HI Market View Commentary 03-16-2020

How many of you have seen the movie Red Dawn? 80 version is better

Probably NOT going to martial law but more importantly for us we probably not as close tot the bottom as we think

Things are looking Yummy but here is the question: How will the market react when the virus really hits the fan?

How, When and at What Price do we start to pick up more shares !!!!

I have protection expiring 3/27. 4/03. 4/09

I may have to take the profits, add the shares, protect through earnings and keep adding more shares again if we drop another 21%

| Market Recap |

| WEEK OF MAR. 9 THROUGH MAR. 13, 2020 |

| The Standard & Poor’s 500 Index fell 8.8% last week as the expanding fallout from COVID-19 resulted in one of the most volatile weeks in history.

The benchmark average closed the week at 2,711.02, down from last week’s close of 2,972.37, but above its 15-month low of 2,478.86 when President Donald Trump’s declaration of a national emergency and pledge to mitigate the human and economic cost of the virus fueled a late-day rally before Friday’s close. While the S&P spent most of the week in negative territory, the prospect for fiscal stimulus and a bail-out of the oil industry triggered a 5% rally in the S&P on Tuesday. On Thursday, however, the index suffered its worst single-day loss since 1987 when panic selling permeated all sectors of the index despite a massive liquidity injection by the Federal Reserve. And it was again the economically sensitive energy, financial and industrial sectors that bore the brunt of the meltdown with energy shares down a collective 12% in a single day. By Thursday’s close, the index retraced more than 50% of the move from the February 2016 low to the record highs set four years later. The price war between Russia and Saudi Arabia coupled with the anticipated impact on global growth from travel bans and restricted consumer spending continued to wreak havoc on the energy sector which was down 24% from the prior week’s close. As a result, the sector was bombarded with downgrades with Apache (APA) downgraded by SunTrust to Hold and Occidental Petroleum (OXY) downgraded by BofA Securities, Credit Suisse and SunTrust. Both were the worst-performing stocks in the sector, shaving more than two-thirds of their stock price in a single week. With Treasury yields at historic lows, the financial sector dropped 10%. As a result of the company’s exposure to annuities and reinsurance claims, American International Group (AIG) was one of the worst-performing stocks in the sector. In just the past week, the stock has dropped 25% and is down 55% for the month. Even highly-capitalized banks like Citigroup (C) were not immune to the carnage this week with Citi down 17% from a week ago. Within the industrial sector, which tumbled 13% for the week, Boeing (BA) crashed more than 35%, Caterpillar (CAT) was down 18% and United Technologies (UTX) fell by 16%. Elsewhere, the utilities sector crashed 14% while materials dropped 13%. While there were no sectors in the green this week, the health care sector was less bloodied than the other 10 sectors, closing out a very difficult week with a loss of just over 6% as investors braced for the anticipated strain on the health care system from COVID-19. Within the sector, Cardinal Health (CAH) lost 7% for the week, followed closely behind by Cigna (CI) and Humana (HUM) with losses of 8% and 15%, respectively. |

Empire -21.5 vs est 4.7

Where will our markets end this week?

Lower

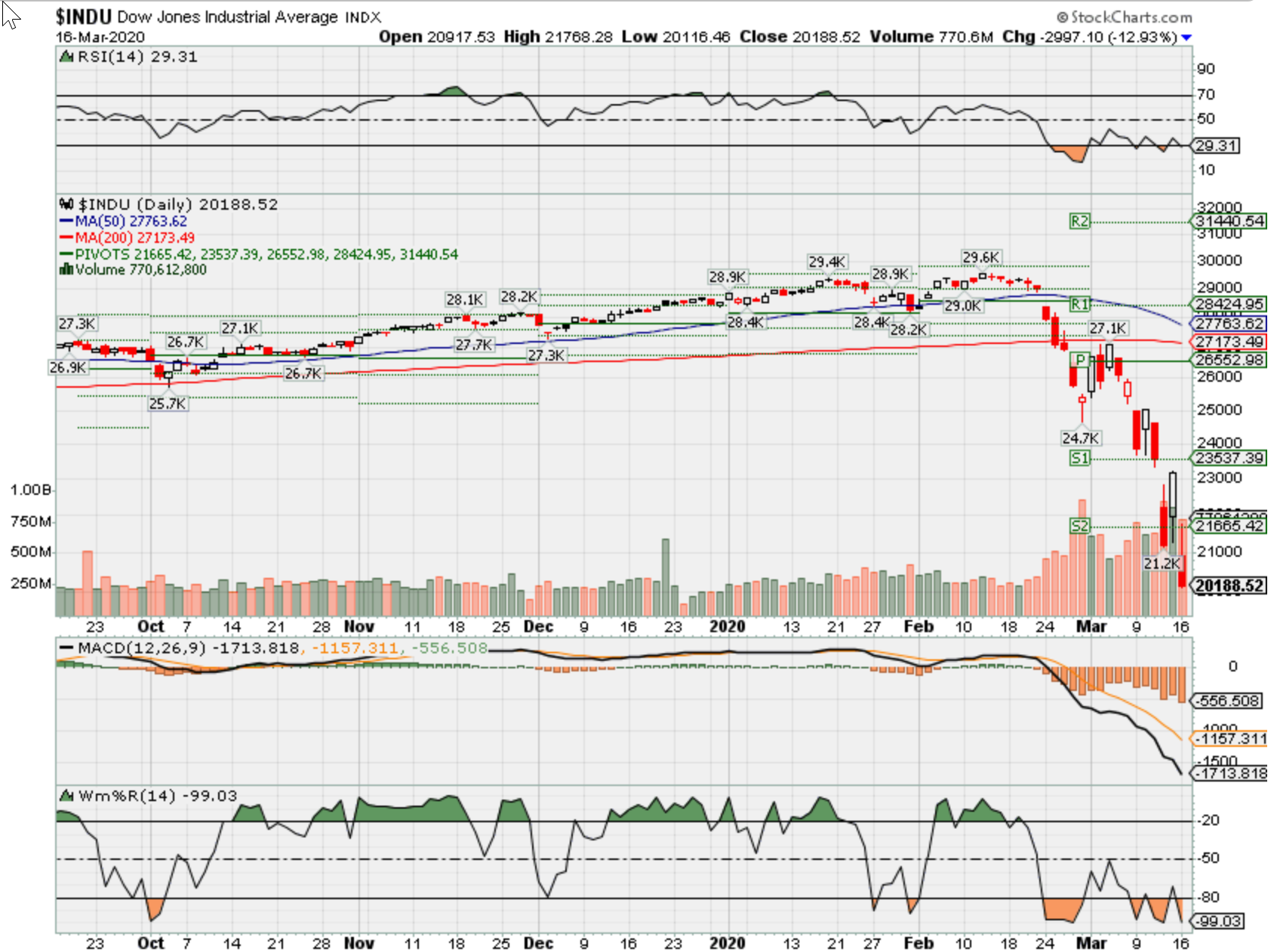

DJIA – Bearish

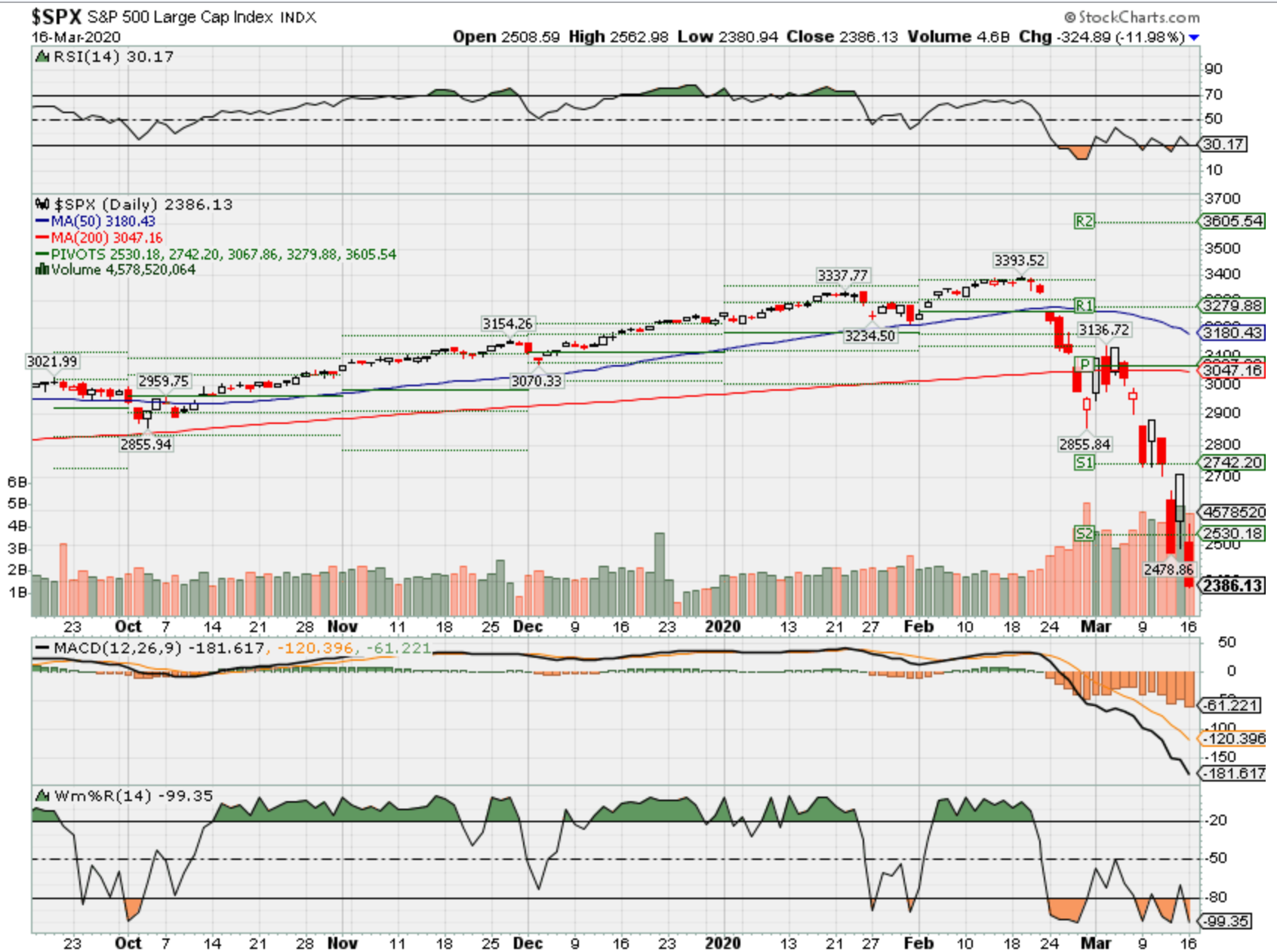

SPX – Bearish

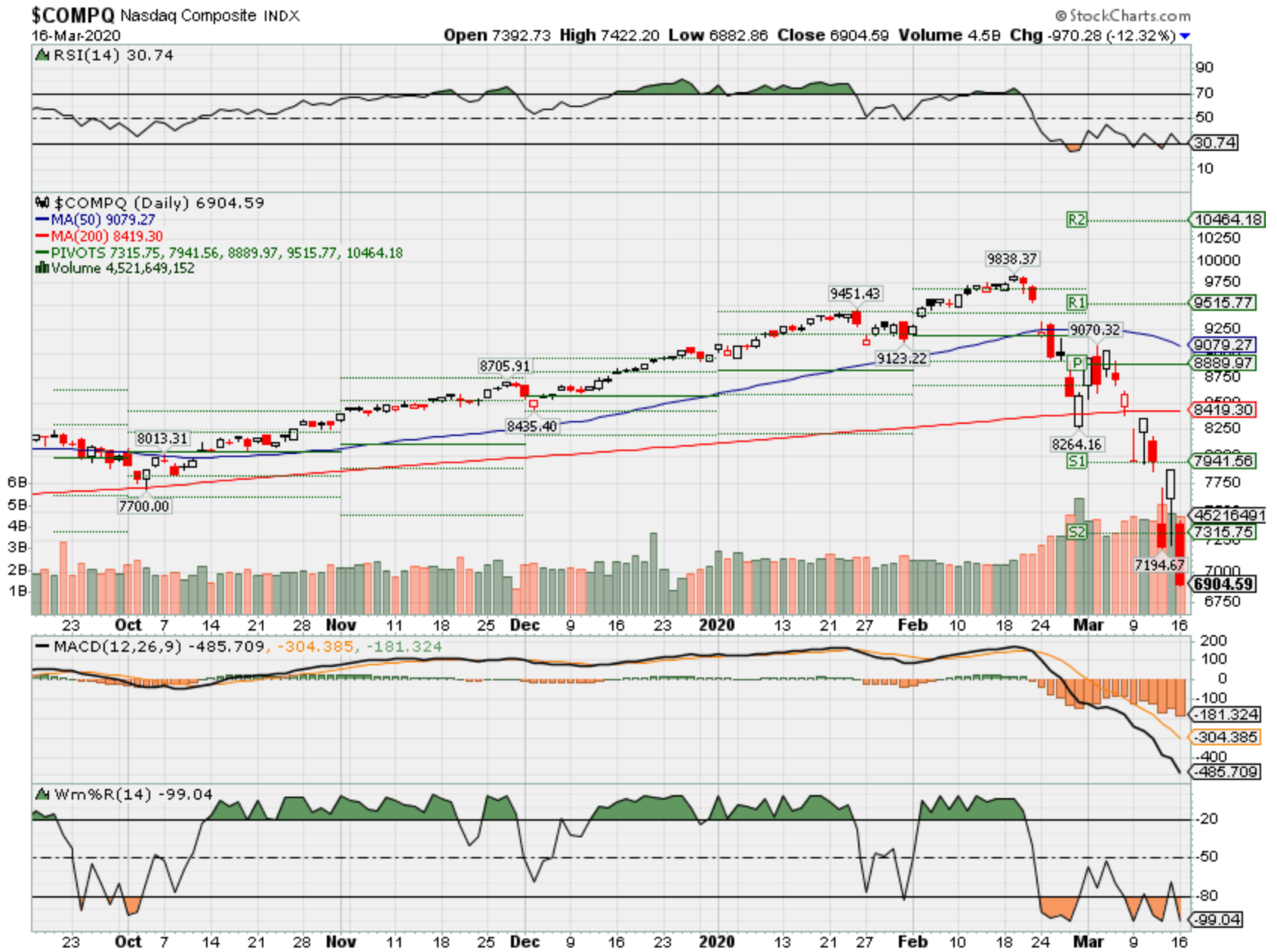

COMP – Bearish

Where Will the SPX end March 2020?

03-16-2020 -15.0%

03-07-2020 0.0%

03-02-2020 +5.2 %

Earnings:

Mon:

Tues: FLR, MIK, FDX

Wed: GIS, GES, FIVE, MLHR, TCOM

Thur: DRI, DLTH, LEN, CTAS

Fri: TIF

Econ Reports:

Mon: Empire, NET Long Term TIC Flows

Tues: Retail, Retail ex-auto, Industrial Production, Capacity Utilization,

Wed: MBA, Housing Starts, Building Permits,

Thur: Initial, Continuing, Phil Fed, Current Account Balance

Fri: Existing Home Sales, Monthly OPTIONS EXPIRATION

Int’l:

Mon – CN: Industrial Production, Retail Sales, G7 Corona Virus Call

Tues –

Wed – JP: BoJ Monetary Policy Meeting

Thursday –

Friday- CN: PBoC Rate Decision ***

Sunday –

How am I looking to trade?

Protection still on and coming due 3/27/ 04/03, 04/09

When and how to pick up shares and most likely add more protection/Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Market Crash Reveals The ‘Liquidity Problem’ Of Passive Investing

Mar. 10, 2020 7:52 AM ET

Summary

The biggest risk to investors is when “passive indexers” turn into “panic sellers.”

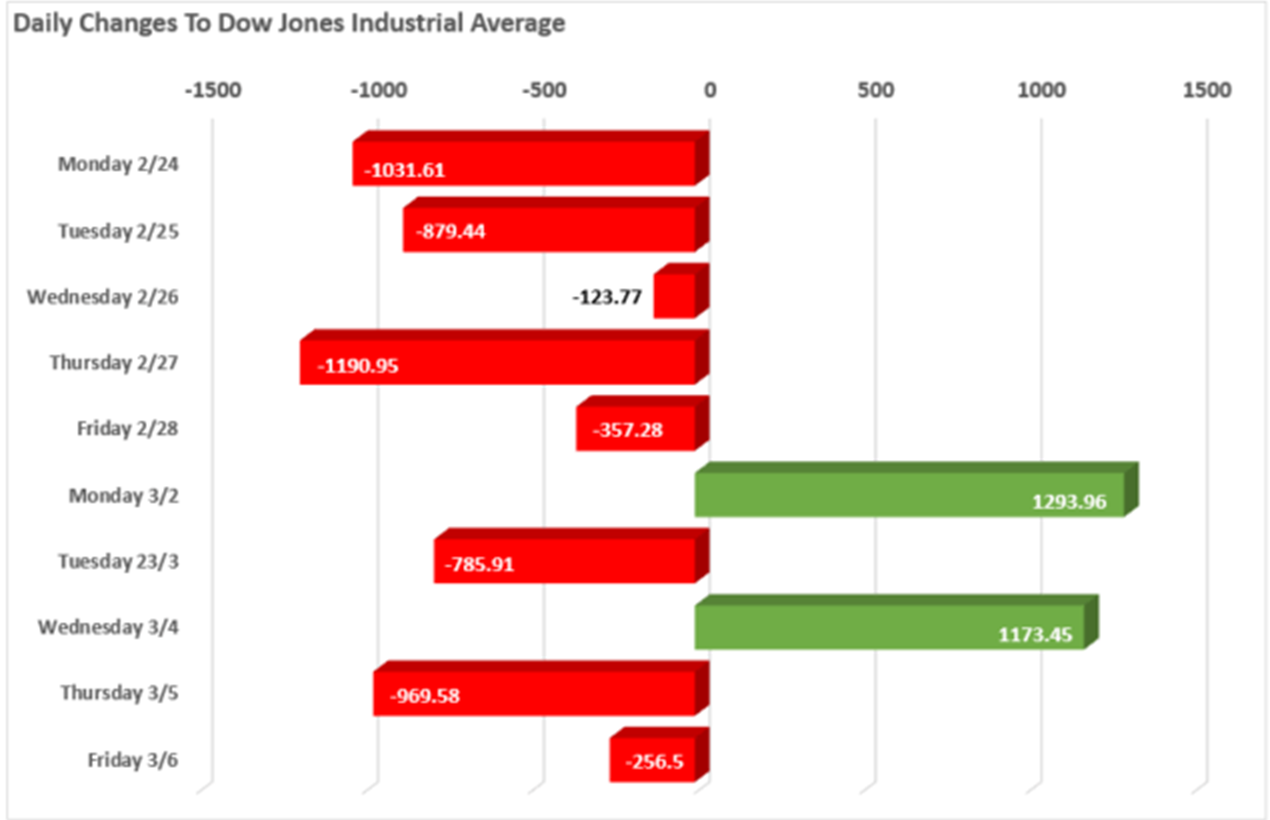

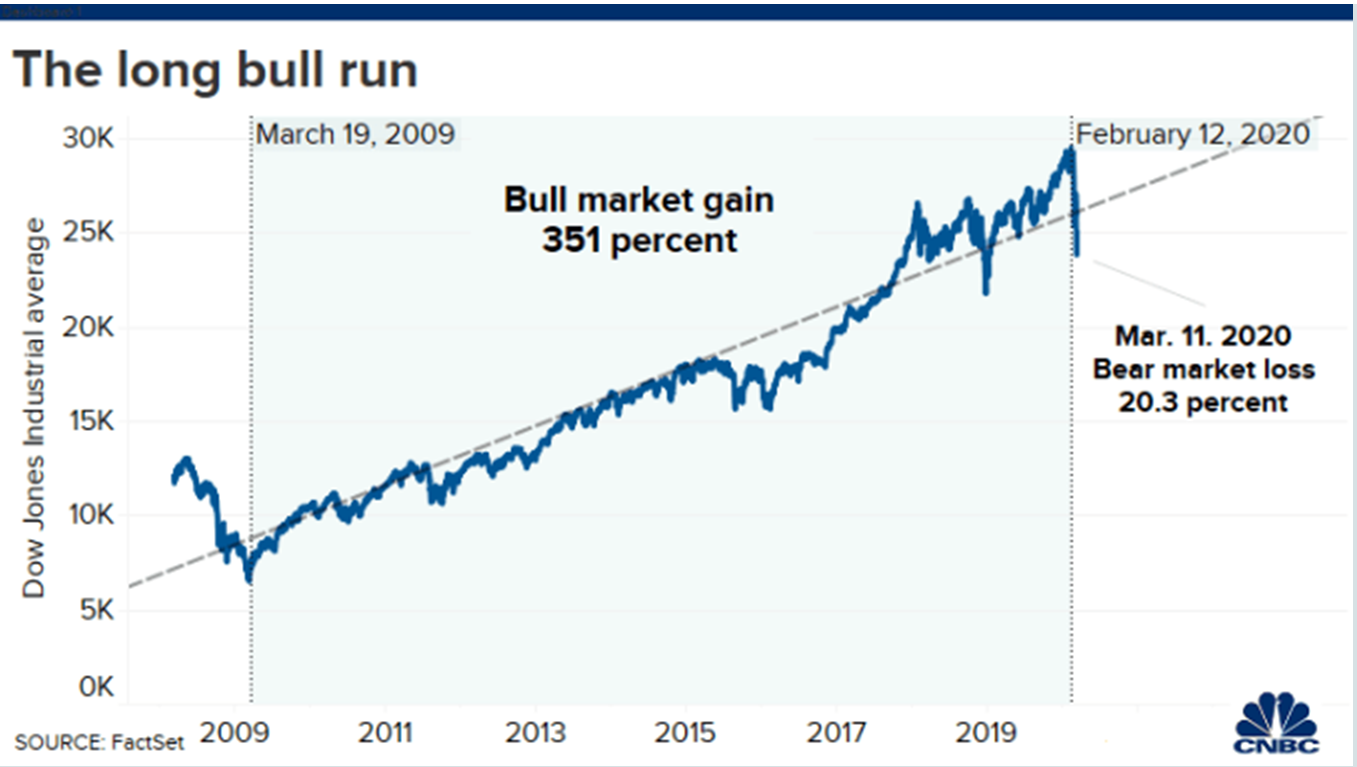

While the “sell-off” over the last couple of weeks was brutal, with the Dow posting some of the biggest declines in its history, it was exacerbated by the “passive indexing revolution.”

The problem with individuals and “passive” investing is they are just “active” investors in a different form. They make all the same mistakes that individual stock investors make, such as “buying high and selling low,” but just using a different instrument to do it.

“When it comes to investing, it’s a losing proposition to try and be anything better than average.

If there’s no point in trying to beat the market through ‘active’ investing – using mutual funds that managers run, selecting what they hope are market-beating investments – what is the best way to invest? Through “passive” investing, which accepts average market returns (this means index funds, which track market benchmarks)”

– Forbes

The idea of “passive indexing” sounds harmless enough – buy an “index” and be an “average” investor.

However, it isn’t as simple as that, and we have spilled a lot of ink digging into the relative dangers of it. Last week, investors saw those risks first-hand.

The biggest risk to investors is when “passive indexers” turn into “panic sellers.”

While the “sell-off” over the last couple of weeks was brutal, with the Dow posting some of the biggest declines in its history, as I will explain, it was exacerbated by the “passive indexing revolution.”

Jim Cramer previously penned (courtesy of Doug Kass) an interesting note on the active vs. passive conflict.

“The answer is that there are two kinds of sellers in this market: hedge fund sellers, who react off of research, and portfolio shufflers, who buy and sell ETFs and index funds.

The former jumps on anything, right or wrong, as long as it is actionable. The latter, the index funds and ETF traders, rarely jump although they may press down harder on a bedraggled ETF, like one that includes the consumer products group.

But there are two kinds of buyers. The opportunistic buyers, and the index buyers. The opportunists think that the downgrades are noise and give them a chance to buy high-quality stocks with the money that comes in over the transom.

The index and ETF buyers? Well, they just buy.”

The dichotomy explains a lot of the bullish action, and isn’t talked about enough.

While Jim wrote this about those “buying” ETF’s, the same is true when they begin to “sell.”

“The index and ETF sellers? Well, they just sell.”

It is often suggested that individuals who buy “passive indexes,” such as the SPDR S&P 500 Index (NYSEARCA:SPY), are they themselves “passive investors.” In other words, these individuals are willing to buy an “index” and hold it for an extended period regardless of market volatility.

Reality has been far different.

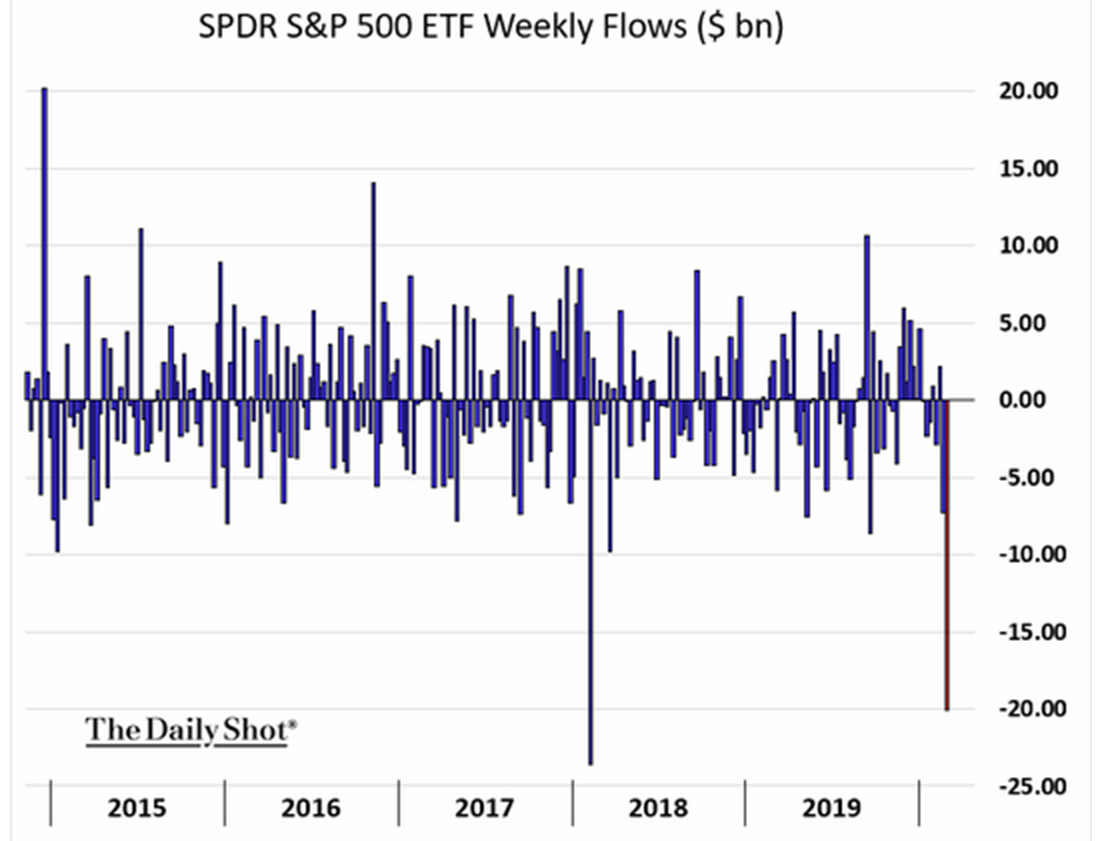

This was clear last week as the S&P 500 ETF saw some of the biggest outflows in its history, with the exception of the February 2018 market plunge as Trump announced his “Trade War with China.”

The problem with individuals and “passive” investing is they are just “active” investors in a different form. They make all the same mistakes that individual stock investors make, such as “buying high and selling low,” but just using a different instrument to do it.

As the markets declined last week, there was a slow realization that “this decline” was something more than another “buy the dip” opportunity. Concerns of the impact on the global supply chain, due to “COVID-19,” slowing earnings, economic growth, and a reduction of liquidity from the Federal Reserve, all culminated in a “panicked exit.”

As losses mounted, anxiety rose until individuals began to sell to “avert further losses” by selling.

Yes… it’s that psychology thing.

Individuals refuse to act “rationally” by holding their investments as losses mount.

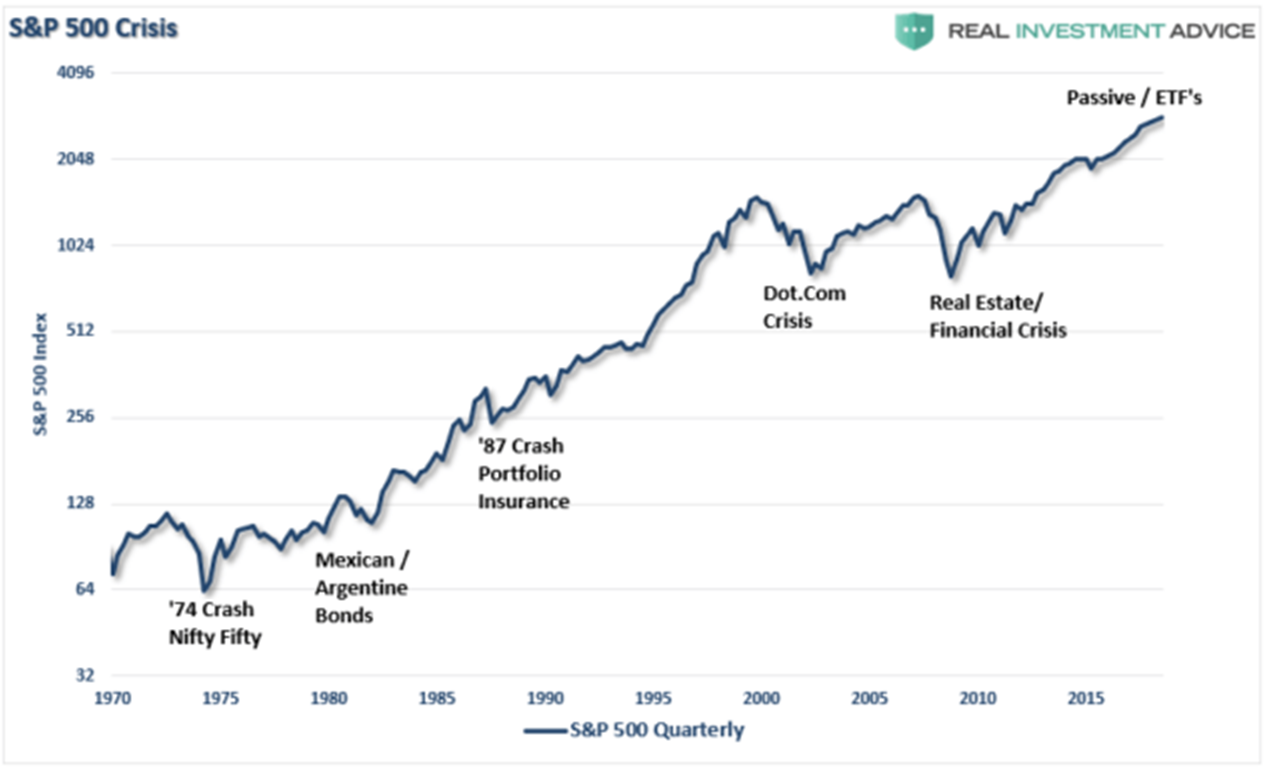

The behavioral biases of investors are one of the most serious risks arising from ETFs, as too much capital is concentrated into too few places. This concentration risk in ETFs is not the first time this has occurred:

- In the early ’70s, it was the “Nifty Fifty” stocks.

- Then Mexican and Argentine bonds a few years after that.

- “Portfolio Insurance” was the “thing” in the mid-’80s.

- com anything was a great investment in 1999.

- Real estate has been a boom/bust cycle roughly every other decade, but 2007 was a doozy.

- Today, it’s ETFs and Bitcoin.

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing.

Until it goes in the other direction.

While the sell-off last week was large, it was the uniformity of the price moves, which revealed the fallacy “passive investing” as investors headed for the exits all at the same time.

The Apple Problem

Currently, there more than 1750 ETF”s trading in the U.S., with each of those ETFs owning many of the same underlying companies. For an ETF company to “sell” you product, they need good performance. In a late-stage market cycle driven by momentum, it is not uncommon to find the same “best-performing” stocks proliferating a large number of ETFs.

For example, out of the 1750 ETFs in the U.S., there are 175, or 10%, which own Apple (AAPL). Given that so many ETFs own the same company, the problem of “liquidity” is exposed during a market rout. The head of the BOE, Mark Carney, warned about the risk of “disorderly unwinding of portfolios” due to the lack of market liquidity.

“Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.”

Howard Marks, also noted in “Liquidity“:

“ETF’s have become popular because they’re generally believed to be ‘better than mutual funds,’ in that they’re traded all day. Thus an ETF investor can get in or out anytime during trading hours. But do the investors in ETFs wonder about the source of their liquidity?‘”

Let me explain.

There is a statement often made by individuals about the market.

“For every buyer, there is a seller.”

The belief has always been that if an individual wants to sell, there will always be a buyer available to execute the transaction at any given price.

However, such is not actually the case.

The correct statement is:

“For every buyer, there is a seller… at a specific price.”

In other words, when the selling begins, those wanting to “sell” overrun those willing to “buy,” so prices have to drop until a “buyer” is willing to execute a trade.

The “Apple” problem, using our example above, is that while investors who are long Apple shares directly are trying to find buyers, the 175 ETFs that also own Apple shares are vying for the same buyers to meet redemption requests.

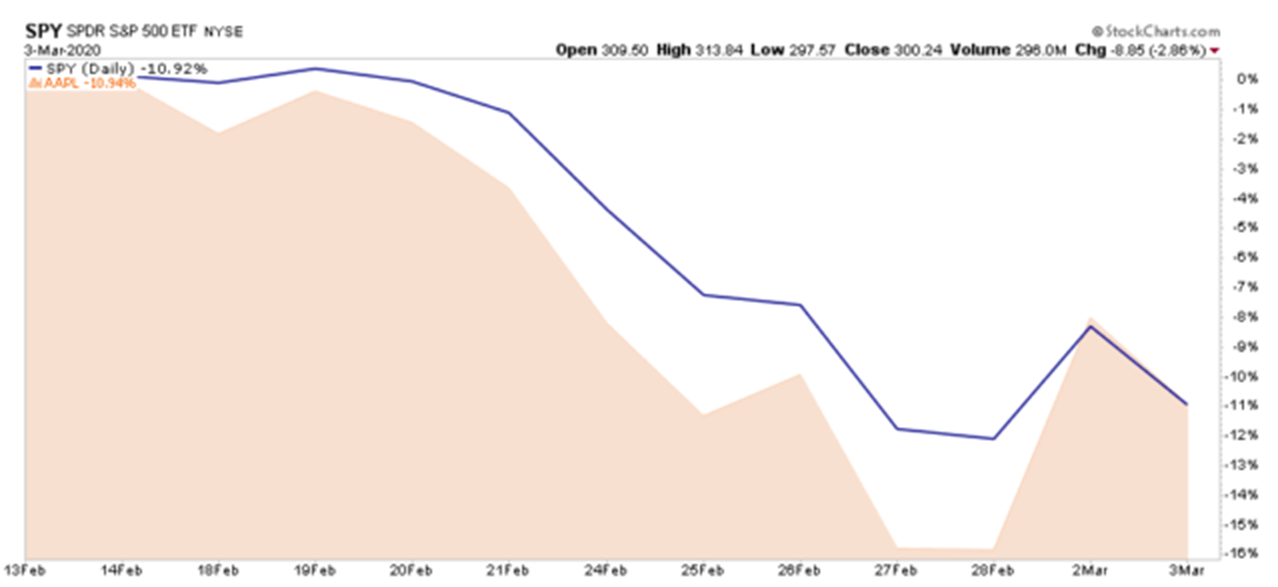

This surge in selling pressure creates a “liquidity vacuum” between the current price and the price at which a “buyer” is willing to step in. As we saw last week, Apple shares fell faster than the SPDR S&P 500 ETF, of which Apple is one of the largest holdings.

Secondly, the ETF market is not a passive market. Today, advisors are actively migrating portfolio management to the use of ETFs for either some, if not all, of the asset allocation equation. Importantly, they are not doing it “passively.” The rise of index funds has turned everyone into “asset class pickers” instead of stock pickers. However, just because individuals are choosing to “buy baskets” of stocks rather than individual securities, it is not a “passive” choice, but rather “active management” in a different form.

While “passive indexing” sounds like a winning approach to “pace” the markets during the late stages of an advance, it is worth remembering it will also “pace” just as well during the subsequent decline.

The correction had the “perma bulls” scrambling to produce commentary as to why markets will continue only to rise. Unfortunately, that is not the way markets actually work over the long term, and why the basic rules of investing are really hard to follow.

Despite the best of intentions, individual investors are not passive even though they are investing in “passive” vehicles. When these market swoons begin, the rush to liquidate entire baskets of stocks accelerate the decline, making sell-offs much more violent than what we have seen in the past.

With this concentration of risk, lack of liquidity, and a market increasingly driven by “robot trading algorithms,” reversals are no longer a slow and methodical process, but rather a stampede with little regard to price, valuation, or fundamental measures as the exit becomes very narrow.

February was just a “sampling” of what will happen to the markets when the next bear market begins.

Are you prepared?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Stocks are expected to see more wild swings, even if Fed makes big policy move

PUBLISHED FRI, MAR 13 20205:14 PM EDTUPDATED SUN, MAR 15 20208:54 AM EDT

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- Stocks could continue to trade with extreme volatility in the week ahead, after this week’s biggest one-day loss since 1987 was followed by the best one-day gain since the financial crisis.

- Analysts say the market is closer to finding a bottom, but that will depend on a slowdown in negative news on the virus.

- The Federal Reserve meets in the coming week, and the market is looking for it to make a big move.

Now that stocks have entered a bear market, more wild volatility is expected in the week ahead as investors await a big policy move by the Federal Reserve.

The Federal Reserve meets Tuesday and Wednesday and is expected by some economists to take its benchmark federal funds target range back to zero, as the economy looks more and more like it could fall into a recession, due to the impact of the coronavirus.

In the past week, the market was sharply lower but swung wildly in both directions, including the stunning 10% decline in the Dow Thursday, the worst one-day drop since the 1987 market crash followed by Friday’s 9.3% gain, the best day in more than 11 years.

The S&P 500 ended up 9.3% Friday at 2,711, its best day since Oct. 28, 2008. The S&P is now 20.2% below its February high.

Strategists say the market purge is not over, though it could be closer to a bottom, with some expecting the S&P 500 to fall through 2,400 before it finds a floor.

“You could say we’re pricing a garden variety recession,” said Lori Calvasina, chief U.S. equities strategist at RBC. “We come up with a range of 2,300 to 2,600 as recession territory.” She said the average drop during a recession, since the 1930s, was 32%. The S&P had been as much as 29% off its Feb. 19 high.

“If [S&P] went below 2,300, it would be telling you the market is pricing in something worse than a recession, In the financial crisis we lost 57% and in the tech bubble, we lost 49%,” said Calvasina.

The S&P 500 was down 8.9% for the week, its worst loss since the week of Feb. 28.

“I think we needed to get through this week, in particular — the one where the country went into shut down and now get the second go around of policy response. If they really do bring out the bazookas we should be darn close” to the bottom, said Barry Knapp, Ironsides Macroeconomics director of research.

But strategists also point out that the coronavirus is unpredictable and it is hard to say when it will peak, even though many economists expect a bounce back in economic growth by the fourth quarter.

President Donald Trump declared a state of emergency Friday, which allows him to tap federal agencies to provide emergency funds and other responses to the crisis. The president also announced the government would buy oil to fill the Strategic Petroleum Reserves and that 1.4 million test kits would be available in the next week.

The House reached agreement and passed a bill that would provide assistance to individuals affected by the disease by provided free testing, unemployment benefits and paid leave.

Markets will also be looking for further action, which the Trump administration says could include targeted financial aid to industries that are hard hit, like airlines.

As communities around the country attempt to stop the spread of the virus, the potential hit to the economy grows. Companies have told workers to work from home, universities are shutting campuses, a handful of states closed public schools, and major sporting and other events have been canceled.

“If it indeed is declared a recession, it will really only be a three-month drop in activity,” said Knapp. “In 2008, the household sector had the highest debt levels it ever had, and the household sector was in no position to respond to stimulus. This is quite different.”

“We see where are are today is pricing in a recession. It went from a growth scare down to recession territory,” said Calvasina. She said the market is not ready to move higher yet. “I think something else we’ve got to see in addition to extreme panic ratings from the sentiment indicators, we do need to see the news flow get better on the virus.”

Investors will continue to look for more action from Washington, and in the coming week it will also be the Fed’s policy response that could drive the market.

“In light of the continued growth in coronavirus cases in the US and globally, the sharp further tightening in financial conditions, and rising risks to the economic outlook, we now expect the FOMC to cut the funds rate 100bp on March 18, a faster return to the crisis-era 0-0.25% rate than under our previous call for two 50bp steps in March and April,” Goldman economists wrote.

The Fed on Thursday announced a significant increase in funds available for its repo operations, to provide liquidity for the short term funding markets. It also said it would purchase a broad range of Treasury securities, across maturities, with the $60 billion it currently uses to buy Treasury bills on a monthly basis.

Economists say the Fed could announce other policy moves, like purchases of mortgage securities. Some expect it to return to a “patient” stance, showing a willingness to keep rates extremely low for a long time.

Analysts have been watching the corporate bond market, where spreads blew out dramatically in the past week, particularly in high yield. Calvasina said she is not yet concerned.

“We’ve got problems in energy. We have problems in some hospitality related industries. There are pockets of stress, but for me, when I look across most S&P companies’ balance sheets are in really good shape,” Calvasina said. “I don’t think this is a prolonged sort of downturn.”

These retailers are closing stores to slow coronavirus outbreak

PUBLISHED SUN, MAR 15 202011:20 AM EDTUPDATED 2 HOURS AGO

Christina Cheddar Berk@CCHEDDARBERK

KEY POINTS

- Major retailers across the U.S. are shutting down their stores in response to the coronavirus outbreak.

- Others are reducing store hours or pitching in to offer space for virus testing.

- The closures come as there are at least 3,774 confirmed COVID-19 cases in the U.S., and at least 69 deaths, according to the latest data from Johns Hopkins University.

Major retailers across the U.S. are shutting down their stores or reducing hours in response to the coronavirus pandemic.

The decisions, while smart for customers, workers and the community at large, will no doubt weigh heavily on the already-stressed retail industry. One analyst has estimated this could result in a record year for permanent retail store closures, which could mount to over 15,000.

Public health officials have asked people to refrain from large gatherings to help stem the spread of the virus. They say the virus can be spread from person-to-person when they are in close contact with one another, often through respiratory droplets emitted when an infected person coughs or sneezes. Researchers say the virus can live on surfaces for several days. For this reason, retailers that remain open have stepped up cleaning measures.

To date, there are at least 3,774 confirmed COVID-19 cases in the U.S., and at least 69 deaths, according to the latest data from Johns Hopkins University.

On Sunday, Abercrombie & Fitch announced store closures outside the Asia-Pacific region, but it warned the situation would have a “material adverse” impact on its financial performance. As a result, the company withdrew its earnings forecast. It likely won’t be the last retailer to offer up such a warning.

Jefferies analyst Randal Konick said he expects to see more retailers close stores, and if they don’t, they likely will see little demand as malls become ghost towns.

“With stores accounting for 75% of sales for most retailers, we anticipate massive EPS declines for 1Q, especially as most retailers appear to be paying employees during the 2 week closures,” Konick wrote in a research note.

In Italy and France, where COVID-19 cases have been rising rapidly, all non-essential retail has been ordered to be shut down to help prevent the spread of the virus.

Retailers that sell essentials like food, medicine and cleanings supplies have seen a surge in demand. Some grocers have been forced to limit the number of certain products to prevent hoarding, and employees are working hard to keep items on the shelves.

CEOs of both Walmart and Target appeared alongside President Donald Trump on Friday as he provided an update on the U.S.‘s response to the coronavirus. Target CEO Brian Cornell and Walmart CEO Doug McMillon said they would offer space in the stores’ parking lots for virus testing.

Here are some of the announcements retailers have made so far. This list is being updated daily as new announcements come in.

Abercrombie & Fitch

From Sunday, March 15 through March 28, Abercrombie & Fitch plans to close all its stores outside of the Asia-Pacific region. Online stores will continue to operate. In addition to its namesake brand, the retailer operates Hollister stores. It has about 880 stores worldwide.

“The decision to close all our stores outside of the APAC region has been done with a focus on the wellbeing of our associates, our customers, our partners, and our communities, and it is in keeping with our commitment to being a responsible corporate citizen,” said CEO Fran Horowitz.

But the store closures are creating much uncertainty about the retailer’s business prompting the company to withdraw the financial outlook it issued earlier this month for both the fiscal first quarter and full year.

Allbirds

Corporate staff is working remotely, but all stores are closed in the U.S. and Europe from March 15-27. The shoe retailer will continue to offer its employees full pay and benefits during this time. Online ordering is still available at this time.

“It’s hard to navigate the unknown, but as we continue to better understand how to slow the spread of COVID-19 we want to do all we can to keep our customers, employees and local communities safe,” co-founders Tim Brown and Joey Zwillinger said in an email.

American Dream

The New Jersey megamall is closing March 16 and delaying the openings of new attractions, which had been scheduled for March 19. The closure will last through at least the end of March.

Co-CEOs Don and Mark Ghermezian said they hope the shutdown will curb the spread of the virus. The outbreak is just the latest challenge for the megamall, which has faced many setbacks and changes in ownership since it broke ground in 2004.

Apple

The iPhone maker closed all of its stores outside of greater China until March 27.

“As rates of new infections continue to grow in other places, we’re taking additional steps to protect our team members and customers,” Apple CEO Tim Cook said in a blog post Friday. Apple had closed all of its mainland China stores in early February, but by March 13, they had reopened with limited working hours. Cook said that all hourly workers will “will continue to receive pay in alignment with business as usual operations.”

Aritzia

The clothing retailer has shut its more than 90 stores across North America “until further notice,” according to its website. Its online business is still operating. Aritzia also said that all of its profits for the time being are being funneled into its Community Relief Fund, to help workers and their families who are being impacted.

Away

The luggage startup is closing its stores for at least two weeks starting close of business March 16. It is also delaying the opening of a new store in Dallas. But its online business will continue during this time.

Away has a dozen stores, including the Dallas location, according to the company’s website. Ten of the stores are in the U.S., and it has one in London and Toronto.

The company said all employees will receive pay while stores are closed. It said it will encourage employees at its corporate offices to work remotely. Away has more than 500 corporate and retail employees.

“Travel is at the heart of what we do at Away, because it brings us all together,” the company said in a letter on its website. “In this uncertain time, we urge our community to continue to act with compassion and care as we consider how we move about the world, and take all necessary precautions to protect yourselves and each other.”

Buck Mason

The men’s clothing company has closed its stores until at least March 19. It has 10 locations in the U.S., in cities including New York and San Francisco, according to its website. Its online business is expected to stay open during this time.

Buck Mason said it will be compensating all employees during the planned closures. It added that it will continue shipping internet orders “with no breaks in service.”

Columbia Sportswear

The sportswear company is shutting all of its stores across North America until at least March 27. Its website is still up and running. Columbia had 122 outlet stores and 21 branded stores in the U.S. as of Dec. 31, according to its website.

“Columbia has been in business since 1938 and weathered many storms by keeping our focus on the well-being of consumers, employees and the larger community,” CEO Tim Boyle said in a statement.

Everlane

The clothing retailer is closing its six stores until March 28, but said its online store will stay open. The company said it will pay store employees during the closures and urge corporate employees to work remotely.

In an FAQ on its website, Everlane said its factories and distribution center will continue to operate and it said it plans to launch new products as brick-and-mortar locations are closed. “Our hope is that we can bring some sense of normalcy to our customers who still want to shop with us,” it said.

Fossil

The watch retailer has shut all of its stores and outlet locations in North America until March 28. Fossil said workers will still be compensated for their hours until then. Fossil’s online business is still operating at this time.

Gap

The company is cutting store hours in the U.S. and Canada, starting Monday, across its namesake Gap brand, Banana Republic, Janie and Jack, Athleta and its outlet stores. Gap Inc. also said it is closing over 100 select stores, based on guidance from local government and health officials.

It said it has put into place “enhanced continued pay policies to further support both its full and part time employees in light of this situation.”

“We are reviewing information each day and hour that influences how we must operate differently right now – both in how we run our business and in our everyday lives,” incoming Gap Inc. CEO Sonia Syngal said in a statement. “We have been using the learnings from our Asia teams, who have been weathering this crisis over the past several months…”

Glossier

The cosmetics retailer is closing all stores and ceasing online operations, according to a blog post from founder and CEO Emily Weiss. Glossier has locations in Atlanta, New York and London and is delaying the opening of a new location in Arizona. The closure is planned for two weeks and employees will be compensated during this time.

“This is a tough call for many reasons,” Weiss said in the post. “In our New York City flagship alone, 2,000 people gather daily from around the world.”

Levi Strauss & Co.

The denim maker is temporarily closings its owned and operated retail locations in the U.S. and Canada from Monday through at least March 27. Levi Strauss & Co. said all store workers will be paid for their scheduled hours during the closures. Its online business is still up and running.

“We are facing an unprecedented global pandemic, and our first priority is to do the right thing for the health and safety of our employees and our consumers,” CEO Chip Bergh said in a statement.

The company said it will provide more details about how COVID-19 is impacting its business when it reports quarterly earnings on April 7.

Lululemon

The athleticwear retailer is closing its stores in North America and Europe, from this Monday through March 27. Lululemon said Sunday that it will continue to pay workers for all of their hours during this time. And they will receive pay for 14 days if they are asked to self-quarantine due to COVID-19.

“We are living in uncertain times and we’re learning more about this virus every day,” CEO Calvin McDonald said in a statement. “We are taking this step to help protect our global community, guests and people, and ensure we are doing our part to prevent the spread of COVID-19.”

Lululemon said customers can still shop online in the interim.

Lush Cosmetics

Lush Cosmetics is shutting all 258 of its locations across the U.S. and Canada from this Monday to March 29. It said it is guaranteeing regular pay for all employees during this time.

Because of the store closures, this also means the company will be scaling down its North American manufacturing and distribution operations in the interim. All of its soaps and other goods are made on a weekly basis. Lush said it will still be running its business online. Its owners called COVID-19 “un-chartered territory.”

Neighborhood Goods

The Texas-based company that has been described as “the department store of the future” has closed its three stores in the U.S. until at least March 27. Neighborhood Goods says its team will be paid in full throughout this time, and that pay will not be deducted from a worker’s PTO or sick leave. Its website is still up and running.

“Put simply, commerce does not outweigh our civic duty,” co-founder Matt Alexander said in a statement. “We’re a modest member of an incredible community of brands and personalities, many of whom are acting swiftly for the betterment of us all. It’s a remarkable thing to behold, amidst all of the uncertainty.”

Nike

Nike said it will close its stores in the U.S., Canada, Western Europe, Australia and New Zealand beginning Monday through March 27. Workers will still be paid in full during this time off. Nike had 384 retail stores in the U.S., including Converse and its outlet locations, at the end of 2019, according to SEC filings. Internationally, it had more than 750 locations.

Outdoor Voices

The athletic apparel retailers has closed all of its 11 stores in the U.S. until March 27. It has also postponed all of its community events until further notice. Outdoor Voices said it will be compensating all scheduled store employees in the meantime, and its will employees from its Austin, TX, headquarters will be working remotely.

Patagonia

The sporting goods retailer closed all of its stores and operations. In a memo posted on its website on Friday, Patagonia said, “the scale of impact is still unknown, and we want to do our part to protect our community especially while testing availability is unknown.” Workers will receive regular pay in the interim. While Patagonia did not provide a reopen date, it said it would give an update on March 27. The retailer has 37 in the U.S., according to its website.

Peloton

Peloton has closed close its more than 96 retail showrooms in the U.S. and abroad until March 29. Its online retail business will operate as usual. It said it will continue to produce live content for its bike riders from a closed set.

“As of now, our Field Operations teams will continue to deliver Peloton Bikes and Treads to people’s homes, while taking extra precautions to address the safety of both our Members and our team,” CEO John Foley said in a statement.

PVH

The owner of Calvin Klein, among other brands, is closing all of its locations across North America and Europe beginning Tuesday through March 29. PVH said all of its retail workers will still receive full pay and benefits for their scheduled shifts during this time. PVH’s online businesses are still operating. The company added that many of its stores across the Asia-Pacific region have since re-opened, though some shops are running on reduced hours.

“While retail store traffic has shown some improvement over the past month, it remains down significantly compared with the prior year,” the company said in a statement.

PVH said it will update analysts and investors on how COVID-19 is impacting its business when it reports earnings on April 2.

Reformation

The women’s clothing company has shut all 19 of its stores temporarily, until further notice, according to its website.

REI

The outdoor apparel and recreation retailer will close all of its 162 U.S. stores from Monday through March 27.

REI said all store employees will be paid during the temporary closure. It will also offer free shipping for all purchases on REI.com while stores are closed.

“This is a difficult decision for any business, and I do not make it lightly,” CEO Eric Artz said in a letter on the company’s website. “Our decisions are grounded in the belief that there are more important things than business right now—we owe that to one another.”

Rent the Runway

The clothing and accessories rental company has closed its stores in New York, California, Illinois and Washington, D.C., as of Monday until March 27. Rent the Runway said that all of its scheduled shop workers will be compensated during this time period. Its HQ team will be working from home.

Instead of visiting these stores, Rent the Runway customers have been encouraged to still return their orders, in order to check out new items, via the mail.

Rothy’s

The shoe retailer has temporarily closed its four stores in the U.S. through at least the end of March, according to its website. “Our primary focus remains keeping you and each member of our team feeling safe, healthy and supported in the coming days and weeks,” the company said.

Under Armour

The sporting goods retailer will close all of its stores in North America from Monday through March 28. Under Armour said all of its workers will receive pay during this time. It had 188 locations in North America as of Dec. 31, 2019, according to SEC filings. That consists of 169 factory-outlet shops.

“We are monitoring the situation globally, and closure decisions are being made on a country-by-country basis as necessary to protect our teammates and customers,” a spokesperson said in an emailed statement.

Urban Outfitters

Urban Outfitters operates about 600 stores under the brands Urban Outfitters, Anthropologie, Free People, Terrain and Nuuly. The retailer said its stores will close temporarily until at least March 28. Its online and subscription businesses will continue to operate. All employees also will be paid during the closure, the company said.

Its corporate staff is working remotely, but other workers who are unable to do their jobs from home are working in staggered shifts in order to create “social distance.”

VF Corp.

The owner of brands including Vans and Timberland has closed all of its stores across North America through April 5. Its corporate and brand offices in North America are also being shut down during this time. VF Corp. said that store employees will still receive their full pay and benefits during the closures, which could be extended depending on how long the pandemic lasts.

“The decision to close our retail stores, as well as our corporate and brand offices in North America, is the responsible thing to do to help mitigate the spread of the virus through social distancing,” Chairman Steve Rendle said in a statement.

The company added that it has experienced limited disruption to its supply chain, overall, due to COVID-19.

Walmart

The nation’s largest retailer is closing its stores overnight to allow for cleaning and restocking. Stores that were open 24-hours will now operate from 6 am to 11pm. The retailer has more than 4,700 Walmart and Neighborhood Market locations in the U.S. The shortened hours affect about 2,200 stores across the country that are open 24 hours a day.

Warby Parker

The eyeglass retailer is keeping its online operations running but all stores will close March 15 through March 27. Retail team members will continue to be paid as if they were working in stores during this time, the company said.

Coronavirus crash is a true ‘Black Swan’ as Goldman thought the economy was nearly recession-proof

PUBLISHED SAT, MAR 14 202010:54 AM EDT

Al Lewis@IN/TELLITTOAL/@TELLITTOAL

KEY POINTS

- Goldman Sachs analysts declared the U.S. economy all but recession proof – it wasn’t.

- The problem with economic forecasts is that they can’t anticipate unforeseen events like the coronavirus pandemic.

- Economists debate whether the U.S. is truly headed for a recession, but economic pain is already here.

Goldman Sachs’ economists declared the U.S. economy all but recession-proof at the dawning of 2020, but now it appears a coronavirus-induced recession may have begun just a few months later.

The analysis didn’t account for a “Black Swan,” a term for an improbable and unforeseen event. Instead, it explored the idea of a “Great Moderation,” which is characterized by low volatility, sustainable growth and muted inflation.

“Overall, the changes underlying the Great Moderation appear intact, and we see the economy as structurally less recession-prone today,” Goldman economists Jan Hatzius and David Mericle wrote.

The economy, they argued, would settle gently after 11 years of growth.

“While new risks could emerge, none of the main sources of recent recessions — oil shocks, inflationary overheating, and financial Imbalances — seem too concerning for now. As a result, the prospects for a soft landing look better than widely thought.”

All the risk assessment and economic modeling in the world is futile if it can’t anticipate the one variable that matters most — particularly if it’s a pandemic.

Pioneering economist Burton Malkiel, who is also chief investment office at Wealthfront, was also bullish on the U.S. economy as the year began. Appearing on CNBC’s “Squawk on the Street,” he said he could not spot a recession on the horizon. He also qualified his remarks by saying that predicting a recession is a very difficult task.

“My guess is, if we have a recession, what’s going to cause it is some shock that we don’t know of now,” said Malkiel, author of the 1973 book “A Random Walk Down Wall Street.”

“Some international shock,” he predicted. “It’s going to be something like that, not something we can see in the immediate future.”

Has the recession arrived?

Recessions are not officially declared until the economy is already deep into them, or until after they’ve passed.

Economist Alan Blinder told CNBC’s “Squawk on the Street” on Wednesday that the U.S. was probably already in a recession as the coronavirus outbreak cancelled conferences, events and travel plans.

“I wouldn’t be one bit surprised if when we look back at the data, it is decided … that the recession started in March,” said Blinder, a former Federal Reserve vice chairman who now serves as a professor at Princeton. “It wouldn’t be a bit surprising to me.”

By slight contrast, JPMorgan economists predict the U.S. will skirt the technical definition of a recession. They’re calling for negative growth in the nation’s gross domestic product, but they’re calling that a “novel-global recession” since it will only be temporary, according to their forecast.

In January, it was easy to make bullish forecasts because stocks were setting record highs. Coronavirus was just beginning to make headlines, and it was the furthest worry from most investor’s minds. Many economists and analysts, in fact, were expecting a slowing economy to glide to a soft landing.

Unheeded warnings

Still, analysts warned about flat corporate earnings, weak manufacturing, high corporate debt loads, a possible resurgence of the U.S.-China trade war, and a potentially divisive election cycle. And for a brief moment, the top worry was the prospect of a war with Iran after an air strike that killed Qasem Soleimani, an Iranian major general in the Islamic Revolutionary Guard Corps.

“A violent escalation of hostilities between the U.S. is nearly certain in the coming days, a game changer that will obscure everything else,” declared Greg Valliere, chief U.S. policy strategist at AGF Investments. “There’s a reason, finally for caution in the stock market.”

Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America Merrill Lynch, had put out a note that said the corporate earnings outlook was flat and that the market “feels toppy.”

“Weak revisions don’t bode well for early 2020,” she wrote.

Other market observers warned about lofty price-to-earnings ratios and a high concentration of investment in just a handful of stocks, such as Facebook, Apple, Amazon, Netflix and Google parent Alphabet.

“We still think the greatest risk in the equity market remains in growth stocks, where expectations are too high and priced,” Michael Wilson, chief U.S. equity strategist at Morgan Stanley, wrote in December.

UBS analysts warned of a coming wave of credit downgrades for U.S. stocks, which may still be on the way as a pandemic grinds portions of the economy to a halt.

“It’s no great secret that U.S. companies have been piling on debt in the past decade,” the analysts wrote. “A mere ten years after the financial crisis, total non-financial corporate debt stands just shy of $10 trillion, or about 50% higher than the lows seen in 2009. Interestingly, debt is NOT a major theme in today’s marketplace.”

Last summer, recession worries escalated when the bond market experienced an inversion of the yield curve. Short-term Treasurys began paying a higher yield than long-term Treasurys – a phenomenon that portends a downturn is due within the next 22 months or so.

Michael Darda, chief economist and market strategist, warned that ignoring the yield curve was a mistake. “We are somewhat baffled by the gaggle of Wall Street strategists cheerleading the soft landing based on what we believe is a faulty reading of the macro indicators,” he wrote. “One frequent refrain is that we now have an upward sloping yield curve and hence recession risk has evanesced. Yet, the curve is, on average, 12 months ahead of the cycle, not an instantaneous indicator of real time recession risk.”

In the end, most of the things investors were worried about did not trigger one of the biggest market crashes in Wall Street history or the economic pain that most assuredly will follow. It was an outbreak of a new virus that many thought would be contained to foreign lands — and this was truly a Black Swan.

“We are going into a global recession,” warns chief economic advisor at Allianz Mohamed El-Erian, who correctly called the bear market as it approached. “The economic damage is going to last.”

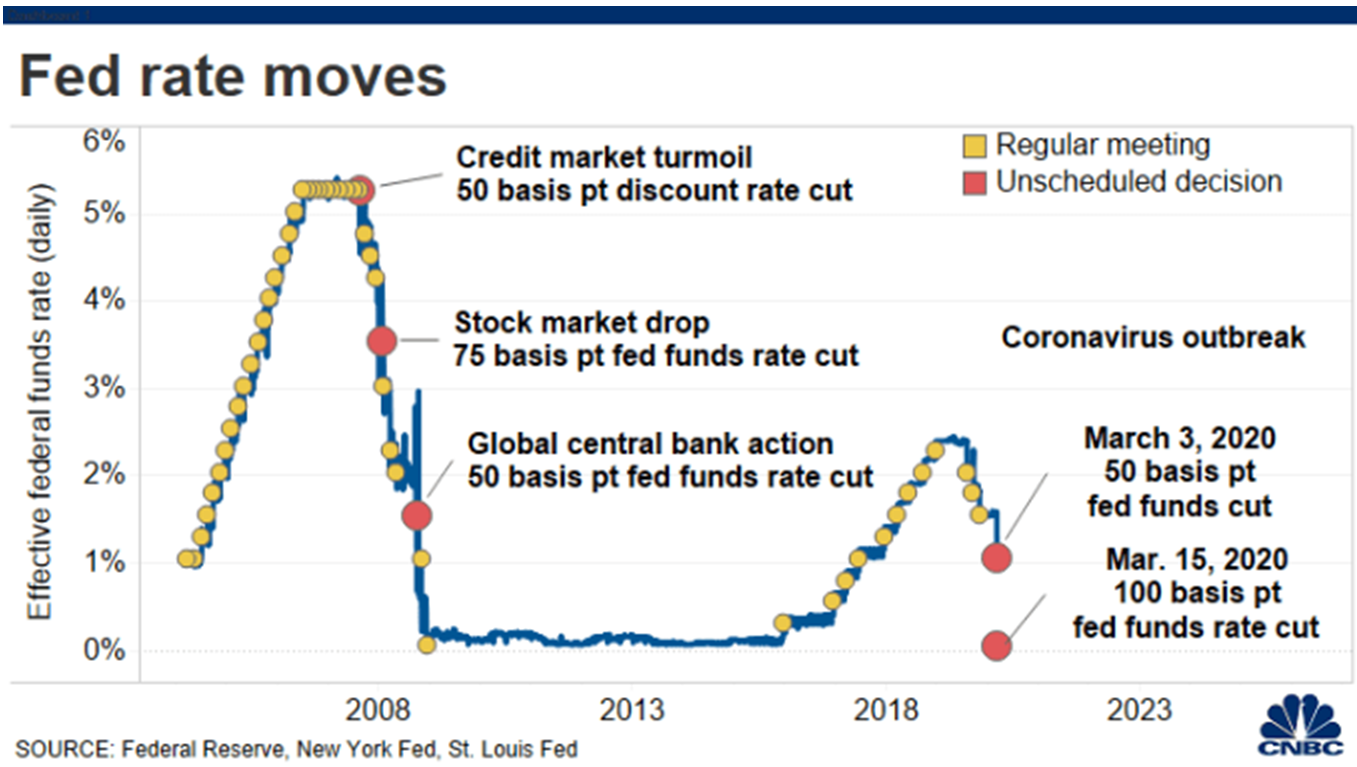

Federal Reserve cuts rates to zero and launches massive $700 billion quantitative easing program

PUBLISHED SUN, MAR 15 20205:00 PM EDTUPDATED 4 HOURS AGO

KEY POINTS

- In an emergency move Sunday, the Federal Reserve announced it is dropping its benchmark interest rate to zero and launching a new round of quantitative easing.

- The QE program will entail $700 billion worth of asset purchases entailing Treasurys and mortgage-backed securities.

- Markets responded negatively, with Dow futures pointing to a drop of 900 points when the market opens Monday morning.

The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus.

The new fed funds rate, used as a benchmark both for short-term lending for financial institutions and as a peg to many consumer rates, will now be targeted at 0% to 0.25% down from a previous target range of 1% to 1.25%.

Facing highly disrupted financial markets, the Fed also slashed the rate of emergency lending at the discount window for banks by 125 basis points to 0.25%, and lengthened the term of loans to 90 days.

Despite the aggressive move, the market’s initial response was negative. Dow futures pointed to a decline of some 1,000 points at the Wall Street open Monday morning.

The discount window “plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy … [and] supports the smooth flow of credit to households and businesses,” a separate Fed note said.

The discount window is part of the Fed’s function as the “lender of last resort” to the banking industry. Institutions can use the window for liquidity needs, though some are reluctant to do as it can indicate they are experiencing financial issues and thus sends a bad message.

Global coordinated action

The Fed also cut reserve requirements for thousands of banks to zero. In addition, in a global coordinated move by centrals banks, the Fed said the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank took action to enhance dollar liquidity around the world through existing dollar swap arrangements.

The banks lowered the rate on these swap line loans and extended the period for such loans. The actions by the Fed appeared to be the largest single day set of moves the bank had ever taken, mirroring in many ways its efforts during the financial crisis that were rolled out over several months. Sunday’s move includes multiple programs, rate cuts and QE, but all in a single day.

At a press conference Sunday evening following the decision, Powell said the Fed would be patient before lifting rates again.

“We will maintain the rate at this level until we’re confident that the economy has weathered recent events and is on track to achieve our maximum employment and price stability goals,” Powell said.

“That’s the test … some things have to happen before we consider … we’re going to be watching, and willing to be patient, certainly,” he added.

The quantitative easing will take the form of $500 billion of Treasurys and $200 billion of agency-backed mortgage securities. The Fed said the purchases will begin Monday with a $40 billion installment.

Cleveland Fed President Loretta Mester was the lone no vote, preferring to set rates at 0.5% to 0.75%, which would have represented a 50 basis point, of half percentage point, reduction.

The Fed added in its statement that it “is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.”

It appeared, though it was not entirely clear, that the meeting that took place will replace the regularly scheduled meeting of the Federal Open Market Committee.

The move follows several actions by the Fed over the past two weeks in which it enacted a 50 basis point emergency rate cut and expanded the overnight credit offering, or repo, for the financial system up to $1.5 trillion.

—CNBC’s Jeff Cox contributed.

Coronavirus updates: Fed slashes rates to shore up economy, US stock futures plunge

PUBLISHED SUN, MAR 15 20208:38 AM EDTUPDATED SUN, MAR 15 20208:48 PM EDT

The coverage on this live blog has ended — but for up-to-the-minute coverage on the coronavirus, visit the live blog from CNBC’s Asia-Pacific team.

All times below are in Eastern time.

- Global cases: More than 156,000, according to Johns Hopkins University

- Global deaths: At least 5,833, according to Johns Hopkins University

- S. cases: At least 2,952, according to Johns Hopkins University

- S. deaths: At least 57, according to Johns Hopkins University

7:25 pm: Plunging stock market futures hit ‘limit down’

Stock futures tanked in overnight trading on Sunday, triggering “limit down” levels to reduce panic in markets.

Contracts on the S&P 500 dropped 5%, reaching a “limit down” band made by the CME futures exchange to prevent further losses. No prices can trade below that threshold, only at higher prices than that down 5% limit.

Dow Jones Industrial Average futures plunged more than 1,000 points, also triggering the limit down level. The halt occurs during non-U.S. trading hours — that is before the 9:30 a.m. ET open of regular trading.

The brutal sell-off in the futures market came even after the Federal Reserve cut interest rates to near zero in an aggressive bid to save the U.S. economy from the coronavirus fallout. —Yun Li

HI Financial Services Mid-Week 06-24-2014