HI Financial Services Mid-Week Commentary 05-12-2015

Comments in general:

Lack of leadership in the stock market

I don’t see fear in the VIX or in the orderly selling I’ve seen over the last month

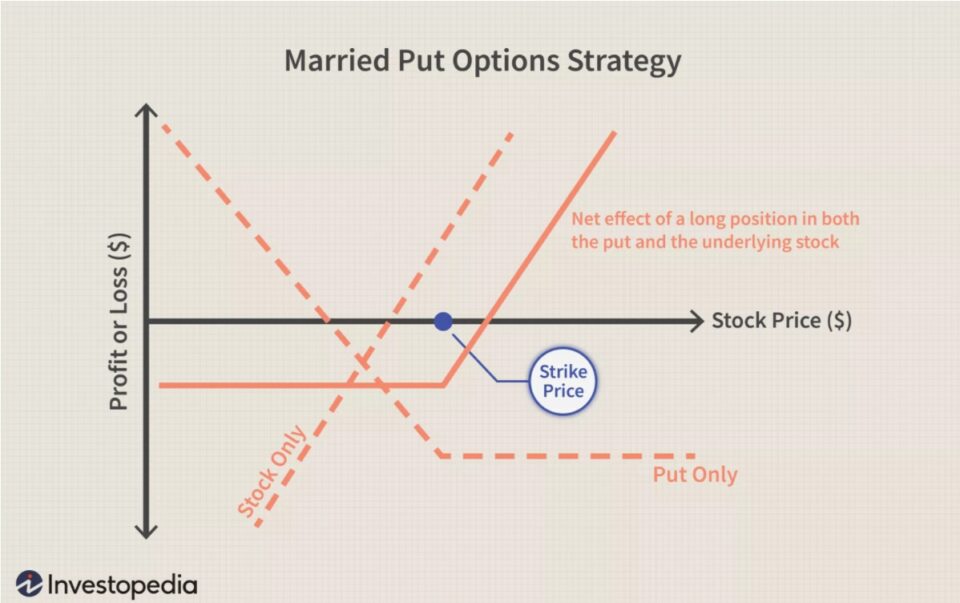

I want to be NON-Directional – Trades are Collar trade, Straddle/Strangle, Ratio Spreads

Protect yourself in Protective puts or collar trades:

BIDU: It the Money Protective Puts that made $1.55 today when the stock lost $0.865 !!!! Love it when volatility makes more on the way down than the stock loses. I have been able to make up almost $20 a share on the way down which will allow me to add additional shares on options expiration Friday !!!

What’s happening this week and why?

China rate decrease of 25 basis points

Greece mad an IMF payment one day early totaling 750 Million Euros !!

Oil is still rising for the year

Jolts Job openings 4.994 M vs est 5.133 M

Treasury Budget 157.0 B vs est 155.0 B

Where will our market end this week?

Our markets to rebound end finish higher

DJIA – Technically bullish holding the 50 SMA but in a range – Upside of 18200 downside of 17770 to 17600

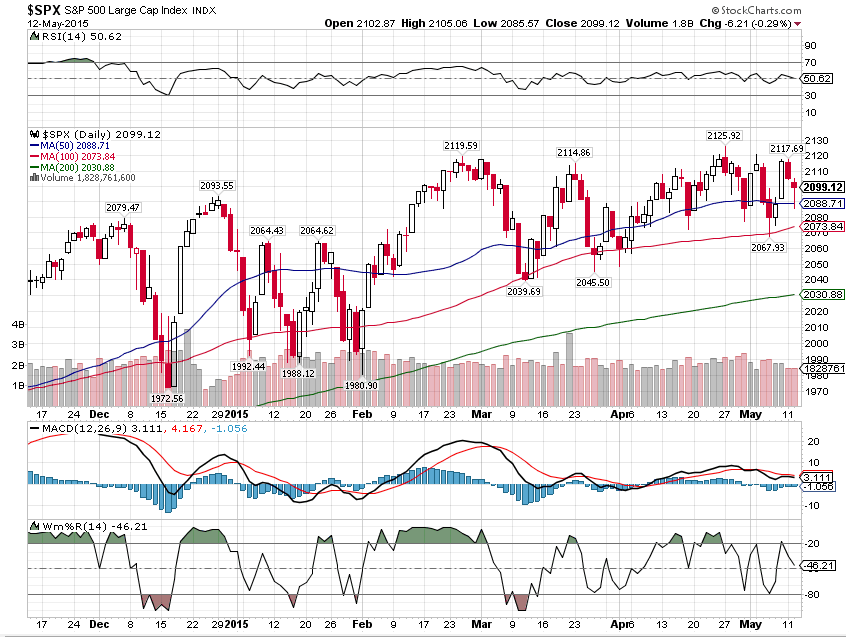

SPX – We have two indicators that are flat and indecisive!!!

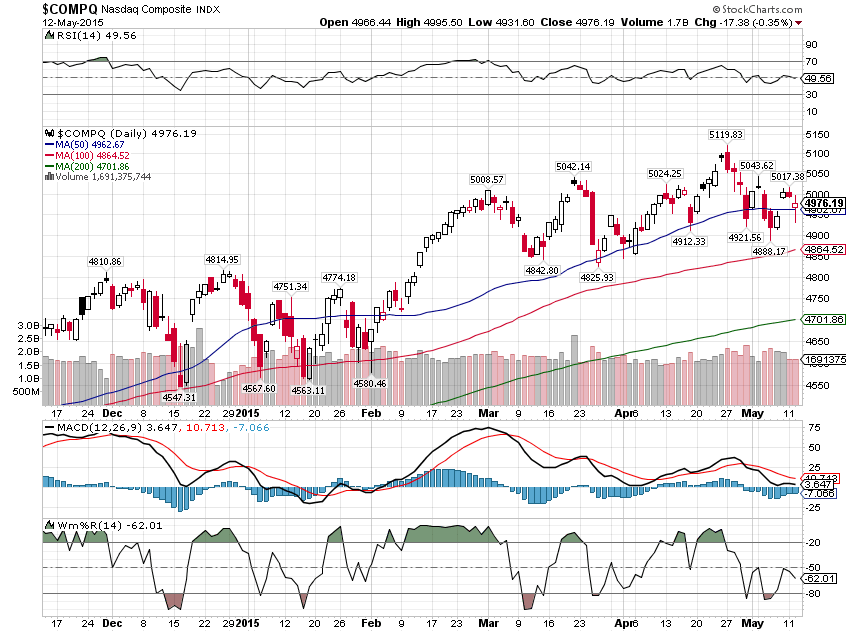

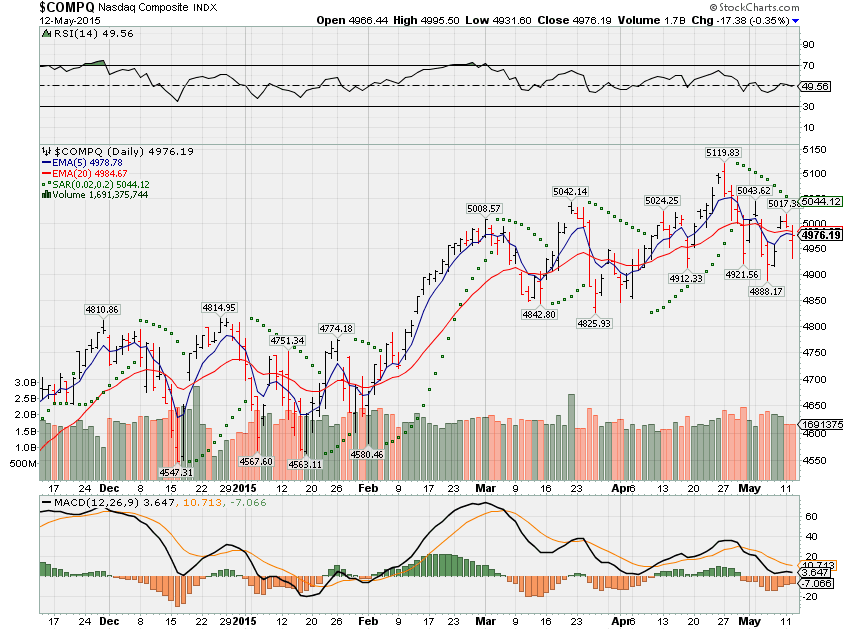

COMP – Technically bearish with two bearish indicators and the RSI laying on the median line

Where Will the SPX end May 2015?

05-12-2015 Sell in May and go away down 3 to 6% 2050 level

05-05-2015 Sell in May and go away down 3 to 6% 2050 level

04-28-2015 Sell in May and go away down 3 to 6% 2050 level

What is on tap for the rest of the week?=

Earnings:

Tues: GDDY, Z

Wed: DDS, CTRP, JCP, NTES, RL, SHAK, M

Thur: AMAT, LOCO, KSS, JACK, LWN,

Fri:

Econ Reports:

Tues: Jolts, Treasury Budget

Wed: MBA, Crude, Export, Import, Retail sales, Retail ex-auto, Business Inventories

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Empire Manufacturing, Capacity Utilization, Industrial Production, Mich Sentiment, Net long term TIC Flows

Int’l:

Tues – CN: Retail Sales, Industrial Production

Wed – FR:DE:EMU GDP Flash EMU:Industrial Production, ECB Minutes

Thurs – JP: PPI

Friday –

Sunday – JP: Tertiary Index

How I am looking to trade?

Collars and Protective puts right now

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014