GOLD & Silver vs the US Market

Let’s first go over the misnomers of Gold and Silver:

There are several misnomers surrounding gold investment, from misconceptions about its nature as a productive asset to its role in a portfolio. These myths are often perpetuated by fear-based marketing tactics from some gold dealers.

Here are some of the most common misnomers about gold investments:

1. “Gold is a productive investment”

Unlike stocks, bonds, or real estate, gold does not generate income, pay dividends, or produce profits. Its value does not grow inherently. A share of stock represents a portion of a company, which can produce profits over time. An ounce of gold remains just one ounce of gold, no matter how long you hold it.

2. “Gold is a hedge against inflation”

While gold is often touted as an inflation hedge, its track record for this is inconsistent.

- Gold prices can rise significantly during periods of high inflation, preserving some purchasing power.

- However, during a period of decades-high inflation in 2022, gold prices declined due to the strengthening of the U.S. dollar, contrary to the typical expectation.

- From 1980, it took 27 years for gold to regain its peak price, a period during which inflation reduced its purchasing power.

3. “Gold is a safe investment”

Gold is not always a safe or low-risk investment.

- Price volatility: The price of gold can be highly volatile, especially in the short term, fluctuating in response to economic news and shifts in investor sentiment.

- Loss of faith: The value of gold is largely based on the collective belief that it is a store of value. A loss of faith in this concept could cause its price to decline, creating a self-reinforcing downward spiral.

4. “Gold only increases in value during times of fear”

While gold often acts as a hedge against market uncertainty and geopolitical crises, the belief that its value is solely driven by “fear and speculation” is a misnomer. While demand for it as a “safe haven” does drive the price, its value is also supported by industrial demand, finite supply, and a long history of being valued by human civilization.

5. “Gold mining stocks are better than physical gold”

Investing in gold mining stocks is fundamentally different from owning physical gold.

- Greater risk: Mining stocks are more volatile and risky, as their value depends on the company’s performance, management, and other factors, not just the price of gold.

- Greater potential reward: If a mining company performs well, its stock may offer a greater return than the price increase of gold itself.

- Different purpose: While gold stocks are a speculative investment on a company’s success, physical gold is used as a hedge against market weakness and geopolitical events.

6. “Gold is difficult to buy, sell, or store”

Modern investment methods have made it easier to hold gold exposure.

- ETFs: Exchange-Traded Funds (ETFs) allow you to invest in gold without the logistical hassles and security risks of holding physical metal.

- Physical storage: Many dealers offer vault storage for bullion, and ETFs that track physical gold hold the metal on your behalf.

- Liquidity: Gold is a highly liquid market, and ETFs offer even greater liquidity for buying and selling.

7. “Gold jewelry is a good investment”

Generally, gold jewelry is not a wise investment. The price of jewelry includes design and manufacturing costs that are much higher than the intrinsic value of the gold itself. When reselling jewelry, you are likely to get less than its original purchase price, even if gold prices have risen.

8. “Gold or Silver is going to be the replacement for the dollar”

The U.S. went off the gold standard in two main steps: first, for domestic transactions in 1933 under President Franklin D. Roosevelt, and then, by severing the dollar’s international convertibility in 1971 under President Richard Nixon. This transition ended the system where U.S. currency could be redeemed for gold and established the current fiat money system, where currency’s value is based on government decree and public trust.

It’s going to $5,000 or $55 in value??? Maybe but nobody really know

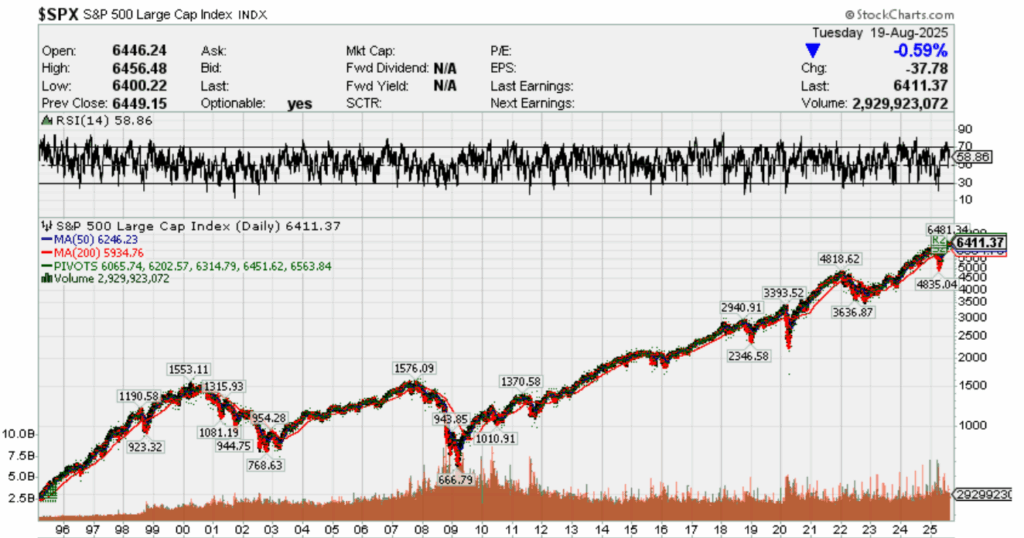

GOLD and Silver vs the S&P 500 Returns

Gold

The S&P 500’s 1-year return is approximately 14.80% as of August 2025, reflecting a significant increase from one year ago. This figure includes both the index’s price appreciation and reinvested dividends over the past 12 months.

YCharts (Ending August 5, 2025): The 5-year total return, excluding dividends, was 93.80%.

The 20-year return for the S&P 500 varies depending on the exact timeframe, but historical data suggests an average annual return of around 11.0% to 10.3% including reinvested dividends. This results in a total return of roughly 700% over two decades. However, this is an average, as the market experiences significant year-to-year volatility, with both substantial losses and gains occurring within any given 20-year period.

How a 30-year investment has performed

A look at the cumulative growth since 1994 illustrates the potential of a long-term investment in the S&P 500, assuming dividends were reinvested:

- Initial investment in 1994: A $100 investment at the start of 1994 would have grown to approximately $2,382 by the end of 2025.

- Total growth: This represents a cumulative return of 2,282.84%, or about 10.56% per year.

The effect of inflation

While nominal returns show impressive growth, inflation reduces the purchasing power of those gains over time.

- Inflation-adjusted return: The average 30-year inflation-adjusted return has been closer to 6–8%.

- Adjusted 1994–2025 growth: The inflation-adjusted cumulative return on that $100 investment from 1994 is closer to 993.14%, or 7.87% per year.

Silver

S&P 500

Gold IRA Accounts

https://www.bbb.org/us/tx/austin/profile/coin-dealers/us-money-reserve-inc-0825-52264/complaints