HI Financial Services Commentary 08-07-2018

You Tube Link: https://youtu.be/W0MqU7g5428

What I want to talk about today?

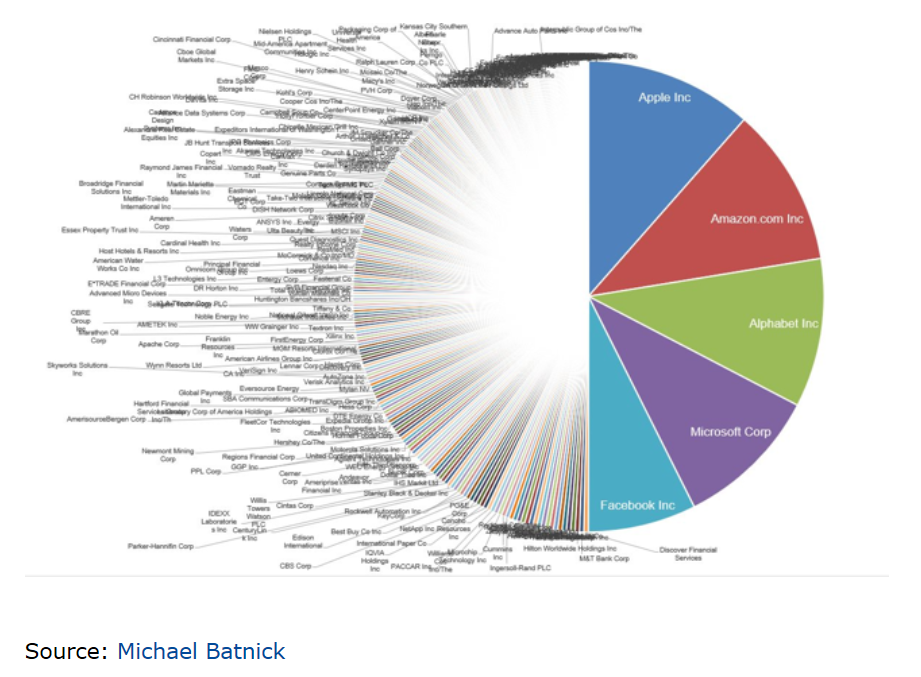

Please explain to me what you think this picture pie chart is trying to tell us?

Ytd 5 companies are responsible for over half of the S&P 500 gains

What does this mean for portfolios?= IF you are trying to beat the S&P500 you have to be overweight or unbalanced with having a FANG stock or two in your portfolio!

This is why small accounts less than 100K are so hard to grow – difficult to be fiscally responsible in diversification without being able to own higher priced growth or momentum stocks

My fear is that the next “correction” (10%) may be more than just a bear market correction (20%)

I could definitely and mathematically see a 35-50% correction next time around

What happening this week and why?

This week I’m traveling and spent 25 hours on the road. Listened to every political and financial talk show to pass the time and I listened to the NFL Hall of fame inductees = PAIN

As financial Advisors we also deal with pain:

Daily returns

Portfolio Creation = being right in a time frame that the clients can handle

When you take care of the risk the profits will come

Where will our markets end this week?

Down

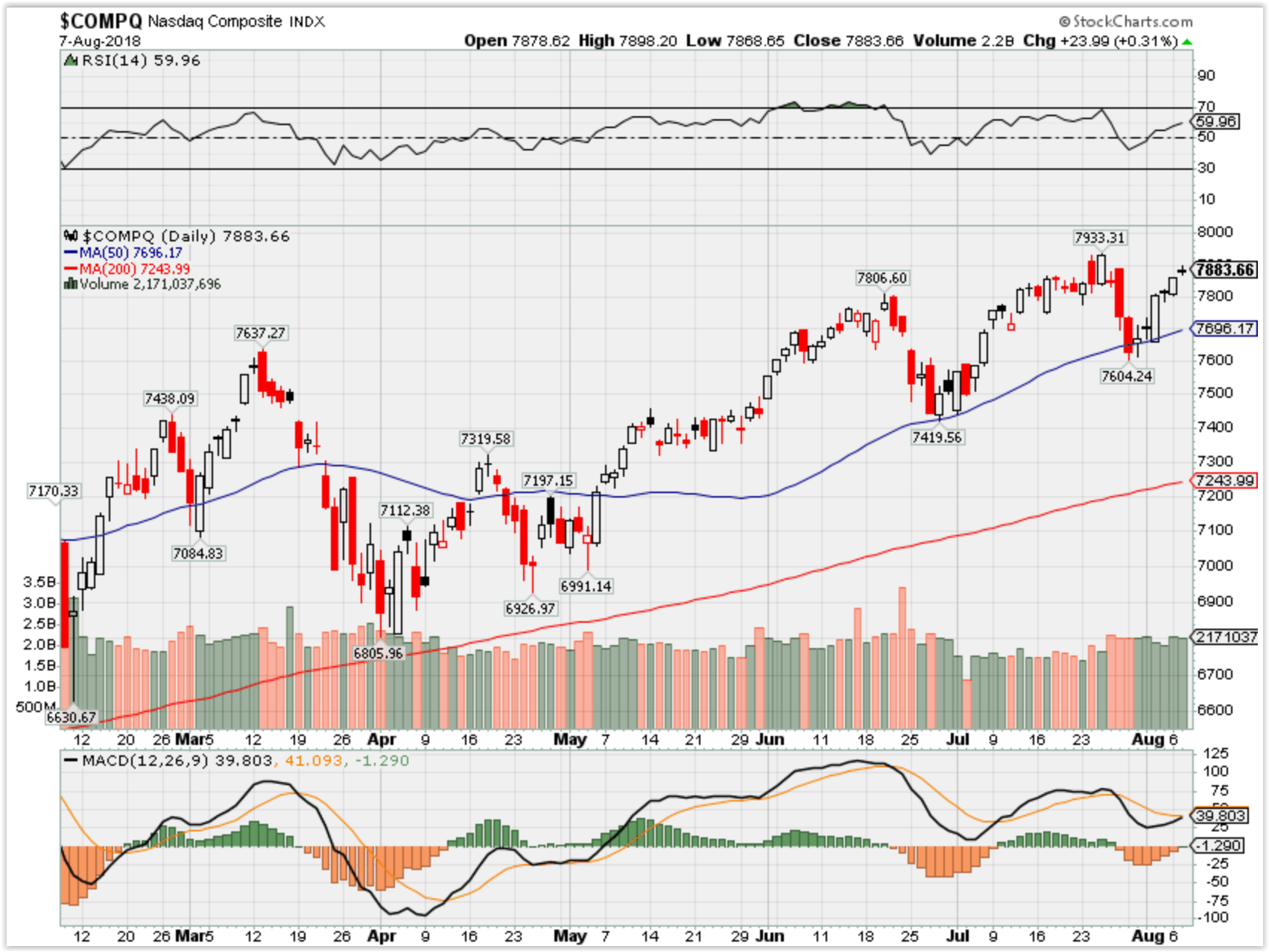

SPX – Bullish

COMP – Bearish

Where Will the SPX end August 2018?

08-07-2018 -2.0%

07-31-2018 -2.0%

Earnings:

Tues: DF, EMR, PPL, WEN, DIS

Wed: CVS, KDP, KORS, DNB, JACK, FLS, MUR, MNST, ROKU

Thur: DDS, DBX

Fri:

Econ Reports:

Tues: Consumer Credit

Wed: MBA, Jolts

Thur: Initial, Continuing, PPI, Core PPI, Wholesale Inventories

Fri: CPI, Core CPI, Michigan Sentiment, Treasury Budget

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

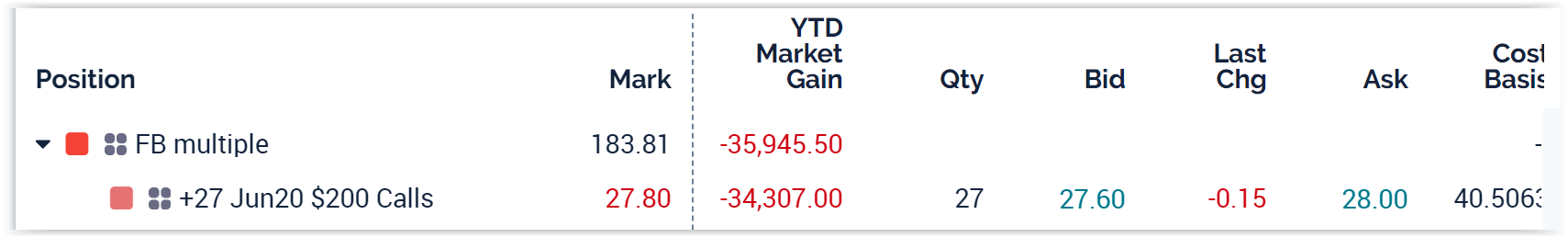

How am I looking to trade?

IN protective puts or collar trades for earning

And Bull putting long puts with bullish stocks and bear putting the long puts on bearish stocks

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2018/08/06/tech-stocks-should-be-a-portfolio-favorite-deutsche-bank.html

Tech stocks should still be a portfolio favorite, despite recent weakness: Deutsche Bank

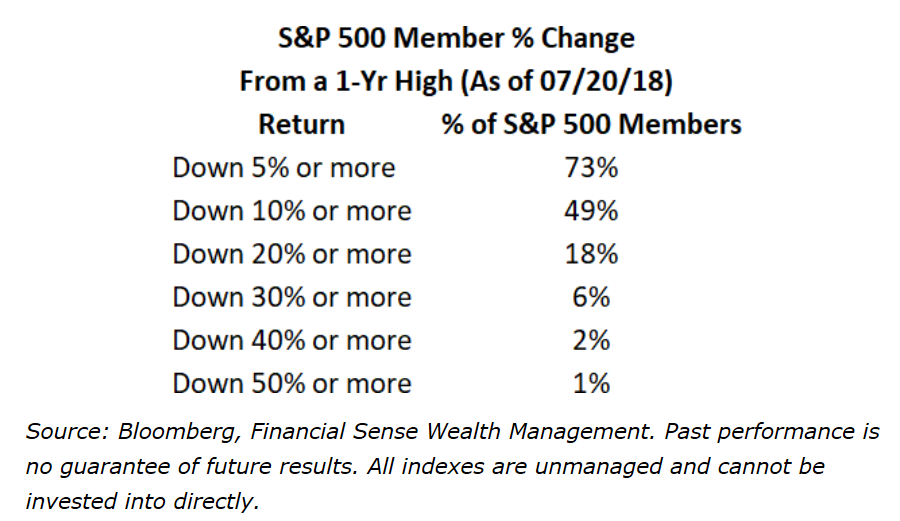

- Although 18 percent of the S&P 500 information technology sector and 43 percent of the Nasdaq companies are down more than 20 percent from their year to date highs, Deutsche Bankis still positive on the tech space.

- Despite the stumbles, Deutsche Bank said tech shares are still great for investors because of solid earnings, cheaper projected valuations, and expected higher dividend payouts, among other factors.

Published 2:55 AM ET Mon, 6 Aug 2018 Updated 21 Hours AgoCNBC.com

Investors may be tempted to steer clear of tech stocks after recent steep losses, but that weakness hasn’t shaken Deutsche Bank’s confidence in the sector.

On July 26, the tech-heavy Nasdaq Composite dropped more than 1 percent as Facebook posted its worst day ever. One day later, the index dropped 1.46 percent, with shares of Intel and Twitter leading declines.

“Following recent weakness in social media and other tech related names, there has been increased rhetoric surrounding the ‘demise of Tech’ and the suggestion that tech has lost its market leadership position. In short, we believe this rhetoric is premature,” Larry Adam, chief investment officer of Deutsche Bank’s Wealth Management Americas unit, wrote in an August 3 note.

The German bank acknowledged that 18 percent of the S&P 500 information technology sector and 43 percent of Nasdaq companies are down more than 20 percent from their year-to-date highs. But it also pointed out that the S&P 500 IT sector is still 28 percent higher over the past year, and it’s the top performer in the index over that period.

Despite the stumbles, Deutsche Bank said tech shares are still great for investors because of solid earnings, cheaper projected valuations, and expected higher dividend payouts, among other factors.

Tech companies have had record cash flows, and that has led to a number of “supportive shareholder friendly” actions: buybacks of $66 billion in the second quarter of 2018, and expected dividends of 11 percent in 2018 and 9 percent in 2019, Adam wrote.

Tech firms’ earnings have also remained “robust,” Adam added, with the sector posting earnings growth of 33.5 percent, and over 90 percent of companies beating earnings estimates.

Going forward, Adam said, tech results should still be strong, with full year earnings expected to go up by about 20 percent in 2018 and 11 percent in 2019.

Valuations in the sector are expected to become cheaper, the Deutsche note said, which mean the stocks might be more attractiveto investors.

Finally, the strong growth in the U.S. economy is bound to benefit American information technology companies, which will enjoy strong consumer demand and a surge in business spending, Adam said.

Bulls Make A Charge For The Highs – 08-03-18

Written by Lance Roberts | Aug, 4, 2018

- Bulls Make A Charge For The Highs

- Weekly Buy Signal Is In – Don’t Jump

- All FAANG’ed Up

- Sector & Market Analysis

- 401k Plan Manager

Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha

Bulls Make A Charge For The Highs

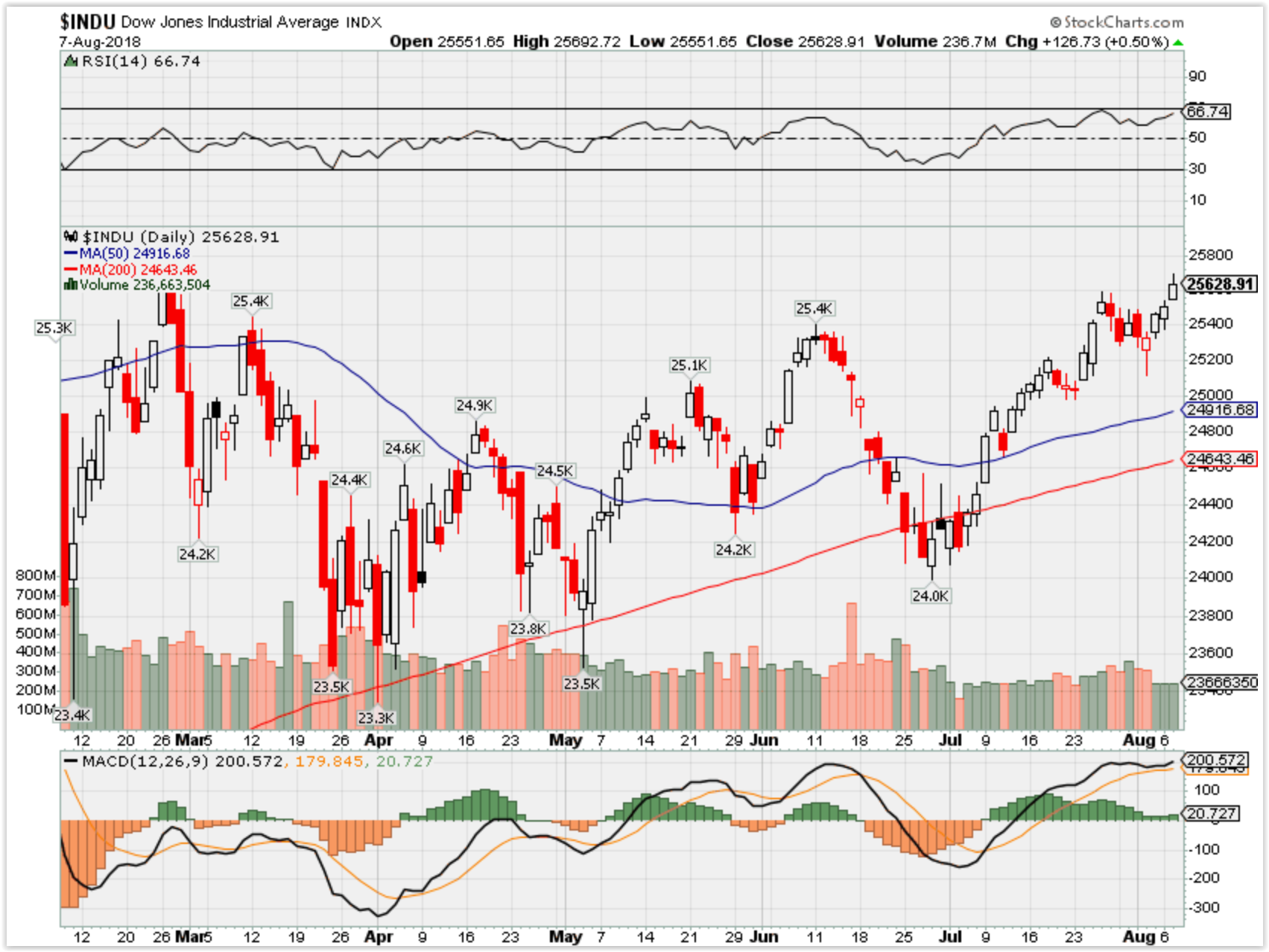

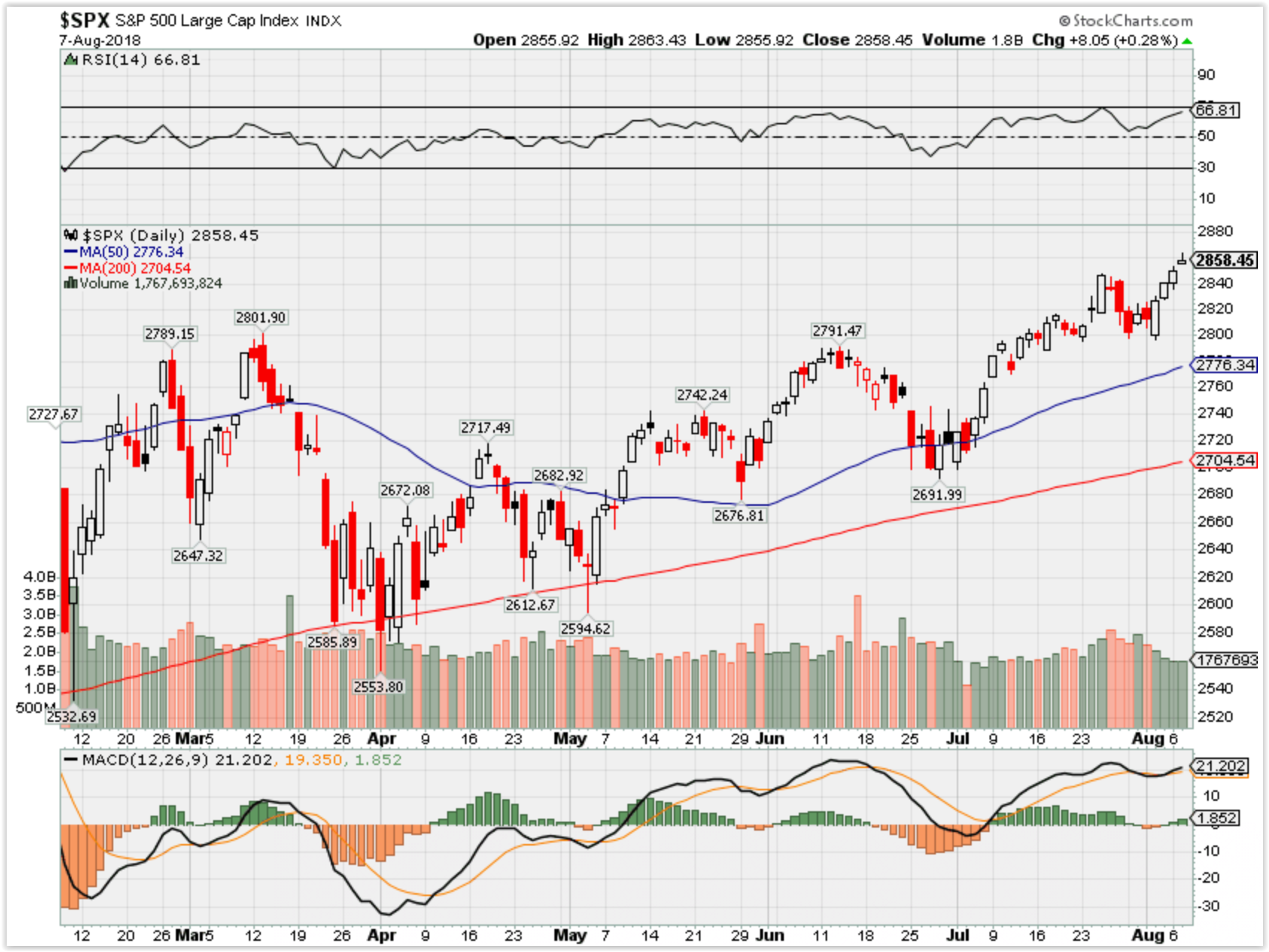

Last week, we discussed how the market managed to clear the “Maginot Line” which brings January highs into focus. The chart below is the updated analysis from last week.

Given this is a “weekly” chart, it takes much more time for signals to register. The advance over the last few weeks has taken the market back into overbought territory and was a point made last week:

“The market can most assuredly get even more overbought from current levels, but does suggest that upside is becoming more limited from current levels. However, with the weekly ‘buy signal’ triggered this past week, we must give the bulls some room to run.”

Currently, the “bulls” remain clearly in charge of the market…for now. While it seems as if much of the “tariff talk” has been priced into stocks, what likely hasn’t as of yet is rising evidence of weakening economic data (ISM, employment, etc.), weakening consumer demand, and the impact of higher rates.

While on an intermediate-term basis these macro issues will matter, it is primarily just sentiment that matters in the short-term. From that perspective, the market retested the previous breakout above the March highs last week (the Maginot line) which keeps Pathway #1 intact. It also suggests that next week will likely see a test of the January highs.

With moving averages rising, this shifts Pathway #2a and #2b further out into the August and September time frames. The potential for a correction back to support before a second attempt at all-time highs would align with normal seasonal weakness heading into the Fall.

Currently, there is a very low risk of a deeper correction (Pathway #3). However, it is a possibility that should not be ignored at this juncture. With the administration gearing up for further tariffs against China, and China retaliating in kind, at a time when the Fed is already more aggressively tightening monetary policy, it would be remiss to ignore the risk of “something going wrong.”

It would also be remiss to not remind you that despite the “bullish short-term view,” the long-term outlook remains decidedly bearish. With valuations elevated, price extended, and deviations near historic records, the potential for a more severe correction in prices is an absolute certainty.

The issue is that these cycles can remain both fundamentally and technically overvalued for longer than logic would dictate particularly when there are artificial influences at play. However, the message is clear for those that choose to listen. This is why it is crucially important to have a discipline and strategy in place which will manage the exposure to risk when things change in the market.

Weekly Buy Signal Is In, But Don’t Jump

In the 401k Plan Manager at the bottom of this newsletter each week, I publish the model that drives our portfolio allocations over time.

There are two important concepts to understand about this model.

- Risk knows no age:Risk doesn’t care how old you are. It is often said that if you are 20, you should take on a lot of portfolio risk. However, if that risk is taken at the top of a market cycle, the damage to the long-term financial goals can be disastrous. We believe that our allocation to risk has nothing to do with our age, and everything to do with the potential for the loss of capital. Therefore, our allocation model is broken into two parts.

- Allocation model is based upon current valuation

- If valuations were 10-12x earnings the target allocation levels would be primarily weighted towards equity (i.e. 80% Stocks / 20% Bonds)

- As valuations rise behind historical extremes, target equity levels are reduced. (i.e. 60/40, 50/50, etc.)

- The EQUITY portion of the allocation is also adjusted based on current market risk.Earlier this year, the equity risk portion of the allocation model was reduced from 100% to 75% due to a triggering of a confirmed “sell” signal. There are 4-primary indicators to the model:

- 1st signal– short-term warning signal. Only an alert to pay attention to portfolio risk.

- 2nd signal– reduce equity by 25%.

- 3rd signal– (Moving average cross-over) reduce equity by another 25%.

- 4th signal– (Trend change) – reduce equity by another 25% and short the market.

- Allocation model is based upon current valuation

We will be posting a live version of our indicators at RIAPro.net (currently in beta) as shown below.

The 4-signals above also run in reverse. So, when a signal reverses itself, equity risk is increased in the model as is the case this week.

With that signal in place, we must now increase our portfolio allocation model to 100% of target.

However, it is important to note these signals are based on “weekly” data and are intermediate-term in nature. Therefore, by the time these longer-term indicators are triggered, the very short-term conditions of the market are generally either very overbought, or oversold.

So, Do I Buy Or Not?

At this juncture, most individuals tend to let their emotions get the better of them and they make critical errors with their portfolios. Emotional buying and selling almost always leads you into doing exactly the opposite of what you should do.

Currently, the market has registered a “buy signal,” which means we need to be following our checklist to ensure we are making sound investment decisions:

- What is the allocation model going to look like between asset classes?

- How will those choices affect the volatility of my portfolio relative to the market?

- What is the inherent risk of being wrong with my choices?

- What is my exit point to sell as the market goes up?

- Where is my exit point to sell if the market goes down?

- What specific investments will I use to fill each piece of my allocation model?

- How does each of those investments affect the portfolio as a whole as well as each other?

- Where is my greatest and least amount of exposure in my portfolio?

- Have I properly hedged my risk in my portfolio in case of a catastrophic event?

If you can’t answer the majority of these questions – you should not be putting your money in the market.

These are the questions that we ask ourselves every day with our portfolio allocation structures and you should be doing the same. This is basic portfolio management. Investing without understanding the risk and implications is like driving with your eyes closed. You may be fine for a while but you are going to get seriously hurt somewhere along the way.

There is NO RULE which states you have to jump into the market with both feet today. This is not a competition or game that you are trying to beat. Who cares if your neighbor made 1% more than you last year. Comparison is the one thing that will lead you to take far more risk in your portfolio than you realize. While you will love the portfolio as it rises with the market; you will rue the day when the market declines.

Being a “contrarian” investor, and going against the grain of the mainstream media, feels like an abomination of nature. However, being a successful investor requires a strict diet of discipline and patience combined with proper planning and execution. Emotions have no place within your investment program and need to be checked at the door.

Unfortunately, being emotionless about your money is a very difficult thing for most investors to accomplish. As humans, we tend to extrapolate the success or failure within our portfolios as success and failure of ourselves as individuals. This is patently wrong. As investors, we will lose more often than we would like – the difference is limiting the losses and maximizing the winnings. This explains why there are so few really successful investors in the world.

With this in mind, it doesn’t mean that you can’t do well as an investor. It just means that you must pay attention to the “risks” inherent in the market and act accordingly.

- Yes, the market is on a “buy” signal.

• Yes, we need to add exposure as shown in the 401k plan manager below.

• No, it doesn’t mean that you need to act immediately

However, it does mean that we need to pay close attention to developments over the next couple of weeks to be sure the “intersection” is clear and that we can proceed to the next traffic light safely. Hopefully, we can catch it “green” – if not, we will obey the signal, stop, and wait for our turn once again.

While the model is being increased back to 100% of target, we will selectively add equity exposure during short-term corrective actions in the market.

As I noted last week:

“With our portfolios nearly fully allocated, there are not a lot of actions we need to take currently as the markets continue to trend higher for now. We will continue to monitor our exposure and hedge risk accordingly, but with the weekly “buy signal” registered, we are keeping our hedges limited and are widening our stops just a bit.

As noted above, a short-term correction is needed before adding further equity exposure to portfolios. That correction likely started on Friday, and I will not be surprised to see it continue into next week. A retest of 2800 is likely at this point, which would keep Pathway #1 intact. However, a violation of that level will likely trigger a short-term sell signal, which could push the market back towards previous support at 2740.

There is a lot of support forming at 2740, which should be supportive of the market over the next couple of months. A violation of that level suggests something has likely broken and more protective actions should be taken.”

Until that happens, we will give the markets the benefit of the doubt…for now.

All FAANG’ed Up

Doug Kass had an interesting point on Apple’s surge to $1 Trillion in market cap.

A consensus has formed among economists that the trend toward corporate concentration – in terms of the size of companies and their grasp on profits – is real and may be long-lasting.

“The number of papers that are being written on this from week to week is remarkable,” said David Autor, a Massachusetts Institute of Technology economics professor who has studied the phenomenon…”Apple and Google combined now provide the software for 99 percent of all smartphones. Facebook and Google take 59 cents of every dollar spent on online advertising in the United States. Amazon exerts utter dominance over online shopping and is getting bigger, fast, in areas like streaming of music and videos.” –New York Times, Apple’s $1 Trillion Milestone Reflects Rise of Powerful Megacompanies

With much justification, a small group of stocks, referred to as FAANG, has dominated the U.S. stock market and U.S. economy.

Nearly half of this year’s gains in the S&P 500 Index have come from the five component stocks of FAANG (Facebook (FB) , Amazon (AMZN) , Apple (AAPL) , Netflix (NFLX) and Alphabet — aka Google (GOOGL) ).

Lance here:

A couple of week’s ago I addressed this market capitalization issue, to wit:

“The current environment has the look and feel of a late-stage market cycle. This is particularly the case when you have 20-stocks making up more of the overall S&P 500 index than the bottom 400 combined.”

“Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.” – Bob Farrell’s Rule #7:

Back to Doug:

Indeed, FAANG stocks have fueled much of the near-decade-long bull market since March 2009.

The rise of FAANG has contributed and influenced our domestic economy, in a not-so-good way. Facebook, Amazon, Apple, Netflix and Google’s unfettered growth has manifested in declining levels of unionization and contributed to the disruption of numerous industries, thus influencing the general trend of weak wage growth and impacting the rise in income inequality.

As the technology of FAANG has rapidly eclipsed the influence of regulatory supervision and an antiquated antitrust legislation, their sales growth and market dominance have gone nearly untouched by the hand of government.

The business media has rejoiced in Apple reaching a $1-trillion market cap and, not surprisingly, has embarked on a trivial, simplistic and superficial discourse, questioning how much further Apple can rise, which will be the next $1-trillion company, and so forth.

Rather, one should consider the consequences of the concentrative issues relating to FAANG and consider what happened to the U.S. and global economies when our banking industry grew exponentially by leveraging itself into oblivion, proving that it was not too big to fail in 2008-2009.

“A year ago, the big tech companies were basically untouchable; today, they seem not to be.”

–Luigi Zingales, University of Chicago

To me, the existential risk to FAANG is that their growth is dulled by the above realities and the U.S. government takes a more aggressive position toward FAANG’s domination. After all, in an age of populism seen both on the political left and the right, assaults by legislators and government regulatory bodies seem likely to intensify.

As well, should the current phase of protectionism continue and the possibility of trade wars intensify even further, it could result in the disruptors being disrupted.

After all, nearly 19% of Apple’s sales are derived from China.

By contrast, the existential risk to our economy is that their growth is allowed to continue at a helter-skelter pace, with some of the downside factors mentioned in this morning’s missive multiplying should the growth snowball be permitted to roll further down the economic hill.

*******

Doug’s point is interesting as it dovetails into an article that David Robertson, CFA wrote for RIA this past week wherein he noted:

“Such competition moves the tradeoffs of centralization vs. decentralization to the geopolitical stage: ‘The AI competition may be better viewed as part of a broader struggle between a decentralised democratic model and a digital authoritarian system.’

So are technology companies breaking bad? That would probably be an overstatement, but it is very fair to say that many of the elements crucial to harness the full potential technological innovation are underrepresented in today’s environment. Knowledge of technologies is insufficient, governance is slow and weak, and public engagement is low. This creates a weak position from which to wrest power from companies with strong economic incentives. This is important for investors. Unless things change, there is a good chance that not only will the great potential of technological innovation fail to be realized, but also that such innovations will continue to be exploited right up until things break.”

The risk of concentration into the few stocks poses an enormous risk to investors when, not if, something inevitably goes wrong.

As we saw just recently with plunges in $FB and $NFLX, given the massive levels of leverage currently built into the system a concentrated sell-off in the FAANG stocks could lead to a rather disastrous unwinding for investors.

While such an event is widely dismissed as impossible, it is important to remember it was deemed to be that way previously. This tweet from David Rosenberg sums it up succinctly.

Big and bigger. As Apple becomes the first to join the trillion-dollar club, Nasdaq’s market cap-to-GDP ratio is now rapidly approaching the bubble peak during the dotcom era.

120 people are talking about this

As I noted last week, the underlying economic environment, and the associated structural deformations pose a substantial risk to investors longer-term.

“While fighting trade wars, pushing tax cuts and increasing government spending may provide short-term boosts to the economy by pulling forward future consumption – they do not address the issues which are detracting from longer-term growth.’

- Debt

- Spending Hikes

- Demographics

- Surging health care costs

- Structural employment shifts

- Technological innovations

- Globalization

- Financialization

While Doug’s, David’s and Rosie’s points are valid, these are issues that will take time to develop. As such, the ongoing performance of FAANG stocks will continue to lure unwitting investors into the trap which will eventually lead to their demise.

But such is the nature of markets historically.

Just be careful you don’t get F.U.B.A.R.ed. (FAANG’ed Up Beyond All Recognition)

See you after next week.

Market & Sector Analysis

Data Analysis Of The Market & Sectors For Traders

S&P 500 Tear Sheet

Performance Analysis

ETF Model Relative Performance Analysis

Sector & Market Analysis:

Last week, this section wasn’t available due to my travels. Therefore, changes in this week’s commentary is based on two week’s of data.

Discretionary and Technology – After recommending to take some profits out of the Technology sector, the $FB episode led to sell-off back to the 50-dma support. The same occurred with the discretionary sector as well. The trends for both remain very bullish right now, and the pullback provides an opportunity to rebalance sector holdings back to target weights.

Healthcare, Staples, and Utilities – after cooling briefly, money has once again flowed strongly into the sector. Healthcare, in particular, has gotten very extended and taking some profits and rebalancing back to portfolio weight makes sense. Despite the recent uptick in rates, Utilities have also continued to perform nicely after a long basing period earlier this year. Staples also continue to improve.

Financial, Energy, Industrial, and Material stocks showed a bit of improvement this past week. Industrials were the only sector in the group to climb back above its 50-dma but remains below several previous tops. While the trend for Energy remains in place, for now, we remain underweight holdings due to lack of relative performance. We currently have no weighting in Industrial or Materials as the “trade war” continues to negatively impact the companies in the sectors. The decline of the “yield curve” continues to weigh on major banks.

Small-Cap and Mid Cap continue to perform well as of late. We noted two weeks ago, that after small and mid-caps broke out of a multi-top trading range, we needed a pull-back to add further exposure. That pullback to the 50-dma happened and we added exposure to portfolios with stops at the 50-dma. On any further weakness in the markets that hold supports and we increase exposure further to get us to full target weights in our models.

Emerging and International Markets were removed in January from portfolios on the basis that “trade wars” and “rising rates” were not good for these groups. Furthermore, we noted that global economic growth was slowing which provided substantial risk. That recommendation to focus on domestic holdings in allocations has paid off well in recent months. With emerging markets and international markets continuing to languish, there is no reason to ad exposure at this time. Remain domestically focused to reduce the drag on overall portfolio performance.

Dividends and Equal weight continue to hold their own and we continue to hold our allocations to these “core holdings.”

Gold – we haven’t owned Gold since early 2013. However, we suggested three months ago to close out existing positions due to a violation of critical stop levels. We then recommended that again given the cross of the 50-dma back below the 200-dma.

That bounce came and went and gold broke to new lows. With gold very oversold on a short-term basis, if you are still long the metal, your stop has been lowered from $117 two weeks ago, to $114 this week. A rally sale point has also declined from the previous level of $121 to $117.50.

Bonds – This past week, bonds sold off on concerns of a major issuance of new bonds by the Treasury to fill the Government’s funding gap. With the 50-dma about to cross back above the 200-dma, the technical backdrop continues to build for adding bonds to portfolios. However, be patient and let’s see what happens next week. As noted previously, we remain out of trading positions currently but remain long “core” bond holdings mostly in floating rate and shorter duration exposure.

REIT’s keep bouncing off the 50-dma like clockwork. Despite rising rates, the sector has continued to catch a share of money flows and the entire backdrop is bullish for REIT’s. However, with the sector very overbought, take profits and rebalance back to weight and look for pullbacks to support to add exposure.

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Portfolio/Client Update:

As I noted last week, the market’s improvement allowed us the ability to further increase equity exposure in portfolios in anticipation of registering a confirmed buy signal. With the retest of the “Maginot Line” this past week, we will look to further increase equity exposure on opportunity. However, given the August and September are historically weak months for the market, we will remain a bit more cautious on the how and when we increase holdings in our models.

The cluster of support at the 50- and 100-dma remains in place which limits much of the downside risk currently. However, we are quite aware of the risk stemming from “tariff talk” and further tightening of Fed policy. As we noted several weeks ago:

“While we are not raging long-term bulls, we do think that with earnings season in process the bias will be to the upside. There is a high probability of a substantive rally over the next couple of weeks.”

While that has indeed been the case, we continue to follow our “process” internally with an inherent focus on the risk to client capital.

- New clients:We added 50% of target equity allocations for new clients. We will look to add further exposure opportunistically.

- Equity Model:We previously added 50% of target allocations. We “dollar cost averaged” into those holdings opportunistically. We recently added new positions to the model and will continue to look for opportunity accordingly.

- Equity/ETF blendedmodels were brought closer to target allocations as we added to “core holdings.”

- Option-Wrapped Equity Modelwere brought closer to target allocations and collars will be implemented.

Again, we are moving cautiously, and opportunistically, as we continue to work toward minimizing risk as much as possible. While market action has improved on a short-term basis, we remain very aware of the long-term risks associated with rising rates, excessive valuations and extended cycles.

It is important to understand that when we add to our equity allocations, ALL purchases are initially “trades” that can, and will, be closed out quickly if they fail to work as anticipated. This is why we “step” into positions initially. Once a “trade” begins to work as anticipated, it is then brought to the appropriate portfolio weight and becomes a long-term investment. We will unwind these action either by reducing, selling, or hedging, if the market environment changes for the worse.

THE REAL 401k PLAN MANAGER

The Real 401k Plan Manager – A Conservative Strategy For Long-Term Investors

There are 4-steps to allocation changes based on 25% reduction increments. As noted in the chart above a 100% allocation level is equal to 60% stocks. I never advocate being 100% out of the market as it is far too difficult to reverse course when the market changes from a negative to a positive trend. Emotions keep us from taking the correct action.

Buy Signal Is In…

The market did trigger a weekly confirmed “buy” two week’s ago as we previously discussed. However, as noted in the main part of missive above, by the time these signals occur the market has generally gotten either overbought or oversold in the short-term.

There is “no requirement” to make immediate adjustments to your 401k plan. As you will note in the chart above, there have previously been “buy signals” which were reversed a few months later. This could well be one of those times given some the condition of the macro environment. However, for now, while we do recommend some caution, particularly if you are closer to retirement, follow the rules below:

- If you are overweightequities – reduce international and emerging market exposure.

- If you are underweight equities– begin increasing exposure towards equity in small steps. (1/3 of what is required to reach target allocations.)

- If you are at target equity allocationscurrently, do nothing for now.

While will officially upgraded our allocation model back to 100% exposure, there is no rush in immediately adding additional equity risk. Do so opportunistically.

If you need help after reading the alert; don’t hesitate to contact me.

Current 401-k Allocation Model

The 401k plan allocation plan below follows the K.I.S.S. principle. By keeping the allocation extremely simplified it allows for better control of the allocation and a closer tracking to the benchmark objective over time.(If you want to make it more complicated you can, however, statistics show that simply adding more funds does not increase performance to any great degree.)

401k Choice Matching List

The list below shows sample 401k plan funds for each major category. In reality, the majority of funds all track their indices fairly closely. Therefore, if you don’t see your exact fund listed, look for a fund that is similar in nature.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

HI Financial Services Mid-Week 06-24-2014