HI Financial Services Commentary 06-27-2017

Next week low volume on Monday so don’t place or consider the market movement on that day a trend

Market closed on Tuesday

What’s happening this week and why?

Pullback on the major indexes but not out of control or panic selling yet

Close but not close to repealing Obamacare and Senate will look it over after the July 4th recess

Headlines like Draghi’s comments today about continued easing, no repeal are still moving markets

Where will our market end this week?

Higher

Two reasons why – 1. Buyers came back in today to try to push the market higher

- Williams %R

- Big money seemed to sell off for the end of the month which only leaves window dressing

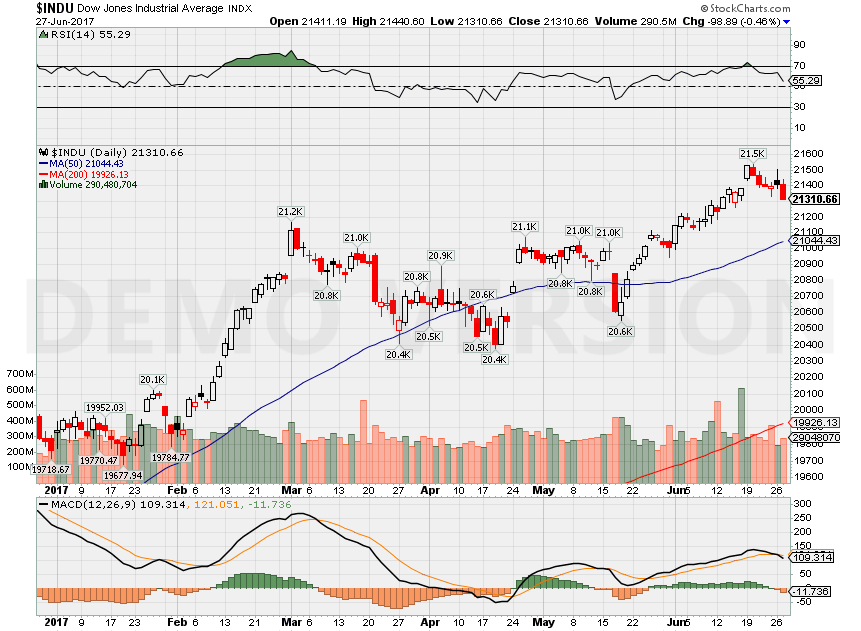

DJIA – Bullish

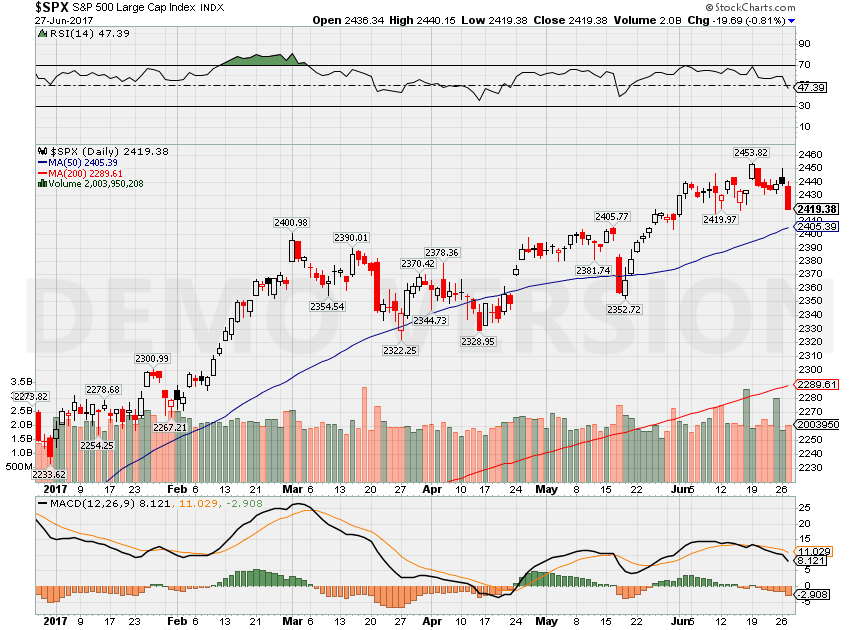

SPX – Bullish

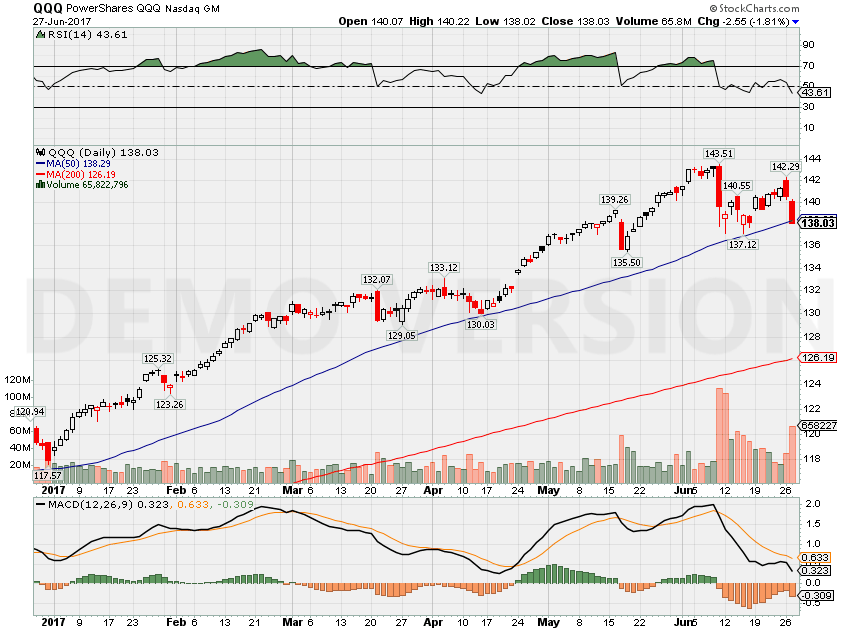

COMP – Bearish

Where Will the SPX end July 2017?

06-27-2017 -2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: KBH, DRI

Wed: WBA, NKE, RAD

Thur: MU

Fri:

Econ Reports:

Tues: Case Shiller, Consumer Confidence

Wed: MBA, Pending Home Sales

Thur: Initial, Continuing Claims, GDP 3rd est, GDP Deflator

Fri: Personal Income, Personal Spending, PCE Prices, Chicago PMI, Mich Sentiment

Int’l:

Tues –

Wed – JP: Retail Sales

Thursday – CN: CFLP Manu PMI

Friday –

Sunday –

How I am looking to trade?

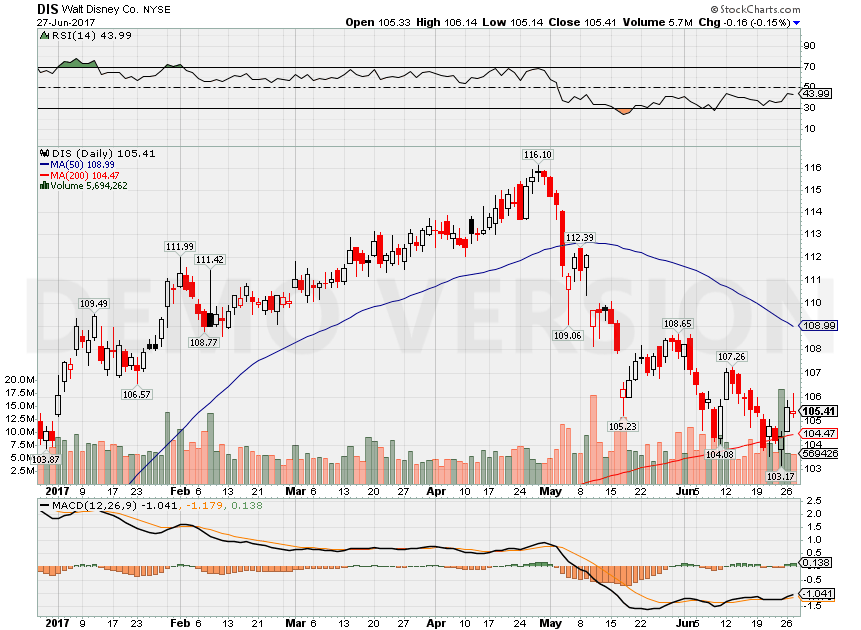

An early entry point for a 200 SMA bounce even though cross overs haven’t. It would be a bullish play for a naked 105 July short put if you could take stock ownership, a 102.50/100 bull put or bull call, or a 105/110 bull call

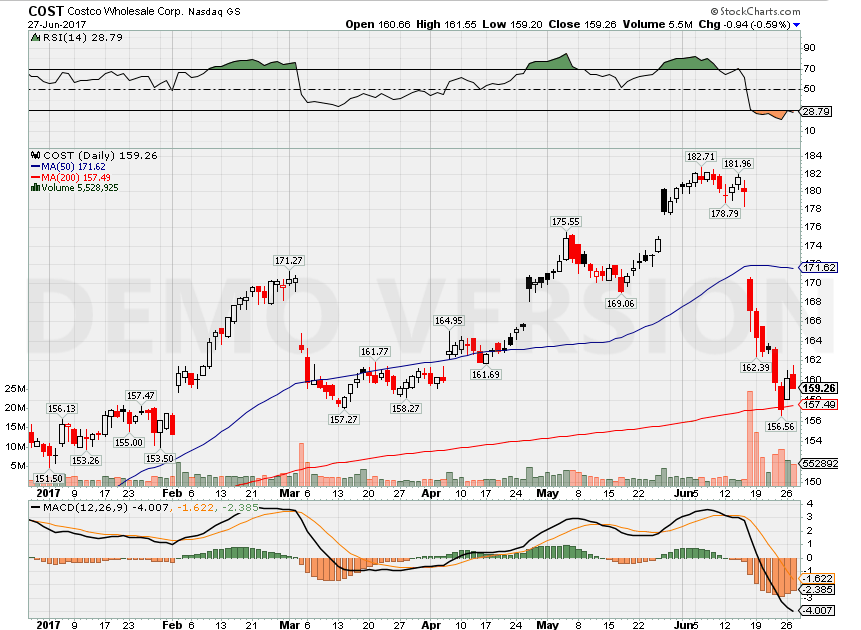

Does the amazon purchase really warrant a $20 drop in stock price and an oversold stock? I don’t think so either and 160 is a support level with the 200 SMA. Again an bullish trade like a protective put, out of the money covered call, bull call, bull put, naked put all can use the 160ish level of support

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Billionaire Warren Buffett says ‘the real problem’ with the US economy is people like him

13 Hours Ago

Warren Buffett says people like him are the problem with the U.S. economy.

With a net worth of more than $75 billion, Buffett is currently the second richest man alive, according to Forbes. As the CEO of investing house Berkshire Hathaway, he is hallowed as the Oracle of Omaha. But for all his personal success, Buffett says the issue really is the 1 percent.

“The real problem, in my view, is — this has been — the prosperity has been unbelievable for the extremely rich people,” says Buffett on PBS Newshour.

“If you go to 1982, when Forbes put on their first 400 list, those people had [a total of] $93 billion. They now have $2.4 trillion, [a multiple of] 25 for one,” he says. “This has been a prosperity that’s been disproportionately rewarding to the people on top.”

“THE REAL PROBLEM, IN MY VIEW, IS … THE PROSPERITY HAS BEEN UNBELIEVABLE FOR THE EXTREMELY RICH PEOPLE.”-Warren Buffett, CEO of Berkshire Hathaway

The stock market has been trending upwards since the crash in March 2009 and the U.S. economy is growing at roughly 2 percent, says Buffett on Newshour. That growth rate (while a third less than the 3 percent rate President Donald Trump has been touting) is a healthy number for the economy and will improve the quality of life of many Americans.

It will add “$19,000 of GDP per person, family of four, $76,000 in one generation,” says Buffett. “So, your children and your children’s children and all that, they will live far, far, far better than we live with 2 percent growth.”

And yet, many individuals are stuck. “The economy is doing well, but all Americans aren’t doing well,” says Buffett.

Part of the reason some are struggling, says the octogenarian investor, is that the automation and digitization of the U.S. labor force is happening faster than employees can be retrained.

“We always see shifts in employment. If you think about it, if you go back to 1800, it took 80 percent of the labor force to produce enough food for the country. Now it takes less than 3 percent. Well, the truth is that market systems move people around,” says Buffett.

“There’s always a mismatch. I mean, you know, as the economy evolves, it reallocates resources.”

As employees fall out of the labor force because their skills are no longer utilized, Buffett says it ought to be the responsibility of society to take care of them as they are retrained to re-enter the workforce.

“WHEN YOU HAVE SOMETHING THAT’S GOOD FOR SOCIETY, BUT TERRIBLY HARMFUL FOR GIVEN INDIVIDUALS, WE HAVE GOT TO MAKE SURE THOSE INDIVIDUALS ARE TAKEN CARE OF.”-Warren Buffett, billionaire

The evolving economy “doesn’t benefit the steelworker maybe in Ohio,” says Buffett on Newshour. “And that’s the problem that has to be addressed, because when you have something that’s good for society, but terribly harmful for given individuals, we have got to make sure those individuals are taken care of.”

Buffett made his extreme wealth by investing in the stock market, an interest that took hold young. Buffett bought his first stock when he was 11 and has been in the market for 75 years. He recommends others do the same.

“They should just keep buying and buying and buying a little bit of America as they go along. And 30 or 40 years from now, they will have a lot of money,” he says.

In an effort to compensate for the wealth inequality that he himself has benefited from, Buffett and his billionaire buddy Microsoft co-founder Bill Gates co-founded the Giving Pledge, a voluntary commitment by the richest people in the world to give away at least half of their wealth. The goal of the Giving Pledge is not only to help those in need but to encourage others to do the same.

Like this story? Like CNBC Make It on Facebook.