HI Financial Services Commentary 09-04-2018

YouTube Link: https://youtu.be/ME_bIZGGZwI

What I want to talk about today?

What can you tell me about the Month of September in the stock market?

Mark P- Totally overextended, could drop 20% but in solid uptrend

S&P 500 at all time high valuations and always has had an over 30% correction when touching valuations above 25

We are 5.5 year overdue for a 20% corrections

Long puts are NOT worth the cost when VIX and Extrinsic value push the price of the long put into “dumb” pricing

From Abraham: From VectorVest on Friday 8/31

SEPTEMBER ALMANAC.

September is the month the mood changes. Vacation season has ended, it’s time to put away the things of summer and it’s time to face reality.

Hirsch’s Stock Trader’s Almanac identifies September as the “Biggest % loser on the S&P, Dow, and NASDAQ since 1950.” Since 1998, the VectorVest Composite has gone up 11 times with an average gain of 3.39% and down 9 times with an average loss of 5.97%.

The reasons for September’s relatively poor performance have varied over the years from psychological mood changes to anecdotal claims of money managers cleaning house and analysts lowering forecasts after Labor Day. But rising earnings augur well for this September Almanac.

Why do people say that September is the worst month for investing?

By Chris Gallant | Updated February 22, 2018 — 9:22 PM EST

Answer:

Often in the financial media, you will hear people make reference to specific times of the week, month or year that typically provide bullish or bearish conditions.

One of the historical realities of the stock market is that it typically has performed poorest during the month of September. The “Stock Trader’s Almanac” reports that, on average, September is the month when the stock market‘s three leading indexes usually perform the poorest.

Since 1950, the month of September has seen an average decline in the Dow Jones Industrial Average (DJIA) of 0.8%, while the S&P 500 has averaged a 0.5% decline during September. Since the Nasdaq was first established in 1971, its composite index has fallen an average of 0.5% during September trading. This is, of course, only an average exhibited over many years, and September is certainly not the worst month of stock-market trading every year.

There are several theories that attempt to explain this phenomenon. One particular theory points to the fact the summer months usually offer light trading volumes on the stock market, as a good deal of investors typically take vacation time and refrain from selling stocks from their portfolio. Once fall begins, these investors typically return to work and exit positions they had been planning on selling. When this occurs, the market experiences increased selling pressure and, thus, an overall decline.

Additionally, many mutual funds experience their fiscal year end in September. Mutual fund managers, on average, typically sell losing positions before year end, and this trend is another possible explanation for the market’s poor performance during September.

Read more: Why do people say that September is the worst month for investing? https://www.investopedia.com/ask/answers/06/septworstmonth.asp#ixzz5QB4sVOvT

Follow us: Investopedia on Facebook

What happening this week and why?

ISM Index came in at 61.3 vs est 57.6

Construction spending 0.1 vs est 0.5

UNLESS tariffs of 200 Billion are levied against China

Canada trade agreement starts tomorrow

All of this Equals- MASSIVE HEADLINE RISK

So what saves us? = Protection through the event, Stocks still are buying trillions of dollars of shares back, see a Fed NOT raise rates, dollar lose value

AAPL vs AMZN

AAPL revenue 168B vs 200B in revenue from AMZN over the last two years

APPL Profit 130B and AMZN profit was 6B

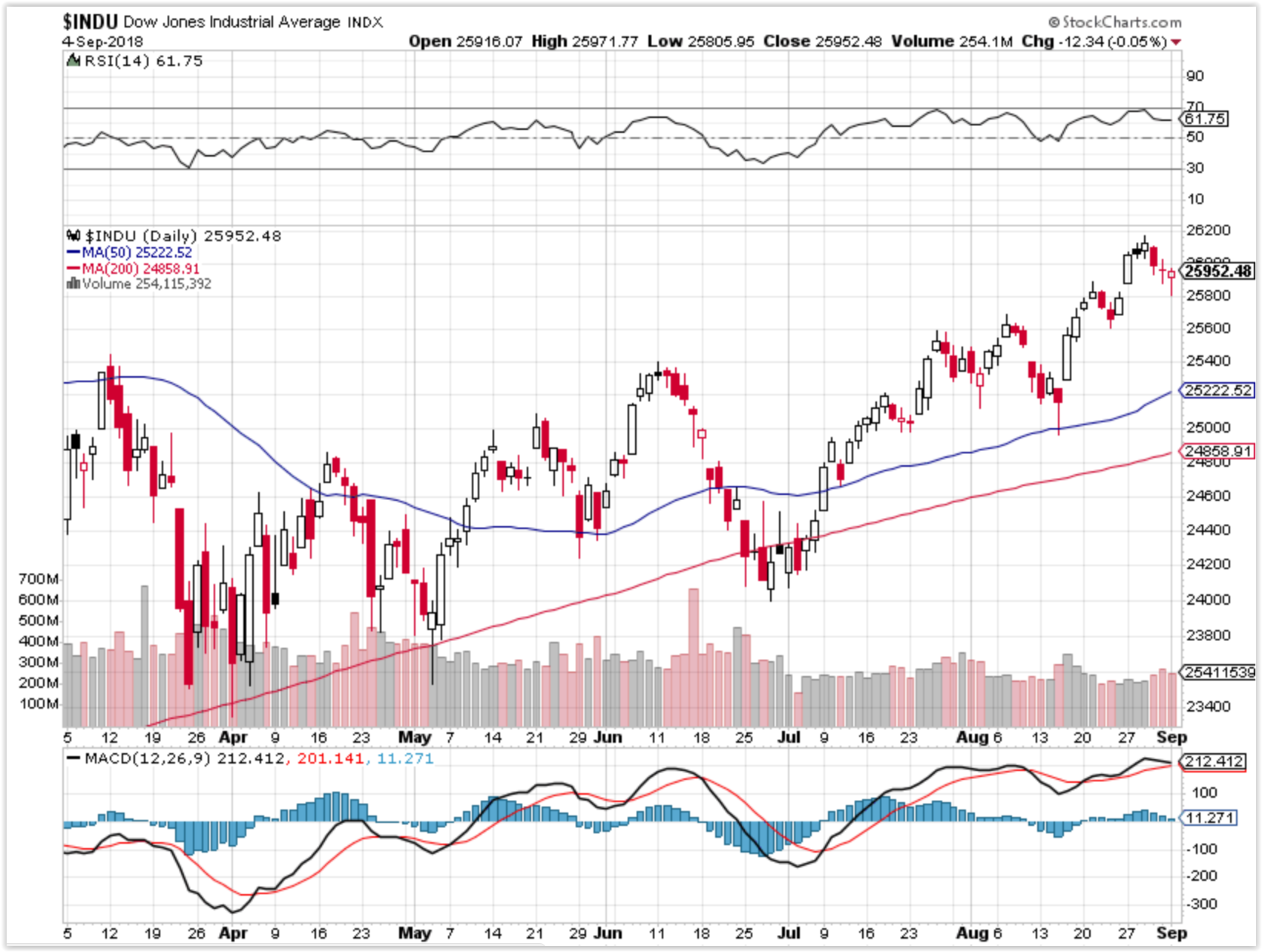

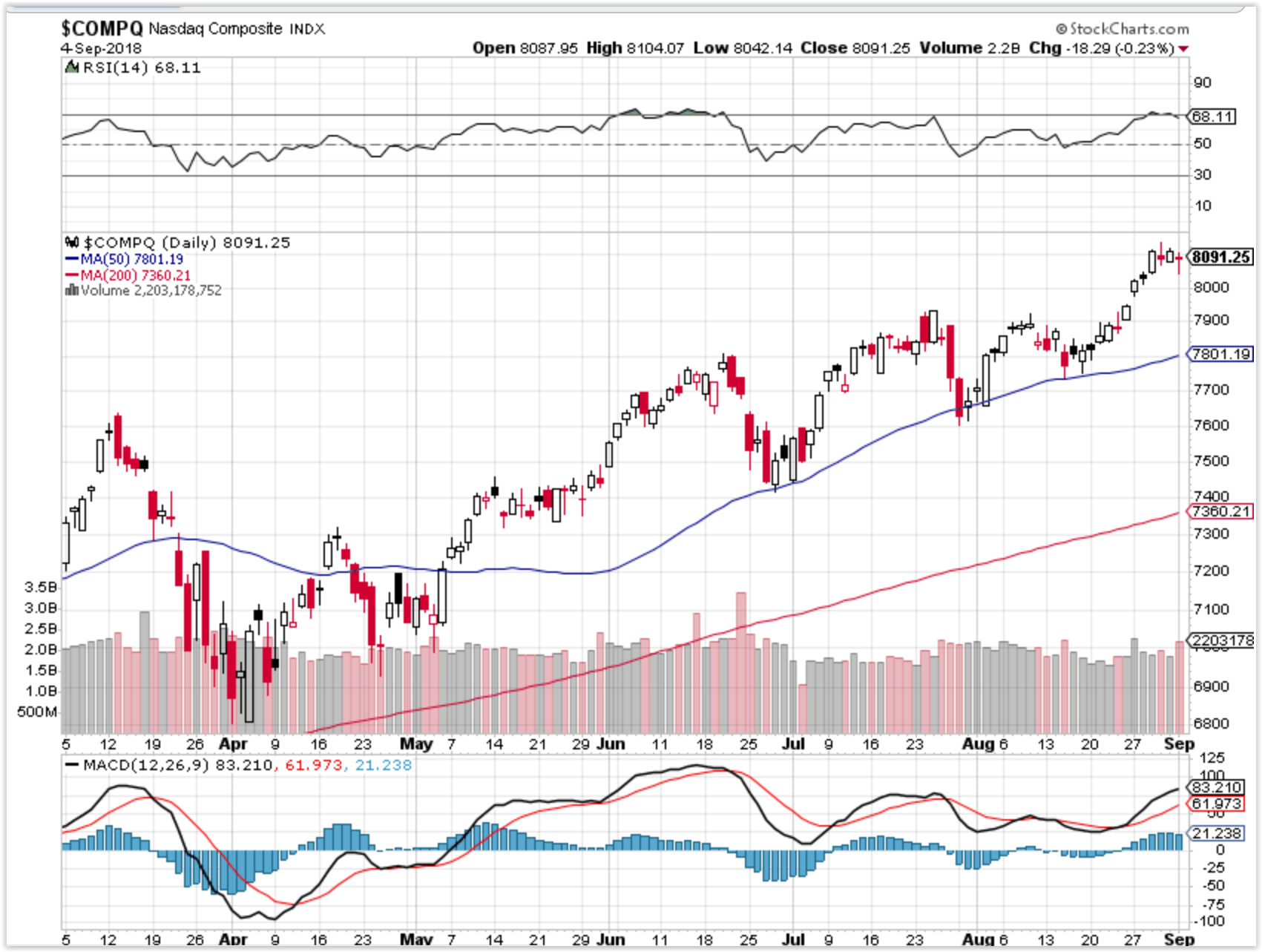

Where will our markets end this week?

Lower

COMP – Overbought Bullish

Where Will the SPX end September 2018?

09-04-2018 -2.0%

Earnings:

Tues: SHLD

Wed: CTRP, DOCU

Thur: ACGO, FNSR, FIVE, GME, MRVL

Fri:

Econ Reports:

Tues: ISM Index, Construction Spending

Wed: MBA, Trade Balance, Auto, Truck

Thur: Initial, Continuing, ADP Employment, Productivity, Unit Labor Costs, Factory Orders, ISM Services,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings,

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Added Long puts or bear puts out to OCT monthly for BIDU

Added a small number of FB long call contracts at Jun 2020 $200 Strike

Added F Jan 2020 long calls $10 for $1

Added Leap long calls Jan 2020 A $240 strike on AAPL for a few new client money

BUT a small amount to dollar cost average into a drop in Sept and OCT of 2018

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Posted Aug 31, 2018 by Martin Armstrong

The US share markets are being driven up by two main factors. First, institutions have sold the market assuming there would be a major crash. In February at the lows, Goldman Sachs was forecasting that the market could plunge another 25%. In May, Goldman Sachs again was warning that the next crash will be worse because of computerized trading. Investopedia published an article last January: Why The 1929 Stock Market Crash Could Happen In 2018. Fox Business reported on October 18, 2017: Stock market crash inevitable, financial historian says. The number of forecasts that keep calling for a major crash has been truly amazing. This has been one reason why I have said that this is the Most Hated Bull Market in History! For at least the final 18 months going into the high on September 3rd, 1929, the general consensus turned bullish. People were also bearish and in fact, the Wall Street Journal even accused Jesse Livermore of turning bullish to try to influence the presidential election. Strangely reminiscent of Russian hackers in 2016. As long as the major remain bearish calling for every top to be the last one, you know we are nowhere near the high yet.

Besides the constant selling that has led to repeated short-covering, we also have the excuse that the rally is primarily being caused by massive buybacks by corporations of their own shares. They point out that corporate-buy-backs will also reach an all-time high in 2018. They present this as evidence that somehow these purchases are not legitimate. In truth, the excess cash has led companies to buy back shares which will have two interesting impacts. First, it actually creates a shortage of shares. This was one factor in creating the 1929 bubble. Indeed, some of the last stocks to be floating going into the high of 1929 were Mausoleum companies.

Additionally, the US share market has benefited from the political-economic turmoil outside the USA – especially in Europe. Even IMF acknowledged that the European Central Bank’s pledge to buy government bonds set in motion a capital flight and the financial fragmentation of the eurozone back on October 9th, 2012. the return of global dollar capital to the US as a result of the central bank’s interest rate hikes also contributed to the positive trend. When we look at the Dow Jones Industrials, we can easily see that it continues to make new highs in Euro. This foreign buying has absorbed domestic selling.

We will be doing a special update and a political report. Mueller is conspiring with the Deep State to overthrow Trump. Since he cannot prove Trump conspired with Russians to leak the GENUINEemails of the Democrats, he is systematically moving to indict all of his friends including probably his son all to put pressure on him to be impeached or resign by October to influence the November elections and overturn Congress by removing the Republicans. We are witnessing the most corrupt attempt to pull off a coup in the United States in the entire history of the nation. This very well may form the foundation for a civil war.

This is the DEEP STATE in full swing. They cannot assassinate Trump for that would make a hero out of him like Kennedy. They are looking to destroy him politically and personally. This is becoming an all-out coup by the left to seize control of the country. The Democrats are even now advocating boycotting companies who donate money to Republicans. This is outright unconstitutional but law no longer means anything. So hold your breath – we are in for a wild ride into November.

JP Morgan’s top quant warns next crisis to have flash crashes and social unrest not seen in 50 years

- P. Morgan’s top quant, Marko Kolanovic, predicts a “Great Liquidity Crisis” will hit financial markets, marked by flash crashes in stock prices and social unrest.

- The trillion-dollar shift to passive investments, computerized trading strategiesand electronic trading desks will exacerbate sudden, severe stock drops, Kolanovic said.

- Central banks will be forced to make unprecedented moves, including direct purchases of equities, or there could even be negative income taxes.

- Timing of when this next crisis will occur is uncertain but markets appear to be safe through the first half of 2019, he said.

Sudden, severe stock sell-offs sparked by lightning-fast machines. Unprecedented actions by central banks to shore up asset prices. Social unrest not seen in the U.S. in half a century.

That’s how J.P. Morgan Chase‘s head quant, Marko Kolanovic, envisions the next financial crisis. The forces that have transformed markets in the last decade, namely the rise of computerized trading and passive investing, are setting up conditions for potentially violent moves once the current bull market ends, according to a report from Kolanovic sent to the bank’s clients on Tuesday. His note is part of a 168-page mega-report, written for the 10th anniversary of the 2008 financial crisis, with perspectives from 48 of the bank’s analysts and economists.

Kolanovic, a 43-year-old analyst with a Ph.D. in theoretical physics, has risen in prominence for explaining, and occasionally predicting, how the new, algorithm-dominated stock market will behave. The current bull rally, the longest in modern history by some measures, has been characterized by extended periods of calm punctuated with spasms of selling known as flash crashes. Recent examples include a nearly 1,600 point intraday drop in February and a 1,100 point decline in August 2015.

“They are very rapid, sharp declines in asset values with sharp increases in market volatility,” Kolanovic, the bank’s global head of macro quantitative and derivatives research, said in a recent interview. But those flash crashes occurred during a backdrop of a U.S. economic expansion; the new market hasn’t been tested in the throes of a recession, he said.

“If you have these liquidity-driven sharp sell-offs that come at the end of the cycle, or maybe even causes the end of the cycle, then I think you can have a much more significant asset price correction and even more significant increase in market volatility,” Kolanovic said.

No one to step in and buy

In his report, Kolanovic explains how the major market trends that occurred after the 2008 crisis exacerbate selling during moments of panic. The massive shift from active to passive managed investments — he estimates that $2 trillion has moved that way in the past decade — has removed a pool of buyers who can swoop in if valuations tumble, he wrote.

The rise of automated trading strategies is also a factor because many quant hedge funds are programmed to automatically sell into weakness, he said. Together, index and quant funds now make up as much as two-thirds of assets under management globally, and 90 percent of daily trading comes from those or similar strategies, he wrote.

“Basically, right now, you have large groups of investors who are purely mechanical,” Kolanovic said. “They sell on certain signals and not necessarily on fundamental developments, such as increases in the VIX, or a change in the bond-equity correlation, or simple price action. Meaning if the market goes down 2%, then they need to sell.”

Lastly, electronic trading desks at banks and other firms tend to withdraw when markets get rough, removing liquidity and contributing to a cascading decline in prices.

The ‘Great Liquidity Crisis’

Kolanovic says that this potential meltdown in stock prices could cause the next financial crisis. His name for it: the Great Liquidity Crisis. (In markets, liquidity is a measure of the ease and speed a financial instrument can be traded without significantly impacting its price. For example, cash is highly liquid. Meanwhile real estate is usually illiquid.)

If markets fall by 40 percent or more, the Federal Reserve would need to leap into action to prevent a spiral that led into depression, Kolanovic said. That could lead to unconventional actions, including direct purchases of equities, a move that Japan’s central bank has already taken.

“Suddenly, every pension fund in the U.S. is severely underfunded, retail investors panic and sell, while individuals stop spending,” Kolanovic said. “If you have this type of severe crisis, how do you break the vicious cycle, the negative feedback loop? Maybe you stimulate the economy by cutting taxes further, perhaps even into negative territory. I think most likely is direct central bank intervention in asset prices, maybe bonds, maybe credit, and perhaps equities if that’s the eye of the storm.”

In an hourlong interview, Kolanovic said this scenario is less a prediction than a warning about a rising risk. He also said that the chance of a crisis happening are low until at least the second half of 2019. The exact timing of this crisis is uncertain but will be determined by the speed in which the Fed hikes interest rates and reverses bond purchases (a legacy of the last crisis), he said. The developing trade dispute with China could accelerate or delay the end of the cycle as well, he said.

Kolanovic closes his report on an ominous note: “The next crisis is also likely to result in social tensions similar to those witnessed 50 years ago in 1968.”

That year saw the peak of both the Vietnam War and anti-war movement and the assassinations of Martin Luther King Jr. and Sen. Robert F. Kennedy. Today, the internet and social media are helping to polarize groups, and events including the U.S. election and Brexit show tensions that will probably worsen in the next crisis, he said.

He was a bit more measured in his interview. If central banks can head off the worst of a crisis by providing a floor for asset prices, then the status quo will probably be maintained, he said.

“If they don’t manage to,” Kolanovic said, “then you’re spiraling into depression, social unrest and a lot more disruptive changes that can negatively affect returns for a very long time.”

A lot of times I won’t have an insight into a business because I don’t understand it or because it’s too complex. General Electric is a great example. As a value investor I should be all over this iconic stock, which is making a generational low.

Not at all. I have looked at GE at least half a dozen times over the years, and always have walked away without understanding the business or what it is worth.

To make things worse, despite GE’s being one of the most-admired companies in the U.S., I have always hated its culture. Former CEO Jack Welch went into the corporate history books as the best American CEO ever. I’d argue that this history needs some serious rewriting.

Welch built a company with a “beat this quarter” culture. Welch’s GE was not in the business of building moats and investing for the long run; he was in the business of beating quarters. In his book, Welch raved that from the early 2000s GE always beat Wall Street estimates. He was proud of how managers of one division were able to “come up with” a few more cents of earnings if another division fell short of its forecast. I kid you not — reread that sentence, three times. If I was at the SEC I’d investigating GE’s accounting.

GE played games with its earnings for a long time, but in reality its cash flows couldn’t cover its dividend, which was supposedly half of its earnings, and that triggered a wake-up call for investors. GE is another reminder that it is incredibly dangerous to own a stock just because you like the dividend. Consistency of recurrence of dividend payments creates an optical illusion that the dividend will always will be there. Just think about it: GE’s dividend of 96 cents was half of what the company was expected to earn and it still couldn’t afford to pay it.

Welch is on the opposite end of the spectrum from Jeff Bezos, CEO of Amazon.com. Bezos doesn’t even know how to spell quarterly earnings. Amazon’s founder once explained that Amazon makes decisions years out. So the current quarter’s report reflects decisions Amazon made several years ago.

As an investor, I don’t want to own companies that are run by the likes of Welch, but my firm does have positions in a few companies with CEOs who have similar approaches as Bezos does to running a business. (We don’t own Amazon shares, though.) Whenever you hear management praise their ability to beat last quarter’s earnings, run.

GE was ultimately destroyed by enormous capital misallocation. Management assumed anything they touched with Six Sigma (a process designed to improve a company’s operations) would turn to gold, regardless of the price they paid. Accordingly, GE wasn’t concerned with how much it paid for acquisitions.

There is another lesson here. As an investor, simplicity and transparency from a company is key. If a company’s business is complex and opaque, move on. One of the most important things in investing is what you do in-between buying or selling a stock. After you buy it is just a matter of time before your initial assumptions come under fire. Maintaining rationality throughout your ownership of the company is paramount, and to do that you need to understand the business well. That’s why I have no opinion on GE shares now.

Once in a while, after my firm has done extensive research on a business we understand, I may have an opinion that runs contrary to the market’s. In those few situations you can drive a truck between the stock price and what we believe the company’s value is, and this is when we dig in and become contrarian-driven buyers.

Above all, never make a decision based solely on someone else’s research; use it as a starting point for your own investigation. (Tips on how to do this are included in this article). And keep in mind that any media reports, or even sophisticated brokerage research, about a company are just snapshots of the moment. If the facts change, be able to change your mind.

Where Supreme Court nominee Brett Kavanaugh stands on key issues

By Clare Foran and Joan Biskupic, CNN | Posted – Sep 2nd, 2018 @ 11:08am

NEW YORK (CNN) — The confirmation battle over Brett Kavanaugh, President Donald Trump’s pick to fill the Supreme Court vacancy created by retiring Justice Anthony Kennedy, is set to intensify when hearings on his nomination start Tuesday before the Senate Judiciary Committee.

Kavanaugh, 53, currently serves as a judge on the powerful US Court of Appeals for the District of Columbia Circuit. Here’s where he stands on some hot-button issues:

Roe v. Wade

Republican Sen. Susan Collins of Maine told reporters in August that Kavanaugh informed her that he considers Roe v. Wade, the landmark Supreme Court ruling that legalized abortion nationwide, to be settled law.

Kavanaugh has not expressed outright opposition to Roe v. Wade. In 2006, Sen. Chuck Schumer of New York, now the Senate Democratic leader, pressed Kavanaugh on his personal opinion about Roe, but he declined to answer, saying, “I don’t think it would be appropriate for me to give a personal view on that case.” The exchange took place during a hearing to consider Kavanaugh’s nomination to serve on the DC circuit.

Advertise with usReport this ad

Kavanaugh did say, however, that if he became a judge on the circuit court, he would uphold Supreme Court precedent with respect to Roe. “If confirmed to the DC Circuit, I would follow Roe v. Wade faithfully and fully. That would be binding precedent of the court. It has been decided by the Supreme Court,” he said at the time. (The Supreme Court, of course, can overturn its previous decisions.)

Because Kennedy was a swing vote in favor of abortion rights, his departure from the court has sparked alarm among abortion rights activists that Roe v. Wade could be overturned. In addition, Trump has long vowed to appoint justices who would reverse Roe and allow the states to determine whether abortion should be legal.

Abortion

One of Kavanaugh’s opinions likely to draw scrutiny from senators is his dissent from a ruling of the DC Circuit last October that an undocumented immigrant teen in detention was entitled to seek an abortion.

In his dissent, Kavanaugh wrote the Supreme Court has held that “the government has permissible interests in favoring fetal life, protecting the best interests of a minor, and refraining from facilitating abortion.” He wrote that the high court has “held that the government may further those interests so long as it does not impose an undue burden on a woman seeking an abortion.” He said the majority opinion was “based on a constitutional principle as novel as it is wrong: a new right for unlawful immigrant minors in US government detention to obtain immediate abortion on demand.”

Executive branch authority

Democrats are likely to make Kavanaugh’s views on presidential power a focus of the hearings.

In a 2009 Minnesota Law Review article, Kavanaugh wrote that “Congress might consider a law exempting a President — while in office — from criminal prosecution and investigation, including from questioning by criminal prosecutors or defense counsel.” In the same article, however, he noted, “If the President does something dastardly, the impeachment process is available.”

Kavanaugh said back in 1999 that the landmark Supreme Court opinion that ordered President Richard Nixon to turn over White House recordings toward the end of the Watergate investigation might have been “wrongly decided.”

The comments were part of an interview in Washington Lawyer magazine. Reached for comment, the White House pointed to a more recent speech in which Kavanaugh praised the 1974 opinion in United States v. Nixon, which set a key precedent limiting presidential claims of executive privilege.

Agency power and government regulation

Kavanaugh has demonstrated a deep suspicion of government regulation, a pattern aligned with the Trump administration and perhaps best exemplified by his dissent in the case of a killer whale that attacked a SeaWorld trainer.

As Kavanaugh criticized a Labor Department move to sanction SeaWorld following the drowning of a trainer by the orca Tilikum, he declared that the agency had “stormed headlong into a new regulatory arena” and warned that regulators would try to impose new safety requirements on sports, the circus and more.

Overall, his view is that agencies should exercise authority as clearly spelled out in federal statutes and that judges should not, as occurred in the SeaWorld case, defer to agency interpretations that go beyond what’s explicit in a law.

In opinions and speeches, Kavanaugh has questioned a ruling in a 1984 Supreme Court case, Chevron v. Natural Resources Defense Council, that said judges should defer to agency interpretations of ambiguous laws. That, he said in a 2017 speech, “encourages agency aggressiveness on a large scale.”

Religious liberty

Kavanaugh’s opinion in a case involving a challenge under the Religious Freedom Restoration Act to the Affordable Care Act’s so-called contraceptive mandate, Priests for Life v. HHS, has also drawn scrutiny. In a dissent, he expressed sympathy for the religious challengers. Making reference to the Supreme Court’s ruling in Burwell v. Hobby Lobby, he wrote that “the regulations substantially burden the religious organizations’ exercise of religion because the regulations require the organizations to take an action contrary to their sincere religious beliefs.”

In a line that has attracted some conservative criticism, however, Kavanaugh also wrote in his dissent that Supreme Court precedent “strongly suggests that the government has a compelling interest in facilitating access to contraception for the employees of these religious organizations.”

Obamacare

When a lawsuit challenging the Affordable Care Act reached Kavanaugh’s Washington appeals court in 2011, he was careful not to commit and did not vote on the merits of the case.

Kavanaugh dissented from the 2-1 ruling in favor of the 2010 law known as Obamacare. He said judges had no jurisdiction at that point to resolve the merits of the dispute.

He described the law requiring people to buy health insurance as “unprecedented” and the breadth of the Obama administration’s defense of it “jarring.” But at the same time, Kavanaugh said judges “should be wary of upending” Congress’ effort to help provide Americans with quality health care.

Second Amendment

In 2011, Kavanaugh dissented from a majority opinion of the DC Circuit that upheld a ban that applied to semiautomatic rifles in the District of Columbia.

In his dissent, he wrote that the Supreme Court had previously “held that handguns — the vast majority of which today are semiautomatic — are constitutionally protected because they have not traditionally been banned and are in common use by law-abiding citizens.”

Citing a previous high court ruling, Kavanaugh went on to say, “It follows from Heller‘s protection of semiautomatic handguns that semiautomatic rifles are also constitutionally protected and that DC’s ban on them is unconstitutional.”

Privacy and national security

In 2015, Kavanaugh wrote an opinion defending the US government’s controversial metadata collection program, in part citing national security considerations. He wrote that the program “is entirely consistent with the Fourth Amendment,” which protectsagainst unreasonable search and seizure.

He wrote that the program “does not capture the content of communications, but rather the time and duration of calls and the numbers called,” and said it “serves a critically important special need — preventing terrorist attacks on the United States.” Kavanaugh argued “that critical national security need outweighs the impact on privacy occasioned by this program.”

Net neutrality

In a 2017 dissent, Kavanaugh said he believed that Obama-era net neutrality regulations were “unlawful” and wrote that the policy violated the First Amendment.

At issue were rules approved by the Federal Communications Commission in 2015 to more strictly regulate the Internet. The rules, based on the principle of “net neutrality,” were intended to provide equal opportunity for Internet speeds and access to websites. In a May 2017 order, a majority of the DC Circuit declined to review an earlier decision siding with the FCC. Under the Trump administration, the FCC has since moved to dismantle the regulation.

Kavanaugh wrote in his 2017 dissenting opinion that the regulation was consequential and “transforms the Internet.” But he said the rule “impermissibly infringes on the Internet service providers’ editorial discretion,” and he suggested the FCC had overreached in issuing the regulation. “Congress did not clearly authorize the FCC to issue the net neutrality rule,” he wrote.

https://www.cnbc.com/2018/08/31/heres-how-much-money-americans-have-saved.html

Here’s how much money Americans have saved

Megan Leonhardt | @Megan_Leonhardt

10:00 AM ET Mon, 3 Sept 2018

A new study finds the median American household has $4,830 in a savings account. That’s enough to cover minor emergencies and potentially even a few months of living expenses.

Overall, between bank accounts and retirement savings, the median American household currently holds about $11,700, according to MagnifyMoney. Yet almost 30 percent of households have less than $1,000 saved. Among households that report having at least some money set aside, the median savings level is higher, just under $73,000.

MagnifyMoney estimates median household balances in various types of banking and retirement savings accounts by using data from the Federal Reserve and the Federal Deposit Insurance Corp. They calculate the median because it gives a more accurate estimate of what most Americans have saved; the average can be skewed by high-earners and older savers. Their results indicate that half of all U.S. households have more than $4,830 while half have less.

Retirement is by far the most popular type of savings. Over 80 percent of Americans’ savings is in a 401(k) or individual retirement account, MagnifyMoney found.

Other surveys and studies have found similar results. Using data from the Federal Reserve’s Survey of Consumer Finances, SmartAsset found earlier this year the median American household had about $5,200 in savings. And according to a 2017 GOBankingRates survey, about 12 percent of respondents had between $1,000 to $4,999 in a savings account, while more than half of Americans (57 percent) had less than $1,000.

Americans may still owe more in debt than they save. The Northwestern Mutual’s 2018 Planning & Progress Study recently found Americans now have an average of $38,000 in personal debt, excluding home mortgages. That’s up $1,000 from a year ago.

Meanwhile “fewer people said they carry ‘no debt’ this year compared to 2017 (23 percent vs. 27 percent),” according to the study.

“People’s purse-strings are clearly caught in a tug of war between enjoying the present and saving for the future,” says Emily Holbrook, director of planning for Northwestern Mutual.

1 comment

Nice Blog liked it alot. If you are looking for finance analyst job in Mumbai contact Tresvista for itas they will help you a lot in getting a finance analyst job.