HI Financial Services Mid-Week Commentary 05-19-2015

“It (a default event) is on the cards, it’s been on the cards for ages but the key is this: Greece is like a horse with three broken legs. The only discussion is about who is going to shoot it, “Philippa Malmgren, founder of consultancy DRPM Group, told CNBC Europe’s “Squawk Box” Monday.”

What’s happening this week and why?

NAHB Housing Market Index 54 vs est 57

Housing Starts 1135 vs est 1019 and revisions to 944 from 926 last month

Building Permits 1143 vs est 1065

Consumer Spending

Company expansion – New Employees, Building new sites, Spending money on infrastructure

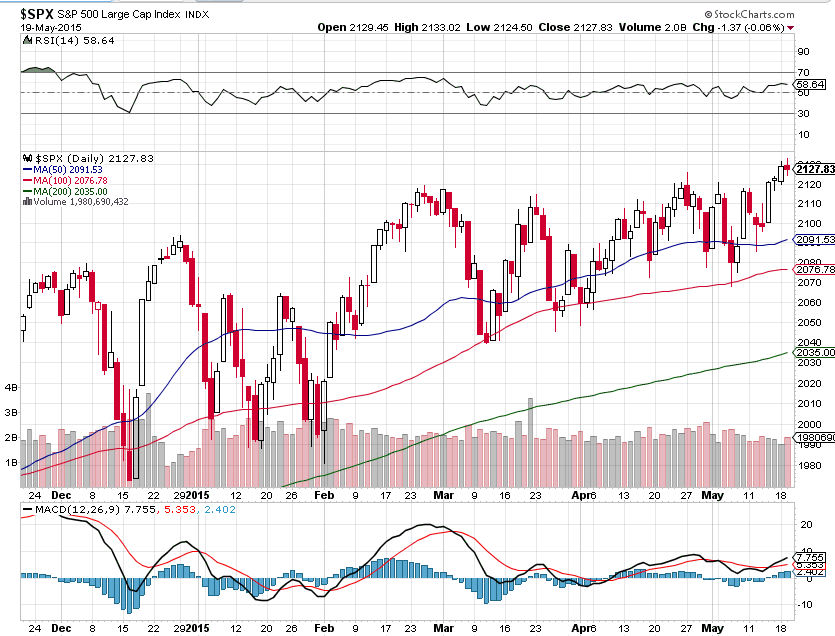

Records highs don’t mean a lot !!!! The new record highs on the S&P 500 is 10 points or less than 0.5%

Where will our market end this week?

Slow grind higher but last day of volume will be Thursday with it being the Memorial Day weekend.

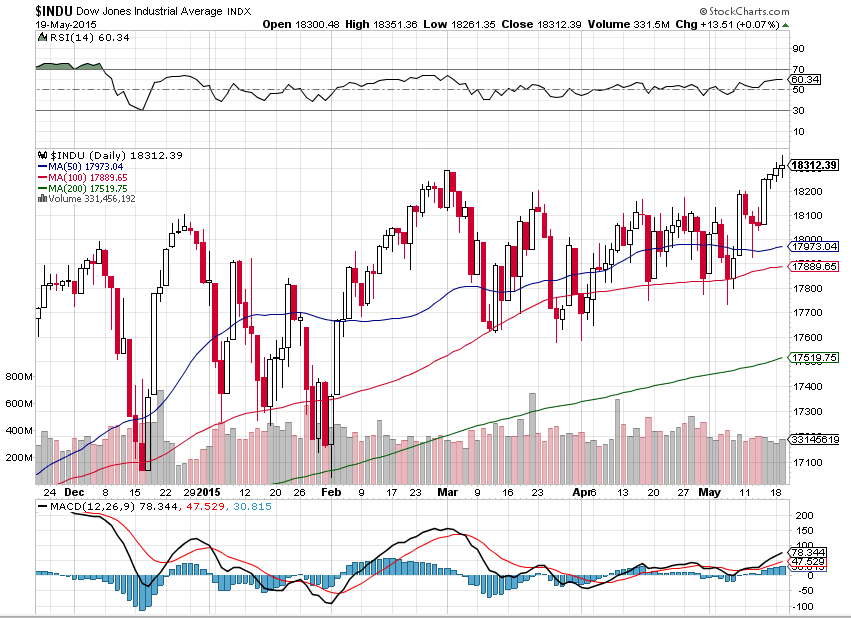

DJIA – Technically speaking we are bullish

SPX – Technically speaking we are bullish

COMP – Technically speaking we are bullish

Where Will the SPX end May 2015?

05-19-2015 UP 2% for the month

05-12-2015 Sell in May and go away down 3 to 6% 2050 level

05-05-2015 Sell in May and go away down 3 to 6% 2050 level

04-28-2015 Sell in May and go away down 3 to 6% 2050 level

What is on tap for the rest of the week?=

Earnings:

Tues: DKS, HD, QIHU, WMT

Wed: AEO, HRL, LOW, NTAP, SHLD, SPLS, TGT

Thur: ARO, CRMT, BBY, BKE, DLTR, GPS, HPQ, LGT, ROST,

Fri: ANN, CPB, DE, FL

Econ Reports:

Tues: Housing Starts, Building Permits

Wed: MBA, Crude, FMOC Minutes

Thur: Initial Claims, Continuing Claims, Existing Home Sales, Phil Fed, Leading Indicators

Fri: CPI, Core CPI

Int’l:

Tues –

Wed – GB: BOE Minutes, JP: All Industry Index

Thursday – JP: BOJ Announcement, PMI Manufacturing, CN: PMI Flash Mfg Index

Friday – DE:FR:EMU: PMI Composite

Sunday – JP: Tertiary Index

How I am looking to trade?

Positions expired to change the Collars and Protective puts that I was in. Right now I am in mostly stock ownership with leap short calls as a little downside protection.

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014