HI Market View Commentary 07-07-2025

Daily Process:

- Have awareness of after hours stock market movement

- Have awareness of news events

- Stay Calm and Carry ON!

- WATCH the first hour of market movement

- E-mini futures get cleared out and opening volatility settles down

- What stocks are moving with the market and what stocks are doing worse?

- CHECK individual stock news to see stock specific news moving the stock

- CHECK Charts and NOTICE support and resistance and technical trends

- IS a stock struggling because of a price resistance level?

- IS a stock staying above a support level or breaking through it?

New clients come in and ask, “how are we doing so darn well in just a few months?!”

- Because we are awesome obviously!

- BUT the process we are currently reaping the benefits from, is a longer process

- We’ve had multiple stocks have awesome runs into earnings as well as the bounce back from tariff fears.

- BUT we are doing so well, also, because we were able to add more shares on the tariff fear market drop!

- AND we were able to add more shares when the market dropped last summer and fall!

- AND we were able to add more shares when the market dropped as inflation wouldn’t let up

- And when interest rates shot up before that

- And so on and so on…

We don’t have a crystal ball. We simply look at undervalued stocks, we add shares by using protective puts when those stocks fall. Then we wait over time for the market to give some love top those undervalued stocks, and we reap the benefit. We never know when those stocks are going to pop.

Earnings

JPM 07/15 AMC

BAC 07/16 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 23-Jun-25 07:36 ET | Archive

Stock Market Outlook Q3 2025: Volatility, Valuations, and Smart Investment Strategies

Briefing.com Summary:

*The market is priced for positive outcomes. That will restrain upside potential and invite material downside risk if those positive outcomes don’t materialize.

*Another market thrill ride awaits in the third quarter with unfolding developments on the geopolitical, legislative, tariff, and earnings fronts.

*Total return potential for passive index investing will be restrained in the third quarter given the starting point of a high valuation for the market cap-weighted S&P 500.

In The Big Picture column published on February 21 we contended that the stock market was primed to go everywhere and nowhere, likening its future performance to that of a roller-coaster ride. That view was tied to a recognition that there were many “big issues” looming over the market that lacked closure.

As it turned out, we were right on the money with that thinking.

The S&P 500 hit an all-time high of 6,147.43 on February 19, yet the market would subsequently get broadsided by tariff announcements and economic concerns that hit a fevered pitch when President Trump announced reciprocal tariff rates on April 2. The S&P 500 hit a low of 4,835.04 on April 7. By June 11, though, the S&P 500 had climbed back to 6,059.40, having rallied off that April low after President Trump announced a 90-day pause on the reciprocal tariff rates.

It was a 21.4% decline from peak to trough and a 25.3% gain from that trough to the June 11 peak. The S&P 500 currently sits at 5,967.84, up 1.5% for the year and down 0.8% since February 21. Yes, indeed, the market has gone everywhere and nowhere.

So, what might the third quarter bring? Keep your seatbelts fastened. Another thrill ride, perhaps not as extreme as the one we just experienced but thrilling nonetheless, awaits.

Factors for a V-Shaped Recovery

First, let’s briefly review why the market was able to recover like it did.

- On the heels of President Trump announcing the 90-day pause for reciprocal tariffs for most countries until July 9, the U.S. and China reached an agreement to scale back their draconian tariff rates for each other.

- First quarter earnings turned out much better than expected, and while there were instances of pulling guidance because of the tariff uncertainty, the reports and guidance in aggregate were good enough to keep the market’s worst tariff fears in check.

- Hard economic data, namely spending and employment data, continued to paint a picture of a resilient economy that defied the dour-looking soft survey data for consumer sentiment.

- The Trump administration, which had a heightened focus on cost cuts and the deportation of illegal immigrants, started talking more about its efforts to cut taxes and regulations. On a related note, Congress got more active and vocal in its negotiations pertaining to the “One Big, Beautiful Bill.”

- Inflation data continued on an encouraging path, showing little to no impact from the tariff announcements.

- Notwithstanding concerns about inflation and the deficit, market rates were held in check.

- The “Magnificent 7” stocks, as a cohort, rebounded sharply, as did the market’s excitement for the AI trade.

The V-shaped recovery was exacerbated by short-covering activity, a race to get more equity exposure, and a fear of missing out on further gains. The price action itself, which was imbued with a persistent buy-the-dip inclination, became its own positive catalyst.

Three Is a Crowd

The start of the third quarter is just around the corner, and it is primed to start with a bang. That expectation has nothing to do with Fourth of July fireworks either. Rather, it has everything to do with the fireworks that will be ignited by the following:

- The Israel-Iran conflict

- President Trump said on June 20 that he will decide on a final course of action with respect to Iran over the next two weeks, but on June 21 a squadron of B-2 bombers dropped several bunker-busting bombs that destroyed nuclear enrichment facilities at Fordo, Natanz, and Isfahan.

- Iran has vowed that it will respond to the U.S. attack, leaving the oil market and capital markets on edge.

- The progression of the “One Big, Beautiful Bill”

- President Trump set an optimistic deadline of July 4 to have the “One Big, Beautiful Bill” on his desk for signing into law.

- The Senate is still working through its changes, and it is unclear if they will be acceptable to House members to keep the legislation on track to be signed by July 4. Senate leaders aim to have a vote on the Senate floor by the middle of the coming week.

- The CBO estimates that the House version of the bill will add $2.8 trillion to the deficit over the next decade.

- The pause on reciprocal tariff rates expires July 9

- Reportedly, the pause on reciprocal tariff rates for countries negotiating new trade deals in good faith with the U.S. could be extended, yet there is no assurance that will be the case. It is shaping up to be a “game-time decision,” and which countries get the benefit of an extended pause will matter greatly to the market.

Accordingly, with the second quarter coming to an end, the U.S. got involved directly in destroying Iran’s nuclear enrichment capabilities; and in the first two weeks of the third quarter, the “One Big Beautiful Bill” may or may not be signed into law, creating misgivings about the trajectory of the budget deficit and national debt and/or hope that it will pave the way for stronger economic growth that pays for the bill; and the lid could come off tariff rates and spark another growth scare.

The latter half of July, meanwhile, will feature second-quarter earnings reports and guidance. That is always the case, but the guidance stakes are higher this year with the market sporting a premium valuation that rests on the continuation of good earnings news.

A Valuation Snapshot

At 21.4x forward twelve-month earnings, the S&P 500 trades at a 16% premium to its 10-year average of 18.4x, according to FactSet. On a trailing twelve-month basis, the S&P 500 trades at 23.8x earnings, which is a 15% premium to its 10-year average of 20.6x.

The point we have made in the past and will continue to make is that the market’s valuation is less demanding on an equal-weighted basis. To that end, the equal-weighted S&P 500 trades at just 16.8x forward twelve-month earnings and 18.3x trailing twelve-month earnings, roughly in line with the 10-year average. The discount relative to the market cap-weighted S&P 500 speaks to the influence of the mega-cap stocks on the market cap-weighted index.

The mega-cap companies, by and large, have earned their premium valuation. Objectively, then, the market may not be as overvalued as it looks and will likely persist in an “overvalued” state so long as its mega-cap leaders continue to deliver robust earnings growth. The risk, of course, is that they don’t deliver or the outlook changes to create an impression that they won’t deliver, as was clearly demonstrated in the peak-to-trough selloff between February 19 and April 7.

Many of these stocks, fortunately, continue to trade with a head of AI steam. There is a mass transformation just getting started with the advancement of AI and its various applications throughout the economy. There is no slowdown in the AI economy, only questions about how long it will take the hyperscalers to see a return on their massive investment in data centers, how long it will take other companies to integrate AI solutions in their service and production work processes, and what changes this might bring to the labor market.

Fed Speak

The labor market is in reasonably good shape. Initial jobless claims have perked up a bit but remain well below levels associated with a recession, and the unemployment rate at 4.2% is consistent with full employment. The four-week average for continuing jobless claims, though, is at its highest level since November 20, 2021, and above levels that were seen before COVID.

The summation, aptly described by Fed Chair Powell, is that businesses have been slow to lay off employees but that it has grown harder to find a job after losing a job. The Federal Reserve is keeping a close eye on the labor market, and although it says it is attentive to the risks to both sides of its mandate, it continues to be steered more by its inflation concerns.

Specifically, many Fed officials are worried that cutting rates again, before they know what effect the tariffs are having on prices, could reignite inflation. Fed Chair Powell said after the June FOMC meeting that he expects a meaningful amount of inflation to arrive in coming months because of the tariffs. What he and others want to ascertain is if any tariff-driven inflation will be a one-time price adjustment or something that is longer lasting.

The consensus among Fed officials isn’t shared by all. Fed Governor Waller recently said that he thinks the Fed could cut rates at its July FOMC meeting since he isn’t expecting the tariffs to drive up inflation significantly and that, if the Fed is worried about the labor market weakening, it should be ahead of that and not wait for it.

Mr. Waller is in the minority, certainly at the Fed and in the market for that matter. While others have argued that the Fed should have cut rates again already or should in July, the fed funds futures market is following the voice of the Fed Chair. The CME FedWatch Tool currently shows just a 16.5% probability of a 25-basis point rate cut at the July 29-30 FOMC meeting.

There will be another employment report and another round of CPI, PPI, and PCE Price Index data before then, so the probability of a rate cut at the July meeting is certain to change in the interim, but for now, it is looking like the Fed will be keeping the target range for the fed funds rate steady at 4.25-4.50% past the July meeting.

What To Do

The Israel-Iran conflict has entered a new realm of uncertainty; the impact of the “One Big, Beautiful Bill” is wide open for the market’s interpretation; the Fed is paying a lot of lip service to inflation concerns as a basis for holding the target range for the fed funds rate steady; and earnings growth prospects have been tarnished by the tariff uncertainty, geopolitical tension, and a growing body of anecdotal evidence that consumers are growing more conscientious about their discretionary spending activity.

So, what is one to do with so many loose ends left untied?

An investor should remain invested but be cognizant that total return potential for passive index investing will be restrained in the third quarter given the starting point of a high valuation for the market cap-weighted S&P 500.

For passive investing, we would favor an equal-weighted approach when it comes to the S&P 500. The Invesco S&P 500 Equal Weight ETF (RSP) is a good option in this respect. For active investors, we would look to allocate money in the equity portion of a diversified investment portfolio into several buckets, if you will, that can benefit in good times, help mitigate losses in bad times, and provide attractive long-term return potential.

Those buckets would be tilted toward the following strategies:

- Companies with attractive price-to-earnings growth ratios

- Briefing.com analysts like: automotive supplier Dana Inc. (DAN), jewelry retailer Signet Jewelers (SIG), rideshare and food delivery company Uber (UBER)

- Companies that are less exposed to tariff issues

- Briefing.com analysts like: appliance maker Whirlpool (WHR), warehouse retailer Costco (COST), payment processing network Visa (V)

- Companies that are steady growers regardless of economic conditions

- Briefing.com analysts like: electric utility company Entergy (ETR), retailer Walmart (WMT), robotic-assisted surgery company Intuitive Surgical (ISRG)

- Companies with quality attributes that include a competitive advantage, a strong balance sheet, healthy free cash flow, consistent earnings growth, and solid management

- Briefing.com analysts like: the JPMorgan U.S. Quality Factor ETF (JQUA)

- Companies that are in good position to capitalize on secular growth trends

- Briefing.com analysts like: the iShares Cybersecurity and Tech ETF (IHAK), the Global X Artificial Intelligence & Technology ETF (AIQ)

Briefing.com Analyst Insight

While the run by the market off the April 7 lows has made things look easy, this is not an easy investing environment. Market risk has risen with valuations. Multiple expansion will be harder to achieve, and if the guidance coming out of the second quarter earnings reporting period doesn’t surpass a relatively high bar, the third quarter could be punctuated with multiple compression.

It isn’t an easy period to forecast because the range of outcomes for many key issues is fairly wide, but the market is priced for positive outcomes.

There is nothing wrong with that, but it implies a lot of good news is priced in already, which makes further upside harder to come by and invites material downside risk if those positive outcomes don’t materialize.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bullish Slightly Overbought

SPX – Bullish Slightly Overbought

COMP – Bullish slightly overbought

Where Will the SPX end July 2025?

07-07-2025 -1.0%

06-30-2025 ???%

Earnings: (NEXT WEEK)

Mon:

Tues: BLK, BK, C, WFC, JPM

Wed: FHN, GS, JNJ, MS, AA, UAL, BAC

Thur: ABT, PEP, USB, IBKR, GE, NFLX

Fri: MMM, AXP, SCHW, SLB

Econ Reports:

Mon:

Tue Consumer Credit

Wed: MBA, Wholesale Inventories,

Thur: Initial Claims, Continuing Claims,

Fri: Treasury Budget

How am I looking to trade?

Time to start protecting for earnings

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2025/07/07/trump-tariffs-trade-letters-japan.html

Trump announces steep tariffs on 14 countries starting Aug. 1

PUBLISHED MON, JUL 7 202512:27 PM EDTUPDATED 2 HOURS AGO

Kevin Breuninger@KEVINWILLIAMB

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

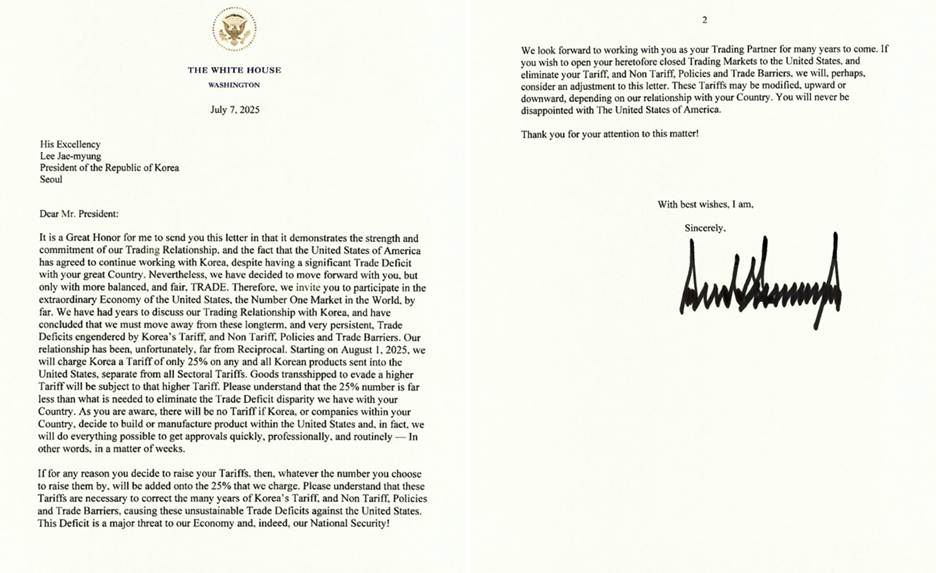

- President Donald Trump shared screenshots of signed form letters dictating new tariff rates to the leaders of Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, Myanmar, Tunisia, Bosnia and Herzegovina, Indonesia, Bangladesh, Serbia, Cambodia and Thailand.

- Trump signed an executive order to delay the date when his “reciprocal” tariffs are set to snap back higher.

President Donald Trump holds a chart as he announces a plan for tariffs on imported goods during an event April 2, 2025, in the Rose Garden at the White House.

Demetrius Freeman/The Washington Post via Getty Images

At least 14 countries’ imports are set to face steep blanket tariffs starting Aug. 1, President Donald Trump revealed Monday.

The president, in a series of social media posts, shared screenshots of form letters dictating new tariff rates to the leaders of Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos and Myanmar.

Later in the day, he shared another set of seven letters, to the leaders of Bosnia and Herzegovina, Tunisia, Indonesia, Bangladesh, Serbia, Cambodia and Thailand.

Goods imported to the U.S. from Japan, South Korea, Malaysia, Kazakhstan and Tunisia are now set to face 25% tariffs, according to the letters Trump posted.

South African and Bosnian goods will be subject to a 30% U.S. tariff, and imports from Indonesia will be hit with a 32% excise duty.

Bangladesh and Serbia are both at 35%, while Cambodia and Thailand are set for 36% tariff rates, the president’s letters said.

Imports from Laos and Myanmar will face a 40% duty, according to the letters Trump posted on Truth Social showed.

The letters Trump signed add that the U.S. will “perhaps” consider adjusting the new tariff levels, “depending on our relationship with your Country.”

The letters are the first to be sent before Wednesday, the day his so-called reciprocal tariffs on dozens of countries were scheduled to snap back to the higher levels he had announced in early April.

White House press secretary Karoline Leavitt said even more letters will be sent out in the coming days.

Later Monday afternoon, Trump signed an executive order delaying the Wednesday tariff deadline until Aug. 1. The order says Trump made that decision “based on additional information and recommendations from various senior officials.”

U.S. financial markets closed down on Monday. The Dow Jones Industrial Average fell 422.17 points, or 0.94%, to end the day at 44,406.36. The S&P 500 shed 0.79% to close at 6,229.98, and the Nasdaq Composite dropped 0.92% and closed at 20,412.52.

For most of the countries, the new U.S. tariff rates hew fairly closely to what they had faced after Trump announced his “liberation day” tariffs on April 2.

For instance, under those initial rates, U.S. imports from Japan were assigned a 24% tariff and South Korean imports faced a 25% duty.

Following a chaotic week of losses across global markets, however, Trump on April 9 issued a 90-day pause, which lowered the various tariff rates to a flat 10%. That pause was set to expire Wednesday, before Leavitt announced that Trump would extend it by more than three weeks.

President Donald Trump’s letter to the prime minister of Japan.

Donald Trump via Truth Social

President Donald Trump’s letter to the president of the Republic of Korea.

Donald Trump via Truth Social

All of the letters say that the blanket tariff rates are separate from additional sector-specific duties on key product categories.

The letters also say, “Goods transshipped to evade a higher Tariff will be subject to that higher Tariff.” Transshipping in this case appears to refer to the practice of transferring goods to an interim country prior to their final shipment to the U.S., in order to skirt tariffs.

The form letters assert that the new tariff rates are necessary in order to correct for persistent U.S. trade deficits with the 14 countries.

Trump, an avowed tariff fan and a skeptic of free trade deals, regularly points to those deficits as evidence that the U.S. is being taken advantage of by its trade partners. Experts have criticized the view that trade deficits are inherently bad and questioned whether the U.S. can or should seek to close them.

Not all of the countries targeted Monday have large trade surpluses with the U.S.

While the U.S. in 2024 had a $68.5 billion goods deficit with Japan and a $66 billion goods deficit with South Korea, its deficit with Myanmar was $579.3 million, according to the Office of the United States Trade Representative.

The U.S. is a major buyer of cars, machinery and electronics from Japan and South Korea. Kazakhstan exports crude oil and metal alloys to the U.S., Malaysia sells America electronic components, and South Africa largely sends precious metals. Key U.S. imports from Laos include optical fibers, glasses and clothing, while Myanmar’s largest exports category is mattresses and bedding.

Monday’s letters preemptively warn the 14 countries not to respond to the new U.S. tariffs by imposing retaliatory duties on their own imports of American goods.

“If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 25% that we charge,” the letters say.

If the countries “eliminate” their “Tariff, and Non Tariff, Policies and Trade Barriers,” then the U.S. “will, perhaps, consider an adjustment to this letter,” according to the letters.

“These tariffs may be modified, upward or downward, depending on our relationship with your Country,” the letters say. “You will never be disappointed with The United States of America.”

After Trump imposed his three-month reciprocal tariff pause in April, his administration claimed that it could strike as many as 90 deals in 90 days.

But as that pause was set to expire, the U.S. has announced only broad frameworks with the United Kingdom and Vietnam, as well as a preliminary agreement with China.

Trump said the Vietnam deal puts a 20% tariff on the country’s imports to the U.S. and a 40% “transshipping” duty, while the U.S. would get tariff-free access to Vietnam’s markets.

Trump’s reciprocal tariffs were struck down in late May by a federal district court, which ruled that he did not have the legal authority to impose the sweeping duties under the emergency-powers law he had cited at the time.

The Trump administration appealed to the federal circuit, which allowed the tariffs to remain in effect while it reviews the lower court’s decision.

— CNBC’s Nick Wells and Gabriel Cortes contributed to this report.

The declining dollar faces more headwinds after posting worst first-half return in 52 years

PUBLISHED MON, JUL 7 20252:53 PM EDTUPDATED 5 HOURS AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The U.S. dollar tumbled 10.7% against its global peers through June, making it the worst first half since 1973.

- Many of the same factors causing weakness — likely will stay on the minds of investors as they seek other avenues for safe havens.

- To be sure, the dollar’s continued decline is by no means a sure thing, and others on Wall Street think the trend down could reverse.

U.S. dollar banknote and decreasing stock graph are seen in this illustration taken April 25, 2025.

Dado Ruvic | Reuters

Fresh off its worst performance since Richard Nixon was president, the U.S. dollar faces a variety of headwinds heading into the second half of the year that could have important investing implications.

The greenback tumbled 10.7% against its global peers through June, making it the worst first half since 1973, back when Nixon broke the Bretton Woods gold standard. At its bottom, the currency hit its lowest point since February 2022.

The path ahead may not look much brighter.

That’s because many of the same factors — policy volatility, swelling debt and deficits and potential interest rate cuts from the Federal Reserve, just to name a few — likely will stay on the minds of investors as they seek other avenues for safe havens.

ICE U.S. Dollar Index

RT Quote | Exchange | USD

97.36-0.12 (-0.12%)

Last | 7:56 PM EDT

WATCHLIST+

Dollar drop

“Some of this was probably due, and then we’ve certainly given currency traders enough to contemplate for what’s the catalyst now,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “You could check a lot of boxes. You’re running massive deficits, and nobody wants to stop that on either side of the aisle. You’re alienating friends both militarily and trade-wise. You’ve got enough potential negative catalysts. And then once momentum starts, it’s hard to kind of stop it.”

Indeed, the dollar’s slid started in mid-January and has shown only occasional signs of moderating since. Hopes that President Donald Trump’s tariffs would not be as steep as thought helped spark a brief rally in mid-April, but for the most part the gravitational pull has been lower.

Market impact

Of course, the dollar’s slide hasn’t exactly been poison for stocks.

With more than 40% of revenue for S&P 500 companies coming from international sales, a weaker dollar helps make American exports cheaper, an important point to consider amid the ongoing trade war.

However, the move lower has coincided with growing chatter about the potential end of American exceptionalism and dollar hegemony, with the public share of U.S. debt nearing $30 trillion and the 2025 deficit on track for close to $2 trillion. Should American assets such as the greenback and Treasury debt lose their prominence on the global stage, that could have strong ramifications for risk assets like stocks.

WATCH NOW

VIDEO02:22

The trend on the weaker U.S. dollar will continue, says Tim Seymour

Global central banks, for one, are ramping up their gold purchases, to 24 tons a month, per the World Gold Council, as an alternative to U.S. assets. Gold had its best first-half run since 1979.

“We think central banks are buying gold to diversify reserves, reduce reliance on the [dollar], and hedge against inflation and economic uncertainty,” Lawson Winder, research analyst at Bank of America, said in a note. Winder said it’s “A trend that we think is set to continue, especially amid uncertainty surrounding US tariffs and fiscal deficit concerns.”

Likewise, TS Lombard is maintaining a short position on the greenback, which it calls “the gift that keeps on giving.”

“Trump’s attacks on the Fed and the administration’s explicit desire for a weaker dollar only add to that view,” wrote Daniel Von Ahlen, senior macro strategist at the firm. “The dollar remains overvalued on most FX metrics … With USD negatives ubiquitous, why not expect the dollar to become undervalued? We remain firmly short dollar across a range of trades in our book.”

The Federal Reserve also could exert more downward pressure by coming through on expected rate cuts in the back part of the year. However, the impact of Fed loosening can be tricky to handicap, considering that the dollar and Treasury yields rose sharply when the central bank last cut in 2024.

Hope for a reversal

To be sure, the dollar’s continued decline is by no means a sure thing, and others on Wall Street think the trend down could reverse.

Thomas Matthews, head of Asia Pacific markets at Capital Economics, said the recent rally in stocks points to growing comfort with U.S. assets, with the earlier dollar weakness perhaps just a product of the intended appreciation of other currencies as well as a switch in hedging strategies.

Wells Fargo also thinks dollar-related fears are overblown.

“Taking a statistical approach to analyzing the U.S. dollar’s role, it is clear to us that the greenback remains the linchpin of global trade and finance and is far from becoming irrelevant,” Wells Fargo investment strategy analyst Jennifer Timmerman wrote. “We believe the U.S. dollar benefits from deep-seated advantages (such as the rule of law, transparency, and a highly liquid financial market) that make a global shift away from the dollar an extremely difficult and slow-moving process – especially because of underlying weaknesses of the most visible dollar alternatives.”

Treasury Secretary Scott Bessent also weighed in, telling CNBC on Monday that the currency fluctuations are “not out of the ordinary.”

However, rising yields on Treasury debt also signifies that concerns over the dollar and other U.S. assets linger.

“We’re in that stage of being overdone to the downside in terms of the momentum,” said Hogan, the B. Riley strategist. “But fundamentally, you could certainly whiteboard out plenty of things that you’d be concerned about.”

1 comment

Incredible points. Outstanding arguments. Keep up the good spirit.