HI Financial Services Commentary 09-11-2018

YouTube Link: https://youtu.be/j3SDMU1eJeM

What I want to talk about today?

Hello Everyone,

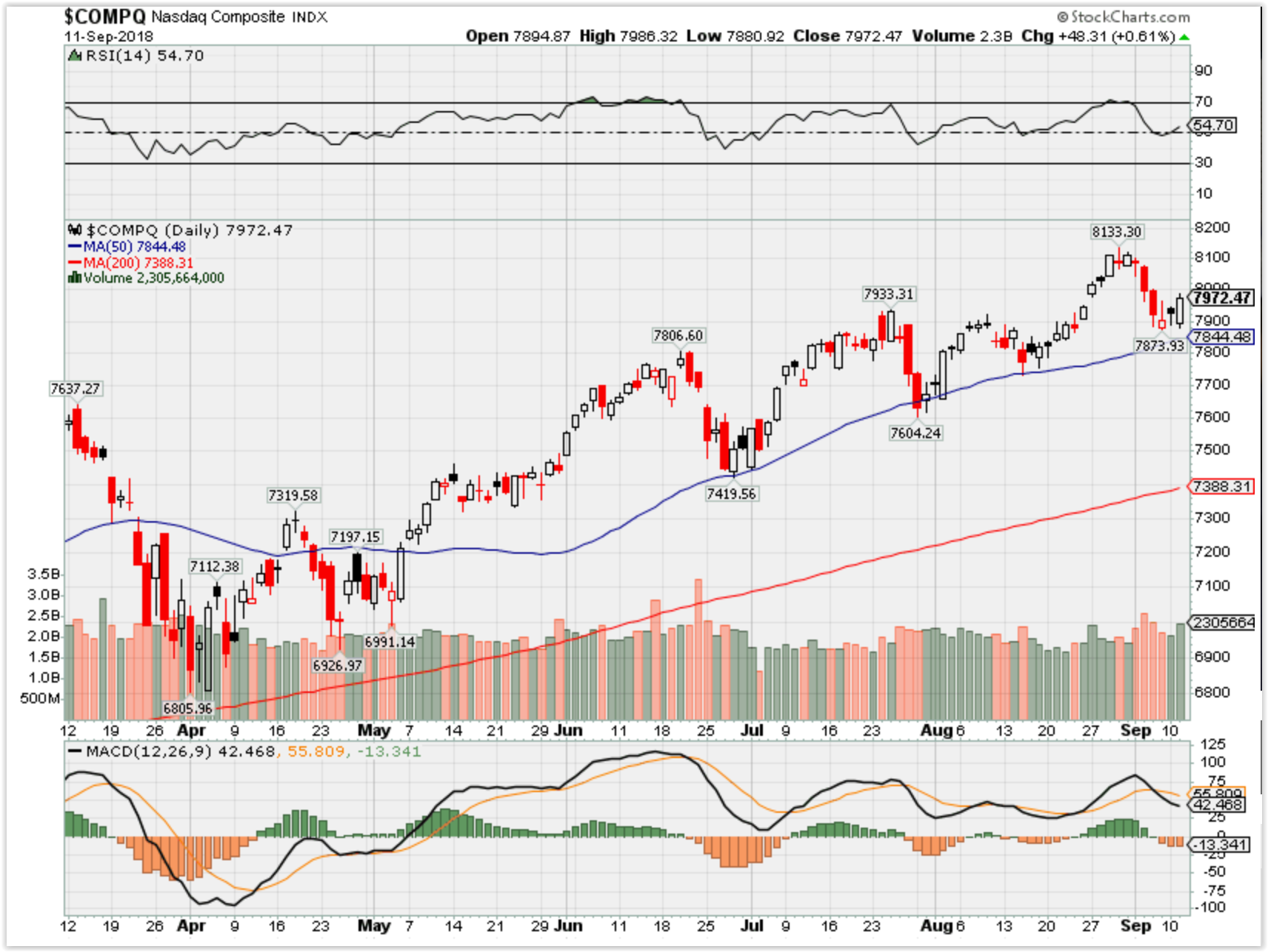

Welcome to September and to the worst month historically in the market. The market historically can be down 3-7% and usually rebounds towards the end of September slightly being down 0.5-2.8%. This is a standard range and one deviation outside of this is a drop of 7% or more. Why? Mutual funds sell their losers to make the fund look better on paper, sell a few winners to book a profit and we have a scary October to look forward to as well. What’s in October? The start of the nasty mid-term elections, a China based gold backed currency to trade oil, and a possible interest rate hike if the Fed stays the course. Not to mention we are 5.8 years overdue for a 20% correction which leads me to my next paragraph of information.

There hasn’t been a good buying opportunity all year long! We just hit our highs in January and have fallen back down to having the S&P 500 be just under a 6% gain for the year. It’s been a very difficult year with such high valuations that don’t justify the high market prices, Presidential tweets going out on everything, and a raising interest rate environment that makes the next “correction” look like it could be worse than 2008. Tax saving have boosted earnings but it’s not the growth that justifies our current market prices. I’M WORRIED but the correction will probably not happen until next year when companies earnings have to beat the previous year when the earnings that was boosted 25-35% due to tax cuts. Pretty hard to beat number from the previous year when you have to have an increase in sales equalling the tax cuts. I can tell you now it will not happen and we will hear a lot about “bringing numbers, estimates and earnings down”.

So, we made it through earnings and a sector rotation into consumer staples. Usually that rotation starts in April and this year it happened in August. Once again past history doesn’t guarantee future returns. You can see in most portfolios we have added protection to last through the month of October. We started adding our protection weeks ago and our goal is to make up at least half of the downward movement. It DOESN’T mean we make up every penny on the way down because it is impossible to predict the tops and bottoms of the price ranges of equities. ANYTHING we make on the way down is a profit as investments come back up. Please know we are looking daily at every portfolio. Yes, some have significant amounts of cash that you probably noticed some went to work today in BIDU, UAA and F that have hit levels of purchase for the first time all year. We run probability calculations weekly to find the best probability/valuation to purchase stocks that should head higher. Yes we use the same research, calculations and entry points as Warren Buffett. If greatest investor of all time thinks the market is overpriced and hasn’t made a lot of purchases this year, Hurley Investments probably won’t be a contrarian investor to Warren. Yes, money will be put to work this month as prices fall to a level that warrant an end of the year, Christmas Rally run at the end of November.

SO what about some positions that aren’t currently protected. Some have hit levels to take the protection off and look for a bounce higher. Some are a stock replacement options strategy that the protection is built into the position itself. For example, you may notice a BAC, FB or V position in your account that is not stock ownership. Some of these symbols have a long call option which acts like stock ownership and makes money as the stock moves higher. This position is a tenth of the price of stock ownership usually which means being in this position takes 90% of the cost of the stock out of the equation. We lower the risk of purchasing the stock by 90%!!! These positions are dollar cost averaged to lower the cost basis and are usually out in time for years. We look for levels of support to add to these positions, which in turn lowers the cost basis, which means the stock doesn’t have to move as high to be profitable. It’s a process and at times doesn’t make a portfolio look good but we know what we are doing. Please have a little patience, give us a call and trust the system. Investing was never meant to have a day trading, quarterly or even a yearly outlook. Wallstreet and investing was supposed to be a 10 year process or more but welcome to the information age of technology. Know anything we make on the way down benefits you in the long run. Please take a moment today to remember the 9/11 victims, remember we get to live in one of the greatest countries of all time, and when you protect your portfolios to the downside the returns will take care of themselves. Mathematically there’s never been a more high risk time to be invested yet we have the solution to make a major market drop a very profitable opportunity for you instead of a nightmare!

What happening this week and why?

Macro news moves our Market daily = Global economy or the $1 has more importance than you know

The rest of the world is on fire right now!!!!

Where will our markets end this week?

Lower

DJIA – Bullish

Where Will the SPX end September 2018?

09-11-2018 -2.0%

09-04-2018 -2.0%

Earnings:

Tues:

Wed:

Thur: KR, ADBE

Fri:

Econ Reports:

Tues: NFIB Small Business Optimism Index, Jolts, Wholesale Inventory

Wed: MBA, PPI, Core PPI, Fed Beige Book

Thur: Initial, Continuing, CPI, Core CPI, Treasury Budget

Fri: Retail Sales, Retail ex-auto, Michigan Sentiment, Export, Import, Industrial Production, Capacity Utilization, Business Inventory

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Added Long puts or bear puts out to OCT monthly for BIDU

Added a small number of FB long call contracts at Jun 2020 $200 Strike

Added F Jan 2020 long calls $10 for $1

Added Leap long calls Jan 2020 A $240 strike on AAPL for a few new client money

BUT a small amount to dollar cost average into a drop in Sept and OCT of 2018

AMZN ITM Sept 1995/2000 Bull Call for $3.30 per contract

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2018/09/07/goldman-sachs-raises-apple-outlook-eat-our-hat-on-iphone-demand.html

Goldman admits it was wrong on Apple, boosts stock outlook by 20 percent

- Goldman Sachs raised its price target on Apple stock to $240 per share from $200 per share on Thursday.

- “We had expected worse iPhone X demand and some pullback in the stock — clearly neither of these two things happened,” analyst Rod Hall said in a note.

Michael Sheetz | @thesheetztweetz

Published 3:17 PM ET Fri, 7 Sept 2018

Updated 5:07 PM ET Fri, 7 Sept 2018

Goldman Sachs raised its price target on Apple stock all the way to $240 per share from $200 per share on Thursday, admitting they got the stock completely wrong this summer as it rallied to a $1 trillion valuation.

Goldman laid out its expectations for the next generation of iPhones and reversed its previous bearish position on the technology giant.

“We also take this opportunity to eat our hat somewhat on our cautious stance this Summer,” Goldman analyst Rod Hall said in a note. “We had expected worse iPhone X demand and some pullback in the stock — clearly neither of these two things happened.”

Shares of Apple rose 0.7 percent in trading to $224.65 a share in trading Friday, about 7 percent away from the new Goldman target. The stock closed down 0.8 percent at $221.30 per share after Apple announced President Donald Trump‘s tariffs on Chinese goods will hurt the company.

Goldman estimates Apple will price the iPhone 9 at $849, rather than the $699 some have speculated. The firm sees “some flexibility down to $800” for the iPhone 9 offering but doubts Apple will “go for lower price points” after iPhone X demand was more than expected the last few months.

“Apple is once again proving itself tough to bet against,” Hall added.

https://www.cnbc.com/2018/09/09/market-bull-gives-three-winning-picks-through-next-year.html

Market bull gives three winning sector picks through next year

Stephanie Landsman | @stephlandsman

Published 7:57 AM ET Sun, 9 Sept 2018

f the United States works out its trade issues, then B. Riley FBR’s Arthur Hogan sees stocks blasting through his 2018 year-end target, on their way to another profitable year ahead.

It’s a scenario reflected in the long-time bull’s current investment strategy.

On CNBC’s “Trading Nation,” Hogan gave three winning picks to get investors through the next 16 months.

1. Technology

According to Hogan, technology’s rapid growth will continue into next year.

“I think technology will significantly outperform and probably be the lead sector in the S&P 500,” the investment firm’s chief market strategist said Friday.

2. Health care

He also believes health care will grab solid gains.

Hogan noted health care will become the second largest sector in the S&P on September 28. That’s when some of technology’s biggest stocks such as Facebook, Netflix and Alphabet officially become part of the newly minted Communication Services sector. He suggested the shift could make health care look more attractive.

3. Financials

He’s also very bullish on financials.

“I think financials will finally catch a leg because of rising interest rates on the long end of the curve. We are going to see some spread, and I think that is something that the financials have been waiting for,” he added. “So, the fundamentals behind the financials are very solid. And, I think they have rock solid balance sheets, and I think they are undervalued.”

His hunch is the S&P 500 will end 2019 around 3200, about an 11 percent gain from Friday’s close and above Hogan’s target of 3000. So, stocks are generally where he wants to be.

“I’d be afraid of anything that looks like a bond,” said Hogan, who expects yields to begin moving higher in the coming months — diminishing the attractiveness of that asset class.

https://www.cnbc.com/2018/09/10/chart-shows-surge-in-corporate-cash-brought-home-since-tax-cuts.html

This chart shows the dramatic rise in corporate cash brought home since the tax cuts

- Companies during the first quarter brought home $300 billion of the $1 trillion in cash they had been holding overseas.

- The Tax Cuts and JobsAct encouraged the repatriation of profits, which had been subject to additional U.S. levies after it was brought home.

- The act put a one-time tax on the money, eliminating the incentive to keep it abroad.

Published 2:57 PM ET Mon, 10 Sept 2018

Updated 13 Hours Ago

Companies took major advantage of last year’s tax cuts to bring home profits they had stored overseas.

In the first quarter alone, multinational enterprises brought home about $300 billion of the $1 trillion held abroad, according to a recent Federal Reserve study. A good chunk of that repatriated money went to share repurchases — for the top 15 cash holders, some $55 billion was used on buybacks, more than double the $23 billion in the fourth quarter of 2017.

Goldman Sachs economists expect that the total buybacks from all companies in 2018 could exceed $1 trillion.

The Fed’s estimate of total cash overseas is a good deal lower than other estimates that have been as high as $2.5 trillion, so the amount of cash brought home might be even higher.

Companies had been holding profits in foreign countries to avoid additional taxation when it was brought back to the U.S. Under the Tax Cuts and Jobs Act, the foreign holdings were subject to just a one-time tax, thus eliminating the incentive to keep the money offshore.

As the Fed’s chart shows, the return of cash compared to previous years was dramatic.

HI Financial Services Mid-Week 06-24-2014