HI Market View Commentary 05-04-2020

“You don’t drowned by jumping in the river. You drowned by staying submerged!”

143 S&P 500 companies reporting this week

| Market Recap |

| WEEK OF APR. 27 THROUGH MAY. 1, 2020 |

| Last week the S&P 500 closed lower for a second straight week as Wall Street took a more sobering view of the re-opening of the economy and as corporate earnings continued to underscore the detrimental impact COVID-19 would have this year.

The index was down 0.2% for the week ending May 1, closing at 2,830.71 versus last week’s close of 2,836.74 on April 24. Despite the lower close in each of the past two weeks, the S&P 500 closed out April up 13%, the best monthly performance for the index in more than three decades. Still, the risk of a second wave of infections that could result from premature opening of the economy, coupled with US President Donald Trump’s threat to rekindle a trade war with China, encouraged market players to “sell in May” and reverse much of the prior gains. The utility sector was the top laggard with a loss of 4.2% from last Friday’s close. Of the 28 stocks in the sector, more than half were in the red with Eversource Energy (ES) at the bottom of the pack and the second week in a row that the stock has suffered heavy losses. Stocks in the healthcare sector were also under pressure despite Gilead’s (GILD) success with remdesivir as a potential treatment for COVID-19 and better-than-expected quarterly results from Merck (MRK), Pfizer (PFE) and Novartis (NVS). The sector was down 2.5%, weighed down by heavy losses this week in shares of Regeneron (REGN) and Vertex (VRTX) which were down 7.2% and 5.5%, respectively, suffering significant selling pressure mid-week. Proposed OPEC Plus production cuts and the concurrent 14% gain in WTI propped up shares in energy, making it the best-performing sector of the S&P 500 this week, up 3.6%. Among shares in the sector, Marathon Oil (MRO) was launched to the top of the leaderboard with an 11.6% gain this week. A deluge of tech earnings this week from heavy-hitters like Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL) and Facebook (FB) lifted the technology sector into the green, albeit only by a modest 0.3%. Industrials were also higher, advancing by 1.1% for the week. United Rentals (URI) and Parker Hannifin (PH) were the top-performing stocks in the sector thanks to better-than-expected results this week, while Textron’s (TXT) disappointing Q1 results left the stock limping into the close with a 3.0% loss. |

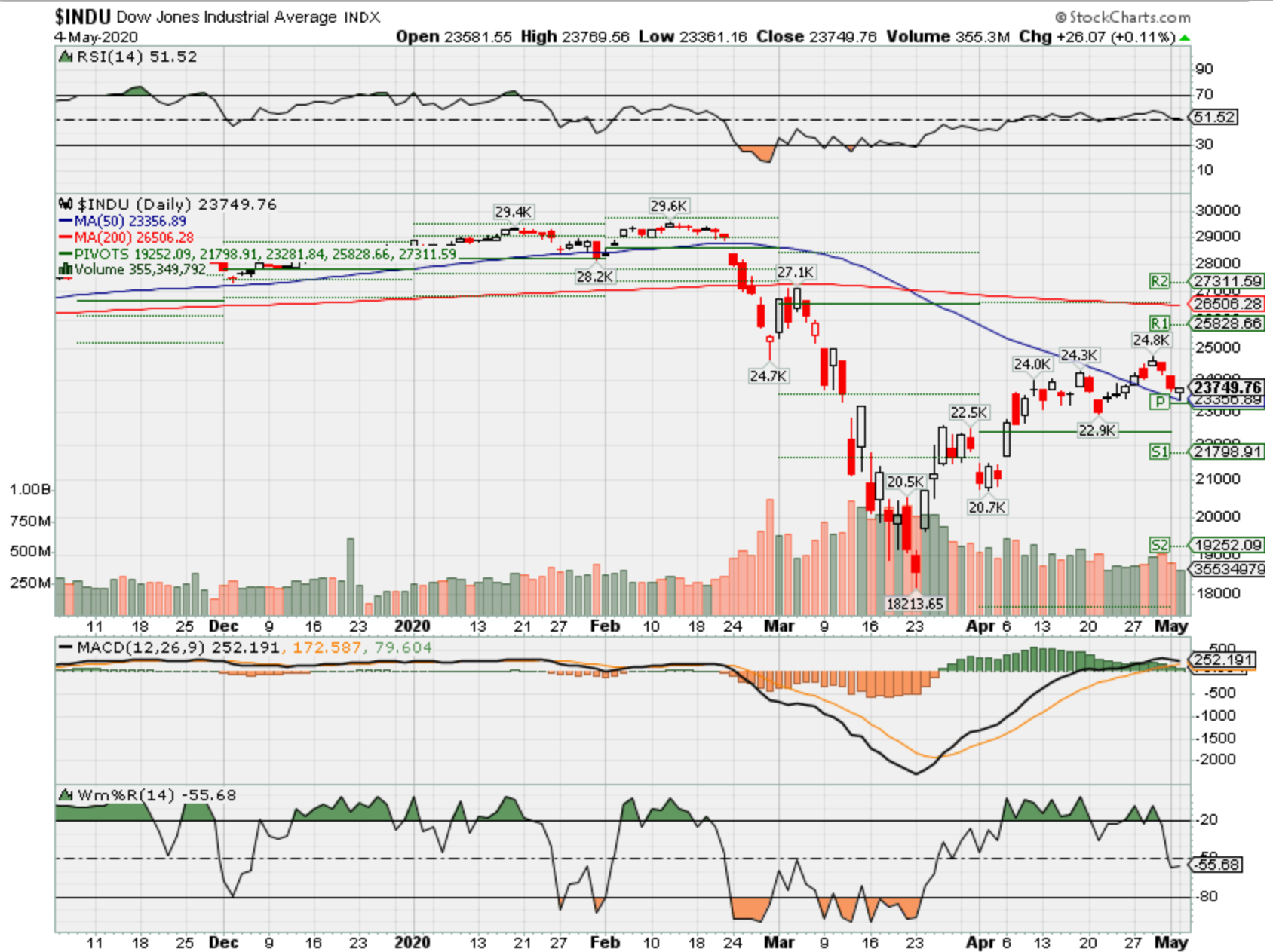

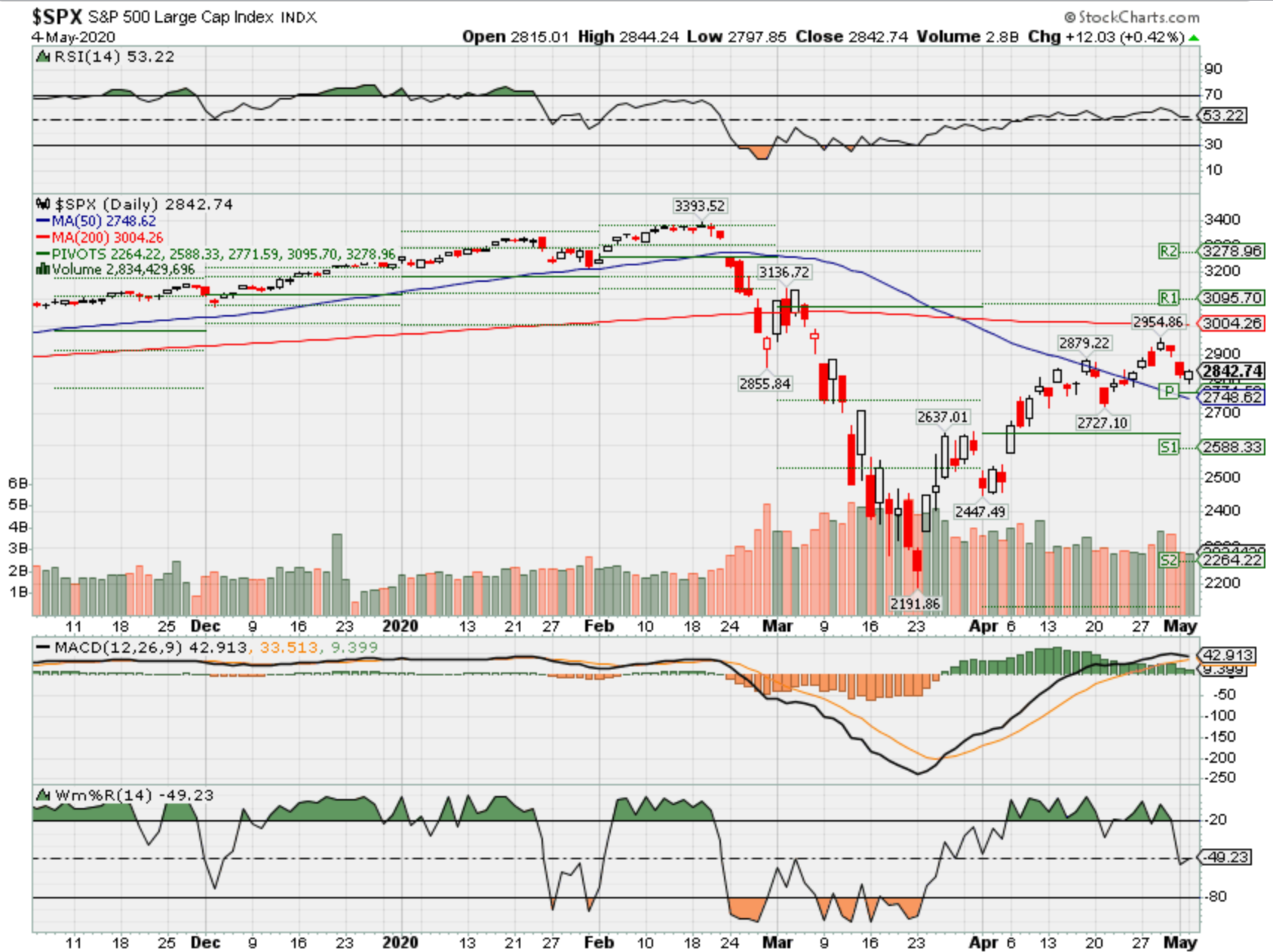

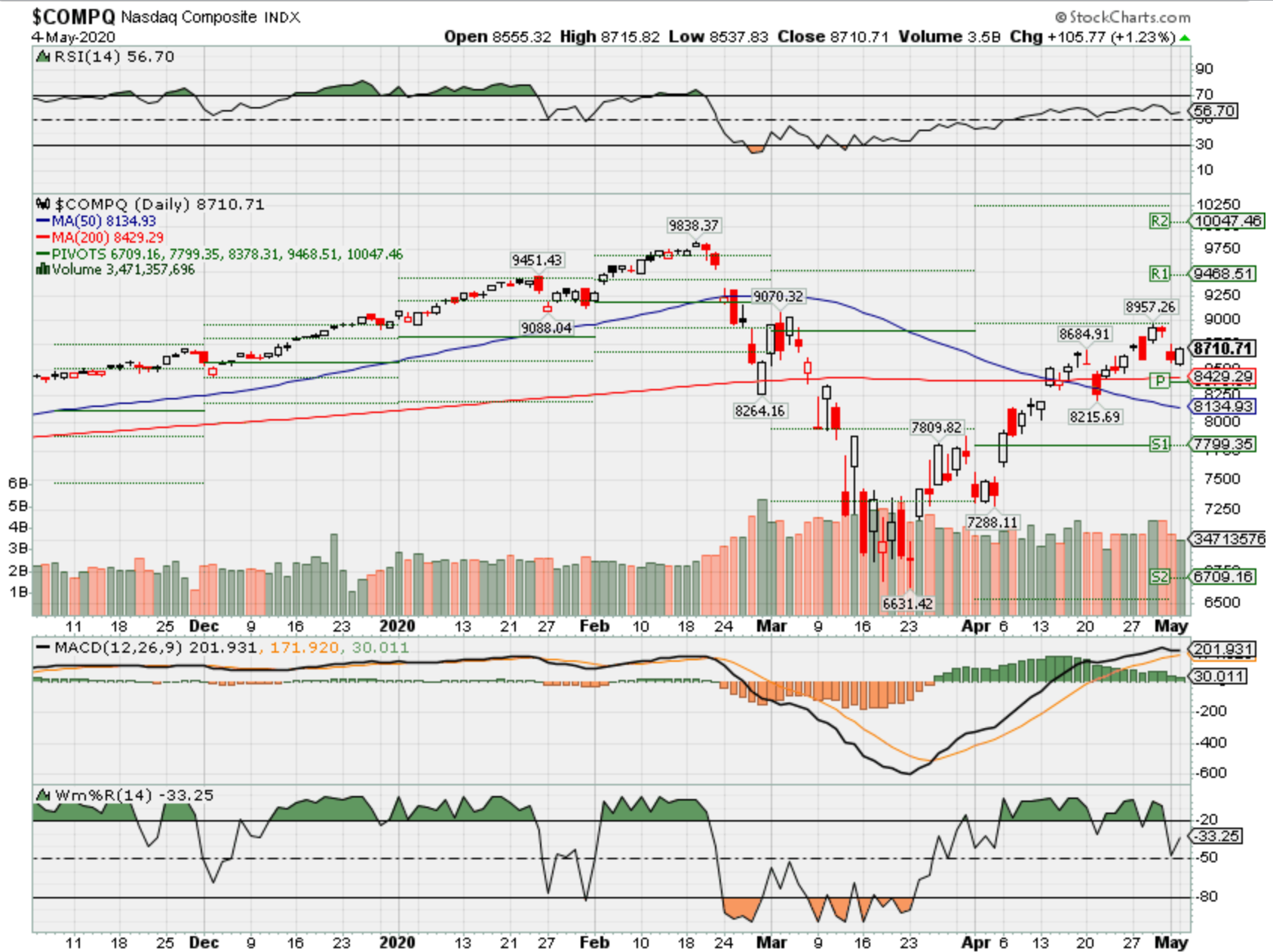

Where will our markets end this week?

Higher

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2020?

05-03-2020 +2.0%

04-27-2020 +2.0%

Earnings:

Mon: TSN, CAR, CHGG, MOS, RMBS, SHAK, SWKS,

Tues: ALK, AGN, D, DD, FLR, TREE, RCL, ATVI, ALL, BYND, DVN, EA, MAT, MYGN, PINS, WU, DIS

Wed: AEP, GOLD, CCL, FOSL, GM, ODP, PZZA, SHOP, WM, WEN, APA, CTL, GRUB, NUS, PYPL, SQ, MRO

Thur: AES, BLL, BMY, MUR, RTX, VG, ADT, GPRO, IQ, ROKU, SKYW, SWX, UBER, VSLR, HLT, JBLU, BIDU, VAC

Fri: BLMN, NBL, PPL

Econ Reports:

Mon: Factory Orders

Tues: Trade Balance, ISM Non-Manufacturer Index

Wed: MBA, ADP Employment Change

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Consumer Credit

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Wholesale Inventories

Int’l:

Mon –

Tues –

Wed – JP: Industrial Production

Thursday – CN: Non-Manufacturing Index, Caixin Manu PMI, EUR: GDP

Friday-

Sunday –

How am I looking to trade?

I’m protecting through earnings, rolling long puts up and out and I wouldn’t think of not having protection on during an earnings season that so far has no forgiveness.

I can and might be adding short calls after earnings for a little extra credit

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

What about BA in regards to Buffett’s Airline comments?

Buffett said NOTHING about Boeing

Why can’t Buffett find value?

Because Cheap doesn’t mean a good deal

Jeffrey Gundlach is shorting the market, says a retest of the low ‘very plausible’

PUBLISHED MON, APR 27 202012:49 PM EDTUPDATED MON, APR 27 20207:06 PM EDT

KEY POINTS

- DoubleLine CEO Jeffrey Gundlach said the market could retest its March low as investors could be underestimating the social disruptions from the coronavirus.

- “I think a retest of the low is very plausible,” Gundlach said. “People don’t understand the magnitude of … the social unease at least that’s going to happen when … 26 million-plus people have lost their job.”

- The so-called bond king revealed he just initiated a short position against the stock market.

Jeffrey Gundlach, CEO of DoubleLine, said Monday that the stock market could sell off again to retest the low in March as he believes investors are too optimistic about the economic recovery from the coronavirus pandemic.

“I’m certainly in the camp that we are not out of the woods. I think a retest of the low is very plausible,” Gundlach said on CNBC’s “Halftime Report.” “I think we’d take out the low.”

“People don’t understand the magnitude of … the social unease at least that’s going to happen when … 26 million-plus people have lost their job,” Gundlach said. “We’ve lost every single job that we created since the bottom in 2009.”

The so-called bond king revealed he just initiated a short position against the stock market.

“Actually I did just put a short on the S&P at 2,863. At this level, I think the upside and downside is very poor. I don’t think it could make it to 3,000, but it could. I think downside easily to the lows or beyond … I’m not nearly where I was in February when I was very, very short,” Gundlach said.

The S&P 500 has bounced 30% off its March 23 low of 2,191.86 as investors cheered the Federal Reserve’s unprecedented stimulus measures as well as signs that the pandemic could be easing.

In March, the S&P 500 tumbled into a bear market at the fastest pace ever as the outbreak caused unprecedented economic uncertainty. At its worst level of the sell-off, the S&P 500 was down about 34% from its all-time high on Feb. 19. The equity benchmark is now about 16% below that record.

Gundlach also said Monday the popular corporate bond ETF LQD looks like the most overvalued fixed income asset because of the Fed’s massive quantitative easing program.

DoubleLine had more than $148 billion in assets under management as of the end of 2019, according to its website.

The Fed won’t move on rates this week, but here are some other things it could do

PUBLISHED MON, APR 27 20203:28 PM EDTUPDATED MON, APR 27 20206:10 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The Federal Reserve meets this week and no one is expecting any change to its benchmark interest rate.

- However, there are some other policy moves the Fed will be considering as it guides markets and the economy through the coronavirus crisis.

- Possibilities include more explicit guidance about how long rates will stay low, some tinkering with other rates, and asset purchases targeted toward driving down longer-term rates.

After unleashing the most aggressive programs to support markets and the economy in its history, the Federal Reserve is likely to pause any additional initiatives until it has more information about how those moves are working and what lies ahead.

That does not mean, however, that central bank officials won’t have some news in store when they meet this week.

In the months since the coronavirus has ripped through the nation and the world, the Fed has slashed its benchmark interest rate to near zero and launched a variety of programs that also look to get money to households and businesses in need.

Wall Street expects the Fed to keep a lid on interest rates into the foreseeable future and continue to run its liquidity and lending programs for as long as it takes to get the U.S. economy back on its feet and financial markets running smoothly.

Outside of that, it has other work to do, and some moves could be revealed when the Federal Open Market Committee wraps up its meeting Wednesday. On the agenda, according to economists and strategists, could be more explicit guidance about how long rates will stay low, some tinkering with other rates to make sure the benchmark funds level is where it should be, and asset purchases targeted toward driving down longer-term rates.

This week’s meeting “comes after what has been the most active and condensed period of Fed policy-making in its history,” Lewis Alexander, chief U.S. economist at Nomura, said in a note. “Given how much the Fed has already done we are not expecting major innovations in Fed policy. … Regarding the path of short-term rates, we expect the FOMC to reiterate that they expect to keep their targets at current levels for the foreseeable future.”

Still, Alexander expects some tweaks.

For one, he thinks the committee will affirm that it is slowing its asset purchases from the blistering pace of late March and early April. The Fed expanded an existing program where it was buying Treasurys and mortgage-backed securities to an open-ended operation, pushing its balance sheet to $6.6 trillion, a 54% increase in just seven weeks. However, the Fed already has decelerated purchases in the past few weeks as market functioning has improved.

Possible rate moves

The Fed won’t be changing its current federal funds interest rate target of 0% to 0.25%. But it could adjust the rate, currently at 0.1%, that it pays on excess reserves that banks store at the Fed.

That would be a technical adjustment aimed at pulling up the funds rate from the 0.05% level where it has traded since early April. Ideally, the Fed likes to keep the rate around the midpoint of the target range.

The FOMC also might affirm what it calls “forward guidance,” or a pledge not to raise rates until certain metrics, particularly considering employment and inflation, are hit. Fed watchers, though, expect that something more formal will be released at a later meeting, with this month’s commitment more generic in nature.

“We expect the statement to be adjusted, perhaps to say rates will be low until the recovery is ‘well underway’ and the committee is ‘confident’ that its dual mandate will be achieved,” wrote Citigroup economist Andrew Hollenhorst. “At some point, perhaps in late summer, we expect the Fed will explicitly commit to keep rates low until inflation reaches or exceeds 2% for a sustained period. … However, with rates already low and much uncertainty to be resolved in coming months, we see little reason for the Fed to announce this at the April meeting.”

There’s also the possibility the Fed either could announce or discuss an effort to buy more bonds further out on the yield curve in an effort to drive down long-term rates. Known as “yield curve control,” such an effort was in discussion even before the coronavirus hit.

More generally, Wall Street is looking for language from the Fed acknowledging the damage done to the economy, and the central bank’s determination to keep policy accommodative.

“The Committee’s statement will have to take on board the dramatic deterioration in the economy since the last meeting in March,” Goldman Sachs economists said. “The Committee’s April statement will have to take on board this dramatic deterioration in the economy. We expect the statement to note that economic activity has ‘contracted sharply,’ to take stock of the historic surge in layoffs, and to acknowledge that household spending and business investment have ‘declined sharply.’”

Goldman expects less activity at the meeting than some of its Wall Street counterparts.

The firm’s economists see Chairman Jerome Powell during his post-meeting news conference indicating that “officials are content” with the current policy moves. Consequently, they now forecast the Fed won’t raise rates until late 2023.

Millennials are piling into stock trading to beat the market. Here’s what you need to know

Published Mon, Apr 27 202010:26 PM EDTUpdated Mon, Apr 27 202010:53 PM EDT

Stock markets have taken a battering as the ongoing coronavirus pandemic continues to rattle global economies. But some young people are taking it as an opportunity to kick-start their investing careers.

Online stock trading platforms have seen a surge in demand in recent months as investors seek to take advantage of undervalued equities.

Investing app Robinhood saw “record” deposits in the first quarter of 2020, with daily trades up 300% compared to late-2019. Elsewhere, eToro and Raging Bull Trading saw demand surge 220% and 158%, respectively, over the same period.

Even as the severity of the outbreak and its implications for markets began to unfold in March, another online platform Wealthsimple Trade recorded a 54% surge in new users and a 43% uptick in total trades. So far in April, the trading site has added new users at a weekly rate of 7,000.

Many of those new users are young or even first-time investors. Over half (55%) of Wealthsimple’s new users are aged 34 or below. That is unsurprising, according to Raging Bull Trading’s founder, Jeff Bishop, who said many millennials are now looking for new opportunities to make some extra cash — or recover earlier losses.

“A lot of people are at home and have got more time on their hands. And many, unfortunately, have lost their jobs and are looking for new opportunities,” Bishop told CNBC Make It.

“Younger investors are looking for ways to recoup their money,” he continued. “They’re really interested in low, beat-up stocks.”

Stock picking

The advent of online investment platforms has made it easier than ever for people to buy stocks in individual companies.

That can be a risky business. Generally, financial advisors recommend opting for diversified vehicles, such as passively-managed index funds or ETFs, which provide access to a full range of stocks. “Investors should always factor in balancing their investments between different regions, sectors and asset classes,” noted Joel Carpenter, divisional director of marketing at St James’ Place Wealth Management.

We’re seeing dramatic swings in the prices of some of the most popular stocks, and investors are trying to capitalize on that.

Ben Reeves

CHIEF INVESTMENT OFFICER, WEALTHSIMPLE

However, the shock nature of the current downturn — which has wiped out the market value of many companies — has some suggesting that now could be a good time to get a foothold in otherwise strong companies.

“Typically, when you see a decline like this one, the expected return of stocks goes up,” Ben Reeves, chief investment officer at Wealthsimple told CNBC Make It. “We’re seeing dramatic swings in the prices of some of the most popular stocks, and investors are trying to capitalize on that.”

In particular, investors are interested in stocks that are thriving under the new environment — such as telecoms, pharmaceuticals and entertainment, as well as those they believe have been “oversold,” like travel, dining and bank stocks.

The most traded companies across Robinhood, Raging Bull Trading, eToro and Wealthsimple last month included Apple, Disney, Microsoft, American Airlines, Boeing, Carnival, Tesla, Air Canada, Aurora Cannabis, Netflix, Amazon and Toronto Dominion Bank.

CNBC investment expert Jim Cramer recently described the list as “not perfect, but very good for speculation.”

Getting started

Choosing the right bets is no easy feat, however. “Especially now, the market is very volatile, you can make a lot of mistakes,” noted Raging Bull Trading investor Kyle Dennis.

Anyone thinking of trying stock picking for the first time should do so only once they have set aside an emergency cash fund, agreed the investors CNBC Make It spoke to. And even then, individual stocks should only represent a small portion of an overall investment strategy, they said.

People should be trying to establish an amount they want to make each month.

Jeff Bishop

FOUNDER, RAGING BULL TRADING

But, with a small pot on disposable income, it can provide a good opportunity to “learn” for the long term, said Raging Bull’s Bishop.

“People should be trying to establish an amount they want to make each month. Find a way to do that and get a routine in place,” he said.

“For some investors, a little ‘fun money’ to play around with can help remove the temptation to try to get fancy with the money you should be leaving in something boring — like your retirement fund,” added Reeves.

Latest Computer Model Predicts Between 0 And 12.6 Billion New COVID-19 Deaths By Summer

April 27th, 2020

U.S.—After several embarrassing and widely divergent revisions to the coronavirus projections of infection, hospitalization, and death rate used by government officials around the world to justify shutting down the global economy, experts at John Hopkins have now deployed a state-of-the-art super-scientific computer model and have now determined that between 0 and 12.6 billion people will contract the disease and be completely dead by summer.

“The panel of experts came together to give Americans the true picture of what we are looking at,” said Dr. Robert Redfield, director of the Centers for Disease Control and Prevention, as he pointed to lots of completely accurate up-to-date charts and graphs from the study. “This is not just the flu. This is going to wipe out between 0 and 12.6 billion people before summer hits.”

As a result of the new predictions, the CDC has revised their guidelines for essential workers to not only continue to wear a face covering and regularly take their temperature, but to also begin praying to whatever higher power they choose as they await the impending death of everyone on June 1.

The CDC website was updated with an infographic informing Americans they had a final 34 days to “slow the spread.”

“We told everyone that there would be no ventilators and that hospitals were going to be overwhelmed across the entire nation by April, even with extensive social distancing recommendations and shutdowns in place,” stated Dr. Anthony Fauci, Director of the National Institute of Allergy and Infectious Diseases and member of the White House’s coronavirus task force. “It didn’t happen quite that way, so we went to get better numbers. Now it looks like in this new expert modeling that everyone will actually die by June 1. We are super serious.”

“It is absolutely vital that no one shake hands ever again. Though after June 1 it won’t matter as much,” he added.

At publishing time, President Trump was telling reporters that his housekeepers recommend bleach to clean surfaces and that maybe that could be injected somehow.

Warren Buffett’s Berkshire swings to massive $50 billion net loss after coronavirus pummels stock investments

PUBLISHED SAT, MAY 2 20208:27 AM EDTUPDATED AN HOUR AGO

KEY POINTS

- Berkshire’s first-quarter net loss totaled $49.75 billion.

- A year earlier, net earnings totaled $21.66 billion, or $13,209 per share.

- Quarterly operating profit, which Buffett considers a better performance measure, rose 6% to $5.87 billion.

Warren Buffett’s Berkshire Hathaway on Saturday posted a record net loss of nearly $50 billion as the coronavirus pandemic pummeled its common stock investments, but operating profit rose even as COVID-19 hurt its businesses.

Berkshire’s first-quarter net loss totaled $49.75 billion, or $30,653 per Class A share, reflecting $54.52 billion of losses from investments, mainly common stocks. A year earlier, net earnings totaled $21.66 billion, or $13,209 per share.

Quarterly operating profit, which Buffett considers a better performance measure, rose 6% to $5.87 billion, or about $3,624 per Class A share $5.56 billion, or about $3,388 per share.

An accounting rule requires Berkshire to report unrealized stock losses and gains with earnings. This causes huge swings in Berkshire’s net results that Buffett considers meaningless.

Nonetheless, Berkshire has loaded up on stocks in part because of Buffett’s inability to find large companies to buy outright, a drought that has lasted more than four years and left Berkshire with about $137.3 billion of cash.

The Standard & Poor’s 500 slid 20% in the first quarter but there were steeper falls in several large Berkshire holdings including American Express, Bank of America, Wells Fargo and four airlines — American, Delta, Southwest and United.

Berkshire’s operating businesses, like much of corporate America, were not unscathed by COVID-19, which hurt volumes at the BNSF railroad and forced retail businesses such as See’s Candies to temporarily close stores.

Most of Berkshire’s businesses have been hurt by the pandemic, with effects so far ranging from “relatively minor to severe,” and revenues of businesses deemed “essential” have slowed “considerably” in April, the company said.

Vice Chairman Charlie Munger told The Wall Street Journal last month that a few small Berkshire businesses might close altogether.

99% of Those Who Died From Virus Had Other Illness, Italy Says

By Tommaso Ebhardt, Chiara Remondini and Marco Bertacche

March 18, 2020, 8:56 AM EDT

We’re tracking the latest on the coronavirus outbreak and the global response.

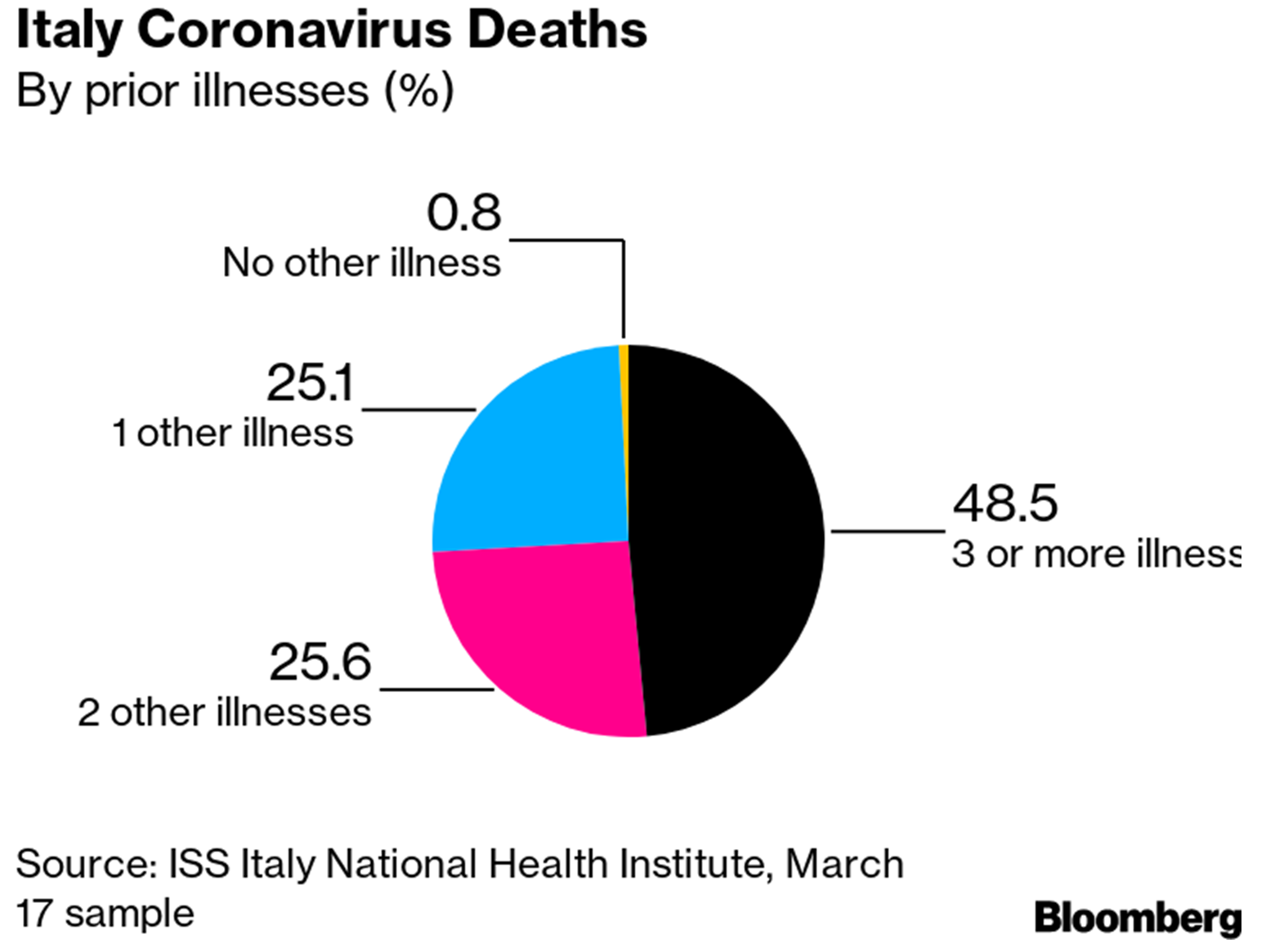

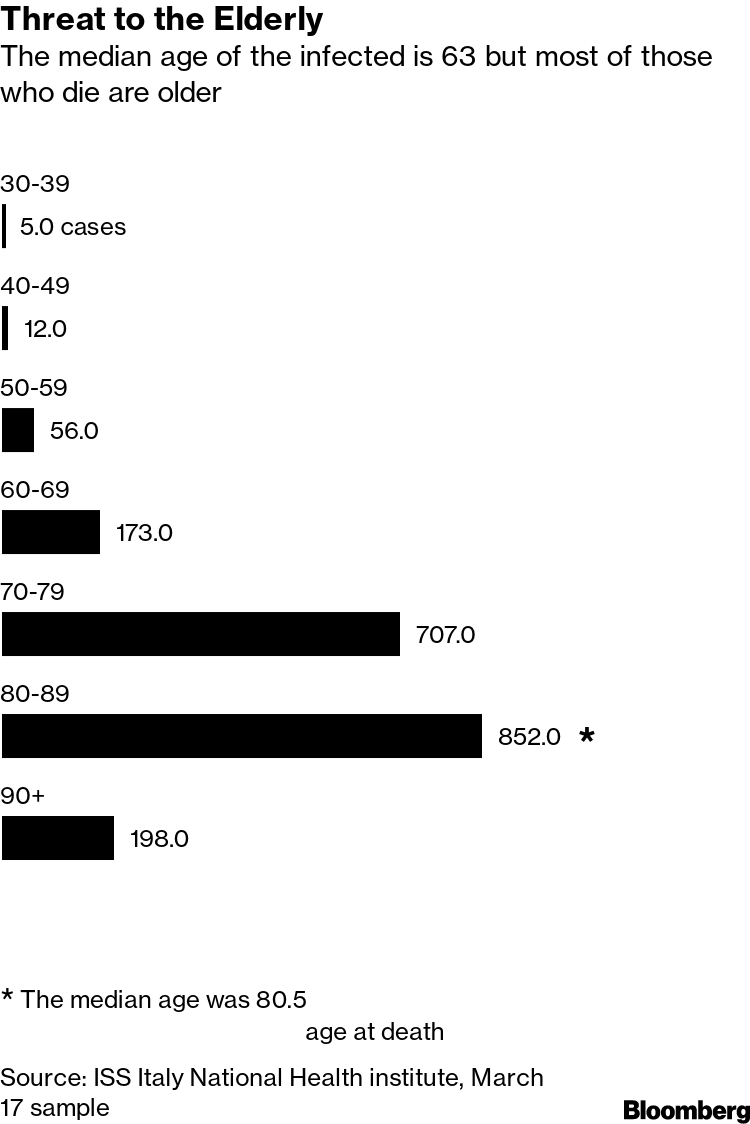

More than 99% of Italy’s coronavirus fatalities were people who suffered from previous medical conditions, according to a study by the country’s national health authority.

After deaths from the virus reached more than 2,500, with a 150% increase in the past week, health authorities have been combing through data to provide clues to help combat the spread of the disease.

Prime Minister Giuseppe Conte’s government is evaluating whether to extend a nationwide lockdown beyond the beginning of April, daily La Stampa reported Wednesday. Italy has more than 31,500 confirmed cases of the illness.

The new study could provide insight into why Italy’s death rate, at about 8% of total infected people, is higher than in other countries.

The Rome-based institute has examined medical records of about 18% of the country’s coronavirus fatalities, finding that just three victims, or 0.8% of the total, had no previous pathology. Almost half of the victims suffered from at least three prior illnesses and about a fourth had either one or two previous conditions.

More than 75% had high blood pressure, about 35% had diabetes and a third suffered from heart disease.

The average age of those who’ve died from the virus in Italy is 79.5. As of March 17, 17 people under 50 had died from the disease. All of Italy’s victims under 40 have been males with serious existing medical conditions.

While data released Tuesday point to a slowdown in the increase of cases, with a 12.6% rise, a separate study shows Italy could be underestimating the real number of cases by testing only patients presenting symptoms.

According to the GIMBE Foundation, about 100,000 Italians have contracted the virus, daily Il Sole 24 Ore reported. That would bring back the country’s death rate closer to the global average of about 2%.

— With assistance by Karl Maier, and Alessandro Speciale

Oil’s Recovery Could Take Decades, Not Years

Or the industry might never fully rebound from the virus, leaving massive spare capacity all along the supply chain.

By Julian Lee

May 2, 2020, 11:00 PM MDT

Where to keep it all?

Who knows what the new normal for oil demand will be once Covid-19 is firmly in the rear view mirror? Not me, that’s for sure. But it is likely to be lower than it was in 2019, and it could be that way for many years. That’s going to create overcapacity throughout the oil supply chain and weigh on prices.

While signs are emerging that we might have passed the worst of this historic oil demand rout, they’re very tentative. No one is predicting a swift recovery to where we were before the pandemic struck. Some, including Royal Dutch Shell Plc’s chief executive officer, Ben van Beurden, suggest that oil demand may never recover fully.

Citigroup analysts don’t see jet fuel consumption back at last year’s level until well into 2022, and they’re at the optimistic end of the spectrum. Boeing’s CEO suggests passenger traffic might not get back to 2019 levels for three years, and even when the flying public does return, airlines will use their newest and most efficient planes to carry them, as my colleagues Liam Denning and Brooke Sutherland note here.

So let’s make a guess about the loss in future demand, and let’s make a fairly small one. Let’s assume it’s about 5 million barrels a day. That doesn’t sound like too much; it’s about 5% of last year’s global oil demand. The drop in worldwide oil consumption in April has been put as high as 35 million barrels a day, and forecasts estimate 2020 oil use will be about 10 million barrels a day (or 10%) lower than in 2019.

Partial Recovery

Rush-hour traffic in Beijing has recovered to pre-crisis levels, but roads remain quiet at other times

Source: Bloomberg calculations using data from TomTom Traffic Index

Note: Additional time taken for a journey that would last an hour in uncongested conditions.

Sure, many of us will return to our pre-Covid-19 ways of life just as quickly as we can, but others will gladly give up the daily commute in favor of working from home more often — and employers may be happy to accommodate their wishes. After months of successful teleconferencing, those business trips that helped keep planes full of high-paying travelers may also come under more scrutiny. These changes may push up electricity use while they dampen fuel demand, but that will do little to help the oil industry, which is increasingly struggling to hold onto its fragments of the power-generation sector.

Of course, we could collectively shrug off this latest crisis, just as we did the financial crash of 2008-09, which was consigned to history with barely a backward glance. But the global pandemic feels very different from the financial crisis. It hits at our physical well-being as well as our financial health, and it has forced us all, to one degree or another, to adopt new ways of living and working, whether we like them or not.

The industry can survive a 5% drop in long-term demand, but it will find it much harder to thrive.

A loss like that will cause structural overcapacity, right through the oil supply chain. There will be too many wells to get oil out of the ground, too many ships to move it, too many refineries to process it.

Even before the pandemic, we were looking at a world where oil demand growth was increasingly concentrated in plastics, rather than fuels. That was already darkening the outlook for refiners in Europe and North America, which were also facing growing competition from newer plants in the Middle East and Asia that were more efficient and had beneficial long-term oil supply deals. A prolonged drop in demand will only make that competition stiffer, as more plants seek markets for their excess products.

The upstream part of the business — the bit that’s concerned with finding the crude and getting it out of the ground — may face fewer problems. Oil fields naturally go into decline once they’re brought into operation, requiring producers to create new capacity elsewhere. Nowhere is that more obvious than in the U.S. shale patch.

But the second U.S. shale boom was driven by, among other things, several years of robust growth in global oil demand. This led to most of the world’s oil producers, including almost all of the OPEC countries, pumping as hard as they could, and helped to keep oil prices at around $50 a barrel.

Lots to Spare

OPEC’s spare production capacity is set to jump to more than it has been in over three decades

Source: Bloomberg

But those OPEC producers are now cutting production by more than 20%, and non-OPEC countries are seeing their output fall by similar percentages. True, some of the wells that get shut will never be reopened, but most will sit waiting for their owners to see an opportunity to get them back to work. That overhang of spare production capacity will put an effective cap on oil prices, just as it did throughout the 1990s.

No amount of Saudi-led supply management, or U.S. presidential bullying of foreign oil producers, will be able to remove that spare capacity. And once the current crisis is past, Riyadh may be less willing to play the role of swing producer, restraining its output while everybody else reopens the taps.

Every time oil prices rise, producers will rush to use their idled capacity, undermining the recovery. After the oil-price slump of the mid-1980s, it took two decades for prices to return to their previous levels — longer if you build in the effects of inflation. This time the wait could be even more protracted.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Julian Lee at jlee1627@bloomberg.net

To contact the editor responsible for this story:

Nicole Torres at ntorres51@bloomberg.net

Stocks are in little danger of retesting the March low, top strategist Art Hogan says

PUBLISHED SUN, MAY 3 20205:00 PM EDT

Stephanie Landsman@STEPHLANDSMAN

National Securities’ Art Hogan believes the consensus view that stocks must retest the March low is wrong.

According to Hogan, there are too many unprecedented factors, including an intentional decision to freeze the economy, to suggest the market will follow a preset course based on historical trends.

“That pace at which we got to the correction here is the fastest that we’ve ever seen,” the firm’s chief market strategist told CNBC’s ″Trading Nation” on Friday. “Usually it takes the Fed and certainly Congress a much longer time to adjust to the here and now and to find the corporate polices to support the economy, and they did that in record time.”

Hogan’s view may be on the more optimistic side, but he’s not expecting a sharp, sustainable rally.

“We’re in a middle ground where we’re a little bit more than 20% off the lows [and] a little bit less than 20% from the highs,” he said. “This is going to be a place we churn through for most of the first half.”

Stocks kicked-off May deep in negative territory. But since the March 23 low, the S&P 500 and Dow have surged 23% and 24%, respectively.

The rebound doesn’t surprise Hogan.

Five days before the S&P 500 and Dow hit their lows, Hogan predicted on “Trading Nation” stocks would bottom before coronavirus cases peak in the United States.

Now, he’s seeing some progress on the virus front.

“If new cases continue to plateau, then 2021 is certainly going to look a whole lot better than 2020,” he added. “I would argue that the second half looks way better than the first half of this year.”

Hogan, who has $15 billion in assets under management, speculates a slow and deliberate reopening of the economy will likely be successful and spark a demand frenzy.

“There has been a lot of delayed consumption,” he said. “There is going to be maybe some pent up economic energy that explodes into the fourth quarter and certainly into 2021.”

It’s a scenario, according to Hogan, that should put Wall Street and Main Street firmly back into the green.

“Corporate America has the ability to get back into place relatively quickly. This is not a great financial crisis,” Hogan said. “Going into this, the U.S. economy was in pretty good darn shape, and so was corporate America’s balance sheets.”

Stock surge is a bear market rally that will collapse, James Bianco warns

PUBLISHED WED, APR 29 20208:39 PM EDT

Stephanie Landsman@STEPHLANDSMAN

Market researcher James Bianco warns April’s big run will collapse.

His reason: Investors are too bullish.

“I understand the market has been up a lot since the March low. But what I see in the market is a retracement rally that looks very similar to the first type of rallies that you get in protracted bear markets,” the Bianco Research president told CNBC’s “Trading Nation” on Wednesday.

Bianco warned last month the coronavirus turmoil would be worse than the financial crisis. In early March, he put all his money in cash and never looked back — despite the bounce.

So far this month, the S&P 500 is up almost 14%. If the trend holds, it’ll be the index’s best showing since 1974. Meanwhile, the Dow is up more than 12% in the same period and is on track for its best monthly performance since January 1987.

“We’ll revisit the 2,200 S&P low, if not make a lower low — probably by late summer,” he said. “That’s going to come because we’re going to find out now is a critical time for the market.”

Bianco predicts there will be an overwhelming realization that life isn’t getting back to normal when then economy starts to reopen.

“What the market seems to be thinking is we’re going to restart, and we’re all going to pretend that it’s 2019,” said Bianco. “And, we’re all going to stand on the subway platform with 500 other people waiting for the next train.”

He contends a recovery will still be long and slow — despite the Federal Reserve’s aggressive policies to support the economy and financial system.

“We are moving to a lower growth environment, and I think the market is a little ahead of itself right now in what that means,” Bianco said. “There’s going to be more changes and more evolution that the economy is going to have to go through before we’re ready to start a full on bull market.”