HI Financial Services Mid-Week Commentary 07-14-2015

Stock Market Higher amid Greece hopes and Oil Gains – CNBC

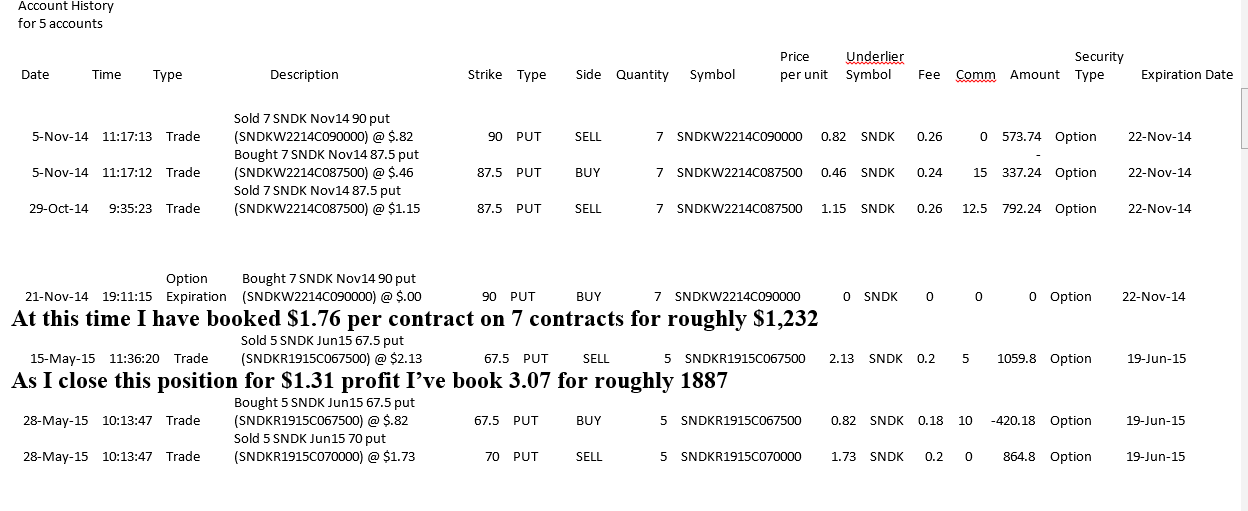

I was asked about short puts and the what’a, could’a, should’a that is involved with that trading process.

If and when place a short put be prepared to take stock ownership as the easiest and most profitable adjustment.

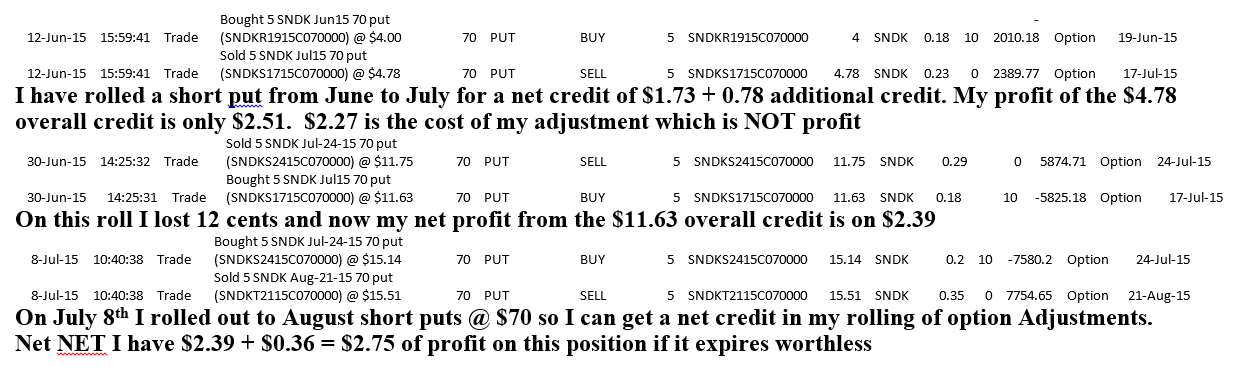

SNDK short put history and current position

On July 8th I rolled out to August short puts @ $70 so I can get a net credit in my rolling of option Adjustments.

Net NET I have $2.39 + $0.36 = $2.75 of profit on this position if it expires worthless

What’s happening this week and why?

Retail sales numbers disappoint -0.3 vs est 0.3

Ex-trans for retail sales -0.1 vs est .5

Exports -0.1 vs est 0.7

Imports -0.2 vs est 0.0

Business Inventories came in at 0.3 vs est 0.2

Where will our market end this week?

????

Yellen Speaks on Wednesday to the House Financial Committee

Wednesday we find out more Greece info

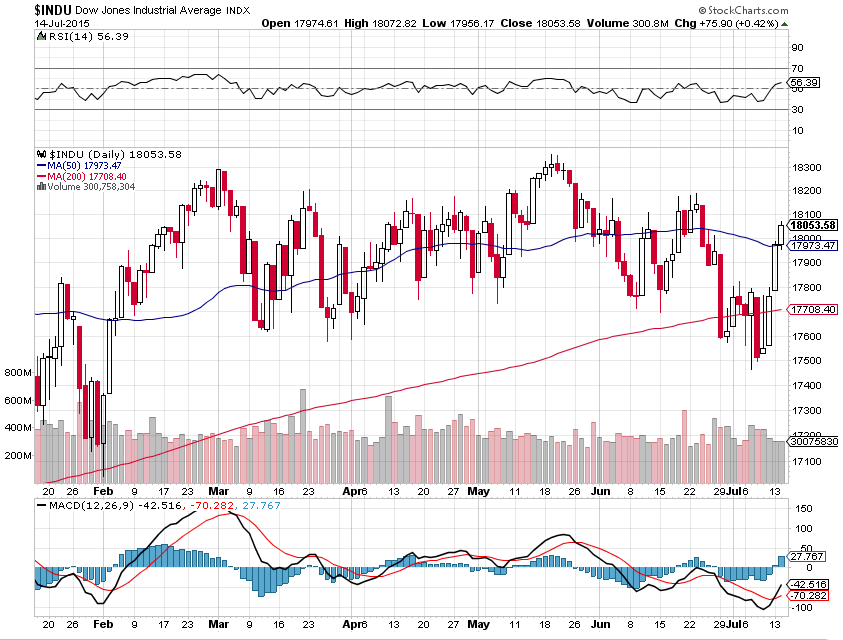

DJIA – Bullish and gained back the 50, 200 SMA

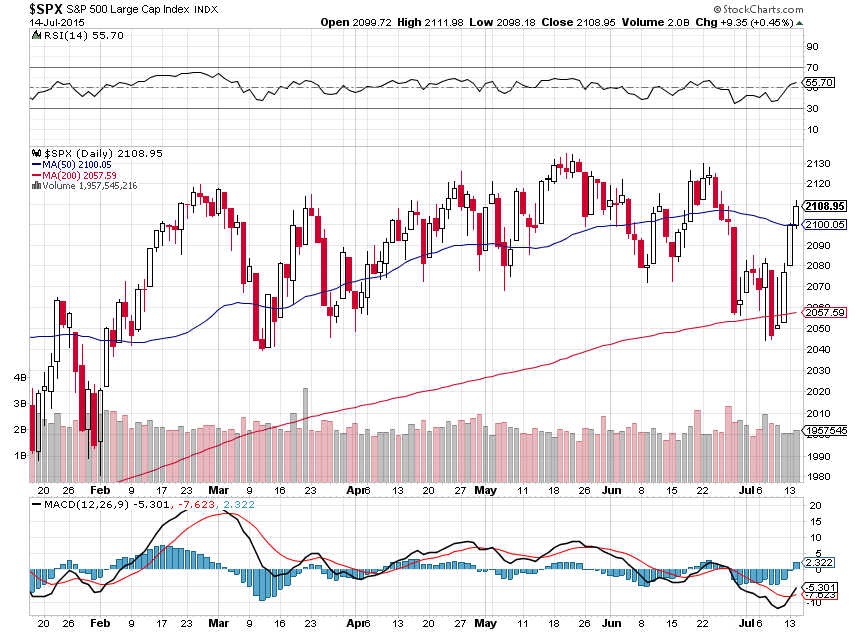

SPX – Bullish and gained back the 50, 200 SMA

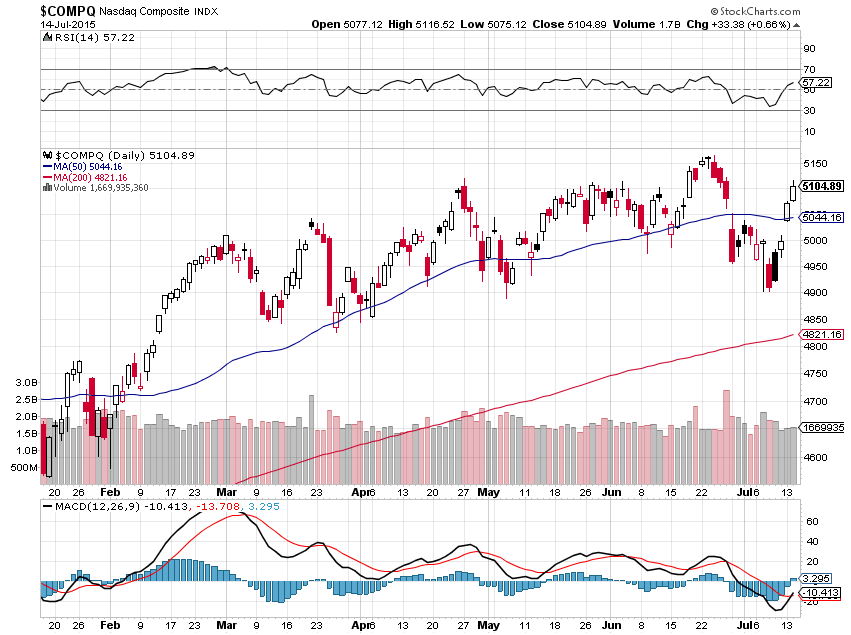

COMP – Bullish and gained back the 50 SMA

Where Will the SPX end July 2015?

07-14-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

07-07-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

What is on tap for the rest of the week?=

Earnings:

Tues: FAST, JNJ, WFC, YUM

Wed: BLK, DAL, INTC, KMI, NFLX, USB

Thur: C, DPZ, GS, GOOGL, MAT, PM, SLB, VFC

Fri: ALV, GE, GWW

Econ Reports:

Tues: Retail Sales, Retail ex-auto, Import, Export, Business Inventories,

Wed: MBA, PPI, Core PPI, Empire, Industrial Production, Capacity Utilization, Fed Beige Book

Thur: Initial Claims, Continuing Claims, Philadelphia Fed, NAHB Housing Market Index, Net long term TIC Flows

Fri: CPI, Core CPI, BLDG Permits, Housing Starts, Michigan Sentiment

Int’l:

Tues – JP: BOJ Announcement, EMU: Industrial Production, CN: GDP, Industrial Production, Retail Sales,

Wed – GB: Labour Market Report

Thursday – EMU: ECB Announcement and the HICP, Merchandise trade

Friday –

Sunday –

How I am looking to trade?

I am preparing for earnings and started two weeks ago. The need to protect for a vacation came at a great time for the Greece and China market drops.

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014