HI Market View Commentary 03-02-2020

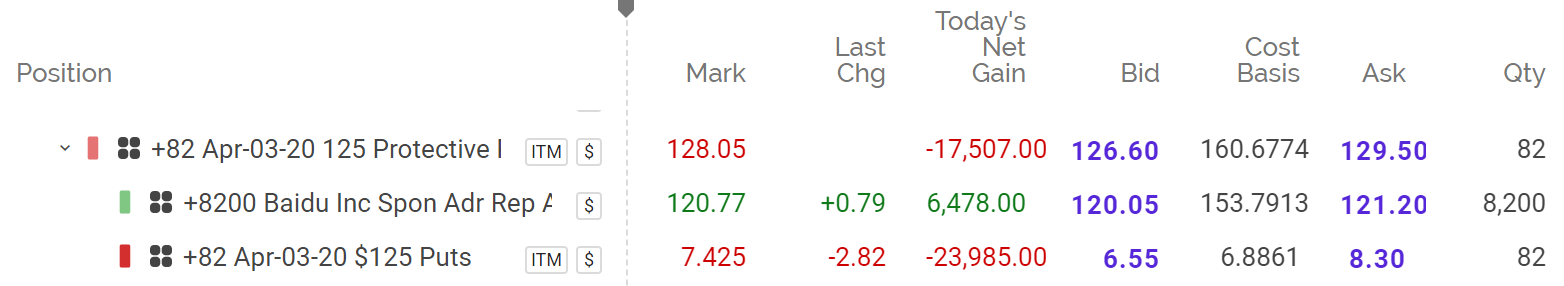

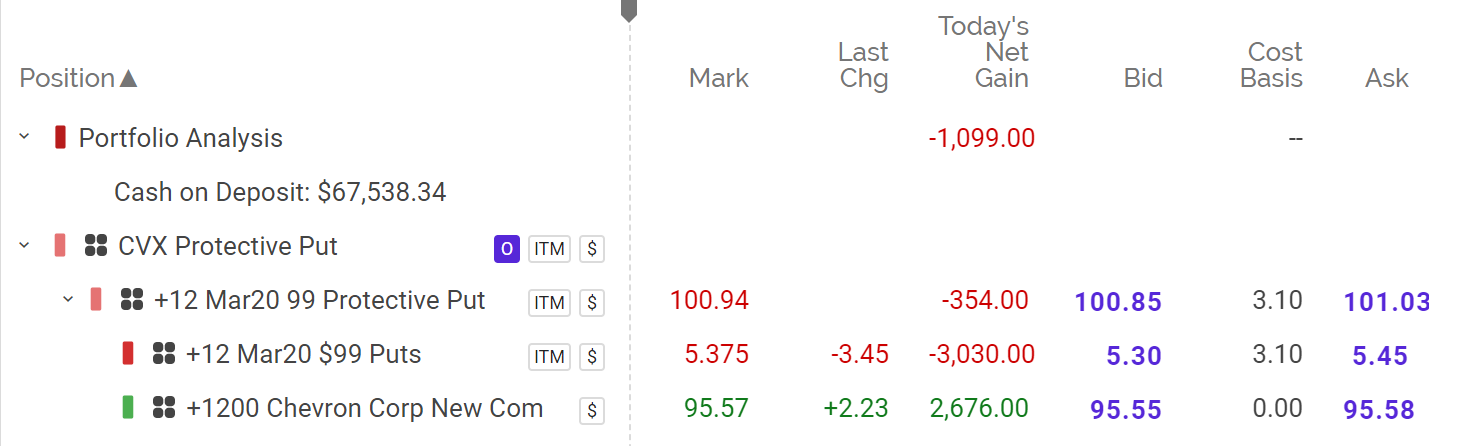

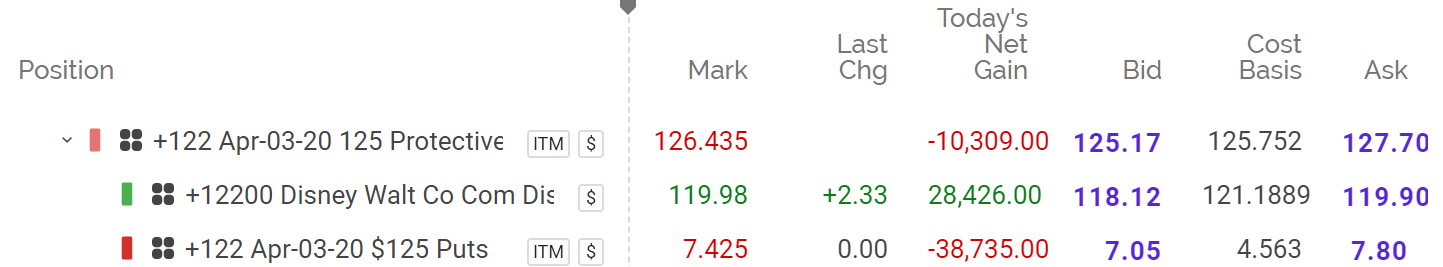

Here is the best example of what I’ve been telling you why it’s risky to buy insurance (long puts) through high volatility

The KEY to what we do us to make up some of the downward movement so when things come back they don’t have to move as far for us to be profitable

We had twice as many insurance contracts on stock positions at the start of today and anyplace we had double the insurance protection we took one set off = ALL for a profit

Some other bullish call position ( stock option replacements) we dollar cost averaged today

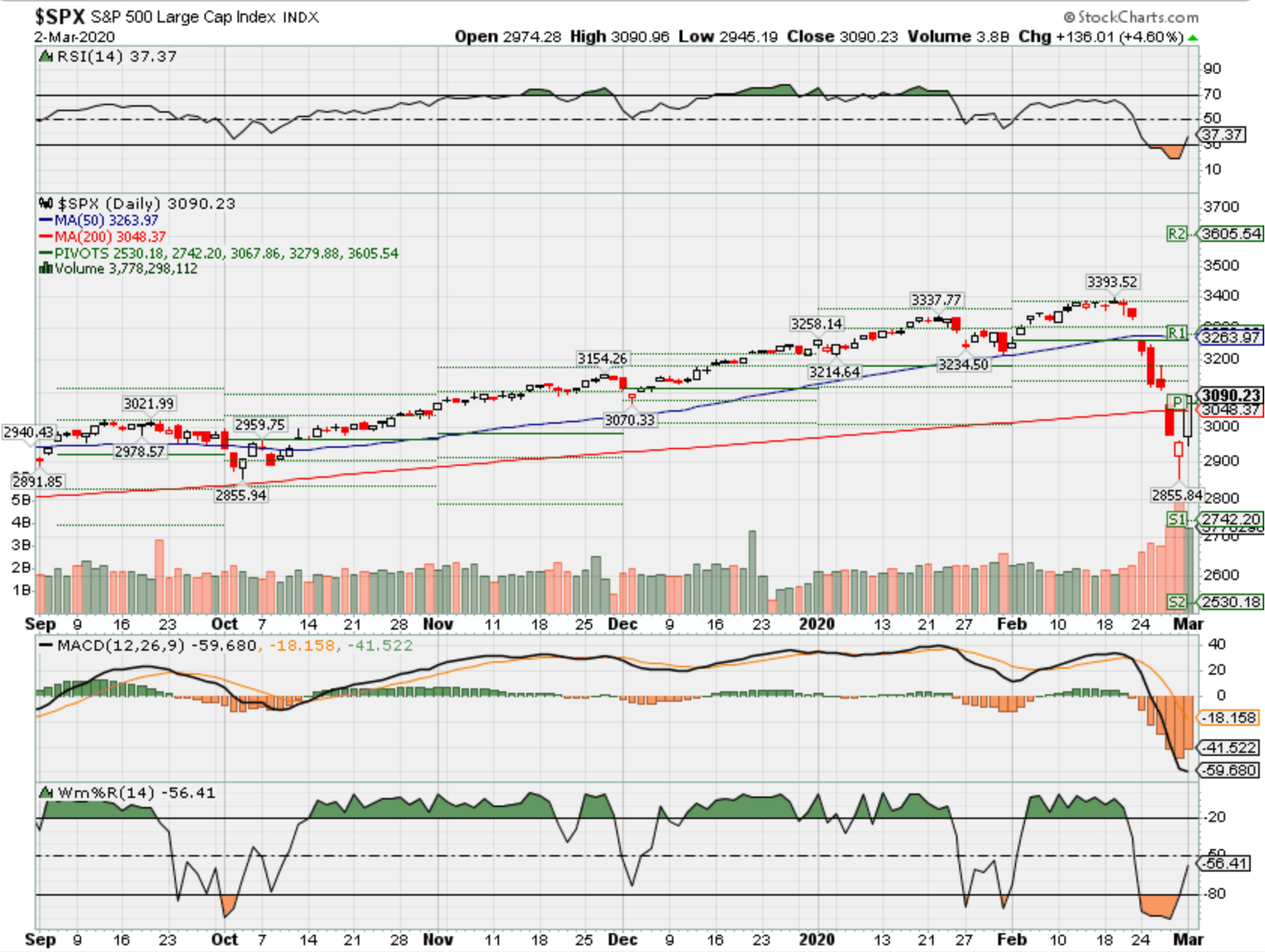

Markets in turmoil ?!?!?!???? Up again on Super Tuesday?

With cash on hand we can enter new positions, take off protection and play the short term run up

ANYTHING we make up to the downside is profit as things come back

| Market Recap |

| WEEK OF FEB. 24 THROUGH FEB. 28, 2020 |

| The Standard & Poor’s 500 index plummeted 11.5% last week as COVID-19-led panic gripped the financial markets and fueled a selling frenzy among all sectors within the S&P.

The energy sector, down 16.4%, again bore the brunt of investors’ risk aversion, followed by outsized losses in the financial sector, which was off 13.6%, and the material and industrial sectors, both sliding 12.6%. The S&P ended the week at 2,954.22, down from last week’s closing level of 3,337.75, vaporizing all of the benchmark’s gains for 2020 in less than one week amid concerns that self-imposed and national-level quarantines will choke off consumer spending and cause the US economy to stall. As fears of a global pandemic continued to reverberate from the prior week, selling pressure went into overdrive after the US Centers for Disease Control warned of the likelihood of an “extremely serious outbreak” of the coronavirus in the US. The US Food and Drug Administration and German officials exacerbated fears with their own warnings that the spread of the virus could no longer be tracked. As a result, by Friday, the S&P suffered its biggest one-week loss since the 2008 financial crisis. The energy sector limped into the close with concerns about global growth prospects weighing on the sector, amplified by a rumored rift between Saudi Arabia and Russia concerning possible production cuts. All component stocks within the sector suffered heavy losses with Devon Energy (DVN), Cimarex Energy (XEC) and Occidental Petroleum (OXY) down by as much as 29% from a week ago. Record-low Treasury yields trashed the financial sector, which was down 12.9% for the week. Among Wall Street’s largest banks, Bank of America (BAC) was the worst-performing stock, down 17.1%, followed by a 17.0% drop in the share price of Citi Group (C). Even JPMorgan (JPM) couldn’t escape the carnage with a loss of 14.5% from last Friday’s close. Defensive sectors didn’t fare any better. Utilities were down 11.6% and real estate stocks — despite better-than-expected new home sales and pending homes sales data this week — lost more than 12% as investors fled equity assets for safety in US Treasuries. In the tech space (-11.1%), chipmakers led the downturn as concerns about disruptions to global supply chains left shares of Advanced Micro Devices (AMD) and Nvidia (NVDA) lower by 14.6% and 8.2%, respectively. Despite upbeat Q4 results, Nomura downgraded Nvidia this week to reduce from neutral citing a growing risk to the company from the coronavirus. Consumer-related sectors didn’t fare much better with consumer discretionary and consumer staples sectors slumping 11.1% and 10.3%, respectively. In consumer discretionary, Booking Holdings (BKNG) took a 12.1% hit on the week after cutting its guidance, again citing the COVID-19 impact. |

Positive today – AAPL, COST

Now we know what we can buy on the dips

Where will our markets end this week?

Higher

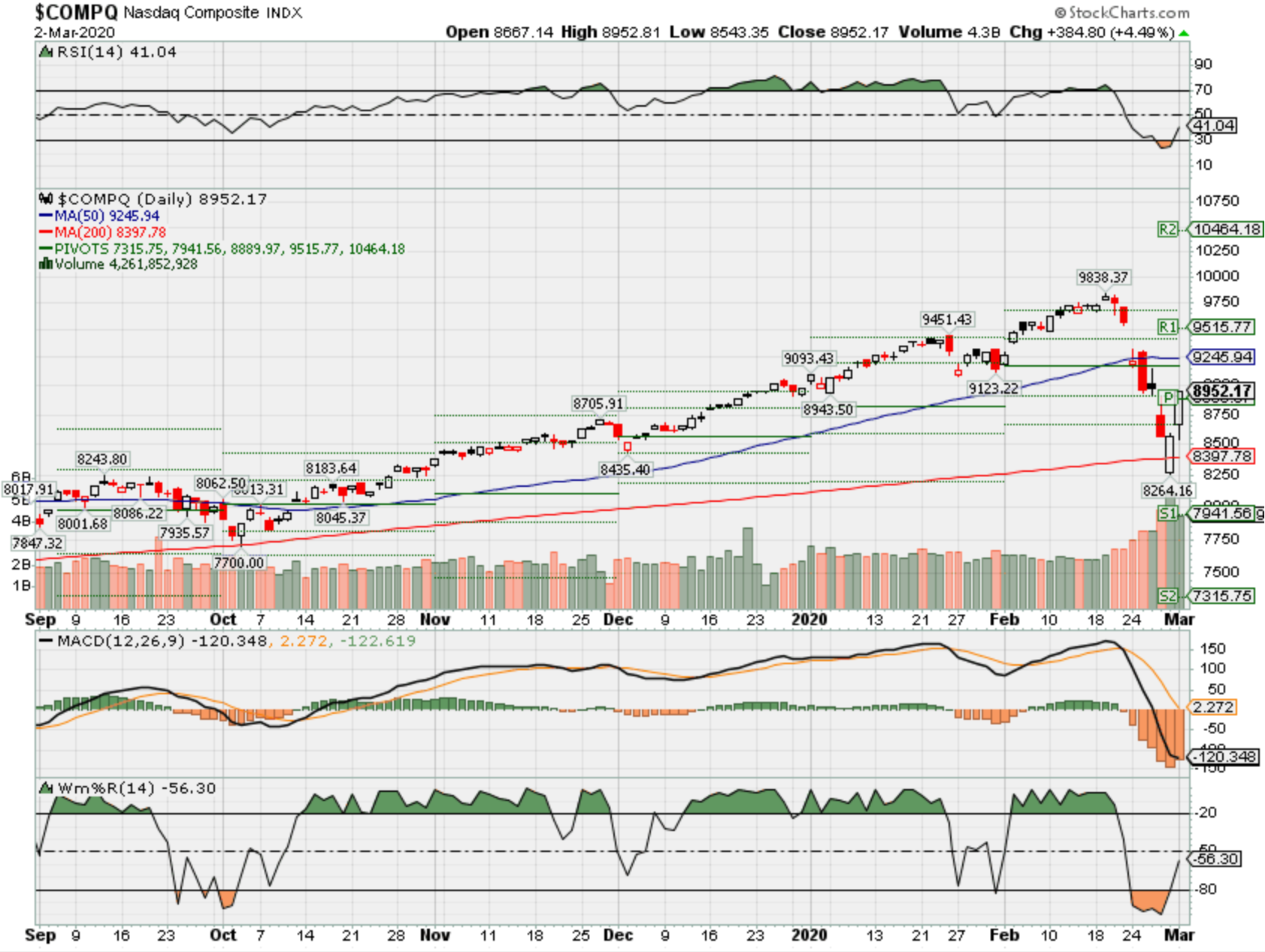

SPX – Bearish

COMP – Bearish

Where Will the SPX end March 2020?

03-02-2020 +5.2 %

Earnings:

Mon: JD

Tues: AZO, FLR, KSS, HPE, JWN, ROST, URBN, TGT

Wed: ANF, CPB, DLTR, AEO, MRVL, ZM

Thur: BJ, BURL, GNC, KR, AOBC

Fri: ADT, CHUY, LOCO,

Econ Reports:

Mon: Construction Spending, ISM Manufacturing

Tues: Auto, Truck

Wed: MBA, ADP Employment, ISM Services

Thur: Initial, Continuing, Productivity, Until Labor Costs, Factory Orders,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Trade Balance, Consumer Credit

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings are coming up and protecting through earnings with protective puts and NO short Calls

AOBC – 3/06 AMC

MU – 3/19 est

TGT – 3/02 BMO

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Deutsche Bank bumps Disney target

Feb. 25, 2020 10:36 AM ET|About: The Walt Disney Company (DIS)|By: Jason Aycock, SA News Editor

Deutsche Bank has boosted its price target on Walt Disney (DIS -1.4%) by about 6%.

The firm has a new target of $147, now implying 12% upside.

It’s keeping a Hold rating; by contrast, most of the sell side is Bullish on Disney stock.

Seeking Alpha authors are Bullish as well, while Disney has a Quant Rating of Neutral.

GE: More Good News For Investors

Feb. 26, 2020 8:44 AM ET

Summary

General Electric made great progress towards stabilizing its balance sheet and cash flow during 2019.

The possibility of substantial unrecognized liabilities in GE’s runoff insurance business represents one of the biggest remaining risks for investors.

GE recently completed its annual statutory cash flow testing for the insurance business, resulting in no major changes to its existing reserve funding plan.

Many investors appear to attribute negative value to GE Capital, but its actual value could be close to its $15.3 billion book value.

General Electric (GE) entered 2019 with a dismal outlook and a gaping hole in its balance sheet. However, the company dramatically outperformed management’s initial expectations during the year, particularly in terms of cash flow production. Meanwhile, GE lined up a series of asset sales to shore up its balance sheet.

In short, over the past year, General Electric has addressed many of the concerns that had been weighing on its share price. One of the biggest remaining questions entering 2020 was whether GE had reserved enough cash to meet its legacy insurance obligations. Two years ago, the company disclosed that it would need to add about $15 billion to its reserves over seven years to address rising claims in its long-term care reinsurance business.

However, for the second time since that shocking announcement, GE has completed the annual statutory cash flow testing for its insurance operations with no major changes needed to its funding plan. That’s great news for investors as GE continues to work through its turnaround plan.

The balance sheet has been fixed

During 2019, General Electric completed the sale of its transportation division and sold another chunk of its stake in Baker Hughes (BKR), ending its majority ownership of that company. Together, those moves brought in $9 billion of proceeds, with another $9 billion or so on the way, mainly from GE selling the rest of its Baker Hughes stake. Meanwhile, GE completed $12 billion of asset reductions at its GE Capital subsidiary last year.

The biggest divestiture of all was announced a year ago but has not been completed yet. GE is selling its biopharma business to Danaher (DHR) for total consideration of approximately $21.4 billion (including $21 billion of cash). Danaher’s management recently confirmed that the deal is on track to close this quarter.

Thanks to these moves, GE reduced the debt-to-equity ratio at GE Capital from 5.7x to 3.9x during 2019, achieving its target of a debt-to-equity ratio of less than 4x. The industrial side of the business reduced its adjusted net debt by $7 billion last year. Leverage fell to 4.2x EBITDA from 4.8x EBITDA a year earlier.

Importantly, GE’s pension deficit increased by only $900 million during 2019, despite a sharp drop in interest rates. By contrast, CEO Larry Culp had warned in September that lower interest rates could cause the deficit to surge by $7 billion.

Between the closing of the biopharma deal and additional sales of Baker Hughes shares, GE is on track to reduce its net debt to 2.5 times EBITDA or less by the end of 2020. In tandem with the conservative leverage ratio at GE Capital, that would give the company solid, investment-grade credit metrics. As I have previously discussed, this means GE has the balance sheet flexibility to absorb additional losses in its run-off insurance businesses. However, those liabilities may not be as large as many investors assume.

(Source: General Electric Q4 2019 Investor Day Presentation, slide 7)

Insurance risk may be overstated

GE investors and analysts were blindsided by the size of the one-time charge and required reserve contribution announced in early 2018. As a result, many have been waiting for the proverbial other shoe to drop ever since.

In essence, announcing a giant shortfall did not cause most investors to believe that GE was now using realistic (as opposed to optimistic) assumptions to assess its insurance liabilities. It just made them fear that if the required reserves could increase by nearly $15 billion in a single year, they could potentially increase by another $15 billion in any year going forward.

These fears started to subside during 2019, as new CEO Larry Culp restored a sense of order to the company. It was a short-lived respite, though. Last August, serial whistleblower Harry Markopolos alleged that GE would need to boost its long-term care reserves by another $18.5 billion, beyond the $14.5 billion it had already agreed to contribute.

The Kansas Insurance Department (which regulates GE’s insurance business) quickly responded that Markopolos had not submitted any allegations of fraud to the department. It also noted that Markopolos had a conflict of interest, as he stood to profit from betting against GE stock and from filing a formal federal whistleblower complaint. Most notably, the department stated, “After initial review, components of this particular report appear fairly simplistic in nature and don’t appear to incorporate certain technical reserve considerations that were considered during the Department’s most recent financial examination…”

Of course, GE concurred with the regulator’s assessment. More significantly, an independent analysis from Goldman Sachs (GS) also found that GE’s budgeted long-term care reserves were about right.

(Source: GE March 2019 Insurance Teach-In Presentation, slide 5)

At an investor conference last week, Culp revealed that this year’s annual statutory cash flow testing for GE’s insurance business found a negligible deficiency of about $100 million. Many analysts had expected a much larger hit of up to $1 billion. Of course, GE bears like Markopolos have been warning that the deficiency could be at least an order of magnitude higher.

GE Capital may be worth more than zero

Some bears will undoubtedly shrug off last week’s news as another output of GE’s bad (or even fraudulent) accounting. However, this line of thought is based in a circular, unfalsifiable logic: bad results are taken as evidence of GE’s weak financial position; good results are taken as evidence that GE is committing fraud to cover up its weak financial position.

Taken together, the Kansas Insurance Department’s critique of Markopolos’ report, Goldman Sachs’ independent analysis, and GE’s recent statutory cash-flow testing results can’t decisively disprove the contention that GE needs to dramatically increase its insurance reserves. But they do put the allegations in context. There is some risk that GE would need to dramatically increase its insurance reserves again in the future, but it is not the most likely outcome.

Indeed, whereas the insurance business was an underappreciated source of risk a few years ago, the market may now be overestimating the risk from GE’s insurance subsidiaries. Most investors appear to view GE Capital as a liability rather than an asset. That’s not very surprising, given that it has been the source of several big special charges, has frequently reported operating losses in recent quarters, and has required repeated cash infusions.

However, the GE Capital business has a positive book value of $15.3 billion. Most of its continuing operations are quite profitable. If GE is estimating its insurance liabilities properly now, this segment could easily be worth book value, which translates to about $1.75 per share. By contrast, in previous attempts to value GE as the sum of its parts, I have assumed that GE Capital is worth zero to be conservative.

With GE stock currently trading for less than $12 after Monday’s big selloff, getting even $1/share of value out of GE Capital (which would still leave room for nearly $10 billion of additional pre-tax charges) would be positive for shareholders. Thus, investors reassessing the value of GE Capital (and starting to treat it as an asset rather than a liability) could be a significant lever for share price appreciation at GE over the next five years or so.

If you enjoyed this article, please scroll up and click the follow button to receive updates on my latest research covering the airline, auto, retail, and real estate industries.

Disclosure: I am/we are long GE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Here’s how long stock market corrections last and how bad they can get

PUBLISHED THU, FEB 27 202010:43 AM ESTUPDATED THU, FEB 27 20204:24 PM EST

KEY POINTS

- There have been 26 market corrections (not including Thursday) since World War II with an average decline of 13.7%.

- Recoveries have taken four months on average.

- The most recent corrections occurred from September 2018 to December 2018. The S&P 500 bounced into and out of correction territory throughout the autumn of 2018.

- The S&P 500′s close below 3,047.53 — its current threshold for a correction — also marked the quickest 10% decline from an all-time high in the index’s history.

The U.S. stock market fell into a correction Thursday as investors punished equities in favor of safer assets as anxiety over the spread and potential impact of the virulent coronavirus.

A correction is defined as a 10% decline in one of the major U.S. stock indexes, typically the S&P 500 or Dow Jones Industrial Average, from a recent 52-week high close.

Historical analysis shows these corrections result in a 13% decline and take about four months to recover to prior levels, on average.

But there’s one big caveat. This is only if it does not fall into bear market territory, down 20% from a high. If the losses stretch to 20%, then there’s more pain ahead and a longer recovery time.

Here are the numbers, according to CNBC and Goldman Sachs analysis:

- There have been 26 market corrections (not including Thursday) since World War II with an average decline of 13.7% over an average of four months.

- Recoveries have taken four months on average.

- The most recent corrections occurred from September 2018 to December 2018. The S&P 500 bounced into and out of correction throughout the autumn of 2018 before plunging into a bear market (a 20% decline from its all-time high) on Christmas Eve.

The Dow and the S&P 500 each fell 4.4% on Thursday — the Dow lost a record 1,190.9 points — and each closed well in correction territory based on their recent record close. The S&P 500 and Dow are each down more than 10% since Monday and more than 12% each since their respective all-time intraday and closing highs hit earlier in February.

The S&P 500′s close below 3,047.53 — its current threshold for a correction — also marked the quickest 10% decline from an all-time high in the index’s history, according to Bespoke Investment Group.

- There have been 12 bear markets since World War II with an average decline of 32.5% as measured on a close-to-close basis.

- The most recent was October 2007 to March 2009, when the market dropped 57% and then took more than four years to recover. The S&P 500 closed in a bear market in December 2018 using intraday data.

- Bear markets have lasted 14.5 months on average and have taken two years to recover on average.

— CNBC’s Nate Rattner contributed reporting.

BNP Paribas names the Asian stocks to buy during — and after — the coronavirus outbreak

PUBLISHED SUN, FEB 23 202011:42 PM EST

KEY POINTS

- Sectors such as travel and tourism, consumer discretionary and manufacturing that’s closely linked to Chinese production were the “obvious losers” in the coronavirus epidemic, BNP Paribas analysts wrote in a Friday report.

- But as more consumers choose to stay home, online retail players will stand to benefit, the analysts said.

- In addition, some Asian economies are less exposed to the potential economic fallout in China — which make them a safe market to invest in now, they said.

- BNP Paribas identified the Asian sectors and stocks that are “safe” to invest in now, and after concerns about the virus ease.

The global spread of the new coronavirus has shown little signs of abating, with several analysts warning that the hit to economies worldwide could be more severe than what’s currently expected.

“We believe it is too early to call an end to the market turmoil arising from the COVID-19 outbreak,” analysts from BNP Paribas, France’s largest bank, wrote in a Friday report. The new coronavirus, believed to have first emerged from the Chinese city of Wuhan in Hubei province, was recently named COVID-19 by the World Health Organization.

The bank said that while “the true extent of the stress on the Chinese economy is just beginning to emerge,” the degree to which China is economically linked with the rest of Asia means that “all the Asian markets could suffer — some more, some less.”

Sectors such as travel and tourism, consumer discretionary and manufacturing that’s dependent on production input from China were the “obvious losers” of the coronavirus epidemic, the analysts said in the report.

But that doesn’t mean investors should avoid buying Asian stocks now.

‘Safe’ sectors and stocks to buy now

As more consumers choose to stay home, online retail players stand to benefit, said BNP Paribas.

In addition, some Asian economies are less exposed to the potential economic fallout in China — that makes them a safe market to invest in now, the analysts said, adding that “India is the first one that comes to mind.”

Here are the sectors and stocks that BNP Paribas identified as safe to invest in now:

- Chinese internet: Tencent, Alibaba, Baiduand com

- Chinese telecom: China Mobileand China Unicom

- Chinese education: China Education Group

- Indian IT: Infosys, HCL Tech

- Indian telecom: Bharti Airtel

- Indian consumer staples: Marico Industries

Sectors and stocks to buy during recovery

When concerns surrounding COVID-19 ease, some sectors most impacted by the outbreak could bounce back sharply, according to the bank.

“We expect the Chinese consumption to recover rapidly. Tourism might not, as changes in consumer behaviour, especially where such behaviour could potentially expose one to infection, could be much more long drawn out,” the analysts said.

They added that as manufacturers in China resume operations, concerns about output disruptions would “rapidly diminish.” That’s good news for economies and regional companies that are closely tied to China’s production, they said.

These are the sectors and stocks that BNP Paribas said could bounce back:

- Chinese consumer discretionary: Jiangsu Yanghe Brewery, Anta Sports, Brilliance China, Midea Group, Sands China, MGM China

- Chinese energy: CNOOC

- Korean tech: Samsung Electronics, SK Hynix

- Taiwan tech: TSMC, Hon Hai, Largan Precision

The BNP report was released on Friday, before South Korea raised the alert on the disease to its highest level on the weekend. The number of cases on Friday morning was 204 — it tripled to 763 on Monday morning.

10-year Treasury yield collapses to another record low below 1.12%, 2-year rate tumbles to 0.9%

PUBLISHED FRI, FEB 28 20202:01 AM ESTUPDATED FRI, FEB 28 20203:14 PM EST

The 10-year U.S. Treasury yield plunged to a fresh record low on Friday as investors dumped riskier assets and searched for safer options amid the coronavirus outbreak.

The benchmark rate traded at 1.116%, marking the first time ever it traded below 1.2%. The 2-year rate slid to 0.874%, its lowest level since Nov. 2016. Yields move inversely to bond prices, which are rising as purchases surge.

The 10-year yield has tumbled more than 30 basis points this week alone as the massive sell-off in stocks intensified. (A basis point is 0.01%.)

TREASURYS

| TICKER | COMPANY | YIELD | CHANGE | %CHANGE |

| US 3-MO | U.S. 3 Month Treasury | 1.211 | -0.074 | 0.00 |

| US 1-YR | U.S. 1 Year Treasury | 0.937 | -0.046 | 0.00 |

| US 2-YR | U.S. 2 Year Treasury | 0.909 | 0.031 | 0.00 |

| US 5-YR | U.S. 5 Year Treasury | 0.944 | 0.032 | 0.00 |

| US 10-YR | U.S. 10 Year Treasury | 1.163 | 0.037 | 0.00 |

| US 30-YR | U.S. 30 Year Treasury | 1.718 | 0.05 | 0.00 |

Concerns about the global economic impact of the coronavirus have dented investor sentiment this week. The death toll in China from the virus has topped 2,700. New Zealand and Nigeria reported their first coronavirus cases overnight. In Iran, the number of cases has grown to nearly 400.

The outbreak sent investors fleeing equities in favor of Treasurys, which have traditionally been a safer alternative to stocks. The Dow Jones Industrial Average and S&P 500 were headed for their biggest one-week losses since the financial crisis.

Yields tumbled as the Fed signaled late Friday it might be willing to support the economy if necessary. Fed Chairman Jerome Powell said the central bank is monitoring the coronavirus for risks it poses.

“The fundamentals of the U.S. economy remain strong,” Powell said in a mid-day statement. “However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

The Dow tumbled another 1,000 points at its low on Friday, bringing its losses this week to nearly 4,000 points. The 30-stock benchmark plummeted nearly 1,200 points on Thursday — its biggest one-day point drop ever — closing in correction territory along with the S&P 500 and Nasdaq Composite.

“Markets seem to view an impossible trade-off: draconian quarantine measures triggering recession or a pandemic. Either scenario is extreme but it’s too early to fade rate moves,” Ralf Preusser, global head of rates strategy at Bank of America Merrill Lynch, said in a note on Friday.

Amid the market rout, traders are increasingly pricing in Fed rate cuts in the coming months. The fed funds futures market is assigning a 100% chance of at least one rate cut at the Fed’s March policy meeting, according to the CME FedWatch Tool.

St. Louis Fed President James Bullard said Friday the outbreak would have to reach levels of the ordinary flu before he would consider cutting interest rates.

“The Fed can’t do anything to stop the spread of COVID-19, but they also can’t stand idly by in the face of a global equity correction,” Ian Lyngen, BMO’s head of U.S. rates, said in a note on Friday. “The market believes the Powell Put is alive and well; the current episode will function as an important litmus test for this core tenet.”

Yields remained lower after solid economic data on Friday. Consumer sentiment climbed to its highest level since March 2018, while personal income rose 0.6% in January, more than the 0.3% rise expected.

— CNBC’s Silvia Amaro and Michael Bloom contributed reporting

Jim Cramer: 10 tech stocks to buy now in this coronavirus-plagued market

PUBLISHED THU, FEB 27 20206:49 PM ESTUPDATED THU, FEB 27 20206:55 PM EST

Tyler Clifford@_TYLERTHETYLER_

KEY POINTS

- CNBC’s Jim Cramer recommended 10 tech stocks that he said “don’t need China, they don’t need the Fed, they don’t need enterprise spending and they don’t need us to stop the coronavirus.”

- “If anything, some of them should do even better as this outbreak gets worse,” the “Mad Money” host said.

- Cramer’s basket of stocks are levered to the stay-at-home environment.

CNBC’s Jim Cramer on Thursday rolled out a list of technology stocks that investors can pick from in the current volatile environment on Wall Street.

The “Mad Money” host said these companies can benefit from a “stay-at-home era” — performing well even if consumers don’t go out in public in order to avoid coming in contact with the spreading coronavirus.

“These 10 tech stocks … don’t need China, they don’t need the Fed, they don’t need enterprise spending and they don’t need us to stop the coronavirus,” Cramer said. “If anything, some of them should do even better as this outbreak gets worse.”

Cramer presented his suggestions after the major averages went through another brutal trading day this week. The Dow Jones Industrial Average shed 1,190.95 points, or 4.4%, for its biggest one-day point drop in history. The S&P 500 also lost 4.4% of value, and the tech-heavy Nasdaq dropped 4.6%.

Investors are trying to digest the potential impact of an already slowing global economy, further pressured by the COVID-19 outbreak, which is dragging stock prices down. Cramer said the 10 stock picks can work, even if the epidemic spreads across the United States as public health officials have warned.

The host said the market is now oversold.

“If you can find stocks with solid, long-term secular growth themes that have persistently high growth, regardless of the economy, that have little China exposure and, most importantly, that work in a largely stay-at-home … environment, then these names will be worth buying tomorrow,” Cramer said.

- At $337.52, Adobe stock is more than $45 off its Feb. 19 close

- “In my view, Adobe’s the best of the cloud kings, and I like that Morgan Stanley just this morning bumped its price target from $410 to $450 in the teeth of an obvious sell-off,” Cramer said.

- Etsy shares surged 14% to $57.92 on a top in its fourth-quarter report.

- “I was looking for stocks where people can use the product while they’re working from home … and that’s exactly what Etsy is for both buyers and sellers,” Cramer said. “It’s the ultimate remote stock.”

- Moderna shares last traded at $26.16, $3 off the all-time closing high Wednesday.

- The stock jumped almost 57% between two days earlier this week on hopes that the biotech company could develop a coronavirus vaccine.

- Shares of Nvidia, a gaming and data center supplier, are down about $62 to $252.60 since Feb. 19

- “If anything, the data center will only grow as more people stay at home, and gaming is the ultimate stay-at-home entertainment,” Cramer said

- Cloud communications provider RingCentral shares have pulled back $13 to $235.73 in the past six trading days.

- “Businesses bring in RingCentral so their employees can stay in touch with customers wherever they are … and however they want to be reached,” Cramer said.

- Shopify stock at $438.37 is almost 20% off its closing high on Feb. 19

- “Right now, you’re getting a brutal exogenous pullback in the stock. I think you can start buying it right here,” Cramer said.

- Square shares are off 7.5% in the past week, closing at $79.31.

- “Their Square Cash app is growing like a weed, they have a remarkable payments processing business with a terrific money-lending kicker that’s tied right to [a client’s cash] register,” Cramer said, adding it’s a potential takeover candidate.

- Teladoc, a telemedicine company, saw its stock value surge 15.7% to $135.15 per share Thursday. The stock is up more than 61% this year.

- Cramer suggested investors can either wait for a pullback or pounce on the stock now.

- Shares of Trade Desk, a digital advertising company, have plummeted more than 20% to $250.01 since Feb. 19.

- “This is the company that’s heavily levered to cord cutting for at-home [television] watching,” Cramer said.

- Zoom Video Communications, which provides work collaboration and video conferencing tools, set a new all-time closing high of $113.55.

- Zoom Video is “the No. 1 name to buy … on any pullback because it is the ultimate stay-at-home” stock, Cramer said.

Disclosure: Cramer’s charitable trust owns shares of Nvidia.

https://www.cnbc.com/2020/03/01/awaiting-us-stock-futures-open-at-6-pm-after-wall-streets-worst-week-since-2008.html?__source=iosappshare%7Ccom.apple.UIKit.activity.Mail

Dow roars back from coronavirus sell-off with biggest gain since 2009, surges 5.1%

PUBLISHED SUN, MAR 1 20205:27 PM ESTUPDATED 2 HOURS AGO

Stocks rebounded sharply from their worst week since the financial crisis on Monday, with the Dow Jones Industrial Average posting its best day in more than a decade. Expectations that the Federal Reserve would cut rates drove the gains, which accelerated aggressively into the close.

The Dow closed 1,293.96 points higher, or 5.1%, at 26,703.32. The move on a percentage basis was the Dow’s biggest since March 2009. It was the largest-ever points gain for the 30-stock average.

The S&P 500 climbed 4.6% — its best one-day performance since Dec. 26, 2018 — to close at 3,090.23. The Nasdaq Composite also had its best day since 2018, surging 4.5% to 8,952.16.

Monday’s gains snapped a seven-day losing streak for the Dow.

Apple shares led the Dow higher with a 9.3% jump; Merck and Walmart gained 6.3% and 7.6%, respectively. Utilities, tech, consumer staples and real estate all rose more than 5% to lead the S&P 500 higher.

The major averages were coming off a massive decline from the week before as worries over the coronavirus spreading dented investor sentiment.

“The market has been conditioned to buy on any weakness,” said Keith Buchanan, portfolio manager at GLOBALT. “We’ve grown accustomed to bad days being followed by a few good days in a row.”

The major averages had their worst weekly performance since 2008 last week and entered correction territory, down more than 10% from all-time highs set last month. On Monday, however, the Dow, S&P 500 and Nasdaq all closed out of correction. The Dow and Nasdaq were 9.7% and 9% below their respective record highs. The S&P 500 ended the day 8.9% below its all-time high.

But Peter Cardillo, chief market economist at Spartan Capital Securities, was skeptical the worst was over for the market.

“I wouldn’t put too much into this,” he said, noting longer-dated U.S. Treasurys are still trading near record levels as coronavirus fears persist. “Although I think we’re getting close to putting in a bottom, I still think we need to drop another 2% to 3% to have some sort of capitulation.”

More than 89,000 cases have been confirmed around the world along with more than 3,000 virus-related deaths. Australia, Thailand and the U.S. reported over the weekend their first coronavirus-related deaths. Rhode Island was the first U.S. state on the East Coast to report a coronavirus case.

The number of cases in England rose to 35 after 12 new cases were confirmed on Sunday. Cases in China also reported more than 500 new cases on Saturday. New York Gov. Andrew Cuomo confirmed Sunday night the state’s first positive coronavirus case.

Horrible China economic data

Wall Street got its first look over the weekend at the economic toll the virus has taken on China, the epicenter of the outbreak.

A private survey on Chinese manufacturing activity released during Asian trading hours on Monday came in at its weakest level ever. The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) came in at 40.3 for February, far below expectations of a reading of 45.7 by economists in a Reuters poll. PMI readings above 50 indicate expansion, while those below that level signify a contraction.

That came after an official data released Saturday showed China’s official manufacturing PMI plunging to 35.7 in February, a record low, from 50 in January. A reading below 50 indicates contraction in a sector.

The plunge “shows the extent to which an outbreak can hit an economy,” said Ed Hyman, a widely followed economist on Wall Street and Evercore ISI chairman, in a note to clients. “All this is quite uncertain, and we may be overreacting. But we also don’t want to underreact.”

Gaming revenues in Macau also plunged nearly 88% last month.

Data out of the U.S. was also lackluster. The ISM manufacturing index fell to 50.1 in February, the lowest level since the end of 2019. It also came below an estimate of 50.8.

Worries over the coronavirus’ impact on corporate profits and the global economy led investors to seek safer alternatives to stocks, pushing U.S. Treasury yields to all-time lows. On Sunday night, the benchmark 10-year rate broke below 1.04% for the first time ever. It was last at 1.14%.

“Global investors will be prone to panic as the virus arrives at their doorstep, underscoring the need for near-run prudence and patience before augmenting favored holdings,” strategists at MRB Partners wrote in a note. “The outlook is uncertain, or rather certainly bearish in the near term as quarantining spreads around the world, but with considerable doubt as to the duration and depth of the economic fallout.”

But at the end of the day, the weak data didn’t matter as expectations increased for easier monetary policy from global central banks, including the Federal Reserve.

CME Group’s FedWatch tool shows traders have priced in a 100% probability of a 50 basis-point rate cut later this month. Expectations for another rate cut in April are around 70%.

“The ultimate risk factor in our view is the U.S. consumer,” said Gregory Faranello, head of U.S. rates trading at AmeriVet Securities. “We have coronavirus cases showing up in the U.S. To the extent that that continues to spread, which we all hope will not be the case, the risk factor for the Fed grows because this now is no longer something that they can point the finger to relative to tariffs and say the global economy is slow, but we’re okay.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

HI Financial Services Mid-Week 06-24-2014