HI Market View Commentary 06-03-2019

So Kevin What are we going to do about the Summer doldrums – Add some longer term short calls, dollar cost average the leap or long calls, and add more shares where we can on stocks that have really fallen hard

Of course some stocks have already had long puts in placed but some have been added here recently

Range bound under the moving averages (200SMA) until earnings

We make them us as things start to come back, we make more quicker due to what we’ve made on the way down

Where will our markets end this week?

Down

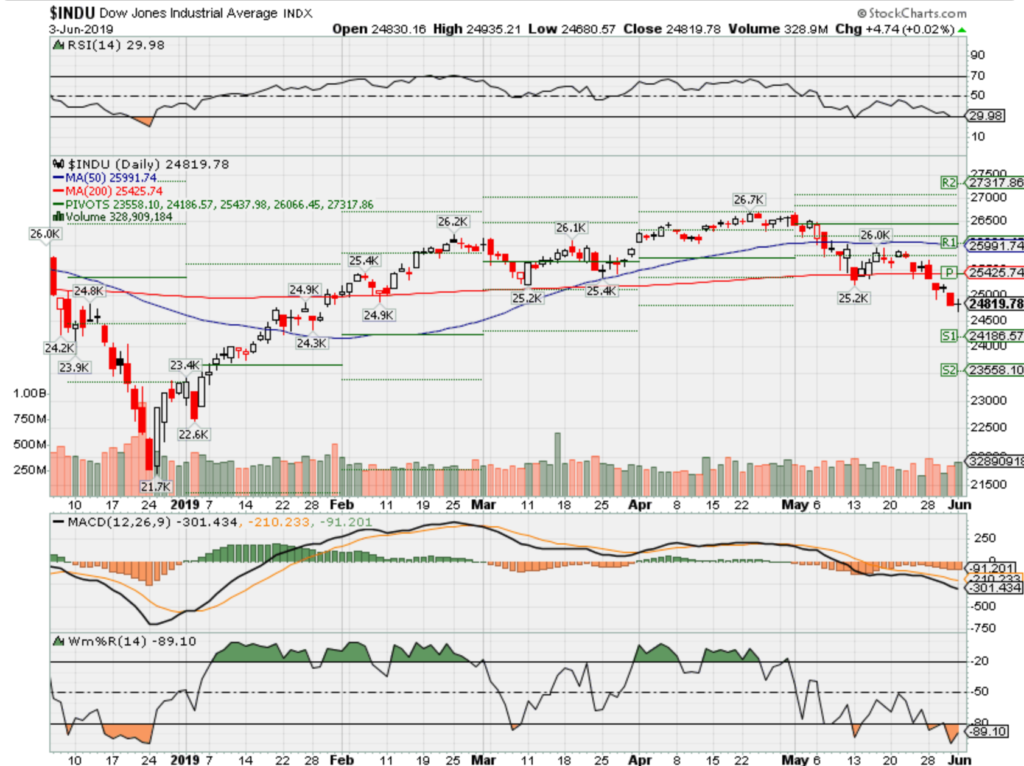

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end June 2019?

06-03-2019 -1.0%

05-27-2019 -1.0%

Earnings:

Mon:

Tues: GME, TIF, CRM

Wed: FIVE

Thur: KIRK

Fri:

Econ Reports:

Mon: Construction Spending, ISM Manufacturing Index

Tues: Factory orders

Wed: MBA, ADP Employment, ISM Services, Fed Beige Book

Thur: Initial, Continuing, Productivity, Trade Balance

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Consumer Credit, Wholesale Inventories

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Extending protection out until most likely the next earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Business

The Man Who Lost $35 Billion in One Year Has Some Advice for Elon Musk

By Peter Millard and David Biller

May 29, 2019, 4:00 AM MDT Updated on May 29, 2019, 9:21 AM MDT

Walking down a busy street in Rio de Janeiro one recent afternoon, we bumped into the Brazilian who is best known for losing $35 billion in a single year. After initially trying to deflect questions, he begrudgingly invited us along for a lunch that lasted two hours.

The man, of course, is Eike Batista, who once famously told Mexico’s Carlos Slim to watch out because, he said, he was poised to surpass him as the world’s wealthiest person. Slim has since faded to ninth on the list, Batista to oblivion. Now, he’s staging a comeback. Or trying to, at least. He’s also got lots of ideas for a man on the hot seat right now that he sees as something of a kindred spirit, Tesla CEO Elon Musk, and he’s quick to spew criticism at those he feels did in his empire.

Batista sat at the head of the table at one of his favorite Japanese restaurants in Rio, holding court and quizzing companions about Brazil’s ongoing oil bonanza while he scribbled calculations on a place mat. Pinned to his black sport coat was a golden sun, the logo of his erstwhile commodities empire that once made him the world’s eighth-richest person, and a household name in Brazil.

“People don’t even know it’s working,” Batista said between bites of shrimp tempura, describing a port he owned that now loads giant oil tankers bound for China. “It’s bigger than Manhattan!”

‘Except the Oil’

Other former ventures are all humming along under foreign ownership, and remain a source of pride. Then a slight frown came across his face. “Except the oil.”

He was referring to OGX, which went bust under a mountain of debt after an unsuccessful exploration campaign. He blames President Luiz Inacio Lula da Silva for succumbing to a bout of resource nationalism, leaving only shallow-water scraps for him. Then, without missing a beat, he drew parallels to an acquaintance who’s in the kind of tight spot he knows too well.

“Elon Musk is suffering from this right now,” he said.

Like OGX before it, Musk built Tesla on the premise of greater sales than were delivered, and the failure sent shares tumbling. Terms like “distressed credit” and “restructuring” entered the conversation. It’s the biggest decliner in the Nasdaq 100 Index this year.

Cautionary Tale

While differences between the men are glaring — Musk wants his electric cars to break the world’s fossil fuel addiction — the sudden downfall of Batista’s oil company offers a cautionary tale for Tesla investors.

Both Batista and Musk have attacked short sellers with caustic tweets and made market-moving announcements on social media, then came under scrutiny from regulators for doing so. (Brazil’s securities commission this week banned Batista from running publicly-traded companies for seven years and slapped him with a 536-million-real ($132 million) fine.) They also regretted having taken their companies public once markets turned against them, and suffered high-profile staff departures.

The two have a personal relationship. In 2008 Musk traveled to Rio during another difficult moment, Batista said. A failed rocket launch had put Musk’s space program in doubt. They also met at Tesla’s factory in California, and Musk returned to Rio in 2014 for the World Cup where Batista assisted with his social agenda. “I helped him to go to some parties.”

OGX still exists under a different name as a minor producer, not the giant Batista envisioned. Tesla, too, risks being relegated to a niche player amid growing competition from established carmakers who are flooding the market with new models.

Speedboat Racer

Batista’s big concern for the company is the quality — or lack-there-of, he says — of the interior of Tesla cars. It’s an unusual perspective. Not even the most bearish Tesla bears tend to dwell much on the seats.

“You can choose a Mercedes, Audi, or Jaguar that are cheaper than his SUVs, and you sit in there and see the interior; you can’t compete!” said Batista, a former speedboat racer and car buff who displayed a Lamborghini in his living room until police seized it. “If you don’t correct this, you fall behind.”

Tesla is preparing a revamp of its Model S sedan to include seats from a higher-end model and a longer range battery, CNBC reported Wednesday, citing unidentified current and former employees.

Batista doesn’t see Tesla bringing down Musk’s wider group of companies the way OGX sank his, even if the carmaker doesn’t endure. In any case, Musk has already altered the course of history by forcing the wider auto industry to produce electric cars.

“He provoked a beautiful and massive move toward change,” Batista said, and then made a comparison to himself. “We are perfectionists, we are nation-builders.”

Toothpaste Startup

The conversation continued the next day at his office, a more modest space than he occupied in his heyday, but still offering a view of Rio’s iconic Sugarloaf mountain and decorated by trophies from the past. A surf board once ridden by Gabriel Medina, Brazil’s two-time world champion, rested in a corner. A title belt given to him by a mixed martial arts fighter hung on his wall, and a coffee table featured a pair of samurai swords that were also a gift.

The man who once regularly graced Brazil’s front pages declined to have his photo taken.

He played videos showcasing the companies he once owned, then spoke about the 15 “unicorns” he’s “breeding in my garage” that will restore him to prominence. One plan entails producing millions of tons of calcium phosphate to sequester carbon emissions from power plant stacks and car engines. Another is toothpaste that regenerates enamel, though the tubes he passed around the conference table were for now filled with water.

Batista says he’s looking forward, and is untroubled by the past.

“The difficulty is for people to understand that my relation to money is very different. I didn’t mind breaking my empire,” Batista said, adding that he quickly sold his companies on the cheap. “You can’t let projects of that scale stop; if it stops for 2, 3, 4 years, sometimes you can’t catch up.”

https://seekingalpha.com/article/4267688-facebook-worrisome-trend?dr=1

Facebook: Not A Worrisome Trend

May 31, 2019 4:17 PM ET

Long/short equity, growth at reasonable price, research analyst, Deep Value

Summary

Facebook is forecast to continue losing average time spent by users.

The ARPU remains a crucial metric to monitor the impact of lower time on Facebook.

The social site has a long runway to increase monetization outside the US & Canada.

The stock remains a bargain based on my 2020 EPS target of $10.

A lot of the investment story in Facebook (FB) and any social media stock is based on user growth. The whole story sometimes centers on just getting more users to use their platform all day. The right user metric focus can deliver better platform monetization and reward shareholders such as the case with this stock.

Right User Metrics

Social media investors have a whole host of user metrics to utilize to craft an investment thesis. One can use metrics that focus on how often somebody logs into the platform or how somebody uses the platform or the level of engagement of users on the social platform.

The typical metrics focus on the daily average users (DAUs) and monthly active users (MAUs), but these numbers are relatively basic. The commonly used MAU is probably the least useful metric once a social site is established. The global reach of a site like Facebook or Instagram is important, but a user that logs in every 30 days isn’t that valuable to the overall success of the social site.

A much more important metric is DAUs as a highly engaged user offers far more data to use in targeting ads along with substantial more engagement to serve ads. A big separation over a site like Twitter (TWTR) is the high DAU ratio, where Facebook is over 65% and Twitter has historically trended closer to only 40%.

A more meaningful engagement is average time spent by users. Facebook has long dominated the sector with nearly double the time spent by users at 40 minutes spent on the site per day in 2016. According to eMarketer, Facebook will lead both Instagram and Snapchat (SNAP) by over 10 minutes of usage per day this year.

The hiccup is that Facebook is now losing usage, but investors don’t need to fret as all of the additional time is going straight to Instagram, owned by Facebook. The combined family of platforms has a target of 66 minutes of usage in 2021, up slightly from 65 minutes in 2019.

Less Is More

Facebook made the wise move at the start of 2018 to shift focus away from items that left users on mindless functions on the platform. The outcome has been higher quality time and better monetization. In Q1, the US & Canada ARPU jumped 28% to continue a trend of growing revenues for these key users by a fast clip.

Source: Facebook Q1’19 presentation

To no big surprise here, Facebook has again made a move to appease regulators and skeptics that only ends up ultimately improving the quality of engagement. For a fully developed social platform, the most useful metric is likely a mix of light user engagement growth with a strong focus on ARPU.

Analysts have revenues growing 24% this year and another 21% in 2020. A big component of future growth is boosting ARPU dramatically for ex-US/Canada locations such as Europe that don’t come close to reaching the US level. Europe barely topped 30% of the $30.12 generated by the average MAU on Facebook during the last quarter.

Europe has a larger DAU base difference of ~100 million at 286 million. The MAUs are a far larger gap of 141 million with Europe having 384 million people that regularly utilize Facebook on a monthly basis.

Source: Facebook Q1’19 presentation

For this reason, Facebook hardly needs more users on the platform. The key to growth is far more monetization in Europe and even Asia-Pacific and ROW, where an additional $2 ARPU would add over $3 billion in additional quarterly revenues for a company that just hit $15 billion in Q1 revenues.

Takeaway

The key investor takeaway is that time spent trends aren’t meaningful with the platform looking to clean up the site. Facebook can easily expand monetization of existing users by increasing the quality of time on their family of sites while growing non-US monetization to more normalized levels.

With my 2020 EPS estimate of $10, Facebook remains a cheap stock at $182. The stock isn’t the bargain it was at the lows last year when beaten up by the privacy issues, but the social platform should head towards the previous highs of $220. The higher quality time spent on the platform remains a positive part of the story as ARPU grows.

Disclosure: I am/we are long TWTR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

https://seekingalpha.com/article/4267587-visa-stock-good-quality-reasonable-valuation?dr=1

Visa Stock: Good Quality And Reasonable Valuation

May 31, 2019 1:25 PM ET

Andres

Cardenal, CFA

Summary

Visa is up by 25% in the past year, and investors may be wondering if the stock is too expensive at current prices.

The company is a world-class business with impeccable financial performance and outstanding profitability.

Looking at valuation ratios, discounted cash flows, and multi-factor analysis, the stock is reasonably valued.

Visa looks well positioned for solid – but not outstanding – returns at current prices and any pullback down the road should be seen as a buying opportunity.

Looking for a portfolio of ideas like this one? Members of The Data Driven Investor get exclusive access to our model portfolio. Start your free trial today »

Visa (V) stock is on fire lately, shares of the payments leader have gained over 25% year to date on the back of rock-solid financial performance from the company. There is little discussion on the fact that Visa is a high-quality business, but even the best companies can be mediocre investments if the stock price is excessively high.

In that spirit, the following paragraphs will be taking a look at Visa stock through multiple points of view: valuation ratios, discounted cash flows, and multi-factor analysis.

Valuation is an art as much as a science, and the true value of the business will ultimately depend on the earnings and cash that the company generates in the future, which cannot be forecasted with certainty.

Nevertheless, based on current performance and reasonable expectations about the future, Visa looks fairly priced at current levels, especially since we are talking about a world-class business.

Exceptional Quality

In order to assess valuation, we need to begin with a discussion of the company’s quality. In Warren Buffett’s words, “price is what you pay and value is what you get”, so price and value are two sides of the same coin when it comes to valuation.

Visa is the global leader in electronic payments, with a gargantuan scale of 3.36 billion cards in circulation as of the quarter ended in March of 2019. Brand recognition and massive acceptance are key sources of competitive strength and sustained market leadership for the company.

Consumers all over the world are increasingly replacing paper money with more convenient payments methods, and the online commerce boom is a major engine behind this transformation. Visa is doing a spectacular job in terms of transforming its growth opportunities into increasing sales and earnings for shareholders over the long term.

Data by YCharts

The company generates outstanding profitability levels. Looking at profitability as a percentage of revenue and also when measuring profitability on capital and assets, Visa is ahead of the average player in the sector by a wide margin.

Source: Seeking Alpha Essential

Valuation Ratios

Wall Street analysts are on average expecting Visa to make $6.21 in earnings per share during the fiscal year 2020 and $7.21 in fiscal 2021. Under these assumptions, the stock would be trading at forward price to earnings ratios around 26.2 and 22.6 respectively. These valuations are relatively expensive in comparison to the broad market but not necessarily excessive considering that Visa is a top-quality company.

Successful players in the payments industry are trading at demanding valuation levels because the industry offers attractive growth opportunities and abundant profitability. In this context, Visa is not too expensive at all by industry standards.

The chart below shows enterprise value to EBITDA, projected PE, and projected PE to long-term growth expectations for Visa versus Mastercard (MA) and PayPal (PYPL). Visa is cheaper than both Mastercard and PayPal across the three indicators considered.

Importantly, valuation is a dynamic as opposed to a static concept. Visa has an impeccable track record in terms of delivering earnings numbers above Wall Street expectations over time. This level of consistency is exceptional because a high bar is hard to beat, and it’s generally quite difficult for companies to keep outperforming expectations quarter after quarter.

Source: Seeking Alpha Essential

The chart below shows how earnings estimates for Visa in both the current year and next fiscal year have significantly increased over time.

Data by YCharts

Fundamental momentum can be a pervasive force in the market, and companies that outperform expectations tend to continue doing so more often than not. If Visa keeps delivering better than expected numbers in the future, this would mean that the stock is actually cheaper than what current valuation ratios are indicating.

Discounted Cash Flows

The discounted cash flow valuation is based on the following assumptions:

- Sustainable free cash flow is $11.5 billion

- Free cash flow is expected to grow at 14% per year over the next 5 years

- Free cash flow growth will slow down to 9% annually for 5 more years

- The terminal growth rate is 3%

- The required rate of return is 9%

Based on these calculations, we reach an estimated fair value of $176 per share for Visa stock, representing a modest discount of 8.21% versus current prices.

| Sum of Present Value of Cash flows (Millions) | $137,868 |

| Perpetuity Value of Final Cash flow (Millions) | $247,045 |

| Equity Value (Millions) | $384,913 |

| Implied Share Price | $176.13 |

| Discount/Premium to Current Price | 8.21% |

This valuation exercise is not intended to accurately estimate free cash flow generation over the coming decade because these kinds of forecasts necessarily carry a high degree of error.

The idea is not trying to reach a precise estimate of the company’s true intrinsic value, the main point is working with the numbers in order to assess if Visa stock is moderately priced based on reasonable assumptions about cash flow generation going forward. Looking at these numbers, the stock looks in fact fairly reasonably priced.

Multi-Factor Analysis

The PowerFactors system is a quantitative algorithm available to members in The Data-Driven Investor. This algorithm ranks companies in the market according to a combination of quantitative factors that includes: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

Data from S&P Global via Portfolio123

The backtested performance data indicates that companies with a high PowerFactors ranking tend to deliver superior returns over the long term. Visa is in the top 3% of stocks in the market according to the PowerFactors ranking, with a score of 97.03 as of the time of this writing.

The value factor ranking is reasonable but not particularly attractive at 68.56. However, the stock ranks remarkably well across the other indicators considered: quality (99.21), fundamental momentum (82.99), and relative strength (90.96).

The data is showing that Visa is not too cheap at current prices, but the stock is still priced at reasonable levels, and the company is remarkably solid across the other quantitative factors considered.

Risk Factors And Final Considerations

Visa is a market leader in a highly concentrated market, and the company makes massive amounts of money. This means that Visa is always an easy target for regulators in different countries.

Besides, the competitive landscape is also evolving, with companies such as Apple (AAPL), Google (GOOG) (GOOGL), PayPal, and Square (SQ) making big inroads in payments. Blockchain technologies could also have a disruptive impact on the payments industry over the long term.

The leading players in the payments sector tend to make profitable alliances as opposed to savagely competing for customers. However, it’s important to monitor the industry landscape in case competition becomes more aggressive or regulatory pressure produces some damage to the company’s business.

Those risks being acknowledged, Visa is an exceptional company, generating outstanding financial performance and trading at reasonable valuation levels for such a high-quality stock. Valuation is no bargain at current prices, but Visa is strong enough to continue delivering solid returns for investors from these levels.

Importantly, Visa is a great candidate to watch closely and consider buying on any pullback because short-term price weakness in a world-class business such as Visa is generally a buying opportunity for long-term investors.

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I am/we are long PYPL, GOOGL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/news/3468212-auto-sector-reeling-mexico-tariff-warning?dr=1#email_link

Auto sector reeling after Mexico tariff warning

May 31, 2019 7:31 AM ET|About: First Trust NASDAQ Global… (CARZ)|By: Clark Schultz, SA News Editor

Automaker stocks trade lower after President Trump’s threat to apply a 5% tariff on imports from Mexico threatens the supply chain and is seen cutting into sales volume due to higher consumer prices.

General Motors (NYSE:GM) is down 4.68% premarket, while Ford (NYSE:F) is off 3.70%. Fiat Chrysler Automobiles (NYSE:FCAU) is down 5.52% in the early session. Even U.S.-producing Tesla (NASDAQ:TSLA) is retreating by 1.65%.

Japanese automakers are also in harm’s way due to the number of parts that bounce between the U.S and Mexico before final car assembly. Honda (NYSE:HMC) is down 2.98% premarket, while Toyota (NYSE:TM) is 1.54% lower. In Tokyo trading, Nissan (OTCPK:NSANY) fell 5.31% and Mazda (OTCPK:MZDAY) was off 7.13%.

https://seekingalpha.com/article/4267375-trade-war-hurting-bank-america?dr=1

How The Trade War Is Hurting Bank Of America

May 30, 2019 3:36 PM ET

Summary

The escalation of the trade war between the United States and China increasingly presents risk to the U.S. economy.

Bank of America is a cyclical with special exposure to the U.S. economy, and so its exaggerated declines versus the market are appropriate.

The forward economic outlook is more important for the shares of this cyclical stock than its current economic environment and will determine the stock’s appropriate value.

Bank of America (BAC) shares have fallen 3.4% since I cut my rating from Strong Buy to Neutral on April 7, 2019, and the stock is down by double digits from its 52-week high near $32. As a result of its decline along with financial sector stocks, some market pundits are today referring to the discounted financial sector and the bank as opportune for purchase. However, I see these shares as simply reflecting the important economic risks currently factoring for equities. Namely, the trade war and the economic and market uncertainty it brings are weighing against these cyclical shares today. I see these risks appropriately incorporated in the value of Bank of America shares, and I continue to expect intensified volatility around developments. BAC shares’ upside is likely limited and its direction less clear given the current situation and potential disruption to global growth, despite full employment and economic growth in the U.S. today. I reiterate my neutral rating for Bank of America shares.

Data by

It’s been a long hard road getting to recent heights for BAC shares. The stock has arrived from the days when it shares traded in the low-single-digits in 2008 and the mid-single-digits again in 2011. Today, BAC is not far off its highs in dollar terms, but for recent buyers of the last couple years, percentage losses to their holdings may still amount to something significant. Investors need to know now why their stock is lower and whether it represents a dislocation of reason from value.

The Trade War is Problematic for Bank of America

The trade war that the United States is currently engaged in with China, and the battle it threatens to escalate with Europe, are problematic for Bank of America shares. Until recently, trade negotiations were widely anticipated to result in a near-term deal, but at the latest meetings in the United States, I believe market sentiment about the issue changed. In fact, I believe we are at heightened risk of a stock market correction as a result of the market’s reweighting of the issue.

With existing U.S. tariffs on imported goods from China hiked to 25% from 10%, and with China backtracking on previous conciliatory measures, it has become clear that the road to a deal will be long and tedious. And, there is the risk of an unexpected consequence, with the possibility of China employing asymmetric trade warfare in a battlefield where its options for equivalent countermeasures are limited.

That Which Disrupts the U.S. Economy Hurts Bank of America

To-date, a 25% tariff on $250 billion of Chinese exports has not meant much to U.S. economic growth. That action along with the counteractions of China on U.S. exports is estimated by Bloomberg economists as having just a 0.2% impact to U.S. growth at its future peak in 2021. However, this weekend, as of June 1st, the U.S. threatens to impose 25% tariffs on all China exports into the U.S. Bloomberg’s economists estimate that 25% tariffs on all bilateral trade between the two countries would have a 0.8% impact to the output of China, and a 0.5% impact on the output of the Unites States and the world.

There is a worse result. Supposing the trade war escalates beyond the orderly battles that have occurred thus far. What if asymmetric warfare is exploited by either the U.S. or China or both? One might argue that the U.S. efforts against the business of Huawei Technologies have amounted to as much. The same can certainly be said about the decades of intellectual property theft by China and Chinese firms against the U.S. and its companies. Still, a commensurate China countermeasure against Apple (AAPL) or Boeing (BA) might start a stock market selloff, in my estimation. It would signify the trade war moving to another level, and really starts to feel more like war than trade to me. Similarly, if China were to publicly move away from U.S. treasury holdings or to devalue its currency, this would shock the market. If a 10% equity market correction is included in the impact summation of the trade war, then Bloomberg’s economists suggest we could see a 0.7% impact to U.S. GDP and a 0.6% impact to that of the world in 2021. However, I would expect worse, and a recession sooner.

The United States is also taking a strong position against Europe, with tough trade negotiations expected on this front soon. Already we are seeing the U.S. demand Europe comply with its sanctions on Iran, threatening sanctions against European nations and firms if they fail to fall in line with U.S. interests. As the U.S. takes stronger actions against China, everything it threatens others will be taken more seriously by market participants. Risk rises, and market disruption becomes more likely.

Bank of America is Especially Exposed to Risk

There are ripple effects expected, so that some countries are impacted worse than others. Likewise, some industries and companies would be hurt more than others. Within that group of extra-sensitive companies is Bank of America.

Bank of America is a cyclical company, as evidenced by its beta coefficient, which stood at 1.56 (3-year monthly) recently. So that declines in the broader stock market (and economy) are exaggerated by the stock. Thus, if the S&P 500 corrects 10%, then we would expect Bank of America shares to correct by over 15%. This risk underlies the stock’s decline from its 52-week high. The SPDR S&P 500 ETF (SPY) is down 5% from its 52-week high, while the shares of BAC are off by 12.6%.

Data by

Impacts of stress to the U.S. economy are especially important to the bank. For instance, its net interest margin is directly impacted by the spread between short and long-term yields, since the bank lends mostly through long-term loans and borrows via deposits at short-term rates. So, when the yield curve flattens or even inverts due to economic concerns as it has most recently, the impact of this is registered by investors in banks. Even declines in short rates, perhaps driven by Federal Reserve actions to support the economy, hurt Bank of America’s profitability. Though, this is less of a factor than economic recession, and perhaps necessary medicine to restore economic healthy.

And the volume of the bank’s business will naturally be impacted by the health of the economy. A faster growing economy that employs plenty of people generates more demand for mortgages, auto loans and business loans, as well as usage of consumer credit cards. Likewise, if the economic outlook is one that is increasingly reflecting concern for a negative change, then decreases in loan demand will begin to be reflected in the bank’s shares before real declines are seen in the company’s performance. This is the reason why we are today seeing declines in the banking stock despite still strong operating performance for the company.

What about valuation? As the bank’s price-to-book value declines, some are suggesting today that the bank is a better buy. However, if the outlook is for slower growth of shareholder equity or for the destruction of that value due to economic weakness, then we are employing an inflated current denominator to determine a future value that will reflect a lower denominator value.

Conclusion

In conclusion, in my estimation, the value destruction in Bank of America shares correctly incorporates the real risk present for the economy and the company. As news flow around this contentious trade war issue continues to dominate market sentiment, the shares of this cyclical bank will experience greater volatility and have excessive downside exposure. Thus, despite what still may prove to be a period of extended economic growth and with the possibility of a trade solution, I maintain my neutral view for BAC shares.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

HI Financial Services Mid-Week 06-24-2014