HI Market View Commentary 03-20-2023

I want you to be the advisor:

What is going to happen to our markets?

Depends on Powell, Rate hike Wednesday, most probable will go down and how much we don’t know, Depends on IF there are any more bank failures, swing back and forth depending on media

What is the expected S&P 500 Earnings for 2023?= 16x, 9% growth, increase, $127

$166-$228 = In General $200 x PE 18X = 3800

MS said $228 = 4104

$200 x .94 = $188 x 18X = 3384 ending year total

What do tell your clients that you just lost 33-40% last year in 60/40 Mix when mutual funds are the alternative to the bond losses ?

Kevin I am going to lie – You will make money most years so don’t worry

It will come back so just sit tight, May want to sell more funds that have done better in down year ,

Move to cash,

Two phone calls today :

#1 – I would expect the market to come back the back half of the year (June) and now is a great time to buy lower than December

#2 – It depends on your time horizon but a dated 60/40 portfolio allocation is always the best way to run a portfolio

We are hedged for Wednesday rate hike and Powell is penciled into a corner!!!!

T-Bill short term rates have been over 5%

He inversion between 10 year notes and 6 month bills have had a spread 110 bp

Because of this inversion Banks will find it hard to borrow against and make money this year – BAC, JPM, GS

PPI Last +0.7, CPI getting 0.3

Marty Walsh – The former Labor Secretary that resigned after the Jan 517K jobs number

Fed, ECB, BOJ holding 22 Trillion dollars of US debt in Treasuries

Central Banks hold “a lot” of weak mortgage debt (1-2% interest rate) AND their portfolios going mark to market show huge losses –70% or more

What did you expect with all the Quantitative Easing ? = Perhaps the printing press @ treasury are running hot, Entitlements should be done with,

1st RED FLAG = The reserve currency status

2nd = Interest rates over 8%

3rd = a with back in forth with interest rate hikes = Mortgage rates in the teens again like the 80’s

4th = Democrats win the elections

Food Storage, Homes paid off, hedged portfolio for the days that the market can come back (+5%)

Earnings dates:

MU – 3/29

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 17-Mar-23 15:37 ET | Archive

Banking crisis a soon-to-be shock to earnings estimates

Market participants have been clamoring for relief on the interest rate front, and, boy, have they gotten it. The question, though, is at what cost?

Something Shocking This Way Comes

The 2-yr note yield plunged 79 basis points this week to 3.80% and the 10-yr note yield dropped 31 basis points to 3.39%. A little over two weeks ago, the 2-yr note yield stood at 5.06% and 10-yr note yield hit 4.10%.

The rapid reversal wasn’t precipitated by some unequivocally friendly inflation data. It was precipitated by the shocking failures of Silicon Valley Bank and Signature Bank.

We say shocking because those failures happened almost overnight and because Fed Chair Powell didn’t give any hint in his semiannual monetary policy testimony the week before that he was concerned about systemic risk to the banking system.

It was not a good look for the Fed Chair and the Federal Reserve’s supervisory capacity. They missed it, but to be fair, so did just about everyone else. Prior to last week, there were no public calls or research notes screaming that a banking crisis was at hand.

Nope. The focus on March 8 was whether the Fed would raise the target range for the fed funds rate by 50 basis points at the March 21-22 FOMC meeting.

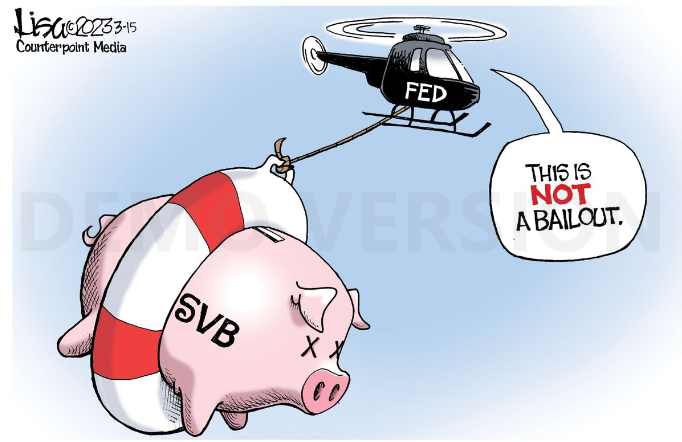

On March 10, before the close of trading, Silicon Valley Bank was taken over by regulators. On March 12 Signature Bank was closed by its state chartering authority, and later that evening Treasury Secretary Yellen, Fed Chair Powell, and FDIC Chairman Gruenberg issued a joint statement noting that all depositors at these banks would be made whole under a systemic risk exception.

The Fed also introduced a Bank Term Funding Program designed to stem deposit runs on other banks by accepting high-quality assets as collateral at par value.

And just like that, it was evident to the world that the U.S. banking sector had a crisis on its hands. The characterization that this is a crisis might be debatable. It certainly doesn’t have the same characteristics as the financial crisis of 2008-2009 (thankfully), but the Treasury Department, Federal Reserve, and FDIC have themselves deemed it a crisis by invoking the systemic risk exception.

Some of the more unnerving elements of this latest bank “crisis” are that the decline in Treasury yields accelerated, and that bank stocks continued to decline, after the depositor rescue plan was announced. Also, Credit Suisse (CS) was compelled to engage the Swiss National Bank to shore up its liquidity position.

Remarkably, what hasn’t gone down (yet) are earnings estimates.

A Loaded Question

On March 8 the forward twelve-month earnings estimate for the S&P 500 was $226.19. Today, it sits at $226.66.

We can’t help but ask the question: do you think the 12-month outlook for earnings got better or worse since this latest banking crisis came to light?

We’ll load that question with the added insight that just about everyone now is labeling this banking crisis a disinflationary/deflationary force beyond the short term and is suggesting that banks of all stripes will be tightening their lending standards, managing their balance sheets more conservatively, and facing net interest margin pressures as they are forced to raise interest rates on deposit accounts.

When banks go into protection mode so to speak, it is not a good thing for growth prospects. Credit is the lifeblood of economic expansion, and when there are blood clots in the flow of credit, the economy suffers.

Accordingly, calls for the economy to experience a recession have picked up since the dawn of this latest banking crisis and many pundits are again pointing to the Treasury yield curve as their guide, only not because the 2s10s spread is widening further but because it is steepening.

That is, short-term rates are falling more rapidly than long-term rates on the assumption that weak economic conditions are going to force the Fed to cut rates. The widening in the 2s10s spread might be looked at as the canary in the coal mine, but the steepening in the wake of an adverse development is seen as the canary dying in the mine.

There may still be a chance for the canary to escape, but its survival will have a lot to do with how this banking crisis resolves itself both in terms of form (an abatement of deposit concerns) and function (the extent of bank lending activity).

Nevertheless, there is little doubt that the economy has been harmed by this crisis, which has compounded an already high sense of uncertainty and has created excess volatility in the capital markets that should weigh further on consumer and business confidence.

Growth Concerns in the Mix

The concerns about a slowdown in growth on account of the banking crisis were not limited to the Treasury market. Since March 8, WTI crude futures prices have fallen 13% to $66.39 per barrel, copper futures have dropped 3.2% to $3.90/lb, the ICE BofA U.S. High-Yield Index Option-Adjusted Spread has widened 84 basis points to 4.93%, and the S&P 500 Materials Sector has declined 7.6%.

Conversely, the Vanguard Mega-Cap Growth ETF (MGK) has risen 2.2%, versus a decline of 1.8% for the S&P 500, in the equivalent of a flight-to-safety trade within the stock market, as mega-cap issues like Apple (AAPL) and Microsoft (MSFT) are seen as having fortress balance sheets, sufficient distance from the banking issues, and the ability to hold up better than most if economic times do get quite tough. Over the same period, the Invesco S&P 500 Equal Weight ETF (RSP) has declined 5.8%.

The uncertainty about how difficult things might get will impede spending decisions and lead to more conservative management overall by companies outside the banking industry.

That would be considered a textbook response, but relative to earnings expectations, it is a new revelation to account for that wasn’t accounted for as much a little more than a week ago. What market participants also have to account for is the potential for collateral damage beyond the banks.

To that end, a favored trade before the banking crisis was to be long oil and short Treasuries. Any money manager levered up on those positions would naturally have some exposure issues on their hands. That’s not to say they didn’t cut their risk, but it is not unusual after a crisis that leads to outsized movement in prices to hear that a fund is in trouble and/or that some forced liquidations are taking place.

Thus far, it has been quiet on that exposure front, but one shouldn’t be surprised if such a story arises knowing that talk of liquidity crunches has been injected into the market narrative.

We digress.

What It All Means

The collateral damage in a collective sense should be showing up soon enough in declining earnings estimates. That will be particularly true for the banks, but if the economy stumbles like many think it will because of the banking crisis, it will be true of most companies.

That thinking has yet to make its presence felt in the forward twelve-month earnings estimate, but the banking crisis should soon be forcing a recalibration of earnings models.

We suggested in mid-February that earnings estimates for the second half of 2023 would be at risk along with the economy. Admittedly, that view didn’t envision a banking crisis being part of the equation, but it is now.

Sure, it might strike some as hopeful that market rates have come way down in the last few weeks and that the Fed’s terminal rate might not stretch as high as previously feared only a week ago. Some might see that as a basis for multiple expansion.

The impetus for those shifts, however, hasn’t been anything good. On the contrary, the impetus has been a negative shock to the economy that is going to be worse for earnings prospects. That is a basis that should keep the stock market in check because it is difficult to find a bottom in stock prices when confidence is low that there has been a bottom in earnings estimates.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of April 3)

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAR. 13 THROUGH MAR. 17, 2023 |

| The S&P 500 index rose 1.4% last week, recovering some but not all of the prior week’s tumble, as some investors saw the recent stock market declines as presenting buying opportunities while a show of support among big banks for First Republic Bank (FRC) also provided some relief.

The market benchmark ended Friday’s session at 3,916.64, up from last Friday’s closing level of 3,861.59. It is now up 2% for the year-to-date but down 1.3% for March to date. The S&P 500 slid 4.5% the week before amid the collapse of Silicon Valley Bank. Since then, Signature Bank also collapsed, and financial stocks tumbled as investors worried about what other banks might be next. Concerns ramped up last week over First Republic Bank, but on Thursday, a group of 11 banks announced $30 billion in deposits into First Republic Bank in a show of support that helped ease fears a bit. Still, investors remain wary. The communication services sector had the largest percentage increase last week, climbing 6.9%, followed by a 5.7% rise in technology and a 3.9% increase in utilities. Other sectors in positive territory for the week included consumer discretionary, health care, consumer staples and real estate. The energy sector led to the downside, falling 7%, followed by a 6.1% drop in the financial sector. The materials sector also was in the red, down 3.5%, followed by a 2.5% decline in industrials. The gainers in communication services included Facebook parent Meta Platform (META) as the social network operator lowered its 2023 expense guidance amid plans to cut about 10,000 jobs. The company will remove “multiple layers of management” and increase direct reports of each manager, Chief Executive Mark Zuckerberg said in a memo. As a result, Meta now expects 2023 expenses of $86 billion to $92 billion, down from $89 billion to $95 billion previously anticipated. Shares climbed 9% on the week. In the technology sector, shares of Microsoft (MSFT) rose 12% as the software company disclosed new artificial intelligence-powered functionalities for its Microsoft 365 suite of workplace apps, including Word, Excel and Outlook, to help improve productivity. On the downside, the energy sector’s drop came as crude oil futures also fell. Decliners included Devon Energy (DVN), which fell 11% on the week, and APA Corp. (APA) and Schlumberger (SLB), down 12% each. In the financial sector, shares of First Republic ended the week down a staggering 72% from last Friday. While investors were relieved to see other banks’ efforts to support First Republic, they continued to worry about the bank as it suspended its dividend. Other regional banks whose shares were hit hard last week included Keycorp (KEY), Zions Bancorp (ZION) and Comerica (CMA), whose shares fell 26% each. Next week’s economic calendar will be light with no major reports expected on Monday and only February existing home sales anticipated on Tuesday. However, the market will be heavily focused on a two-day Federal Open Market Committee meeting that concludes on Wednesday with a rate decision. Later in the week, February new home sales will be reported on Thursday and February durable goods will come on Friday. Also on Friday, Standard & Poor’s is expected to release its final March purchasing managers indexes for the US services and manufacturing sectors. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bearish

COMP – Bearish

Where Will the SPX end March 2023?

03-20-2023 -2.0%

03-13-2023 -2.0%

03-06-2023 -2.0%

02-27-2023 -2.0%

Earnings:

Mon: FL

Tues: TME, GME, NKE

Wed: FUL, KBH, CHWY

Thur: DRI, GIS

Fri:

Econ Reports:

Mon:

Tue Existing Home Sales

Wed: MBA, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, New Home Sales

Fri: Durable Goods, Durable ex-trans

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Beware of these S&P 500 stocks expected to struggle

PUBLISHED SUN, MAR 19 20238:15 AM EDTUPDATED SUN, MAR 19 20238:15 AM EDT

Investors may want to consider dumping some stocks expected to underperform going forward, especially as market volatility remains elevated.

The S&P 500 fell more than 1% on Friday as concern over the state of the global banking system dampened investor sentiment. The broader market index is also down more than 1% for the month, on pace for its third monthly decline in four months.

And, while market declines do provide buying opportunities, they can also be used to get rid of names that are expected to struggle in the near future. CNBC Pro used FactSet to screen the S&P 500 for stocks that met the following criteria:

- Average analyst rating of hold or less (FactSet divides ratings into five categories: buy, overweight, hold, underweight and sell)

- Rated sell by at least 20% of analysts covering them

- Average analyst price target implies a decline over the next 12 months

Here are the seven stocks that made our list.

HATED STOCKS ON WALL STREET

| SYMBOL | NAME | MARKET VALUE | AVERAGE RATING | (%) SELL RATING | UPSIDE TO AVG PT (%) |

| TROW | T. Rowe Price Group | 24,273.2 | Underweight | 37.5 | -14.0 |

| ED | Consolidated Edison, Inc. | 33,953.0 | Underweight | 29.4 | -7.2 |

| EXPD | Expeditors International of Washington, Inc. | 16,432.6 | Underweight | 40.0 | -8.6 |

| CLX | Clorox Company | 19,021.6 | Underweight | 31.8 | -8.9 |

| CPB | Campbell Soup Company | 15,986.0 | Hold | 20.0 | -0.9 |

| CHRW | C.H. Robinson Worldwide, Inc. | 11,174.5 | Hold | 25.0 | -2.4 |

| PNW | Pinnacle West Capital Corporation | 8,786.9 | Hold | 20.0 | -3.5 |

Source: FactSet

Bleach maker Clorox made the list with an average analyst rating of underweight. The stock is also rated sell by nearly 32% of analysts covering it. Clorox shares are expected to fall 9% over the next year.

Clorox last month reported a stronger-than-expected adjusted profit for its fiscal fourth quarter. However, the company also forecast a 2% revenue drop for fiscal 2023.

“There is a still a lot of wood to chop here with the company undergoing a digital transformation while trying to stabilize demand. Feels choppy at best in the near term,” traders at Barclays said in a note.

C.H. Robinson also made the list. The transportation stock has an average rating of hold, and 25% of analysts covering it rate it as sell. The average analyst price target on C.H. Robinson shares implies downside of 2.4% over the next 12 months.

JPMorgan downgraded the stock in February to underweight from neutral, citing rail congestion fees, truckload rate cycles and coal volumes as headwinds for the company.

“C.H. Robinson’s primary North American Surface Transportation segment remains significantly exposed to the spread between contract and spot truckload rates as well as the timing of contract negotiations and overall freight market demand,” analyst Brian Ossenbeck wrote.

Another name that made the list is Campbell Soup, which has an average rating of hold and a price target that points to a slight decline over the next 12 months. The company posted better-than-expected quarterly results earlier this month. However, Stifel analyst Christopher Growe maintained a hold rating on the stock, citing “the relatively slow growth outlook for the business following the benefit from COVID-19.”

Other stocks that made our list are Pinnacle West Capital, Expeditors International of Washington, Consolidated Edison and T. Rowe Price.

— CNBC’s Michael Bloom contributed reporting.

Fed poised to approve quarter-point rate hike this week, despite market turmoil

PUBLISHED FRI, MAR 17 20231:55 PM EDTUPDATED MON, MAR 20 20235:53 AM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The Federal Reserve likely will approve a quarter-percentage-point interest rate increase this week, according to market pricing and many Wall Street experts.

- A rate increase would come just over a week after other regulators rolled out an emergency lending facility to halt a crisis of confidence in the banking industry.

- “This might be one of those times where there’s a difference between what they should do and what I think they will do. They definitely should not tighten policy,” said Mark Zandi, chief economist at Moody’s Analytics.

Even with turmoil in the banking industry and uncertainty ahead, the Federal Reserve likely will approve a quarter-percentage-point interest rate increase next week, according to market pricing and many Wall Street experts.

Rate expectations have been on a rapidly swinging pendulum over the past two weeks, varying from a half-point hike to holding the line and even at one point some talk that the Fed could cut rates.

However, a consensus has emerged that Fed Chairman Jerome Powell and his fellow central bankers will want to signal that while they are attuned to the financial sector upheaval, it’s important to continue the fight to bring down inflation.

That likely will take the form of a 0.25 percentage point, or 25 basis point, increase, accompanied by assurances that there’s no preset path ahead. The outlook could change depending on market behavior in the coming days, but the indication is for the Fed to hike.

“They have to do something, otherwise they lose credibility,” said Doug Roberts, founder and chief investment strategist at Channel Capital Research. “They want to do 25, and the 25 sends a message. But it’s really going to depend on the comments afterwards, what Powell says in public. … I don’t think he’s going to do the 180-degree shift everybody’s talking about.”

Markets largely agree that the Fed is going to hike.

As of Friday afternoon, there was about a 75% chance of a quarter-point increase, according to CME Group data using Fed funds futures contracts as a guide. The other 25% was in the no-hike camp, anticipating that the policymakers might take a step back from the aggressive tightening campaign that began just over a year ago.

Goldman Sachs is one of the most high-profile forecasters seeing no change in rates, as it expects central bankers in general “to adopt a more cautious short-term stance in order to avoid worsening market fears of further banking stress.”

A question of stability

Whichever way the Fed goes, it’s likely to face criticism.

“This might be one of those times where there’s a difference between what they should do and what I think they will do. They definitely should not tighten policy,” said Mark Zandi, chief economist at Moody’s Analytics. “People are really on edge, and any little thing might push them over the edge, so I just don’t get it. Why can’t you just pivot here a little and focus on financial stability?”

A rate increase would come just over a week after other regulators rolled out an emergency lending facility to halt a crisis of confidence in the banking industry.

The shuttering of Silicon Valley Bank and Signature Bank, along with news of instability elsewhere, rocked financial markets and set off fears of more to come.

Zandi, who has been forecasting no rate hike, said it’s highly unusual and dangerous to see monetary policy tightening under these conditions.

“You’re not going to lose your battle against inflation with a pause here. But you could lose the financial system,” he said. “So I just don’t get the logic for tightening policy in the current environment.”

Still, most of Wall Street thinks the Fed will proceed with its policy direction.

Cuts still expected by year’s end

In fact, Bank of America said the policy moves of last Sunday to backstop depositor cash and support liquidity-strapped banks allows the Fed the flexibility to hike.

“The recent market turbulence stemming from distress in several regional banks certainly calls for more caution, but the robust action by policymakers to trigger systemic risk exceptions … is likely to limit fallout,” Bank of America economist Michael Gapen said in a client note. “That said, events remain fluid and other stress events could materialize between now and next Wednesday, leading the Fed to pause its rate hike cycle.”

Indeed, more bank failures over the weekend could again throw policy for a loop.

One important caveat to market expectations is that traders don’t think any further rate hikes will hold. Current pricing indicates rate cuts ahead, putting the Fed’s benchmark funds rate in a target range around 4% by year end. An increase Wednesday would put the range between 4.75%-5%.

Citigroup also expects a quarter-point hike, reasoning that central banks “will turn attention back to the inflation fight which is likely to require further increases in policy rates,” the firm said in a note.

The market, though, has not had the benefit of hearing from Fed speakers since the financial tumult began, so it will be harder to gauge how officials feel about the latest events and how they fit into the policy framework.

The biggest concern is that the Fed’s moves to arrest inflation eventually will take the economy into at least a shallow recession. Zandi said a hike next week would raise those odds.

“I think more rational heads will prevail, but it is possible that they are so focused on inflation that they are willing to take their chance with the financial system,” he said. “I thought we could make our way through this period without a recession, but it required some reasonably good policymaking by the Fed.

“If they raise rates, that qualifies as a mistake, and I would call it an egregious mistake,” Zandi added. “The recession risks will go meaningfully higher at that point.”

These elite dividend stocks have raised their payments for over 60 consecutive years

PUBLISHED SUN, MAR 19 20238:24 AM EDT

Through recessions and economic booms, over decades of market volatility, only eight companies in the S&P 500 have hiked their annual dividends year-in and year-out for at least 60 years.

Given the recent turmoil across the banking sector and increased fears of a broader economic downturn, investors seeking to pocket steady income can turn to these companies, which are the most reliable of a group known as “dividend aristocrats.”

Many of these companies are well known household names like 3M, Coca-Cola, Colgate-Palmolive, Johnson & Johnson and Procter & Gamble. But the group also includes industrial conglomerate Dover, manufacturing giant Emerson Electric and auto parts maker Genuine Parts.

“These companies have had management that have been able to change with the times and adapt to new competition, new technology,” said Howard Silverblatt, senior index analyst at S&P Global Dow Jones Indices. “Companies who have increased for so many years — and this goes for not just 60, but also 10 years — it becomes part of their cultures and they increase even when they can’t.”

Take Coca-Cola. It pays an annual dividend of $1.84 per share, and currently has a dividend yield of 3.07%, while the S&P 500′s average dividend yield is 1.65%.

The Atlanta-based beverage giant has been using a two-pronged strategy to boost sales by raising prices, while still marketing more affordable products to lower-income customers. The company has also rolled out new drink flavors in recent years and various low-sugar products, such as Coke Zero and Diet Coke, for consumers that have begun to seek out healthier options. Last year, Coca-Cola’s revenue rose 11% to $43 billion, driven by 11% growth from product mix and pricing.

In February, Citi analyst Filippo Falorni named Coke one of his top buy-rated picks, saying the company emerged from the pandemic in a much stronger position.

Coca-Cola Co

Meanwhile, Dover has increased its dividend for 67 years — nearly every year since its inception in 1955. The Illinois-based company offers has a dividend yield of 1.48%. Over the years, it has completed numerous acquisitions into highly consolidated end markets, including in retail refrigeration equipment, industrial printing and clean energy.

As of Friday’s close, Dover’s stock is up nearly 1% this year.

Mizuho Securities reiterated its buy rating on the stock earlier this month after Dover’s investor day, touting the company’s opportunities to grow its sales.

“DOV has an underappreciated portfolio,” analyst Brett Linzey wrote, as he set a $165 price target on the stock.

While this group forms an exclusive club, it’s worth recognizing other long-time dividend payers.

Manufacturing company Stanley Black & Decker and food and beverage giant PepsiCo have raised their annual dividends for more than 50 years. ExxonMobil and Chevron have hiked their annual dividends for 40 and 36 years, respectively.

Companies in the S&P 500 paid out $564 billion in dividends in 2022, a 10% increase from 2021 and a record payout by far, according to S&P Global. Disappointed by the price declines in equities, investors last year piled into ETFs that specialized in paying dividends — a trend that is likely to continue this year.

Silverblatt said he expects U.S. cash dividends to again reach a new all-time high in 2023, but that growth will see a definitive slowdown, likely at half of its rate last year.

“As far as the cash dividends, we will have a record, even if companies fail to increase. They actually have to pull back in order to not have a record this year,” said Silverblatt.

Based on the current dividend rate, with no additional increases or decreases, Silverblatt expects cash payments for 2023 to increase 3.9% over 2022. There were 73 dividend increases and 4 decreases last month, compared with February 2022′s 71 increases and 2 decreases, he said.

I spent 5 years interviewing 233 millionaires—here’s the No. 1 career move that made them rich

Published Wed, Feb 22 20239:45 AM ESTUpdated Wed, Feb 22 202312:45 PM EST

Tom Corley, Contributor@RICHHABITS

I spent five years studying and interviewing 233 millionaires to learn about their habits and the way they think.

Work was a big topic: 51% were entrepreneurs, 28% had traditional 9-to-5 jobs, and 18% were senior-level executives at large companies.

But they all had one thing in common: They quit their mid- to late-career jobs, saying they felt it was the only way they could truly succeed and build wealth. Some left to start their own businesses, while others found lateral roles that offered more growth opportunities and a higher salary.

Here are the most common red flags that made them decide to quit:

They were being underutilized.

The millionaires in my study often felt like they were always doing “zombie work” — boring, repetitive tasks that didn’t showcase their strengths and talents.

One person worked for a container shipping company. He felt underutilized and ultimately quit his job to join forces with another industry peer.

Together, they launched a new U.S. branch of an international container shipping company. Today, they are executives at the multibillion-dollar company.

They had toxic bosses.

Managers who are demanding, selfish, arrogant or have little interest in your opinions won’t help you reach your earning potential.

One millionaire said he was so fed up with his manager, who would only criticize his work instead of giving constructive feedback. He got tired of it and left to start his own home construction company, taking with him a number of key employees who felt the same way.

Their company grew into a successful home builder, making the founders very wealthy.

They dreaded their office culture.

An undermining culture of malicious gossip can make anyone feel a sense of anxiety going into work every day. This was the case for one of the individuals in my study, who was a manager at an accounting firm.

He ultimately left due to the toxic environment. After months of job interviewing, he landed an offer at a competitor firm, where he rose up the ladder and became a partner.

They weren’t paid enough (or getting raises).

A sure sign that it was time to start looking for another opportunity, the participants told me, was when their salaries could barely keep up with the bills.

They couldn’t afford they vacations they wanted or save up enough money to buy a house.

One person who worked for a large car dealership decided to strike out on his own. Thanks to investments from his family and friends, he launched his own dealership and franchised it, which allowed him to build significant wealth.

They had a draining commute.

One self-made millionaire in my study had a lengthy commute from her home in New Jersey to New York City. It was wearing on her, so she decided to look for something closer to home.

She took another job at a New Jersey-based company in the pharmaceutical industry, and it paid off. She climbed to a senior position and retired early thanks to a very generous stock compensation package.

Before you hit your breaking point, consider having a conversation about a hybrid remote option, or moving into a position where there is little travel required.

Their industry was unsteady.

One IT professional left his struggling manufacturing company to join a new business offering discount online brokerage services.

At the time, it was a relatively new industry. But the risk was worth it: As the company prospered, so did he. This a good reminder that your skills may be more transferable than you think.

Don’t be afraid to get on the ground floor of something that excites you.

Tom Corley is an accountant, financial planner, and author of “Rich Habits: The Daily Success Habits of Wealthy Individuals” and “Rich Kids: How to Raise Our Children to Be Happy and Successful in Life.” He holds a master’s degree in taxation. Follow Tom on Twitter @richhabits.

HI Financial Services Mid-Week 06-24-2014