HI Market View Commentary 02-20-2023

WHAT THE CPI ?!?!?!?!?!!!!

Tomorrow one of the biggest movers of the market is going thru a change in their calculations

Any guess for the market drop last week? Weapons for Ukraine

It surprises me to see so much hope and at the same time there is no end is sight

Kevin are we going to have a better back half of the year ? = No more interest hikes, lowering inflations because of the rate hike, next year hopium rate cuts

Morgan Stanley’s Wilson: Equity Prices ‘Disconnected from Reality’

The firm’s chief U.S. equities strategist and chief investment officer believes that the earnings recession projected by his team has “begun in earnest.”

February 13, 2023

Morgan Stanley’s top-ranked strategist, Michael Wilson, believes that U.S. stocks are heading for a downturn and will hit the bottom this spring, according to news reports.

The stock market “is refusing to accept” that the Federal Reserve may have to continue raising rates to tame inflation, a team led by Wilson — Morgan Stanley’s chief U.S. equities strategies and chief investment officer — wrote in a note, according to Bloomberg.

Last week, Federal Reserve chair Jay Powell cautioned that the central bank may need to raise interest rates further to tackle inflation, given strong jobs data.

The stock market, meanwhile, has started the year with a record increase, though the rally has tempered since Powell’s warning, Bloomberg writes.

“Price is about as disconnected from reality as it’s been during this bear market,” Wilson’s team wrote, according to the news service.

Last month, Wilson warned that an earnings recession was “imminent” but suggested that the bear market could end as soon as later this quarter.

Banks make their two main – Commercial lending, Bond funds = rolling their own debt Third mutal funds

Earnings dates:

BIDU – 2/22 BMO

MU – 3/29

SQ – 2/23 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 10-Feb-23 15:37 ET | Archive

Yield signs point to a dogfight

There is a famous scene in the first Top Gun movie where Maverick inverts his F-14 and gives a friendly greeting to the pilot of the Russian MiG about two meters below. That inversion — and that greeting — were declarations of victory over the enemy, who knew it was time to bug out and head for home.

If life could imitate art in the Treasury market, there would be a lot of victory signs because there are inversions all along the curve.

Yield Signs

The 1-yr T-bill (4.93%) yields more than the 2-yr note (4.50%); the 2-yr note yields more than the 3-yr note (4.18%); the 3-yr note yields more than the 5-yr note (3.91%); the 5-yr note yields more than the 7-yr note (3.85%); and the 7-yr note yields more than the 10-yr note (3.73%).

For good measure — and arguably the most telltale measure for presaging a recession — the 3-mo T-bill (4.74%) yields more — a lot more — than the 10-yr note (3.73%). This spread is followed closely by the Fed, which knows it has inverted ahead of prior recessions. Research done by the New York Fed has indicated as much.

The 3mo10yr spread is also looked at closely by the market, which knows its predictive power for the U.S. economy. This spread is not only piquing recession concerns, it is also giving way to criticism that the Fed is going to overtighten and induce a hard landing for the U.S. economy.

Or will it?

Don’t Believe the Hype

There is no question that the financial crisis and global pandemic led to the hardest of landings for the U.S. economy. Naturally, high-yield spreads widened considerably during those periods. They did as well during the 2001 recession, although the path to the peak spread then had less economic panic in it.

We’d say that is very much the case today as well, as seen in the chart below. The high yield option-adjusted spread sits at 4.05%. That is up noticeably from the lows seen at the start of 2022 (3.05%), but it is still a long way from conveying fear about a hard landing.

Moreover, it is a considerable improvement from where things stood last July (5.99%), when the target range for the fed funds rate was 300 basis points lower (1.50-1.75%) than it is today (4.50-4.75%). At 4.05%, the high yield option-adjusted spread is effectively the same as it was in February 2020 before COVID turned the world upside down and the global economy crashed.

Things can change in a hurry, which the chart below also shows, but it is fair to say at this point that the high yield option-adjusted spread is not corroborating the recession hype that the deeply inverted yield curve is.

What It All Means

Time will be the ultimate tell in terms of how the U.S. economy evolves. It had a pretty solid fourth quarter with real GDP up 2.9% at an annualized rate. The Atlanta Fed’s GDPNow model estimate for real GDP growth in the first quarter is 2.2%, or a bit below the 2.6% quarterly average for 2019 when no one was talking about a hard landing.

The inversions along the Treasury yield curve aren’t giving a friendly economic signal. Then again, the high yield option-adjusted spread isn’t exactly bugging out.

The mixed signaling speaks to the divided views about the degree of softness the U.S. economy will face. To be sure, it is a dogfight that is apt to keep investors on edge and the market trading in a fitful manner.

—Patrick J. O’Hare, Briefing.com

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF FEB. 6 THROUGH FEB. 10, 2023 |

| The S&P 500 index fell 1.1% last week, with the communication services sector leading a broad decline as Q4 earnings continued to come in mixed and rate concerns persisted.

The market benchmark ended Friday’s session at 4,090.46, down from last Friday’s closing level of 4,136.48. It is still up 6.5% for the year-to-date. The S&P 500 had a strong start to 2023, jumping 6.2% in January, amid hopes for the Federal Reserve’s Federal Open Market Committee to slow its rate increases. However, the index gave back some of those gains in the past week as investors have grown more concerned about how much the FOMC will be able to slow rates, especially after January jobs data released last Friday came in stronger than expected, indicating more aggressive moves may still be needed to fight inflation. Adding to investors’ concerns, corporate earnings have been coming in mixed, with some companies issuing downbeat guidance while others have warned they are preparing for possible recession. Communication services had the largest percentage drop, falling 6.6%, followed by a 2.2% slip in consumer discretionary, a 2% decline in real estate and a 1.7% drop in materials. All other sectors also declined, with the exception of energy, which rose 5%. The decliners in communication services included shares of Lumen Technologies (LUMN), which tumbled 25% on the week. The wireline operator’s Q4 results topped analysts’ mean estimates but its guidance for 2023 missed. The company forecast 2023 adjusted earnings before interest, taxes, depreciation and amortization of $4.6 billion to $4.8 billion, well below analysts’ mean estimate at the time of $5.23 billion, according to Capital IQ. Lumen also forecast 2023 free cash flow of $0 to $200 million, versus analysts’ mean estimate at the time of $332.3 million. In the consumer discretionary sector, shares of VF Corp. (VFC) fell 14%. The branded apparel and footwear company posted fiscal Q3 adjusted earnings per share and revenue above analysts’ mean estimates but said it is shifting resource priorities across the company, including reducing its dividend, exploring the sale of non-core assets, cutting costs and eliminating non-strategic spending. The new quarterly dividend is down 41% from the previous quarter’s dividend. On the upside, the energy sector’s climb came as crude oil and natural gas futures rose. Gainers included shares of Phillips 66 (PSX), which rose 8.7% as the company’s board boosted its quarterly dividend by 8%. Phillips 66 was also one of 18 energy companies that received a contract from the US Defense Logistics Agency for various types of fuel. Next week’s earnings reporters will include Coca-Cola (KO), Airbnb (ABNB), Marriott International (MAR), Cisco Systems (CSCO), Applied Materials (AMAT) and Deere (DE). Economic reports being released next week will be heavy on inflation readings early in the week, with the New York Fed’s latest inflation expectations due on Monday and the January consumer price index on Tuesday. January retail sales as well as the industrial production index for the month are among the reports expected on Wednesday, followed by the final reading on the January producer price index as well as building permits and housing starts on Thursday. The January import price index and the index of leading economic indicators will round out the week on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end February 2023?

02-13-2023 +2.0

02-06-2023 +2.0

Earnings:

Mon: CAR, DENN

Tues: MAR, ABNB, GDDY, KO

Wed: KHC, LAD, OC, NUS, ROKU, ZG

Thur: CROX, HAS, H, DKNG, HUBS, AUY

Fri: DE

Econ Reports:

Mon:

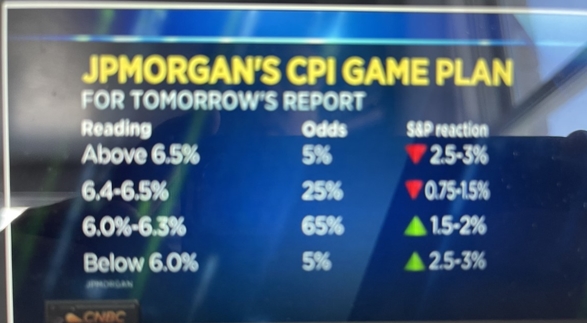

Tue CPI, Core CPI

Wed: MBA, Retail Sales, Retail ex-auto, Empire Manufacturing, Capacity Utilization, Industrial Production, Business Inventories, NAHB Housing Market Index

Thur: Initial Claims, Continuing Claims, PPI, Core PPI, Housing Starts, Building Permits, Phil Fed

Fri: Import, Export, Leading Indicators, MONTHLY Options Expiration

How am I looking to trade?

Currently running mostly stocks with protection

BIDU & SQ Earnings next week

Monday Holiday

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Nikki Haley presidential run would sink DeSantis and hand Trump victory – poll

Yahoo News/YouGov survey finds that an additional Republican candidate would split the vote in former president’s favor

Nikki Haley is due to announce her campaign in her home state of South Carolina next week. Photograph: Olivier Douliery/AFP/Getty Images

Martin Pengelly in New York @MartinPengelly

Thu 9 Feb 2023 02.00 EST

As the former South Carolina governor Nikki Haley prepares to announce a run for president, a new poll found that just one additional candidate in the 2024 Republican primary will be enough to split the vote and keep Donald Trump ahead of Ron DeSantis, his only current close rival.

The Yahoo News/YouGov poll gave DeSantis, the Florida governor, a 45%-41% lead over Trump head-to-head. Similar scenarios in other polls have prompted increasing attacks on DeSantis by Trump – and deflections by DeSantis.

Speaking to reporters on Wednesday, DeSantis said: “I don’t spend my time trying to smear other Republicans.”

But the Wednesday poll also produced an alternative scenario involving Haley that may worry DeSantis.

Haley was ambassador to the United Nations under Trump before resigning in 2018. Having changed her mind about challenging her former boss, she is due to announce her campaign in her home state next week.

Yahoo News reported: “In a hypothetical three-way match-up, Haley effectively plays the spoiler, attracting 11% of Republicans and Republican-leaners while DeSantis’s support falls by roughly the same amount (to 35%), leaving Trump with more votes than either of them” at 38%.

When Trump first ran for the Republican nomination, in 2016, he did so in a primary field which was 17 strong come the first debate. Trump won the nomination without winning a majority of votes cast.

He ended his presidency twice-impeached and in wide-ranging legal jeopardy but he is still the only declared candidate for the nomination in 2024, having announced shortly after last year’s midterm elections.

Defeats for Trump-endorsed candidates cost Republicans dearly in November, particularly as the US Senate remained in Democratic hands, prompting some Republicans to turn against the idea of a third Trump nomination.

Haley is due to announce her run on 15 February in Charleston, South Carolina, before heading to New Hampshire, which also has an early slot on the primary calendar.

According to the Yahoo/YouGov poll, Haley attracted much more support than other potential candidates including the former vice-president Mike Pence, former secretary of state Mike Pompeo and Larry Hogan, a former governor of Maryland.

According to NBC News, Chris Sununu, the governor of New Hampshire and like Hogan a Republican moderate, is also preparing to run.

The Yahoo/YouGov poll said the same vote-splitting scenario played out with fields larger than three: the anti-Trump vote split and Trump therefore beat DeSantis. Other polls have returned similar results.

Art Cullen, editor of the Storm Lake Times in Iowa, the state that will vote first, recently told the Guardian: “These folks must be watching Trump’s poll numbers and that’s why there’s a delay [in announcements].”

“Trump and DeSantis are doing this sparring around the ring. Others are watching to see if somebody takes a blow and gives them an opening.”

But Sarah Longwell, publisher of the Bulwark, an anti-Trump conservative website, recently wrote: “Presumably the numerous candidates gearing up to run in the GOP primary understand that a fractured field benefits Donald Trump.

“Are we sure they understand that they’d need to coalesce around a frontrunner by February 2024 to avoid the same scenario that gave us Trump in 2016?”

I hope you appreciated this article. Before you move on, I was hoping you would consider taking the step of supporting the Guardian’s journalism.

From Elon Musk to Rupert Murdoch, a small number of billionaire owners have a powerful hold on so much of the information that reaches the public about what’s happening in the world. The Guardian is different. We have no billionaire owner or shareholders to consider. Our journalism is produced to serve the public interest – not profit motives.

And we avoid the trap that befalls much US media – the tendency, born of a desire to please all sides, to engage in false equivalence in the name of neutrality. While fairness guides everything we do, we know there is a right and a wrong position in the fight against racism and for reproductive justice. When we report on issues like the climate crisis, we’re not afraid to name who is responsible. And as a global news organization, we’re able to provide a fresh, outsider perspective on US politics – one so often missing from the insular American media bubble.

Around the world, readers can access the Guardian’s paywall-free journalism because of our unique reader-supported model. That’s because of people like you. Our readers keep us independent, beholden to no outside influence and accessible to everyone – whether they can afford to pay for news, or not.

If you can, please consider supporting the Guardian today. Thank you.

Betsy Reed

Editor, Guardian US

An 85-year Harvard study found the No. 1 thing that makes us happy in life: It helps us ‘live longer’

Published Fri, Feb 10 202311:25 AM ESTUpdated Fri, Feb 10 20236:48 PM Undefined EST

Robert Waldinger, Contributor@ROBERTWALDINGER

Marloes De Vries for CNBC Make It

In 1938, Harvard researchers embarked on a decades-long study to find out: What makes us happy in life?

The researchers gathered health records from 724 participants from all over the world and asked detailed questions about their lives at two-year intervals.

Contrary to what you might think, it’s not career achievement, money, exercise, or a healthy diet. The most consistent finding we’ve learned through 85 years of study is: Positive relationships keep us happier, healthier, and help us live longer. Period.

The No. 1 key to a happy life: ‘Social fitness’

Relationships affect us physically. Ever notice the invigoration you feel when you believe someone has really understood you during a good conversation? Or a lack of sleep during a period of romantic strife?

To make sure your relationships are healthy and balanced, it’s important to practice “social fitness.”

We tend to think that once we establish friendships and intimate relationships, they will take care of themselves. But our social life is a living system, and it needs exercise.

Marloes De Vries for CNBC Make It

Social fitness requires taking stock of our relationships, and being honest with ourselves about where we’re devoting our time and whether we are tending to the connections that help us thrive.

How to take stock of your relationships

Humans are social creatures. Each of us as individuals cannot provide everything we need for ourselves. We need others to interact with and to help us.

In our relational lives, there are seven keystones of support:

- Safety and security:Who would you call if you woke up scared in the middle of the night? Who would you turn to in a moment of crisis?

- Learning and growth:Who encourages you to try new things, to take chances, to pursue your life’s goals?

- Emotional closeness and confiding:Who knows everything (or most things) about you? Who can you call on when you’re feeling low and be honest with about how you’re feeling?

- Identity affirmation and shared experience:Is there someone in your life who has shared many experiences with you and who helps you strengthen your sense of who you are?

- Romantic intimacy:Do you feel satisfied with the amount of romantic intimacy in your life?

- Help (both informational and practical):Who do you turn to if you need some expertise or help solving a practical problem (e.g., planting a tree, fixing your WiFi connection).

- Fun and relaxation:Who makes you laugh? Who do you call to see a movie or go on a road trip with who makes you feel connected and at ease?

Below you’ll find a table arranged around the seven keystones. The first column is for the relationships you think have the greatest impact on you.

Place a plus (+) symbol in the appropriate columns if a relationship seems to add to that type of support in your life, and a minus (-) symbol if a relationship lacks that type of support.

Remember, it’s okay if not all — or even most — relationships offer you all these types of support.

CNBC Make It

Think of this exercise like an X-ray — a tool that helps you see below the surface of your social universe. Not all of these types of support will feel important to you, but consider which of them do, and ask yourself if you’re getting enough support in those areas.

Looking at the gaps on the chart, you might realize that you have plenty of people you have fun with, but no one to confide in. Or maybe you only have one person you go to for help, or that a person you take for granted actually makes you feel safe and secure.

Don’t be afraid to reach out to the people in your life. Whether it’s a thoughtful question or a moment of devoted attention, it’s never too late to deepen the connections that matter to you.

Robert Waldinger, MD, is a professor of psychiatry at Harvard Medical School, director of the Harvard Study of Adult Development, and director of Psychodynamic Therapy at Massachusetts General Hospital. He is a practicing psychiatrist and also a Zen master and author of “The Good Life.” Follow Robert on Twitter @robertwaldinger.

Marc Shulz, PhD, is the associate director of the Harvard Study of Adult Development, and a practicing therapist with postdoctoral training in health and clinical psychology at Harvard Medical School. He is also the author of “The Good Life.”

https://www.huffpost.com/entry/chinese-military-linked-to-spy-balloons_n_63e50737e4b022eb3e2e3c4a

U.S. Says Chinese Military Behind Vast Aerial Spy Program

High-altitude surveillance balloons, similar to the one shot down over the Atlantic Ocean, targeted more than 40 countries, the Biden administration said Thursday.

Feb 9, 2023, 09:59 AM EST

00:07China’s Eyes In The Sky

WASHINGTON (AP) — China’s military is likely behind a huge aerial spy program that has targeted more than 40 countries on five continents with high-altitude surveillance balloons similar to one the U.S. shot down over the Atlantic coast last weekend, the Biden administration said Thursday.

The fleet of balloons is used specifically for spying, outfitted with high-tech equipment and capable of collecting communications signals and other sensitive information from targets across the globe, the U.S. government said.

The statement from a senior State Department official offered the most detail to date linking China’s People’s Liberation Army to the balloon that traversed the United States. The public details are meant to refute China’s persistent denials that the balloon was used for spying, including a claim Thursday that U.S. accusations about the balloon amount to “information warfare” against Beijing.

Navy sailors recover China’s high-altitude surveillance balloon off the coast of Myrtle Beach, S.C., on Sunday, in this image provided by the U.S. Navy.

In Beijing, before the U.S. offered new information, Chinese Foreign Ministry spokesperson Mao Ning repeated his nation’s insistence that the large unmanned balloon was a civilian meteorological airship that had blown off course and that the U.S. had “overreacted” by shooting it down.

“It is irresponsible,” Mao said. The latest accusations, he said, “may be part of the U.S. side’s information warfare against China.”

China’s defense minister refused to take a phone call from Defense Secretary Lloyd Austin to discuss the balloon issue on Saturday, the Pentagon said. China has not answered questions as to what government department or company the balloon belonged to, or how it planned to follow up on a pledge to take further action over the matter.

The U.S. official said imagery of the balloon collected by American U-2 spy planes as it crossed the country showed that it was “capable of conducting signals intelligence collection” with multiple antennas and other equipment designed to upload sensitive information and solar panels to power them.

A senior state department official said the U.S. has confidence that the manufacturer of the balloon shot down on Saturday has “a direct relationship with China’s military and is an approved vendor of the” army.

The official said an analysis of the balloon debris was “inconsistent” with China’s explanation that it was a weather balloon that went off course. The U.S. is reaching out to countries that have also been targeted, the official said, to discuss the scope of the Chinese surveillance program.

The official provided details to reporters by email on condition of anonymity due to the sensitive nature of the matter, which had already forced the cancellation of a planned visit to China earlier this week by Secretary of State Antony Blinken.

The official said the U.S. has confidence that the manufacturer of the balloon shot down on Saturday has “a direct relationship with China’s military and is an approved vendor of the” army. The official cited information from an official PLA procurement portal as evidence for the connection between the company and the military.

This is not the first time the U.S. government has publicly called out alleged activities of the People’s Liberation Army. In a first-of-its-kind prosecution in 2014, the Obama administration Justice Department indicted five accused PLA hackers of breaking into the computer networks of major American corporations in an effort to steal trade secrets.

Alleged hackers with the PLA were also charged in 2020 with stealing the personal data of tens of millions of Americans in a breach of the credit-reporting agency Equifax.

Florida to place leadership of Disney’s special operating district under DeSantis’ control

PUBLISHED FRI, FEB 10 20233:47 PM EST

Rob Wile

Florida lawmakers have approved a bill that makes changes to Disney’s Reedy Creek special governing district, including replacing its board of supervisors and giving it a new name.

Gov. Ron DeSantis is expected to sign the bill into law.

The new legislation, which overrides an earlier proposal to dissolve the district entirely, will keep the region’s key operational procedures intact. One of those procedures concerns the district’s ability to raise taxes and issue bonds to build and maintain infrastructure serving the Walt Disney World Resort.

“In terms of the day-to-day operation of the district, it doesn’t look like much is going to change,” said Aubrey Jewett, associate professor and assistant school director at the University of Central Florida.

The biggest change: DeSantis will now be able to appoint the district’s five board members, subject to state Senate approval. Previously, Disney had de facto control of the board as the district’s largest landowner.

DeSantis has sought greater authority over the district in the wake of his squabble with Disney. The governor’s actions were motivated in part by the media and entertainment giant expressing objections to DeSantis’ bill to restrict teaching about sexual orientation and gender identity to students in the state from kindergarten to third grade.

And the district will be renamed: From the Reedy Creek Special Improvement District to the Central Florida Tourism Oversight District.

DeSantis’ administration has called the new legislation necessary, saying in a statement that the district had historically “gifted extraordinary special privileges to a single corporation.”

“Until Governor DeSantis acted, the Walt Disney Company maintained sole control over the District,” a spokesman for the governor said in a statement. “This power amounted to an unaccountable Corporate Kingdom. Florida is dissolving the Corporate Kingdom and beginning a new era of accountability and transparency.”

Disney is monitoring the legislation, Jeff Vahle, president of Walt Disney World Resort, said in a statement.

“Disney works under a number of different models and jurisdictions around the world, and regardless of the outcome, we remain committed to providing the highest quality experience for the millions of guests who visit each year,” Vahle said.

Disney recently announced the layoffs of 7,000 employees as part of a broad restructuring. But construction still appears to be progressing on a Disney office campus in Lake Nona, roughly 20 miles east of Disney World. According to the Orlando Business Journal, Disney recently filed a zoning application for a master plan for the campus, which is slated to house 2,000 jobs.

HI Financial Services Mid-Week 06-24-2014