HI Financial Services Commentary 12-12-2017

You Tube Link: https://youtu.be/DIrajTjtsiE

What I want to talk about today?

How do you take time off for the holidays and suggest we do as well?

You can add long puts to protect positions

Because low to no volume over the Christmas Holiday means no new trend changes

Signed and approved “new tax plan”, Window dressing

Risk is a tax selloff

Bitcoin: Yes I would like the returns you are seeing currently but NO I don’t want to be a bitcoin holder

Why no bitcoin or penny stocks that can skyrocket – The odds are the same as gambling in Vegas and you don’t get a show and a drink. Why not invest in the power ball, lottery, or the race track. SIMPLE I’M NOT A GAMBLER I’m a professional registered invest advisor.

Bitcoin has not been hacked yet but it will sometime in the future

More on Timing- If you want all the upside you have to be willing to take…..ALL THE RISK !!!!

What happening this week and why?

Rate Hike vs potential new signed tax plan = both can be a catalyst

Where will our markets end this week?

Higher

DJIA – Bullish and overbought

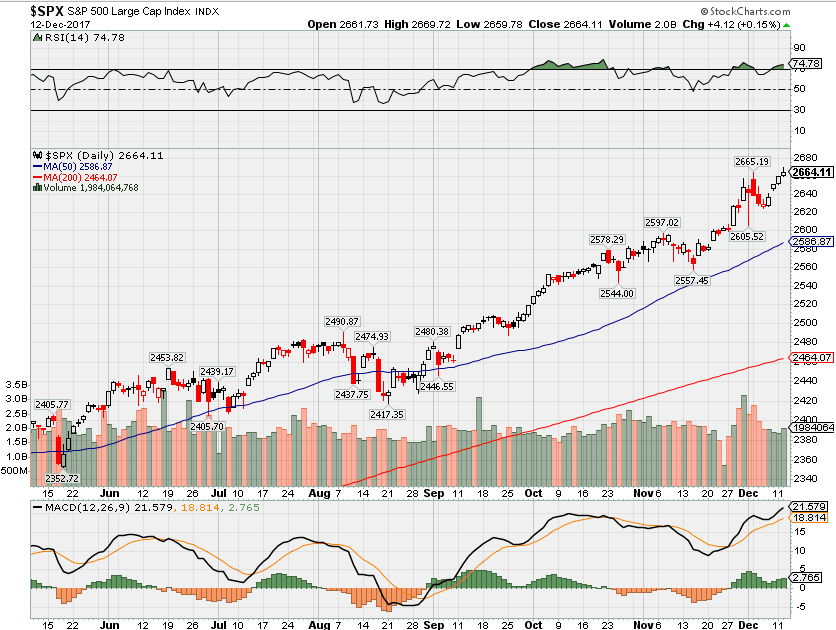

SPX – Bullish and overbought

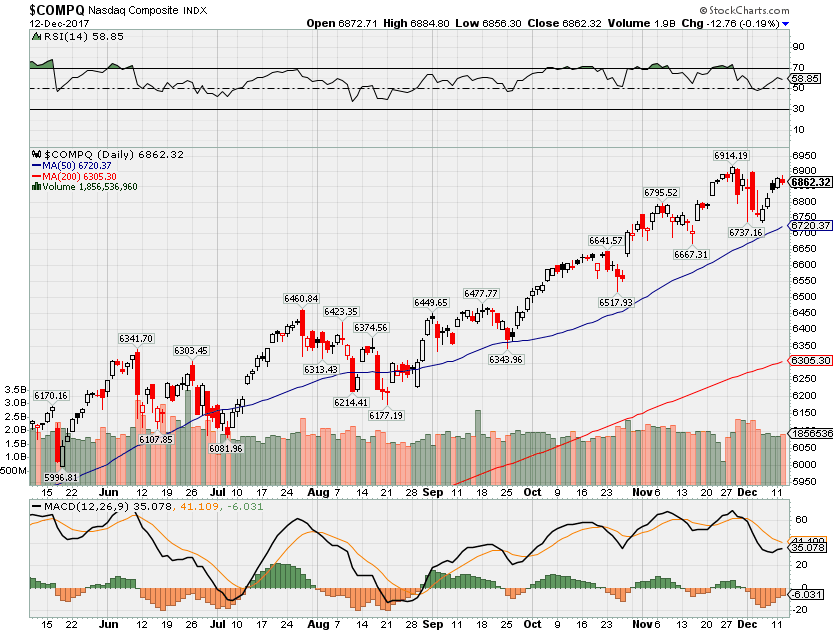

COMP – Bullish

Where Will the SPX end December 2017?

12-12-2017 +1.5%

12-05-2017 +1.5%

What is on tap for the rest of the week?=

Earnings:

Tues:

Wed: RMAX, PIR

Thur: ADBE, COST, ORCL, JBL

Fri:

Econ Reports:

Tues: PPI, Core PPI,

Wed: MBA, CPI, Core CPI, FOMC Rate Decision

Thur: Initial, Continuing Claims, Retail Sales, Retail ex-auto, Import, Export, Business Inventories

Fri: Empire Manufacturing, Capacity Utilization, Industrial Production, Net Long Term ATIC Flows,

Int’l:

Tues –

Wed – CN: Industrial Production, Retail Sales,

Thursday –

Friday-

Sunday –

Questions???

Yes on AAPL, NFLX, NVDA (new orders), FB, BIDU I have wide bear put spreads in place out to Feb, MAR for protection

BAC, C, ZION, MS order for financials to be invested in

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

https://finance.yahoo.com/news/heres-big-bitcoin-problem-just-discovered-211912644.html

Here’s a big bitcoin problem I just discovered

I bought a fraction of a bitcoin in October, and my little investment has appreciated about 150% since then. But if I want to cash out, I might have a problem — because apparently it’s not so easy to sell.

I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin. That’s where my bitcoin resides. To my mind, it’s the same as buying a mutual fund or ETF at Vanguard or Fidelity, which would then hold the shares and maintain the account.

But the frenzied buying and selling of bitcoin during the last several weeks has caused repeat outages at Coinbase, as the firm’s servers get overloaded. I don’t really want to sell my bitcoin right now, but what if I did?

As a test, I tried to place a sell order for $10 worth of bitcoin. Here’s the message I got:

View photos

Source: Coinbase

More

I tried again about an hour later, and this time Coinbase let my order go through: I sold off $10 worth of bitcoin. But there have been other times during the past few weeks when I wasn’t even able to access my account, since the whole website appeared to be offline. Such Coinbase crashes have occurred sporadically during heavy trading days since 2015, at least.

Coinbase has characterized its technical problems as “minor service outages” caused by “high traffic.” And its website says the company has insurance to protect all customer deposits, in full. Another popular exchange, Kraken, has had similar outages.

View photos

Source: Coinbase

More

This comes amid a dizzying week for bitcoin, with the price soaring 82% during the past seven days and more than 2,200% during the last year. The action has been so volatile lately that by the time you read this story, any price changes I note as I’m writing it will assuredly be obsolete.

Those giant price gains are luring rabid investors hoping for a cut of the action, with soaring demand, in turn, pushing prices even higher. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Most financial markets have “circuit breakers” and other mechanisms to slow runaway trading, but only for a while. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes.

That’s not the case with bitcoin, which was launched in 2009 and has gained a following gradually until this year, with dramatic surges in value drawing mainstream attention. Yet the immature infrastructure supporting bitcoin is one reason it remains risky, with volatile price swings.

At one point on Dec. 7, for instance, various exchanges quoted bitcoin prices that varied by more than $2,000, from a low of $15,592 to a high of $18,259 — all at the same time. On established financial markets, there can be very minor discrepancies in prices quoted simultaneously on various exchanges— but never in the range of 15% of a security’s entire value.

Bitcoin is not liquid

On mature markets, traders would take immediate advantage of large price variations by buying at the lowest price and selling at the highest price, normally in a matter of seconds. Computers might even do it automatically. But the limited liquidity on bitcoin markets doesn’t completely allow for that—for now. And one reason is the difficulty some bitcoin holders have selling when market action is hot.

If you can’t sell when the price is rising, it might not be that big a deal. You just have to wait until trading calms down and you can get an order through, by which time the price will be even higher.

But if you can’t sell when the price is falling, that could be a major problem that compounds losses, intensifies selling pressure and wrecks confidence in the cryptocurrency. If you want to sell at $10,000 but can’t get an order in until the price drops to $8,000, the delay costs you $2,000, or 20%, on top of whatever the loss would have been at $10,000. As word gets out that sell orders may not be filled, more people are likely to submit sell orders preemptively, hoping to get in line while they can.

The Dow could suffer a 2,400 point blow at any time, warns Wall Street legend Byron Wien

Stephanie Landsman | @stephlandsman

Published 8:39 AM ET Thu, 7 Dec 2017 Updated 9:56 AM ET Thu, 7 Dec 2017CNBC.com

A correction hasn’t shaken the historic market rally yet, but Wall Street legend Byron Wien says it’s “definitely” coming.

“A 10 percent correction could come along at any time, and particularly when the market has done as well as it’s done. I mean basically it’s gone straight up since Donald Trump was elected,” Wien warned on Wednesday on CNBC’s “Trading Nation.”

If a correction of that magnitude were to hit today, the Dow would suffer a 2,400 point blow.

Wien, vice chairman of Blackstone’s Private Wealth Solutions group, gives a 50 percent probability for a deep sell-off by year-end. He’s been in the correction camp all year — and says he’s concerned it hasn’t happened yet.

“The market is overbought and investors are optimistic,” said Wien. “An overbought market with optimistic investors is vulnerable, and the question is what triggers the vulnerability?”

It’s not an easy answer, according to Wien. His hunch is a geopolitical development, such as a major conflict with North Korea, could trigger a correction by causing instability. But it’s also possible the rally could just pause on its own.

“Maybe the market just spontaneously begins to fade,” added Wien, who believes the markets are already borrowing performance from 2018.

Regardless of how it materializes, Wien doesn’t see it as a sign that a bear market is around the corner. He believes stocks would bounce back quickly, and ultimately end 2018 higher than current levels.

“Fundamentals are very strong,” Wien said.

The Dow, which is up 32 percent since Trump was elected, saw its second negative session in a row on Wednesday after falling about 40 points. It closed at 24,140.

6 things, including bitcoin, that Bill Gross thinks investors need to worry about in 2018

- Janus Henderson portfolio manager Bill Gross thinks investors should worry about central banks, debt and inflation in 2018.

- The bond guru has been warning about investment dangers all year and has advised staying away from both bonds and stocks.

- Gross discusses bitcoin, economist Hyman Minsky and the cost of carry.

Published 8:29 AM ET Thu, 7 Dec 2017 Updated 11:48 AM ET Thu, 7 Dec 2017CNBC.com

Bond guru Bill Gross thinks investors need to “be careful in 2018” and cites six areas they need to watch as the calendar is set to turn.

In his monthly newsletter to clients, Gross frets over debt, liquidity and even bitcoin. The warnings come in a year when the portfolio manager at Janus Henderson expressed disdain for both stocks and bonds and advised owning real assets instead.

Of course, stocks have been on fire while bonds have been flat. Gross’ $2.2 billion Janus Henderson Global Unconstrained Bond Fund has been a laggard, returning just 2.74 percent year to date and in the bottom third of its class, according to Morningstar rankings.

His cautious approach to investing remains, and he outlined a half-dozen reasons why:

Central banks

The Federal Reserve and its global counterparts have begun the first steps of policy normalization but have kept interest rates low.

While providing a backstop for the economy and markets, it also has given central banks less room to move in the future. Gross sees that as a problem because investors have less “insurance,” in the form of central bank maneuverability, for bad times ahead.

“Should a crisis arise because of policy mistakes, geopolitical crises, or other currently unforeseen risks, the ability to protect principal will be impaired relative to history,” he wrote. “That in turn argues for a more cautious and easier Fed than otherwise assumed.”

Financial instability

Gross cites economist Hyman Minsky who warned about how long periods of financial stability actually could create instability. A “Minsky moment” in market parlance refers to a point where asset prices crash due to a sudden shift in debt or currency stability.

The surge in leverage since the financial crisis has been a concern for Gross and others, including Fed Chair Janet Yellen, who recently warned that the surge in government debt should “keep people awake at night.”

Minsky “alerted economists to the fact that an economy is a delicate balance between production and finance. Both must be balanced internally and then the interplay between them balanced as well,” Gross said.

Credit and asset prices

Capitalism in the current sense depends on credit creation that leads to asset price growth which ultimately generates business investment, Gross said.

However, it’s a delicate ecosystem that can break down.

“This model, however, is leverage dependent and – 1) debt levels, 2) the availability, and 3) cost of that leverage are critical variables upon which its success depends,” he wrote. “When one or more of these factors deteriorates, the probability of the model’s success and stability go down.”

Cost of carry

“Carry” refers to the price investors pay to hold assets on their balance sheets.

Professional investors need to be mindful of that cost and how it compares to whatever benchmark it is they are trying to beat. When the carry equation doesn’t work anymore, investors have to move on.

“Timing that exit is obviously difficult and perilous, but critical for surviving in a new epoch. We may be approaching such a turning point, so invest more cautiously,” Gross said.

The question of ‘money’

Gross discusses the difference between cash and credit. When too many investors turned to cash and equivalents over credit, that can create a liquidity breakdown in the system.

“When the possibility of default increases and/or the real return on credit or liquidity decreases and persuades creditors to hold classical ‘money’ (cash, gold, bitcoin), then the financial system as we know it can be at risk (insurance companies, banks, mutual funds, etc.) as credit shrinks

and “money” increases, creating liquidity concerns,” he said.

The Fed and inflation

The Fed and Treasury always have an interconnected relationship, but particularly so over the past decade as the central bank’s holdings of government debt have surged.

At present the Fed is holding nearly $2.5 trillion of Treasurys on its $4.5 trillion balance sheet. However, the central bank is allowing a capped level of government debt to run off each month. Essentially, what the Fed has been doing is allowing the government to borrow money and pay a low level of interest on its debt.

“Money for nothing – The Treasury issuing debt for free. No need to pay down debt unless it creates inflation,” Gross wrote. “For now, it is not. Probably later.”

http://theirrelevantinvestor.com/2017/01/04/looking-for-the-next-amazon/

Looking For The Next Amazon

Posted January 4, 2017 by Michael Batnick

Amazon is the sixth largest company in the S&P 500 by market cap. Incredibly, they wear this crown despite having earned less than 121 different companies over the previous twelve months. It’s no secret that Amazon is an expensive stock. Even if Bezos were to capture 100% of the total retail revenue, its price-to-earnings ratio would still be 63! Amazon’s stock has received a lot of attention over the years because its performance has been off the charts while maintaining a nosebleed valuation that has been the envy of their competition.

Amazon is the third best performing S&P 500 stock since going public in 1997 (trailing only Monster Beverage and Celgene). Below you’ll see the 38,155% return since its IPO, which is 100 times better than the index over the same time. Each dollar invested at the IPO has compounded at 35% per year, which I’m pretty confident will not continue. If it did, its market cap would exceed $5 trillion by 2025.

This massive outperformance has led to an explosion in hindsight bias, with investors fooling themselves into believing Amazon’s ascent was somehow obvious or inevitable. But the truth is this 38,000% return was handed to nobody, it was earned through enormous dedication. Actually, lunacy might be a better way to describe it, being that you had to be some sort of sociopath- void of any human emotions, to earn these monstrous gains.

Below is an incredible chart I’ve shared before, which shows that Amazon’s path to a 38,000% return was filled with heartache, despair, and a nausea.

Some of the losses Amazon has experienced along the way have been totally insane. It fell 15% in just three days 107 different times, it has lost 6% in a single day 199 times, and it fell 95% from December 1999 to October 2001.

People anchor to January 1 for diets and exercise as well as investment returns. Every year the clock resets. So below I show the max intra-year drawdown, i.e. how far the stock fell from its high in each calendar year. Amazon has had a double-digit drawdown each year since going public and a 20% drawdown in 16 out of 20 years. The average DD is -36% (median is -30%). I wanted to provide a reference point of just how insane this is, so I included the Dow (sue me) in black. You’ll notice that Amazon had far deeper drawdowns in every year but 2009 and 2015

People waste way too much time looking for the next Amazon, but I get it, it’s part of what makes investing exciting. So if you’re going to search for a potentially life-changing investment, here are a few things you should consider:

- A lot of people spend their life looking for the next Amazon. Few people ever find it.

- Sticking to a boring 60/40 portfolio is hard enough. Focus on getting the big things right.

- If you can’t help yourself, limit yourself to a few speculative ideas a year. Two or three sounds about right.

- Keep the amount you wager small. No more than 1 or 2% of your portfolio.

- Earning 100% on a stock can be an emotional roller coaster. Earning 10,000% can lead to a lot of sleepless nights.

- Let’s say you do find a unicorn; As the dollar amount you have invested grows, you become much more sensitive to drawdowns.

- Just because you take big risks, that does not mean you’re entitled to big rewards.

Source:

The Discipline of Value Investing

HI Financial Services Mid-Week 06-24-2014