HI Market View Commentary 06-13-2022

1. Received a phone message from Steve Brown today wanting to know what Etrade could do to earn me back. Don’t know anybody from etrade and did not call him back. I figured you or Keve should answer this question if you so desire.

THIS IS Morgan Stanley trying to POACH CLIENTELE

2.Will we be impacted by the $187 million settlement from Schwab. SEC charges that it misled robo advisor clients on fees.

I WISH !!! But no we will not be affected by the settlement NOR are we eligible to receive any of it because we did not have Schwab Advisor services managing our accounts under their “proprietary” ROBO Service algorithm

My SON Jared – Saturday Jared was doing Parkour – Flipping and tricking

In his trick he caught his foot on The railing and feet 20ft ish on his head to the cement

Left side of skull is crushed, GS 3 moved to 5, crushed the right orbital and but it didn’t “pop” of the retina nerve,

Broken neck, two vertebrae broken with leaking spinal fluid, CSF leaking out of skull, nose, ear, eyes, mouth, broken back two vertebrae, left lung collapsed – chest tube and they have him on a ventilator, 7 ribs detached from thoracic spine, broken writs and radial arm bone right hand, still scheduled for a Craniotomy in the near future if the swelling approaches 20 ml mark.

Bill asked and said take the week off – I can’t because its my money too

It has been two weeks since HI mentioned the drop we are expecting due to higher interest rate hikes – June 14-15th

Last Monday we started protecting position in an upward moving market

Mon – S&P 0.03 and we had protection on AAPL, UAA $10

Tues – S&P 0.90 and we added protection on BIDU

Wed S&P -1.02

Thur – 2.37 and we protected DIS, BA, FB, SBUX, UAA,

Friday – V, F, BAC, JPM

In the last three day –2.37, – 2.91 -3.88 = -9.16 in three days = In general HI 3.91-4.13

What more can we do? = We started back to adding an additional put contract per 5 contract on puts

Sprinkling more puts than shares of stock to make more money to the downside

Kevin Why didn’t you do full collar trade two weeks ago? I didn’t because I could have been wrong

How much father are we going to go = WE ARE IN BEAR MARKET Territory = S&P 500 down 20%

MY expectation is an overreaction to the rate hike, definitely lose another 5% and then we should begin another slow upward climb

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 10-Jun-22 15:30 ET | Archive

The Fed has much work left to do to tame the bane of our existence

President Biden said recently on a late-night talk show that “inflation is the bane of our existence.” It sounded melodramatic, but it was not.

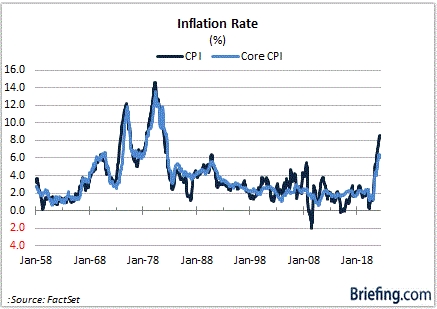

Inflation is a source of misery for a lot of people, and their misery intensified in May based on the numbers seen in the Consumer Price Index (CPI).

At the same time, the misery for stock investors worsened, too, because the CPI report for May made it clear that the Federal Reserve has a lot of work left to do to quell inflation.

Feeling Young Again

Looking at the CPI report made your author, who is 50 years old, feel like a kid again, because the year-over-year changes for a lot of categories haven’t been seen since when I was a kid and thought the bane of my existence was doing yardwork.

Let’s go to the numbers:

- Total CPI was up 8.6% year-over-year versus 8.3% in April. That was the largest 12-month increase since December 1981.

- Core CPI, which excludes food and energy, was up 6.0% year-over-year. That was down from 6.2% in April (and 6.5% in March), but it is still a long way from the Fed’s longer-run inflation goal of 2.0%.

- The food index increased 10.1% year-over-year. That was the first increase of 10.0% or more since the period ending March 1981. The food at home index was up 11.9% year-over-year. That was the largest increase since April 1979. The food away from home index jumped 7.4% year-over-year. That was the largest increase since November 1981.

- The energy index was up 34.6% year-over-year, which was the biggest jump since September 2005. The gasoline index, though, soared 106.7% year-over-year, which was the largest 12-month increase on record dating back to 1935 (before my 83-year-old dad was a kid, let alone born)!

- The shelter index was up 5.5% year-over-year. That was the largest increase since February 1991 when my shelter was a dorm room.

The troubling consideration with respect to inflation right now is that there isn’t much convincing reason to think the pace of disinflation is going to happen rapidly.

We’d like to be wrong, but with China continuing to embrace its zero-COVID policy, Russia continuing to wage its war in Ukraine, energy costs still rising, and knowing that the measurement of rent and owners’ equivalent rent lags home prices, total inflation and core inflation could remain stuck at elevated levels that keep the Fed in a difficult situation.

Seeing the Light

The Treasury market seemed to see the light of the Fed’s difficult situation. The behavior of the 2-yr note, which is sensitive to changes in the fed funds rate, said it all following the release of the CPI report.

The yield on the 2-yr note went from 2.82% to 3.05% (as of this writing). That is a huge swing that packed a punch of fresh insight.

Specifically, the market is sensing a need for more aggressive policy action on the part of the Federal Reserve.

A week ago, the fed funds futures market saw only a 22% probability that the target range for the fed funds rate would be at least 3.00-3.25% by year end. Following the release of the May CPI report, that probability has increased to 83.1%.

In other words, market participants no longer think 2.50% is a viable neutral rate, as projected by the Fed in its summary of economic projections provided in March.

Those projections will be updated next week in conjunction with the June 14-15 FOMC meeting, which is expected to feature a 50-basis point increase in the target range for the fed funds rate. It would be shocking, in light of the May CPI report and the Treasury market’s response to it, to see the Fed’s median estimate for the neutral rate unchanged.

Shock Value

Fed Chair Powell said following the last meeting in May that it is likely the FOMC will agree to 50-basis point increases at the FOMC meetings in June and July.

Given the elevated inflation rates seen in the May CPI report, the following question must be asked: if the Fed pretty much knows it is going to raise the target range by 50 basis points in June and July, why not just accelerate the action and raise the target range for the fed funds rate by 100 basis points at the June meeting?

Critics would suggest that the Fed doesn’t want to shock the market. Well, if the market keeps getting negatively surprised by the inflation data, maybe a shock-and-awe approach by the Fed is what is needed to send a stronger statement that the Fed didn’t like what it saw either in the May CPI report and is intent on winning back its inflation-fighting credibility.

The Fed probably won’t do that, however, because it presumably liked what it saw in the core-CPI rate. It moderated again in May, yet 6.0% is not a cause for celebration.

The fed funds futures market isn’t pricing in any probability of a 100-basis point increase at the June meeting, so that would certainly cause some shock and maybe even some awe that the Fed means business.

There has been an increased allowance for a 75-basis point increase in June after the May CPI report. The probability of such a move stood at 3.6% yesterday, but today it has risen to 20.2%.

What It All Means

The stock market did not react favorably to the inflation report or to the jump in Treasury yields. The 10-yr note yield for its part moved up 11 basis points to 3.15% (as of this writing).

When the week began, the 2s10s spread stood at 27 basis points. Currently, it sits at 10 basis points. In turn, the 5s30s spread has inverted, going from 16 basis points to minus six basis points. The flattening action is indicative of concerns about growth prospects and the Fed’s aggressive policy action driving weaker growth.

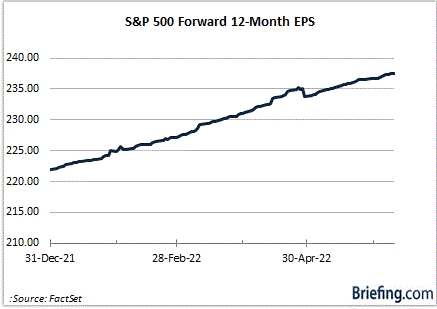

The May CPI report, however, made it clear that the Fed needs to take aggressive action. Inflation is a problem, and it has become a bigger problem for the stock market this year because it knows the Fed has to respond with much higher policy rates that will lead to slower growth — and possibly a recession — that will diminish earnings prospects.

The writing is on the wall that a more challenging economic climate lays ahead, yet earnings growth estimates remain inflated in their own right. They need to be reined in, too, and investors know that.

The stock market sold off in the wake of the May CPI report because it was discounting a future with lower earnings growth that will be a byproduct of the Fed using much higher policy rates to tame the bane of our existence — and I don’t mean yardwork.

—Patrick J. O’Hare, Briefing.com

(Editor’s note: The next installment of The Big Picture will be published the week of June 20)

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF JUN. 6 THROUGH JUN. 10, 2022 The S&P 500 index fell 5.1% last week as inflation data showed US consumer prices rose more than expected in May, adding to investors’ concerns ahead of a rate policy meeting being held next week by the Federal Open Market Committee. The market benchmark ended the week at 3,900.86, down from last Friday’s closing level of 4,108.54. This marks the index’s second weekly decline in a row and puts the S&P 500 down 5.6% for the month of June to date. It is now down 18% for the year to date. Weighing on stocks, data from the Bureau of Labor Statistics showed the US consumer price index, a key inflation measure, was up 8.6% in May year over year, an acceleration from April’s 8.3% increase and representing the fastest year-over-year pace since December 1981. On a monthly basis, the US seasonally adjusted consumer price index rose by 1% in May, larger than the 0.7% increase expected and following an April gain of 0.3%. Core CPI, which excludes food and energy prices, rose by 0.6%, faster than the consensus estimate for a 0.5% increase but even with a 0.6% rise in core CPI in April. The data came ahead of an FOMC meeting next week at which the central bank’s policy-setting committee is expected to raise its benchmark rate by half a percentage point. An increase by the same amount is anticipated for July as well. Investors are anxious about whether Friday’s data could impact the anticipated moves. The S&P 500’s weekly drop was broad, with every sector in the red. Financials had the largest percentage drop of the week, down 6.8%, followed by a 6.4% slide in technology, a drop of 6.2% in real estate and a slide of 6.1% in consumer discretionary. Energy had the smallest decline of the week, down 0.9%, as futures in natural gas and crude oil climbed week over week. The decliners in the financial sector included Charles Schwab (SCHW), down 11% on the week, and PNC Financial Services (PNC), down 8.6%. In technology, shares of Intel (INTC) fell 9.7% as a Reuters report citing an internal memo said the chip maker has suspended hiring in the division overseeing PC desktop and laptop chips for at least two weeks. Intel paused all hiring and put all job requisitions on hold in a bid to re-evaluate priorities, the report said, citing the memo. In the energy sector, Valero Energy (VLO) shares rose 3.8% on the week, helping limit the sector’s decline, as Credit Suisse raised its price target on the stock to $145 per share from $120. Credit Suisse maintained an investment rating of outperform on the stock. Next week, while the FOMC meeting will take center stage, investors will also be focusing on data including May retail sales, building permits, housing starts and leading economic indicators. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end June 2022?

06-13-2022 -3.0%

06-06-2022 -2.0%

05-30-2022 +3.0%

Earnings:

Mon: ORCL,

Tues:

Wed:

Thur: JBL, KR, ADBE, TCOM

Fri:

Econ Reports:

Mon:

Tues: PPI, Core PPI

Wed: MBA, Retail Sales, Retail Ex-trans, NAHB Housing Market Index, Business Inventories, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, Housing Starts, Building Permit, Phil Fed

Fri: Industrial Production, Capacity Utilization, June Monthly Options Expiration

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

When to we flip the switch to make more to the downside than we are losing?

There is no one size fits all, there is no rule that you follow ever time

We expect at HI to make up the next 5% of downside movement

This recession will be different, so buy these names with higher-income customers, Bank of America says

Some restaurant names that cater to higher-income consumers may fare better than their peers if a recession hits, Bank of America says.

“So just as the [Global Financial Crisis] proved that not all limited-service restaurants were equally equipped to weather the storm, we think the same is true now,” wrote analyst Sara Senatore in a note to clients Friday.

One of the main differences this time around is inflation, which has hit lower-income consumers particularly hard.

Restaurant meal consumption rises as income grows and many higher-income households can fall back on savings accumulated during the pandemic, even as rising gas prices may put a damper on discretionary spending, Senatore said.

“If these divergences persist, then the very high-ticket concepts that struggled the last time may prove more resilient this time around,” she wrote. “Companies that have higher income customer bases and for which return to normal patterns of work and spending are most beneficial are best positioned.”

Restaurant spending dipped during the early days of the pandemic as consumers sheltered at home. That market has rebounded as economies reopen but faces ongoing pressure as costs rise and inflation hits the public’s pockets.

Here are some of the names best positioned to weather the volatility:

BANK OF AMERICA’S RESTAURANT PICKS

| TICKER | NAME | YTD % CHANGE | CLOSE PRICE (6/9) | BOA PRICE TARGET | UPSIDE TO TARGET |

| SBUX | Starbucks | -34.6% | $78.91 | $110 | 39.4% |

| CMG | Chipotle Mexican Grill | -24.2% | $1,369.59 | $1,590 | 16.1% |

| FWRG | First Watch | -12.0% | $15.76 | $20 | 26.9% |

Source: Bank of America / FactSet

Starbucks is one of the names best situated for a downturn, according to Bank of America. Shares of the coffee retailer have plummeted about 35% this year but could rally 39% from Thursday’s close, given Bank of America’s $110 price target.

Restaurant chain Chipotle Mexican Grill also made the cut even as shares have cratered nearly 25% this year. Last month, Bank of America named Chipotle among a list of steady stocks to weather the unpredictable market. A May screen from CNBC Pro indicated the restaurant chain was among some of the cheapest stocks in the S&P 500 and a potential buying opportunity.

Bank of America also named First Watch among its picks to benefit if a recession hits.

Buffett disciple Mohnish Pabrai shares 3 ways to identify long-term winners

Finding the right stocks to invest in can be a daunting task, but veteran investor Mohnish Pabrai tells CNBC how he identifies long-term winners.

Pabrai, managing partner of Pabrai Investment Funds, is widely known for closely following Warren Buffett’s principles on value investing and capital allocation.

Value investing has come into focus as an investing strategy amid a massive selloff in global equities this year, as investors seek to snap up shares in companies that have been beaten down the most amid the rout.

Focus on the fundamentals

Market watchers have been reluctant to call the bottom on the brutal Wall Street selloff, but Pabrai is unfazed by the market turmoil. Instead, he is focused on choosing the right companies to invest in.

“I have no idea whether we are at the bottom,” he told CNBC Pro Talks on Wednesday, as he advised investors to focus on the fundamentals of a business, rather than the prevailing macro landscape.

“As value investors, we focus on individual businesses. What we are trying to do is look at what we think will happen in five, 10 or 15 years,” Pabrai said. “And so, in the near term, interest rates or whether we are going to go into a recession have some relevance. But they don’t have that much relevance. What is more important is what happens to the business in the long run,” he said.

A value investing strategy uncovers stocks that trade at prices perceived to be relatively cheap for their returns. These stocks may be beaten down in the short term in response to market volatility, even if their fundamentals suggest otherwise.

“You have to have a strong belief in what you think that business could look like five or 10 years from now. And if you don’t have a view on that, then I think you’re better off not making those bets,” he said.

Not all cheap stocks are good buys

With stocks now in bear market territory, investors could be forgiven for falling into so-called “value traps” when they go bargain hunting. These traps may appear promising as they appear to be cheaply priced but may prove to be big letdowns for investors if they don’t perform.

But Pabrai believes it’s impossible to always get it right while investing. Getting it wrong is “par for the course,” he said.

“The best we can do is do our homework. Look at the long history of the business,” he said. “Try to make bets where the odds favor you and then if you make enough bets where the odds favor you, then even with a relatively high error rate, the end result should be more than acceptable,” he added.

How to evaluate a company

Pabrai identified several metrics that investors can use to evaluate a company.

“What would be their cash flows? What would be the net income if it stopped growing? Those are questions an investor should try to answer,” he said.

Net income, otherwise known as net earnings, is the revenue after accounting for a company’s expenses.

He also advised investors to look at a company’s reinvestment rate of return — the profit that a company makes after reinvesting the cash flows from an investment.

Pabrai highlighted Amazon as an example of a company with a demonstrated ability to reinvest at very high rates.

“For Amazon, [investing] $10 billion into the cloud or $10 billion into warehouses or trucks or vans, what is the return on that money?” He said. “And if their business is producing very strong returns on those reinvested dollars, north of 20% to 30% a year, it’s an incredible business. And historically, a business such as Amazon has shown an ability to reinvest at very high rates and has done well.”

Pabrai also looks at return on equity, which measures a company’s profitability and how efficiently it generates those profits.

“Does the business have very high returns on equity? Can it grow and prosper without the use of debt? What does the length of the runway look like? Can this business invest the high returns and equity back at high rates?” He asked.

The price-to-earnings ratio is a popular metric used to value a stock. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.

But Pabrai believes the metric alone is “inadequate” for investors to evaluate a company.

“There could be a business that’s trading at 50 times trailing earnings, and it could be really cheap, and it turns out to be a great investment and could go up 100 times,” he said. “And there could be a business that’s trading at three times earnings that could be really expensive and you could lose money on it.

“So, I think the price- to-earnings ratio as a tool to determine which investments to make is quite inadequate,” he added.

Ultimately, whether a stock is ‘cheap’ or ‘expensive’ may not be a reliable indicator of its attractiveness, Pabrai said.

“Charlie Munger said if a business can earn 20% to 25% return on equity for a long period of time and reinvest those rates, even an expensive looking price is going to turn out to be a great investment,” he added, referring to the American billionaire investor, who is vice chairman of Berkshire Hathaway.

Stanley Druckenmiller says the bear market has a ways to run and a recession is in the cards

Stanley Druckenmiller

Billionaire investor Stanley Druckenmiller struck an pessimistic tone about the markets Thursday, seeing a turbulent road ahead as the Federal Reserve struggles to engineer a soft landing.

“For those tactically trading, it’s possible the first leg of that has ended. But I think it’s highly, highly probable that the bear market has a ways to run,” the founder of Duquesne Family Office said at the 2022 Sohn Investment Conference.

The S&P 500 has fallen more than 15% this year, as the Fed’s aggressive tightening action stoked recession fears. The benchmark briefly dipped into bear market territory last month on an intraday basis.

The longtime trader believes that an economic downturn is likely on the horizon as the central bank faces an uphill battle with inflation stubbornly standing at a 40-year-high. The Fed has enacted two rate increases totaling 75 basis points, including a 50 basis point increase in May.

“The probabilities of being a soft landing are pretty remote. Historically, I think we’ve only pulled off two or three in history….there’s so much wood to chop. And there’s been such a broad asset bubble going into it,” Druckenmiller said. “Once inflation has got above 5%… it’s never been tamed without a recession. So if you’re predicting a soft landing, you’re going against decades of history.”

Druckenmiller said he’s mostly sitting on the sidelines instead of shorting the market aggressively as bear markets are known to have big bounces.

’I’ve lived through enough bear markets, that if you get aggressive in a bear market, on the short side, you can get your head ripped off in rallies. I’m pretty much taking a break,” Druckenmiller said. “My anticipation is I will be going back to the short equity position at some point if the market affords me, if not, hopefully, I’ll just sidestep a decline.”

Druckenmiller once managed George Soros’ Quantum Fund and shot to fame after helping make a $10 billion bet against the British pound in 1992. He later oversaw $12 billion as president of Duquesne Capital Management before closing his firm in 2010.

The investor believes that geopolitical risks are also weighing on a volatile stock market.

“Given the extent of the asset bubble and the destruction in the markets, given what’s going on in Ukraine, giving zero Covid policy in China, I don’t take a lot of comfort from that,” Druckenmiller said. “So I assume, and pretty strongly, soon we’re going to have a recession sometime in 2023.”

HI Financial Services Mid-Week 06-24-2014