HI Financial Services Commentary 05-08-2018

You Tube link: https://youtu.be/vaEUgShGZ9I

What I want to talk about today?

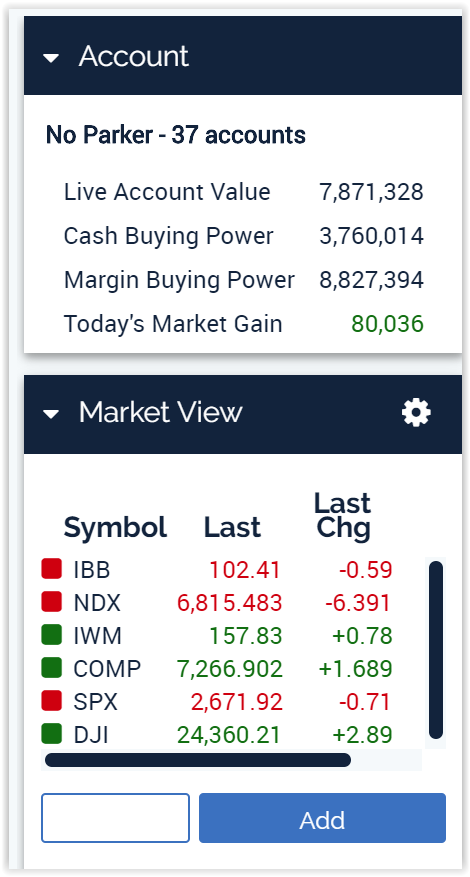

How is the market doing this year? What would you tell me

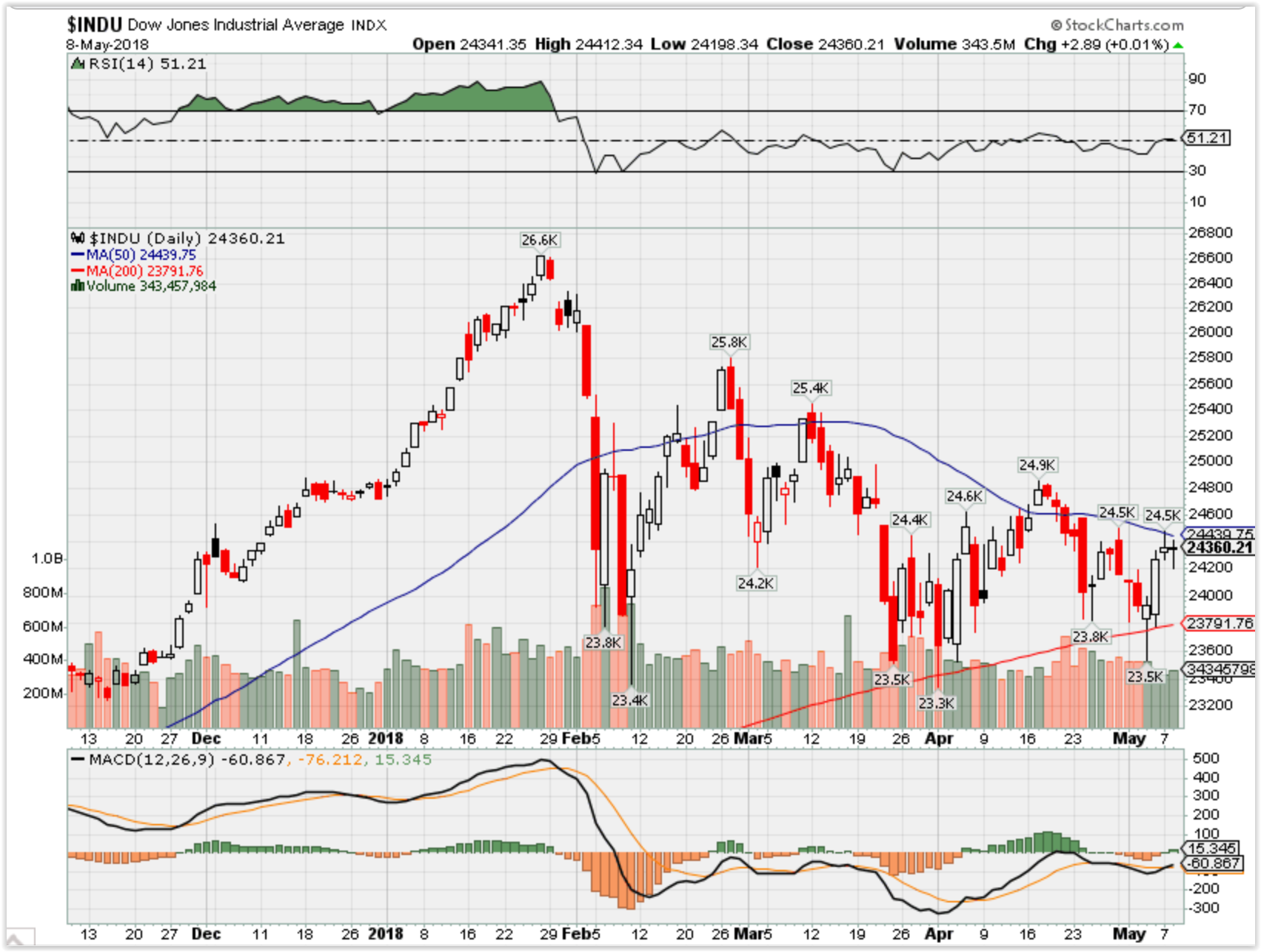

DJIA -1.45%

SPX -0.06%

Nasdaq + 5.27%

https://www.cnbc.com/2018/05/02/jeff-bezos-this-is-what-you-are-going-to-regret-at-80.html

Jeff Bezos: This is what you are going to regret at 80

“When you think about the things that you will regret when you’re 80, they’re almost always the things that you did not do. They’re acts of omission. Very rarely are you going to regret something that you did that failed and didn’t work or whatever,” says Bezos in an interview with Axel Springer CEO Mathias Döpfner, published by Business Insider on Saturday.

What happening this week and why?

US backing out of the Iran Deal. = Spike in OIL, Uncertainty in US policy making, and the possible start to sanction that may be perceived as implicating a trade war

How will the US economy fair with rising wages and higher interest rates,

Uncertainty is palpable to the point you can feel it in the market

Where will our markets end this week?

Higher

DJIA – Bearish

SPX – Bearish

COMP – Bullish

Where Will the SPX end May 2018?

05-08-2018 -2.0%

05-01-2018 -2.0%

Earnings:

Tues: DF, JD, VG, LC, MNST, PZZA, VSLR, WEN, DIS

Wed: BUD, GRPN, ODP, CTL, CTRP

Thur: DDS, DUK, NVDA, YELP

Fri:

Econ Reports:

Tues: NFIB Small Business, Jolts

Wed: MBA, PPI, Core PPI, Wholesale Inventories.

Thur: Initial, Continuing, CPI, Core CPI, Treasury Budget

Fri: Import, Export, Michigan Sentiment

Int’l:

Tues –

Wed – CN: CPI, PPI

Thursday – BOE Announcement and Minutes

Friday-

Sunday –

How am I looking to trade?

Letting the winners run with bull putting the protective put earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2018/05/06/avengers-infinity-war-crosses-1-billion-faster-than-any-movie.html

Avengers: Infinity War’ reaps $1 billion at the box office, at a pace faster than any other movie

- Walt Disney estimates that “Avengers: Infinity War” earned $1.16 billion at the global box office through Sunday

- The film did so during 11 days of release, marking the fastest sprint to the milestone in film history

- The superhero sequel’s earnings on Friday helped push Disney over the $3 billion mark for the year

Tom DiChristopher | @tdichristopher

Published 1:38 PM ET Sun, 6 May 2018

Updated 2 Hours Ago

“Avengers: Infinity War” set another record this weekend, destroying the box office competition and drumming up $1 billion faster than any other film on the books.

Walt Disney estimated that the superhero sequel’s global haul will stand at $1.16 billion through this weekend, even though it has yet to open in the all-important Chinese market. The film crossed the billion-dollar threshold on Saturday, just 11 days after its release.

“Infinity War” just barely edged out Disney’s “Star Wars: The Force Awakens,” which crossed the milestone in 12 days. The third Avengers film also topped “The Force Awakens” to post the best-ever U.S. opening last weekend.

Disney projects “Infinity War” will earn $112.5 million in its second weekend at U.S. theaters, and earn $162.6 million internationally in the Friday-Sunday window. That makes “Infinity War” the second best sophomore weekend at the U.S. box office, trailing only “The Force Awakens.”

“This speedy sprint toward the coveted and exclusive $1 billion club is a testament to the undeniable global appeal and drawing power of the Marvel brand,” said Paul Dergarabedian, senior media analyst at comScore.

With “Infinity War,” Marvel Studios is capping off a decade of storytelling spanning 18 previous movies, an unprecedented feat in Hollywood franchise-building. The comic book flick unites the Avengers, the “Guardians of the Galaxy” and several other properties, including “Black Panther” and “Spider-Man” in one blockbuster.

“An irresistible concept that brings together an almost unimaginable cast of superhero characters in one massive popcorn movie treat has proven to be cinematic nirvana for film fans around the world,” said Dergarabedian.

“Infinity War” is set to be just the fifth movie ever to earn more than$100 million in its second weekend at U.S. theaters. Marvel Studios’ “Black Panther” became the fourth movie in history to achieve that status earlier this year.

“Infinity War” has yet to debut in China, which consistently ranks as the second biggest market for Marvel Studios films.

The earnings for “Infinity War” on Friday, May 4 tipped Disney over the $3 billion mark at the global box office for 2018. That broke a speed record for the House of Mouse, surpassing the previous record set on May 6 in 2016.

https://finance.yahoo.com/news/disneys-espn-problem-comes-simple-math-225813515.html

Disney’s ESPN problem comes down to simple math

Senior Writer

Yahoo FinanceMay 9, 2017

In Disney’s Q2 earnings report on Tuesday, the company said that revenue for its cable networks division increased 3% but profit decreased 3%. It explained that this way: “The decrease in operating income was due to a decrease at ESPN… The decrease at ESPN was due to higher programming costs.”

The same exact sentence, almost verbatim, appeared in its earnings report for the past three quarters in a row. (See: Q2 2O17; Q1 2017; Q4 2016.)

It’s become the de facto narrative every time Disney reports earnings: ESPN gets framed as the dark cloud of “doubt” that “drags down” Disney. And indeed, ESPN has lost more than 10 million subscribers in four years. ESPN is still profitable for Disney—which too many hot-take stories overlook—but less profitable than it was in the past. (Last month, ESPN cut more than 100 employees, most of them on-air talent.)

And when Disney reports these dour numbers, pundits like to sound off on what exactly ESPN is doing wrong. Many vocal people on Twitter blame politics and accuse ESPN of going liberal. TV analysts point to the rise of cord-cutting that has plagued the industry at large.

But the largest problem ESPN faces is simple, stark math: it is paying more and more in rights fees to show games, while suffering more and more subscriber losses.

The scale is tipped on the wrong side. This situation is untenable.

ESPN will spend $8 billion in 2017 in programming fees.

It pays $1.9 billion per year to show 17 Monday Night Football games. It recently signed an eye-popping new deal with the NBA that took effect this season: $24 billion for 9 years, or $1.4 billion per year. It pays $700 million per year to show MLB games. It pays $600 million per year to show the College Football Playoff and other bowl games.

BTIG analyst Rich Greenfield has called these astronomical agreements ESPN’s “big mistake.”

But ESPN president John Skipper has insisted the NBA package (the deal most commonly criticized recently) was not a mistake. And on Disney’s Q2 2017 earnings callTuesday, Disney CEO Bob Iger said that ESPN will continue to pay big for rights fees.

We will continue to be aggressive at buying live sports rights,” Iger said, “which have not gotten cheaper, we understand, but have gotten only more valuable.”

Iger isn’t wrong, in the sense that anything ESPN does not bid for, it risks losing to Fox, which has tried to make its FS1 network a direct ESPN challenger.

But something has to give. ESPN cannot continue paying higher and higher fees unless it also turns around its business. Judging by Iger’s comments, it will do that by focusing on one word: mobile.

“As we expand and enhance our mobile presence, we’re seeing tremendous advances in mobile viewing,” Iger said on the call. “Almost 80% of people who access ESPN each month access it on mobile devices… ESPN has taken a number of steps on their mobile business, particularly consolidation of their apps and improving user interface and use of video on the apps… The numbers have been tremendous. That’s going to continue to grow and they’ve got big plans to do that.”

The plans start with some kind of OTT (over the top) streaming service for ESPN, which will come later this year, Iger said. BAM Tech, the spun-off video arm of Major League Baseball that Disney invested $1 billion in last year, will build it.

But it will not yet be the all-access ESPN offering that cord-cutters crave, Iger stated: “We don’t have plans right now to take ESPN as it is currently distributed and go over the top with it… frankly, we don’t really feel we’ve got a great need to do that.”

Translation: ESPN’s forthcoming OTT product will not be akin to HBO Now, the standalone service HBO offers that gives access to all HBO programming, past and present. Rather, it will be additive, likely offering programming that isn’t shown on ESPN’s cable channel.

Will that be attractive enough to offset ESPN’s subscriber losses and rising programming fees?

https://www.cnbc.com/2018/05/08/why-amazon-could-be-the-next-black-swan-for-the-market.html

Why Amazon could be the next black swan for the market

Lawrence McDonald | @ConvertBond

Published 12 Hours Ago

Updated 10 Hours Ago

Amazon appears untouchable.

It’s rallied 37 percent this year, outperforming the market nearly fourfold. And a stunning quarter, reported last month, prompted nearly two dozen firms to up their price targets on the e-commerce giant; a handful of those newly minted price targets place the company north of the $1 trillion threshold.

But at this juncture, I suspect a black swan has taken flight. Just consider the stock’s presence in so many passive vehicles.

An overwhelming passive presence

Amazon is a top holding in over 140 exchange-traded funds. A liquidity event for Amazon shares — perhaps triggered by issues related to the Trump administration’s ordered review of the company’s impact on the U.S. Postal Service — would create uncontrollable selling, in our view.

Zooming in further, around 40 ETFs hold Amazon within the top 5 percent. Look out below: This is a colossal failure of common sense.

A passive overdose

Investors have been stuffing themselves on a Thanksgiving feast full of technology stocks. Today, tech sector equities comprise nearly 30 percent of all large-cap mutual fund portfolios; this is an accident waiting to happen.

This represents the largest “overweight” relative to traditional benchmarks, relative to other large-cap sectors, in two decades. This represents, too, nothing more than a passive overdose on big tech, setting up large downside risk.

This development causes me to hearken back a decade.

Of course, who could possibly forget the great gorging on the financial sector heading into the crisis? Leading into 2007, banks and insurance companies comprised nearly 24 percent of the S&P 500. Today, the tech sector’s large market weighing puts it up near 26 percent of the market’s total capitalization.

https://www.cnbc.com/2018/05/05/warren-buffetts-three-best-investing-tips-explained.html

Warren Buffett’s three best investing tips — including ‘margin of safety’ — explained

- Warren Buffett believes investors should buy stockswithin their “circle of competence” and at attractive values to succeed in the stock market.

- Buffett’s track record is unparalleled. From 1965 to 2017, Berkshire Hathaway’s rising market value generated a 20.9 percent annual return compared to S&P 500’s 9.9 percent.

Published 12:01 PM ET Sat, 5 May 2018

Updated 6:42 AM ET Mon, 7 May 2018

Graham’s three investing principles 4:02 PM ET Thu, 3 May 2018 | 00:54

Warren Buffett is one of the most celebrated investors in history. Many accomplished fund managers credited their success to following the Oracle of Omaha’s common sense value investing philosophy.

Buffett’s track record is unparalleled. From 1965 to 2017, Berkshire Hathaway’s rising market value generated a 20.9 percent annual returncompared to S&P 500’s 9.9 percent, resulting in a cumulative gain of 2,404,748 percent versus the market’s 15,508 percent return.

CNBC researched Buffett’s strategy combing through decades of Berkshire Hathaway meeting transcripts using the Buffett Archive to find his best wisdom and strategies for the average investor.

Here is what we found.

1) Circle of competence

“Different people understand different businesses. And the important thing is to know which ones you do understand and when you’re operating within what I call your circle of competence.” — Warren Buffett, 1999 Berkshire Hathaway Annual Meeting

Buffett stressed the importance looking at companies that are within his areas of expertise to avoid large investing mistakes. He wants to know how a business makes money and be confident on the sustainability of its profit streams over the long-term. He called the process “judging the future economics of a business.”

He said if an investor is not sure if a company is within his or her circle of competence, it likely is not.

2) Piece of a business

“And I read Ben’s [The Intelligent Investor] book in 1949 when I was at University of Nebraska, and that actually just changed my whole view of investing. And it really did, basically, told me to think about a stock as a part of a business … Once you crank into your mental apparatus that you’re not looking at things that wiggle up and down on charts, or that people send you little missives on, you know, saying buy this because it’s going up next week, or it’s going to split, or the dividend’s going to get increased, or whatever, but instead you’re buying a business.” — Warren Buffett, 2002 Berkshire Hathaway Annual Meeting

Buffett wasn’t born a great investor. He admitted he couldn’t make any money in stocks even after reading many investing books as a teenager.

But everything changed when Buffett read Ben Graham’s classic “The Intelligent Investor.” The book’s key tenet is to look at each stock purchase as buying a slice of a business and avoid being distracted by stock price movements.

Buffett attributed his eventual success to this investing framework.

3) Margin of Safety

“On the margin of safety, which means, don’t try and drive a 9,800-pound truck over a bridge that says it’s, you know, capacity: 10,000 pounds. But go down the road a little bit and find one that says, capacity: 15,000 pounds.” — Warren Buffett, 1996 Berkshire Hathaway Annual Meeting

When Buffett analyzes a prospective investment, he wants the value at his entry price to be much lower than his value estimate for the company. The difference between the two figures is his “margin of safety,” which limits the size of losses in case there are errors in his business analysis or assumptions.

“The margin of safety concept boils down to getting more value than you’re paying,” Buffett’s partner Charlie Munger once said.

https://www.cnbc.com/2018/05/02/jeff-bezos-this-is-what-you-are-going-to-regret-at-80.html

Jeff Bezos: This is what you are going to regret at 80

12:44 PM ET Wed, 2 May 2018

It’s not what you do and mess up, it’s what you don’t do that will plague you when you are old and looking back on your life.

So says Amazon and Blue Origin boss Jeff Bezos.

“When you think about the things that you will regret when you’re 80, they’re almost always the things that you did not do. They’re acts of omission. Very rarely are you going to regret something that you did that failed and didn’t work or whatever,” says Bezos in an interview with Axel Springer CEO Mathias Döpfner, published by Business Insider on Saturday.

It’s not only true of professional decisions, but of life too, says the 54-year-old entrepreneur, who is currently worth $130.5 billion according to Forbes.

“I’m not just talking about business things,” says Bezos. “It’s like, ‘I love that person and I never told them,’ and you know, 50 years later you’re like, ‘Why didn’t I tell her? Why didn’t I go after it?’

“So that’s the kind of life regret that is very hard to be happy about when you’re telling yourself in a private moment that story of your life.”

Bezos is himself embodiment of that willingness to act.

He famously left a Wall Street investment banking career to start selling books online with a little website called Amazon. In hindsight it was a lucrative decision. At the time, however, Bezos, and his wife MacKenzie, were taking a risk — one that not everyone agreed with.

“I was working at a financial firm in New York City with a bunch of very smart people, and I had a brilliant boss that I much admired,” recalled Bezos in a commencement speech he gave at his alma mater, Princeton, in 2010. “I went to my boss and told him I wanted to start a company selling books on the Internet. He took me on a long walk in Central Park, listened carefully to me, and finally said, ‘That sounds like a really good idea, but it would be an even better idea for someone who didn’t already have a good job.'”

Bezos did think about the decision carefully.

“That logic made some sense to me, and he convinced me to think about it for 48 hours before making a final decision. Seen in that light, it really was a difficult choice, but ultimately, I decided I had to give it a shot,” said Bezos in his speech.

“I didn’t think I’d regret trying and failing. And I suspected I would always be haunted by a decision to not try at all,” he explained. So he “took the less safe path to follow my passion, and I’m proud of that choice,” he said.

In addition to that mindset, Bezos says having supportive and loving people in his life also helped inspire him to take risks.

“MacKenzie, you know, she had married this stable guy working on Wall Street, and a year after we got married, I went to her and said I wanted to quit my job, move across the country and start this internet bookstore. And MacKenzie, of course, like everybody I explained this to, her first question was: ‘What’s the internet?’ Because nobody knew. This was 1994,” says Bezos in his interview with Döpfner.

“But even before she could say ‘What’s the internet?’ she said, ‘Great — let’s go!’ Because she wanted to support it and she knew that I had always had this passion for invention and starting a company,” says Bezos.

In addition to his wife, Bezos credits his parents and grandfather as major influences in his life, giving him strength.

“My mom had me when she was 17 years old, and she was still in high school, in Albuquerque, New Mexico, and this is in 1964. I can assure you that being a pregnant teenager in high school was not cool in Albuquerque, New Mexico, at that time. And so it was very difficult for her,” says Bezos. “My grandfather went to bat for her, and then they tried to kick her out of school, and they’re incredible, so the gift I had was I that had this incredible family.”

Feeling supported and loved afforded him the confidence to take bold actions, Bezos says.

“When you have loving and supportive people in your life — like MacKenzie, my parents, my grandfather, my grandmother — you end up being able to take risks,” says Bezos. “Because I think it’s one of those things, you know, you kind of know that somebody’s got your back. And so if you’re thinking about it logically, it’s an emotional thing.”