HI Market View Commentary 02-01-2021

Hey Kevin, explain your earnings season pattern or trading techniques

First if the stock has fallen significantly we take profits and want the protection ATM = close to the current price.. Why? Because if we don’t take the profits we can’t make anything to the upside

Hey Kevin, on up days or down should we expect our accounts to do as good or poorly as the broader market S&P 500 – IF the market is up 1 ½% should our accounts be as well? NO not necessarily during the earnings seasons. Personally it is a process meaning yes I look every single day for being overweight in a individual stock position, Weekly is a statistic for me and monthly is what matter most.

I spread out earnings season stocks so the market risk won’t affect the whole portfolio !!!

Last Thursday we took profits on BAC, added shares 100% paid for, and then added long puts back at $30

AAPL said let’s sell 14B in bonds to buy back 104 ish million shares. It will cost us $3.20 per share over the next two years…. SO if our stock price raises more than $3.20 over the next two years we’ve made a profit.

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

Earnings Watch List

BIDU 2/25

CVS 2/16 BMO

DIS 2/11 AMC

F 2/04 AMC

KO 2/10 BMO

MU 3/24

NEM 2/18 BMO

TGT 3/02 BMO

UAA 2/09

WMT 2/18 BMO

SQ 2/23 AMC

RCL 2/02

CCL 2/04

MGM 2/11

Where will our markets end this week?

DOWN

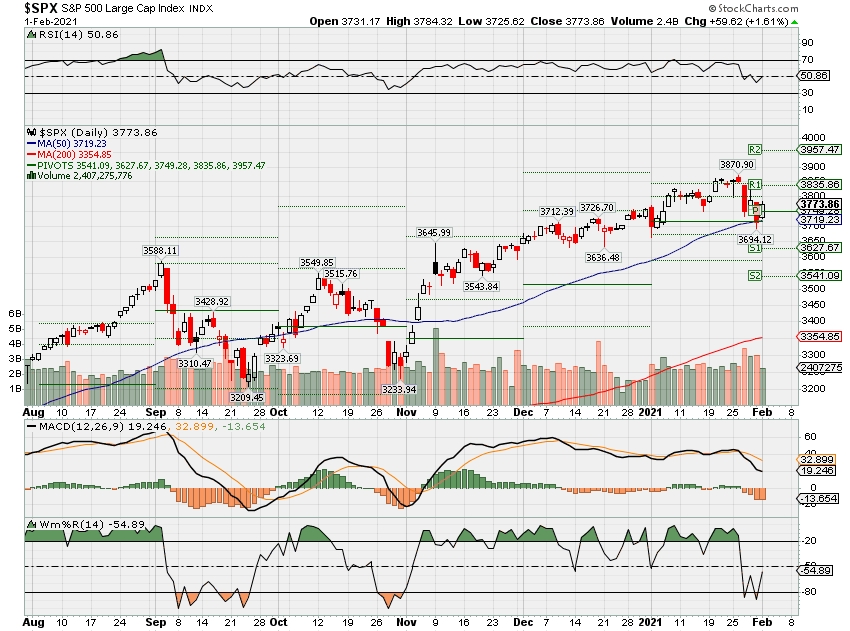

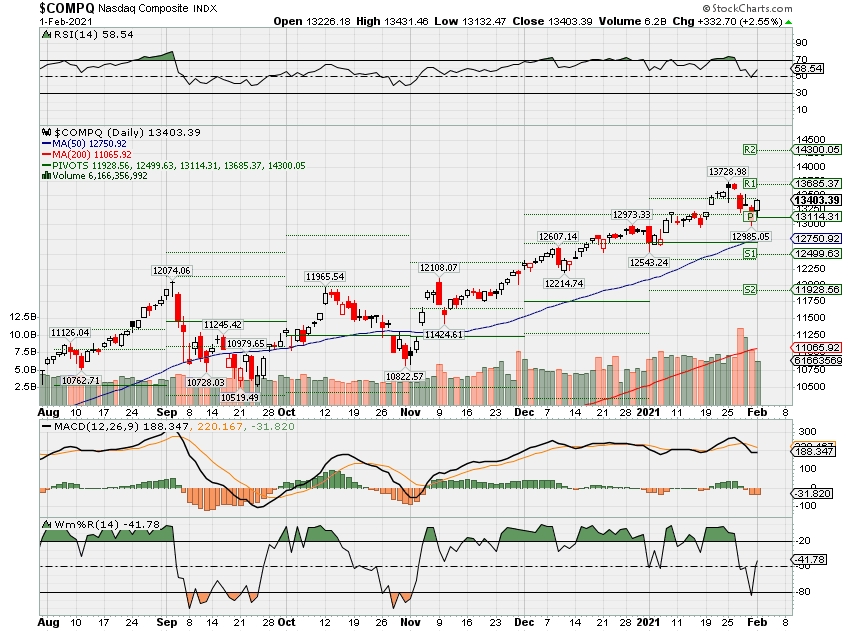

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2021?

02-01-2021 -2.0%

Earnings:

Mon: RMBS

Tues: BABA, BP, COP, XOM, HOG, PFE, SIRI, UPS, GOOG, AMZN, FEYE

Wed: BSX, GWW, HUM, SPOT, EBAY, GRUB, PYPL, QCOM

Thur: CLX, CMI, IP, MRK, RL, TPR, YUM, ATVI, GPRO, SKYW, SNAP, TMUS, WYNN, CCL, F,

Fri: CAH, EL

Econ Reports:

Mon: Construction Spending, ISM Manufacturing

Tues:

Wed: MBA, ADP Employment, ISM Services

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Factory Orders

Fri: Average Workweek, Hourly Earnings, Non-Farm Payroll, Private Payroll., Trade Balance, Unemployment, Consumer Credit

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Waiting for earnings and will protective put into this earnings season and add short calls after the announcement and after I listen to the guidance

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Kevin, what if you are wrong with AAPL, I will add puts back on farther out in time

10 Republican senators present Biden with smaller Covid stimulus proposal, call for compromise

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The senators explained that their version of the Covid relief package provides “more targeted assistance” to Americans with the greatest need.

- Sen. Rob Portman of Ohio said the proposal would be a slimmer version of what was presented by the Biden administration.

- The Democratic-controlled House is set to pass a budget resolution this week, the first step toward approving the $1.9 trillion relief bill through reconciliation.

- Sen. Bernie Sanders of Vermont said he believes Senate Democrats have the votes to pass the bill through reconciliation.

WASHINGTON – A group of 10 Republican senators called on President Joe Biden to consider a smaller, alternative Covid-19 relief proposal as his administration works to pass a $1.9 trillion package to address the economic fallout triggered by the pandemic.

In a letter to Biden on Sunday, Sens. Susan Collins of Maine, Mitt Romney of Utah, Rob Portman of Ohio, Lisa Murkowski of Alaska and five other lawmakers said they would unveil their proposed legislation on Monday.

“We recognize your calls for unity and want to work in good faith with your administration to meet the health, economic, and societal challenges of the Covid crisis,” the senators wrote.

“With your support, we believe Congress can once again craft a relief package that will provide meaningful, effective assistance to the American people and set us on a path to recovery,” the group wrote asking for a meeting with Biden in order to discuss the proposed legislation in greater detail.

The Republican senators explained that their version of the Covid relief package provides “more targeted assistance” to Americans with the greatest need. The proposed legislation asks for a total of $160 billion for vaccine development and distribution, testing and tracing, treatment as well as other crucial supplies.

The senators laid out the following details of their plan:

- An additional round of economic impact payments for families who need assistance the most including their dependent children and adults.

- Extends enhanced federal unemployment benefits at the current level.

- Fully funds nutrition assistance to help struggling families.

- Additional resources to help small businesses and their employees through the Paycheck Protection Program and the Economic Injury Disaster Loan Program.

- Funds resources for opening schools safely and for child care.

- Provides $4 billion to bolster behavioral health and substance abuse services.

On Sunday, Portman told CNN’s “State of the Union” that the proposal would be a slimmer version of what was presented by the Biden administration.

“It’d be less than $1.9 [trillion] because much of what the administration has laid out has nothing to do with Covid-19,” Portman explained. “As an example, with regard to the direct payments, we think they should be much more targeted,” he added.

Brian Deese, director of the National Economic Council, told MSNBC’s “Meet the Press” on Sunday that the White House had received the letter and was open to discussing the proposed legislation.

“The president has said repeatedly, he is open to ideas wherever they may come that we could improve upon the approach to actually tackling this crisis. What he is uncompromising about is the need to move with speed on a comprehensive approach here,” Deese said.

“We’ve been engaging with members of Congress from both parties and in both houses over the course of the last week or two. We will continue to do that as we go forward,” he added.

Deese also told CNN’s “State of the Union” that the administration is willing to negotiate on the stimulus checks.

The Republican counter-proposal comes as the House is set to pass a budget resolution this week, the first step toward approving the relief bill through reconciliation. The process would enable Senate Democrats to approve an aid measure without Republican support.

Senate Majority Leader Chuck Schumer of New York signaled last week that the chamber would also work to pass a budget resolution soon. He said the Senate “as early as next week will begin the process of considering a very strong Covid relief bill.”

When asked if Senate Democrats could pass the rescue bill through the reconciliation process, Sen. Bernie Sanders of Vermont told ABC’s “This Week” that he believed the party had the votes to do so.

“It’s hard for me to imagine any Democrat, no matter what state he or she may come from, who doesn’t understand the need to go forward right now in an aggressive way to protect the working families of this country,” Sanders said.

“Look all of us will have differences in opinion, this is a $1.9 trillion bill, I have differences and concerns about this bill but at the end of the day we are going to support the president of the United States and we are going to do what the American people want us to overwhelmingly do,” he added.

In a Twitter post on Sunday, Secretary of Treasury Janet Yellen echoed the administration’s call for Congress to act as soon as possible.

https://platform.twitter.com/embed/index.html?creatorScreenName=amanda_m_macias&dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1355885276816683011&lang=en&origin=https%3A%2F%2Fwww.cnbc.com%2F2021%2F01%2F31%2Frepublican-senators-present-smaller-covid-proposal.html&siteScreenName=CNBC&theme=light&widgetsVersion=ed20a2b%3A1601588405575&width=550px “The President is absolutely right: The benefits of acting now — and acting big — will far outweigh the costs in the long run,” Yellen wrote.

CNBC’s Jacob Pramuk, Tucker Higgins and Emma Newburger contributed to this report from New York.

Retailers Cut Debt and Dividends. The Trend Might Not Last.

By

Feb. 1, 2021 1:46 pm ET

While retailers were hit hard by the pandemic, the sector has actually reduced its net debt burden since early last year. That doesn’t necessarily guarantee the future health of their balance sheets, however.

Retailers relied on markets to deal with shutdowns and a near-halt in economic activity during the pandemic: Like other companies, they borrowed from banks and investors by taking out loans and selling bonds. Many that couldn’t borrow or refinance their prior debt ended up filing for bankruptcy to restructure their debt.

Something unusual happened to the surviving retailers after they took on all of that debt, as BMO analyst Simeon Siegel pointed out in a Monday note. They managed their operations and spending very conservatively, and as a result, are holding more cash as well. Among the retailers he covers, all 16 with stock-buyback programs paused them, and nine of the 11 dividend payers paused those payments as well.

That means that while the retailers Siegel covers have taken on a significant amount of new debt, their net debt burden—the amount of net debt on their balance sheets—has declined slightly. Compared to next year’s forecasts for earnings before interest, taxes, depreciation, and amortization, or Ebitda, net debt fell most for National Vision Holdings (ticker: EYE), Revolve Group (RVLV), and L Brands (LB) during the pandemic.

Our coverage [area] actually saw a slight improvement in net leverage as, in many cases, cash borrowed was not spent and forced inventory reductions and expense pauses improved working capital, he wrote.

The question now is whether the sector’s cash hoard will last. Retailers may resume more-aggressive financial and operating policies as the pandemic recedes and economies reopen.

That trend wouldn’t necessarily be bad for shareholders, because it could involve dividends and buybacks, but could undermine the sector’s financial viability over the longer run because, in Siegel’s words, debt is the sector’s kryptonite. Total debt has climbed to 2.5 times last year’s earnings before interest and taxes, Siegel found, up from 1.5 times before the pandemic. So if companies end up spending their cash quickly, they could find themselves with fast-rising debt burdens.

Different retailers have also varied widely in their cash- and debt-management practices. For example, VF (VFC), Nordstrom (JWN), Under Armour (UAA) and Planet Fitness (PLNT) all added a significant amount of net debt compared to next year’s forecast Ebitda, Simeon found.

The implications for investors of the cash hoarding aren’t entirely clear, however. On one hand it could signal room for future returns of cash through buybacks and dividends. On the other it could be a sign that the retailer expects a bumpy and slow recovery from the Covid-19 crisis.

Retailers that performed well during the pandemic have also been the most aggressive with their balance sheets. Nike (NKE) stock, for example, has soared 40% in the past 12 months, even though the apparel giant has not repaid pandemic debt, and still has raised its dividend 12%, Simeon pointed out. While TJX (TJX) has paid down some debt, the discount retailer reinstated its dividend at 13% more than before the suspension. Its stock is up about 9% in the past 12 months.

Investors may want to focus on companies that already have shored up their balance sheets by paying down a significant proportion of the debt they took on during the pandemic. While such repayments cut into cash reserves, it also means shareholders will have marginally less competition over future cash flows.

The good news is that 15 of the 17 companies that Simeon covers who have drawn on their revolving bank-credit lines have paid at least part of those borrowings back. The companies that have cut debt most in the past year are Capri Holdings (CPRI), which has paid down more than three times the debt it took on during Covid-19, Ulta Beauty (ULTA), and Urban Outfitters (URBN). The latter two companies have paid back all of their pandemic borrowings.

Write to Alexandra Scaggs at alexandra.scaggs@barrons.com

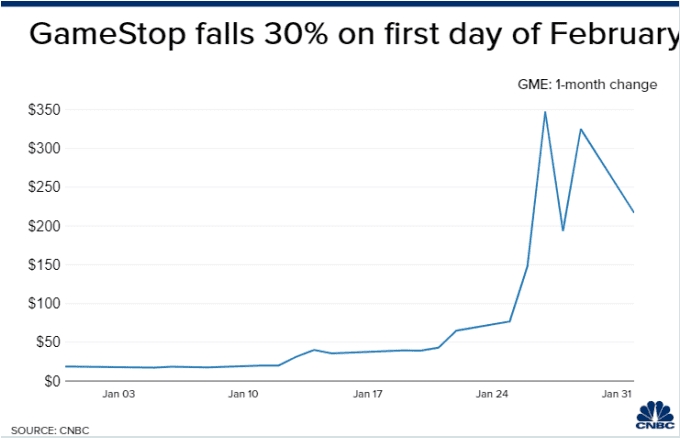

https://www.cnbc.com/2021/02/01/gamestop-shares-reddit-trader-frenzy-continues-into-february.html

GameStop shares lose nearly a third of their value on Monday following 400% short-squeeze spike last week

Maggie Fitzgerald@MKMFITZGERALD

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

GameStop shares fell more than 30% and were briefly halted on Monday as the Reddit-fueled frenetic trading extended into February.

Shares of the bricks-and-mortar video game retailer closed down 30.8% on Monday. GameStop jumped as much as 18% to $384.89 in premarket trading.

The stock surged 1,625% in January as point-and-click investors piled into the name while hedge funds rushed to cover their losses from shorting the stock.

The astronomical rally has inflicted a mark-to-market loss of almost $13.5 billion to hedge funds with short positions against the stock, according to data from S3 Partners through Friday’s close.

Robinhood and other trading apps continue to limit buying of GameStop stocks and options contracts, along with those of other heavily shorted names, following a week of hugely volatile trading due to a retail trading frenzy led by 5 million-strong Reddit thread “WallStreetBets.”

Currently, Robinhood only allows clients to buy 20 shares of GameStop, unless they already own shares 20, in which case the client can’t buy any shares. Robinhood eased the restrictions on Monday before announcing another $2.4 billion cash injection.

Limitations are also in place for AMC Entertainment, BlackBerry, Koss, Express, Nokia, Genius Brands International and Naked Brand Group.

AMC Entertainment closed up 0.3% after jumping more than 20% earlier in the session.

Most of the other restricted names were lower on Monday, including Express, which is down nearly 17%, Koss, which dropped about 45%, and Naked Brand Group, which fell nearly 14%.

Genius Brands, BlackBerry and Nokia were the restricted names that traded higher on Monday.

Short selling is a strategy in which investors borrow shares of a stock at a certain price on expectations that the market value will fall below that level when it’s time to pay for the borrowed shares.

— CNBC’s Yun Li contributed to this report.

Tim Cook condemns Facebook business model, says valuing engagement over privacy leads to ‘polarization’ and ‘violence’

– Jan. 28th 2021 9:14 am PT

Speaking at the EU data protection conference CPDP today, Tim Cook gave the opening keynote with his talk entitled “A path to empowering user choice and boosting user trust in advertising.” Cook covered Apple’s concerns about privacy and security in the technology industry, the hope it sees for change going forward, what it is doing to protect privacy, its deep concerns and consequences with Facebook’s business model, and much more.

Tim Cook touched on a variety of concerning issues Apple sees when it comes to privacy and security across the technology industry. He reiterated the point that in many cases, people aren’t customers anymore but rather the product that businesses are selling to advertisers.

“As I’ve said before, if we accept as normal and unavoidable that everything in our lives can be aggregated and sold, we lose so much more than data, we lose the freedom to be human. And yet, this is a hopeful new season, a time of thoughtfulness and reform.”

Cook praised GDPR for being the most concrete progress in consumer privacy and security and said it’s time for the US and the rest of the world to pass similar legislation.

Together, we must send a universal, humanistic response to those who claim a right to users’ private information about what should not and will not be tolerated.

Cook made the point that advertising thrived for decades without invading personal privacy. And detailed Apple’s recent privacy features like privacy nutrition labels and the upcoming iOS 14 ad tracking transparency feature.

While Cook didn’t call out Facebook by name, he condemned its business model that any engagement is good engagement and capturing as much user data as possible.

If a business is built on misleading users, on data exploitation, on choices that are no choices at all, it does not deserve our praise, it deserves reform.

Going further he said:

Too many are still asking the question, “how much can we get away with?” when they should be asking “what are the consequences?”

Cook believes the end result of this approach to technology is the polarization of society, loss of trust, and violence.

The tension between Apple and Facebook has been growing over the recent months, and particularly even more since yesterday. Facebook CEO Mark Zuckerberg said during the company’s earnings call that “Apple has every incentive to use their dominant platform position to interfere with how our apps and other apps work, which they regularly do to preference their own. This impacts the growth of millions of businesses around the world, including with the upcoming iOS 14 changes, many small businesses will no longer be able to reach their customers with targeted ads.”

He also said that Facebook increasingly sees “Apple as one of our biggest competitors.” And just this morning we learned that Facebook may be preparing an antitrust lawsuit against Apple regarding the new ad tracking transparency in iOS 14. However, the Electronic Frontier Foundation and many others have sided with Apple on this.

Working to contrast Apple with Facebook and others’ approach, Cook elaborated on what the company sees as ethical technology:

At Apple, we made our choice a long time ago. We believe that ethical technology is technology that works for you. It’s technology that helps you sleep, not keeps you up. It tells you when you’ve had enough, it gives you space to create, or draw, or write or learn, not refresh just one more time. It’s technology that can fade into the background when you’re on a hike or going for a swim but is there to warn you when your heart rate spikes or help you when you’ve had a nasty fall. And with all of this, always, it’s privacy and security first, because no-one needs to trade away the rights of their users to deliver a great product.

CBO sees rapid growth recovery, labor force returning to pre-pandemic level by 2022

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The Congressional Budget Office upgraded its U.S. economic outlook, saying GDP growth will recover “rapidly.”

- GDP is expected to return to its pre-pandemic size in mid-2021 and the labor force is forecast to rebound to its pre-pandemic level in 2022, the CBO said.

- Importantly, the CBO said its rosier projections do not assume any new stimulus, including President Joe Biden’s $1.9 trillion plan.

- The CBO projects the unemployment rate to fall to 5.3% in 2021 and to 4% between 2024 and 2025.

U.S. economic growth will recover “rapidly” and the labor market will return to full strength quicker than expected thanks to the vaccine rollout and a barrage of legislation enacted in 2020, according to a government forecast published Monday.

Gross domestic product, or GDP, is expected to return to its pre-pandemic size by mid-2021 and the labor force is forecast to rebound to its pre-pandemic level in 2022, the nonpartisan Congressional Budget Office said.

Importantly, the CBO said its rosier projections do not assume any new stimulus, including President Joe Biden’s $1.9 trillion plan.

Here’s what the CBO sees for the U.S. economy:

- Real GDP to grow 3.7% in 2021

- GDP growth to average 2.6% over the next five years

- The unemployment rate to fall to 5.3% in 2021, and further to 4% between 2024 and 2025

- Inflation to rise to 2% after 2023

- The Federal Reserve to start hiking the federal funds rate in mid-2024

- Upgraded economic outlook through 2025

These projections are a stronger outlook than the budget office’s prior forecast from summer 2020, when the CBO said it expected the coronavirus to sap about $7.9 trillion of economic activity over the next decade-plus.

The CBO said it upgraded its estimates “because the downturn was not as severe as expected and because the first stage of the recovery took place sooner and was stronger than expected.” CBO staff added that businesses proved more able to adapt to government-imposed restrictions, but that certain industries — such as hospitality and food services — are still struggling.

Regardless, the rapid expansion the CBO projects for the next five years is expected to moderate in the five years thereafter amid an uptick in prices and a more normal level of long-term consumer spending.

Between 2026 and 2031, the CBO foresees real GDP growth of about 1.6% annually and the Fed allowing inflation to run above its 2% target.

The office also issued some analysis of the recent, $900 billion stimulus package that Congress passed in December. CBO estimates that the pandemic-related provisions in that legislation will add $774 billion to the deficit in fiscal year 2021 and $98 billion in 2022.

Those provisions will boost the level of real GDP by 1.5%, on average, in calendar years 2021 and 2022, CBO estimates.

The CBO’s outlook comes at a precarious time for the U.S. economy as the coronavirus prompts many states to impose business closures and other social-distancing measures to help slow the spread of the disease.

Economists say the economy suffered a brief but sharp recession in 2020 as the unemployment rate spiked to 14.8% in April and growth contracted 31.4% in the second quarter. Covid-19 has killed more than 440,000 Americans, according to data compiled by Johns Hopkins University.

While the economy has come a long way since then, both Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell have in recent months warned that Congress may need to pass additional stimulus to support households and business until the Covid-19 vaccine is more widely available.

According to the latest reading, the U.S. employment rate stood at 6.7% in December. The Labor Department is scheduled to publish the next look at the U.S. employment situation on Friday.

Biden has for months lobbied for another round of stimulus in addition to the $2.2 trillion CARES Act that Congress passed last March and the $900 billion package passed in December.

Earlier this month, the new administration floated a $1.9 trillion plan that includes $1,400 direct payments, a per-week federal unemployment benefit of $400 through September and an increase to the federal minimum wage to $15 per hour.

Moderate Republicans in the Senate, as well as conservative Democrat Sen. Joe Manchin of West Virginia, have balked at the lofty price tag of Biden’s plan. Ten Republican senators on Sunday floated to the administration a $600 billion counteroffer.

Apple launches $14B bond sale

Feb. 01, 2021 2:48 PM ET

By: Brandy Betz, SA News Editor

- Apple (NASDAQ:AAPL) officially launches its six-part $14B debt offering and the longest part is a $1.75B 40-year fixed security with initial price talk at 115-120 over Treasuries, according to Bloomberg sources.

- Until 2020, Apple hadn’t sold bonds more than once a year since 2017. The tech giant has now tapped the bond market for the third time in about eight months.

- Apple reportedly wants to take advantage of the current low interest rates and will use the proceeds toward general corporate purposes, including capital allocation through repurchases and dividends.

- Apple shares are up 1.8% to $134.38.

- Earlier today, Bloomberg reported on the potential bond sale and the terms of the 40-year security.

HI Financial Services Mid-Week 06-24-2014