HI Financial Services Mid-Week 01-21-2015

“When the odds are against you, you have to dig deep… deeper than you thought was in your power. You have to find that inner strength and use it to focus on what matters. It’s only then that you’ll have clarity. Right now, your mind is racing. Find that inner strength and focus on what matters most.” – Christopher David Peterson – The Curse of Atlantis

#1 What am I doing and why?

I am collar trading based on technical crossovers and allowing 2 to 4 days for those crossovers to validate themselves

#2 What has helped you the most with trading?

Education but after education I read a lot !!! I probably spend 2 hours a day reading about the market, stock news that I am in, Investopedia to better understand what others look at like valuation, cash flow, future earnings projections, etc….

What’s happening this week and why?

China GDP better than expected but still less than last year

NAHB Housing Market Index 57 vs est 58

Building permits 1032 vs est 1060

Housing starts 1089 vs est 1040

Where will our market end this week?

It all comes down to the Thursday ECB meeting and if Draghi can actually do something “big”

Rumor is the ECB will buy 58 Billion (Euros) worth of government back bonds

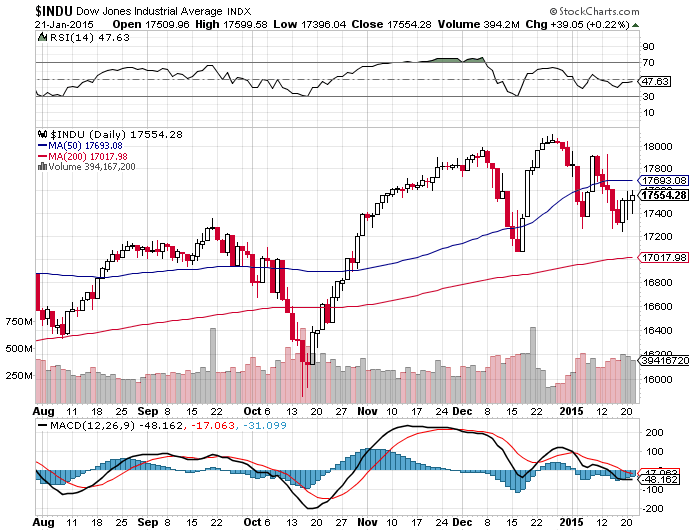

DJIA – Technically still bearish, below the 50 SMA

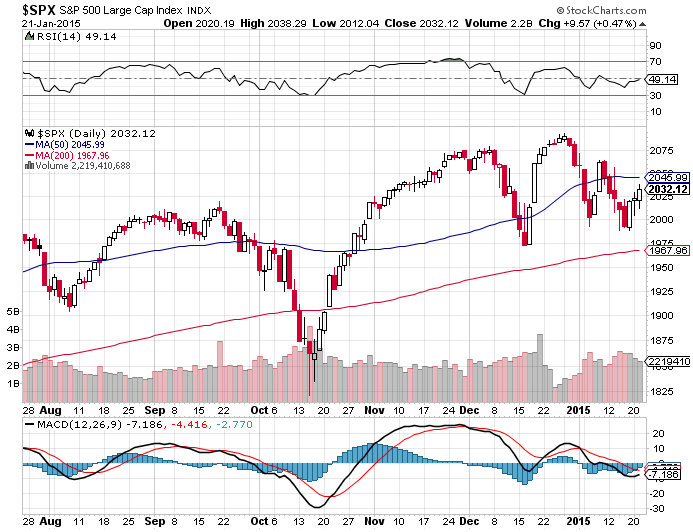

SPX – Bearish and mirrors the DJIA with bounces off the 1986 ish level

COMP – technically bearish with bounces off the 4550 level in a triple bottom

Where Will the SPX end January 2015?

01-20-2015 I would expect down 3% but moving up 1% or more this week. Earnings may change my mind

01-13-2015 I would expect down 3% but moving down 7 to 10% during the month. Earnings may change my mind

01-06-2015 I would expect down 3% but moving down 7 to 10% during the month

What is on tap for the rest of the week?=

Earnings:

Tues: MS, COH, IBM, CREE, DAL, GD, JNJ, HAL, NFLX, AMC

Wed: SNDK, AXP, DFS, EBAY, FFIV, USB, UNH

Thur: VZ, SBUX, ALK, ALTR, LUV

Fri: BK, GE, HON, KMB, MCD

Econ Reports:

Tues: NAHB Housing Market Index

Wed: MBA, Crude, Building Permits, Housing Starts

Thur: Initial Claims, Continuing Claims, FHFA Housing Price Index

Fri: Existing Home Sales, Leading Indicators

Int’l:

Tues – CN: GDP, Industrial Production, Retail Sales, JP: All Industry Index

Wed – GB: Labour Market Reprot

Thurs – FR:DE:EMU: PMI Composite, ECB Announcement

Friday –

Sunday – JP: Merchandise Trade

How I am looking to trade?

I am prepared for earnings

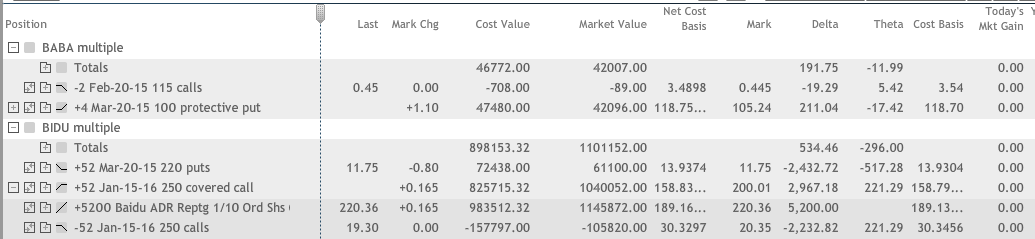

True cost basis for the stock is closer to $107 due to short puts getting into the stock, short calls against the shares and long put profits

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

AAPL – 01/27 AMC

BABA – 01/29 BMO

BIDU – 02/18

CLDX – 03/02 BMO

D – 01/30

DIS – 02/03 AMC

F – 01/29 BMO

FB – 01/28 AMC

LNCO – 02/26

NVDA – 02/11

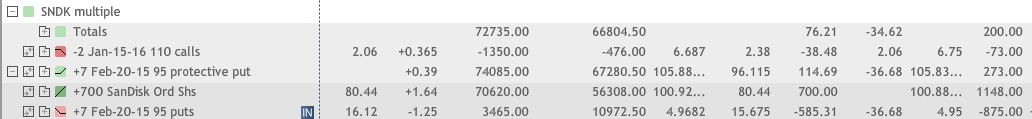

SNDK – 01/21 AMC

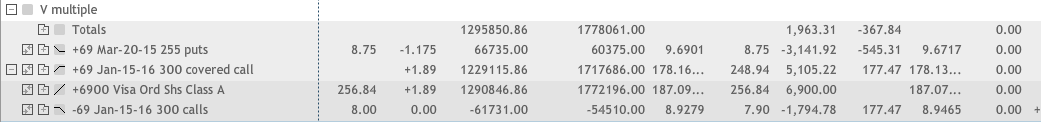

V – 01/29 AMC

VZ – 01/22 BMO

WBA – 03/24

ZION – 01/26 AMC

SBUX – 01/22 AMC

MS – 01/20 BMO

PCLN – 02/19

NKE 3/19

RHT 3/26

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

Why people pick Team Apple versus Team Android

http://www.cnbc.com/id/102289985

Here’s what the Swiss move just exposed

http://www.cnbc.com/id/102341727

Facebook hiring spree hints at virtual reality plans

http://www.cnbc.com/id/102347457

Looking to the ECB to move the dial

http://www.cnbc.com/id/102347441

DIS: Infinity holiday sales solid for Disney