HI Market View Commentary 05-13-2019

What is the problem in our market?

China, Chinese Tariffs, too much liquidity, Fear and over-reaction,

Dumb people, The trade deal “WAS” built into our markets and now is being backed out

Coming off the highs and down maybe 6%

The whole day my decision was to go bearish or to wait it out and look for an opportunity to dollar coast average or enter a new position with cash on the sidelines.

Chinese retaliation to our raising of tariffs and Trump being pissed off that they backed out of months of negotiations

Risk tolerance and do you think this is the big one where we lose 40% of our market

Where will our markets end this week?

Higher but giving most of it back Friday

DJIA – Bearish and brolke the 200 SMA

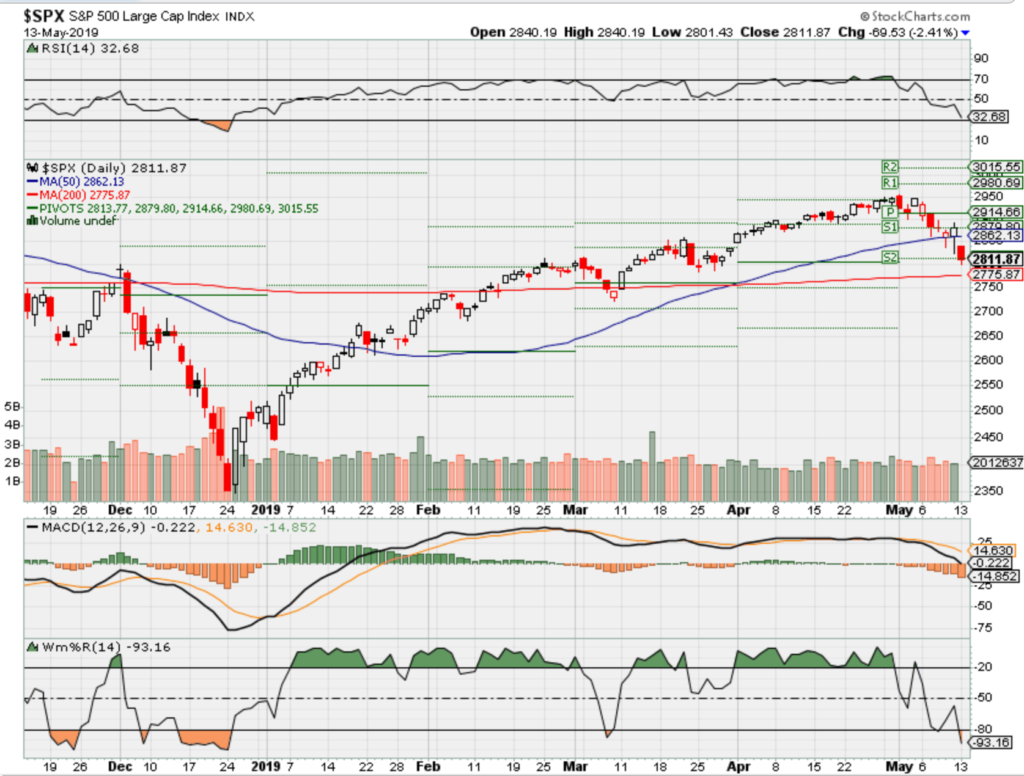

SPX – Bearish

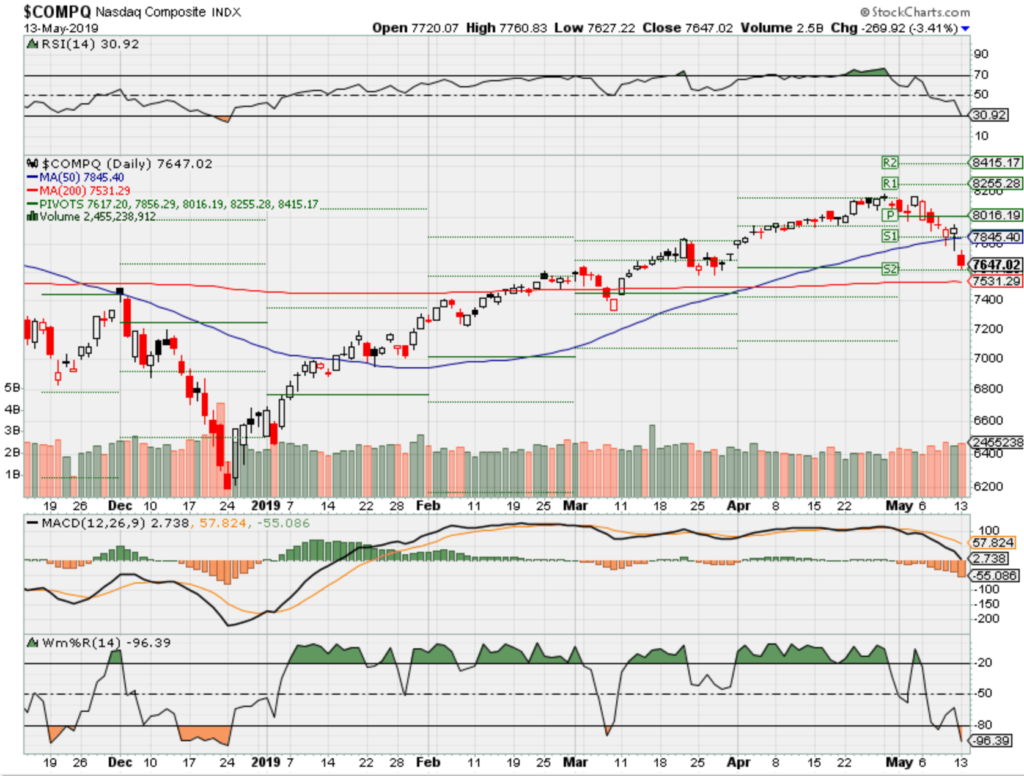

COMP – Bearish

Where Will the SPX end May 2019?

05-13-2019 0.0%

05-06-2019 3.0%

04-29-2019 3.0%

Earnings:

Mon: LM

Tues: RL, A

Wed: M, BABA, CSCO, JACK, NTES

Thur: WMT, AMAT, NVDA, BIDU, IQ

Fri: DE

Econ Reports:

Mon:

Tues: NFIB Small Business Optimism, Import, Export

Wed: MBA, Retail, Retail ex-auto, Empire Manufacturing, Industrial Production, Capacity Utilization, Net Long Term TIC Flows

Thur: Initial, Continuing, Housing Starts, Building Permits, Phil Fed,

Fri: Leading Indicators, Michigan Sentiment, OPTIONS EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Extending protection out from Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Hackers steal over $40 million worth of bitcoin from one of the world’s largest cryptocurrency exchanges

PUBLISHED TUE, MAY 7 2019 10:40 PM EDTUPDATED WED, MAY 8 2019 10:38 AM EDT

KEY POINTS

- Hackers stole 7,000 bitcoin from major cryptocurrency exchange Binance, the platform said.

- They used a variety of methods to carry out the “large scale security breach, ” according to the exchange.

- Binance said it would cover the incident “in full” and no user funds will be affected.

Hackers have stolen over $40 million worth of bitcoin from Binance, one of the world’s largest cryptocurrency exchanges, the company said on Tuesday.

Binance said the hackers ran off with over 7,000 bitcoin and used a variety of attack methods to carry out the “large scale security breach” which occurred on Tuesday.

They also managed to get some user information such as two-factor authentication codes, which are required to log in to a Binance account.

The cryptocurrency exchange was able to trace the stolen bitcoin to a single wallet, it said.

“The hackers had the patience to wait, and execute well-orchestrated actions through multiple seemingly independent accounts at the most opportune time,” Binance said in a statement.

“The transaction is structured in a way that passed our existing security checks. It was unfortunate that we were not able to block this withdrawal before it was executed. Once executed, the withdrawal triggered various alarms in our system. We stopped all withdrawals immediately after that.”

Binance said the theft occurred from the company’s so-called “hot wallet,” which accounts for about 2% of its total bitcoin holdings. A wallet is a digital means of storing cryptocurrency. A “hot wallet” is one that is connected to the internet as opposed to a “cold” one which stores digital coins offline.

Deposits and withdrawals on Binance’s platform will remain suspended but trading will be allowed.

Binance also warned that “hackers may still control certain user accounts and may use those to influence prices.”

However, the company said that it will cover the incident “in full” and no users’ funds will be affected.

The hack comes after a recent rally in bitcoin. The price of the digital coin is about 9% higher over the past week.

https://seekingalpha.com/article/4261871-play-visa

How To Play Visa

May 9, 2019 9:10 AM ET

Growth, dividend investing, long-term horizon, value

Summary

Visa has been one of the most best-performing, large-cap stocks over the last decade.

The stock has appreciated by 868% over the last decade and has hardly dropped below a 20-times earnings ratio.

It is a tremendous growth and value stock and as it rarely appears cheap it could be difficult to get into the stock.

Investors need to set back their recency bias and instead put their investment on auto-pilot in order to easily benefit from Visa’s growth.

Visa (V) is a tremendous stock. Although the company has been around since 1958 it only went public in 2007. Since then the stock only knew one direction which is upward. Its 10-year chart is nothing short of amazing.

Data by YCharts

Over this 10-year period you hardly see any dips as the stock has marched upward year after year. Even the almost 50% drop during the Great Financial Crisis in 2009 is hardly recognizable. The stock has appreciated by almost 900% over that time period setting all-time high after all-time high.

Its most recent correction in December 2018 has quickly been compensated with the stock hitting fresh all-time highs this year almost every week.

Data by YCharts

If you see that stock chart it appears to be a no-brainer to invest in Visa no matter what the price is. This is basically true but psychologically it is not that easy to invest in a stock which is almost always trading near its all-time high with a valuation between 20-35 times earnings.

An investor’s recency bias is difficult to overcome in this case. Instead, I believe the better way to play Visa is to invest on autopilot via an automated savings plan. In this article I am going to quickly review Visa’s last quarter and then show my own investment path with Visa and its results.

What is going on at Visa?

Visa’s latest FQ2 2019 earnings have beaten estimates on the bottom line and top line for the 11th consecutive time. Visa recorded revenue growth of 8.3% Y/Y and posted EPS of $1.31 which currently translate into a TTM P/E ratio of around 32.

Visa has been seeing high-single-digit and double-digit growth across payment volumes and processed transactions as the company benefits from two global mega trends: 1) more transactions are shifted to mobile 2) more transactions are processed digitally than in cash. For total fiscal 2018, Visa processed 124 billion transactions worldwide and this figure has been increasing year after year. Visa operates the largest credit card network in the U.S. and in many other countries.

With less and less transactions being handled with cash Visa is set to grow strongly for years if not decades. Visa is a pure cash-generating machine and while its current yield is significantly below 1%, its dividend growth and payout ratio are second to none. Over the past 10 years Visa has grown its dividend with a CAGR of a whopping 32.59% and while that figure certainly benefits from the virtually zero dollar starting dividend, its 3-year CAGR of bang on 20% is among the best as well.

At the same time, this explosive dividend growth has not come at the expense of a deteriorating payout ratio. Despite some ups and downs in this chart, Visa’s business is basically not depending on Capex and as such Visa can convert most of its operating cash flow into free cash flow. Based on earnings its current payout ratio is only at 20% despite these massive dividend increases.

Data by YCharts

Visa and its main rival Mastercard (MA) are operating in a league of their own and their stock prices reflect that unique position. I personally only owned Visa so far, but I consider both stocks to be generational buy-and-hold forever holdings.

How to invest in Visa

Personally, I very much prefer to buy quality stocks which have been beaten down but with that investment methodology you either need to have a lot of luck or you need to wait a lot of time until this criterion makes a stock like Visa a buy. The last time this happened very briefly was in December 2018 and you would have to basically monitor the stock markets daily in order not to miss this opportunity.

As I consider Visa to be one of very few buy-and-hold forever stocks, I want to be able to constantly invest in this company without having to worry about the company’s stock price. As a result, I have initially set up one monthly savings plan in December 2015 which always invests a fixed amount of 50€ (growing 5% p.a.) every month on day 1 into Visa. Last year I decided to expand this path by setting up another savings plan on Visa which gets executed on day 15 of every month.

Now more than three years later I have taken the time to analyze all these monthly investments in order to assess how I have been doing.

This chart depicts all my individual purchases in Visa. The bars represent the stock opening price on the day of purchase and the label annotates the respective number of shares I have bought. For this to work as it does, it is important that the broker allows to buy fractional shares. For me as a German investor, the only broker with this feature and automated savings plans is consorsbank.de but for U.S. investors there are numerous ones. The chart is no rocket science and you can easily see that the higher the stock price the less shares were purchased. Having said this, it is also blatantly obvious how the December stock price correction has helped me buy more shares.

The “Day 1” savings plan only purchased 0.3845 shares but following the melt-down in the stock the “Day 15” savings plan already purchased 0.4532 shares.

Certainly, the invested amounts are small but contributing around $100 every month for years (and for even more years in the future) will ultimately also accumulate a lot of capital.

Over a long time, multiple single purchases of $50 or a $100 every month can also generate significant returns. Here is a chart showing how each single purchase has performed so far as well as the accumulated gains over time.

A lot of my purchases between 2015 and 2016 have effectively already doubled whereas more recent ones have naturally generated far less capital appreciation. Strikingly though, at the time I wrote this article, there was not a single purchase with an unrealized loss. If you know, mentally plot this against Visa’s stock price chart and its valuation, which has shown that Visa was hardly ever cheap over this period. I am very delighted to have decided to put Visa on autopilot.

Had I not done this I would have been very restrictive with purchasing shares as I would have almost always considered them to be expensive and instead bought other shares. Finally, here we can see how these purchases (shown in pink) are plotted on Visa’s stock price chart.

On the bottom of this chart I have shown how the dividend payments have developed over time. The growth is fueled by Visa’s organic 20% dividend growth as well as all the new purchases over the years. Although in absolute terms my dividend income is still very low (for instance, it would only take 15 shares of AT&T (T) to generate identical net dividends today) it has grown quickly and predictably and will soon approach the $10 net dividend quarterly milestone. At the same time, price return currently stands at 49%.

Investor Takeaway

Visa is a great stock to own but it almost always appears to be expensive. Waiting for the stock to be “cheap” could take a long time and means that investors could miss significant returns. Imagine the stock is currently at $50 with a P/E of 30. Over the next 3 years the stock doubles and still sports a P/E ratio of 30. Now the stock suddenly corrects and drops to $75 which sends its P/E to 22.5 (assuming constant earnings). In that case you would probably consider it to be a great buy at this price but having waited these three years for the P/E to drop to these values has prevented you to accumulate stock between $50 and $75 at higher P/E ratios.

To overcome this psychological hurdle I have set my investments in Visa on autopilot and have no complaints about the results. As long as Visa can maintain its unique position and benefits from secular mega-trends I see no reason to change any of this.

If you like this content and want to read more about this and/or other dividend-related topics, please hit the “Follow” button on top of the screen and you will be notified of new releases.

Disclosure: I am/we are long V, T. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision. I am long all stocks mentioned in the portfolio composition table.

https://seekingalpha.com/article/4260526-improving-margins-push-armour-higher-dtc-decrease-risk

Improving Margins Should Push Under Armour Higher, But DTC Decrease Is A Risk

May 6, 2019 11:51 AM ET

Summary

Under Armour’s stock saw significant appreciation after reporting first-quarter earnings due to expanding margins that allowed management to increase full year guidance.

International growth, fewer promotional activities, and inventory optimization were largely responsible for expanding margins; however, DTC revenue disappointed.

Trends are expected to continue with 2019 guidance, which should lead to additional stock gains; however, execution remains a significant risk.

Investment Thesis

Under Armour (UAA, UA) is an innovative company with a premium brand that has faced margin issues as a result of growing pains and a competitive athleisure marketplace. The company has begun to reverse these issues and is showing signs of a turnaround with improved margins. Given this, I think Under Armour’s stock has room to appreciate; however, don’t be surprised if there are selloffs on the way due to lack of execution as the company is seeing a possible risk in its DTC segment.

Introduction

When Under Armour reported first-quarter 2019 results, the stock was rewarded by the market where the stock saw upside of 5% compared to pre-earnings. Both, revenue and GAAP EPS, surpassed analysts’ expectations. Revenue only grew 2% year-over-year, but the story was GAAP EPS of $0.05 when analysts expected $0.00. Excluding the impact of foreign currency headwinds, revenue grew 3% to $1.2 billion in Q1 2019. It has been a difficult recent history for Under Armour facing various headwinds that have really hit the stock price hard and have set expectations low. The past 2 quarters have signaled life to the Street and provided optimism for the rest of 2019 and beyond, but should investors be excited? Here’s a breakdown of the company’s first-quarter earnings:

North America Slump

Despite the increase in revenues, the company is continuing to contract in North America, where sales were down 3% to $843 million. The contraction was less than the 6% seen in the fourth quarter of 2018. This is coming as the North American athleisure market has become highly competitive and saturated with options (even by brands not in the sports apparel business). Additionally, the trends appear to be slowing down as consumers are growing preference for jeans and boots again. While this will slow down the general public’s purchases of athleisure apparel, Under Armour needs to ensure that they are focusing on active athletes that will remain when the general population moves on to another fad. I believe Under Armour is positioningitself for this by performing “North American cleanup in 2018.” This involves optimizing inventory to better follow demand, normalizing pricing, and promotional activities, and sharpening the company’s product segmentation strategy. Under Armour did see some benefit from operational enhancements and improved service levels as a result. Additionally, the company sold fewer items in its off-price channel and as the company attempts to reset toward a more premium price point. By doing this, the company will resurrect the Under Armour brand that demands a premium and improves the bottom line. This is clearly starting to take shape.

Inventories, Gross Margins, and Operating Costs Improving

That’s exactly what it did in the first quarter of 2019. Gross margin increased 100 basis points to 45.2% while operating margin was 2.9% versus analyst expectations of 0.6%. The improvement is being driven by product cost improvements, regional product mix and prior period restructuring costs. Even from a Sales, general and administrative cost perspective, the company was able to decrease by 1% to 42.3% of revenue. Cutting costs was a clear goal of management’s for the company to reclaim success. The first step was optimizing inventory, which they were able to do in the 1st quarter of 2019 as inventory was down 24% to only $875 million (lower than $1 billion at YE 2018). This is key as excess inventory results in promotions, lower sales price, more air freight costs, and an unquantifiable hurt to the company’s brand image. Under Armour must carry this margin momentum throughout 2019 and into the future.

2019 Guidance

The company made small adjustments to the guidance that was released at the company’s Investor Day in early December 2018. The company continues to expect revenue to increase by 3% to 4% for the full year. The growth, similar to the first-quarter results, is being driven by the International market while trying to hold the North American market flat. Gross margin guidance was increased to an improvement of 70 to 90 basis points (excluding 2018’s restructuring charges) which was an improvement from the previous guidance of 60 to 80 basis points. Improvements are expected as a result of sales mix, less promotional activity, improved supply chain, and more Direct to Consumer (DTC) sales. Ultimately, these targets should allow the company to achieve an operating income in the range of $220 million to $230 million compared to a $25 million loss in 2018. Aside from reducing costs and improving margins, the top line drivers to this guidance in 2019 will be the DTC and International efforts.

Direct To Consumer Growing

In the first quarter of 2019, DTC revenue was down 6% to $331 million as a result of softer demand and impacts from the shift toward more premium price points and lower levels of discounting. DTC sales representing 27% of total revenue which was down from 35% in 2018 when DTC revenue increased 4% to $1.8 billion. Despite these lackluster results, management reaffirmed its original guidance of mid-single-digit growth in 2019 for the channel. This is an extremely worrisome metric for the company given that brands are pushing more sales through the DTC channel, but Under Armour didn’t in the first quarter. The DTC channel gives insight into customers, control over pricing and branding, and higher margins. This will be important to watch in the next quarter. If management updates lower guidance for the year, it will be punished by the market. Management hopes that more frequent product releases, mobile site optimization, customization, personalization will drive this segment higher.

International increasing

The International market has become the company’s growth driver, with the North American market holding flat. In the first quarter of 2019, the International market was up 12% to $328 million versus the North American market declining 3% to $843 million, which represents more than a quarter of the company’s business. This was a result of increasing in several markets including EMEA (up 9% neutral), Asia-Pacific (up 30% currency neutral), and Latin America (up 10% currency neutral). International sales are consistent with guidance where management is expecting a low double-digit growth. The growth opportunity is coming from expanding retail locations and servicing additional country websites in order to give customers access to the products.

Conclusion

Under Armour was able to provide optimism with the first-quarter earnings release. It showed that the company can improve margins by optimizing inventory and reducing promotional activities. It also proved that the International markets are a source of future growth as North American sales stabilize. One area of concern was the lower DTC sales, but management expects full-year performance to match original guidance. Given the strong product and these turnaround signals, I think Under Armour’s stock has room to appreciate; however, don’t be surprised if there are selloffs along the way due to lack of execution given the risk. For example, if the company has to revise DTC guidance lower due to ongoing weakness in the second and third quarters of 2019. However, the Under Armour brand is here to stay and doesn’t have a lot of room to fall.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://www.ksl.com/article/46550734/china-retaliates-on-tariffs-stock-markets-go-into-a-slide

China retaliates on tariffs, stock markets go into a slide

By Joe McDonald and Paul Wiseman, Associated Press | Updated – May 13th, 2019 @ 4:39pm | Posted – May 13th, 2019 @ 8:43am

BEIJING (AP) — Sending Wall Street into a slide, China announced higher tariffs Monday on $60 billion worth of American goods in retaliation for President Donald Trump’s latest penalties on Chinese products.

Duties of 5% to 25% will take effect on June 1 on about 5,200 American products, including batteries, spinach and coffee, China’s Finance Ministry said.

With investors worried about the potential economic damage on all sides from the escalating trade war, the Dow Jones Industrial Average fell 617 points, or 2.4%, and the technology-heavy Nasdaq plunged 270 points, or 3.4%, its biggest drop of the year. Earlier, stocks fell in Europe and Asia.

“We appear to be in a slow-motion train wreck, with both sides sticking to their positions,” said William Reinsch, a trade analyst at the Center for Strategic and International Studies and a former U.S. trade official. “As is often the case, however, the losers will not be the negotiators or presidents, but the people.”

Advertise with usReport this ad

Beijing’s move came after the U.S. raised duties Friday on $200 billion of Chinese imports to 25%, up from 10%. In doing so, American officials accused China of backtracking on commitments it made in earlier negotiations. The same day, trade talks between the two countries broke up without an agreement.

On Twitter, Trump warned Xi that China “will be hurt very badly” if it doesn’t agree to a trade deal. Trump tweeted that Beijing “had a great deal, almost completed, & you backed out!”

The rising trade hostilities could damage the economies of both countries. The tariff increases already in place have disrupted trade in such American products as soybeans and medical equipment and sent shockwaves through other Asian economies that supply Chinese factories.

Still, the two countries have given themselves something of an escape hatch: The higher Chinese tariffs don’t kick in for 2½ weeks. The U.S. increases apply to Chinese goods shipped since Friday, and those shipments will take about three weeks to arrive at U.S. seaports and become subject to the higher charges.

Also, both countries have indicated more talks are likely. Top White House economic adviser Larry Kudlow said Sunday that China has invited U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin to Beijing. But nothing has been scheduled. And Trump said Monday that he expects to meet Chinese President Xi Jinping in late June at the G-20 summit in Osaka, Japan.

The president has repeatedly insisted that increased tariffs on Chinese goods don’t hurt American consumers. But Kudlow, head of the president’s National Economic Council, acknowledged over the weekend that U.S. consumers and businesses will bear some of the costs.

“Both sides will pay,” he told Fox News.

In the U.S., prices of soybeans, targeted by Chinese tariffs last year, fell Monday to a 10-year low on fears of a protracted trade war.

In a statement, American Soybean Association President Davie Stevens, a soybean farmer from Clinton, Kentucky, expressed frustration that “the U.S. has been at the table with China 11 times now and still has not closed the deal. What that means for soybean growers is that we’re losing. Losing a valuable market, losing stable pricing, losing an opportunity to support our families and our communities.”

Trump told reporters Monday that a new program to relieve U.S. farmers’ pain is “being devised right now” and predicted that they will be “very happy.” The administration last year handed farmers aid worth $11 billion to offset losses from trade conflicts.

Trump seemed to suggest that the aid will make up for or partially cover the $15 billion that he said represented “the biggest purchase that China has ever made with our farmers.” In fact, U.S. farm exports to China approached $26 billion in both 2012 and 2013 and came in at $19.5 billion in 2017 before his trade war began taking a toll on agricultural sales to China.

The president’s allies in Congress scrambled to limit the damage to farm country.

Republican Sen. Chuck Grassley of Iowa said it is time for U.S. allies to “get in the game” to push China to the negotiating table. “China needs to get with it,” he said. “You can’t move these goalposts like they’re moving them and expect to be respected.”

The highest tariffs announced by China will apply to industrial chemicals, electronic equipment, precision machinery and hundreds of food products.

Beijing is running out of U.S. imports to penalize because of the lopsided trade balance between the world’s two largest economies. Chinese regulators have instead targeted American companies in China by slowing down the clearing of shipments through customs and the processing of business licenses.

Oxford Economics calculated that the higher tariffs will reduce the U.S. economy by 0.3% in 2020, a loss of $490 per American household.

Similarly, forecasters have warned that the U.S. tariff increases could set back a Chinese recovery that had appeared to be gaining traction. Growth in the world’s second-largest economy during the January-through-March period held steady at 6.4% compared with a year earlier, supported by higher government spending and bank lending.

The tensions “raise fresh doubts about this recovery path,” Morgan Stanley economists said.

The latest U.S. duties could knock 0.5 percentage points off annual Chinese economic growth, and that could widen to 1 percentage point if both sides extend penalties to all of each other’s exports, economists say. That would pull annual growth below 6%, raising the risk of politically dangerous job losses.

China’s state media tried to reassure businesses and consumers that the ruling Communist Party has the means to respond.

“There is nothing to be afraid of,” said the party newspaper People’s Daily. “The U.S.-instigated trade war against China is just a hurdle in China’s development process. It is no big deal.”

Trump has threatened to extend tariffs to the remaining $300 billion or so in Chinese tariffs that haven’t been targeted yet, but told reporters Monday: “I have not made that decision yet.”

The president started raising tariffs last July over complaints China steals or pressures foreign companies to hand over technology and unfairly subsidizes Chinese businesses that are striving to become global leaders in robotics and other technology.

A stumbling block has been U.S. insistence on an enforcement mechanism with penalties to ensure Beijing carries out its commitments.

___

Wiseman reported from Washington.

Jill Colvin and Catherine Lucey in Washington contributed to this story.

HI Financial Services Mid-Week 06-24-2014