HI Financial Services Mid-Week Commentary 07-07-2015

Volatility is King and a killer – Kevin Hurley

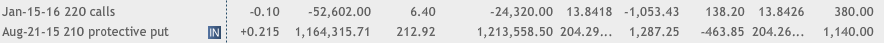

It has been tough being in a headline risk market environment. Kind ‘a nice to have volatility help both sides of the options on the stokc. The protective put strategy made a NET +$0.215 on a three dollar drop on BIDU and the calls we sold also lost -$0.10. A net $0.315 or 10% on the loss of $3 on the stock. Pretty cool to make money on a stock down $3 for the day.

What’s happening this week and why?

It is all about Greece and we really have no rational market direction at this time.

Where will our market end this week?

Nobody knows so I’m not going to even guess

DJIA – Technically bearish but we held the 200 SMA. Watch that level to hold as support

SPX – Bounce below the 200SMA but it held so we are also watching that important level.

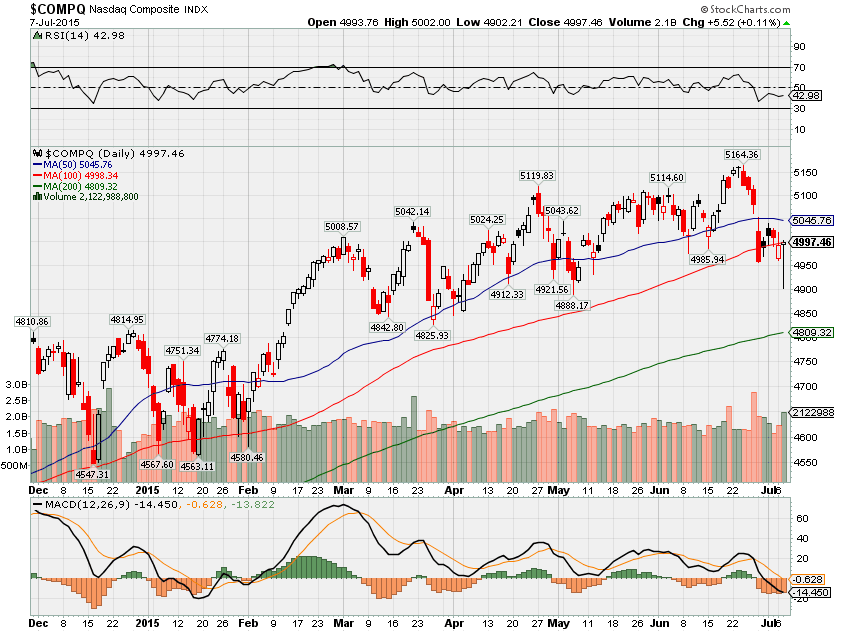

COMP – 100 SMA is holding and technically bearish also

Where Will the SPX end July 2015?

07-07-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

What is on tap for the rest of the week?=

Earnings:

Tues:

Wed: AA, WDFC

Thur: PEP

Fri:

Econ Reports:

Tues: Trade Balance, JOLTS, Consumer Credit

Wed: MBA, FOMC Minutes

Thur: Initial Claims, Continuing Claims,

Fri: Wholesale Inventories

Int’l:

Tues – DE:GB: Industrial Production

Wed – CH: PPI, CPI

Thursday – JP: PPI, GB: BOE Announcement

Friday – FR: Industrial Production

Sunday – CN: Merchandise Trade Balance

How I am looking to trade?

I am preparing for earnings and started two weeks ago. The need to protect for a vacation came at a great time for the Greece and China market drops.

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley