HI Financial Services Mid-Week 01-27-2015

It has been said that history turns on small hinges, and so do our lives. Decisions determine destiny. But we are not left unaided in our decisions. – Thomas S Monson

How safe do you think it is to spread trade with our volatility in the market? There is no right answer but non direction spread trades are the best right now – Strangle, Straddle, Collar, Ratio Spreads and maybe Calendars if Way out in time

Today’s Market

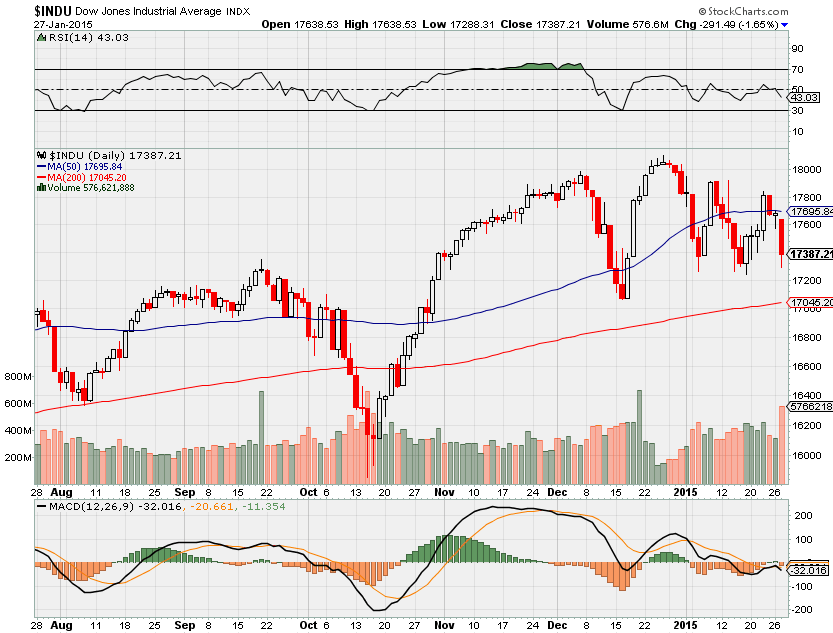

DJIA Down -291 or 1.65%

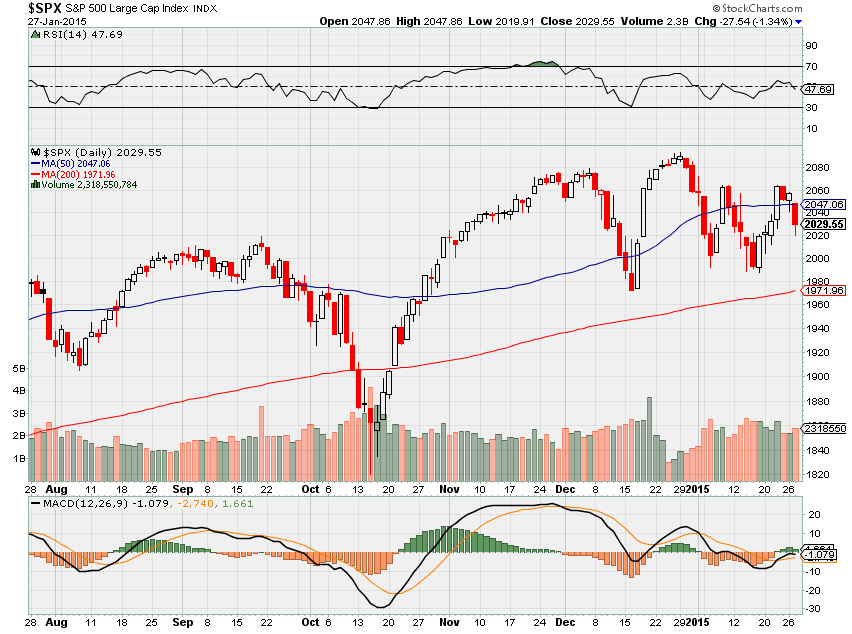

SPX Down -27.54 or 1.34%

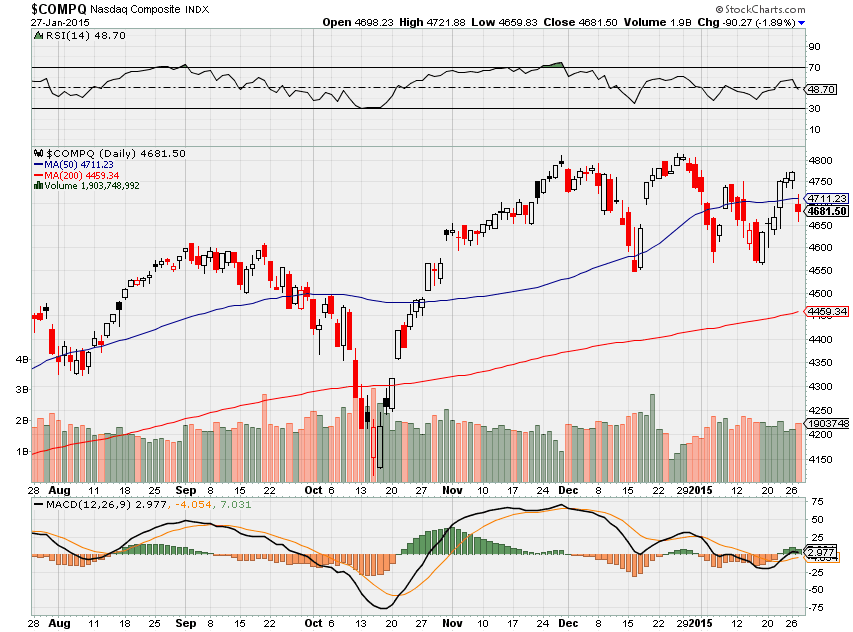

Comp Down -90 or 1.89%

How much was HI down today at the close? Bert won with ALL Trade Monster Accounts down $28,990

Putting that into perspective – Did I beat the market today? YES

Am I beating the market YR to Date? YES down 37K on 6.1 Million

Am I able to sit thru volatility? YES – WHY? Hedged, Collars, Non directional Spreads

What saved me today was chart analysis, collars, non-direction and portfolio hedges with the SPX, !!!!

Put on the hedge yesterday 30 minutes before the market close and closed it 30 mintes today before the market close. Reason Why? Based on positive tech earnings or earnings in general on AAPL, T, YAHOO, MMM, BMY in all honesty I expected bad earnings from COH, CAT, FCX, PFE

If you are fearful of the stock market you should NOT be trading !!! IF you can’t pull the trigger on a trade you should NOT be trading !!! Save your money and wait until volatility slows down or change your style of trading.

18 of the 150 S&P 500 that reported this week up to this morning ALL cited stronger dollar for lower overall revenues and weaker guidance than estimate

What’s happening this week and why?

Greek Elections and new President promises !!!

Durable goods -3.4 vs est 0.5

Durable ex trans -0.8 vs est 0.6

Case Shiller 4.3 vs est 4.3

Consumer Confidence 102.9 vs est 96.0

New Home Sales 481 vs est 450

AAPL, YHOO, PFE beat big today and we will probably see a bounce or follow through into tomorrow and the rest of the week

Where will our market end this week?

End of the month so I will call for 1% down with selling at the end of the month BUT funds have to be in AAPL so the Nasdaq will most likely run positive into the end of the month

DJIA – Bearish on all three tech indicators

SPX – Technically speaking we are bullish, with resistance at 2060 ish and support at 2020ish

COMP – Bullish but today closed below the 50 SMA

Where Will the SPX end January 2015?

01-27-2015 I would expect down 3% but moving down 7 to 10% during the month. Feb my guestimate is 2050 or slightly positive

01-20-2015 I would expect down 3% but moving up 1% or more this week. Earnings may change my mind

01-13-2015 I would expect down 3% but moving down 7 to 10% during the month. Earnings may change my mind

01-06-2015 I would expect down 3% but moving down 7 to 10% during the month

What is on tap for the rest of the week?=

Earnings:

Tues: AAPL, MMM, T, CAT, BMY, PG, GLW, COH, FCX, JNPR, PFE, YHOO, WDC, X

Wed: FB, ATK, BA, GD, HES, IP, LVS, MUR, QCOM, TROW, WYNN

Thur: F, V, ABOT, AMZN, ALV, COP, DOW, DECK, GOOGL, HOG, HSY, JDSU, PSX, RTN, VLO

Fri: BZH, CVX, MA, XRX, TSN

Econ Reports:

Tues: Durable Goods, Durable ex-trans, Case Shiller, Consumer Confidence, New Homes Sales

Wed: MBA, Crude, FOMC Rate Decision,

Thur: Initial Claims, Continuing Claims, Pending Home Sales,

Fri: GDP, Chain Deflator, Employment Cost Index, Chicago PMI, Michigan Sentiment

Int’l:

Tues – FR: Business Climate, GB: GDP

Wed –

Thurs – EMU: MS Money Suppley, EC Economic Sentiment, JP:CPI, Unemployment Rate, Industrial Production

Friday – DE: Retail Sales, EMU: HICP Flash, Unemployment Rate

Sunday –

How I am looking to trade?

I am prepared for earnings

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

AAPL – 01/27 AMC

BABA – 01/29 BMO

BIDU – 02/11 AMC

CLDX – 03/02 BMO

D – 02/06 AMC

DIS – 02/03 AMC

F – 01/29 BMO

FB – 01/28 AMC

LNCO – 02/26

NVDA – 02/11

SNDK – 01/21 AMC

V – 01/29 AMC

VZ – 01/22 BMO

WBA – 03/24

ZION – 01/26 AMC

SBUX – 01/22 AMC

MS – 01/20 BMO

PCLN – 02/19

NKE 3/19

RHT 3/26

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

Sticker shock! Stock valuations at 10-year high

http://www.cnbc.com/id/102364086

Billionaires are buying these dividend stocks

Why Facebook Is A Better Investment Than Google On Digital Video

Lew: Strong US dollar is ‘good for the world’

http://www.cnbc.com/id/102363240

Facebook: Digital Payments, Not Oculus Rift, Offer Better Long-Term Benefits

Supreme Court passes on looking at swipe fees cap

Disney Has The Best Movie Director Of All Time

HI Financial Services Mid-Week 04-29-2014