HI Market View Commentary 06-29-2020

Decision Making = when I make my decisions I’m not always right but I have to be able to justify why I made my decision

Due diligence is important

MU = Earnings

BA = Price action

We make our decisions with the most pertinent information we have at that time

| Market Recap |

| WEEK OF JUN. 22 THROUGH JUN. 26, 2020 |

| With COVID-19 cases rising across Florida, Texas and Arizona and a V-shaped recovery at risk, the S&P 500 index closed nearly 2.9% lower with all eleven sectors underwater last week.

The benchmark index closed at 3,009.02 versus the prior week’s close of 3,097.74. As investors grappled with the risk of pandemic-fueled closures and renewed travel restrictions, the outlook for the economy resulted in energy stocks taking the brunt of this week’s selling pressure. The energy sector was down by 7.7% with ONEOK (OKE) being the worst-performing stock within the energy sector. Financial stocks took a beating this week and limped into the close after the Federal Reserve ruled for large US banks to suspend share buybacks and cap their dividend payments in the third quarter to preserve capital amid the uncertain economic environment. The announcement reversed early gains tied to relaxing the Volker Rule and giving banks with a $40 billion break on swaps, leaving the entire financial sector 5.8% lower for the week. Stocks within the communication sector were down by a collective 5.5% as the fallout from the resurgence in COVID cases undermined shares of Live Nation (LYV) and Disney (DIS). Facebook (FB) and Twitter (TWTR) also weighed on the sector after Unilever pulled its ads amid criticism that the social media sites fail to adequately censor hate speech. Also taking heavy losses this week were industrials as investors disregarded bullish data from the Chicago Fed as well as a significant improvement in durable goods orders, and new home sales. Airline stocks went back on the defensive and were down an average of 12% this week as investors braced for new COVID-related travel restrictions, dragging Boeing (BA) down by 9.1% in sympathy. With the help from Apple (AAPL), Nvidia (NVDA), and Adobe (ADBE) to mitigate losses for the majority of stocks in the sector, the tech sector closed only 0.7% lower over last week’s close. This week, Apple said it was closing more stores amid the COVID outbreak, but also announced that it would dissolve its relationship with Intel (INTU) and start making its own chips. Nvidia announced an in-vehicle, AI collaboration with Mercedes while Goldman hiked its price target for Adobe by 31%. The economic data was mixed this week with market-friendly data from the Chicago and Richmond Fed, along with much better-than-expected data on durable goods orders and new home sales. The good news, however, was mixed with a miss on the manufacturing and services PMIs as well as a larger-than-expected drop in existing home sales. And jobless claims remain above the 1 million mark, adding to this week’s worries that the coronavirus will undermine the possibility for an economic resurgence. The upcoming holiday-shortened week brings more housing market data in the form of pending home sales along with consumer confidence, the purchasing managers and Institute for Supply Management manufacturing indices, and the minutes from the June FOMC meeting, culminating in the June non-farm payroll data on Thursday. |

Where will our markets end this week?

Flat

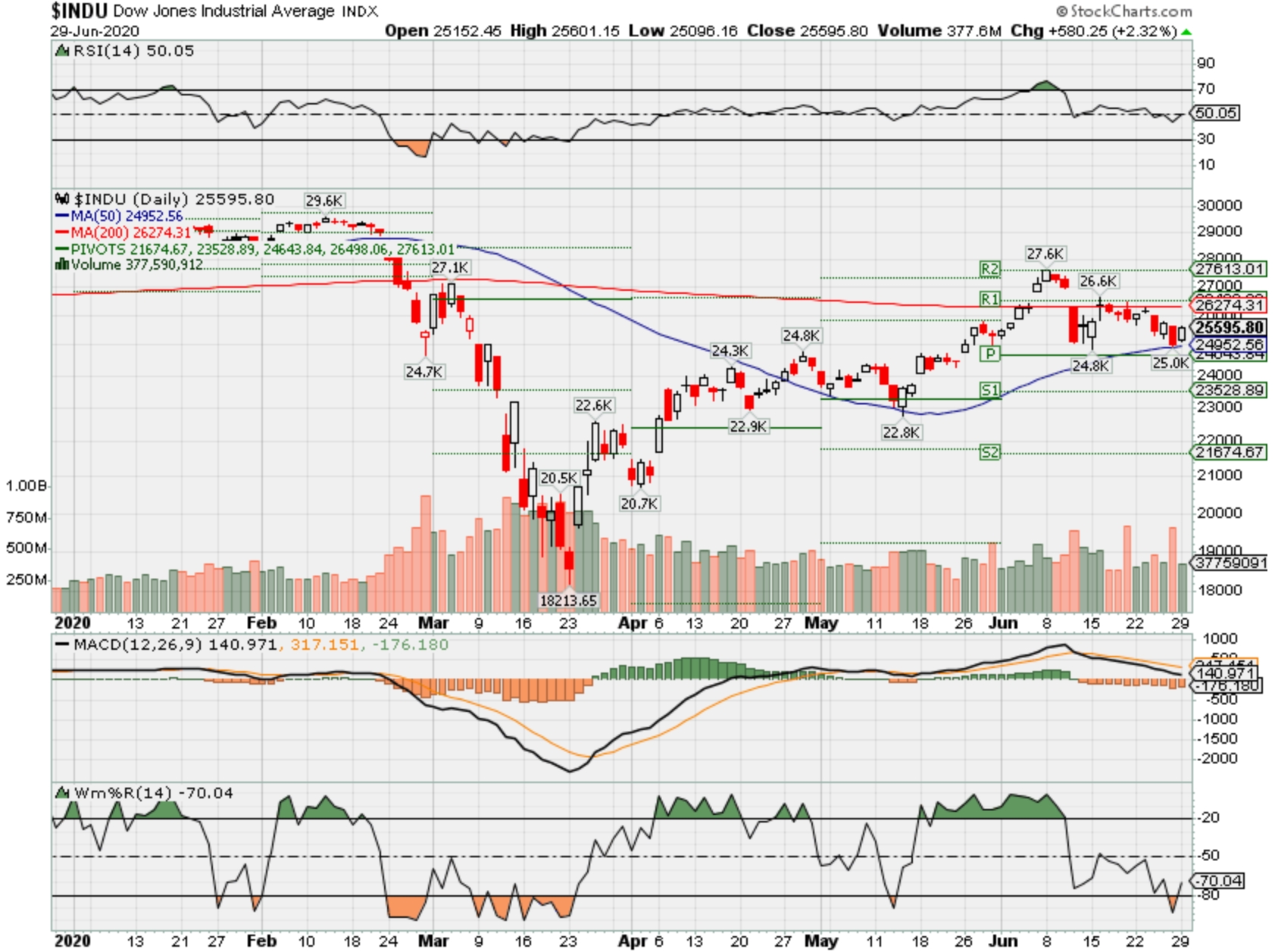

DJIA – Bullish

SPX – Bullish

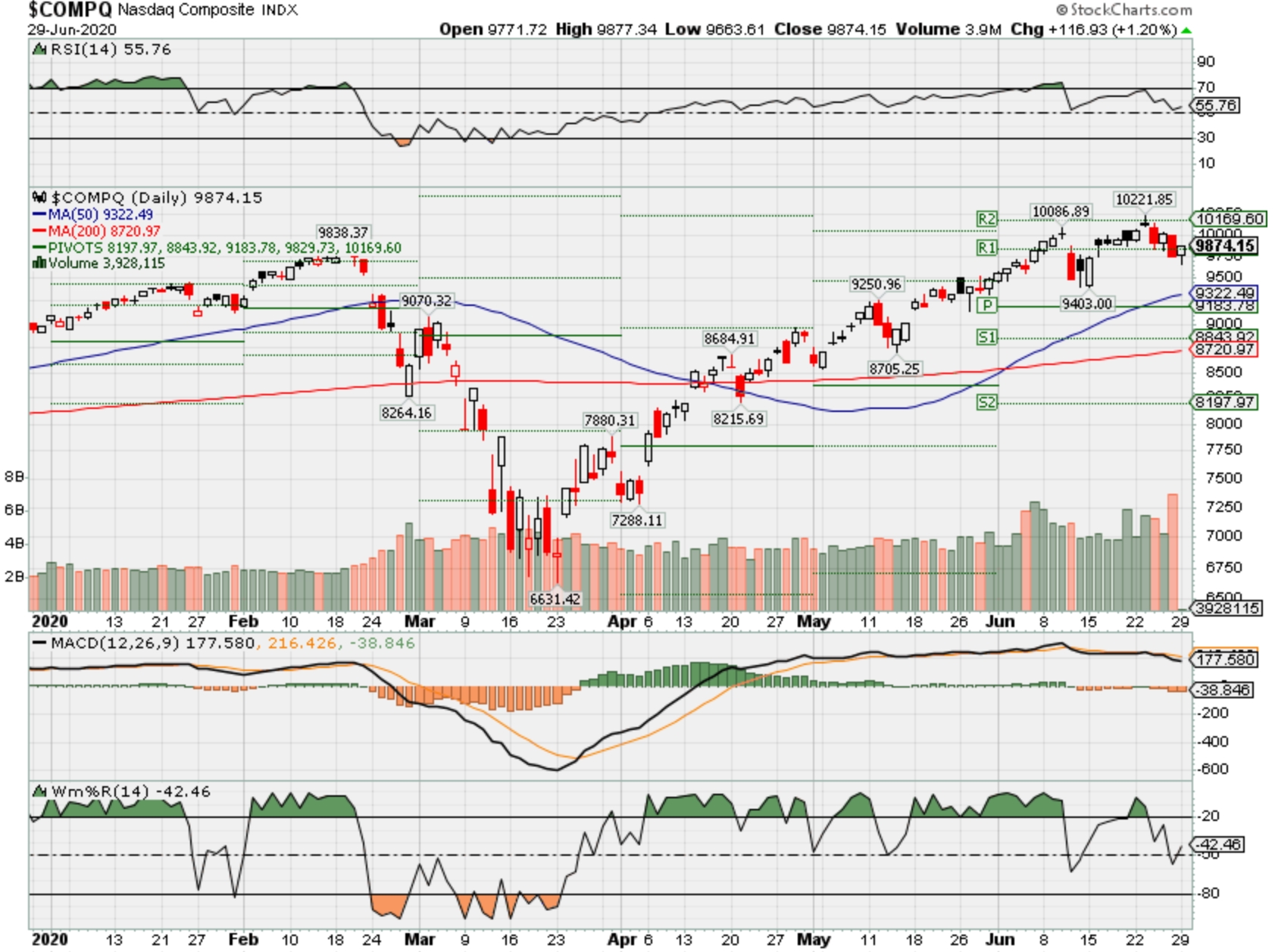

COMP – Bullish

Where Will the SPX end July 2020?

06-29-2020 +0.0%

Earnings:

Mon: MLHR, MU

Tues: FDX

Wed: GIS, STZ

Thur:

Fri:

Econ Reports:

Mon: Pending Home Sales.

Tues: S&P Case Shiller, Chicago PMI, Consumer Confidence

Wed: MBA, Auto, Truck, ADP Employment, ISM Manufacturing Index, Construction Spending, FOMC Minutes

Thur: Initial Claims, Continuing Claims, Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Trade Balance, Factory Orders

Fri: Market Closed for 4th of July

Int’l:

Mon –

Tues –

Wed – CN: Non- Manufacturing PMI, NBS Manufacturing PMI

Thursday – CN: Caixin Manufacturing PMI

Friday-

Sunday –

How am I looking to trade?

Letting some things run, Taking Profits

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Some investors are making the biggest bet against the stock market in nine years

PUBLISHED TUE, JUN 23 20203:20 PM EDTUPDATED 2 HOURS AGO

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- The net short position in E-mini S&P 500 futures is growing and is now at a level it was last at in 2011.

- The short position could be a contrarian signal for the market, meaning stocks could keep rising.

- However, one analyst says the theory that the herd mentality is wrong and stocks could go higher anyway may not work this time.

Investors are making the biggest bet in the futures market since 2011 that the stock market is going to sell off.

There’s been a net short position in E-mini S&P 500 futures building since April.

Some strategists believe when a lot of investors take the same position, there’s a herd mentality at work and investors are actually sending a contrarian signal. In this case, that would be positive for stock market gains. But Peter Boockvar, chief investment strategist at Bleakley Advisory Group, disagrees that stock futures investors are necessarily representing a contrarian call.

According to the CFTC, as of last week, there was a net short position of 303,000 futures contracts for the S&P E-minis held by the noncommercial traders, an investment group viewed as speculators. In early March, the same investors held a net positive position, at a high of about 55,000 contracts.

Boockvar said about twice as many futures contracts were now short as long, for the week ended last Tuesday. He points to cases where the shorts were right, like in September 2007 when they were at a record high ahead of the market peak in October.

He said there were record high longs in March 2009, another trade that turned out to be right as the long bull market began that month.

“They were right. I’m skeptical to look at this as a contrarian indicator. I’m going to argue that sometimes the shorts are right,” he said.

Boockvar said he doesn’t actually know what to make of the positioning. It’s more cut and dry in the case of commodities futures, like corn or oil, where the producer is on the other side of the trade.

“CFTC data should be looked at as a contrarian indicator, but I don’t believe that’s with the S&P 500 futures. You could have people long stocks and hedging with futures. That doesn’t mean they’re net short,” he said.

Ford’s new F-150 is on the way, and the stakes are high for this pickup to aid its turnaround

PUBLISHED WED, JUN 24 20208:37 AM EDTUPDATED WED, JUN 24 20209:37 AM EDT

KEY POINTS

- Ford is introducing a new F-150 pickup truck Thursday night.

- The automaker needs its highly profitable flagship product to drive a global restructuring plan and pay off debt related to the coronavirus pandemic.

- Full-size pickups accounted for 37% of the automaker’s 2.4 million vehicles sold last year in the U.S.

The importance of a new F-150 pickup to Ford Motor has never been greater.

The automaker needs its highly profitable flagship product to drive a global restructuring plan and pay off debt related to the coronavirus pandemic. It also needs to convince Wall Street that the company can retain its decades-long leadership position in the segment as new and traditional competitors begin to offer all-electric pickups.

Ford’s response to these rivals includes trucks with traditional internal combustion engines as well as new hybrid and all-electric versions. It’s also adding significantly more technology to the truck, which has been America’s best-selling vehicle for 38 consecutive years and the country’s top-selling truck for more than 40 years.

“We’ve stayed No. 1 for 43 years now. We’re very focused on raising that bar again and letting the competition follow,” Kumar Galhotra, Ford president of The Americas, told CNBC. “It is obviously a very important launch.”

We’re about to change the game once again. Keep it locked here for the reveal on 6/25.

Ford is scheduled to unveil the traditional and hybrid versions of the 2021 F-150 on Thursday night. The all-electric version is expected sometime in the next two years — in line or slightly later than new electric pickups from General Motors, Tesla and start-up manufacturer Rivian.

The importance of Ford’s full-size pickups, which include the F-150 and larger trucks, can’t be overstated. The trucks accounted for 37% of the automaker’s 2.4 million vehicles sold last year in the U.S. — 10 percentage points more than in 2010.

“So much of Ford’s performance and livelihood is resting on this vehicle” said Jessica Caldwell, executive director of industry analysis at Edmunds. “The F-150 is Ford’s cash cow.”

The F-150 is a key part of the automaker’s plans to profitably grow the commercial side of Ford’s business to aid an $11 billion restructuring and pay off more than $20 billion in new debt due to the coronavirus.

The nearly 900,000 F-Series pickups Ford sold last year in the U.S. generated about $42 billion in revenue, according to a study Ford commissioned from the Boston Consulting Group. Ford’s automotive revenue was $143.6 billion in 2019.

Wall Street remains skeptical of the company’s turnaround. It has been particularly critical of Ford CEO and President Jim Hackett. Since Hackett started leading the automaker in May 2017, the stock’s price has nearly been cut in half and its credit rating has been downgraded to “junk.”

Ford shares, which have a market value of $24.5 billion, closed Tuesday at $6.15, down 2.1%. Shares are down 33.9% since the beginning of the year.

New tech

Ford must add enough new technology to the pickup without alienating its traditional truck buyers, who are among the most loyal and passionate consumers in the automotive industry. It’s something Ford is aware of and has accomplished with the new F-150, according to Ford’s Galhotra.

That includes offering over-the-air, or remote, updates as well as an integrated power generator. The onboard generator, he said, will be able to power up tools and other equipment.

The entire truck, according to Galhotra, is “designed around those kinds of ideas” that will enable better performance and more convenience for customers.

Galhotra said Ford hired anthropologists to assist in understanding how truck owners use their vehicles and how to make the best improvements. That includes Ford’s decision to offer hybrid and all-electric versions of the truck.

“The segment size is so large,” Galhotra said. “The types of customers have very, very different needs.”

Galhotra declined to comment on expected sales for the hybrid model, which he said could provide incremental growth by attracting new customers to the pickup segment. Pickups with traditional gas and diesel engines are expected to remain the majority of sales for the foreseeable future, he said.

The F-150 also will be the first with Ford’s new electrical architecture, or brains, of the vehicle. The equipment is a key enabler for advanced driver-assist systems such as Ford’s “Active Drive Assist,” an advanced system comparable to Tesla’s Autopilot.

“It’s really about technology and productivity,” Ford Chief Operating Officer Jim Farley told investors about the F-150 during a Deutsche Bank conference earlier this month.

Competitive segment

Despite hype for all-electric pickups, the vehicles are expected to remain a small minority of sales. That is, once they go on sale. All-electric pickups from GM, Tesla, Rivian and others such as Nikola and Lordstown Motors aren’t expected to go into production until at least next year.

For the time being, Ford is expected to focus on the non-EV version of its prized pickup, which has come under assault from newer models from GM and Fiat Chrysler in recent years.

“For awhile it was hard to conquest truck buyers, but we’re seeing more of that happen. We’re just seeing the loyalty numbers go down,” Edmunds’ Caldwell said. “The market share numbers show how competitive this segment has been.”

Fiat Chrysler’s Ram brand has done an impressive job in gaining market share since 2015, which was when Ford last introduced a new F-150. Market share of the Ram 1500 has grown from less than 20% in 2015 to 25.1% in 2019, according to Edmunds. The greatest growth occurred after the company unveiled a new version of the pickup in 2018 that was well-received, including a larger, more comfortable interior.

The launch of the newest Ram 1500, Caldwell said, was successful in gaining owners from other brands, particularly because of the company’s focus on the vehicle’s interior.

Coronavirus pandemic

The importance of the F-150 also is critical due to the coronavirus pandemic. Sales of pickups have not declined as much as other segments this year. In fact, automakers, including Ford, have prioritized the production of pickups due to low inventories following plant shutdowns from March to mid-May due to Covid-19.

“The F-150 is really important to Ford, particularly now with the pandemic,” Caldwell said. “Pickup truck sales have done fairly well over the past three months.”

Ford is well aware that there’s no room for error in the launch of the new F-150. Farley made it clear to investors earlier this month that missteps that plagued the redesigned Ford Explorer last year will not be repeated.

“The setup for the F-150 is really different than Explorer,” he said, adding the two plants that produce Ford’s trucks in Michigan and Missouri don’t have to be completely rebuilt with the new models.

https://www.aier.org/article/covid-19-made-the-federal-reserve-sick/

COVID-19 Made the Federal Reserve Sick

– June 24, 2020

Money makes the world go ‘round, as the old saying goes. And central banks make money. The US central bank, the Federal Reserve, oversees the money creation process. That is a major power in its own right. But, thanks to its response to COVID-19, the Fed has become even more important. It is currently planning $2.3 trillion in asset purchases to soften the pandemic’s economic blow. Understanding what this means for economics and politics is crucial for all citizens.

Sometimes people say the Fed “turns to the printing press” to create money. Technically, that is incorrect. The actual printing presses are owned and operated by the Treasury. And, when the Fed wants to increase the money supply, it rarely turns to them. Instead, it creates money by adding electronic balances to the accounts of depository institutions that hold funds at the Fed.

You can think of the Fed as a “bankers’ bank.” Member banks of the Federal Reserve System hold reserves at the Fed. To expand the money supply, the Fed electronically increases the size of banks’ reserves. This shows up as an asset on banks’ balance sheets and a liability on the Fed’s. But the Fed doesn’t go around crediting and debiting accounts willy nilly. Instead, it credits (debits) accounts when it buys (sells) financial assets, typically government bonds, in transactions known as “open market operations.”

Or rather, it used to be. Since the 2007-8 financial crisis, things have changed quite a bit. As a result, the Fed’s focus has shifted from managing the money supply to directing the allocation of credit.

During the financial crisis, the Fed experimented with balance sheet policy. It took risky assets off financial institutions’ books and replaced it with cash. It also made a wide array of emergency loans.

Following the economic turmoil created by COVID-19, the Fed has gone even deeper into balance sheet policy, including some never-before tried programs: direct lending to small- and medium-sized businesses, as well as state and local governments.

While effective at stabilizing markets in the short run, the Fed’s policies have dangerous costs in the long run. First, the Fed’s policies almost certainly reallocate credit. If a business gets a loan from the Fed that it could not have gotten elsewhere, the Fed has redistributed purchasing power. And since purchasing power is used to acquire goods and services, the Fed has effectively altered the pattern of economic activity.

Reallocating credit is far afield of the Fed’s traditional mission. The Fed used to be focused on liquidity: helping markets by ensuring an adequate supply of money. Now it seems the Fed is no longer content to be a referee. It wants to be a player in the game.

The second cost is political. Much of the Fed’s post-coronavirus activities were authorized by Congress when it passed the CARES Act in March. But the legality of the Fed’s new activities offer little consolation. Congress is using the Fed to avoid democratic oversight of its usual taxation and budgeting decisions. If Congress wants to bail out a business or make an emergency loan, it should do so itself. Instead, it is trying to rope the Fed into becoming its fiscal policy agent. That undermines the Fed’s independence and, by diverting attention from its traditional role, makes the Fed less effective at conducting monetary policy.

Politically and economically, COVID-19 has pushed us into novel territory. We will be wrestling with the consequences of the virus for years to come. The change in the Fed’s mandate is not something we can afford to ignore. Its new policies come with significant economic and political costs. If we do not come to grips with them, the Fed might not be able to help much when the next crisis hits.

IRS Announces CARES Act RMD Relief

The 60-day rollover period for any RMDs already taken this year has been extended to August 31

by John Sullivan, Editor-In-Chief

If a retiree took a required minimum distribution but is having second thoughts in the wake of COVID, they are now able to roll it back.

The Internal Revenue Service announced Tuesday that anyone who already took a required minimum distribution (RMD) in 2020 from certain retirement accounts can take advantage of the CARES Act RMD waiver for 2020.

The 60-day rollover period for any RMDs already taken this year has been extended to August 31, 2020, to give taxpayers time to take advantage of this opportunity.

The IRS described the change in Notice 2020-51 (PDF). The Notice also answers questions regarding the waiver of RMDs for 2020 under the Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act.

The CARES Act enabled any taxpayer with an RMD due in 2020 from a defined-contribution retirement plan, including a 401(k) or 403(b) plan, or an IRA, to skip those RMDs this year. This includes anyone who turned age 70 1/2 in 2019 and would have had to take the first RMD by April 1, 2020. This waiver does not apply to defined-benefit plans.

Exempt from certain rules

In addition to the rollover opportunity, an IRA owner or beneficiary who has already received a distribution from an IRA of an amount that would have been an RMD in 2020 can repay the distribution to the IRA by August 31, 2020.

The notice provides that this repayment is not subject to the one rollover per 12-month period limitation and the restriction on rollovers for inherited IRAs.

The notice provides two sample amendments that employers may adopt to give plan participants and beneficiaries whose RMDs are waived a choice as to whether or not to receive the waived RMD.

The RMD waiver provided by the CARES Act is similar to the 2009 RMD waiver provided by section 201 of the Worker, Retiree, and Employer Recovery Act of 2008.

https://www.realclearscience.com/blog/2016/09/the_basic_laws_of_human_stupidity.html

The Basic Laws of Human Stupidity

By Ross Pomeroy

September 14, 2016

In the early 1600s, pioneering astronomer Johannes Kepler put forth his three laws of planetary motion, which, for the first time, provided an accurate and evidence-based description of the movement of the Solar System’s planets around the Sun. By the end of the century, Isaac Newton followed Kepler’s example with three laws of his own, describing the relationship between an object and the forces acting on it, thus laying the foundations for classical mechanics. Almost exactly three hundred years later, Carlo M. Cipolla, a professor of economic history at the University of California – Berkeley, introduced a set of laws no less revelatory than those of Kepler or Newton: The Basic Laws of Human Stupidity.

While these laws are not taught in grade school, they do hold lessons worthy of reflection in this modern era. Stupidity today is on display more than ever before — on TV, YouTube, and the city streets you frequent each and every day. To better react to and avoid such dimwitted behavior, one must first understand it. Cipolla’s insightful set of five laws is a helpful guide.

His first law sets the stage.

“Always and inevitably everyone underestimates the number of stupid individuals in circulation.”

Glaringly pessimistic, the first law is meant to prepare you for what’s out there, and what’s out there are hordes of people who do stupid things, often without notice. And there are always more of them than you think.

Contributing to the first law is Cipolla’s second law.

“The probability that a certain person will be stupid is independent of any other characteristic of that person.”

Anybody, whether intellectual or ignorant, blue-collar or white collar, book smart or street smart, can be stupid. Moreover, idiocy persists at roughly equal proportions at all levels of society. The rate of stupidity amongst Nobel laureates is just as high as it is amongst male swimmers on the U.S. Olympic team.

“[The Second Basic Law’s] implications are frightening,” Cipolla wrote. “The Law implies that whether you move in distinguished circles or you take refuge among the head-hunters of Polynesia, whether you lock yourself into a monastery or decide to spend the rest of your life in the company of beautiful and lascivious women, you always have to face the same percentage of stupid people — which (in accordance with the First Law) will always surpass your expectations.”

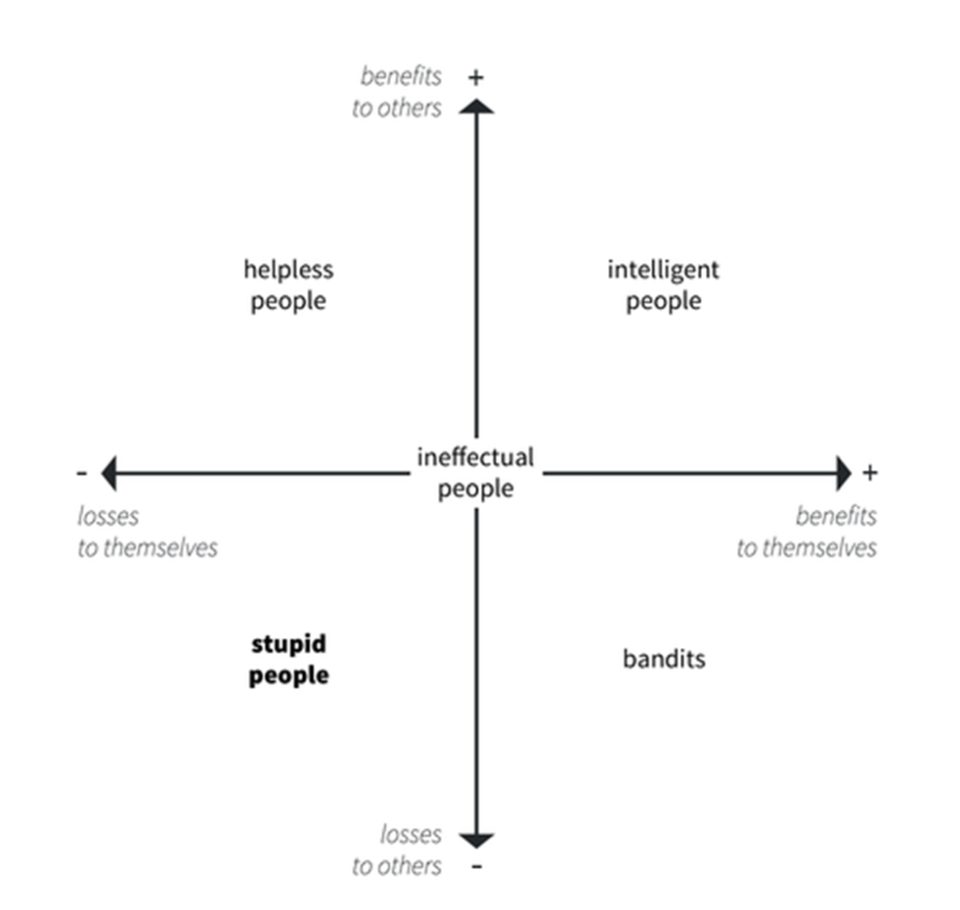

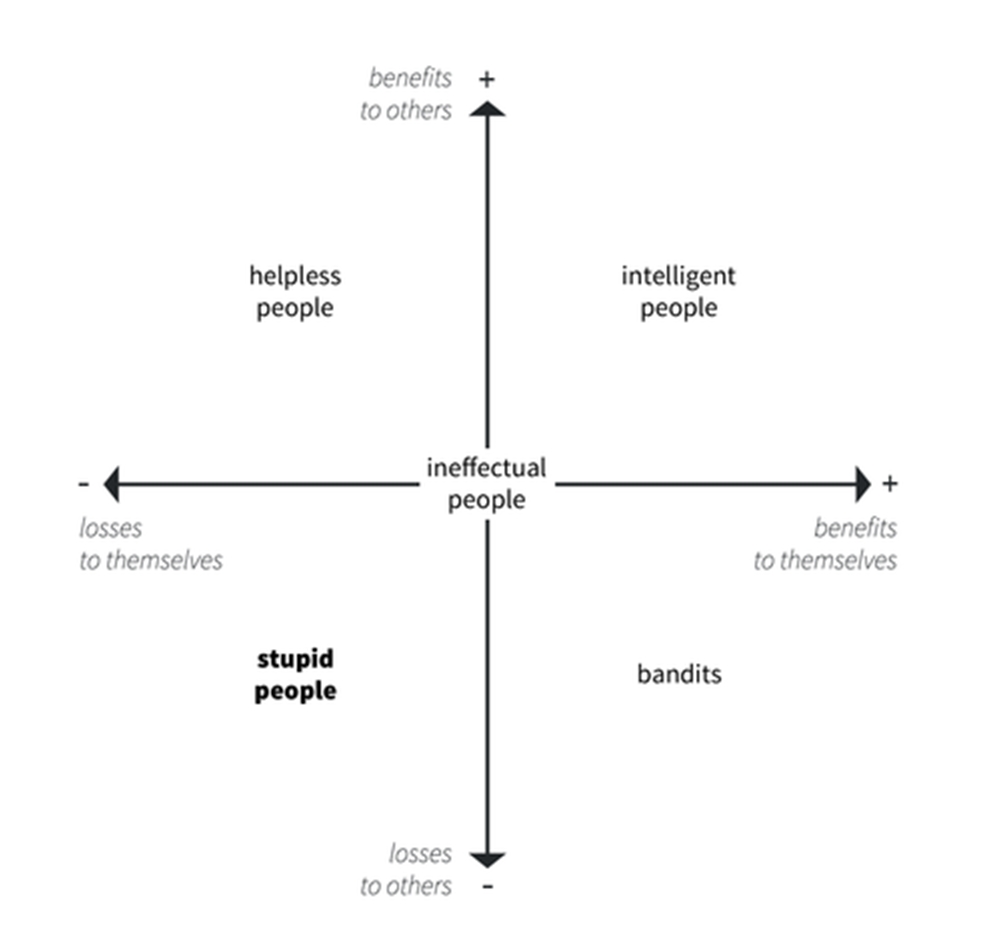

How can this be? Well, it might make more sense in light of the definition of stupidity, which Cipolla provides in his third law. Understandably, given his background, he tackles the term from an economic perspective. (See the figure below for a visual explanation of the definition.)

“A stupid person is a person who causes losses to another person or to a group of persons while himself deriving no gain and even possibly incurring losses.”

The brute who starts a bar fight; the tailgating driver; the football player who commits a flagrant personal foul; the video gamer throwing a temper tantrum and deciding to sabotage his team; all of these are “stupid” people. Their actions are so utterly thoughtless and unreasonable that reasonable individuals have trouble fathoming how these people can function, Cipolla insists.

“Our daily life is mostly made of cases in which we lose money and/or time and/or energy and/or appetite, cheerfulness and good health because of the improbable action of some preposterous creature who has nothing to gain and indeed gains nothing from causing us embarrassment, difficulties or harm. Nobody knows, understands or can possibly explain why that preposterous creature does what he does. In fact there is no explanation – or better there is only one explanation: the person in question is stupid.”

With his next law, Cipolla admonishes the members of society who tacitly encourage stupidity. Most of us are guilty.

“Non-stupid people always underestimate the damaging power of stupid individuals. In particular non-stupid people constantly forget that at all times and places and under any circumstances to deal and/or associate with stupid people always turns out to be a costly mistake.”

When we have a good idea of who stupid individuals are, we still hang out with them, even if it’s to our detriment, Cipolla laments.

“Through centuries and millennia, in public as in private life, countless individuals have failed to take account of the Fourth Basic Law and the failure has caused mankind incalculable losses.”

Cipolla’s fifth law of stupidity is unequivocal.

“A stupid person is the most dangerous type of person.”

Yes, more dangerous even than a bandit (refer back to the figure above), who inflicts losses upon others but at least reaps benefits for himself. Stupid people drag down society as a whole, Cipolla insists.

“Stupid people cause losses to other people with no counterpart of gains on their own account. Thus the society as a whole is impoverished.”

It’s the great and burdensome responsibility of everyone else, particularly the intelligent, to keep them in check.

Source: Cipolla, Carlo M. “The Basic Laws of Human Stupidity.” Whole Earth Review (Spring 1987 pp 2 – 7)

HI Financial Services Mid-Week 06-24-2014