HI Financial Services Commentary 06-13-2017

What will happen to the typical June Swoon this year?

Apparently Not and the buy the dippers are back but they are different.

How are they different? Not in FANG – Facebook, AAPL, NVDA, NFLX, GOOG, ALPHABET, AMZN

Rotating out of big tech into boring and financials

Boring – PG, GE,

I don’t just throw protection on because of one bad day

I need reasons – breaking of the 50 SMA, Technical crossovers, macro news, specific news events ie…CFO, CEO change

What do two consecutives down or up days do to spreads? Quick profits or real quick losses – Lance

Big value changes on swings in the market, could get you out of the trade on limit loss orders

Things happen and one day or even one week shouldn’t “destroy” a portfolio

IT CAN ruin a position, spread trade or stop limits BUT should not ruin a whole portfolio

Things that hurt you in one day – upgrades, downgrades, black swan events, The Fed, crazy news, gaps,

Crazy event if they are ruining a portfolio you are probably over leveraged in some regard

What’s happening this week and why?

Fear of another rate hike tomorrow

CNN Comey, Session or open hearings about possible classified or illegal government officials activities

Rotation and profit taking from Tech and/or FANG

Where will our market end this week?

???

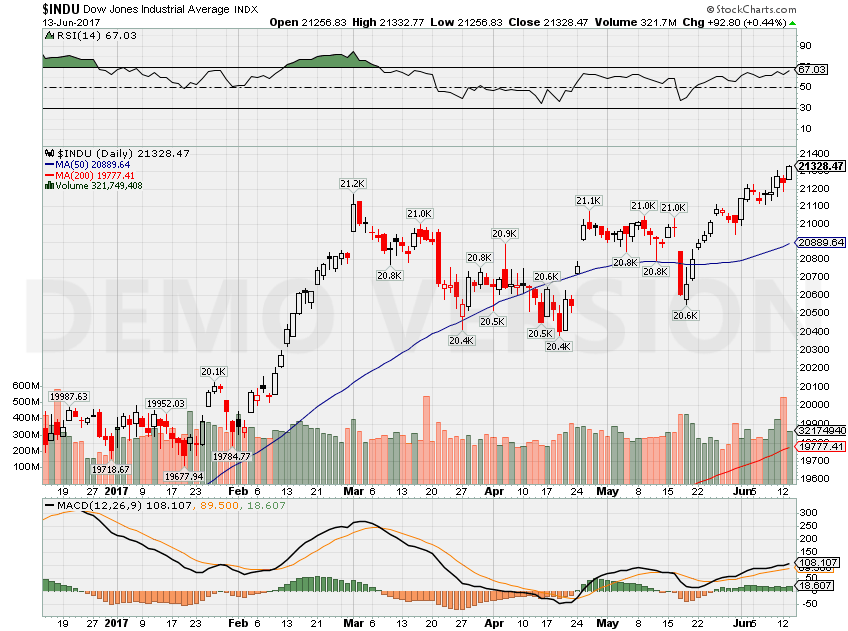

DJIA – Bullish

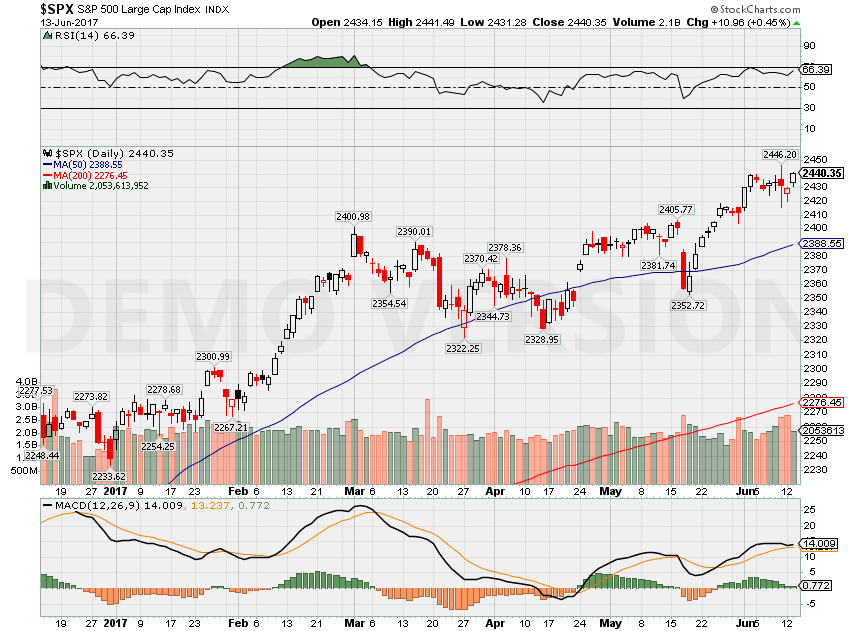

SPX – Hit the RSI Overbought limit line Bullish

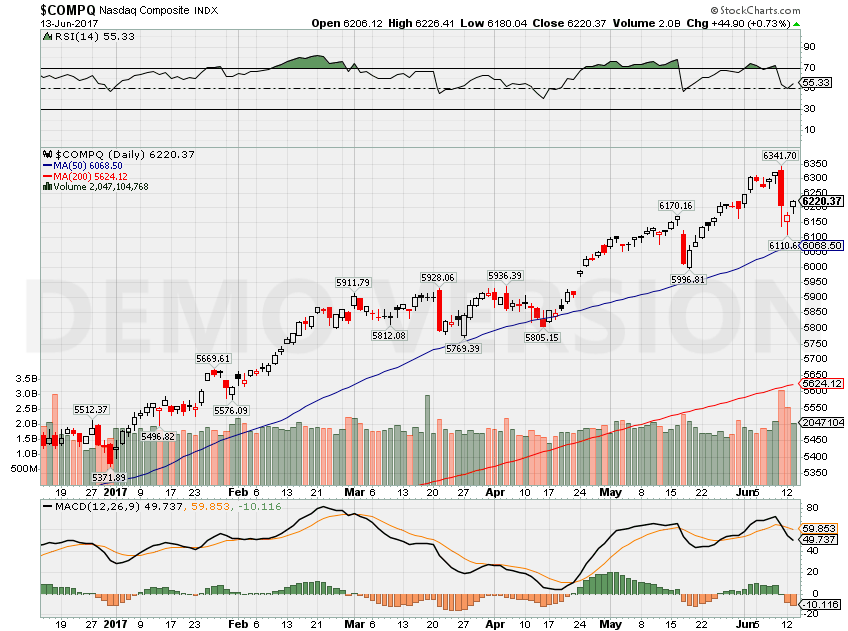

COMP – Overbought bullish

Where Will the SPX end June 2017?

06-1`3-2017 -2.0%

06-06-2017 -2.0%

05-30-2017 -2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: HRB

Wed: JBL

Thur: KR, FNSR

Fri:

Econ Reports:

Tues: PPI, Core PPI

Wed: MBA, CPI, Core CPI, Retail Sales, Retail ex-auto, FOMC Rate Decision

Thur: Initial, Continuing Claims, Phil Fed, Import, Export, Empire Manufacturing, Capacity Utilization, Industrial Production

Fri: Housing Starts, Building Permits, Michigan Sentiment

Int’l:

Tues – CN: Industrial Production, Retail Sales,

Wed –

Thursday –

Friday –

Sunday – JP: Merchandise Trade, CN: House Price Index

How I am looking to trade?

VIX at 12 to start to try to sell some premium

Looking to sell credit for a sideways moving market – bull puts, short puts and little credit high short calls

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

A ‘horrendous storm’ is set to hit stocks, and may drag the S&P down 34%, David Stockman says

President Reagan’s OMB director predicts a 34 percent drop in the S&P 500 could be months away.

Read more: http://www.cnbc.com/id/104518226

Here’s why oil prices could drop to $30 a barrel again: Fesharaki

A leading global energy market academic warns crude prices could sink back to $30 a barrel if OPEC fails to make additional cuts to production.

Read more: http://www.cnbc.com/id/104527813

Death of the human investor: Just 10% of trading is regular stock picking, JPMorgan estimates

By trade volume, machines and exchange-traded funds are leaving the traditional stock picker in the dust.

Read more: http://www.cnbc.com/id/104527239

HI Financial Services Mid-Week 06-24-2014