HI Market View Commentary 07-06-2021

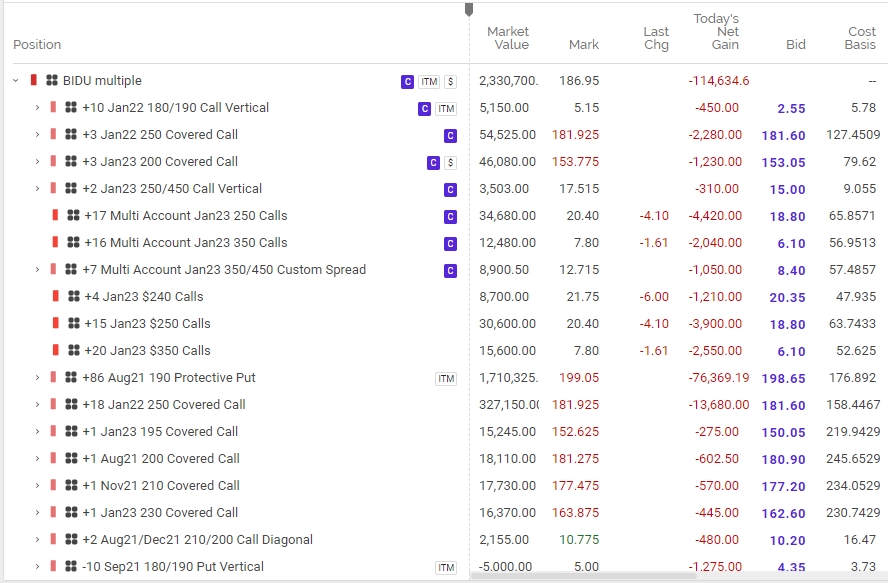

What is happening to the 250 or 240 Leap long calls? Why have we lost everything? Why have we not sold them

SO my standard answer is to understand Trading/investing IS A PROCESS

These call expire in Jan 2023

COST basis ranges between 67 and as low as 48

I understand We have these positions that are losing value ? BUT not losing money

Because I sold short options against the longs AFTER they became profitable

YOU are in a risk free trade or guaranteed profitable position that has until; Jan 2023

How?

You have until JANUARY 2023, The third Friday for BIDU to trade above $240/250 and ANYTHING above those strike price or values is more profit

My question back to you ? WHY would you sell a risk free trade that has 18 months to become profitable?

The process requires Patience and patience is a sucky virtue to have to learn

Why not dollar cost average?= Because it introduces risk into the trade

What the hack is China doing?= New Regulations

They’re doing EVERYTHING the USA has asked them to do for the last 30 years

Why are they doing it now? Trump tariffs and Biden has NOT removed them yet

I do recommend BIDU because it is transparent, it has 5 revenue streams, it works with AAPL and it has made me millions over the years

IF you’ve taken and education, retake the classes and learn from them

DON’T EVER blindly follow trade advisory’s PERIOD

How do you add protection – 83% of the time stocks fall 10% or more during a six week period of time

Two weeks prior to earning and four weeks after = Fox News or CBOE

Right now Hurley Investments is NOT beating the S&P 500

We have added protection/insurance and have not really needed it

DO you ever go back to your home owners, health insurance provider, car insurance, life insurance and asked for you money back if you didn’t need it? They will laugh you out of their offices

The insurance protects whether you need it or not

The positions we are in are great undervalued blue chip stocks

When people come back to work in September, when the reflation trade comes, when deflation rears its head, when infrastructure stimulus kicks in we will make it all up and then some because we were protected and at times added shares

Deflation is good because it lowers the price of goods we make here in the USA which means people go out and buy stuff at cheaper prices which increases the GDP. The problem with Deflation is over time companies make less which hurts the stock market and some people get worried and start saving .

WHY when the stock market goes on sale everyone rushes for the exit?

https://go.ycharts.com/weekly-pulse

| WEEK OF JUN. 28 THROUGH JUL. 2, 2021 |

| Happy Independence Day from YCharts! |

Earnings Dates

AAPL – 07/27 AMC

BA – 07/28 est

BABA – 08/19 est

BAC – 07/14 BMO

BIDU – 08/12 est

COST – 09/23 AMC

DIS – 08/12 AMC

F – 07/28 AMC

FB – 07/28 AMC

FSLR – 07/29 est

GE – 07/27 BMO

GM – 08/04 AMC

JPM – 07/13 BMO

MU – 06/30 AMC

TGT – 08/19 BMO

UAA – 08/03 BMO

V- 07/27 est

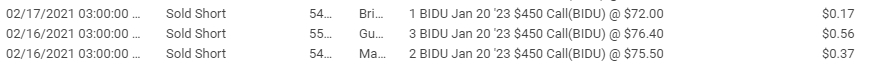

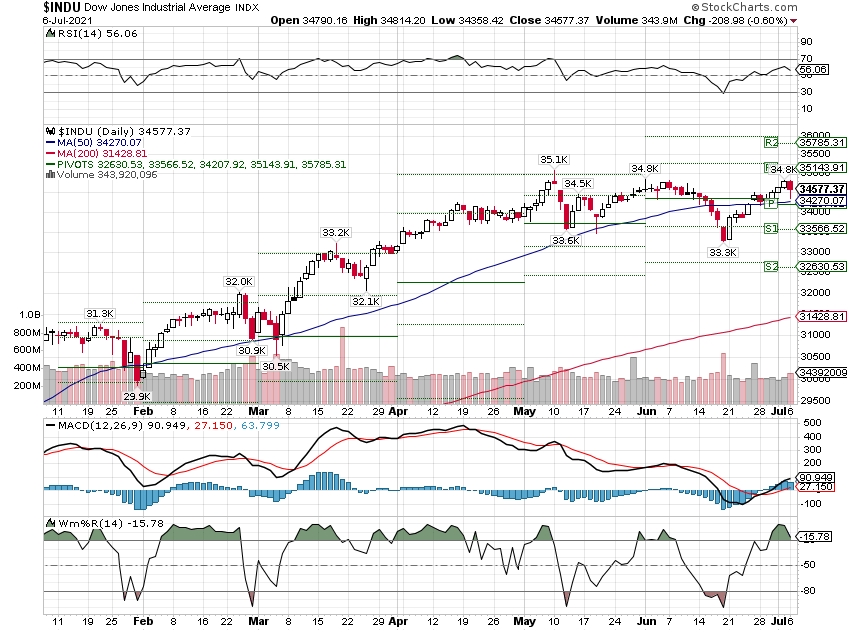

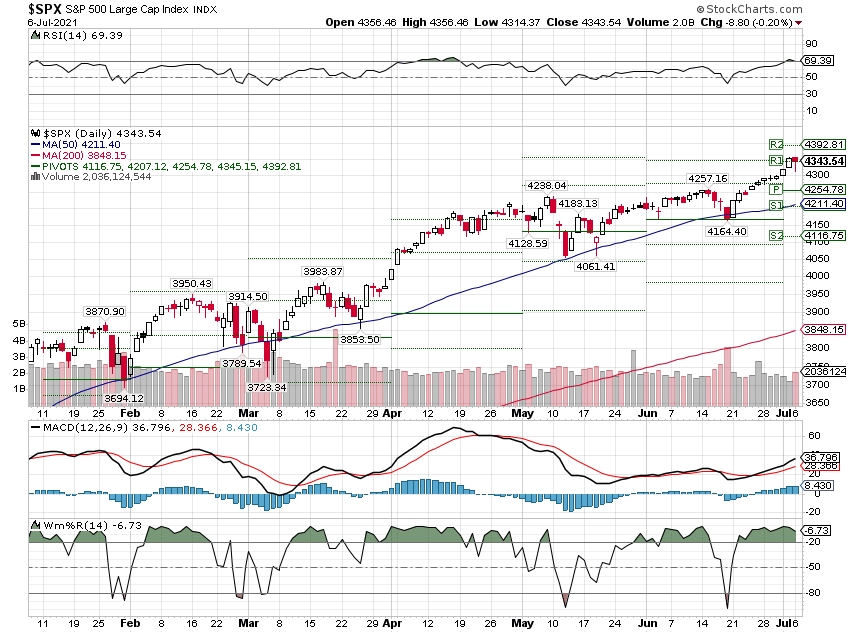

Where will our markets end this week?

Flat

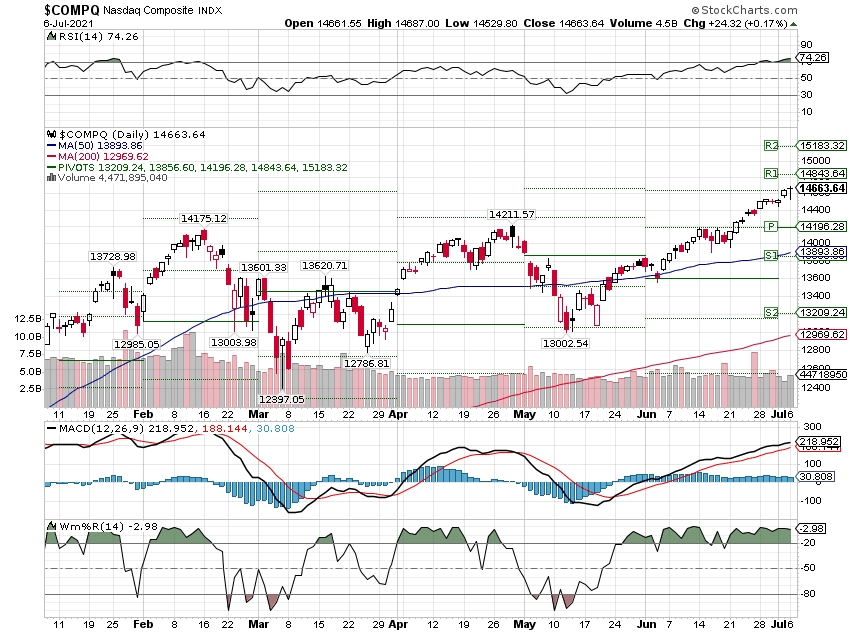

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end July 2021?

07-06-2021 3.0%

06-28-2021 3.0%

Earnings:

Mon:

Tues:

Wed:

Thur: LEVI

Fri:

Econ Reports:

Mon:

Tues: ISM Non- Manufacturing,

Wed: MBA, JOLTS, FOMC Manufacturing

Thur: Initial Claims, Continuing Claims, Consumer Credit

Fri: Wholesale Inventories,

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Apple shares underperform Nasdaq returns for first half of 2021

Krish Sankar, senior research analyst at Cowen, joined “Squawk Box” on Thursday to discuss his outperform rating and $180 price target on Apple’s stock.

THU, JUL 1 20218:57 AM EDT

Warren Buffett says the pandemic has had an ‘extremely uneven’ impact and is not yet over

PUBLISHED TUE, JUN 29 20219:01 PM EDTUPDATED WED, JUN 30 202112:43 PM EDT

Legendary investor Warren Buffett said the economic consequences of the pandemic are falling disproportionately on small businesses and the unpredictability of Covid-19 is far from over.

“The economic impact has been this extremely uneven thing where … many hundreds of thousands or millions of small businesses have been hurt in a terrible way, but most of the big companies have overwhelmingly done fine,” the Berkshire Hathaway CEO said during an interview with Becky Quick on CNBC’s special “Buffett & Munger: A Wealth of Wisdom,” which aired Tuesday.

In March 2020, the pandemic cut a deadly swath across America, which led to a shutdown of a $20 trillion economy in full swing. Thousands of small businesses were forced to close their doors while big-box retailers and e-commerce giants took in those customers. Gross domestic product for the first quarter last year dropped 31.4%, which was unprecedented in post-Great Depression America.

“It’s not over,” the 90-year-old investor said. “I mean, in terms of the unpredictability … it’s been very unpredictable, but it’s worked out better than people anticipated for most people and most businesses. And it’s just, for no fault of their own, it’s just decimated all kinds of people and their hopes.”

Covid created ‘fabulous success’

For some businesses like auto dealers, the pandemic even brought on windfall profits, said Charlie Munger, vice chairman of Berkshire and Buffett’s longtime business partner.

“It didn’t create just a return to normal; it created fabulous success they didn’t anticipate,” Munger said. “The auto dealers are coining money that they wouldn’t have had except for the pandemic.”

Due to factory shutdowns and a global shortage of semiconductors, automakers and dealers have experienced surging, if not record, profits and even selling vehicles before they arrive at dealerships.

Berkshire Hathaway Automotive is one of the largest dealership groups in America, with more than 78 independently operated dealerships. The conglomerate also owns the BNSF Railway and NetJets, a private business jet charter and aircraft management company.

“All of the dealers that we have partners in each dealership, they very sincerely felt that they were going to have one hell of a problem in March and April,” Buffett said. “Some might have wanted to go in for the assistance from the government, but we wouldn’t let them, because they had a rich parent … we didn’t know what was going to happen with NetJets in terms of the demand.”

The biggest lesson

Buffett said the biggest lesson he learned from the unprecedented pandemic is how ill-prepared the world can be for emergency situations that are bound to happen.

“I learned that people don’t know as much as they think they know. But the biggest thing you learn is that the pandemic was bound to occur, and this isn’t the worst one that’s imaginable at all,” Buffett said. “Society has a terrible time preparing for things that are remote but are possible and will occur sooner or later.”

More than 600,000 people have died of Covid in the U.S., and countries are grappling with new variants amid vaccine rollouts. The delta variant, now in at least 92 countries, including the United States, is expected to become the dominant strain of the disease worldwide. In the U.S., the prevalence of the variant is doubling about every two weeks.

“There’ll be another pandemic, we know that. We know there’s a nuclear, chemical, biological, and now cyberthreat. Each one of those has terrible possibilities,” Buffett said. “And we do some things about it, but … it’s just not something that society seems particularly capable in fully coming to grips with.”

A steady uptick in sweeping cyberattacks this year has directly impacted Americans and hampered logistics and services in the United States. In May, a ransomware attack on Colonial Pipeline forced the U.S. company to shut down approximately 5,500 miles of pipeline.

“Charlie and I have been ungodly lucky in many ways. But the luckiest thing was actually being around at this time and place,” Buffett said. “How do we actually do this so that mankind, 50 and 100 and 200 years from now, should enjoy the incredibly better life that could be enjoyed while not screwing it up?”

Stocks should add to gains in the second half, but there are two big concerns

PUBLISHED TUE, JUN 29 20213:28 PM EDTUPDATED TUE, JUN 29 20215:32 PM EDT

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- Stocks head into the second half of the year at record levels and should continue to gain, powered by a strong economy and robust earnings growth.

- Inflation and the possibility of tighter Fed policy are two concerns for the market.

- “It’s kind of like you have a free pass for the summer,” one economist said. “The market is accepting any number whether it’s on core inflation, wages or job openings. September is the magic month for everyone. If it doesn’t start to improve, it’s not Goldilocks anymore.”

Stocks are expected to move higher in the second half of the year, propelled by strong earnings gains and super-charged economic growth.

The market’s gains, however, are not expected to be as robust as in the first half, when indexes jumped by double digits and set multiple all-time highs. Strategists caution there are risks of a pullback, though they have been warning of that for awhile, and the market has continued to power higher.

“Strong growth, strong earnings, low interest rates, a bond market that’s been lulled to sleep. The bond yields aren’t really reacting to inflation news,” Bank of America head of global economic research Ethan Harris said. ”[Fed Chairman Jerome] Powell has done a good job of calming the waves in the bond market, so this is Goldilocks for equities.”

But there are a few risks strategists are watching out for in the latter half 2021. One is the potential for choppy trading when the Federal Reserve begins to discuss slowing down its bond buying, which would be its first step away from the easy policies put in place during the pandemic.

The time frame for that is not known, but many Fed watchers expect the central bank to begin the discussion at their Jackson Hole symposium in late August.

The second is again Fed related, and it is the fear that hot inflation readings are not really going to be as fleeting as central bankers expect, but that rising prices could become a bigger problem for the economy. The concern is that higher inflation readings could speed up the Fed’s timeframe on interest rate hikes, currently forecast by Fed officials to start in 2023.

September the ‘magic month’

Harris said the economy needs to show improvement within several months, on the labor front and on the supply shortages and bottlenecks. Job growth has been strong, but not as robust as expected, as employers complain about labor shortages.

“It’s kind of like you have a free pass for the summer,” Harris said. “The market is accepting any number whether it’s on core inflation, wages or job openings. September is the magic month for everyone. If it doesn’t start to improve, it’s not Goldilocks anymore.”

September is when extended unemployment benefits run out for many Americans, and also when parents may be freed up to return to the workforce as children go back to school. It is also when many workers return to their offices.

Another important factor overhanging global markets is the course of the pandemic. The spread of the delta variant is causing economic shutdowns in some parts of the world, particularly in Asia.

But the market has been able to brush off concerns. “The market doesn’t care about the variant because it’s known the more we vaccinate, the more we can deal with it,” Bleakley Global Advisory chief investment officer Peter Boockvar said.

Inflation is ‘kryptonite’

Boockvar said markets care far more about inflation and how central bankers respond to it globally.

“To me inflation is kryptonite, and it’s just a matter of whether we can kick away the kryptonite or if it’s going to be hovering around us longer than we’re accustomed to when we see hot inflation stats,” Boockvar said. “If you start to see August, September, October stats that show inflation is very sticky, the Fed has no choice but to taper.”

The Consumer Price Index jumped sharply this spring, and was up 5% year over year in May, the hottest pace since 2008 when oil prices were skyrocketing. The Fed has targeted an average range around 2%.

Meanwhile, stocks are moving higher as investors count on 40% profit growth this year and view those elevated inflation numbers as temporary. The economy is booming, and it heads into the second half following expected growth of 10.4% in the second quarter, according to the CNBC/Moody’s Analytics survey of economists’ forecasts. For the year, gross domestic product is expected to grow at a 7.2% pace.

“I think the market is going to be fine through the end of the year. It’s going to be single digit-like market gains,” Harris said.

The S&P 500 is up 14.3% for the year through Tuesday’s close. The Dow is up 12%, and Nasdaq has a 12.7% year-to-date gain. The S&P 500 closed at 4,291.80.

“Right now we are in the top 20 in terms of best first halves,” CFRA chief investment strategist Sam Stovall. “Following such strong first halves, it’s good [in the second half] but just not as good as it was. We’re likely to have a 50% advance of the first half” gain or about 7% for the S&P 500.

“Second halves are almost all pretty good,” he said. “On average, the S&P has gained 4.5% in all second halves since World War II. But for the top 20, they’re up 8%.” His yea-rend target is 4,444 for the S&P.

Harris said the market is aware the Fed will be winding back its bond program. Under that quantitative easing program, it is purchasing $120 billion a month in Treasurys and mortgage securities. Once it is done slowly tapering back the purchases, the path is clear for the Fed to raise interest rates.

“The thing that will really get the market concerned is if the evidence builds there’s more sustained inflation. Then the Fed can talk all it wants, but everyone knows they’ll have to start moving sooner rather than later,” Harris said. “This isn’t anything different than any business cycle. What gets the economy in trouble and the equity market in trouble is inflation. it’s just coming very early in the cycle.”

So far, companies have been able to pass along their higher costs to customers, but when that is no longer possible, investors would become worried about margin pressures and weaker profits.

“We’re not worried about inflation becoming embedded. I am a little surprised we haven’t had more volatility as we’ve had these higher inflation readings,” Wells Fargo Investment Institute senior global strategist Scott Wren. “If you look at the 10-year yield, if you look at where the market is at, in my mind, the market is not buying into a long-term inflation problem.”

The benchmark 10-year Treasury yielded 1.48% on Tuesday, well off its March and April highs near 1.75%. Yields move inversely to prices, so investors have been buying bonds and stocks in tandem.

“We’re looking at about 4,500 (S&P 500) as the midpoint of our target range for the end of the year,” Wren said. “We’re a bit surprised we haven’t seen a correction…The market is pretty convinced that this inflation is not going to be something that becomes embedded.”

Even as the Fed moves toward slowing its bond purchases, the stock market can still move higher.

“I think the pressures are mounting internally. I think about half the committee is ready to get moving on this while Powell and his closest allies are trying to postpone that launch date as long as possible,” Bank of America’s Harris said. “I think from a market perspective, this is not really the big risk from the Fed. Everybody knows they have to taper at some point. …The big story is the Fed eventually going to hike interest rates.”

Wells Fargo’s Mike Mayo says financials just hit a major turning point amid dividend increases, buybacks

Mike Mayo from Wells Fargo breaks down the bank dividend and buyback news. With CNBC’s Melissa Lee and the Fast Money traders, Guy Adami, Karen Finerman, Tim Seymour and Brian Kelly.

MON, JUN 28 20215:58 PM EDT

Don’t Believe the Bitcoin Bounce. The U.K.’s Binance Restrictions Are Bad News for Cryptocurrencies.

Don’t believe the Bitcoin bounce. The U.K.’s decision to block Binance from engaging in regulated activity in that country is bad news for cryptocurrencies.

The U.K. government announced that Binance, a crypto exchange, is not allowed to engage in regulated activities and must make that clear on its website. It’s not a ban—Binance can still offer crypto trading on its website—but a limit placed on what it can do.

In an email to The Wall Street Journal, U.K. regulators highlighted that a “significantly high number of crypto businesses are not meeting the required standards” under money-laundering regulations as the reason for its actions.

That’s not a surprise. Traditional banks and brokers are required to check on the legitimacy of their clients. Ultimately, crypto brokers and exchanges might have to do the same, require them to know their clients, something that isn’t really part of the crypto ethos.

Bitcoin is rallying, up almost 5% Monday. The gain, however, doesn’t matter much. It gets the world’s leading crypto to where it was on Thursday, before a 7.8% drop.

Bitcoin remains stuck at the lower end of its $30,000 to $40,000 trading range it’s been bouncing around in for more than a month.

It might have trouble gaining momentum and breaking out as global governments take a closer look at all things crypto.

—Al Root