HI Financial Services Mid-Week Commentary 08-11-2015

“I enjoy working in an industry that is impossible to conquer”. – Kevin Hurley

The “proper trading” perspective

Over the past week I went out to Houston so I could visit my parents. My time was spent with my dad at the MD Anderson cancer institute, fishing with a couple of my brothers and parents, and obviously talking with clients thru a volatile week in the market.

I noticed that the best investors, cancer survivors, and the people I like to spend my time with all have a common characteristic. They all seem to have a “proper perspective” on life. I don’t know how to define what a proper perspective is? I can tell you what I see and like in these individuals.

My dad has a no quit, never die attitude. He is obviously my hero which is quite a statement when Todd Christensen of the Oakland Raiders used to live in my neighborhood. He rolls with the punches and has always been an example to me. He faces some of the toughest decisions in life, shrugs his shoulders and moves forward after a decision is made. I can’t remember a time when he regretted making a choice because he understands it was probably the best choice at that time. I love him and appreciate his example of how to live life.

The best investors I know personally also have great perspectives in the market. They may lose short term but understand the big picture. Long term, even if that only means 30 more days, they seem to find ways to turn it around. By the end of a year they seem to always be profitable even if they don’t beat the S&P 500. In down years in the market they are also profitable. In the years that they might be down when the market is up, they’ve added hundreds of shares to portfolios to kill it the next year. The little things that drive the average investor to dump everything or a quitting the market mentality I don’t see in the professional investor. I think keeping things in the proper perspective through a proven methodology in the stock market keeps the mental art of investing in check. I know it beats the Funds that are out there and it always beats the big box brokerage houses.

As I spent time with my brothers I had time to watch and observe. They are good men even though we sometimes act like 16 year olds when we all get together. As I pondered where I’m going in this life, what I enjoy doing for work and where I want to be in the future none of it revolves around money. I want to play with the family. More time sitting by a lake with a fishing pole. More time holding my little girls and my wife. More time throwing a ball with my boys or just wrestling with them. I want more time to live life to the fullest.

My perspective changed again over the last week. Yes, life takes money to pay for the necessities of life. Yes, money and making money is one of the necessary evils in life. Just make sure it isn’t the only perspective in your life! Some ways to tell if it is taking over the things that are more important might be some of these things:

Spending hours in front of a computer watching, studying or cussing the market

Anger towards other due to frustration with the stock market

Knee jerk reactions to day trading

Lack of Sleeping due to market worry or fear

Running from the market and booking losses that take even longer to come back from

I love being in the stock market when I have the “proper perspective” whatever that might be. I know all of us deserve the financial freedoms the market offers yet so rarely delivers. I’m grateful for the opportunity to juggle life the best I can but right now I’m most grateful for the proper perspective!

What’s happening this week and why?

China Devaluation !!! Why did they devalue the Yaun ?

They want to make their exports cheaper after the -8.3 export reading last month

Greece got their bailout and their banks /stock market opened

Worry about the Fed raising rates = correction

U.S.

Productivity 1.3 vs est 1.4

Wholesale Inventories .9 vs est .8

Labor Cost -.5 vs est .1

Where will our market end this week?

????

DJIA – Bearish and lower higher and lower lows

SPX – Bearish to pretty darn flat – 200 SMA is acting as support, lower highs BUT higher lows

COMP – Bearish but lower highs and flat lows just broke the 50 SMA support

Where Will the SPX end August 2015?

08-04-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

08-04-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

What is on tap for the rest of the week?=

Earnings:

Tues: CREE, FOSL, MYGN, RRGB

Wed: BABA, M, NTES

Thur: AMAT, DDS, KSS

Fri:

Econ Reports:

Tues: Productivity, Wholesale Inventories, Unit Labor Costs

Wed: MBA, Jolts

Thur: Initial Claims, Continuing Claims, Retail Sales, Retail Ex-trans, Import, Export

Fri: PPI, Core PPI, Industrial Production, Capacity Utilization, Michigan Sentiment

Int’l:

Tues – JP:BOJ Minutes

Wed – EMU: Industrial Production, JP: Machine Orders, CN: Industrial Production, Retail Sales,

Thursday – EMU: ECB Minutes

Friday – DE:FR:EMU: GDP Flash

Sunday – JP: GDP

How I am looking to trade?

I was prepared for earnings and have had my hedges in place.

Disappointed in the earnings and I’m in full collar trades to protect on the way down. If you can’t do it I can for you !!!

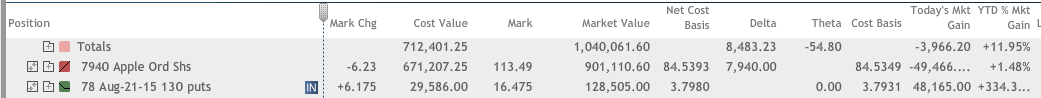

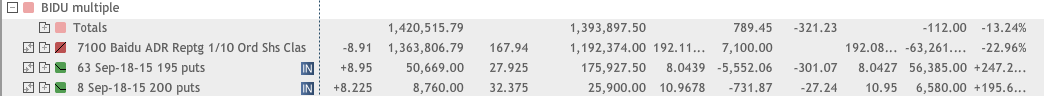

I want to show you some of the positions in my portfolio. I dollar cost averaging without having to use any extra money or ask clients for any extra money.

You are still down in the position but you have 20% more shares with no money out of pocket. I wanted you to be aware that the name of the game is not to not lose money but rather to control your risk in any trade while, most importantly, adding shares for free. Additionally, if we were to take away all the downside in the investment then we would take away all the upside in the investment. Losses are temporary but these extra shares will always be yours. So when the equity turns and starts to move back up again, you will have 20% more profit.

Stocks will always go up and always go down. Our goal is to protect your investments when needed, define your risk during market turmoil, and to add shares at no cost to you when we are able.

And I do have some covered calls where I lost NOTHING on the move down today![]()

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014