HI Market View Commentary 02-08-2021

Presidents Day on Monday and the market is closed. Which means “ big money probably out Thursday morning and low volumes”

What is happening in today’s market. Melting up and waiting for a the sugar rush stimulus package.

In general we are having a very nice run to the beginning of the year AND still have plenty of other positions to move higher

Expectation: we have drop on the near horizon that will most likely come after the one week stimulus sugar rush. There is nothing on the stimulus bill that pushes our markets higher

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

Where will our markets end this week?

DOWN

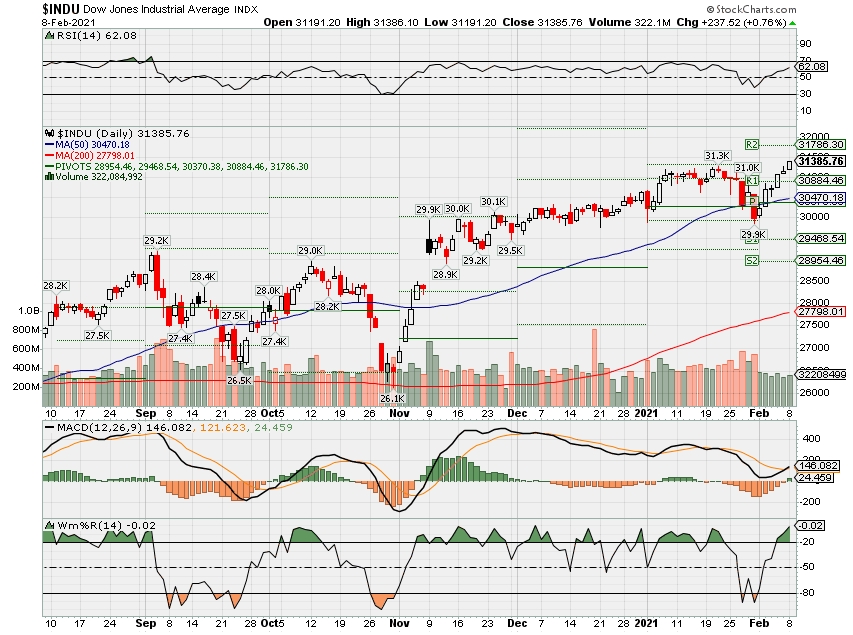

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2021?

02-08-2021 -2.0%

02-01-2021 -2.0%

Earnings:

Mon: HAS

Tues: ARCH, CGC, DD, GT, RCH, AKAM, CSCO, MAT, TWTR, VOYA, YELP

Wed: CME, ELY, UBER, WU, ZNGA, KO, GM, UAA, MGM

Thur: DUK, K, KHC, PEP, GDDY, HUBS, ROKU, AUY, TAP, DIS

Fri: D

Econ Reports:

Mon:

Tues: NFIB Small Business Index

Wed: MBA, Core CPI, CPI, Treasury Budget, Wholesale Inventory

Thur: Initial Claims, Continuing Claims,

Fri: Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Waiting for earnings and will protective put into this earnings season and add short calls after the announcement and after I listen to the guidance

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Proposal(s)

- 1.

Change of Authorised Share Capital by One-to-Eighty Subdivision of Shares: By an Ordinary Resolution that each share classified as Class A ordinary shares, Class B ordinary shares and preferred shares of a par value of US$0.00005 each in the share capital of the Company (including authorised issued and unissued class A ordinary shares, class B ordinary shares and preferred shares) be sub-divided into 80 shares of a par value of US$0.000000625 each (the “Subdivision”), such that, following …(due to space limits, see proxy material for full proposal).

BOARD RECOMMENDATION: NONE

WE VOTED AGAINST

Biden says it will be difficult to achieve Covid herd immunity before summer’s end

Tucker Higgins@IN/TUCKER-HIGGINS-5B162295/@TUCKERHIGGINS

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- President Biden made his comment in a CBS interview that aired before Sunday’s Super Bowl.

- “The idea that this can be done and we can get to herd immunity much before the end of this summer is very difficult,” Biden said.

- The comment came after journalist Norah O’Donnell said that at the current rate, it would take almost a year to vaccinate enough Americans to achieve herd immunity.

President Joe Biden won’t commit to achieving herd immunity to the coronavirus in the U.S. by the end of summer, suggesting a long road ahead to defeating the deadly virus.

“The idea that this can be done and we can get to herd immunity much before the end of this summer is very difficult,” Biden said in an interview broadcast on CBS on Sunday before the Super Bowl.

The comment came after journalist Norah O’Donnell said that at the current daily rate of about 1.3 million doses, it would take almost a year to vaccinate enough Americans to achieve herd immunity.

The White House has set a goal of 100 million doses in Biden’s first 100 days as a minimum, though the pace of vaccinations is higher than that. Biden seemed to up his goal late last month by saying he thinks the U.S. could administer up to 1.5 million doses per day.

Biden’s cautious remarks are in line with the warnings of scientists and public health officials as well as his past statements. They mark a reversal from the approach of Biden’s predecessor, former President Donald Trump, who often claimed that the end of the pandemic was around the corner.

Dr. Anthony Fauci, the nation’s leading epidemiologist, has said at least 75% of the public must be inoculated against Covid-19 to achieve herd immunity. He has predicted a return to normal some time next fall.

Biden also said during the interview that he was exploring new ways to speed up vaccinations.

He said he supported a proposal from the National Football League to use its 30 stadiums as mass vaccination centers, but stopped short of committing to the plan.

“I’m telling my team they are available, and I believe we’ll use them,” Biden said.

Since it spread to the U.S. a year ago, the virus has killed more than 460,000 people in the U.S. and infected nearly 27 million.

https://www.fool.com/investing/2021/02/05/3-no-brainer-stocks-buy-artificial-intelligence/

3 No-Brainer Stocks to Buy in Artificial Intelligence

Baidu and two other companies are still great plays on the AI market.

In fiction, artificial intelligence is often associated with intelligent androids or dystopian futures. But in reality, the AI market mainly revolves around crunching large amounts of data to make quick decisions.

Demand for these services — which power analytics tools, driverless cars, voice assistants, and more — is climbing. The global AI market was already worth $39.9 billion in 2019, according to Grand View Research, but could still grow at a compound annual growth rate of 42.2% between 2020 and 2027.

That’s why many companies are jumping aboard the AI bandwagon. Some of those companies, such as C3.ai (NYSE:AI), are too hot to handle. But several other tech stocks — including Baidu (NASDAQ:BIDU), Palantir (NYSE:PLTR), and NVIDIA (NASDAQ:NVDA) — are still great long-term plays on the growing AI market.

1. Baidu

Baidu, which owns China’s largest search engine, is one of the world’s most advanced AI companies. Its AI services power its main apps, as well as its DuerOS voice assistant and Apollo platform for driverless cars.

DuerOS processed 2.7 billion monthly voice queries last quarter, up 65% from a year ago. The OS provides over 4,300 skills for its mobile apps, Xiaodu smart speakers, Xiaodu Smart Earphones, various third-party hardware devices, and its automotive platform Apollo.

Over 100 automotive and tech companies, including Intel and Ford, are developing self-driving platforms with Apollo. Baidu already launched driverless taxis powered by its services across China last year, and it recently formed a joint venture with the Chinese automaker Geely to produce autonomous electric vehicles.

Baidu’s simultaneous expansion across the AI, voice assistant, and automotive markets could extend its reach beyond traditional searches and reduce its overall dependence on ad revenue.

Baidu’s business might seem weak right now, since its core advertising revenue has withered year over year for six straight quarters. But as I recently noted, its advertising business is recovering, and the stock still looks reasonably valued at 24 times forward earnings.

2. Palantir

Palantir’s data mining platforms, which are used by both government and enterprise customers, gather data on individuals and groups from disparate sources to help organizations make informed decisions.

Its Gotham platform, which is used by the U.S. government, helps the military and government agencies track individuals and plan missions. In its prospectus, Palantir boldly claims Gotham will become the “default operating system for data across the U.S. government.”

But Gotham is also a tinderbox of controversy. In one recent example, the company’s own employees protested its contract with Immigration and Customs Enforcement (ICE) after its tools were used to identify and deport undocumented immigrants. Its Foundry platform, which offers similar services to enterprise customers and other organizations, is less controversial.

Palantir might not appeal to everyone, but its growth is impressive. It expects its revenue to rise 44% in fiscal 2020, fueled by new contracts and big renewals, and analysts anticipate 32% growth in fiscal 2021.

Palantir still isn’t profitable, and its stock isn’t cheap at 45 times next year’s sales. But its Gotham platform will likely power the U.S. government’s AI-driven decisions for the foreseeable future, while Foundry — which still accounts for less than half of Palantir’s revenue — still has room to grow.

3. NVIDIA

NVIDIA is best known for its gaming GPUs, but its higher-end GPUs also process machine learning and AI tasks in data centers. That’s why revenue from its data center business, which acquired the networking technology company Mellanox last April, surged 162% year over year to $1.9 billion last quarter and accounted for 40% of its top line.

NVIDIA also powers driverless cars with its Drive platform, which bundles together its ARM-based Tegra CPUs, GPUs, and other technologies in onboard computers to help cars drive themselves. Over 370 automotive and tech companies, including Baidu, currently use NVIDIA’s Drive technologies.

NVIDIA’s automotive revenue declined last quarter, mainly due to the pandemic’s impact on auto sales, but the strength of its data center business and its gaming revenue — which surged 37% year over year to $2.3 billion — easily offset that decline.

As a result, NVIDIA expects its revenue to rise 51% this fiscal year, and analysts expect its earnings to grow 68%. Next year, they expect its revenue and earnings to rise another 21% and 20%, respectively, even after it laps its takeover of Mellanox. Its pending takeover of ARM, which still faces tough antitrust challenges, could also generate fresh streams of high-margin royalties and licensing revenue once it finally closes.

NVIDIA’s stock isn’t cheap at nearly 50 times forward earnings, but it remains a great long-term play on the AI market as the data center and automotive industries ramp up their purchases of its powerful chips.

Leo Sun owns shares of Baidu, Ford, and Palantir Technologies Inc. The Motley Fool owns shares of and recommends Baidu and NVIDIA. The Motley Fool owns shares of Palantir Technologies Inc. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.

https://finance.yahoo.com/news/investors-undervaluing-baidu-inc-nasdaq-061126445.html

Are Investors Undervaluing Baidu, Inc. (NASDAQ:BIDU) By 28%?

Simply Wall St

Thu, February 4, 2021, 11:11 PM·6 min read

How far off is Baidu, Inc. (NASDAQ:BIDU) from its intrinsic value? Using the most recent financial data, we’ll take a look at whether the stock is fairly priced by taking the forecast future cash flows of the company and discounting them back to today’s value. This will be done using the Discounted Cash Flow (DCF) model. Don’t get put off by the jargon, the math behind it is actually quite straightforward.

Remember though, that there are many ways to estimate a company’s value, and a DCF is just one method. If you still have some burning questions about this type of valuation, take a look at the Simply Wall St analysis model.

Step by step through the calculation

We are going to use a two-stage DCF model, which, as the name states, takes into account two stages of growth. The first stage is generally a higher growth period which levels off heading towards the terminal value, captured in the second ‘steady growth’ period. In the first stage we need to estimate the cash flows to the business over the next ten years. Where possible we use analyst estimates, but when these aren’t available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today’s dollars:

10-year free cash flow (FCF) forecast

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

| Levered FCF (CN¥, Millions) | CN¥25.3b | CN¥26.4b | CN¥36.2b | CN¥46.8b | CN¥54.3b | CN¥60.7b | CN¥66.1b | CN¥70.6b | CN¥74.4b | CN¥77.7b |

| Growth Rate Estimate Source | Analyst x3 | Analyst x3 | Analyst x1 | Analyst x1 | Est @ 16.03% | Est @ 11.83% | Est @ 8.9% | Est @ 6.84% | Est @ 5.4% | Est @ 4.39% |

| Present Value (CN¥, Millions) Discounted @ 9.0% | CN¥23.2k | CN¥22.2k | CN¥27.9k | CN¥33.1k | CN¥35.2k | CN¥36.1k | CN¥36.1k | CN¥35.4k | CN¥34.2k | CN¥32.8k |

(“Est” = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = CN¥316b

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country’s GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.0%) to estimate future growth. In the same way as with the 10-year ‘growth’ period, we discount future cash flows to today’s value, using a cost of equity of 9.0%.

Terminal Value (TV)= FCF2030 × (1 + g) ÷ (r – g) = CN¥78b× (1 + 2.0%) ÷ (9.0%– 2.0%) = CN¥1.1t

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= CN¥1.1t÷ ( 1 + 9.0%)10= CN¥479b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CN¥795b. In the final step we divide the equity value by the number of shares outstanding. Compared to the current share price of US$258, the company appears a touch undervalued at a 28% discount to where the stock price trades currently. Remember though, that this is just an approximate valuation, and like any complex formula – garbage in, garbage out.dcf

The assumptions

The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. You don’t have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company’s future capital requirements, so it does not give a full picture of a company’s potential performance. Given that we are looking at Baidu as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we’ve used 9.0%, which is based on a levered beta of 1.115. Beta is a measure of a stock’s volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

Next Steps:

Valuation is only one side of the coin in terms of building your investment thesis, and it ideally won’t be the sole piece of analysis you scrutinize for a company. DCF models are not the be-all and end-all of investment valuation. Instead the best use for a DCF model is to test certain assumptions and theories to see if they would lead to the company being undervalued or overvalued. If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different. What is the reason for the share price sitting below the intrinsic value? For Baidu, we’ve compiled three fundamental factors you should further research:

- Risks: We feel that you should assess the 1 warning sign for Baidu we’ve flagged before making an investment in the company.

- Future Earnings: How does BIDU’s growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

CDC director says schools can safely reopen without vaccinating teachers

Berkeley Lovelace Jr.@BERKELEYJR

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Teachers do not need to get vaccinated against Covid-19 before schools can safely reopen, the head of the Centers for Disease Control and Prevention said.

- School systems across the U.S. have been under pressure to reopen after shifting to remote learning last year due to the pandemic.

- Teachers and other faculty have expressed concerns about returning to school, potentially putting their health at risk.

Teachers do not need to get vaccinated against Covid-19 before schools can safely reopen, the head of the Centers for Disease Control and Prevention said Wednesday.

“There is increasing data to suggest that schools can safely reopen and that safe reopening does not suggest that teachers need to be vaccinated,” CDC Director Dr. Rochelle Walensky told reporters during a White House news briefing on Covid-19.

“Vaccinations of teachers is not a prerequisite for safely reopening schools,” she added.

During a press briefing later Wednesday, White House press secretary Jen Psaki walked back Walensky’s comments, saying that they were not “official guidance” from the CDC.

If Walensky were here, she would say “that they have not released their official guidance from the CDC yet on the vaccination of teachers and what would be needed to ensure the safe reopening of schools,” Psaki said.

The CDC’s Advisory Committee on Immunization Practices voted to put “frontline essential workers,” which include teachers, next in line to receive a Covid-19 vaccine after first prioritizing health-care workers and long-term care facility residents. However, it may take a while for most teachers to get their shots as U.S. officials work to pick up the pace of vaccinations.

Still, school systems across the U.S. have been under pressure to reopen after shifting to remote learning last year due to the coronavirus pandemic, which has infected more than 26.4 million Americans and killed at least 447,077 in a little over a year.

Some parents have been forced to stay at home to watch their children instead of going to work. Meanwhile, teachers and other faculty have expressed concerns about returning to school, potentially putting their health at risk.

A study from the CDC published late last month found little evidence of the virus spreading at schools in the U.S. and abroad when precautions were taken, such as wearing masks, social distancing and ventilating rooms.

The Biden administration has released a Covid rescue plan that includes providing schools and universities with $170 billion to reopen. The money would be used in part to scale up testing. The administration has said testing is a “critical” strategy for controlling the spread of the virus, but added tests are still not widely available, and the U.S. is still not using the ones it has effectively.

Walensky has previously said that schools should be the first to open and the last to close in the pandemic.

Jeff Zients, President Joe Biden’s Covid-19 czar, said Wednesday that Biden has been “very clear” that he wants schools to “reopen and to stay open.”

“That means every school has the equipment and the resources to open safely,” he said during the news briefing, urging Congress to “do its part” by passing Biden’s Covid rescue plan. “Not just private schools or schools in wealthy areas but all schools.”

Cramer lays out 7 rules for new investors to follow: ‘We are at a critical point in this market’

Tyler Clifford@_TYLERTHETYLER_

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- “If you’re part of this new cadre of investors, I am begging you to follow my seven new rules,” CNBC’s Jim Cramer said Wednesday.

- “We are at a critical point in this market, a point where the cheapest stocks are often the best and the most expensive stocks are often the worst,” the “Mad Money” host said.

- “I want to address the retail revolution … [and] put it in context, because sometimes revolutions fall apart,” he said.

CNBC’s Jim Cramer on Wednesday delivered a message of caution to retail investors who helped drive up the price of so-called meme stocks last week.

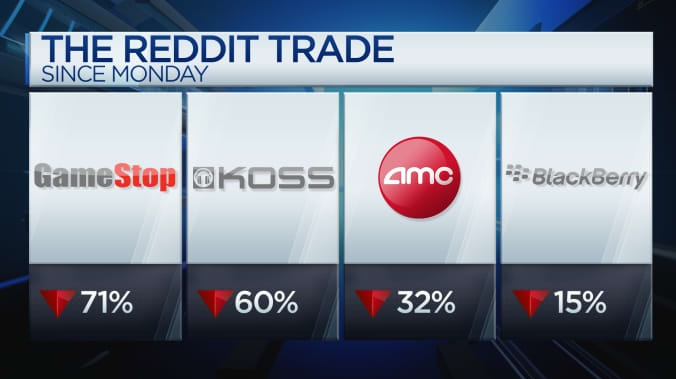

The trading activity that was sparked on Reddit ignored traditional investing logic. It triggered an unprecedented short squeeze in stocks including AMC Entertainment and GameStop that captured the attention of people in and beyond the investing community.

After a mixed day of stock trading on Wall Street, where the Dow Jones and S&P 500 indexes posted modest gains and the Nasdaq Composite slipped a couple of points, Cramer sought to introduce investing guidelines to the retail investors who participated in last week’s craze.

“If you’re part of this new cadre of investors, I am begging you to follow my seven new rules,” the “Mad Money” host said.

The new class of investors Cramer is referring to is, in large part, the tens of millions of market players introduced to stock investing by commission-free trading platforms such as Robinhood, which has come under fire for the way it handled high-volume trading in the meme stocks last week.

With shares of AMC down 56% from its highs and GameStop down 80% from its peak last week, Cramer said the Reddit revolution is at a crossroads. He advised viewers to follow accepted valuation principles such as price-to-earnings ratios to find stocks worth buying, pointing to stocks such as United Parcel Service, Abbvie and Google parent Alphabet as having more acceptable price multiples.

“There’s only one good reason to own stocks, and that’s, of course, to make money,” Cramer said. “We are at a critical point in this market, a point where the cheapest stocks are often the best and the most expensive stocks are often the worst.”

“I want to address the retail revolution … [and] put it in context, because sometimes revolutions fall apart,” he said. “Sometimes you get a two-day junta, then things go back to normal; other times they maybe take the radio station before the tanks roll in.”

Here are Cramer’s seven guiding tenets for new investors:

- Augment your capital with the stocks of companies that deserve to go higher over time

- Don’t try to wipe out other investors

- Find opportunities to capitalize on stock moves driven by emotional trading

- Don’t depend on the government to introduce regulatory changes

- Don’t borrow money from brokers to buy stocks

- Keep a sound head and follow corporate earnings reports

- Invest in companies that are in good shape and poised to do better in the future

Disclosure: Cramer’s charitable trust owns shares of Alphabet, AbbVie and United Parcel Service.

HI Financial Services Mid-Week 06-24-2014