HI Market View Commentary 01-08-2024

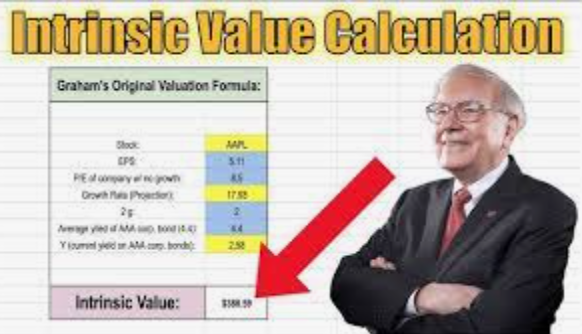

Lesson #1 – Valuations = The Warren Buffett Stock Evaluation

“If you don’t know what you are doing, or how to work the numbers, diversify in an index” – Warren

We Worked the numbers!!!

Looking to this next year

Positives = Rate cuts = 2 0.25% cuts

https://www.briefing.com/the-big-picture

Last Updated: 05-Jan-24 14:26 ET | Archive

Will the Fed fight the market?

There is an adage in the stock market that “you shouldn’t fight the Fed.” What that means is that you should zig when the Fed zigs and zag when it zags.

If the Fed is cutting rates, you should take more risk. If the Fed is raising rates, you should be more risk averse. Okay, it isn’t always that straightforward. 2023 was a case in point. The Fed raised rates four times in 2023 and the S&P 500 still gained 24.2%.

Why? Well, everyone can point to the performance of the “Magnificent 7” as the driving factor, but by the end of the year, that wasn’t the only factor. Let’s not forget that the S&P 500 Equal-Weighted Index gained a respectable 11.6% in 2023.

It took a while for the equal-weighted index to get in gear, but it found its footing when the market resolved inflation is on a downward path to the 2% target rate, that a soft landing is possible, and that 2024 will be a year of multiple rate cuts.

Perhaps, then, the adage would be more clearly defined if it said “you shouldn’t fight expectations about the Fed.” What if the Fed, though, wants to fight the market?

Words Speak Louder than Actions

The Fed doesn’t typically want to surprise the market — not the Powell-led Fed anyway. Instead of fighting, the Powell-led Fed tries, first, to let its words speak louder than its actions.

So, when one hears the Fed Chair say, “we are not even thinking about thinking about cutting rates,” one gets a little nervous. Conversely, when one hears the Fed Chair say, “our policy rate is likely at or near its peak for this tightening cycle,” and that “the question of when will it become appropriate to begin dialing back the amount of policy restraint in place” was a topic of discussion at the December FOMC meeting, one gets a little excited from a risk-taking standpoint.

And sometimes one gets overly excited, as we saw in the stock market rally that persisted from October 27 to December 29. During that span, the Russell 2000 gained as much as 26.8%, the Nasdaq Composite gained as much as 20.2%, and the S&P 500 gained as much as 16.8%, floating like a butterfly and stinging short sellers like a bee.

At the same time, the yield on the 2-yr note went from 5.21% to 4.23% while the yield on the 10-yr note went from 5.02% to 3.88%. Those moves were a springboard for stocks, having been rooted in a friendly monetary policy outlook.

There were a few attempts by Fed officials to try to temper the market’s expectations, but the market was having none of it.

In fact, the market grew even more confident in the idea of a rate-cut cycle unfolding in 2024, so much so that it soon went from pricing in four rate cuts in 2024 to six rate cuts. The important point here is that it did so after the Fed’s Summary of Economic Projections in December showed a median estimate of three rate cuts in 2024 versus only two at the time of the September projection.

What It All Means

Notably, it was apparent in the minutes for the December 12-13 FOMC meeting that the discussion around when the Fed might want to dial back some restraint wasn’t a lively one. We don’t doubt that it happened, but the minutes also revealed that there was some talk of possibly needing to raise rates further or keeping the current target range for the fed funds rate (5.25-5.50%) in place longer than anticipated.

In other words, the discussion around rate cuts seemed lacking relative to the market’s current expectation, measured by the CME FedWatch Tool, that there will be six rate cuts by the end of 2024.

| FOMC Meeting | Expected Rate | Current Probability | Month Ago Probability |

| March | 5.00-5.25% | 66.4% | 62.7% |

| May | 4.75-5.00% | 55.5% | 48.3% |

| June | 4.50-4.75% | 50.8% | 40.2% |

| July | 4.25-4.50% | 42.6% | 32.7% |

| September | 4.25-4.50% | 78.0% | 70.1% |

| November | 4.00-4.25% | 62.2% | 51.4% |

| December | 3.75-4.00% | 54.9% | 43.8% |

Source: CME FedWatch Tool

The Fed could cut rates six times in 2024. That isn’t the Fed’s baseline forecast, which goes to show there is a wide range of variability for a self-described data-dependent Fed. Basically, anything is possible depending on circumstances that have yet to avail themselves.

The market has a sense of how it thinks things will go, so the question is, will the Fed move closer to the market’s way of thinking, or will the Fed use its communication tool to rein in the market’s expectations?

The answer will be in the data, but perhaps not definitively in the data. That is a blueprint for some roller-coaster action like we saw following the release of the better-than-expected December employment report (not good for the market’s rate-cut outlook) and the weaker-than-expected ISM Services PMI for December (better for the market’s rate-cut outlook).

This is a market right now that doesn’t want to fight the Fed or, looked at another way, doesn’t want the Fed fighting the market.

If the data forces the Fed to go toe-to-toe with the market with some more forceful communication, it will be a cold-stone jab for a market still warm to the notion that there will be at least six rate cuts in 2024.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

Where will our markets end this week?

Higher

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end Jan 2024?

01-08-2024 +3.0%

Earnings:

Mon: JEF

Tues: ACI

Wed: KB

Thur:

Fri: BLK, C, DAL, UNH, BAC, JPM

Econ Reports:

Mon: Consumer Credit

Tue Trade Balance,

Wed: MBA,

Thur: Initial Claims, Continuing Claims, CPI, Core CPI

Fri: PPI, Core PPI

How am I looking to trade?

Preparing for earning and may run current long put protection OTM

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

https://finance.yahoo.com/news/micron-mu-report-q1-earnings-130800541.html

Micron (MU) to Report Q1 Earnings: What’s in the Cards?

Micron (MU) to Report Q1 Earnings: What’s in the Cards?

Micron Technology MU is scheduled to report first-quarter fiscal 2024 results on Dec 20.

The company projects a fiscal first-quarter adjusted loss of $1.00 per share. The Zacks Consensus Estimate coincides with management’s guidance and is much wider than the year-ago quarter’s loss of 4 cents per share.

Meanwhile, Micron estimates revenues of $4.7 billion. The consensus mark for revenues is pegged at $4.6 billion, suggesting a 12.6% increase from the year-earlier period’s revenues of $4.09 billion.

The company’s earnings surpassed the Zacks Consensus Estimate twice in the trailing four quarters while missing on two occasions, the average surprise being -67.7%.

Let’s see how things have shaped up before this announcement.

Micron Technology, Inc. Price and EPS Surprise

Micron Technology, Inc. price-eps-surprise | Micron Technology, Inc. Quote

Factors at Play

Micron’s overall first-quarter performance is likely to have been negatively impacted by soft consumer spending due to inflationary pressure and growing concerns over the global economic slowdown. Softened consumer spending has resulted in weak memory chip demand from the smartphone and personal computer end markets.

Substantial customer inventory adjustments across end markets are expected to have hurt the overall financial performance in the first quarter. MU’s customers across multiple end markets have been adjusting their DRAM and NAND memory chip purchases amid soft macroeconomic conditions.

The memory chip maker’s heavy dependence on China is a headwind due to the ongoing tit-for-tat trade spat between the United States and China. In May 2023, the Chinese government imposed restrictions on Micron for selling its products in key domestic industries on national security concerns, stating that the memory chipmaker failed to pass a cybersecurity review initiated in late March 2023. Chip sales in China make up approximately 11% of Micron’s total revenues.

Additionally, a higher mix of lower-margin NAND, coupled with low memory prices and a minimal decline in manufacturing costs, is expected to have strained margins.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Micron this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that’s not the case here.

Micron currently carries a Zacks Rank #3 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Per our model, KB Home KBH, Delta Air Lines DAL and Interactive Brokers IBKR have the right combination of elements to post an earnings beat in their upcoming releases.

KB Home is expected to report fourth-quarter fiscal 2023 results on Jan 10, 2024. The company has a Zacks Rank #3 and an Earnings ESP of +1.19% at present. The company’s earnings beat the Zacks Consensus Estimate thrice in the trailing four quarters while missing on one occasion, the average surprise being 26.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for KBH’s fourth-quarter earnings is pegged at $1.67 per share, suggesting a decline of 32.4% from the year-ago quarter’s earnings of $2.47. KB Home’s quarterly revenues are estimated to decrease 17.1% year over year to $1.61 billion.

Delta Air Lines carries a Zacks Rank #3 and has an Earnings ESP of +2.10%. The company is anticipated to report fourth-quarter 2023 results on Jan 12. Its earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing on one occasion, the average surprise being 4.4%.

The Zacks Consensus Estimate for Delta Air Lines’ fourth-quarter earnings stands at $1.16 per share, implying a year-over-year decline of 21.6%. It is estimated to report revenues of $13.9 billion, which suggests an increase of approximately 3.4% from the year-ago quarter.

Interactive Brokers carries a Zacks Rank #3 and has an Earnings ESP of +2.03%. The company is expected to report fourth-quarter 2023 results on Jan 16. Its earnings surpassed the Zacks Consensus Estimate twice in the trailing four quarters while missing on two occasions, the average surprise being 1.7%.

The Zacks Consensus Estimate for IBKR’s fourth-quarter earnings is pegged at $1.48 per share, indicating a year-over-year increase of 13.9%. The consensus mark for revenues stands at $1.11 billion, calling for a year-over-year rise of 14.1%.

Micron Technology (NASDAQ:MU) Given New $100.00 Price Target at Needham & Company LLC

Posted by ABMN Staff on Dec 22nd, 2023

Micron Technology (NASDAQ:MU – Free Report) had its target price lifted by Needham & Company LLC from $85.00 to $100.00 in a research note released on Thursday, Marketbeat reports. The brokerage currently has a buy rating on the semiconductor manufacturer’s stock.

MU has been the subject of a number of other reports. BMO Capital Markets upped their price objective on shares of Micron Technology from $80.00 to $90.00 and gave the company an outperform rating in a research report on Monday. Rosenblatt Securities restated a buy rating on shares of Micron Technology in a research note on Tuesday. Barclays upped their target price on Micron Technology from $80.00 to $85.00 and gave the company an overweight rating in a research report on Wednesday, November 29th. Morgan Stanley raised their price target on shares of Micron Technology from $58.50 to $71.50 and gave the stock an underweight rating in a research report on Monday, November 27th. Finally, Wedbush reaffirmed an outperform rating and issued a $80.00 price target on shares of Micron Technology in a report on Thursday, September 21st. Two equities research analysts have rated the stock with a sell rating, four have issued a hold rating and twenty-one have given a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of Moderate Buy and a consensus target price of $90.61.

Get Micron Technology alerts:

Check Out Our Latest Stock Report on MU

Micron Technology Trading Up 8.6 %

Shares of MU opened at $85.48 on Thursday. Micron Technology has a 12 month low of $48.43 and a 12 month high of $86.02. The stock’s 50-day moving average is $73.77 and its two-hundred day moving average is $69.42. The company has a debt-to-equity ratio of 0.30, a current ratio of 4.46 and a quick ratio of 2.70. The stock has a market cap of $94.35 billion, a PE ratio of -16.01 and a beta of 1.31.

Micron Technology (NASDAQ:MU – Get Free Report) last released its quarterly earnings results on Wednesday, December 20th. The semiconductor manufacturer reported ($0.95) EPS for the quarter, topping the consensus estimate of ($1.01) by $0.06. Micron Technology had a negative return on equity of 11.65% and a negative net margin of 37.53%. The firm had revenue of $4.73 billion for the quarter, compared to analyst estimates of $4.58 billion. During the same period in the previous year, the company posted ($0.15) EPS. Micron Technology’s revenue for the quarter was up 15.7% on a year-over-year basis. Equities analysts forecast that Micron Technology will post -1.8 earnings per share for the current fiscal year.

Micron Technology Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, January 18th. Stockholders of record on Tuesday, January 2nd will be given a dividend of $0.115 per share. The ex-dividend date is Friday, December 29th. This represents a $0.46 annualized dividend and a dividend yield of 0.54%. Micron Technology’s dividend payout ratio is currently -8.61%.

Insider Transactions at Micron Technology

In other news, CEO Sanjay Mehrotra sold 7,000 shares of the company’s stock in a transaction dated Tuesday, December 19th. The shares were sold at an average price of $81.61, for a total transaction of $571,270.00. Following the completion of the transaction, the chief executive officer now owns 651,759 shares in the company, valued at $53,190,051.99. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, EVP April S. Arnzen sold 3,508 shares of the company’s stock in a transaction dated Monday, October 16th. The shares were sold at an average price of $69.71, for a total transaction of $244,542.68. Following the completion of the transaction, the executive vice president now owns 155,352 shares in the company, valued at $10,829,587.92. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Sanjay Mehrotra sold 7,000 shares of the stock in a transaction dated Tuesday, December 19th. The shares were sold at an average price of $81.61, for a total transaction of $571,270.00. Following the completion of the transaction, the chief executive officer now owns 651,759 shares of the company’s stock, valued at approximately $53,190,051.99. The disclosure for this sale can be found here. Over the last quarter, insiders sold 238,390 shares of company stock worth $18,218,843. Insiders own 0.32% of the company’s stock.

Hedge Funds Weigh In On Micron Technology

Institutional investors and hedge funds have recently bought and sold shares of the stock. Annis Gardner Whiting Capital Advisors LLC bought a new position in Micron Technology in the 3rd quarter valued at about $28,000. Barrett & Company Inc. bought a new position in Micron Technology in the 1st quarter valued at about $25,000. OFI Invest Asset Management bought a new position in Micron Technology in the 3rd quarter valued at about $27,000. VisionPoint Advisory Group LLC grew its position in Micron Technology by 68.3% in the 3rd quarter. VisionPoint Advisory Group LLC now owns 488 shares of the semiconductor manufacturer’s stock valued at $33,000 after buying an additional 198 shares in the last quarter. Finally, Coppell Advisory Solutions LLC bought a new position in Micron Technology in the 2nd quarter valued at about $32,000. Institutional investors own 79.25% of the company’s stock.

Micron Technology Company Profile

Micron Technology, Inc designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprising dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; non-volatile and re-writeable semiconductor storage devices; and non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels.

This is the No. 1 state Americans moved to in 2023—it’s not Florida

Published Fri, Jan 5 202411:08 AM ESTUpdated Fri, Jan 5 202411:09 AM EST

People all over the country are making big moves, whether it’s to a major city for a new job or simply to wherever they can get more bang for their buck.

U-Haul recently released its Growth Index, which highlights the U.S. states that saw the largest number of movers in one-way U-Haul equipment in 2023.

The report found that for the fourth year in a row, California had the largest net loss of one-way movers.

In recent years, California has seen a mass migration out off the state — a phenomenon that people call the “California Exodus.”

Between April 2020 and July 2022, The Los Angeles Times reported the number of people moving out of California was more than 700,000.

One factor is the continuously rising cost of living in California, especially in major cities like San Jose, where residents pay an average of $3,504 in monthly expenses, or 71.2% higher than the national average.

No. 1 state Americans moved to in 2023: Texas

For the sixth time in eight years, Texas is the No. 1 growth state. DIY movers accounted for 50.4% of all one-way U-Haul traffic arriving in Texas.

The Southern state has become a growing base for different industries including tech and aerospace. As of 2022, Texas leads the nation as home to the most Fortune 500 companies.

53 Fortune 500 companies have corporate headquarters in the state and Houston and Dallas are in the top five municipalities in the country, with 21 and 11 companies respectively.

Texas is considered a tax-friendly state because it does not collect any income taxes, according to SmartAssest. Instead, the state does have significant property and sales taxes.

Top 10 states people moved to in 2023

- Texas

- Florida

- North Carolina

- South Carolina

- Tennessee

- Idaho

- Washington

- Arizona

- Colorado

- Virginia

For the second year in a row Florida takes the No. 2 spot on the list. The Sunshine State has been in the top-four growth state for nine years in a row, according to U-Haul.

The last time it was in the No. 1 spot on the Growth Index was in 2019.

Similar to Texas, Florida has no state income tax and none of the cities in the state charge a local income tax.

Since residents of Florida typically enjoy a lower cost of living, it’s no wonder that the state continues to attract high-income earners. The state gained the largest number of high-income workers who make at least $200,000, according to a 2023 SmartAsset report.

Despite the continuing rise in rent and house prices in Florida, it is still a state where one could potentially save money by moving there.

Suze Orman says young people ‘don’t get’ a key money concept that could help them become millionaires

Published Fri, Jan 5 202410:25 AM EST

Lots of people in their 20s miss out on hundreds of thousands of dollars in retirement savings because they “don’t get” the power of compound interest, says Suze Orman, personal finance expert and host of the podcast “Women & Money (and Everyone Smart Enough to Listen).”

“They don’t understand the value of compounding and that the key to their financial independence is their age,” Orman said in a recent interview with the Wall Street Journal. Part of the problem is that younger people think they can catch up on retirement savings when they’re older and making more money, she said.

Building up retirement savings is crucial. Underestimating how much money you’ll need to invest later to catch up, or need in total to retire, could force you to keep working until a later age than you want. In some cases, you may never be able to retire at all.

To illustrate the power of compound interest, Orman used the example of a 25-year-old who puts $100 into an S&P 500 index fund through a Roth IRA, every month until they are 65, assuming an annual interest rate of 12%. That person would retire with roughly $1.2 million in retirement savings, according to CNBC calculations.

However, if they started saving at 35, their total would be just over $350,000. That works out to a difference of about $850,000 lost by beginning to invest just 10 years later.

That’s due to the power of compound interest, the process in which interest is continually earned on both the principal amount plus any accumulated interest, leading to exponential growth over time. Thanks to compounding, the earlier you start making contributions, the more time your money has to grow.

″[Many young people] don’t get that,” said Orman. “They would rather dress cool, go on their TikToks.”

All investments carry a risk that you could lose your money. And an annual return of 12% isn’t widely seen as realistic. Historically, the average annual rate of return for the S&P 500 has been around 10%.

But even with an annual return of 6%, a 25-year-old making $100 monthly contributions would have just over $200,000 by 65 — double what they’d have if they had started making contributions at 35.

Invest ‘more in your 20s than you do in your 30s if you can’

While younger people tend to earn less than they do later in life, that shouldn’t be an excuse to delay monthly retirement contributions, Orman said. Instead, younger people should focus on living below their means but within their needs, so that they can afford monthly retirement contributions.

To afford those contributions for retirement, Orman recommends making them a priority and cutting back on extras. For example, “I refuse to eat out,” she said. “I think that eating out on any level is one of the biggest wastes of money out there.”

It can be helpful to avoid lifestyle creep, too. When Orman started earning money from her books, she determined that she could afford a ”$1 or $2 million penthouse,” she told WSJ. Instead, she chose to live below her means and purchased a $250,000 apartment.

In other words, just because you can afford something doesn’t mean it’s a smart buy.

“The truth of the matter is, you should be investing more in your 20s than you do in your 30s if you can,” Orman said in a 2018 interview with CNBC Make It. Doing so will save younger earners the burden of catching up with their retirement contributions later.

“I would much rather see you invest a specific amount of money when you are young, a lesser amount of money, than waiting and have to invest five or six times [as much] when you are older,” she said.

Fed Governor Bowman adjusts rate stance, says hikes likely over but not ready to cut yet

PUBLISHED MON, JAN 8 20245:34 PM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Federal Reserve Governor Michelle Bowman said Monday interest rate hikes are likely over.

- One of the central bank’s staunchest advocates for tight monetary policy, Bowman said she’s not ready to start talking about rate cuts.

- “In my view, we are not yet at that point. And important upside inflation risks remain,” she said.

Federal Reserve Bank Governor Michelle Bowman gives her first public remarks as a Federal policymaker at an American Bankers Association conference In San Diego, California, February 11 2019.

Ann Saphir | Reuters

Federal Reserve Governor Michelle Bowman, who had been one of the central bank’s staunchest advocates for tight monetary policy, said Monday she’s adjusted her stance somewhat and indicated that interest rate hikes are likely over.

However, she said she’s not ready to start cutting yet.

In remarks delivered at a private event in South Carolina, Bowman noted the progress made against inflation and said it should continue with short-term rates at their current levels.

Based on this progress, my view has evolved to consider the possibility that the rate of inflation could decline further with the policy rate held at the current level for some time,” she said. “Should inflation continue to fall closer to our 2 percent goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive.”

“In my view, we are not yet at that point. And important upside inflation risks remain,” she added.

As a governor, Bowman is a permanent voter of the rate-setting Federal Open Market Committee. Prior to this speech, she had repeatedly said additional rate hikes likely would be needed to address inflation.

Her comments come a few weeks after the committee, at its December meeting, voted to hold the benchmark federal funds rate at its current target range of 5.25%-5.5%. In addition, committee members, through their closely followed dot-plot matrix, indicated that the equivalent of three quarter-percentage point rate cuts could come in 2024.

However, minutes released last week from the Dec. 12-13 meeting provided no potential timetable on the reductions, with members indicating a high degree of uncertainty over how conditions might evolve. Inflation is trending down toward the Fed’s target, and by one measure is running below it over the past six months.

Bowman said policymakers will remain attuned to how things develop and are not locked into a policy course.

“I will remain cautious in my approach to considering future changes in the stance of policy,” she said, adding that if the inflation data reverse, “I remain willing to raise the federal funds rate at a future meeting.”

The Fed meets again on Jan. 30-31, with markets expecting the committee to stay put on rates and then begin cutting in March. Market pricing indicates a total of 1.5 percentage points worth of reductions this year, or six cuts, according to the CME Group’s FedWatch tracker.