It was a quiet week for economic data. A pair of indices measuring the services sector (PMI and ISM) both beat expectations with the ISM non-manufacturing index rising by a record amount to 57.1. The punishing pace of jobless claims slowed but stayed above 1 million for the 17th straight week. Q2 earnings season kicks off this week providing the first look at how shutting down the US economy impacted corporate profits. Data includes June inflation, retail sales, factory production, and the preliminary July University of Michigan consumer sentiment index. Also, June [housing starts and permits on Friday are expected to show a 4.3% and 14% gain, respectively. Provided by MT Newswires. |

What factor caused our drop today? – Virus concerns, “Quiet Period” where companies are not allowed to buy their company shares of stock

One of the hardest things to do in option or collar trading is to let stocks move

We are going to have a very interesting earning season ?

Earnings soon:

AAPL 07/30 AMC

BA 07/29 BMO

BAC 07/16 BMO

BIDU 08/17 est

COST 09/24 AMC

DIS 08/04 AMC

F 07/30 AMC

FB 07/29 AMC

JPM 07/14 BMO

KEY 07/22 BMO

LLY 07/30 BMO

MU 09/24 AMC

TGT 08/19 BMO

UAA 07/28 BMO

V 07/28 AMC

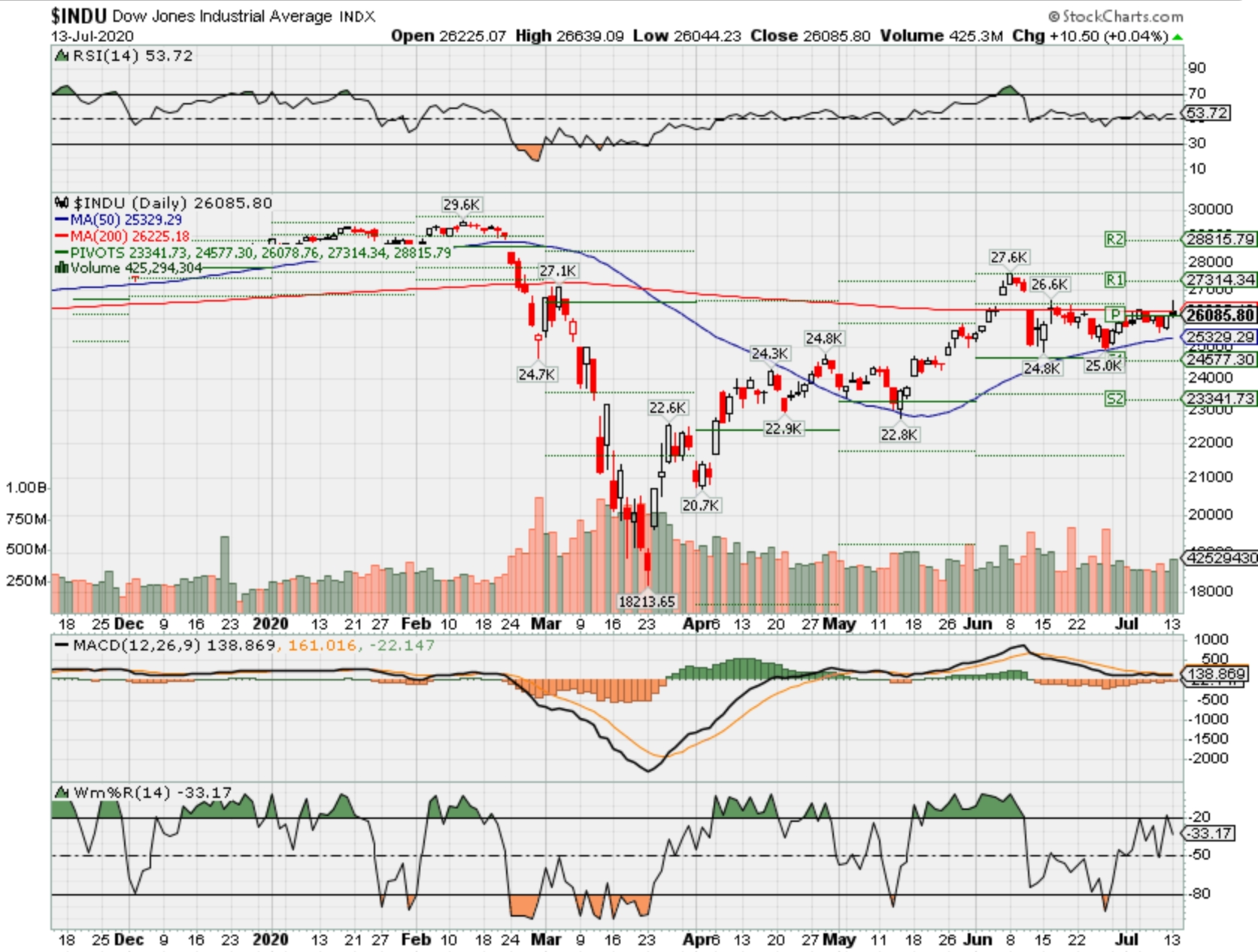

Where will our markets end this week?

Flat

SPX – Bullish

COMP – Bullish

Where Will the SPX end July 2020?

07-13-2020 +1.0%

07-07-2020 +0.0%

06-29-2020 +0.0%

Earnings:

Mon: PEP

Tues: C, DAL, FAST, WFC, CTAS, JPM

Wed: GS, BK, USB, UHC, AA

Thur: ABT, SCHW, DPZ, HON, JNJ, MS, NFLX, BAC

Fri: ALV, BLK, FHN

Econ Reports:

Mon:

Tues: CPI, CPI Core

Wed: MBA, Empire, Import, Export, Industrial Production, Capacity Utilization

Thur: Initial Claims, Continuing Claims, Retail Sales, Retail ex-auto, Phil Fed, NAHB Housing Market Index, Business Inventories, Net Long Term TIC

Fri: Housing Starts, Building Permits, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Letting some things run, Taking Profits, Preparing protection for earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

UAA

Biden tells donors: I’m going to get rid of most of Trump’s tax cuts ‘and a lot of you may not like that’

PUBLISHED MON, JUN 29 20205:58 PM EDTUPDATED TUE, JUN 30 20201:03 PM EDT

Kevin Breuninger@KEVINWILLIAMB

KEY POINTS

- Presumptive Democratic nominee Joe Biden told potential donors to his campaign that he would roll back most of President Donald Trump’s multitrillion-dollar tax cuts – even though “a lot of you may not like that.”

- Biden’s warning to his backers came as the candidate laid out an ambitious suite of policy goals during a virtual campaign fundraiser.

- “I’m going to get rid of the bulk of Trump’s $2 trillion tax cut,” Biden said, “and a lot of you may not like that but I’m going to close loopholes like capital gains and stepped up basis.”

Presumptive Democratic nominee Joe Biden told potential donors to his campaign that his administration would end most of President Donald Trump’s multitrillion-dollar tax cuts – even though “a lot of you may not like that.”

Biden’s warning to his backers came as the candidate laid out an ambitious suite of policy goals during a virtual campaign fundraiser on Monday.

The event raised at least $2 million, CNBC reported.

Biden, who has largely avoided in-person campaign events throughout the coronavirus pandemic, said the recovery from the health crisis could present an “opportunity” to strengthen the middle class and make sweeping investments in clean energy and infrastructure.

“Folks, this is going to be really hard work and Donald Trump has made it much harder to foot the bill,” Biden said, according to a Wall Street Journal reporter’s press pool report about the event.

But even before the coronavirus crisis effectively froze the U.S. economy and sent unemployment skyrocketing, Trump’s “irresponsible sugar-high tax cuts had already pushed us into a trillion-dollar deficit,” Biden said.

“I’m going to get rid of the bulk of Trump’s $2 trillion tax cut,” Biden continued, “and a lot of you may not like that but I’m going to close loopholes like capital gains and stepped-up basis.”

Biden also said he would raise the corporate tax rate to 28%, which he said would raise an estimated $1.3 trillion over the next decade. The Trump tax cuts had shrunk corporate taxes to 21% from 35%.

“We have to think as big as the challenge we face. But this is America, there is nothing we cannot do if we do it together,” Biden said. “But I think the country is ready.”

The Trump campaign didn’t immediately reply to a request for comment.

—CNBC’s Brian Schwartz contributed to this report.

CDC says U.S. has ‘way too much virus’ to control pandemic as cases surge across country

PUBLISHED MON, JUN 29 20204:45 PM EDTUPDATED TUE, JUN 30 20203:30 PM EDT

KEY POINTS

- The coronavirus is spreading too rapidly and too broadly for the U.S. to get it under control as some other countries have, Dr. Anne Schuchat, principal deputy director of the Centers for Disease Control and Prevention, said Monday.

- The U.S. stands in stark contrast to countries like South Korea, New Zealand and Singapore as it continues to report over 30,000 new infections per day.

- “This is really the beginning,” Schuchat said of the U.S.’s recent surge in new cases.

The coronavirus is spreading too rapidly and too broadly for the U.S. to bring it under control, Dr. Anne Schuchat, principal deputy director of the Centers for Disease Control and Prevention, said Monday.

The U.S. has set records for daily new infections in recent days as outbreaks surge mostly across the South and West. The recent spike in new cases has outpaced daily infections in April when the virus rocked Washington state and the northeast, and when public officials thought the outbreak was hitting its peak in the U.S.

“We’re not in the situation of New Zealand or Singapore or Korea where a new case is rapidly identified and all the contacts are traced and people are isolated who are sick and people who are exposed are quarantined and they can keep things under control,” she said in an interview with The Journal of the American Medical Association’s Dr. Howard Bauchner. “We have way too much virus across the country for that right now, so it’s very discouraging.”

New Zealand’s outbreak peaked in early April, when the country reported 89 new cases in a single day, according to data compiled by Johns Hopkins University. On June 8, officials declared that there no more active infections in the island country of almost 5 million. Since then, a handful of cases have entered the country from international travelers, but health officials have managed to contain infections so far to fewer than 10 new daily cases per day through June.

South Korea was among the first countries outside of China to battle a coronavirus outbreak, but health officials managed to contain the epidemic through aggressive testing, contact tracing and isolating of infected people. The outbreak peaked at 851 new infections reported on March 3, according to Hopkins’ data, but the country has reported fewer than 100 new cases per day since April 1.

Like South Korea, Singapore found early success in preventing the spread of the virus through aggressive testing and tracing. However, in April the virus began to circulate among the island country’s migrant worker community, ballooning into an outbreak that peaked on April 20, when the country reported about 1,400 new cases, according to Hopkins’ data. Daily new cases have steadily dropped since then and on Sunday, the country reported 213 new cases, according to Hopkins’ data.

While the outbreaks in New Zealand, South Korea and Singapore have been of different magnitudes and followed different trajectories, officials in all three countries now quickly respond to every new infection in order to stamp out what remains of the outbreak, Schuchat said. The U.S. stands in stark contrast as it continues to report over 30,000 new infections per day.

“This is really the beginning,” Schuchat said of the U.S.’s recent surge in new cases. “I think there was a lot of wishful thinking around the country that, hey it’s summer. Everything’s going to be fine. We’re over this and we are not even beginning to be over this. There are a lot of worrisome factors about the last week or so.”

The sheer size of the U.S. and the fact that the virus is hitting different parts of the country at different times complicates the public response here compared with other countries, Schuchat said. South Korea, for example, was able to concentrate their response on the southern city of Daegu, for a time, and contact tracers were quickly deployed when new cases were later found in the capital Seoul.

“What we have in the United States, it’s hard to describe because it’s so many different outbreaks,” Schuchat said. “There was a wave of incredible acceleration, intense interventions and control measures that have brought things down to a much lower level of circulation in the New York City, Connecticut, New Jersey area. But in much of the rest of the country, there’s still a lot of virus. And in lots of places, there’s more virus circulating than there was.”

The coronavirus has proven to be the kind of virus that Schuchat and her colleagues always feared would emerge, she said. She added that it spreads easily, no one appears to have immunity to it and it’s in fact “stealthier than we were expecting.”

“While you plan for it, you think about it, you have that human denial that it’s really going to happen on your watch, but it’s happening,” she said. “As much as we’ve studied [the 1918 flu pandemic], I think what we’re experiencing as a global community is really bad and it’s similar to that 1918 transformational experience.”

With the current level of spread, Schuchat said the U.S. public should “expect this virus to continue to circulate.” She added that people can help to curb the spread of infection by practicing social distancing, wearing a mask and washing their hands, but no one should count on any kind of relief to stop the virus until there’s a vaccine.

“We can affect it, but in terms of the weather or the season helping us, I don’t think we can count on that,” she said.

Oil major Shell to write down up to $22 billion of assets in second quarter

PUBLISHED TUE, JUN 30 20203:13 AM EDTUPDATED TUE, JUN 30 20204:28 AM EDT

KEY POINTS

- Shell said in a statement to investors that it had reviewed a significant portion of its business given the impact of the coronavirus pandemic and the “ongoing challenging commodity price environment.”

- It said it would take aggregate post-tax impairment charges in the range of $15 billion to $22 billion in the second quarter.

- Shares of the Anglo-Dutch company were over 2.4% lower during early morning deals.

Oil giant Royal Dutch Shell said on Tuesday it will write down the value of its assets by up to $22 billion in the second quarter, after revising down its long-term outlook for oil and gas prices.

It comes after the energy company announced in mid-April an ambition to reduce greenhouse gas emissions to net zero by 2050.

Shell said in a statement to investors that it had reviewed a significant portion of its business given the impact of the coronavirus pandemic and the “ongoing challenging commodity price environment.”

It said it would take aggregate post-tax impairment charges in the range of $15 billion to $22 billion in the second quarter.

This included a write-down of between $8 billion-$9 billion in its integrated gas unit, a $4 billion-$6 billion write-down in upstream assets, and a $3 billion-$7 billion write-down in oil products across its refining portfolio.

Shares of the Anglo-Dutch company were over 2.4% lower during early morning deals.

Earlier this month, U.K.-based energy giant BP also said it would incur non-cash impairment charges and write-offs in the second quarter, estimated to be in an aggregate range of $13 billion to $17.5 billion after tax.

Oil and gas price forecasts

Shell said it expected international benchmark Brent crude prices to average $35 a barrel in 2020, down from a previous forecast of $60.

The firm also lowered its Brent price forecast to $40 in 2021 and $50 in 2022, having previously said it expected prices to average $60 for each respective year.

Brent crude futures traded at $41.39 on Tuesday morning, down around 0.7%, while U.S. West Texas Intermediate futures stood at $39.35, more than 0.8% lower.

The energy giant also said it believes Henry Hub gas prices will average $1.75 per million British thermal units in 2020, before rising to $2.5 over 2021 and 2022, and $2.75 in 2023.

Henry Hub is a natural gas pipeline located in Louisiana and serves as the official delivery location for futures contracts on the New York Mercantile Exchange.

Ford sales fall 33.3% in the second quarter due to coronavirus

PUBLISHED THU, JUL 2 20209:16 AM EDTUPDATED THU, JUL 2 202010:34 AM EDT

KEY POINTS

- Ford Motor reported that its U.S. vehicle sales in the second quarter were down 33.3%, in line with industry expectations.

- S. vehicle sales were forecast to fall by about 34% in the second quarter.

- Every vehicle in Ford’s lineup aside from the Explorer SUV and Ranger midsize pickup were down for the quarter.

Ford Motor reported Thursday that its U.S. vehicle sales in the second quarter were down 33.3%, in line with industry expectations as the coronavirus caused consumers to stay at home and dealerships and factories to shutter.

Ford’s decline was less than its crosstown rivals. Year over year, General Motors reported a 34% decline in sales in the second quarter, while Fiat Chrysler said vehicles sold fell 38.6%.

Overall U.S. vehicle sales were forecast to fall by about 34% in the second quarter, according to auto research firms Edmunds and TrueCar’s ALG. The second quarter is expected to be the worst of the year for the automakers due to the pandemic.

Every vehicle in Ford’s lineup aside from the Explorer SUV and Ranger midsize pickup were down in the second quarter. Those vehicles were up 12.4% and 19.8%, respectively.

Ford reported retail sales to consumers in the second quarter declined 14.3% compared with a year earlier, including a 0.4% decline in truck sales and 22% drop in SUVs. Retail car sales plummeted 34.7%.

Despite the declines, Ford said its retail share grew an estimated full percentage point to 13.3% — the automaker’s best retail share quarter in five years.

“Our performance was driven largely by full-size pickups,” said Mark LaNeve, Ford vice president of U.S. marketing, sales and service.

Largely due to declines in its fleet unit, which includes sales to government and businesses, sales of its F-Series pickups were down 22.7% in the second quarter.

Ford is optimistic about demand recovering for its commercial business as well as retail sales for the remainder of the year.

“We believe we’re in good shape for the third-quarter summer selling season and hopefully we can continue some of those strong share gains,” LaNeve said. “All-in-all in an unprecedented, very challenge quarter we overperformed.”

There remains concerns for the rest of the year regarding a potential resurgence of Covid-19 impacting the auto industry, LaNeve said.

Automakers across the U.S. had to end vehicle production from March until mid-May due to the pandemic. They’ve also cut or deferred executive and white-collar salaries and withdrawn guidance for the year.

https://seekingalpha.com/article/4356575-boeing-suffers-blow

Boeing Suffers Blow

Jul. 2, 2020 10:00 AM ET

Summary

Boeing suffered a big cancellation from Norwegian for 97 Boeing aircraft.

While broadly covered in the media, Boeing already added the order to a tally, which preludes cancellation, in March this year.

The cancellation shouldn’t come as a surprise.

It’s easy to blame the Boeing 737 MAX, but the fact is that Norwegian went on a debt-fueled expansion that left it vulnerable to crises like the world faces today.

This idea was discussed in more depth with members of my private investing community, The Aerospace Forum. Get started today »

In Monday’s trade, shares of Boeing (BA) gained 14.4% on news of a series of certification flights that should eventually send the Boeing 737 MAX back to commercial service (if supporting demand exists) by year-end. After hours, shares dipped as Norwegian (OTCPK:NWARF) cancelled its order for 97 Boeing aircraft and at the time of writing Boeing shares have given up around $12 out of the $24 gain in share prices. When it comes to that price movement in either direction, I’m indifferent as the pop was expected, but for fundamentals to significantly improve Boeing needs a re-certified MAX and a robust market. Even with the first certification flight carried out, there should be the realization that the path forward is a long and complex one.

The cancellation by Norwegian is obviously placed in the Boeing 737 MAX context and that’s not completely unjustified, but it suffices to say that it does not tell the full story on how Norwegian ended up in this position. The link between the Boeing 737 MAX and Norwegian’s cancellation is the obvious angle, but there’s another angle to Norwegian’s story that I will highlight in this report.

Mega orders with Boeing and Airbus

We can kick off Norwegian’s story with its order for 100 Boeing 737 MAX aircraft and 22 Boeing 737-800 aircraft in January 2012. The airline didn’t stop there as it also purchased 100 Airbus A320neo aircraft from Airbus and obtained purchase rights for another 100 Boeing 737 MAX and 50 Airbus A320neo. We’ve seen mega orders, and in recent years, those mega orders became bigger and bigger. But this order for 222 aircraft plus 150 options in 2012 – it’s a big questionable order. Even by today’s standards this order would be considered unrealistically big.

Including options, the order with Boeing can be valued north of $11B while the Airbus (OTCPK:EADSF) order would be valued $7.5B. That means that in 2012, an airline with a fleet of 68 aircraft purchased 222 aircraft plus 150 options valued $18.5B while it didn’t even clear $100 million in profits that year. Call it what you want. I call the orders placed with Boeing and Airbus overly ambitious.

Mega cancellation with Boeing

From mega orders can come mega cancellations. That is the news Boeing received on Monday as Norwegian zeroed its backlog with Boeing. Our Boeing Backlog monitor available to subscribers of The Aerospace Forum shows that Norwegian indeed had 97 aircraft on order: 92 Boeing 737 MAX aircraft and five Boeing 787-9s. We estimated the total value of these aircraft to be $5.4B. That’s a big pill to swallow for Boeing: Norwegian is the third biggest customer for the Boeing 737 MAX in Europe measured by backlog and the second-biggest airline customer for the type in Europe.

So, there’s no doubt that this is an incredibly big blow to Boeing. One thing, however, is not stressed nearly enough and that’s chances are closer to 1 than to 0 that Boeing already anticipated this order cancellation. In 2018, Boeing adopted a new revenue recognition accounting standard (ASC 606) which applies a set of criteria for recognizing a contracted backlog beyond what existed with a firm purchase agreement with the customer. Each month, Boeing updates its orders and deliveries overview. By simply subtracting orders from deliveries, you get the backlog for which a firm purchase contract exists. On top of that Boeing applies the additional criteria for recognizing the contracted backlog. It’s not known which boxes need to be checked to pass the test, but we do know that Boeing does provide information on this – not split out by customer but by aircraft family. We have observed the development of elimination of backlog via this ASC 606 standard and found that for many airlines the orders do end up in the ASC 606, if you will as a prelude to cancellation, when the customer is facing financial difficulties and Boeing no longer expects customer to be able to pay for the aircraft.

This is where I think investors should be mindful, and reporting by news outlets fail to mention a key point: Nowhere has it been mentioned that these aircraft are highly likely to be accounted for in the ASC 606 tally that Boeing provides (accessible to everyone). We often do see that the prelude of the cancellation and the actual cancellation are treated the same either by media or by the reader and in some sense you are not wrong in doing so because I have never seen an ASC 606 adjustment being reverted, but as a reader you should be extremely well aware that there’s a difference. Boeing currently has net orders including ASC 606 adjustments of -602 units. Monday’s cancellation news covering 97 aircraft is not going to bring that tally to -699 units.

The explanation

We did our homework and went the extra mile for our readers. When we write the monthly order and delivery overviews, we try to connect ASC 606 to particular customers. It’s one of the elements that sets our monthly order and delivery overviews apart and it’s one of the things that makes Boeing Backlog Monitor developed for The Aerospace Forum more useful. In April, we reviewed the order and delivery data for March and we observed that five Boeing 787s were added to the ASC 606 tally and 139 Boeing 737 MAX aircraft. It’s quite a time-consuming task to narrow down which specific orders could be in the ASC 606 tally because Boeing doesn’t provide any names of the customer for that part of the backlog update. However, we connected the Boeing 787 with the Boeing 737 MAX, and with some customers of which we knew they had financial difficulties and by doing so the customer that rolls out as the customer behind the prelude to the cancellation is Norwegian. So, we had the prelude of the cancellation back in March and we now have the formal cancellation notice in June. How will Boeing recognize this cancellation? That’s easy: The prelude of the cancellation has now turned into a formal contract cancellation, which means that the ASC 606 adjustments go down by 97 units and the formal cancellation goes up by 97. On a net-basis, you will still see the -699 units (not accounting for any other cancellations). That’s why investors should be very mindful about just taking numbers and feast on cancellation news twice, because what seems like a blow to Boeing is something Boeing already anticipated months ago.

Busted growth and high fixed costs

There’s a connection between the MAX issues and the cancellation. However, there’s also a connection between the cancellation and the current market environment and Norwegian’s financial position. The bottom line is really simple, while the Boeing 737 MAX crisis has hurt Norwegian the airline really hasn’t been in a great spot to cope with a demand shock. What are we seeing now? Exactly that… a demand shock.

In 2012, the airline committed to buying 222 aircraft and 150 purchase rights while having a fleet of just 68 aircraft. The airline positioned itself to grow significantly targeting to grow to the size of Ryanair (RYAAY) quite rapidly. There’s nothing bad with being ambitious, but easyJet (OTCPK:EJTTF), Ryanair (RYAAY) and Wizzair, they all compete for the same buck trying to be the low-cost carrier king of Europe. So, Norwegian was very ambitious in a highly-competitive market. Now, having growth aspirations is not a bad thing as it also unlocks scale advantages. What’s somewhat less likable about Norwegian’s growth trajectory is that it’s fueled by debt. In 2014, the airline started to increase its debt from less than €400 million to €5.3B by the end of 2019 and over €6B by Q1 2020. Revenues didn’t even grow closely to that at 179% while EBIT margins went from 2.8% to 2%.

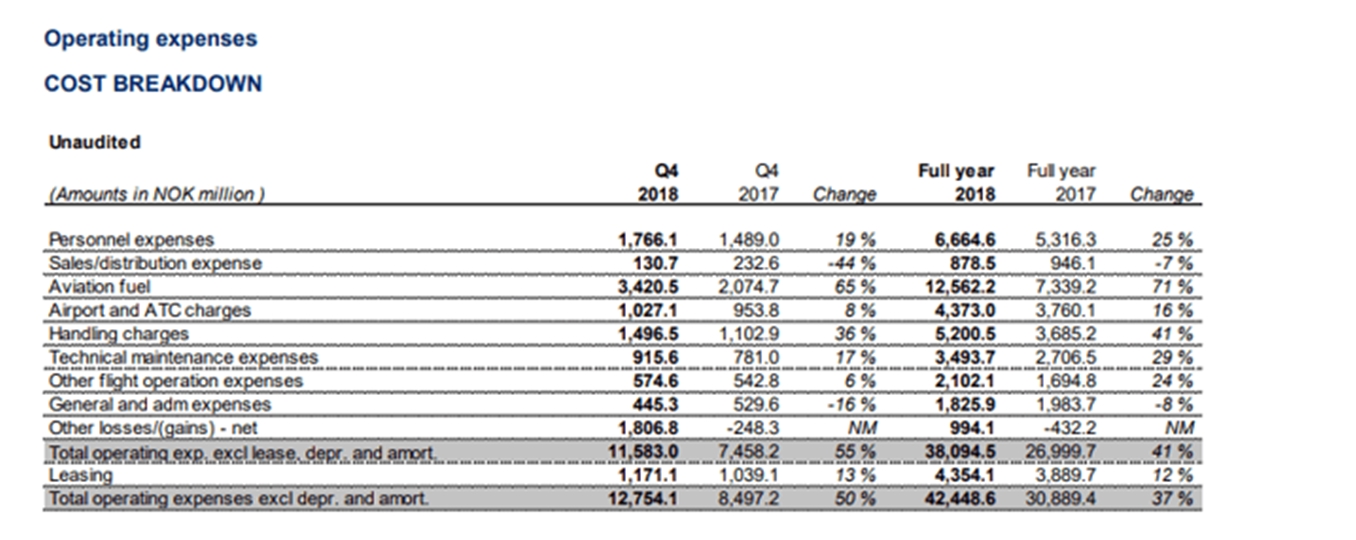

Figure 1: Full year results 2018 and 2017 Norwegian (Source: Norwegian)

The growth in debt certainly didn’t translate into better performance. Obviously, the grounding of the MAX plays a role. If we look at 2018, the year prior to the Boeing 737 MAX grounding, then we see that Norwegian had a hard time controlling costs as the company suffered fuel hedge losses. So, you can blame the Boeing 737 MAX, but even absent of the Boeing 737 MAX problems Norwegian was high on debt and costs. In part, this is because of issues with the Rolls Royce (OTCPK:RYCEF) turbofans on the Boeing 787 fleet for which the company was compensated by Rolls Royce.

Back to 2019: A quick calculation shows that the grounding of the Boeing 737 MAX in 2019 led to roughly $45 million in missed profits for the 18 Boeing 737 MAX aircraft in the fleet and at most $40 million for the 16 aircraft that didn’t enter service with Norwegian in 2019. So, the contribution of the MAX crisis to the $165 million loss is notable yet small with the debt profile in mind.

The pain Norwegian is suffering is because it went on a debt-fueled expansion spree that didn’t translate into better financial results. So, you can blame Boeing, but it’s Norwegian that had a cost structure it could not control and went on a painful long-haul, low-cost adventure. Norwegian is hardly the first airline that burns its hands on long-haul low cost operations. Primera Air and Wow Air tried long-haul low-cost, which resulted in bankruptcy for both. Norwegian just was the airline that kept on trying, believing it could succeed. Maybe they also didn’t have an option there as the company needed to become profitable as debt repayments started closing in. The airline maneuvered itself in an unsustainable position blinded by debt and growth ambitions and the airline didn’t remove its blindfold until Bjørn Kjos stepped down after 17 years at the helm of the company.

What doesn’t help the company either is how the airline does business when purchasing aircraft. To make growth more affordable, the airline has been leasing its aircraft or arrange sale-and-leaseback agreements. It sounds pretty clever to lease so you make monthly lease payments instead of having to make pre-delivery payments to Boeing or Airbus starting two years before the aircraft will be delivered and a final delivery payment typically 40% to 60% of the purchase price. However, whereas an owned asset provides non-cash costs in the form of depreciation, leased aircraft are fixed monthly cash items that you can’t really dodge. Sale-and-lease back transactions sound nice as you sell the asset and receive cash and then pay the lease from that asset, but if demand falls or an airline has more aircraft than its network needs – a leased asset provides a fixed cost for years as these aircraft are usually on 7-12 year lease terms. Norwegian has leased over 80% of its fleet and t has fixed monthly payments. This sounds very familiar to Jet Airways’ fleet structuring, another airline that went out of business because it didn’t have a clear business plan.

Norwegian is still around, but to make debt payments and remain in business it has been selling assets and stakes. With 80% of the fleet leased there simply are not many assets to sell to make debt payments or improve liquidity. Besides that, selling aircraft and leasing them back results in swapping balance sheet value for fixed monthly cost plus a bit of a cash, hardly a good trade. Alternatively, the airline could shrink, but that would leave a smaller airline with the same debt load, which hardly can be called a solution.

How bad things have been for Norwegian becomes clear when we consider that the airline couldn’t make lease payments any longer and AerCap (AER) switched to cash accounting for lease payments from Norwegian. In fact, in a debt-to-equity conversion, AerCap became Norwegian’s largest shareholder.

The challenges, however, remain:

- Norwegian has a fleet likely too big for a post-COVID-19 world.

- Low-cost, long-haul is a challenging operation if you don’t have the right aircraft for it.

- Debt remains high.

Back to Boeing and Airbus

Now back to Boeing and Airbus. Given the problems with the Boeing 737 MAX and the Rolls Royce turbofans used on the Boeing 787 in combination with Norwegian’s financials and the current market environment, the cancellation makes a lot of sense. Norwegian also has terminated the services contracts with Boeing. Again, I won’t say the MAX problems and the frustration about the Rolls Royce turbofans have not played a role but Norwegian didn’t need hundreds of aircraft years ago and it doesn’t need hundreds of aircraft today or tomorrow. So, canceling that order makes a lot of sense.

Norwegian has also sued Boeing to get back its pre-delivery payments made on the aircraft and compensation for the issues with the Boeing 737 MAX and Boeing 787. For the Boeing 787, I believe Norwegian should direct itself to Rolls Royce. For the Boeing 737 MAX, the airline might have a point.

There are 18 aircraft that haven’t flown for 15 months and it might be late 2020 before they can re-enter service. That’s a total of 21 months. That brings the missed profits to around $110 million for the already-delivered aircraft. For the undelivered jets in 2019 there would be at most $40 million in missed profits. That brings the total of $150 million for the aircraft that was supposed to be delivered last year or already in the fleet. Norwegian also could be looking for compensation for the 24 aircraft that it expected this year and the missed profits this year from the aircraft that weren’t delivered through 2019 and the aircraft that were delivered but not operational due to the Boeing 737 MAX grounding. A compensation request for that would be shaky as demand has collapsed but could at most be $200 million. So, there would be $145 million for which I think the claim is reasonably supported, but for another $200 million in possible compensation request it’s hard to make a case in the current market environment.

It’s not quite known how much Norwegian already has paid to Boeing as part of the pre-delivery payment process, but we can estimate this. Starting with the Dreamliner, there were five Boeing 787-9s to be delivered this year. Norwegian cancelled all of these orders. These aircraft were supposed to be delivered within six months meaning that pre-delivery payments to Boeing would amount to roughly $440 million. By canceling the order, Norwegian dodges $325 million to be paid on delivery for aircraft it does not need. At the same time there’s the potential of $115 million in cancellation fees.

Now going to the Boeing 737 MAX, that’s a bit more complex because deliveries are stretching out further. We have seen two common pre-delivery payment profiles. We used both of these models to get an estimate on how much has been paid to Boeing. One such model suggests that Norwegian paid $1.1B in pre-delivery payments for 47 aircraft deliveries valued $2.5B including signing payment on 45 other aircraft within the order quantity. The other model suggests $1.1B has been paid for 77 aircraft deliveries valued $4B including signing payments for 15 aircraft. For an airline that’s facing billions in debt, having those pre-delivery payments for aircraft it no longer wants returned really provides relief. Legally I don’t see why Boeing would have a strong foot not to return those payments, but Boeing being Boeing they’d gladly fight things out in court, it seems. What also plays a role is that the jet maker is facing cash pressures, too and if it just hands Norwegian the money now, it’s a certainty tomorrow more customers will knock at Boeing’s door to have their money back without having to put up a fight for it. Any other day, absent of a Boeing 737 MAX crisis, Boeing would return the money. It’s known that with some key customers Boeing has provided relief instead of letting the airline sink. The current circumstances would, however, result in a major cash outflow for Boeing if it would just start aiding customers… because frankly all key customers are in trouble right now.

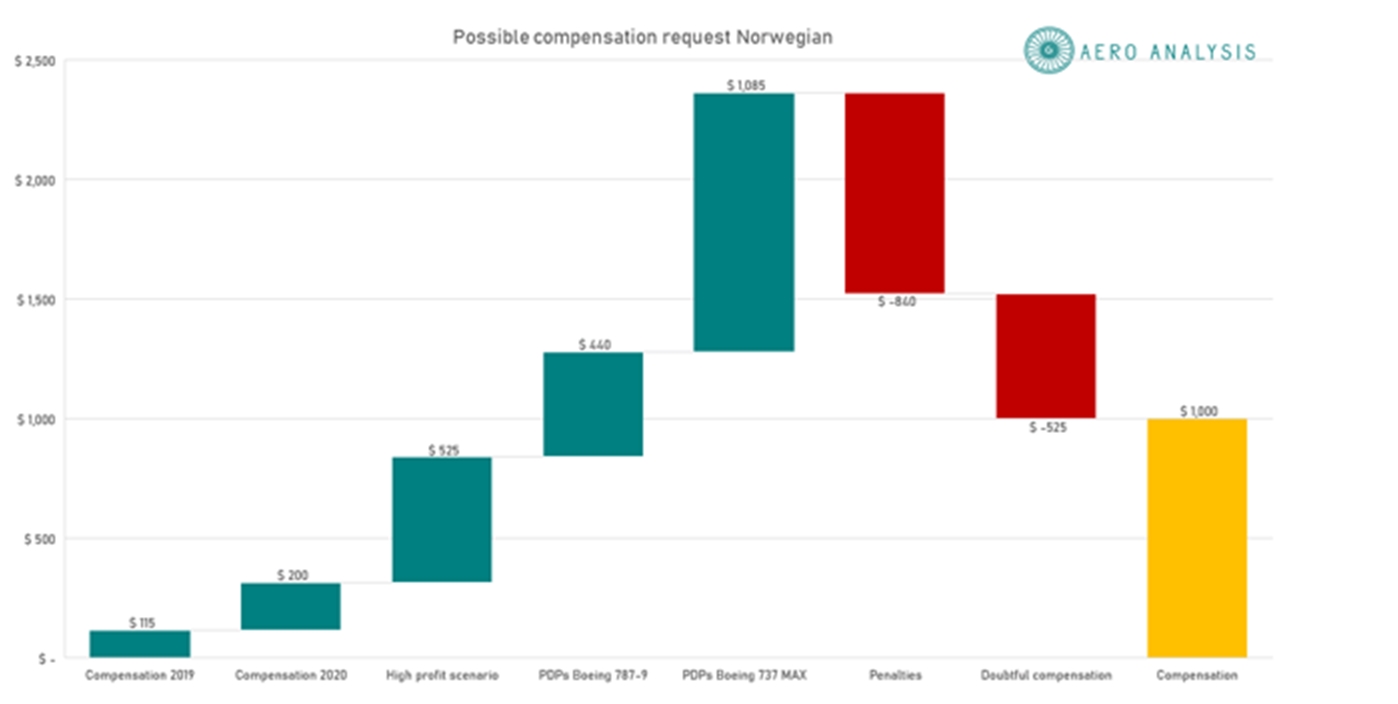

We can put all numbers together to get an idea of how much Norwegian could potentially be looking for:

Figure 2: Compensation estimate Norwegian (Source: Norwegian)

The first three bars account for Boeing 737 MAX related compensations. I believe the airline would be looking into getting at least $90 million for 2019, $200 million for 2020 and if you consider the profitability the airline saw in late 2019 Norwegian could add another $537 million to that request. That brings the Boeing 737 MAX total to $840 million and to that we would add the return of the pre-delivery payments in the amount of $1,525 million. So, Norwegian could ultimately be looking for $2.4B in cash compensation. Now, Boeing could be putting a penalty on the cancellation though I have no idea how strong their position is to enforce this, but that would reduce the compensation by $840 million while I also have doubt that whether Boeing is flexible to provide any compensation for 2020 or provide compensation according to a high profit scenario which Norwegian doesn’t often reach. That would bring the minimum Norwegian could be entitled to $1B. It may be $1B or $2.4B that Norwegian is seeking. Any amount it can get in court will help the airline pay off debts and continue operating.

They currently have money stuck in the form of pre-delivery payments while they don’t need these aircraft. Previously the modus operandi would be to have the leasing arm of Norwegian try to place these aircraft with other airlines, but there’s no demand for that, and since lessors have become the biggest shareholders of Norwegian, they also won’t be eager to be a shareholder in a company that’s not only an airline but also a lessor. I believe that lessors could be the driving power behind terminating the purchase agreement with Boeing as they don’t want Norwegian’s leasing arm to be a competing power going forward – lessors already have been flexible on Norwegian’s lease payments or better said the lack of the lease payments and they have a big say in where the company heads from here and the path forward will unlikely be growing further without working toward a healthier balance sheet that would allow lessors to sell their stakes at some point. After all they are now effectively owning the company.

The big question is what happens with the Airbus order. Previously, five Airbus A320neo orders were cancelled while 30 Airbus A320neo aircraft orders were converted to the long-range variant of the Airbus A321neo and seven aircraft have been delivered to the leasing arm of Norwegian leaving 58 Airbus A320neo aircraft and 30 Airbus A321LR on order with Airbus. At this stage it’s unknown what will happen to these aircraft. Norwegian ordered these aircraft but decided years ago that it would be leasing these aircraft to other airlines. Demand is virtually zero at the moment, but since many of these aircraft would be delivered from 2024 onward there’s no immediate need to terminate the contract and with deliveries pushed out there also isn’t a lot of cash that already changed hands. Norwegian cancelled the order where it had most cash stuck and that’s with Boeing. The Airbus order does not make a lot of sense and it might at some point go as well or be transferred to the lessors that are now shareholders of the company if the market recovers. You could say that over time Norwegian could transform into an all-Airbus fleet but I don’t think that’s likely as that also will introduce costs. However, by terminating the contract with Boeing and keeping the agreement with Airbus for now, Norwegian could generate some leverage in negotiations with Boeing. Either way, whether they are orders with Boeing or with Airbus, at this point, neither does make sense, and if you look back at that 2012 order you could say the order never really made sense. Norwegian bit off more than it could chew. In a good scenario, Norwegian would battle Boeing in court, win, get $1B to $2.4B in compensation and payments returned and terminate its order with Airbus as well waving the leasing business goodbye. The best thing to do now after years of expanding recklessly in all directions would be to focus on one thing and do it well.

Conclusion

The easy angle to the cancellation is that it’s all the fault of Boeing. Partially it is, but Norwegian has gone on a debt-fueled growth spree and surely they have had bad luck with the Boeing 737 MAX and with the Boeing 787-8 and COVID-19, but this is the story of many airlines that failed… everything went well and then everything went south and the structure of the company wouldn’t allow the airline to escape from the death spiral. I feel sorry for the crews working hard for these airlines, but Norwegian’s current failure from which they can still emerge given that lessors are backing the company as shareholders is in part driven by the huge order quantities, mounting debt and lagging profitability. That’s not just on Boeing. Norwegian like many low-cost airlines gambled and lost and at in the current setting terminating existing orders to improve liquidity and reduce future cash requirements is the only wise thing to do. Boeing already knew this back in March.

HI Financial Services Mid-Week 06-24-2014