HI Market View Commentary 04-20-2020

Knowledge of the Future – Howard Marks

Observation from Marc Lipstich was about The World of Investing

- There are few if any facts regarding the future

- Vast amount of our theorizing about the future consists of extrapolating from past pattern

- Opinions are nothing more than lots of speculation

Past opinions of my money managers: Just wait it out, it’s the markets fault not mine, Things changed

Last Thursday a couple people were freaking out !!!! 15% down stock market and you were down 6.7%

The stock market was down 35% and you were down 15%

SO, you can sit and watch you portfolios do worse than the market in funds or you can join the collar trading group – Options

Less risk as you enter Leaps

Protection on positions

Dollar cost averaging without having to add more money to the account

The BEST Part !!!! = You Money Managers spend countless hours reading, researching, crunching numbers on a future that doesn’t care on bit!!!!!

Maybe it’s the Monday evening webinars, doesn’t take as long to make up the losses, a Warren Buffet investing style, get to amass tons of shares for CC, dividends and future growth, occasionally Kevin gets to swear at you

So today I want to talk about survival in life and relate it to the stock market.

Whenever you find yourself on the side of the majority, it is time to pause, reflect and reassess what you are doing ?

Not everyone is experienced in making life or death decisions and the market is never that vital.

Remember, the only easy day was yesterday so relax a bit.

What are the worst things that can happen? Could I do something different so I never go back there ?

Some of us have confronted death numerous times and kicked its ass

Sometimes when death comes you are so beaten down that you have two choices left

Do you choose to live or die?

At this point in life military training or clichés can help you succeed

IF you get kicked off the horse do you get back on

Losing is not an option

Little success will add up to a big win

Anything made up on the way down is a profit on the way back up

What do you need to succeed in the process of a bottoming in bear markets and in life?

| Market Recap |

| WEEK OF APR. 13 THROUGH APR. 17, 2020 |

| The Standard & Poor’s 500 index closed higher for a second week in a row, fueled by solid gains in big tech, as hopes that the economy will reopen overshadowed dismal economic data and COVID-19-impacted Q1 earnings.

The index closed at 2,874.56, up 3.0% from 2,789.82 a week ago, reaching the highest level in five weeks. First-quarter earnings began with a whimper this week with Wall Street heavyweights JP Morgan (JPM), Morgan Stanley (MS), Bank of America (BAC), Goldman Sachs (GS) and Citigroup (C) all falling short of expectations for the quarter as loan and asset markdowns coupled with falling credit card volumes and increased debt issuance drove shares sharply lower. Accordingly, the financial sector took the biggest hit this week, down 4.2% from a week ago. The real-estate sector limped through the week, off 2.8%, as investors digested soft housing data and the increased likelihood that foreclosures will increase as the economic effects of the COVID-19 pandemic continue. Mall operators continue to be hardest hit, and with JC Penney (JCP) and Neiman Marcus facing bankruptcy, shares of Simon Property Group (SPG), the country’s largest mall owner, fell by 17.7% this week. Kimco Realty (KIM), which owns an interest in 409 shopping centers, was next in line with a loss of 17.6% from a week ago. The energy sector was held back by lowered growth forecasts by the International Monetary Fund, as well as a rekindled tensions between Russia and Saudi Arabia. As the price of oil continued to fall, the sector struggled to stay positive with Occidental (OXY) and Diamondback Energy (FANG) again the laggards. The broader sector was fractionally higher vs. last week. The industrial sector was again weighed down by airline stocks which were under pressure by United’s (UAL) CEO who said travel demand is “essentially zero” with no signs of improvement in the near-term. The company cut its flight schedule by 90% and hinted that job cuts are inevitable as a result of the “historically severe economic impact of this crisis.” United shares were 7.7% lower this week, while the full industrials lost 0.1% over the last five days. While most sectors were negative this week, the S&P stayed afloat thanks to an 5.9% gain in consumer discretionary stocks and a 4.7% gain in tech stocks, both of which continue to capitalize on the extraordinary economic environment resulting from quarantined consumers. Amazon (AMZN) and Netflix (NFLX) both set record highs this week. Despite headwinds from shorter store hours and shelter-in-place orders, Advanced Auto Parts (AAP) continued to gain ground and ended the week 11.2% higher, one of the top-performing stocks in the consumer discretionary sector. As pharmaceutical companies race for a cure to the coronavirus, the healthcare sector gained 6.3% this week with Gilead (GILD) higher by 14.3%. The company’s anti-viral Remdesivir was shown to effectively treat patients at the University of Chicago Medicine with COVID-19, launching shares significantly higher on Friday before retreating as analysts warned that the results may be overly optimistic. |

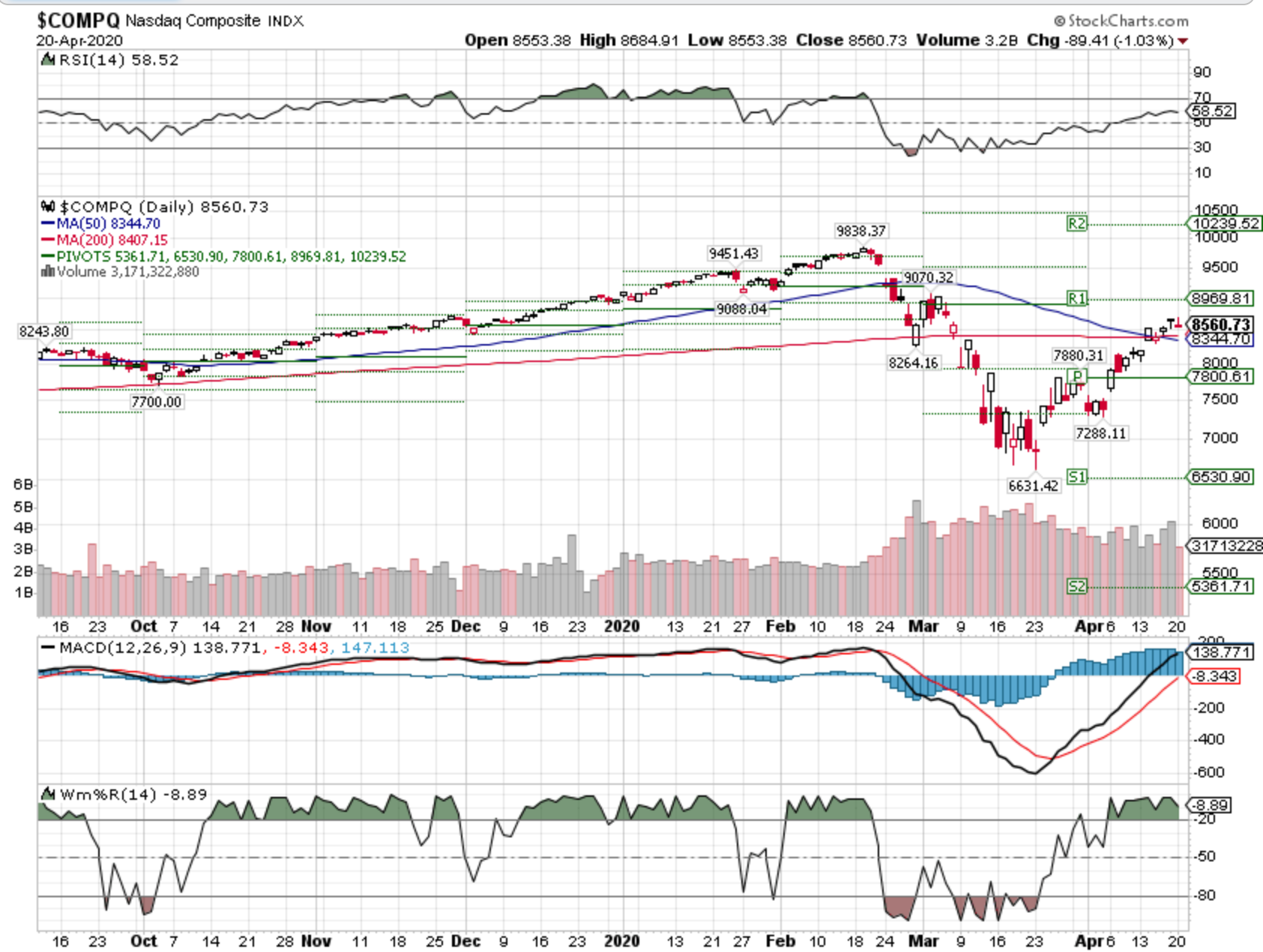

Where will our markets end this week?

?????

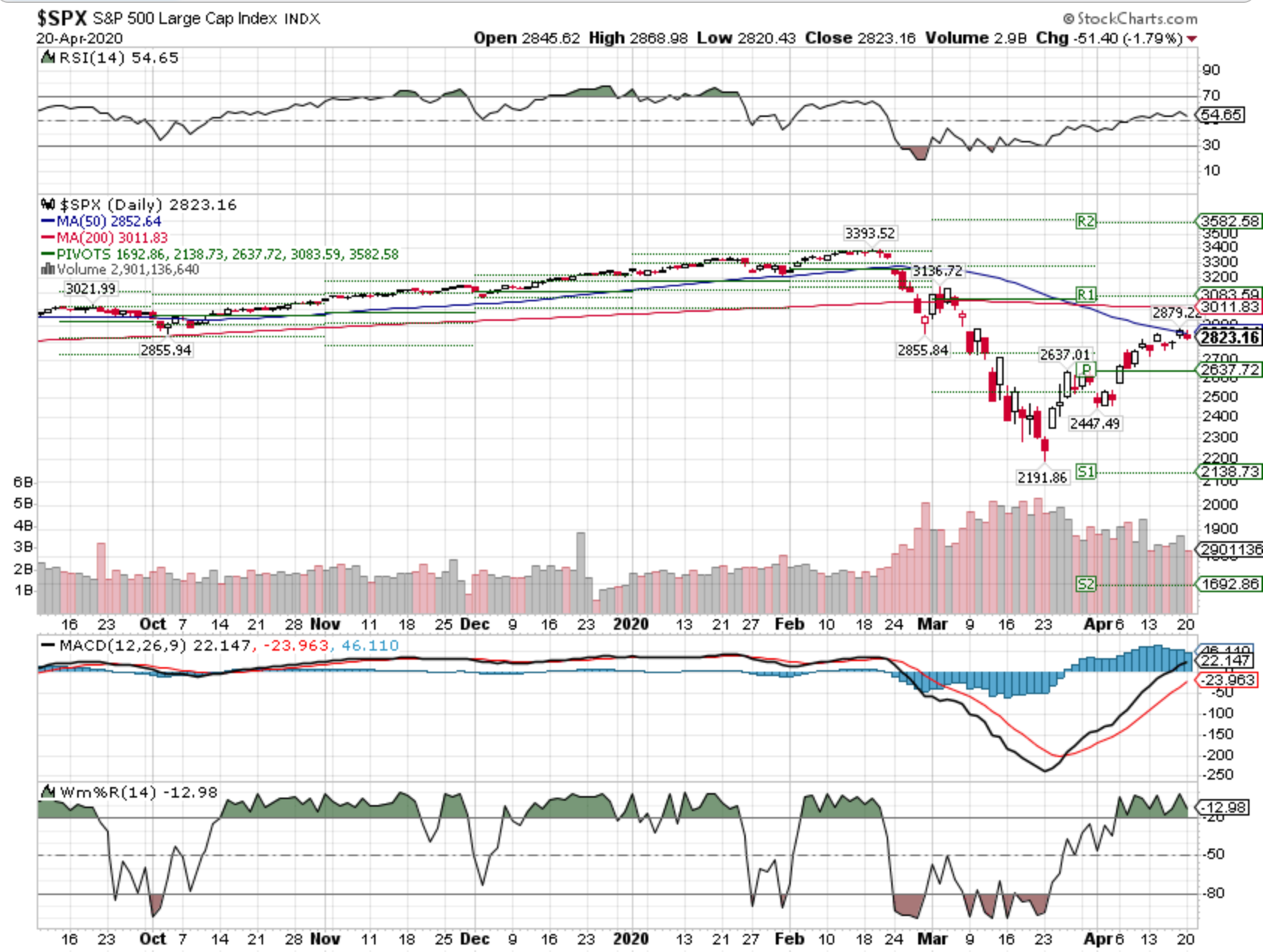

Where Will the SPX end April 2020?

04-20-2020 +5.0%

04-13-2020 +5.0%

04-06-2020 +2.0%

03-30-2020 0.0%

Earnings:

Mon: HAL, IBM, ZION

Tues: CIT, KO, FLR, MJBLU, LMT, PM, CMG, TXN

Wed: T, DAL, KMB, AA, KMI, VMI

Thur: ARCH,MGWW, HSY, PHM, LLY, UAL,

Fri: AAL, AXP, TREE, VZ

Econ Reports:

Mon:

Tues: Existing Home Sales,

Wed: MBA, KHKA Housing Price Index

Thur: Initial Claims, Continuing Claims, New Home Sales,

Fri: Durable Goods, Durable ex-trans, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

I’m protecting through earnings, rolling long puts up and out and I wouldn’t think of not having protection on during an earnings season that so far has no forgiveness.

I can and might be adding short calls after earnings for a little extra credit

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

401k Fraud: A Chilling Account of How Easy It Is

Bad guys are targeting retirement plans because ‘that’s where the money is’

“Houston, we have a problem.”

On the 50th anniversary of Apollo 13, it seems appropriate to examine how those in the retirement plan industry address catastrophes. Specifically, fraudulent distribution requests are at an epidemic level. Everyone in our industry should be concerned.

The Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. USA Today reported a similar story in January. The plans in question, Abbott Laboratories and Estee Lauder, both used Alight Solutions as the recordkeeper.

Alight is hardly alone in facing this problem. Many recordkeepers will tell you, off the record, they have either paid fraudulent distributions to the scammers or discovered the nefarious attempts prior to disbursement.

To paraphrase Willie Sutton, the bad guys are targeting retirement plans because “that’s where the money is.” What’s more, they are part of very sophisticated operations.

One of the fraudulent distribution requests I reviewed included a photocopy of the front and back of the participant’s driver’s license. The signatures of the participant, as well as the plan sponsor, were remarkably good forgeries, too.

I spoke with Chicago attorney Todd A. Rowden of Taft Stettinius & Hollister LLP, who represents the participant in this case. His position is, “Plan administrators and their representatives need to recognize this fraudulent conduct for what it is—crisis level occurrences that demand more and better security and protective action.”

He added, “When someone’s retirement and life savings are at stake, these administrators must do more and be ever vigilant.”

Rowden has filed a federal lawsuit in Chicago to recover $245,000 alleged to have been fraudulently taken from Abbott’s 401k plan because Abbott and its administrator Alight failed to require or enforce sufficient security measures. Rowden told me that the call center recordings were chilling in their lack of adherence to basic security protocols.

Anatomy of a crime

The Abbott affair began on December 29, 2018. The fraudster tried to access the participant’s account and then used the “Forgot Password” option on the website. They then received, via email, a one-time code that enabled full access to the participant’s account. With this access, the bad guy added their new bank account information.

On December 31, the fraudster contacted the call center from a phone number that was not associated with the account. The call center representative read aloud the actual address of the real participant and asked the impersonator if they still lived there. The bad guy answered affirmatively. The representative went on to say that since the account had a new bank account, they would have to wait seven days to process a distribution.

On January 1, 2019, the plan sponsor, via regular mail, sent the participant a notice that an additional bank account had been added to her records. The participant’s preferred method of communication was e-mail. On January 4, the participant’s husband tried to access her account. Access was denied, so he answered the security question and gained access. He then changed the password and the participant was notified of the change via e-mail.

On January 8, the first day after the distribution holding period, the imposter requested another one-time code be sent via e-mail. With this in hand, the fraudster requested a distribution of $245,000. On January 9, via the USPS, the plan notified the participant of the distribution. The participant received this letter on January 14.

Also, on January 9, the thief contacted the call center twice to inquire when they would get the money. The reply was January 14. On January 15, the real participant contacted the call center to report missing funds.

The discussion of prevention and mitigation steps are exhaustive and will be the subject of a follow-up article. One thing is clear, you don’t have to be Nostradamus to figure out how elected officials are going to react to participant’s money being stolen and not being restored. Houston, we have a problem and we need to fix it right now.

Richard Carpenter is president of St. Croix, U.S. Virgin Islands-based USVI Pensions.

Bank of America posts 45% decline in first-quarter profit, braces for big loan losses

PUBLISHED WED, APR 15 20206:30 AM EDTUPDATED WED, APR 15 202010:27 AM EDT

KEY POINTS

- The bank posted profit of $4.01 billion, or 40 cents a share, compared with the 46 cent estimate of analysts surveyed by Refinitiv.

- Bank of America set aside $3.6 billion to loan-loss reserves in the quarter, following similar actions from JPMorgan Chase and Wells Fargo.

- Lower interest rates will weigh on the bank’s net interest income, one of the main drivers of a lender’s revenue, CFO Paul Donofrio said Wednesday during a conference call with analysts.

Bank of America said Wednesday that first-quarter profit slumped 45% as the company set aside $3.6 billion for loan-loss reserves because of the coronavirus pandemic.

The bank posted profit of $4.01 billion, or 40 cents a share, compared with the 46 cent estimate of analysts surveyed by Refinitiv. Revenue of $22.8 billion essentially matched expectations, and trading results exceeded expectations by more than $500 million. Bank of America shares fell 6.5%.

The pandemic caused sharp drops in profits at three of Bank of America’s four main divisions. The lender’s giant consumer banking business saw profit decline 45% to $1.79 billion on higher loan loss reserves and lower interest income. Wealth management profit fell 17% to $866 million and global banking profit was nearly wiped out as the company built larger reserves for commercial loan losses.

Only the bank’s trading division managed to post an increase in profit, a gain of about 33% to $1.48 billion, driven by greater volatility in markets and stronger client activity.

Loan losses will climb this year, and might continue into 2021, CFO Paul Donofrio said Wednesday during a conference call with analysts.

Lower interest rates after the Federal Reserve slashed rates last month will weigh on the bank’s net interest income, one of the main drivers of a lender’s revenue, Donofrio also said. The bank posted $12.3 billion in net interest income in the first quarter, but that figure will be about $11 billion in the second quarter, and will begin to recover after that, the CFO said.

“Our results reflect the strength of our balance sheet, the diversity of our earnings, and the resilience of our teammates to serve clients around the world,” CEO Brian Moynihan said in the release. “Despite increasing our loan loss reserves, we earned $4 billion this quarter.”

On Tuesday, JPMorgan Chase and Wells Fargo also posted sharp drops in first-quarter profit as the banks set aside a combined $10 billion for a coming deluge of loan defaults. At JPMorgan, the hits were partly offset by record quarterly trading revenue.

That was also the case at Bank of America, where fixed income traders produced $2.7 billion in revenue, about $200 million more than expected and equities traders generated $1.7 billion in revenue, about $300 million more than expected.

Bank stocks have been pummeled this year as the pandemic put an end to the longest economic expansion in U.S. history. Investors have sold shares in anticipation that the industry will bear the brunt of loan defaults from retail customers to big corporate clients.

Here’s how Bank of America did:

Earnings: 40 cents a share

Revenue: $22.8 billion

Net Interest Income: $12.3 billion

Trading Revenue: Fixed Income $2.7 billion, Equities $1.7 billion

Wall Street had expected earnings per share of 46 cents on revenue of $22.9 billion, based on the consensus estimates compiled by Refinitiv. Net interest income was expected to come in at $11.7 billion. Trading results at the firm exceeded analysts’ expectations for $2.48 billion in fixed income and $1.39 billion in equities revenue.

Another U.S.-Wide Housing Slump Is Coming

Apr. 12, 2020 6:58 AM ET

Summary

A U.S. housing crisis is coming and although it won’t be anything like the last one, that won’t make it any less painful.

Even though there has been no rampant speculation or subprime mortgage fraud, housing is still overvalued.

And the dearth of inventory that’s plagued the current cycle will reverse in violent fashion once the worst of the virus has passed as financially strapped homeowners seek to raise cash.

As affordability collapses with fewer buyers eligible to buy a home, the only way to rectify the mismatch between supply and demand will be via declining prices.

The coronavirus pandemic will cause many cash-strapped Americans to sell their homes, flooding the market with excess supply.

A U.S. housing crisis is coming and although it won’t be anything like the last one, that won’t make it any less painful. Even though there has been no rampant speculation or subprime mortgage fraud, housing is still overvalued. And the dearth of inventory that’s plagued the current cycle will reverse in violent fashion once the worst of the virus has passed as financially strapped homeowners seek to raise cash. And as affordability collapses with fewer buyers eligible to buy a home, the only way to rectify the mismatch between supply and demand will be via declining prices.

Home prices dropped about 35% between mid-2006 and early 2009 in the first nationwide decline since the Great Depression as measured by the S&P/Case-Shiller home price index. They have since recovered, and are now at 117% of their prior peak level in 2006. Home prices historically meandered in a range of three to four times median incomes, jumping to 5.1 times in December 2005 before collapsing. The ratio is now at 4.4 times, a level that was unprecedented prior to June 2004.

Several factors that characterized the last decade will now work against housing. The lowest interest rates in U.S. history spurred a boom in luxury housing. At the start of the last decade, about a fifth of the homes in the U.S. were priced at $300,000 or higher. Ten years on, that’s true for more than half of all homes. The National Association of Realtors says the inventory of existing homes for sale has dropped to about three months of supply from more than seven months. Supply has shrunk as millions of Baby Boomers unexpectedly delayed downsizing. One of the reasons for this was the longest bull market in stocks in history, which afforded would-be sellers the wherewithal to continue carrying higher maintenance and larger homes than otherwise possible.

The recent reversal in the stock market has the potential to expedite the long anticipated “Silver Tsunami.” A June 2019 Fannie Mae report tallied the number of homes owned by boomers and the generation that preceded at about 46 million, more than a third of the 140-million-home housing stock. Zillow Group Inc. predicts “upwards of 20 million homes hitting the market through the mid-2030s (which) will provide a substantial and sustained boost to supply, comparable to the fluctuations that new home construction experienced in the 2000s boom-bust cycle.”

But now, the number of homes Zillow projected to hit the market in a disciplined fashion over the next 15 years will become an exodus as retirees’ need to monetize the equity in their homes to supplement their disposable income skyrockets. One can only imagine how swiftly home prices will decline once boomers feel safe enough to open their homes to outsiders as part of the normal sales process. The University of Michigan’s preliminary consumer sentiment index for April that was released Thursday showed that plans to buy a home tumbled the most since 1979.

The capping of deductions at $10,000 has already led to a 10% to 25% discount on home prices in high tax states relative to their lower-tax counterparts. Anticipated increases in property taxes to offset collapsing state and municipal budgets will amplify the damage inflict on those on fixed incomes.

A complete unknown that could increase the coming surge in supply is the pool of single-family rentals. About eight million landlords who own between one and 10 properties accounting for half the nation’s rental properties, according to Avail, a software company that caters to landlords. Financial duress will come swiftly for those carrying multiple mortgages. Also, a small cohort of institutional investors own roughly 250,000 of the roughly 16 million pool of rental homes, according to ATTOM Data Solutions.

Making matters worse is the crash in demand for jumbo mortgages, which are those over the $510,400 conforming loan ceiling. Wells Fargo & Co. recently announced that it was halting the purchase of jumbo mortgages that originate from other lenders. Investors are sticking with government-backed loans which have greater security given payments will still be received even if borrowers have been granted forbearance. In the last downturn it took almost five years to close the premium charged to attain a jumbo mortgage over rates on conforming mortgages.

And finally, there are more than nine million second homes in the U.S. that may or may not be financially viable given the depth of the current recession. Lending standards tightened dramatically in the last recession as the unemployment rate crested at 10%. It’s difficult to imagine the challenge prospective homebuyers will face in the coming years given we know a 10% jobless rate is not a best-case scenario.

It’s also impossible to quantify how Americans will perceive homeownership given the hardship so many will endure. If frugality is embraced as it was after the Great Depression, homes will once again be viewed as a utility. The McMansion mentality is at risk of extinction.

The reason why the collapse in the subprime mortgage market hit the housing market so hard was because the lead up was predicated on the fact that there had never been a nationwide decline in home prices. But now for the second time in a little more than a decade, Americans are poised to witness the impossible.

This article originally appeared in Bloomberg Opinions.

https://seekingalpha.com/article/4337130-stimulus-will-not-prevent-next-leg-down-in-u-s-stocks

Stimulus Will Not Prevent The Next Leg Down In U.S. Stocks

Apr. 12, 2020 2:53 PM ET

Summary

Fed and Treasury stimulus will not be able to prevent massive losses of income, production and wealth in the economy.

Despite stimulus, vast numbers of businesses in high employment industries will disappear and/or take many years to recover.

No V-Shaped recovery. It will take years for former levels of production to be reestablished in many industries. It will take nearly a decade for a return to full employment.

There’s no free lunch. Massive increases in public and private debt burdens will impose enormous impediments on future growth.

Looking for a helping hand in the market? Members of Successful Portfolio Strategy get exclusive ideas and guidance to navigate any climate. Get started today »

Since the recent low of 2237.40 registered on March 23, the S&P 500 index has staged a major counter-trend rally gain of 24.69%, as of April 9. This includes a gain of 11.23% in the past week. Although there were several technical factors and news catalysts that have contributed to this massive counter-trend rally, perhaps the most important critical factor has been expectations and announcements regarding unprecedented measures by the US Treasury and the US Federal Reserve to inject massive amounts of fiscal and monetary stimulus into the US economy and financial markets.

In this article I will explain why the combined measures by the US Treasury and Fed will not be enough to prevent massive and long-lasting losses of national income, production and wealth. In particular, I will show that in the context of their inability to prevent a massive and prolonged economic crisis that will extend well into 2021, US Treasury and Fed stimulus measures will not ultimately prevent the occurrence of another massive leg down in US equities. Indeed, after the current counter-trend rally fizzles out and the primary bear market trend resumes, in the course of the next leg down, US equity prices will collapse significantly below recent lows and establish a bottom somewhere between the range of approximately 1900 and 1500 on the S&P 500 index. The eventual recovery from this intermediate-term bottom will most likely be prolonged and painful (as opposed to V-shaped), with potential – depending on various developments – for occurrence of yet another major leg down to even lower levels.

The Economic Backdrop

The Unites States is barely in the initial stages of one of the most devastating economic crises in the nation’s history. Certainly, the forthcoming economic crisis will the most severe since the Great Depression.

After initially underestimating the severity of the crisis, economists at Goldman Sachs, Bank of America, Morgan Stanley and JPMorgan now all agree (several weeks after I had published my own forecasts) that the contraction in US GDP in the second quarter of 2020 will be in the order of 30%-40% – by far the largest quarterly contraction in US economic history, including the Great Depression.

In this context of this economic crisis, unemployment is expected to peak at 20%-30% while business bankruptcies skyrocket to unprecedented levels.

Economists currently disagree on the timing of the economic recovery and regarding how quickly the US economy will be able to re-achieve prior levels output and employment.

My own estimates is that the US will not reach prior peak levels of output until the fourth quarter of 2021, at the earliest. Most worryingly, due to lasting damage to the economy, full employment may not be reached until 2030, or beyond.

Stimulus Measures Announced to Address the Crisis

On Thursday, the US Fed announced an emergency package worth up to $2.3 trillion. The package is extremely broad, encompassing credits to aid small and mid-sized businesses, loans to state and local governments and purchases of some types of high-yield bonds, collateralized loan obligations and commercial mortgage-backed securities. The following is a summary of some of key details:

- The Main Street Lending Program will “ensure credit flows to small and mid-sized businesses with the purchase of up to $600 billion in loans.”

- The Municipal Liquidity Facility will offer as much as $500 billion in lending to states and municipalities.

- The expanded Primary and Secondary Market Corporate Credit Facilities and the Term Asset-Backed Securities Loan Facility will support as much as $850 billion in credit.

- Expansion scope of securities purchasing programs to enable purchase of various types of debt securities and investment instruments such as corporate bonds of “fallen angels,” high-yield bond ETFs and others.

- The Fed will start funding the Paycheck Protection Program Liquidity Facility, “supplying liquidity to participating financial institutions through term financing backed by PPP loans to small businesses.”

The programs that were announced greatly expanded the scope and breadth of the Fed’s efforts to intervene in support of businesses and credit markets. Both the quantity and the manner of the program were expected as they already had been announced.

None of these measures come as a surprise to me. I have fully expected that both the Treasury and Fed would take unprecedented actions to mitigate the damage from the most devastating economic crisis since the Great Depression.

Indeed, in the days, weeks and months ahead, I expect many more announcements of massive rescue programs involving trillions directed at virtually every area of the economy.

However, as I will proceed to explain, none of these measures individually, or in combination, will be enough to prevent a very deep and prolonged economic crisis. In particular, these measures will not be sufficient to prevent the occurrence of another massive decline in US equity prices, in which causes the value of the S&P 500 index to collapse substantially below the short-term low of 2237 recorded on March 23, 2020.

Reasons Why Fiscal and Monetary Stimulus Will Not Be Enough

Due to space constraints, in this article I will merely outline a few of the most important reasons why fiscal and monetary stimulus will not be enough to prevent a deep and prolonged economic crisis and an associated “second leg down” in the ongoing bear market in US equities. I will organize the presentation around the inability of fiscal and monetary stimulus measures to prevent: 1) Severe and prolonged losses of income (individual and business), 2) Acute and long-lasting losses of production, 3) Massive long-term losses of wealth.

Loss of Income

Despite the many programs designed to mitigate losses of income, enormous losses of income by individuals and businesses will go uncompensated. The macroeconomic importance of this is that drastic losses of income will translate into similarly drastic reductions of expenditures on goods and services in the economy.

Loss of Individual Income

Despite government efforts the aggregate personal income of Americans – even after government aid is accounted for – will suffer enormous losses.

- Loss of income due to unemployment. The salaries and wages of unemployed people will not be completely compensated by unemployment insurance. Although it’s true that some workers may end up receiving more money than they previously earned, on average, unemployed workers will experience a substantial decline in their personal income.

- Loss of income due to fewer hours worked.Even among the cohort of the citizenry will not become unemployed, Americans on aggregate, will suffer significant losses of income due to the reduction of regular hours worked and the decrease of overtime hours worked.

- Reductions of salaries and wages.Many firms will cut salaries and wages to avoid losses and even to avert potential insolvency. In this context, it’s important to note that the federal government’s CARES Paycheck Protection Program, which is designed to keep workers on company payrolls via conditional loans that are potentially forgivable, allows companies to cut worker wages and salaries by up to 25%, without forfeiting eligibility for forgiveness of the loan. It’s therefore to be expected that many firms receiving federal benefits will indeed cut wages by up to 25%. Furthermore, wage cuts of greater than 25% can be certainly be expected at the huge number of firms that do not qualify for the forgivable loans under the CARES Act. In this context, it’s important to note that a very large percentage of US firms of all sizes will not qualify for forgivable loans and will therefore face no restrictions in terms of reducing wages and salaries by extremely large amounts.

- Loss of tips, commissions, bonuses and incentive-based compensation.Large amounts of the incomes of US workers is earned in the forms of tips, commissions, bonuses and various forms of incentive-based compensation. At the vast majority of US firms, these forms of compensation will be radically cut and eliminated during 2020. These categories of worker pay will clearly not be compensated by Fed and Treasury stimulus programs. The drastic reductions in these forms of income will have a very large negative impact on US aggregate income.

In sum, there will be massive losses of income to both unemployed and employed individuals in the US throughout 2020, 2021 and beyond. These drastic losses of income will translate into drastic losses of expenditure on goods and services in the economy.

In terms of how this impacts the market value of US equities there are two main effects. The first and most important effect is via the reduction of personal expenditures and the concomitant reduction in US corporate revenues and earnings. The second effect occurs via the impact of reduced income on the propensity to purchase equities (directly or via funds). Individuals who have experienced large losses of income (of fear that they might) are generally not able or inclined to spend or risk scarce cash on stocks – particularly in an environment characterized by the enormous and very frightening types of economic and financial uncertainties that will tend to characterize the US and global economic landscape in the COVID-19 and post COVID-19 era.

Loss of Business Income

Loss of business income in the US economy will be even more drastic in percentage terms than the loss of income by workers. Although Fed and Treasury stimulus programs can certainly mitigate losses of business income to a limited extent, firms and their owners will nonetheless face drastic reductions in their incomes during 2020 and 2021 (relative to 2019) that will be uncompensated by government programs.

- Loss of income by large companies and owners.For example, I estimate that the earnings per share of US publicly-listed companies will decline by no less than 50% on a year-over-year basis in 2020. Indeed, I believe that it is likely that earnings per share of US publicly-listed companies and private companies are likely to be negative on a cumulative basis for the last three quarters of 2020. As a result of the drastic decline in company incomes, dividends to owners also will suffer massive declines.

- Loss of income by small companies and owners.Small businesses are disproportionally represented in the areas of the economy that will be hardest hit by the COVID-19 epidemic. To make matters worse, profit margins and financial flexibility is far lower for US small businesses compared to large businesses. Therefore, on aggregate, US small businesses and small business owners are likely to experience net reductions of income on a cumulative basis during 2020 and 2021 (relative to 2019) that are even greater in proportional terms than that of larger firms.

The above types and magnitudes of losses for large and small companies will occur despite the enormous rescue packages by the Treasury and Fed. This will occur for three reasons.

- Many firms not qualified.Many businesses simply will not qualify for government assistance programs.

- Assistance will not be sufficient to prevent reduction of income.In the case of many businesses that do qualify for government assistance, the programs will not be sufficient to prevent large reductions in their net income. Indeed, many firms will experience large losses despite receiving government assistance.

- Assistance will not prevent business failures. Many businesses that qualify for assistance will simply choose to shut down operations (partly or entirely) causing large reductions of income – as opposed to continuing to operate in the face of potentially generating even larger losses and/or increased indebtedness. For example, not all forms of assistance will be forgivable (meaning it has to be repaid) so many companies will prefer to shut down their operations rather than be saddled with large quantities of debt that the companies will not (or may not) be able to be repay. Furthermore, many businesses that qualify for forgivable loans will nonetheless elect to shut down their operations, in cases in which their owners/operators forecast (or fear) large losses, despite government assistance.

Since business income represents a substantial portion of total income in the US economy, massive reductions of business income will have a profoundly negative impact on the US economy with destructive ripple effects throughout the entire economy. Drastic losses of business income by companies will result in massive declines in ordinary business expenditures (e.g. payroll and supplies) and even more drastic declines in capital investment expenditures.

Although Treasury and Fed stimulus programs will substantially mitigate losses of business income relative to what would have occurred without such assistance, US businesses – both large and small will nonetheless sustain massive losses of income.

Drastic declines in aggregate business incomes in the US economy impact the market value of US equities in two main ways. First, the reduction of business income of US firms means drastically lower profitability of US publicly-traded companies. Lower net earnings and profitability impacts both the intrinsic and perceived value of US firms, thereby negatively impacting the prices of their shares in the stock market. Second, the reduction of business income of US firms lowers their capacity and propensity to buy back their own shares. This is important because stock repurchases by companies of their own shares has in the past decade has represented, by far, the largest single source of net demand for US equity shares – indeed greater than all other sources combined. In this regard, Goldman Sachs has recently published a study in which it’s estimated that stock buybacks by US publicly-traded firms will be slashed by one half compared to 2019 levels. My own firm forecasts show even deeper and more widespread reductions in the amount of share purchases – on the order of -70%.

Increased Savings

In addition to the drastic reduction of business and personal income there will be another factor that will drive a massive contraction in spending in the US economy: Increased savings. Out of every dollar received by US individuals and businesses from ordinary sources of income or via government transfers, they will spend a lower-than-normal fraction of it and save a larger-than-normal fraction of it. When firms and individuals save an increased proportion of their income (including government transfers), the total amount of expenditure in the economy – and concomitantly the total amount of income in the economy – is reduced roughly in proportion to the amount of the increase in savings.

Savings by individuals and firms will increase for at least three reasons:

- Increase in precautionary savings.Frightened consumers and businesses will cut back on spending to save for foreseen and/or unforeseen contingencies.

- Fewer things to spend on.Social distancing necessarily means that people will have far fewer things to spend money on (no concerts, no sporting events, no restaurants/bars/nightclubs, no vacations).

- Reduced use of credit for growth of expenditure.Net savings will increase (and net expenditures will decrease) via the reduced usage of credit used by individuals and firms to grow their expenditures and/or their output. Although many individuals and/or businesses actually will increase use of credit to compensate for lost income, relatively few firms and individuals will make use of credit to grow their level of expenditure. To the contrary, firms and businesses will generally tend to drastically reduce their usage of credit for discretionary spending on non-essential expenditures and investments, thereby causing an overall reduction in the level of expenditures and income in the economy.

While the Fed and Treasury can somewhat mitigate the precautionary motive for savings, they cannot prevent an overall increase in the propensity to save. First, Fed and Treasury measures will not prevent individuals and firms from curtailing savings for precautionary reasons. Second, they cannot provide consumers with opportunities to spend which compensate for the opportunities to spend which have become unavailable. Finally, the Fed and Treasury cannot force consumers and businesses to increase their use of credit to increase their expenditures relative to 2019 (as opposed to using credit to merely compensate for lost income).

To sum up this section on loss of income, while the Fed and Treasury can mitigate losses of income by businesses and individuals to some extent, they will not be able to compensate for all of the losses of income that will occur. In terms of how this impacts aggregate economic statistics, if there are overall losses of personal income plus business income (including government assistance) equaling around 20% of total national income in the next three quarters of 2020 (with peak losses of over 30% in the second quarter), Gross Domestic Income will decline by a similar amount during that period. Furthermore, a reduced propensity to utilize and issue credit will only exacerbate the reduction of expenditures (and concomitant aggregate income) in the overall economy

Loss of Production

The Fed and Treasury can distribute all the money they want to individuals and firms. However, they cannot prevent enormous losses of production that will occur during the course of this crisis. Production will be reduced for various reasons including the following key scenarios, among others.

- Mandated and voluntary social distancing constrain production.Many firms will shut down or reduce production – due to legal restrictions or due to voluntary measures – in order to contain the spread of the COVID-19 virus.

- Global supply chain disruption.Many firms will shut down or reduce production due to global and domestic supply-chain disruptions.

- Loss of demand.Many firms will shut down or reduce their production in response to loss of demand. For example, production at restaurants, entertainment venues and many other sorts of businesses will shut down or be reduced due to the fact that customers will voluntarily restrain themselves from consuming products or services when doing so is perceived to place them at a higher risk of COVID-19 infection. Furthermore, demand will be lost simply due to the drastic reduction in income suffered on the part of consumers and businesses.

Massive losses of production will be occurring for all of these reasons until an effective vaccine is widely available – something that is not expected for another 18 months at least (if it can be developed at all). If overall production of goods and services declines by about 25% in the next three quarters of 2020 (with a peak loss of about 40% in the second quarter), then Gross Domestic Product will decline by roughly 25% during that period.

Loss of wealth

The following are just three ways in which wealth will be massively destroyed in the US economy.

- Destruction in the value of equity.There will be a massive destruction of the wealth of the equity of business owners for reasons that I described in considerable detail in my most recent article. In sum, insolvency, restructuring and recapitalizations will decimate the equity value of most business owners. Furthermore, there will be large reductions in the long-term intrinsic value and market value over owners’ equity due to the reduced long-term growth rates and higher long-term discount rates that will result from this crisis.

- Destruction in the value of debt.Debt holders and creditors of all sorts will suffer massive losses of wealth due to the reduction in the intrinsic value and market value of their debt holdings. Massive quantities of defaults and greatly increased default risk on the part of many debtors will cause massive losses in the intrinsic value and market value of debt, leading to a massive loss of wealth on the part of creditors (with out a corresponding increase in wealth on the part of debtors).

- Destruction in the value of real property. Due to loss of demand for property and loss of income by renters/leaseholders, there will be massive destruction of wealth for real property owners.

How does the massive destruction of wealth in various forms impact the real economy? Wealth destruction will reduce the level of expenditure in the economy for two main reasons. First, wealth destruction reduces the propensity to spend in the economy by both consumers and businesses that have lost wealth – both on consumer and investment goods. Second, wealth destruction reduces credit worthiness, credit capacity and the willingness to both issue and take out credit on the part of consumers and businesses. This lowers the level of current and future growth by inhibiting both investment and consumption expenditures by businesses and consumers.

Fed Cannot Prevent Massive Insolvencies

While Treasury and Fed programs can and will alleviate liquidity problems at many companies, these programs will not be able to address the fundamental solvency problems at many companies that will result in long-term destruction of production, incomes and wealth.

Let us just take a few examples:

- Establishments such as restaurants, bars and night clubs will be devastated by mandated and voluntary “social distancing” measures. Many of these firms will simply shut down. And even assuming that a vaccine is widely distributed in 18 months it will take many years for the former level of activity (and income) in these industries to return to previous levels. This is due to the fact that many former owners and operators of these businesses will be financially devastated and will be either reluctant to get back into business or incapable of doing so due to loss of wealth and credit restrictions.

- Brick and mortar retail. Any business that relies on large numbers of people gathering in limited spaces will not be viable and will face insolvency. For example, high-traffic stores and shopping malls will see massive reductions in business even after mandated lockdowns are eased. This is due to voluntary social distancing. Due to competition from e-commerce, many of these businesses were barely viable before the COVID-19 crisis and were undergoing a slow “retail apocalypse.” In this context, and in the forthcoming era of prolonged social distancing (both mandated and voluntary), a huge proportion of these businesses will simply not be coming back.

- Theme parks, live entertainment events, conventions. These businesses will essentially have to remain shut down at least until a vaccine/cure for COVID-19 is found. This will most likely not happen for at least 18 months. And even then, it may take a long time for these businesses to resume production at former levels given the fact that many operators of these businesses will be financially ruined.

The types of businesses described above do not have a liquidity problem. They have a solvency problem. And so do all of the people that serve these businesses – their suppliers, lawyers, accountants, etc. No amount of government assistance or loans will reactivate lost production and lost income and lost wealth caused by the destruction of these firms.

These businesses are a major part of the economy and employ huge numbers of people. As mentioned previously, after the need for social distancing dissipates, many unemployed owners and workers will be fortunate enough to find employment in their former industries. However, it will take a long time for these industries to ramp back up to their new equilibrium levels of production. Perhaps even more importantly, many of these industries will never return to their former levels of employment, and a many workers in these industries will not be able to return to their old jobs.

It’s not an easy matter to retrain workers for new jobs. And it’s certainly not an easy matter for entirely new industries to emerge that will employ the vast numbers of people that are left unemployed for large periods of time. The upshot of this is that long-term unemployment will be part of the American economic and social landscape for many years.

There’s very little that the Treasury or Fed can do to prevent the massive levels of long-term unemployment that will be caused by this crisis. Furthermore, there’s very little that the Fed and Treasury can do to compensate for the massive losses of wealth suffered by owners and workers in these industries.

There’s No Free Lunch

Almost forgotten in the midst of all of the excitement surrounding government stimulus is a fact that should be obvious: There’s no free lunch. The Fed can finance the US Treasury and US businesses all it wants. This will not change the fact that there will have been an enormous increase in debt in both the public and private sector without any corresponding increase in production and/or productivity in the economy. The addition of a such a huge debt burden (without any corresponding increase in productive capacity) will necessarily cause a huge loss of future production and/or national wealth.

The massive increases in public and private debt brought about by this crisis will ultimately be paid for in two ways – most probably in both ways: 1) Lower future growth. 2) Higher inflation.

High debt lowers future growth by increasing interest burdens, increasing solvency risks and limiting future credit capacity. All of this reduces future potential investment and consumption.

Furthermore, the increase in the enormous levels of debt increases the risk that this will be “paid for” in the future via increased levels of inflation. The problem is that inflation is no free lunch. Although inflation reduces the real value of accumulated debt and makes repayment of debt with fixed interest costs easier, inflation also imposes many costs on the economy and many constraints on future growth.

First, the instability of prices lowers investment since the ability of entrepreneurs and producers to plan the cost of inputs and outputs is reduced. Second, credit costs increase as interest rates rise, thereby impacting both the issuance and taking of credit. Finally, inflation has adverse distributional effects in the economy such as lowering real wages and thereby lowering real consumption, living standards and wealth.

Some people evidently think that the US government can just throw money at the problems caused by this economic crisis and repair the vast damage done such that the net impact on the value of US equities is relatively minor. These people are mistaken. The money thrown at these problems will come with a high price tag in the form of higher levels of debt and higher long-term inflation and/or long-term inflation risks which will significantly impact both future growth and the discount rate at which the future cash flows of equities will be discounted.

Conclusion

Many people seem to assume that massive US Treasury and US Fed stimulus programs will essentially “make up” for all of the economic damage that has been done by the COVID-19 crisis. As I have shown in this article, this is simply not the case. Although Treasury and Fed programs will certainly mitigate many problems it will not come close to compensating for all of the losses of income, production and wealth that will occur. These uncompensated and essentially “unfixable” gaps represent an enormous proportion of the US economy that employs an enormous number of people. The implication of this is that the forthcoming economic crisis will not only be extremely deep but very prolonged in time. Long after the economy is “opened up” and “lock-down” measures are eased, many industries that employ huge numbers of workers will remain devastated.

The devastation in many industries will only really begin to be remedied in earnest approximately 18 months from now – if and when an effective vaccine and/or cure is developed and made widely available. And even after that occurs it will take substantial amount of time for business in devastated industries to reemerge (often with new owners) and for many long-term unemployed people to be re-trained and re-employed in other occupations.

Therefore, there will be no V-shaped recovery of the US economy. The forthcoming recession will be both deep and prolonged. And no amount of Fed and Treasury stimulus can fundamentally alter this inevitable fact. Fed and Treasury stimulus can ameliorate the damage that otherwise would have occurred to the economy. However, they cannot prevent massive business closings, massive unemployment and massive losses of income, production and wealth that will inevitably occur as a result of this crisis. And when economists, investors and the general public finally come to understand this, the current bear market rally will become aborted and the next leg down in US equities will begin.

A reversal of the current bear market rally and a collapse to significant new lows will happen sooner rather than later. It’s important that you devise and quickly implement a portfolio strategy that is designed to deal with this forthcoming collapse in US equity prices and its aftermath.

It is critically important that you have a portfolio strategy that is properly designed to deal with the forthcoming unprecedented economic crisis — and its aftermath. Subscribers of Successful Portfolio Strategy are ready to both manage the risks and capitalize on the opportunities that will be presented in these unprecedented times. Our service empowers you with knowledge and tools needed to implement a winning portfolio strategy.

Please note that our service offers two portfolios: The Total Return Strategy portfolio is designed for conservatively oriented long-term investors. Proprietary Trader is designed for more aggressive and active investors/traders.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All of my investment positions are disclosed in the model portfolios in Investment Portfolio Strategy

Will you have to pay back the coronavirus stimulus check? Plus 6 other stimulus myths debunked

Published Mon, Apr 13 20204:21 PM EDTUpdated Tue, Apr 14 20207:03 PM EDT

Alicia Adamczyk@ALICIAADAMCZYK

The IRS began depositing coronavirus stimulus relief checks this week to some eligible Americans. But questions about the payments, including how quickly Americans will actually receive them, still abound.

Below, CNBC Make It clarified seven myths about the stimulus checks. Here’s what you need to know, from whether or not they are taxed to how long it will take for them to hit your bank account.

Myth 1: The stimulus checks are taxed

The stimulus checks are not taxable income. The checks — which are worth $1,200 for individuals earning up to $75,000 and $2,400 for couples earning up to $150,000, plus $500 for dependents under 17 — are structured as refundable tax credits. That is why even people who do not typically file tax returns qualify for these payments, according to the Tax Foundation, an independent think tank.

Myth 2: I will have to pay back the stimulus check next tax season

Assuming all of the information on your tax returns is correct, you will not repay the check next spring.

You may even receive more money when you file your 2020 taxes. While the checks are based off of your 2019 or 2018 returns to get you money now, they are technically credits for 2020 taxes, per the Tax Foundation. If it turns out that you should receive a larger credit based on your 2020 adjusted gross income (AGI), then you will receive the difference next year. “If a taxpayer’s income drops in 2020, they will be eligible for any remaining rebate credit they were not able to claim using their 2019 or 2018 return,” writes the Tax Foundation.

On the other hand, you will not be penalized by the IRS if your 2020 AGI is higher than this year’s, according to the Tax Foundation. “If the amount of a credit a taxpayer qualifies for in 2020 is less than it was based on their 2019 return, it does not have to be paid back.”

Myth 3: It will take months to receive my check

If the IRS has your direct deposit banking information, then you should receive your payment in the next few weeks, according to the agency. In fact, the U.S. Treasury Department announced Monday that tens of millions of Americans should receive their deposits by Wednesday, April 15, and the department “expects a large majority of eligible Americans will receive Economic Impact Payments within the next two weeks.”

It is those who still need to file a return and those who get their tax refund via a paper check who will potentially wait months to receive their stimulus check, according to the IRS.

Myth 4: I can’t sign up for the stimulus checks

There is nothing most people need to do to receive a check. If you filed your tax return in 2018 or 2019 and the IRS has your banking information, you will receive a payment automatically.

The only people who might need to do something to receive a payment are low-income Americans who do not typically file a return and those who want to provide the IRS with their bank account information to get their payment faster via direct deposit, as opposed to a mailed check. An online portal to update your bank account information is expected to be available in the next few days on the IRS’s website.

Myth 5: Social Security and other benefits recipients aren’t eligible

With a few exceptions, as long as you have a Social Security number and meet the income eligibility requirements, you will receive a check. Those who receive Social Security retirement benefits, as well as disability (SSDI) and Railroad Retirement benefits, will not need to file a new tax return to receive their payments, if they otherwise qualify; the IRS will use the bank account information it already has.

Myth 6: I have not filed my 2019 taxes yet so I will not get a check

Everyone who is eligible will receive a check. If you haven’t filed for 2019 yet, then the IRS will use your 2018 return to estimate your credit.

That said, the IRS “has also advised all taxpayers expecting a refund to file their 2019 tax return as soon as possible,” says the Tax Foundation.

Myth 7: The IRS overpaid me, and now I have to pay back some of the money

The IRS will not ask for money back. Coronavirus pandemic scams are proliferating, and the Federal Trade Commission warns of several related specifically to the stimulus checks. One of the most common: Scammers send a check purportedly from the “IRS,” then claim that they overpaid and you need to wire some money back.

“If you get an official-looking check for more than what you were expecting — say, for $3,000 — the next call you’re likely to get is from a scammer,” warns the FTC. “They’ll tell you to keep your $1,200 payment, and return the rest by sending cash, gift cards or money transfers.” If you experience something like this, you can report it to the FTC.

Keep in mind that the IRS will not call, text or email you. “Scammers are sending official-looking messages — including postcards with a password to be used online to ‘access’ or ‘verify’ your payment or direct deposit information,” warns the FTC. “The IRS will not contact you to collect your personal information or bank account. It’s a scam.”

Editor’s note: This post was updated with the Treasury Department’s most recent announcement.