HI Financial Services Commentary 08-14-2018

You Tube Link: https://youtu.be/vjgLpq-zU5M

What I want to talk about today?

Keve Bybee

Headline news of Turkey problems

What poses a problem for our banks? JPM, C, BAC?

Europe Exposure? BBVA? Spain, Italy

Tough for companies in Turkey to pay debt in dollar and euros.

Bank of America makes money on US treasury yields.

What happening this week and why?

Can you say strong dollar and weak Emerging markets with Turkey getting creamed

I didn’t know how many were getting creamed other than Russia, South Korea, Brazil and Argentina

The only reason I knew they were having a rough go was because of the news.

Where will our markets end this week?

Higher

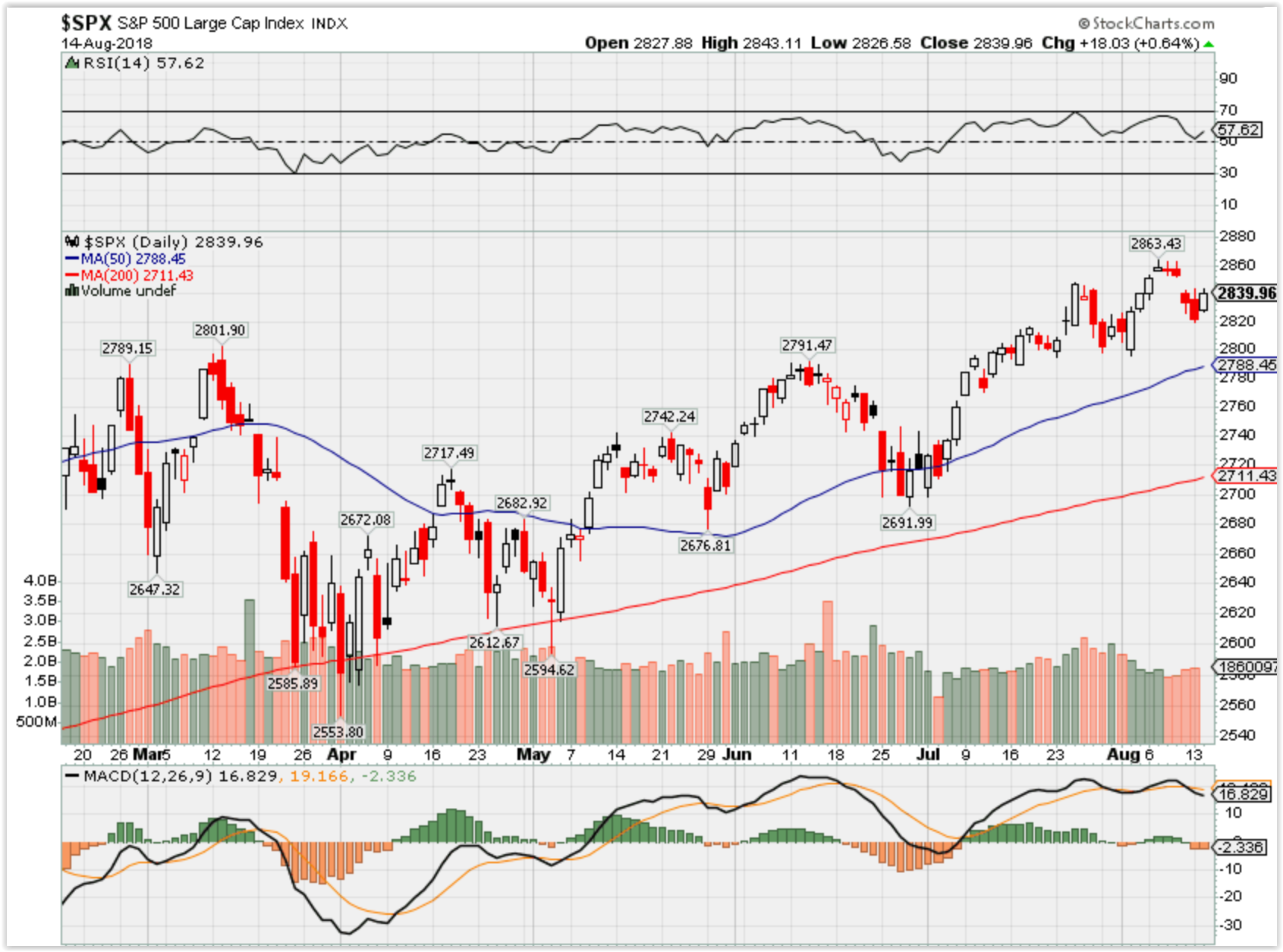

SPX – Bullish

Where Will the SPX end August 2018?

08-14-2018 -1.0%

08-07-2018 -1.0%

07-31-2018 -2.0%

Earnings:

Tues: AAP, HD, TRP, A, CREE, DDS

Wed: M, CSCO, NTAP

Thur: JCP, JD, WMT, JWN, AMAT, NVDA

Fri:

Econ Reports:

Tues: NFIB Small Business Index, Import, Export,

Wed: MBA, Retail Sales, Retail Ex-auto, Productivity, Unit Labor Costs, NAHB Housing Index, Industrial Production, Capacity Utilization, Business Inventories,

Thur: Initial, Continuing, Housing Starts, Building Permits, Phil Fed

Fri: Leading Indicators, OPTIONS EXPIRATION

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

IN protective puts or collar trades for earning

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

UPDATE 2-Disney quarterly profit misses as programming costs surge

Lisa Richwine and Vibhuti Sharma

Published 4:53 PM ET Tue, 7 Aug 2018Reuters

|

|

|

|

|

|

|

(Adds figures)

Aug 7 (Reuters) – Walt Disney Co missed Wall Street profit targets on Tuesday as it lost more subscribers at its cable sports network ESPN and invested in technology and programming to try and capture audiences migrating to streaming television.

Shares of one of the world’s biggest entertainment companies, which have gained nearly 9 percent this year, fell 1.9 percent to $113.66 after the bell.

Disney reported earnings of $1.87 per share excluding certain items, an increase from a year earlier but below Wall Street’s average forecast of $1.95, according to Thomson Reuters I/B/E/S.

Operating income at Disney’s media networks unit declined 1 percent to $1.8 billion. The division recorded a loss from its investment in streaming technology company BAMTech. ESPN, its biggest network, reported higher programming costs and a decline in subscribers, while the fees it collects from distributors rose.

Disney is trying to transform into a broad digital entertainment company as its networks including ESPN are losing viewers to Netflix Inc and other online options. The company is scheduled to launch its own streaming service for family entertainment in late 2019.

Disney also is on the verge of gaining new film and television properties in a $71 billion purchase of assets from Rupert Murdoch’s Twenty-First Century Fox. The Fox properties would bring Disney new franchises such as “Avatar” and “The Simpsons” to mine for future subscription services.

For its fiscal third quarter ended June 30, the company’s theme parks division recorded a 15 percent profit increase to $1.3 billion with increases at domestic and international resorts.

Disney’s movie studio enjoyed blockbuster success with “Avengers: Infinity War” and “The Incredibles 2.” Operating income at the studio rose 11 percent to $708 million.

At consumer products, operating income declined 10 percent to $324 million.

Net income attributable to Disney rose to $2.92 billion, or $1.95 per share, in the quarter, compared with $2.37 billion, or $1.51 per share, a year ago.

Total revenue rose 7 percent to $15.23 billion, but missed analysts’ average expectation of $15.34 billion. (Reporting by Vibhuti Sharma in Bengaluru and Lisa Richwine in Los Angeles; Editing by Arun Koyyur and Bill Rigby)

https://moneyandmarkets.com/buffett-investments-market-crash/

IS WARREN BUFFETT PREDICTING A MARKET CRASH?

Posted by JT Crowe | Aug 7, 2018 | Investing

Warren Buffett, the world’s third-richest person with about $86 billion in net wealth, is known as one of the most successful stock market investors of all time.

“Warren Buffett is still having difficulty in finding value in U.S. — and perhaps global — stocks.”

Buffett started buying stocks when he was 11 years old, and he filed his first tax return at the ripe old age of 13.

Now 87 and the founder and CEO of Berkshire Hathaway, Buffett has dialed back his company’s investments the past couple of years.

At the end of the second quarter, Berkshire Hathaway had $111 billion in cash on hand, the most in the company’s history — and his company’s reluctance to invest that money could be seen as a bad sign for the market as a whole, according to Business Insider.

Considering his company’s reluctance to invest much since 2017 and Buffett’s market expertise, it could be a sign that stocks are currently riding too high and too expensive.

Valuations have only gotten more stretched over that period (since 2017), suggesting that an already tenuous situation has worsened.

Russ Mould, an investment director at AJ Bell, has taken notice. He’s wary of the speculative deal fervor he sees accompanying record stock prices.

“M&A tends to peak when animal spirits are running high and often when executives feel their own shares are expensive enough to make them a valuable acquisition currency,” Mould wrote in a client note. “Warren Buffett is still having difficulty in finding value in U.S. — and perhaps global — stocks.”

Mould points out — and indicates in the chart above — that Berkshire Hathaway’s cash balance has been an effective proxy for market levels over history. As you can see, Buffett held comparatively high levels of cash in the periods preceding the two most recent market crashes, in 1999 and 2007.

Of course, this doesn’t mean the market is set to crash tomorrow, but it is a question investors should weigh when deciding how, when and where to spend their money as we approach the mark for the longest bull market run on record, a mark that could soon be coming to an end.

12 comments

For newest news you have to pay a quick visit world-wide-web and on the web I

found this website as a best web site for latest updates.

Pretty nice post. I just stumbled upon your blog and

wished to say that I have really enjoyed surfing around your blog posts.

In any case I’ll be subscribing to your feed and I hope you write again soon!

Pretty! This has been an extremely wonderful article.

Thank you for providing these details.

What’s Going down i’m new to this, I stumbled upon this

I have discovered It positively helpful and it has aided me out loads.

I’m hoping to contribute & aid different users like its

helped me. Great job.

My partner and I stumbled over here different web

address and thought I should check things out.

I like what I see so now i’m following you. Look forward to looking into your web page again.

Superb blog you have here but I was curious if you

knew of any discussion boards that cover the same topics discussed in this article?

I’d really like to be a part of community where I can get advice from other knowledgeable people that share the same

interest. If you have any suggestions, please let me know.

Appreciate it!

My brother suggested I might like this website.

He was totally right. This post truly made my day.

You cann’t imagine simply how much time I had spent for this info!

Thanks!

Good write-up. I definitely love this website. Thanks!

Hey there I am so thrilled I found your blog, I really found you by mistake, while I was looking on Google

for something else, Regardless I am here now and would just like to say cheers

for a marvelous post and a all round enjoyable blog (I also love the theme/design), I don’t

have time to read through it all at the minute but I have saved

it and also added in your RSS feeds, so when I

have time I will be back to read a great deal more, Please do keep up the

great jo.

Hmm is anyone else having problems with the pictures on this blog loading?

I’m trying to figure out if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

Hi there! I know this is kinda off topic but I’d figured I’d ask.

Would you be interested in trading links or maybe guest writing a blog post or vice-versa?

My website covers a lot of the same topics as yours and I feel we could greatly benefit from each other.

If you’re interested feel free to send me an email.

I look forward to hearing from you! Terrific blog by

the way!

Thanks for one’s marvelous posting! I definitely enjoyed reading it,

you can be a great author.I will make certain to bookmark your

blog and will often come back later in life. I want to encourage you to continue

your great work, have a nice weekend!