HI Market View Commentary 02-07-2022

I’ve never viewed myself as particularly talented. Where I Excel is ridiculous, sickening, work ethic. You know, while the other guy’s sleeping (playing), I’m working” !!!!- Will Smith

So today I want to hit some cold hard facts about 2 things related to investing

#1 I want to do what you are doing?

You probably will spend about 65K in education – Spread Trade Systems, Optionetics, Investools, Safe Option Strategies, Wade Cook who went to jail – Most are BS, most education results are based on paper trading=no risk, only works in a perfect world, a poor guy teaching you how to be rich, Annualized FAKE returns = 1 big win annualized to a fake return

YOU should trade all the different disciplines that are out there – forex (currency) , Commodities, metals, stocks, funds, ETF, futures, options, day trading, AI trading, swaps, cypto,

You have to be licensed, bonded and insured – I was working 50 hours a week and studying 16 other hours

First year expect only 30-40 % of your committed money to actually come over

The when you’ve made it, track record, leads coming in = DO YOU STILL WORK?

Work means being up at around 6am MST to read market news and my day ends at 2pm

The last month = Watching the Asian markets open, up at 2am to see the after lunch open and European opens

Usually finish at 4pm and continue to read, work numbers, prepare for webinars

Friday 2pm my week ends until Sunday evening

#2 It’s not working ?

You need a proven methodology that can work over time

Average returns are a farse they do not equal profitability = Portfolio growth, dollar cost averaging without having to put more money into your account, collar trading because it allows ME to be wrong on the direction of a stock

What are your thoughts on Warren Buffets belief? Some people should not be in the stock market

Too tough

It works but not necessarily on our time table

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 04-Feb-22 15:44 ET

Investing approaches for a rising interest rate environment

Investing is easy. Anyone can do it. All you need is capital and an idea. The hard part is investing in an idea that generates a positive, inflation-adjusted return on that capital in the time you need it to generate a positive return.

Fortunately, the stock market has been a great wealth generating machine for investors with a longer-term time horizon. The historic annualized average return for the S&P 500 is roughly 10% since 1957, but closer to 7% after adjusting for inflation.

That’s pretty good either way and it is the basis for pundits preaching the virtue of buy-and-hold investing.

In 2021, it seemed easy to generate great returns buying individual stocks — or an index fund for that matter. The times, though, they are a changing. They’re changing because interest rates are changing. They are no longer as low as they once were, and they are expected to move higher as the Federal Reserve tries to tackle the persistent inflation pressures with a higher policy rate.

That doesn’t mean you can’t generate a positive, inflation adjusted return on your capital. It just means you have to be more discriminating in a rising interest rate environment about the stocks, industries, and sectors in which you invest.

Change Is Coming

Rising interest rates don’t necessarily have to be thought of exclusively as a bad thing. Interest rates typically rise for good economic reasons. A stronger economy leads to stronger earnings growth, and the stock market is driven by earnings trends.

Still, rising interest rates inevitably force changes in financing conditions that eventually lead to slower economic activity and slower earnings growth. They also impact stock valuation models, as higher interest rates lower the present value of future cash flows.

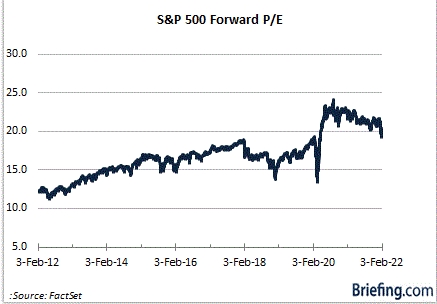

The latter understanding has been a driving force for the multiple compression seen in the early part of 2022. Many stocks have seen their earnings multiples (and sales multiples for profitless companies) compress because investors are not willing to pay as much for every dollar of earnings in a rising interest rate environment as they were when interest rates were declining and sticking at lower levels.

They just don’t expect companies to be as profitable, or to keep generating the same type of sales growth, that would warrant premium valuations.

Even so, at 19.7x forward 12-month earnings, the S&P 500 is still trading at a 6% premium to its 5-yr historical average and an 18% premium to its 10-yr historical average, according to FactSet. That’s before the Federal Reserve has raised rates even once from the zero bound and before the 10-yr note yield has touched 2.0%.

The stock market, though, is forward looking and recognizes that higher rates are on the way, so it is starting to discount that reality now.

The stock market’s behavior has been extra volatile to start the year and losses in many individual stocks have been outsized, not only because of the upward path in interest rates but because of the rapid change in interest rates.

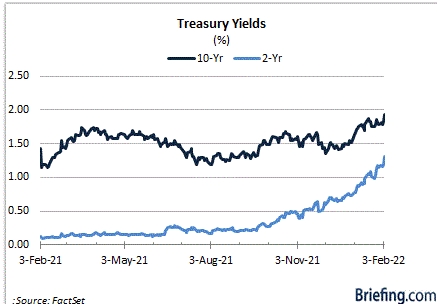

When the year began, the 2-yr note yield, which is more sensitive to changes in the fed funds rate, stood at 0.72%. It is at 1.31% today. The 10-yr note yield, which ended 2021 at 1.51%, is at 1.93%. The fed funds futures market is pricing in the probability of at least five rate hikes by the Fed in 2022, whereas it was considering three rate hikes this year a close call at the end of 2021.

The change has been a function of the ongoing inflation pressures and signaling from the Fed itself. It has also been a function of signaling from other central banks, which are also aiming to tamp down inflation pressures of their own. To be sure, the inflation seen in the U.S. is not just a U.S. problem.

A Counter Argument

We know, then, in the context of this rising interest rate environment that inflation is a problem. From an investment standpoint, that creates investment opportunity in companies that can provide an inflation hedge.

That would include commodity-related stocks that can be found in the energy and basic materials sectors.

It also includes companies that can retain pricing power and where demand for a product or service is inelastic, meaning a change in price isn’t going to change the demand for a product or service by a large amount.

That would include health care and consumer staples companies. Those companies are known as counter-cyclical companies. That is, they tend to do well even when the economy is suffering since the demand for their products or services is fairly constant.

The utilities sector is another counter-cyclical sector, although rising interest rates can still spell problems for these stocks since many utilities companies carry high levels of debt given the investment-intensive nature of their business and pay attractive dividends that might be seen as less attractive versus the income that can be provided by a risk-free Treasury.

In general, though, a rising interest rate environment that triggers an economic slowdown often produces better relative returns for counter-cyclical sectors.

The financial sector is another area that tends to do well when rates start to rise. Banks generally find some investment favor on an assumption that a steepening yield curve, which is typically associated with a strong economy, will drive increased profitability on the back of increased loan demand, higher investment income, and an expansion of net interest margins. Insurers also tend to benefit as they are able to generate more investment income when Treasury yields are higher.

Finding Value in Value

When interest rates go up, you generally want to avoid stocks trading with high valuations relative to the market and their peer group. They will get hit the hardest in the event of an earnings disappointment or, in the case of companies not making money, a slowdown in sales growth.

Stocks accorded premium valuations are growth stocks. Many also carry a moniker of being long-duration issues, meaning a significant amount of their cash flows won’t be seen until the distant future. Consequently, rising interest rates lower the present value of those distant cash flows.

In the same vein, longer-duration bonds are also prone to underperformance since they are more sensitive to changes in interest rates.

Stocks that tend to do better when interest rates start to rise are value stocks. Value is a relative term and there are different analytical approaches for determining what is a value stock. A standard definition is a stock trading below its intrinsic value. Generally, stocks trading at a discount to the market multiple are considered to be value stocks.

Presumably, they carry more upside potential in an improving economy that is accompanied by rising interest rates since they have improved earnings surprise potential that is not reflected in their discounted valuation. Many value stocks are value stocks because of a prior growth disappointment. Some also get left behind because the value factor is out of favor in a market that had previously favored growth stocks.

There is relative value, then, versus the market and relative value versus industry peers. If one is looking to buy a value stock, it is important to distinguish why the stock is trading at a discount to its peer group. That would help avoid falling into a “value trap,” as opposed to investing in a value stock that truly outperforms in a rising interest rate environment.

The relative valuation analysis can be looked at through different ratios, such as price-to-book ratios, P/E ratios, and price-to-earnings growth ratios.

Another generally successful approach in a changing interest rate environment that features rising interest rates is to avoid speculative story stocks and to embrace stocks of established companies that are profitable, free cash flow positive, pay a dividend, and have good balance sheets. That would be blue-chip companies.

In brief, one should be looking to buy quality companies at a reasonable price as opposed to buying unprofitable companies at any price. The latter can work for a time when interest rates are at rock-bottom levels and aren’t thought to be going up soon, but when that perspective changes, the pool of marginal buyers typically gets much shallower and subsequent declines in the event of a disappointment get much deeper.

What It All Means

When interest rates change, investment approaches will also change. Investing in a rising interest rate environment requires more humility and a lot less bravado because inflation-beating returns will be harder to come by. In turn, market volatility will be higher.

Value stocks tend to do better than growth stocks as interest rates start to rise. Eventually, interest rates reach a tipping point for the economy, and when it becomes apparent that higher rates are leading to much lower levels of growth, then growth stocks will start to exhibit some relative strength again.

Of course, one can always stick with the simple approach of owning an S&P 500 index fund. That can be painful to endure at times, but if time is on your side and you have the latitude to hold through the more challenging times, the historical track record speaks for itself as a good investment idea that will provide you a positive, inflation adjusted return on your capital.

–Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

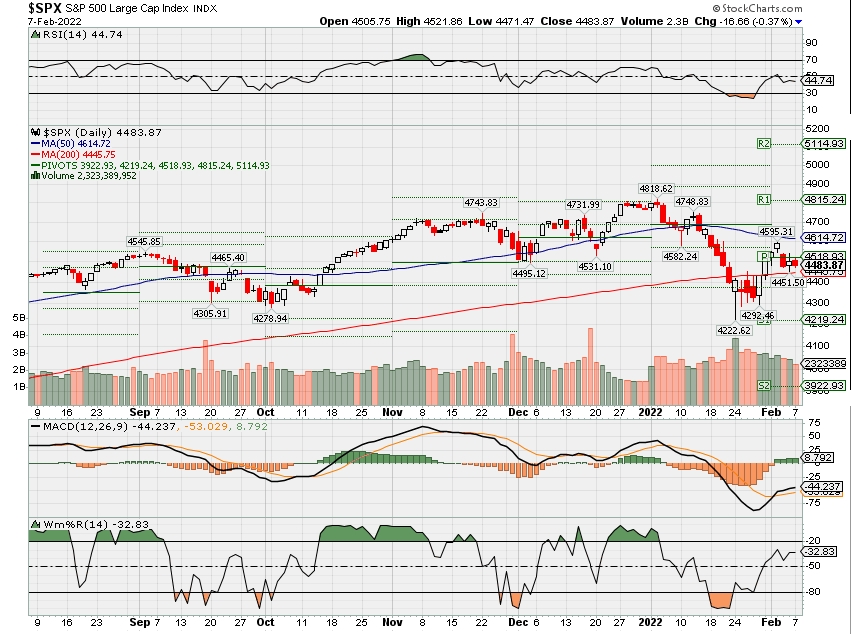

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end February 2022?

02-07-2022 -3.0%

01-31-2022 -3.0%

Earnings:

Mon: TSN, AMGN, RMBS

Tues: BP, DD, HOG, PFE, LYFT, PTON, YUMC

Wed: CVS, DKNG, HMC, LAD, YUM, MAT, PEP, UBER, DIS

Thur: DUK, CYBR, K, TWTR, GDDY, YELP, KO, HUBS

Fri: GT, D, UAA

Econ Reports:

Mon: Consumer Credit

Tues: Trade Balance

Wed: MBA, Wholesale Inventory

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Treasury Budget

Fri: Michigan Sentiment

How am I looking to trade?

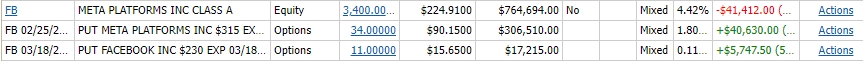

Long put protection has been added to certain stocks

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

How is the transfers coming – Laggards 10% of my business that needs to come over 3.5 million

Will we be using SCHAW or the Street Smart Edge = YES as soon as my accounts come over

Explaining the searing volatility in individual stocks and indexes and what it’s signaling

Michael Santoli@MICHAELSANTOLI

“Volatility” is often invoked by investment professionals as a euphemism for a market in decline, the way “adversity” is used by coaches to describe a losing streak to the beat reporters.

Yet in the past week, stocks were legitimately, empirically volatile — even as the broad S&P 500 index managed a 1.5% gain, with whippy moves around tight corners that left traders’ nerves frayed and hair tousled.

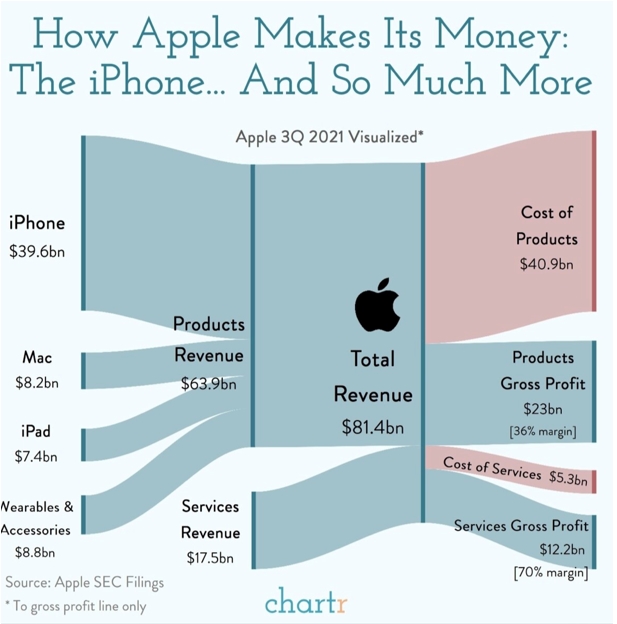

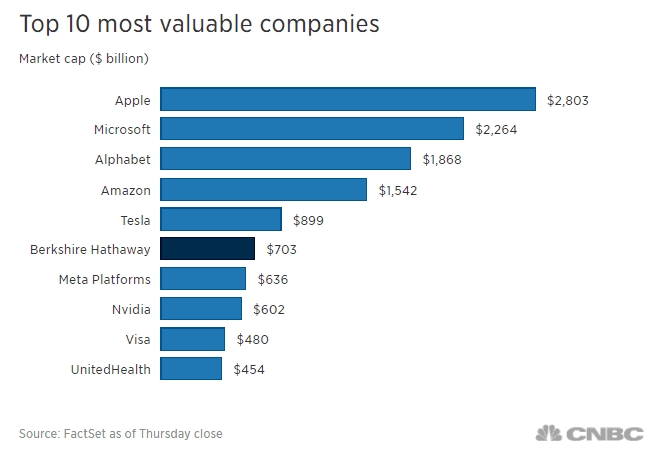

The S&P’s daily trading range each day exceeded 1%, Meta Platforms shed more than $200 billion in market value Thursday and Amazon added almost as much the next day. Every one of the five largest Nasdaq stocks – Apple, Microsoft, Alphabet, Amazon and Meta – moved at least 10% after hours or intraday in response to its earnings release the past two weeks.

Snap shares gained an almost comical 59% Friday after better-than-feared results, but that pop only recovered three weeks’ worth of prior losses and still left the stock 53% off its peak from less than five months ago.

Away from equities, bonds are repricing in a hurry for an expected brisk Federal Reserve tightening effort this year, with Friday’s strong jobs report propelling the two-year Treasury yield as high as 1.32%, a level the 10-year yield brushed against just two months ago.

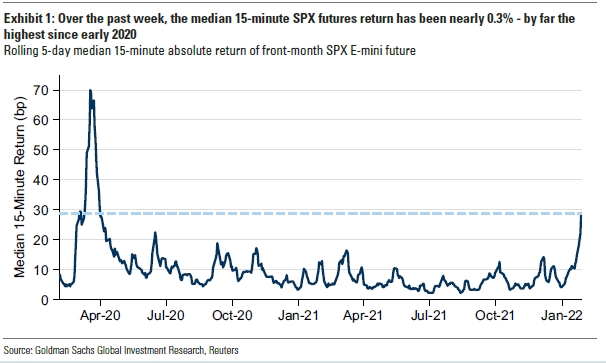

The most heavily traded instruments in finance are unusually jumpy lately, too, a sign of stressed illiquidity conditions and trimmed risk limits among professional wielders of capital.

Goldman Sachs derivatives research showed a week ago that the median change in the S&P 500 E-Mini futures contract over 15-minute intervals has climbed toward one-third of a percent, by far a post-Covid-crash high.

Goldman Sachs

All this agitated action reflects the swirling currents of cyclical, behavioral and mechanical influences, a matter of a macroeconomic transition and fast-money mood swings.

It also suggests, it should be said, some structural fragilities. The mad rush of retail traders into options, often those that expire weekly — as well as the depletion of willing market-maker capital and the heavy presence of passive index funds — have helped contribute to the gappy, tail-wagging-dog behavior.

Without seeming alarmist or charging that the markets are somehow “broken,” these factors become acute in corrections and moments of macro confusion.

Rocky Fishman, equity derivatives strategist at Goldman, wrote last week: “Our biggest technical concern is liquidity, with [S&P] futures’ liquidity resembling March 2020. On-screen liquidity has become so poor that futures have been more than one tick wide over 20% of the time. Weak liquidity means flows matter more and leaves the potential for outsized market moves (in both directions).”

Blame the Fed?

But it’s not all about the technical vulnerabilities. The economy’s speedy progress toward full employment and stubbornly spiky inflation has carried the market toward a late-cycle phase, prompting the Fed to steer market expectations toward several 2022 rate hikes up from “maybe two” just a few months ago. At the same time, GDP and corporate-profit growth is decelerating from high rates, and corporate credit spreads have seen their firmest levels.

The start of a tightening cycle tends not to be the bull market’s matador, but plenty of chop and a less-generous return-to-risk equation are common.

Jurrien Timmer, Fidelity’s director of global macro, shows the S&P 500 over several recent Fed-tightening periods, overlaid at the index peak, with the current path in white. It shows the magnitude of the setback is perfectly normal, as would be more sloppiness in coming months.

Fidelity

An economy with nominal GDP growth of 14% in the fourth quarter stepping down toward something closer to the long-run norm, with the Fed trying to calibrate the correct response on the fly, will inherently mean the range of potential outcomes is much wider than back in the 2010s, when inflation was muted and GDP growth hovered near stall speed in a narrow band. Markets, on some level, will allow for that broad set of possibilities.

Earnings growth is becoming less robust and less inclusive, with margin erosion hitting some more than others and payback from pandemic-related demand acceleration showing up in some unexpected places. As a result, the market’s response to the numbers is tracking as weak as they were in the troubled markets in 2011 and 2001-02, according to Bespoke Investment Group.

Bespoke Investment Group

Add in the copious amounts of accumulated paper profits over the prior two years in portfolios for which bonds are no longer providing an offset in equity sell-offs, and margin-loan balances retreating from a lofty place.

Meta’s collapse sends shockwaves

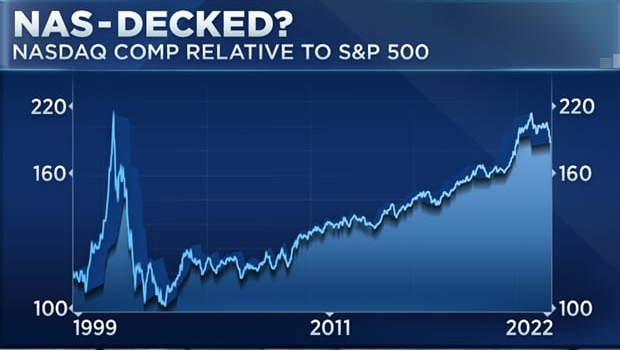

The buckling of the very largest growth stocks in the market – the top five of which rose to 23% of the S&P 500 market value – means they’ve recently changed from a dampener of index volatility to a source of it.

Meta’s 23% collapse, from a starting place well above $800 billion in market cap, immediately ripples through the market in quite-tangible ways. Whether an investor is assessing risk through gut feeling or sophisticated models running stress scenarios, a mega-cap name gapping lower by that much encourages smaller positions and more hedges. Thus, the straight-down moves in Amazon and Snap ahead of their earnings Thursday during Meta’s collapse.

Whether this faltering of the Nasdaq giants relative to the overall market is a hiccup or just getting started is impossible to say. For sure, the Nasdaq-vs.-S&P 500 ratio chart looks like a plausible top here, as the growth leaders leak much of the valuation premium they claimed since early 2020.

The inclusion of the year-2000 inverted-icicle peak in this relationship is not meant to say a rerun is underway, by any means. The run higher into the 2000 peak was ridiculously steep and that Nasdaq was full of less-mature companies. (In fact, Chris Verrone of Strategas has noted it is the ARK Innovation ETF whose recent trajectory most matches up with the Nasdaq’s boom-bust cycle starting in the late-’90s.)

The somewhat good news is, more of the growth-stock bellwethers delivered solid earnings and had their stocks stabilize than didn’t in recent weeks. Only Netflix and Meta were outright flops.

On some level, the market always feels – and is – more twitchy and emotional during corrections such as the one we’ve been in. Prices have moved quickly, making it easy to go back to a recent level even if it’s far away in dollar terms.

In the current case, there was a pretty decisive-seeming flush of liquidation and fear at the Jan. 24 low. The S&P has regained about half of all the ground lost from January high to January low and finished the past week in a somewhat indecisive spot – just above its 200-day average, still below the downtrend line from the peak. It’s around its lowest valuation in two years, but with first-quarter profit forecasts slipping a bit.

There seems plenty of room for investor sentiment and positioning to come back from anxiety and caution. Credit markets have softened up but not yet in a punitive way for corporate borrowers. The corporate stock-buyback window will open wider in coming weeks.

All of this makes it plausible that the Jan. 24 low can hold up and stocks can work higher if in jagged fashion – even as it’s tough to predict truly smooth sailing back to record highs is directly ahead, given imminent consumer-inflation data, seven “live” Fed meetings from March through December and the high-torque feedback loops activated by the year’s mercurial start.

Ford 4Q 2021 earnings disappoint amid semiconductor supply crunch

Thomas Hum·Writer

Thu, February 3, 2022, 3:14 PM CST·3 min read

Ford (F) reported disappointing 4Q 2021 earnings today after the closing bell. The legacy automaker missed consensus estimates amid the global semiconductor shortage and the toll it has taken on its production of vehicles across product lines.

Here were the main metrics from Ford’s report, compared to Bloomberg consensus estimates:

- Revenue: $37.7 billion vs. $34.79 billion expected, $36.0 billion Y/Y

- Adjusted EPS: $0.26 vs. $0.45 expected, $0.34 Y/Y

Ford’s stock is down from a mid-January peak of just over $25. The peak marked a 20-year high for the company, allowing it to breach a $100 billion market cap for the first time. Ford currently sits at a market cap of around $80 billion.

The company is seeing impressive early demand for its electric vehicles (EVs), particularly its E-Transit (van) and the highly anticipated F-150 Lightning. CEO Jim Farley told Yahoo Finance Live that the company has already accepted over 10,000 orders for the E-Transit from “a lot of different customers,” including 1,000 orders from Walmart (WMT). He added that Ford will be aiming to reach an EV sales capacity of 600,000 units over the next 22 months.

The body and chassis of a Ford pre-production all-electric F-150 Lightning truck prototype are seen at the Rouge Electric Vehicle Center in Dearborn, Michigan, U.S. September 16, 2021. REUTERS/Rebecca Cook

F-150 Lightning

As for the F-150 Lightning, reservations for the electric pickup truck are demonstrating strong preliminary numbers as well.

“We have about 200,000 reservations [for the Lightning],” Farley said. “Now we’re converting those into orders where people have to physically order the vehicle, almost very few of them are falling out.”

Ford announced in December that they would be capping the number of reservations for the Lightning at 200,000 as it works to expand production capacity in light of the materials supply crunch. The company reported 167,545 total U.S. vehicle sales for December (down 14.9% year-over-year).

Sales were also relatively unimpressive for January, as the company reported that total sales compared to January 2021 did not see a significant change at 143,531 vehicles. Total truck sales fell 4.3% compared to January 2021, but SUV and EV sales rose 8.5% and 167.2%, respectively.

“Ford electrified vehicle sales in January grew almost 4 times faster than the overall electrified segment,” a Feb. 2 Ford press release said. “With a total of 13,169 vehicles sold, Ford electrified vehicles were up 167.2 percent, with share up 5.0 points to 10.9 percent of segment.”

Trucks and SUVs still comprised the vast majority of vehicle sales for Ford, with 71,734 trucks and 66,122 SUVs sold in January 2022.

Looking forward, Ford continues to invest heavily in clean energy and new technology in a push towards a more sustainable automotive future. According to a Bloomberg report, Ford will be increasing EV spending by as much as $20 billion — on top of the $30 billion it has already committed to the space — through 2025.

Warren Buffett’s long-term focus pays off again as Berkshire Hathaway passes Meta Platforms in value

Warren Buffett is having the last laugh as his old-school Berkshire Hathaway surpassed tech pioneer Meta Platforms in market value, thanks to a slew of stock bets paying off from Apple to big banks and Japanese trading houses.

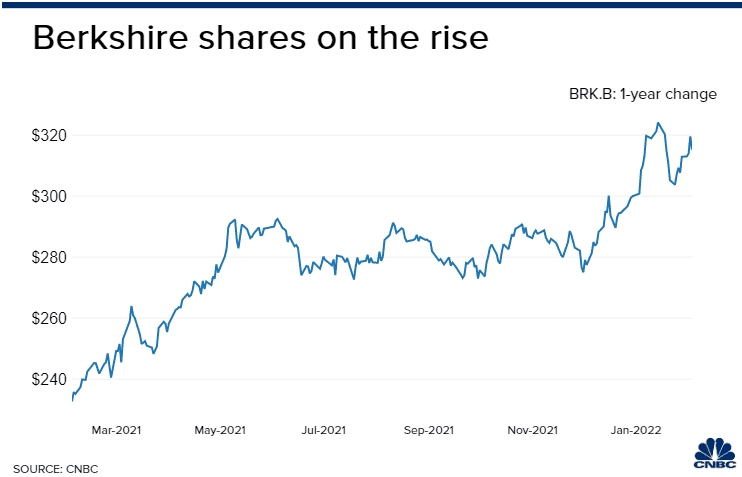

Class B shares of the conglomerate have gained 5.5% in 2022, outperforming the S&P 500 by more than 10 percentage points. The recent rally pushed Berkshire’s market cap above $700 billion, overtaking Facebook parent Meta in the No. 6 spot on the list of most valuable U.S. public companies.

Berkshire is one of the only nontech companies on the pyramid. Its operating business is a patchwork of companies focused on the traditional backbone of the economy, from railroads, to batteries, insurance, home furnishing and retail.

Tech stocks, especially the frothier parts of the market, have been hard hit in the new year as investors rotated out of high-flying names amid a spike in bond yields and expectations that the Federal Reserve will raise rates multiple times this year. The Nasdaq Composite has dipped into correction territory, falling more than 10% from its record high. Meta shares dropped 30% in the past month as the company forecast weaker-than-expected revenue growth.

This has been less of a concern for the “Oracle of Omaha.” The 91-year-old investing legend is reaping profits from his long-term conviction bets that are benefiting from an economic comeback from the coronavirus pandemic. A $40 billion stake in Bank of America proved to be a winning wager as lenders came back in favor with rising rates. Meanwhile, the conglomerate’s massive holding in Apple, which makes up 40% of Berkshire’s equity portfolio, has made more than $120 billion on paper. Apple has fared relatively well in 2022′s tech rout, dipping about 2.8% in the new year.

There’s more good news. The five leading Japanese trading companies Buffett acquired stakes in leading up to his 90th birthday just posted record quarterly earnings. The companies — Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. and Sumitomo Corp. — invest in overseas energy and metals assets, which benefited from a huge rebound in commodity prices.

“I think Berkshire’s equity investment strategy, which seems to be bar-belled between select financial and technology names, is an attractive compliment to its operating strategy, which tends to favor value-oriented businesses like insurance, railroads, energy and consumer staples,” said Cathy Seifert, Berkshire analyst at CFRA Research.

Berkshire’s comeback perhaps redeemed Buffett’s largely criticized move to sell all of his airline bets at the height of the pandemic. He raised eyebrows in 2020 when he revealed he dumped the entirety of his airline investments, worth north of $4 billion, a rare move for the buy-and-hold investor who received criticism for taking a loss on his investment.

Looking back, the loss from the airline trade has long been made up for by Berkshire’s huge returns from Apple and other winning bets, and airline shares after an initial pop have largely stagnated. Buffett could still be right about the fundamental changes in the airline industry as these stocks still haven’t wiped out pandemic losses.

The Omaha, Nebraska-based conglomerate has also been buying back its own stock aggressively. The company repurchased $7.6 billion of Berkshire stock in the third quarter, bringing the nine-month total to $20.2 billion. Berkshire bought back a record $24.7 billion of its shares in 2020.

Berkshire is slated to release its fourth-quarter earnings as well as its annual report on Feb. 26. The company saw a double-digit increase in its operating profit last quarter.

More than $320 million stolen in latest apparent crypto hack

MacKenzie Sigalos@KENZIESIGALOS

- Wormhole, one of the most popular bridges linking the ethereum and solana blockchains, lost about $320 million in an apparent hack Wednesday afternoon.

- The two blockchains are popular in the world of DeFi, where programmable contracts can replace lawyers and bankers in some transactions, and NFTs.

- But few users stick with one blockchain exclusively, so bridges like Wormhole are a necessary go-between.

One of the most popular bridges linking the ethereum and solana blockchains lost more than $320 million Wednesday afternoon in an apparent hack.

It is DeFi’s second-biggest exploit ever, just after the $600 million Poly Network crypto heist, and it is the largest attack to date on solana, a rival to ethereum that is increasingly gaining traction in the non-fungible token (NFT) and decentralized finance (DeFi) ecosystems.

Ethereum is the most used blockchain network, and it is a big player in the world of DeFi, in which programmable pieces of code known as smart contracts can replace middlemen like banks and lawyers in certain types of business transactions. A more recently introduced competitor, solana, is growing in popularity, because it is cheaper and faster to use than ethereum.

Crypto holders often do not operate exclusively within one blockchain ecosystem, so developers have built cross-chain bridges to let users send cryptocurrency from one chain to another.

Wormhole is a protocol that lets users move their tokens and NFTs between solana and ethereum.

Developers representing Wormhole confirmed the exploit on its Twitter account, saying that the network is “down for maintenance” while it looks into a “potential exploit.” The protocol’s official website is currently offline.

An analysis from blockchain cybersecurity firm CertiK shows that the attacker’s profits thus far are at least $251 million worth of ethereum, nearly $47 million in solana, and more than $4 million in USDC, a stablecoin pegged to the price of the U.S. dollar.

Bridges like Wormhole work by having two smart contracts — one on each chain, according to Auston Bunsen, co-founder of QuikNode, which provides blockchain infrastructure to developers and companies. In this case, there was one smart contract on solana and one on ethereum. A bridge like Wormhole takes an ethereum token, locks it into a contract on one chain, and then on the chain at the other side of the bridge, it issues a parallel token.

Preliminary analysis from CertiK shows that the attacker exploited a vulnerability on the solana side of the Wormhole bridge to create 120,000 so-called “wrapped” ethereum tokens for themselves. (Wrapped etherum tokens are pegged to the value of the original coin but are interoperable with other blockchains.) It appears that they then used these tokens to claim ethereum that was held on the ethereum side of the bridge.

Prior to the exploit, the bridge held a 1:1 ratio of ethereum to wrapped ethereum on the solana blockchain, “acting essentially as an escrow service,” according to CertiK.

“This exploit breaks the 1:1 peg, as there is now at least 93,750 less ETH held as collateral,” continued the report.

Wormhole says that ethereum will be added to the bridge “over the next hours” to ensure that its wrapped ethereum tokens remain backed, but it is unclear where it’s getting the funds to do this.

Ethereum founder Vitalik Buterin previously made the case that bridges won’t be around much longer in the crypto ecosystem, in part because there are “fundamental limits to the security of bridges that hop across multiple ‘zones of sovereignty.’”

CertiK noted in its post-mortem report of the incident that when bridges hold hundreds of millions of dollars of assets in escrow and multiply their possible vectors of attack by operating across two or more blockchains, they become prime targets for hackers.

Crypto platforms have faced a number of high-value exploits in recent months.

“The $320 million hack on Wormhole Bridge highlights the growing trend of attacks against blockchains protocols,” said CertiK co-founder Ronghui Gu. “This attack is sounding the alarms of growing concern around security on the blockchain.”

https://finance.yahoo.com/news/aoc-congress-stock-trading-153940351.html

AOC: ‘No mystery’ why it’s hard to ban lawmaker stock trading

·Deputy Managing Editor

Thu, February 3, 2022, 2:47 PM·3 min read

Last week, 27 lawmakers wrote a letter urging leaders of the U.S. House of Representatives to act quickly to bring “commonsense, bipartisan” legislation to the floor banning members of Congress from owning or trading stocks.

That letter called lawmakers’ stock trading a “glaring problem” that won’t go away until Congress fixes it. While federal lawmakers have unveiled a range of bills aiming to stop lawmakers’ from trading stocks, the legislation may face opposition from lawmakers engaged in the behavior it’s trying to rein in.

In a new interview with Yahoo Finance taped on Jan. 27, progressive Congresswoman Alexandria Ocasio-Cortez (D-NY) alluded to the difficulty of persuading members of Congress to police their own behavior.

“It’s not really a mystery to me why it’s difficult to pass,” Ocasio-Cortez, widely known as AOC, told Yahoo Finance’s editor-in-chief, Andy Serwer, in a wide-ranging interview. “I wouldn’t be surprised if it was a majority of members of Congress who hold and trade individual stock.”

The practice of so-called insider trading in Congress has faced widespread criticism in recent years because lawmakers have access to non-public information. Perhaps most notoriously, the Justice Department investigated four senators who sold significant amounts of stock in January and February 2020 as they were being briefed on the looming threat of COVID-19.While those senators didn’t face criminal charges, the investigation highlighted the reality that Congress often has access to inside information that could have a material effect on public companies.

“I am a member of Congress: Members of Congress have access to very sensitive security clearances,” Ocasio-Cortez told Yahoo Finance. “We have access to very detailed, tailored briefs. We, our job is to try to anticipate and legislate for what we see is coming. And we should not have the ability to both have access to that information and be able to hold and trade individual stock.”

While House members can trade stock freely, a 2012 law called the Stop Trading on Congressional Knowledge (STOCK) Act bans them from trading on “material, nonpublic information” and requires them to disclose trades within 45 days. More than a few lawmakers have violated the STOCK Act, though: A recent investigation by Insider identified 54 lawmakers who failed to comply with the law’s reporting requirements.

And in 2020, 75 federal lawmakers held stock in Moderna (MRNA), Pfizer (PFE), or Johnson & Johnson (JNJ) as Congress authorized billions to develop and distribute COVID-19 vaccines made by these very companies, Insider also reported.

One bill recently introduced to further curb insider trading in Congress would aim to strengthen the STOCK Act’s disclosure rules. Meanwhile, a bill introduced last month by Democratic Senators Mark Kelly of Arizona and Jon Ossoff of Georgia would prohibit lawmakers and their immediate family members from owning or trading stocks.

For her part, Ocasio-Cortez favors banning trading altogether, though she stresses that wouldn’t prevent Congress members from having a broader stake in the stock market. “The key here, is that it’s not to say that you can’t have a retirement account or a college savings account … a blind trust … a mutual fund, an index fund,” she said. “These are vehicles of investments that are broad, that individual members of Congress don’t have direct control over.”

Erin Fuchs is deputy managing editor at Yahoo Finance.

HI Financial Services Mid-Week 06-24-2014